Key Insights

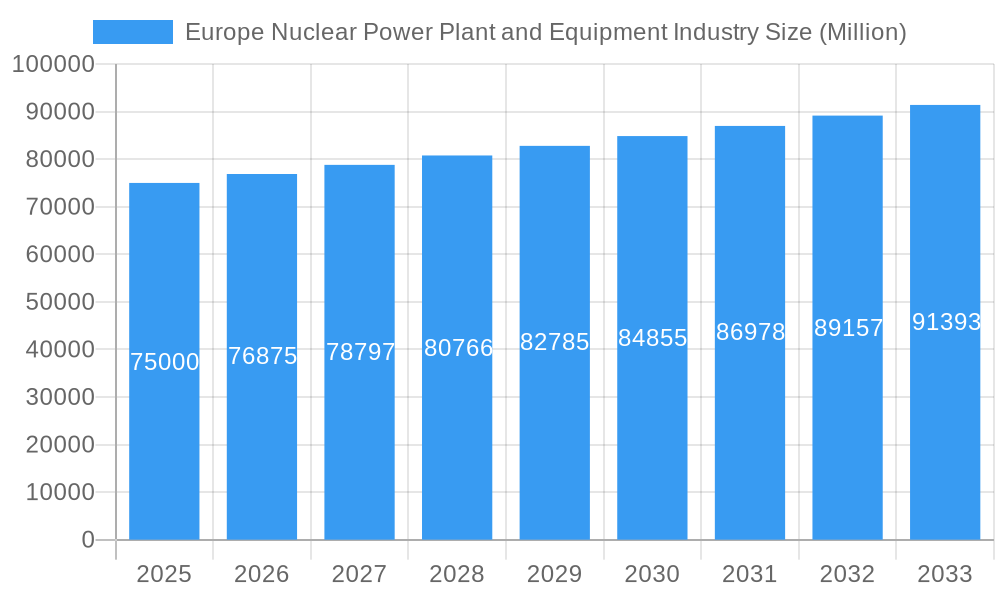

The Europe Nuclear Power Plant and Equipment market is set for significant expansion, projected to reach 41.7 billion Euros by 2024, with a Compound Annual Growth Rate (CAGR) of 3% through 2033. This growth is driven by Europe's strong commitment to decarbonization, with nuclear power serving as a crucial, low-carbon energy source to meet climate objectives and reduce reliance on fossil fuels. Key factors include substantial government investment in new reactor construction and the modernization of existing facilities for improved safety and efficiency. Demand is expected to rise for large reactor components like Pressurized Water Reactors (PWRs) and Pressurized Heavy Water Reactors (PHWRs), alongside essential auxiliary equipment. The market is further stimulated by advancements in next-generation reactor designs and research reactors.

Europe Nuclear Power Plant and Equipment Industry Market Size (In Billion)

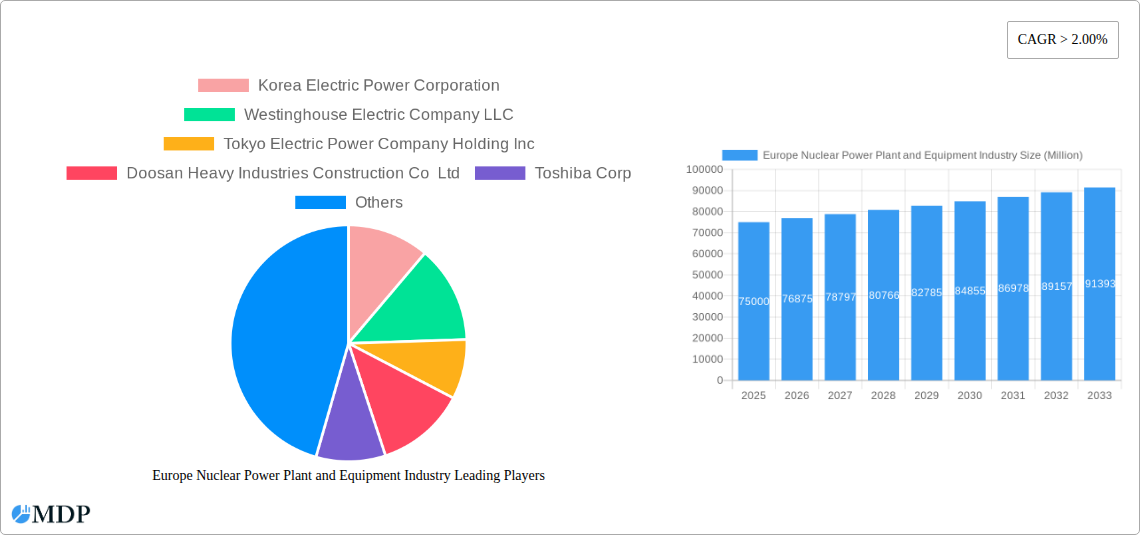

Despite positive growth, the market faces challenges. High initial capital expenditure for new nuclear facilities and intricate regulatory processes can lead to project delays. Public perception regarding nuclear safety and waste management, while improving, can still impact new developments. However, ongoing technological innovations in reactor design, focusing on enhanced safety and waste reduction, are mitigating these concerns. The competitive landscape features global leaders such as Westinghouse Electric Company, Mitsubishi Corp, and General Electric, alongside major regional players like Korea Electric Power Corporation and Rosatom. France and Russia are leading contributors, with other European nations showing growing interest and investment.

Europe Nuclear Power Plant and Equipment Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Nuclear Power Plant and Equipment industry, providing critical insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2024, the analysis explores market dynamics, industry trends, key segments, product developments, drivers, challenges, opportunities, and strategic outlook. It includes granular data on Reactor Types (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Other Reactor Types) and Carrier Types (Island Equipment, Auxiliary Equipment, Research Reactor).

Europe Nuclear Power Plant and Equipment Industry Market Dynamics & Concentration

The Europe Nuclear Power Plant and Equipment Industry is characterized by a moderate to high market concentration, with a few dominant players controlling significant market share. Innovation drivers are primarily focused on enhancing reactor safety, efficiency, and waste management technologies. The regulatory framework plays a pivotal role, with stringent safety standards and evolving environmental policies influencing investment decisions and operational practices. While product substitutes like renewable energy sources present a growing challenge, nuclear power's baseload capacity and low carbon emissions continue to secure its position. End-user trends indicate a growing demand for stable, emission-free energy, driving interest in new build projects and life extension initiatives for existing plants. Mergers and Acquisition (M&A) activities are driven by a desire for technological advancement, market consolidation, and the securing of critical supply chains. Key M&A deals within the historical period reflect strategic acquisitions aimed at expanding service portfolios and geographical reach. For instance, a significant acquisition in the Auxilliary Equipment segment by a leading European player aimed to bolster its offerings in advanced safety systems, accounting for approximately 2% of the total market share in that sub-segment. The number of significant M&A deals observed in the historical period stands at an estimated 8, indicating a consolidating yet competitive landscape.

Europe Nuclear Power Plant and Equipment Industry Industry Trends & Analysis

The Europe Nuclear Power Plant and Equipment Industry is experiencing a multifaceted evolution driven by the imperative for decarbonization and energy security. A significant market growth driver is the renewed governmental and public interest in nuclear energy as a reliable, low-carbon alternative to fossil fuels, particularly in light of fluctuating fossil fuel prices and climate change concerns. Technological disruptions are primarily focused on the development of Small Modular Reactors (SMRs), promising enhanced safety, cost-effectiveness, and flexibility in deployment. Furthermore, advancements in fuel cycle management and waste disposal technologies are crucial for long-term sustainability and public acceptance. Consumer preferences are increasingly leaning towards sustainable energy sources, and nuclear power, despite historical controversies, is being re-evaluated for its role in meeting climate targets. The competitive dynamics within the industry are shaped by a mix of established global giants and specialized European firms, each vying for dominance in new build projects, maintenance services, and equipment supply. The Compound Annual Growth Rate (CAGR) for the Europe Nuclear Power Plant and Equipment Industry is projected to be approximately 5.2% over the forecast period, driven by these evolving trends. Market penetration for advanced reactor technologies is expected to increase, particularly in countries with strong government backing for nuclear expansion. The demand for Island Equipment and sophisticated Auxilliary Equipment is projected to surge as new power plants are commissioned and older ones undergo upgrades. The industry is witnessing a shift towards modular construction and digital twin technologies to optimize efficiency and reduce project timelines. The pursuit of enhanced safety features, including passive safety systems and advanced monitoring, remains a paramount concern for all stakeholders, influencing product development and market strategies.

Leading Markets & Segments in Europe Nuclear Power Plant and Equipment Industry

The Pressurized Water Reactor (PWR) segment stands as the dominant force within the Europe Nuclear Power Plant and Equipment Industry. This dominance is underpinned by decades of operational experience, proven safety records, and established supply chains for components and expertise. Countries such as France, the UK, and Russia (historically a significant player in European nuclear) are key markets for PWR technology, owing to their substantial existing nuclear fleets and ambitious new build programs.

- Economic Policies: Strong government subsidies, favorable loan guarantees, and long-term energy security strategies significantly bolster the PWR segment. Policies aimed at achieving ambitious carbon reduction targets also play a crucial role in driving investment in nuclear power.

- Infrastructure: Well-developed industrial infrastructure capable of supporting the construction and maintenance of large-scale PWR plants, including specialized manufacturing facilities and skilled labor, further solidifies its leading position.

- Technological Maturity: The established technological maturity of PWRs, coupled with continuous innovation in fuel efficiency and safety systems, makes them a preferred choice for utilities seeking reliable baseload power.

In terms of Carrier Type, Island Equipment commands the largest market share. This encompasses the primary systems of a nuclear power plant, including the reactor vessel, steam generators, turbines, and generators, which are critical for energy production. The demand for sophisticated and reliable Island Equipment is directly correlated with the construction of new plants and the life extension of existing ones.

- New Build Projects: The ongoing and planned new reactor constructions across Europe are the primary drivers for the demand for advanced Island Equipment. For instance, France's commitment to building 14 new plants by 2050 will necessitate significant investment in this segment.

- Life Extension Programs: Many older nuclear power plants are undergoing life extension initiatives, which involve significant upgrades and replacements of key Island Equipment to ensure continued safe and efficient operation.

The Research Reactor segment, while smaller in overall market value, plays a crucial role in advancing nuclear science and technology, supporting medical isotope production, and training future nuclear professionals. Its contribution to innovation indirectly benefits the broader industry.

Europe Nuclear Power Plant and Equipment Industry Product Developments

Product development in the Europe Nuclear Power Plant and Equipment Industry is strongly aligned with enhancing safety, efficiency, and sustainability. Innovations in Advanced Reactor Designs, including Generation IV reactors and Small Modular Reactors (SMRs), are gaining traction, promising improved fuel utilization, passive safety features, and reduced waste generation. Companies are also investing in digital technologies, such as AI-powered predictive maintenance and digital twins, to optimize plant operations and reduce downtime. The development of advanced fuel types and efficient waste management solutions are critical for addressing public concerns and ensuring long-term viability. These developments offer significant competitive advantages by enabling lower operational costs, enhanced safety profiles, and a reduced environmental footprint.

Key Drivers of Europe Nuclear Power Plant and Equipment Industry Growth

The growth of the Europe Nuclear Power Plant and Equipment Industry is propelled by a confluence of critical factors. Energy security concerns, amplified by geopolitical instability and the volatility of fossil fuel markets, are driving a renewed focus on diversifying energy portfolios with reliable baseload power sources. The urgent need to combat climate change and meet stringent decarbonization targets is a paramount driver, with nuclear power offering a low-carbon alternative to fossil fuels. Technological advancements in reactor design, such as the development of Small Modular Reactors (SMRs), promise enhanced safety, cost-effectiveness, and flexibility, making nuclear energy more accessible. Furthermore, supportive government policies, including long-term energy strategies, regulatory reforms, and investment incentives, are crucial in de-risking and encouraging new nuclear projects. The ongoing life extension of existing nuclear power plants also contributes significantly to market growth through refurbishment and equipment upgrade demands.

Challenges in the Europe Nuclear Power Plant and Equipment Industry Market

The Europe Nuclear Power Plant and Equipment Industry faces significant challenges that can impede its growth. High upfront capital costs and long project gestation periods remain a major hurdle, requiring substantial and long-term financial commitments. Stringent and evolving regulatory frameworks, while crucial for safety, can lead to delays and increased project complexity. Public perception and social acceptance, often influenced by historical incidents and concerns over nuclear waste disposal, present a continuous challenge. Supply chain vulnerabilities and geopolitical risks can impact the availability of specialized components and materials. Furthermore, competition from rapidly growing renewable energy sectors, which benefit from decreasing costs and increasing public acceptance, poses a significant market challenge. The skill gap in the nuclear workforce is also a growing concern, requiring substantial investment in education and training.

Emerging Opportunities in Europe Nuclear Power Plant and Equipment Industry

The Europe Nuclear Power Plant and Equipment Industry is ripe with emerging opportunities, particularly in the realm of advanced reactor technologies. The development and deployment of Small Modular Reactors (SMRs) present a transformative opportunity, offering scalability, enhanced safety, and potential for deployment in diverse locations, including remote areas and industrial sites. Repurposing of existing nuclear sites for new reactor builds or the integration of SMRs also offers a pathway for accelerated deployment. Strategic partnerships and collaborations between established nuclear players and technology innovators are crucial for accelerating research and development and commercialization. Furthermore, the growing demand for hydrogen production using nuclear energy as a clean energy source opens up new market avenues. The circular economy approach to nuclear fuel and waste management, focusing on recycling and minimizing waste, presents a significant opportunity for innovation and improved sustainability.

Leading Players in the Europe Nuclear Power Plant and Equipment Industry Sector

- Korea Electric Power Corporation

- Westinghouse Electric Company LLC

- Tokyo Electric Power Company Holding Inc

- Doosan Heavy Industries Construction Co Ltd

- Toshiba Corp

- Dongfang Electric Corp Limited

- AEM Technologies JSC

- Mitsubishi Corp

- Rosatom State Atomic Energy Corporation

- General Electric Company

Key Milestones in Europe Nuclear Power Plant and Equipment Industry Industry

- 2021 (June): Rosatom started the construction of the Brest-OD-300 Fast Neutron Reactor in Russia. The 300MWe nuclear reactor unit will be in service by 2026. The license for construction was issued by Russian regulator Rostechnadzor in 2020.

- 2021: The French government declared that it may have 14 new power plants by 2050.

- 2024 (Expected): Very near completion of the Flamanville nuclear power plant, in which the 3rd unit is currently under construction and is expected to be in service by 2024.

Strategic Outlook for Europe Nuclear Power Plant and Equipment Industry Market

The strategic outlook for the Europe Nuclear Power Plant and Equipment Industry is one of cautious optimism, driven by the increasing recognition of nuclear energy's role in achieving net-zero emissions and ensuring energy independence. A key growth accelerator will be the successful development and deployment of Small Modular Reactors (SMRs), which could revolutionize the industry by offering more flexible and cost-effective solutions. Governments are expected to continue to play a crucial role through supportive policies, including R&D funding, regulatory streamlining, and long-term procurement strategies. Strategic partnerships focused on innovation in waste management and fuel recycling will be essential for enhancing sustainability and public acceptance. Furthermore, the integration of digital technologies and advanced manufacturing techniques will be critical for improving efficiency, safety, and reducing project timelines. The industry's ability to effectively communicate its safety record and environmental benefits will be paramount in navigating public opinion and securing future investments.

Europe Nuclear Power Plant and Equipment Industry Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Other Reactor Types

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxilliary Equipment

- 2.3. Research Reactor

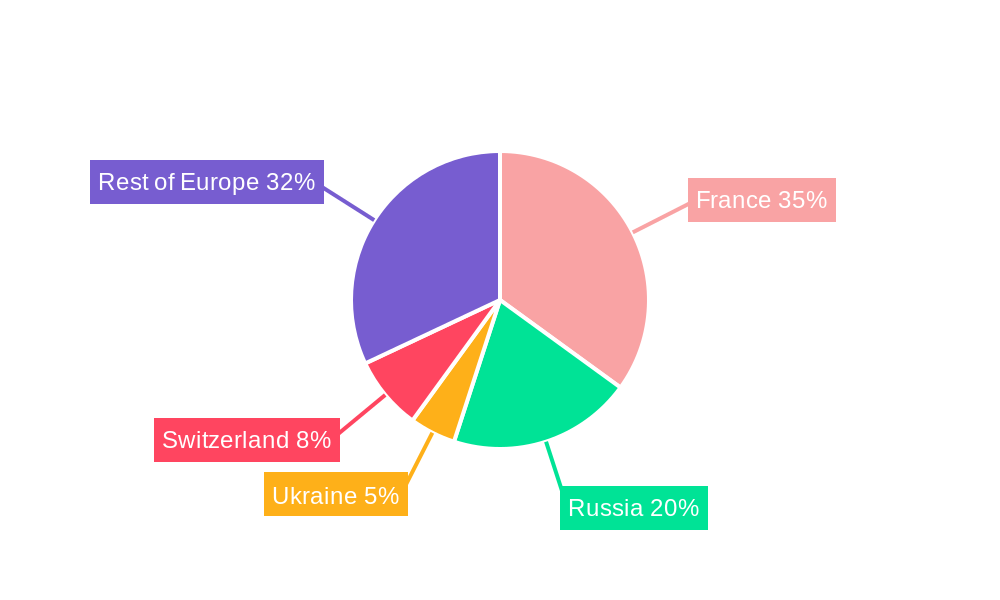

Europe Nuclear Power Plant and Equipment Industry Segmentation By Geography

- 1. France

- 2. Russia

- 3. Ukraine

- 4. Switzerland

- 5. Rest of Europe

Europe Nuclear Power Plant and Equipment Industry Regional Market Share

Geographic Coverage of Europe Nuclear Power Plant and Equipment Industry

Europe Nuclear Power Plant and Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor Type Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxilliary Equipment

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.3.2. Russia

- 5.3.3. Ukraine

- 5.3.4. Switzerland

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. France Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Pressurized Heavy Water Reactor

- 6.1.3. Other Reactor Types

- 6.2. Market Analysis, Insights and Forecast - by Carrier Type

- 6.2.1. Island Equipment

- 6.2.2. Auxilliary Equipment

- 6.2.3. Research Reactor

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. Russia Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Pressurized Heavy Water Reactor

- 7.1.3. Other Reactor Types

- 7.2. Market Analysis, Insights and Forecast - by Carrier Type

- 7.2.1. Island Equipment

- 7.2.2. Auxilliary Equipment

- 7.2.3. Research Reactor

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. Ukraine Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Pressurized Heavy Water Reactor

- 8.1.3. Other Reactor Types

- 8.2. Market Analysis, Insights and Forecast - by Carrier Type

- 8.2.1. Island Equipment

- 8.2.2. Auxilliary Equipment

- 8.2.3. Research Reactor

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. Switzerland Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Pressurized Heavy Water Reactor

- 9.1.3. Other Reactor Types

- 9.2. Market Analysis, Insights and Forecast - by Carrier Type

- 9.2.1. Island Equipment

- 9.2.2. Auxilliary Equipment

- 9.2.3. Research Reactor

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Rest of Europe Europe Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Pressurized Heavy Water Reactor

- 10.1.3. Other Reactor Types

- 10.2. Market Analysis, Insights and Forecast - by Carrier Type

- 10.2.1. Island Equipment

- 10.2.2. Auxilliary Equipment

- 10.2.3. Research Reactor

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Korea Electric Power Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Westinghouse Electric Company LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tokyo Electric Power Company Holding Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Doosan Heavy Industries Construction Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toshiba Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dongfang Electric Corp Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AEM Technologies JSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitsubishi Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rosatom State Atomic Energy Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Korea Electric Power Corporation

List of Figures

- Figure 1: Europe Nuclear Power Plant and Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Nuclear Power Plant and Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 3: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 4: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 5: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 8: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 9: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 10: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 11: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 14: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 15: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 16: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 17: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 20: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 21: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 22: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 23: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 26: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 27: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 28: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 29: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 32: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 33: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 34: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 35: Europe Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nuclear Power Plant and Equipment Industry?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe Nuclear Power Plant and Equipment Industry?

Key companies in the market include Korea Electric Power Corporation, Westinghouse Electric Company LLC, Tokyo Electric Power Company Holding Inc, Doosan Heavy Industries Construction Co Ltd, Toshiba Corp, Dongfang Electric Corp Limited, AEM Technologies JSC, Mitsubishi Corp, Rosatom State Atomic Energy Corporation, General Electric Company.

3. What are the main segments of the Europe Nuclear Power Plant and Equipment Industry?

The market segments include Reactor Type, Carrier Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Pressurized Water Reactor Type Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

In 2021, the French government declared that it may have 14 new power plants by 2050. The very near completion is of Flamanville nuclear power plant, in which the 3rd unit is currently under construction and is expected to be in service by 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nuclear Power Plant and Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nuclear Power Plant and Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nuclear Power Plant and Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Nuclear Power Plant and Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence