Key Insights

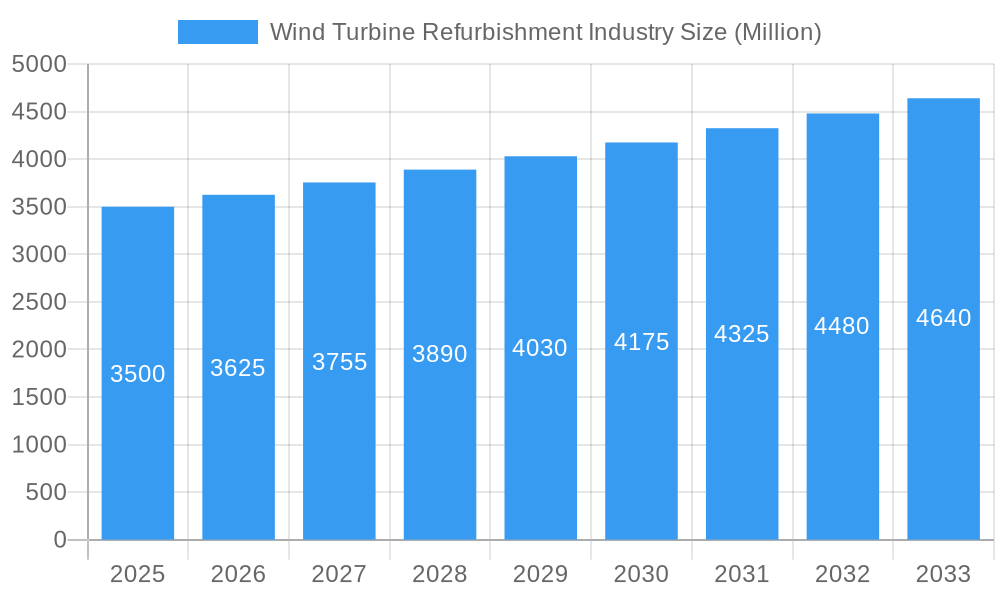

The global wind turbine refurbishment market is experiencing significant expansion, driven by the increasing need to extend the operational lifespan and enhance the efficiency of existing wind farms. With an estimated market size of $5.07 billion in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.11% through 2033, the industry is set for substantial growth. This surge is propelled by the imperative to optimize energy generation from aging turbines, reduce operational expenditures, and adhere to evolving environmental regulations. Key drivers include the vast installed wind capacity reaching a critical maintenance phase and advancements in refurbishment technologies offering cost-effective alternatives to full turbine replacement. The market is segmented by service type, with gearbox repairs, particularly concerning bearings, representing a major focus. Both onshore and offshore deployment considerations necessitate specialized refurbishment solutions.

Wind Turbine Refurbishment Industry Market Size (In Billion)

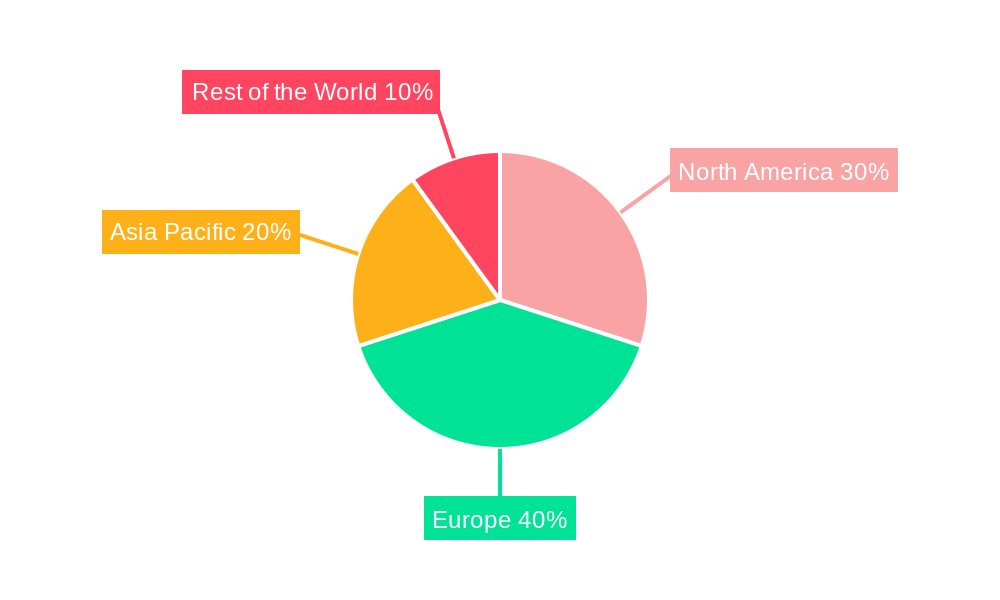

Geographically, Europe and North America are expected to maintain leadership due to their established wind energy infrastructure and supportive government policies. The Asia Pacific region is anticipated to exhibit the fastest growth, driven by rapid wind power deployment and a growing emphasis on asset lifecycle extension. Potential restraints, such as the upfront cost of advanced refurbishment technologies and supply chain vulnerabilities for specialized components, are being mitigated through innovation and strategic collaborations among key industry players including Siemens Gamesa Renewable Energy SA, Winergy Group, and ME Production A/S. The competitive landscape features a blend of established wind turbine manufacturers providing aftermarket services and specialized independent service providers focusing on refurbishment and repair, all competing for a share of this dynamic market.

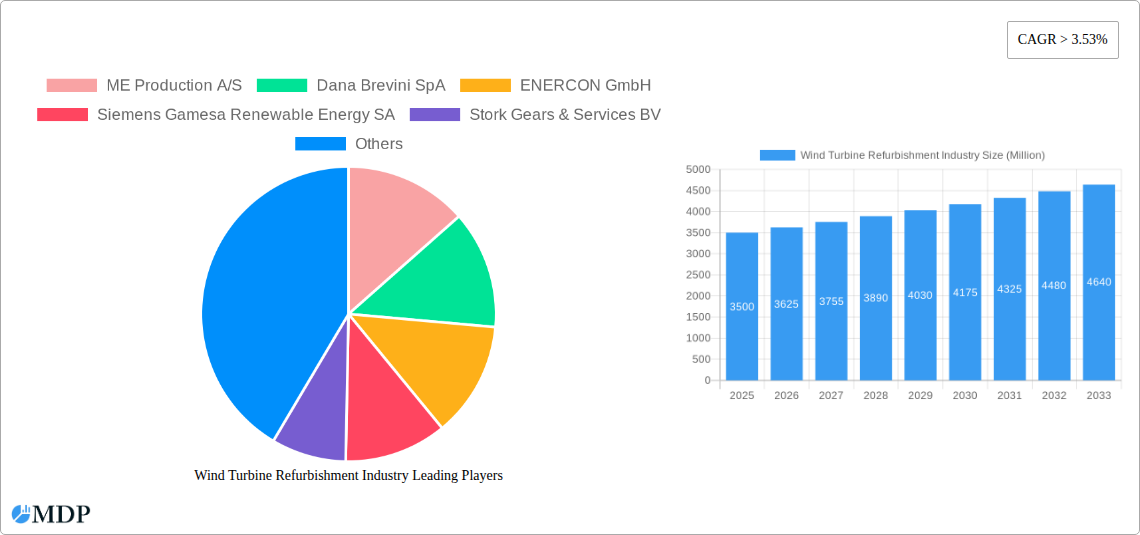

Wind Turbine Refurbishment Industry Company Market Share

This report offers an in-depth analysis of the wind turbine refurbishment market, providing critical insights for stakeholders in the renewable energy sector. Covering the forecast period from 2025 to 2033, with a base year of 2025, this report examines market dynamics, industry trends, key segments, technological innovations, growth drivers, challenges, and emerging opportunities. It is an essential resource for investors, manufacturers, service providers, and policymakers seeking to capitalize on the significant growth potential of the wind turbine refurbishment market.

Wind Turbine Refurbishment Industry Market Dynamics & Concentration

The wind turbine refurbishment industry is characterized by a moderate to high level of market concentration, driven by the significant capital investment and specialized expertise required for complex repair and gearbox failure remediation. Innovation drivers are primarily focused on extending turbine lifespan, improving operational efficiency, and reducing downtime. Regulatory frameworks, such as renewable energy targets and grid integration policies, play a crucial role in shaping market demand. While product substitutes are limited due to the specialized nature of wind turbine components, advancements in predictive maintenance and digital twin technologies are transforming traditional refurbishment approaches. End-user trends indicate a growing demand for cost-effective solutions to optimize existing wind farms, rather than solely relying on new installations. Mergers and acquisitions (M&A) activities are increasingly prevalent as larger players seek to expand their service portfolios and geographic reach. For instance, M&A deal counts are projected to increase by 15% over the forecast period, as companies like Siemens Gamesa Renewable Energy SA and ENERCON GmbH consolidate their positions. Key market players are strategically acquiring smaller, specialized service providers to enhance their capabilities in gearbox failure repair and bearing replacement, thereby strengthening their market share in this dynamic sector. The overall market share of established refurbishment providers is expected to see a steady growth of approximately 8% annually due to the increasing age of operational wind turbines.

Wind Turbine Refurbishment Industry Industry Trends & Analysis

The wind turbine refurbishment industry is experiencing robust growth, fueled by several interconnected trends and a burgeoning demand for sustainable energy solutions. A primary growth driver is the aging fleet of wind turbines globally, many of which are approaching their original design life and require extensive maintenance, repair, and component upgrades to ensure continued optimal performance and safety. The increasing focus on maximizing the return on investment from existing wind farm assets is further accelerating the adoption of refurbishment services. Technologically, there's a significant shift towards predictive maintenance and condition monitoring, employing advanced sensors, AI-powered analytics, and digital twins to anticipate component failures, particularly in critical areas like gearboxes and bearings, before they occur. This proactive approach minimizes unscheduled downtime and reduces the severity and cost of repairs. Consumer preferences are evolving towards more comprehensive, integrated service packages that cover not only repairs but also performance enhancements and life extension strategies. The competitive landscape is intensifying, with both original equipment manufacturers (OEMs) and independent service providers vying for market share. Market penetration of specialized refurbishment services is projected to reach 60% by 2030, up from approximately 40% in 2024. The Compound Annual Growth Rate (CAGR) for the wind turbine refurbishment market is estimated at a strong 9.5% during the forecast period, driven by the continuous need to maintain and optimize renewable energy infrastructure. This growth is further supported by governmental initiatives and incentives aimed at promoting the longevity and efficiency of renewable energy assets, making refurbishment a cornerstone of sustainable energy strategies worldwide.

Leading Markets & Segments in Wind Turbine Refurbishment Industry

The Offshore deployment segment is emerging as the dominant market within the wind turbine refurbishment industry, showcasing exceptional growth potential and strategic importance. This dominance is driven by several key factors, including the increasing number of offshore wind farms reaching maturity and requiring specialized, high-cost maintenance. Economic policies promoting offshore wind development and substantial infrastructure investments in offshore wind hubs are significant catalysts. The sheer scale and complexity of offshore turbines necessitate advanced refurbishment techniques and specialized equipment, creating a premium market for expert service providers.

- Dominant Region/Country: Europe, particularly countries like Germany, the UK, and Denmark, leads in offshore wind farm installations and subsequent refurbishment needs.

- Key Drivers for Offshore Dominance:

- Aging Offshore Fleet: A substantial portion of the early offshore wind turbines are now in need of major overhauls and component replacements.

- Technological Advancements: The development of specialized vessels, underwater repair techniques, and modular refurbishment solutions are enabling efficient maintenance in challenging offshore environments.

- Governmental Support and Investment: Strong policy frameworks and public funding for offshore wind expansion and repowering initiatives directly translate into increased demand for refurbishment services.

- Environmental and Operational Benefits: Refurbishment allows for the integration of newer, more efficient technologies into existing offshore turbines, extending their operational life and increasing energy output.

Within the Type segment, Refurbishment services, encompassing major overhauls and upgrades, are projected to witness higher growth than routine Repair work due to the increasing age of wind farms. For Gearbox Failure Type, Bearings continue to be a critical component requiring frequent attention, but Others (including entire gearbox replacements and complex drivetrain issues) are gaining prominence as turbines age and experience more severe failures. The Onshore deployment segment, while mature, remains a significant market, but its growth rate is expected to be outpaced by offshore due to the substantial influx of new offshore projects and the pressing need for maintenance on existing offshore assets.

Wind Turbine Refurbishment Industry Product Developments

Product developments in the wind turbine refurbishment industry are increasingly focused on enhancing the longevity, efficiency, and reliability of aging wind assets. Innovations in advanced diagnostics and predictive maintenance technologies, utilizing AI and IoT sensors, allow for proactive identification of component wear, particularly in gearboxes and bearings, enabling targeted and timely interventions. Furthermore, the development of modular and standardized repair solutions for critical components like rotor blades, nacelles, and drivetrains is streamlining refurbishment processes and reducing downtime. Companies are also investing in advanced materials and coatings to extend the lifespan of components subjected to harsh environmental conditions. The integration of digital twin technology enables virtual simulation of refurbishment strategies, optimizing outcomes and minimizing risks. These advancements collectively contribute to a more cost-effective and sustainable approach to wind turbine lifecycle management.

Key Drivers of Wind Turbine Refurbishment Industry Growth

The wind turbine refurbishment industry's growth is propelled by a confluence of powerful drivers. The aging global fleet of wind turbines is a primary catalyst, with a significant number of turbines approaching the end of their operational lifespan, necessitating extensive maintenance and component upgrades. Economic incentives, including government subsidies, tax credits, and power purchase agreements, continue to encourage investment in maintaining and optimizing existing wind farms. Technological advancements in predictive maintenance, condition monitoring, and data analytics are enabling more efficient and cost-effective refurbishment strategies, reducing downtime and extending turbine life. Furthermore, the increasing demand for renewable energy and the desire to maximize the output from existing installations are creating a sustained need for refurbishment services. The push towards repowering older, less efficient turbines with newer, more advanced models also falls under the broad umbrella of refurbishment and contributes significantly to market expansion.

Challenges in the Wind Turbine Refurbishment Industry Market

Despite its strong growth trajectory, the wind turbine refurbishment industry faces several significant challenges. Regulatory hurdles, particularly concerning environmental impact assessments and permitting processes for major refurbishments, can lead to project delays and increased costs. Supply chain issues, including the availability of specialized spare parts and qualified technicians, can impact project timelines and profitability. The competitive pressure from both OEMs and independent service providers can lead to price wars, squeezing margins. Furthermore, the increasing complexity of wind turbine technology requires continuous investment in training and specialized equipment. The logistical challenges associated with accessing and working on remote or offshore wind turbines add another layer of difficulty. Finally, the economic viability of extensive refurbishments versus outright replacement remains a constant consideration for asset owners.

Emerging Opportunities in Wind Turbine Refurbishment Industry

The wind turbine refurbishment industry is ripe with emerging opportunities driven by technological breakthroughs and evolving market strategies. The rapid advancement of digitalization and AI-powered predictive maintenance presents a massive opportunity to transition from reactive to proactive refurbishment, significantly reducing costs and maximizing turbine uptime. Modular refurbishment and component remanufacturing are gaining traction, offering more sustainable and cost-effective solutions than complete replacements. Strategic partnerships between turbine manufacturers, component suppliers, and specialized service providers are creating integrated offerings that cater to the full lifecycle needs of wind farm operators. Furthermore, the growing trend of repowering older wind farms with state-of-the-art technology, while retaining the existing infrastructure, opens up substantial market potential. Expansion into emerging markets with rapidly growing wind energy installations also presents significant long-term growth avenues.

Leading Players in the Wind Turbine Refurbishment Industry Sector

- ME Production A/S

- Dana Brevini SpA

- ENERCON GmbH

- Siemens Gamesa Renewable Energy SA

- Stork Gears & Services BV

- Winergy Group

- Connected Wind Services Refurbishment A/S

- Turbine Repair Solutions

- Grenaa Motorfabrik A/S

- ZF Friedrichshafen AG

Key Milestones in Wind Turbine Refurbishment Industry Industry

- 2020 (Ongoing): Increased adoption of advanced sensor technology for real-time performance monitoring and early fault detection in gearbox and bearing systems.

- 2021 (Ongoing): Growing trend of OEMs offering extended warranty and service packages, incorporating refurbishment services as a core offering.

- 2022 (Ongoing): Development and deployment of specialized offshore wind turbine maintenance vessels and platforms, enhancing accessibility for refurbishment.

- 2023 (Ongoing): Significant investments in research and development for AI-driven predictive maintenance algorithms specifically for wind turbine components.

- 2024 (Ongoing): Strategic partnerships formed between independent service providers and technology firms to offer integrated refurbishment solutions.

- 2025 (Projected): Increased focus on remanufacturing of major gearbox and generator components to reduce costs and environmental impact.

- 2026 (Projected): Emergence of digital twin platforms for comprehensive lifecycle management and predictive refurbishment planning.

- 2027 (Projected): Expansion of repowering projects globally, involving the upgrade of older turbine models with newer technologies.

- 2028-2033 (Forecast): Continuous innovation in blade repair techniques and composite material enhancements for extended operational life.

Strategic Outlook for Wind Turbine Refurbishment Industry Market

The strategic outlook for the wind turbine refurbishment industry is overwhelmingly positive, characterized by sustained growth driven by the aging global wind turbine fleet and the increasing imperative for renewable energy optimization. The industry will witness a paradigm shift towards data-driven, predictive maintenance, where AI and digital twins will become indispensable tools for minimizing downtime and extending asset life. Strategic opportunities lie in expanding service offerings to include comprehensive lifecycle management, from diagnostics to repowering. Collaboration between OEMs, independent service providers, and technology innovators will be crucial for delivering integrated solutions. Furthermore, the growing global demand for clean energy will ensure a consistent and expanding market for refurbishment, making it a cornerstone of a sustainable and efficient renewable energy future.

Wind Turbine Refurbishment Industry Segmentation

-

1. Type

- 1.1. Repair

- 1.2. Refurbishment

-

2. Gearbox Failure Type

- 2.1. Bearings

- 2.2. Others

-

3. Deployment

- 3.1. Onshore

- 3.2. Offshore

Wind Turbine Refurbishment Industry Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Rest of the World

Wind Turbine Refurbishment Industry Regional Market Share

Geographic Coverage of Wind Turbine Refurbishment Industry

Wind Turbine Refurbishment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Repair Segment to Witness Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wind Turbine Refurbishment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Repair

- 5.1.2. Refurbishment

- 5.2. Market Analysis, Insights and Forecast - by Gearbox Failure Type

- 5.2.1. Bearings

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Onshore

- 5.3.2. Offshore

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Wind Turbine Refurbishment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Repair

- 6.1.2. Refurbishment

- 6.2. Market Analysis, Insights and Forecast - by Gearbox Failure Type

- 6.2.1. Bearings

- 6.2.2. Others

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. Onshore

- 6.3.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Wind Turbine Refurbishment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Repair

- 7.1.2. Refurbishment

- 7.2. Market Analysis, Insights and Forecast - by Gearbox Failure Type

- 7.2.1. Bearings

- 7.2.2. Others

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. Onshore

- 7.3.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Wind Turbine Refurbishment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Repair

- 8.1.2. Refurbishment

- 8.2. Market Analysis, Insights and Forecast - by Gearbox Failure Type

- 8.2.1. Bearings

- 8.2.2. Others

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. Onshore

- 8.3.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Wind Turbine Refurbishment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Repair

- 9.1.2. Refurbishment

- 9.2. Market Analysis, Insights and Forecast - by Gearbox Failure Type

- 9.2.1. Bearings

- 9.2.2. Others

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. Onshore

- 9.3.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ME Production A/S

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dana Brevini SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ENERCON GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens Gamesa Renewable Energy SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Stork Gears & Services BV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Winergy Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Connected Wind Services Refurbishment A/S*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Turbine Repair Solutions

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Grenaa Motorfabrik A/S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZF Friedrichshafen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ME Production A/S

List of Figures

- Figure 1: Global Wind Turbine Refurbishment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Wind Turbine Refurbishment Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Wind Turbine Refurbishment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Wind Turbine Refurbishment Industry Revenue (billion), by Gearbox Failure Type 2025 & 2033

- Figure 5: Asia Pacific Wind Turbine Refurbishment Industry Revenue Share (%), by Gearbox Failure Type 2025 & 2033

- Figure 6: Asia Pacific Wind Turbine Refurbishment Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 7: Asia Pacific Wind Turbine Refurbishment Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 8: Asia Pacific Wind Turbine Refurbishment Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Wind Turbine Refurbishment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Wind Turbine Refurbishment Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: North America Wind Turbine Refurbishment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Wind Turbine Refurbishment Industry Revenue (billion), by Gearbox Failure Type 2025 & 2033

- Figure 13: North America Wind Turbine Refurbishment Industry Revenue Share (%), by Gearbox Failure Type 2025 & 2033

- Figure 14: North America Wind Turbine Refurbishment Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 15: North America Wind Turbine Refurbishment Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: North America Wind Turbine Refurbishment Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Wind Turbine Refurbishment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Wind Turbine Refurbishment Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Wind Turbine Refurbishment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Wind Turbine Refurbishment Industry Revenue (billion), by Gearbox Failure Type 2025 & 2033

- Figure 21: Europe Wind Turbine Refurbishment Industry Revenue Share (%), by Gearbox Failure Type 2025 & 2033

- Figure 22: Europe Wind Turbine Refurbishment Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 23: Europe Wind Turbine Refurbishment Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: Europe Wind Turbine Refurbishment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Wind Turbine Refurbishment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Wind Turbine Refurbishment Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Wind Turbine Refurbishment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Wind Turbine Refurbishment Industry Revenue (billion), by Gearbox Failure Type 2025 & 2033

- Figure 29: Rest of the World Wind Turbine Refurbishment Industry Revenue Share (%), by Gearbox Failure Type 2025 & 2033

- Figure 30: Rest of the World Wind Turbine Refurbishment Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 31: Rest of the World Wind Turbine Refurbishment Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 32: Rest of the World Wind Turbine Refurbishment Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Wind Turbine Refurbishment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Gearbox Failure Type 2020 & 2033

- Table 3: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 4: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Gearbox Failure Type 2020 & 2033

- Table 7: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Gearbox Failure Type 2020 & 2033

- Table 11: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 12: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Gearbox Failure Type 2020 & 2033

- Table 15: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 16: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Gearbox Failure Type 2020 & 2033

- Table 19: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 20: Global Wind Turbine Refurbishment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wind Turbine Refurbishment Industry?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the Wind Turbine Refurbishment Industry?

Key companies in the market include ME Production A/S, Dana Brevini SpA, ENERCON GmbH, Siemens Gamesa Renewable Energy SA, Stork Gears & Services BV, Winergy Group, Connected Wind Services Refurbishment A/S*List Not Exhaustive, Turbine Repair Solutions, Grenaa Motorfabrik A/S, ZF Friedrichshafen AG.

3. What are the main segments of the Wind Turbine Refurbishment Industry?

The market segments include Type, Gearbox Failure Type, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

Repair Segment to Witness Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wind Turbine Refurbishment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wind Turbine Refurbishment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wind Turbine Refurbishment Industry?

To stay informed about further developments, trends, and reports in the Wind Turbine Refurbishment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence