Key Insights

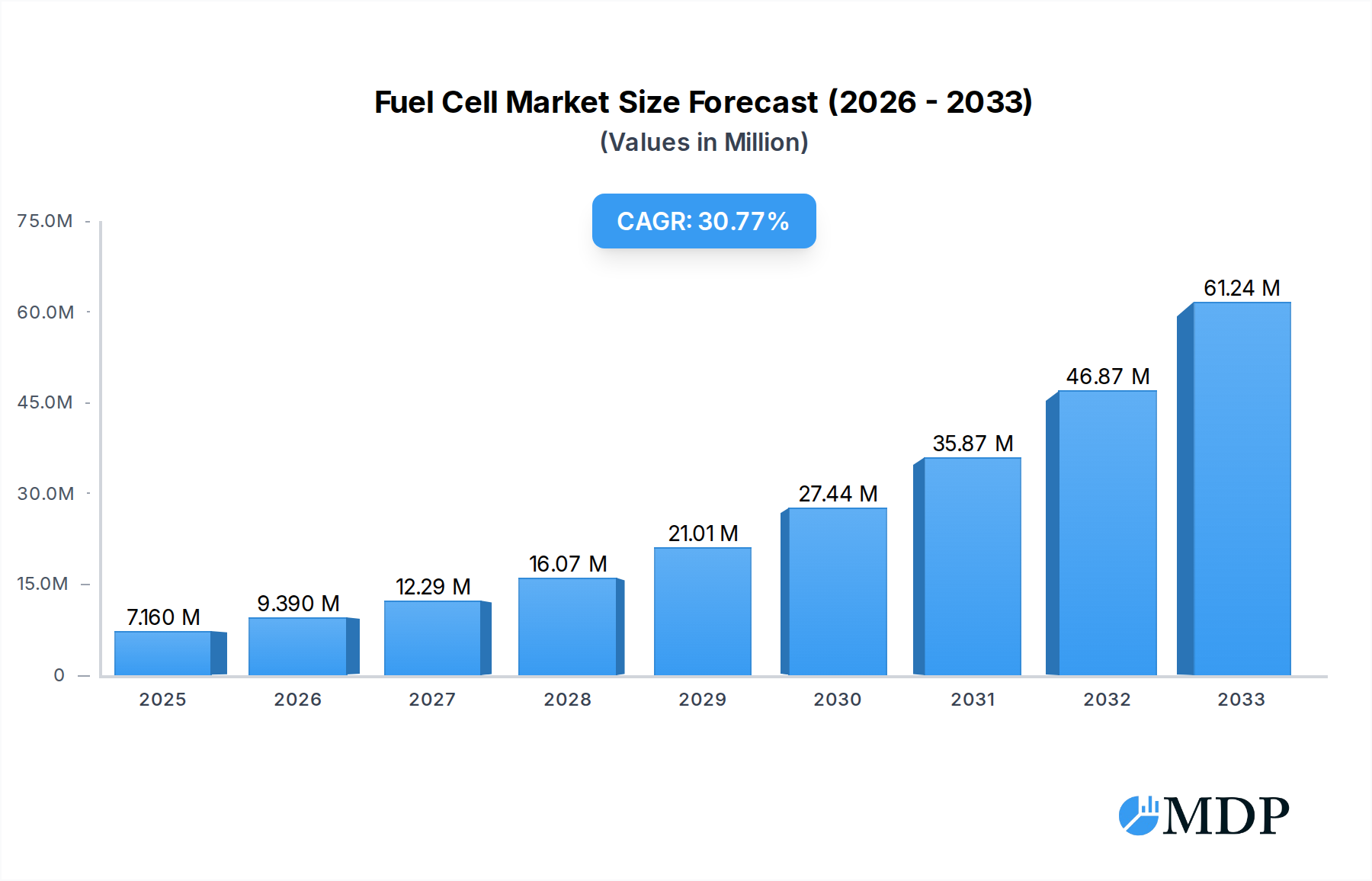

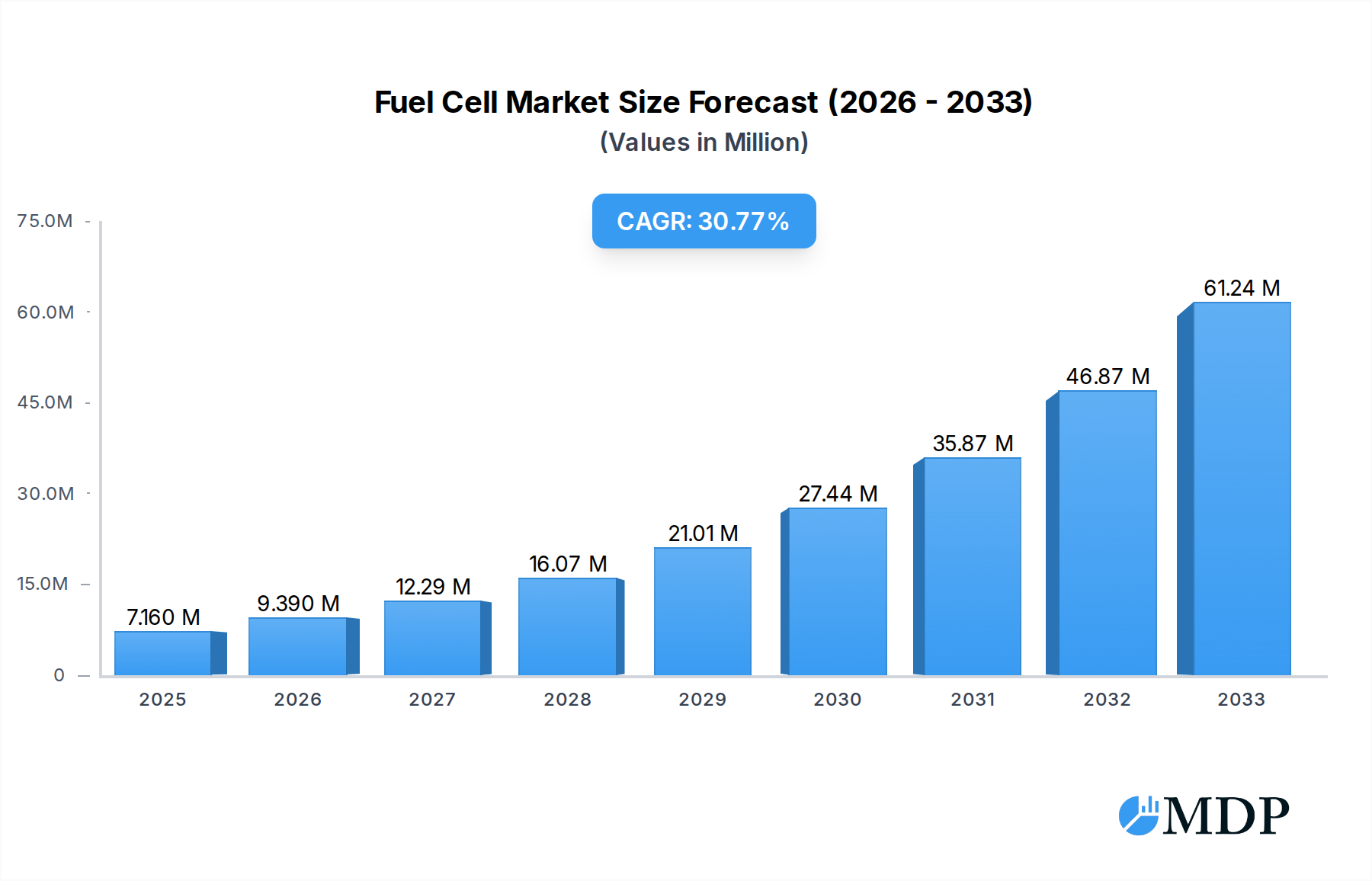

The global Fuel Cell Market is poised for exceptional growth, projected to reach $7.16 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 32.59% throughout the forecast period. This robust expansion is fueled by an increasing demand for clean and efficient energy solutions across various applications. Key drivers include stringent environmental regulations pushing for reduced emissions, advancements in fuel cell technology leading to improved performance and lower costs, and the growing adoption of fuel cells in sectors like transportation and stationary power generation. The market is experiencing a significant surge as industries and governments globally prioritize decarbonization efforts and seek alternatives to fossil fuels. This rapid ascent underscores the critical role fuel cells are set to play in the future energy landscape, offering a sustainable and powerful energy solution for a cleaner planet.

Fuel Cell Market Market Size (In Million)

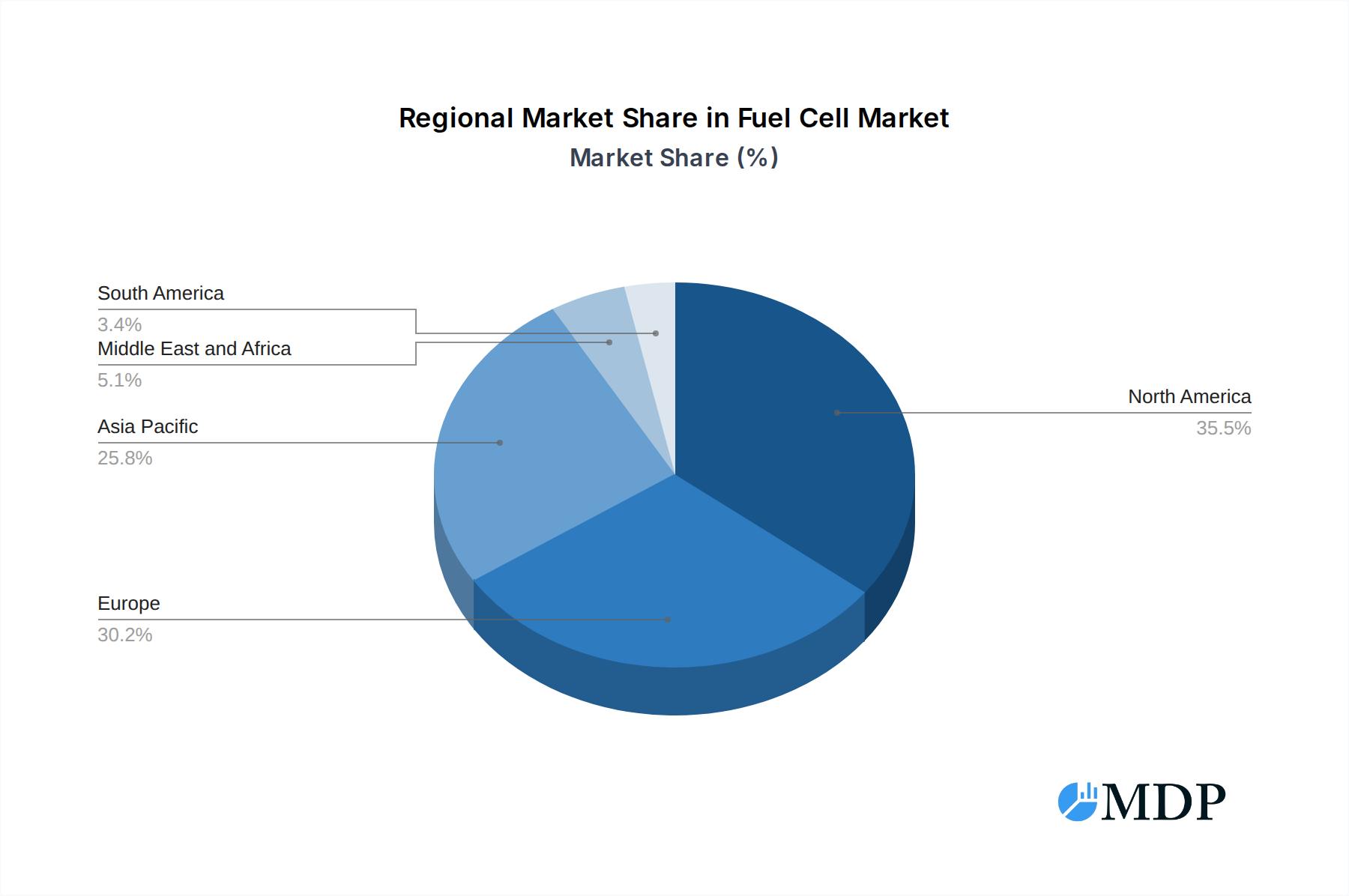

The market's segmentation reveals a dynamic landscape with both vehicular and non-vehicular applications showing strong potential. Within technological advancements, Polymer Electrolyte Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC) are expected to dominate, showcasing their versatility and suitability for diverse operational demands. The competitive environment features prominent players such as SFC Energy AG, Toshiba Energy Systems & Solutions Corporation, and Ballard Power Systems Inc., among others, all actively contributing to innovation and market penetration. Geographically, North America and Europe are leading the adoption, supported by supportive government policies and substantial investments in clean energy infrastructure. Asia Pacific is emerging as a significant growth region, driven by rapid industrialization and a growing awareness of environmental sustainability. The forecast period (2025-2033) indicates a sustained upward trajectory, solidifying the fuel cell market's position as a cornerstone of the global transition to renewable energy.

Fuel Cell Market Company Market Share

Fuel Cell Market: Unlocking a Sustainable Energy Future - Comprehensive Report & Forecast (2019-2033)

Dive deep into the rapidly evolving global fuel cell market with our in-depth report. Explore critical fuel cell technology advancements, hydrogen fuel cell applications, and the burgeoning demand for clean energy solutions. This comprehensive analysis, spanning 2019-2033 with a base year of 2025, provides unparalleled insights into market dynamics, industry trends, leading players like Plug Power Inc., Ballard Power Systems Inc., and FuelCell Energy Inc., and emerging opportunities. Understand the intricate interplay of PEMFC, SOFC, and other fuel cell technologies across vehicular and non-vehicular applications. This report is essential for investors, manufacturers, policymakers, and researchers seeking to capitalize on the transformative potential of fuel cells.

Fuel Cell Market Market Dynamics & Concentration

The global fuel cell market is characterized by dynamic growth, driven by increasing environmental consciousness and stringent government regulations mandating carbon emission reductions. Market concentration is moderately fragmented, with several key players vying for dominance, yet significant opportunities exist for new entrants. Innovation is a primary driver, fueled by continuous research and development in improving fuel cell efficiency, durability, and cost-effectiveness. Leading companies are investing heavily in next-generation technologies and expanding their production capacities. Regulatory frameworks, such as the National Green Hydrogen Mission in India and incentives for hydrogen-powered vehicles in various regions, are creating a favorable landscape for market expansion. Product substitutes, primarily batteries in certain applications, are present, but fuel cells offer distinct advantages in terms of energy density and refueling times for specific use cases. End-user trends are shifting towards sustainable power solutions across transportation, stationary power, and portable electronics. Mergers and acquisitions (M&A) activities are on the rise as companies seek to gain market share, acquire cutting-edge technologies, and expand their geographical reach. The number of significant M&A deals in the past two years has been substantial, indicating a consolidation trend and a strategic focus on building integrated value chains within the hydrogen ecosystem.

Fuel Cell Market Industry Trends & Analysis

The fuel cell market is experiencing robust growth, propelled by an urgent global imperative to decarbonize energy systems and combat climate change. The CAGR is projected to be exceptionally high over the forecast period. This surge is underpinned by significant technological breakthroughs in fuel cell efficiency and cost reduction, making them increasingly competitive against traditional energy sources. Consumer preferences are rapidly evolving, with a growing demand for zero-emission transportation and reliable, sustainable backup power solutions. The market penetration of fuel cells is steadily increasing across various sectors, from heavy-duty vehicles and buses to backup power for telecommunication towers and data centers. Competitive dynamics are intensifying, with established conglomerates and innovative startups alike investing in research and development and strategic partnerships. Governments worldwide are actively promoting the adoption of hydrogen as a clean energy carrier through supportive policies, subsidies, and the development of hydrogen infrastructure. This includes investments in electrolyzers for green hydrogen production and the expansion of hydrogen refueling stations, crucial for the widespread adoption of fuel cell electric vehicles (FCEVs). The integration of fuel cells into smart grids and renewable energy storage systems further amplifies their market potential. The ongoing development of advanced materials and manufacturing processes is also contributing to lower production costs, making fuel cell systems more accessible to a broader range of industries.

Leading Markets & Segments in Fuel Cell Market

The North America region currently holds a dominant position in the fuel cell market, driven by significant government investments in hydrogen infrastructure and favorable policies promoting clean energy adoption, particularly in the United States. The country's aggressive targets for emission reduction and its burgeoning hydrogen economy are key accelerators.

Application: Vehicular

- Heavy-Duty Vehicles & Trucks: This segment is a primary growth engine, with increasing adoption for long-haul transportation due to higher energy density and faster refueling compared to battery-electric trucks. Economic policies supporting the transition to zero-emission freight are crucial drivers.

- Buses & Public Transportation: Municipalities are investing in fuel cell buses to meet air quality standards and reduce their carbon footprint, supported by government grants and mandates.

- Passenger Cars: While facing stronger competition from battery electric vehicles, advancements in cost reduction and infrastructure development are gradually increasing penetration.

Application: Non-vehicular

- Stationary Power: This segment encompasses backup power for critical infrastructure (telecom, data centers), combined heat and power (CHP) systems for buildings, and grid stabilization solutions. The reliability and long-duration power capabilities of fuel cells are highly valued.

- Material Handling Equipment: Fuel cell forklifts offer advantages in terms of fast refueling and continuous operation in demanding warehouse environments.

Technology: Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- Dominance: PEMFCs are the most prevalent technology, especially for vehicular applications, due to their high power density, efficiency, and relatively low operating temperatures. Continuous improvements in membrane durability and catalyst efficiency are expanding their applicability.

- Key Drivers: Advancements in proton exchange membranes, platinum group metal (PGM) reduction strategies, and improved stack designs are critical for market leadership.

Technology: Solid Oxide Fuel Cell (SOFC)

- Growth Potential: SOFCs are gaining traction for stationary power generation, particularly for CHP applications and large-scale power plants, owing to their high electrical efficiency and ability to utilize a wider range of fuels, including natural gas and biogas.

- Key Drivers: Research into advanced ceramic electrolytes and electrode materials, along with efforts to reduce operating temperatures, are enhancing their competitiveness.

Technology: Other Technologies

- Emerging Solutions: This includes technologies like alkaline fuel cells (AFCs), direct methanol fuel cells (DMFCs), and phosphoric acid fuel cells (PAFCs), which find niche applications where their specific advantages outweigh cost or complexity.

Fuel Cell Market Product Developments

Product developments in the fuel cell market are increasingly focused on enhancing performance, reducing costs, and expanding application ranges. Innovations are seen in next-generation PEMFC stacks with higher power density and improved durability, alongside advancements in SOFC technology to lower operating temperatures and improve fuel flexibility. Companies are also developing integrated fuel cell systems that combine fuel cells with energy storage solutions for enhanced reliability and efficiency. The development of more robust and cost-effective catalysts, along with advancements in membrane technology, are crucial for wider market adoption. These product innovations are directly targeting the growing demand for zero-emission transportation, reliable stationary power, and portable energy solutions, providing a significant competitive advantage for early adopters.

Key Drivers of Fuel Cell Market Growth

The fuel cell market's growth is propelled by a confluence of powerful factors. Technological advancements are leading to more efficient, durable, and cost-effective fuel cell systems. Economic factors, such as falling production costs due to economies of scale and declining raw material prices, are making fuel cells increasingly competitive. Crucially, regulatory factors play a pivotal role, with governments worldwide implementing policies, subsidies, and mandates to support hydrogen adoption and reduce carbon emissions. For instance, the push for decarbonization in the transportation sector is a major driver for fuel cell electric vehicles.

Challenges in the Fuel Cell Market Market

Despite the promising outlook, the fuel cell market faces several challenges. Regulatory hurdles can be complex and vary significantly across different regions, impacting widespread adoption. Supply chain issues, particularly concerning the availability and cost of key materials like platinum and rare earth elements, can pose a constraint. High upfront costs compared to conventional technologies, although decreasing, remain a barrier for some applications. Competitive pressures from established battery technologies, especially in the light-duty vehicle segment, also present a challenge. Furthermore, the development of adequate hydrogen infrastructure, including production, storage, and refueling stations, is critical and requires substantial investment.

Emerging Opportunities in Fuel Cell Market

The fuel cell market is brimming with emerging opportunities driven by several catalysts. Technological breakthroughs in areas like solid-state electrolytes and advanced catalyst materials promise further improvements in performance and cost. Strategic partnerships between fuel cell manufacturers, automotive companies, and energy providers are accelerating market penetration and infrastructure development. The growing focus on green hydrogen production using renewable energy sources creates a synergistic relationship, as clean hydrogen is essential for fuel cell applications. Furthermore, the expansion of fuel cells into new market segments, such as aviation and maritime transport, presents significant long-term growth potential.

Leading Players in the Fuel Cell Market Sector

- SFC Energy AG

- Toshiba Energy Systems & Solutions Corporation

- FuelCell Energy Inc.

- Ballard Power Systems Inc.

- Cummins Inc.

- Plug Power Inc.

- Intelligent Energy Limited

- Horizon Fuel Cell Technologies Pte Ltd

- Nuvera Fuel Cells LLC

- Mitsubishi Power Ltd

Key Milestones in Fuel Cell Market Industry

- February 2023: SFC Energy AG and FC TecNrgy Pvt Ltd signed a strategic cooperation agreement to establish a hydrogen and methanol fuel cell manufacturing facility in India, aligning with India's National Green Hydrogen Mission for carbon reduction and clean energy supply.

- August 2022: Bosch announced an investment exceeding USD 200 million in fuel cell stack manufacturing at its South Carolina facility, targeting hydrogen-powered electric commercial trucks in the United States, with production slated to begin in 2026. Globally, Bosch aims to invest approximately USD 1 billion in fuel cell technologies by 2024.

Strategic Outlook for Fuel Cell Market Market

The strategic outlook for the fuel cell market is exceptionally positive, driven by a clear global trajectory towards decarbonization and energy independence. Growth accelerators include the continued development of robust hydrogen ecosystems, government incentives, and increasing industrial adoption for both mobile and stationary power applications. The synergy between renewable energy generation and green hydrogen production will further bolster demand. Key opportunities lie in expanding the adoption of fuel cells in heavy-duty transportation, industrial processes, and long-duration energy storage. Companies that can effectively navigate technological advancements, cost reductions, and infrastructure development will be well-positioned to capture significant market share and contribute to a sustainable energy future.

Fuel Cell Market Segmentation

-

1. Application

- 1.1. Vehicular

- 1.2. Non-vehicular

-

2. Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Technologies

Fuel Cell Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. South Korea

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Fuel Cell Market Regional Market Share

Geographic Coverage of Fuel Cell Market

Fuel Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Competition for Alternative Energy Source

- 3.4. Market Trends

- 3.4.1. Vehicular Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Vehicular

- 5.1.2. Non-vehicular

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Vehicular

- 6.1.2. Non-vehicular

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Vehicular

- 7.1.2. Non-vehicular

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Vehicular

- 8.1.2. Non-vehicular

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Vehicular

- 9.1.2. Non-vehicular

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Vehicular

- 10.1.2. Non-vehicular

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SFC Energy AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Energy Systems & Solutions Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FuelCell Energy Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ballard Power Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cummins Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Plug Power Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intelligent Energy Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Horizon Fuel Cell Technologies Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nuvera Fuel Cells LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Power Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SFC Energy AG

List of Figures

- Figure 1: Global Fuel Cell Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fuel Cell Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Fuel Cell Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Fuel Cell Market Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Fuel Cell Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Fuel Cell Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fuel Cell Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fuel Cell Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Fuel Cell Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Fuel Cell Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Fuel Cell Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Fuel Cell Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Fuel Cell Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fuel Cell Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Fuel Cell Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Fuel Cell Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Pacific Fuel Cell Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Fuel Cell Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Fuel Cell Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fuel Cell Market Revenue (Million), by Application 2025 & 2033

- Figure 21: South America Fuel Cell Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Fuel Cell Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: South America Fuel Cell Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: South America Fuel Cell Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Fuel Cell Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fuel Cell Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Fuel Cell Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Fuel Cell Market Revenue (Million), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Fuel Cell Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Fuel Cell Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fuel Cell Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Fuel Cell Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Fuel Cell Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Fuel Cell Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Fuel Cell Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Fuel Cell Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Fuel Cell Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Fuel Cell Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global Fuel Cell Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Fuel Cell Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fuel Cell Market?

The projected CAGR is approximately 32.59%.

2. Which companies are prominent players in the Fuel Cell Market?

Key companies in the market include SFC Energy AG, Toshiba Energy Systems & Solutions Corporation, FuelCell Energy Inc, Ballard Power Systems Inc, Cummins Inc *List Not Exhaustive, Plug Power Inc, Intelligent Energy Limited, Horizon Fuel Cell Technologies Pte Ltd, Nuvera Fuel Cells LLC, Mitsubishi Power Ltd.

3. What are the main segments of the Fuel Cell Market?

The market segments include Application, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector.

6. What are the notable trends driving market growth?

Vehicular Application to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition for Alternative Energy Source.

8. Can you provide examples of recent developments in the market?

February 2023: SFC Energy AG, a hydrogen and methanol fuel cell supplier, and FC TecNrgy Pvt Ltd inked a strategic cooperation agreement to set up a manufacturing facility for hydrogen and methanol fuel cells in India. SFC Energy AG would oversee the manufacturing and quality assurance of fuel cells. At the same time, FC TecNrgy Pvt. Ltd. would look for the development, installation, and integration of custom fuel cell solutions. This development came against the backdrop of India's strategic framework called the National Green Hydrogen Mission, which aims for carbon reduction and a clean energy supply.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fuel Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fuel Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fuel Cell Market?

To stay informed about further developments, trends, and reports in the Fuel Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence