Key Insights

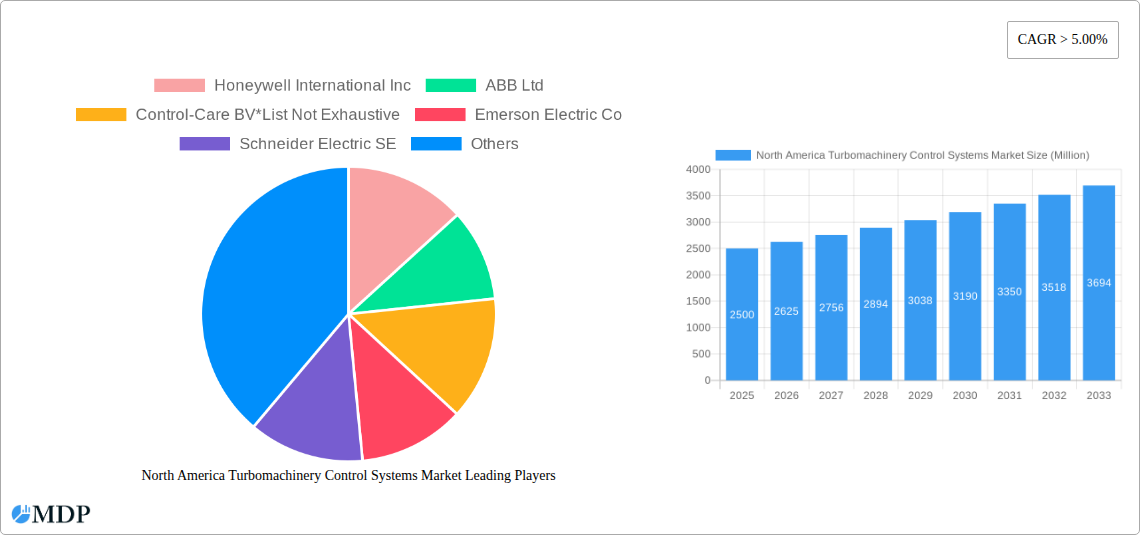

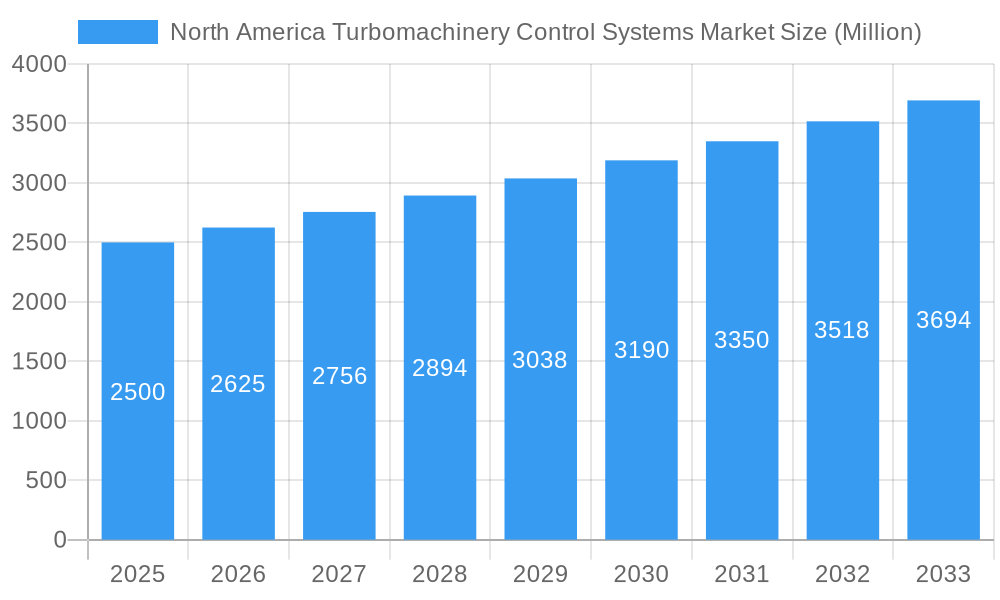

The North America Turbomachinery Control Systems Market is projected for significant expansion, propelled by escalating investments across power generation, oil & gas, and chemical processing sectors. With an estimated market size of USD 7073.5 million in 2025, the sector is forecast to achieve a Compound Annual Growth Rate (CAGR) of 2.3% through 2033. This growth is attributed to the essential requirement for efficient, reliable, and secure operation of turbomachinery, vital for numerous industrial applications. Advancements in digital control systems, including sophisticated automation, predictive maintenance, and IoT integration, are substantially improving operational efficiency and minimizing downtime. These innovations are critical for industries navigating stringent regulations and striving for optimized energy consumption and reduced environmental impact.

North America Turbomachinery Control Systems Market Market Size (In Billion)

Key growth catalysts include the ongoing modernization of power infrastructure, expansion of natural gas networks, and rising demand for high-performance compressors in the chemical and petrochemical industries. The "Other End-use Industries" segment, encompassing metals and mining, also contributes to market growth as these sectors increasingly adopt advanced turbomachinery. Potential restraints involve the substantial initial investment for advanced control systems and the demand for skilled professionals. Geographically, the United States leads the North American market, supported by its robust industrial base and energy infrastructure investments. Canada and other North American regions are also anticipated to experience consistent growth in alignment with technological progress and industrial development. Key market players such as Honeywell, ABB, Emerson Electric, and Siemens Energy are driving market dynamics through innovation and strategic collaborations.

North America Turbomachinery Control Systems Market Company Market Share

North America Turbomachinery Control Systems Market: Comprehensive Analysis and Forecast (2019-2033)

This report provides an in-depth analysis of the North America Turbomachinery Control Systems Market, a critical sector supporting the efficient operation of power generation, oil and gas, and chemical industries. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this research offers actionable insights into market dynamics, key trends, leading players, and future growth opportunities. High-traffic keywords such as "turbomachinery control systems," "turbine controls," "compressor controls," "power generation automation," "oil and gas automation," and "chemical industry automation" are integrated to maximize search visibility for industry stakeholders.

North America Turbomachinery Control Systems Market Market Dynamics & Concentration

The North America Turbomachinery Control Systems Market is characterized by a moderate level of concentration, with a few key players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for greater operational efficiency, enhanced safety, and adherence to stringent environmental regulations. Automation technologies, including advanced digital controls, AI-driven diagnostics, and IoT integration, are at the forefront of product development. Regulatory frameworks, particularly concerning emissions and safety standards, play a crucial role in shaping market demands and product specifications. Product substitutes, while existing in simpler control mechanisms, are increasingly being phased out due to the superior performance and reliability offered by advanced turbomachinery control systems. End-user trends highlight a growing preference for integrated solutions that offer real-time monitoring, predictive maintenance capabilities, and remote operational control. Merger and acquisition (M&A) activities, though not exceptionally high, are strategic, focusing on consolidating market presence, acquiring new technologies, and expanding service portfolios. The market has witnessed several significant M&A deals aimed at enhancing competitive advantages and market reach within the energy and industrial sectors.

North America Turbomachinery Control Systems Market Industry Trends & Analysis

The North America Turbomachinery Control Systems Market is poised for substantial growth, driven by several key factors. The increasing demand for energy, particularly in the power generation and oil and gas sectors, is a primary growth driver. As these industries expand their operations and upgrade existing infrastructure, the need for advanced and reliable turbomachinery control systems escalates. Technological advancements are revolutionizing the market, with a significant shift towards digitalization, the Industrial Internet of Things (IIoT), and artificial intelligence (AI) being integrated into control systems. These technologies enable enhanced predictive maintenance, remote monitoring, and optimized performance, leading to reduced downtime and operational costs. Consumer preferences are evolving towards sophisticated, integrated control solutions that offer greater autonomy, cybersecurity, and adaptability to changing operational demands. The competitive landscape is dynamic, with leading companies continuously investing in research and development to introduce innovative products and solutions. The market penetration of advanced control systems is steadily increasing as industries recognize the long-term benefits of automation and efficiency. The Compound Annual Growth Rate (CAGR) for the North America Turbomachinery Control Systems Market is projected to be robust, reflecting the sustained demand and technological evolution within the sector. The ongoing energy transition, with a focus on renewables and more efficient fossil fuel utilization, also contributes to the market's expansion, necessitating advanced control for a wider range of turbomachinery applications.

Leading Markets & Segments in North America Turbomachinery Control Systems Market

The United States stands as the dominant market within North America for turbomachinery control systems. This dominance is attributed to the country's vast and established power generation infrastructure, extensive oil and gas exploration and production activities, and a significant chemical manufacturing base. Economic policies supporting industrial development and large-scale infrastructure projects further bolster demand.

Application Dominance:

- Turbine Controls: This segment leads due to the widespread use of turbines in power generation (gas turbines, steam turbines) and the oil and gas industry (gas turbine-driven compressors, mechanical drive turbines). The need for precise control over speed, load, and safety parameters is paramount.

- Compressor Controls: This segment is also a major contributor, particularly in the oil and gas sector, where compressors are essential for the transportation and processing of hydrocarbons. The integration of advanced control systems ensures optimal efficiency and prevents operational upsets.

End-use Industry Dominance:

- Power: The power generation sector is the largest consumer of turbomachinery control systems, driven by the need for reliable and efficient electricity production from various sources, including natural gas, coal, and renewable energy integration.

- Oil and Gas: This sector is a significant driver, encompassing exploration, production, refining, and transportation of oil and gas, all of which rely heavily on turbomachinery.

- Chemical: The chemical industry utilizes turbomachinery for various processes, including compression and fluid handling, necessitating advanced control for safety and efficiency.

- Metals and Mining: This industry employs turbomachinery in applications such as ventilation and material handling, contributing to the overall market demand.

Geographical Dominance:

- United States: As mentioned, the US leads due to its extensive industrial base and energy infrastructure.

- Canada: Canada’s significant oil and gas reserves and growing power sector contribute to its substantial market share.

- Rest of North America: This includes Mexico and other smaller economies, with developing industrial sectors showing increasing adoption of advanced control systems.

North America Turbomachinery Control Systems Market Product Developments

Product development in the North America Turbomachinery Control Systems Market is focused on enhancing digitalization, connectivity, and intelligence. Innovations include advanced diagnostics and prognostics capabilities, AI-powered optimization algorithms, and enhanced cybersecurity features to protect critical industrial infrastructure. Companies are developing integrated solutions that offer seamless control and monitoring across complex turbomachinery fleets. The competitive advantage lies in systems that provide real-time performance data, predictive maintenance insights, and the ability to adapt to dynamic operating conditions, ultimately driving efficiency and reducing operational expenditures.

Key Drivers of North America Turbomachinery Control Systems Market Growth

Several factors are propelling the growth of the North America Turbomachinery Control Systems Market. The increasing demand for energy across various sectors, coupled with the need for enhanced operational efficiency and reliability, is a primary driver. Technological advancements, such as the adoption of IIoT for remote monitoring and predictive maintenance, are revolutionizing control system capabilities. Furthermore, stringent regulatory mandates for safety and environmental compliance are pushing industries to invest in advanced control solutions. The ongoing modernization of aging infrastructure in the power and oil and gas sectors also contributes significantly to market expansion, as companies seek to upgrade their control systems to meet current industry standards and improve performance.

Challenges in the North America Turbomachinery Control Systems Market Market

Despite robust growth, the North America Turbomachinery Control Systems Market faces certain challenges. High upfront investment costs for advanced control systems can be a barrier for some smaller enterprises. The complexity of integrating new systems with existing legacy infrastructure can also pose technical hurdles. Furthermore, the cybersecurity risks associated with interconnected industrial systems require constant vigilance and investment in robust security measures. A shortage of skilled personnel to operate and maintain these sophisticated control systems can also impact adoption rates and operational effectiveness.

Emerging Opportunities in North America Turbomachinery Control Systems Market

The North America Turbomachinery Control Systems Market is ripe with emerging opportunities. The growing adoption of renewable energy sources, such as wind and solar, is creating new demands for turbomachinery control systems in associated infrastructure like power grids and energy storage facilities. The increasing focus on energy efficiency and decarbonization initiatives is driving the development of advanced control solutions for optimizing the performance of existing and new turbomachinery. Strategic partnerships between technology providers and end-users are fostering innovation and the development of customized solutions. Furthermore, the expansion of the petrochemical and chemical industries in North America presents a significant opportunity for the deployment of specialized turbomachinery control systems.

Leading Players in the North America Turbomachinery Control Systems Market Sector

- Honeywell International Inc

- ABB Ltd

- Control-Care BV

- Emerson Electric Co

- Schneider Electric SE

- Hollysys Automation Technologies Ltd

- Siemens Energy AG

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- General Electric Company

Key Milestones in North America Turbomachinery Control Systems Market Industry

- March 2022: Baker Hughes awarded a contract to supply turbomachinery to Venture Global for the first phase of the Plaquemines LNG Project in Louisiana, United States, underscoring the demand for advanced control systems in critical energy infrastructure.

- 2021: Siemens Energy launched its new digital control platform for gas turbines, enhancing predictive maintenance and operational efficiency.

- 2020: GE launched its advanced control system for industrial steam turbines, aiming to improve reliability and reduce emissions in power generation.

- 2019: Emerson Electric acquired a company specializing in advanced analytics for industrial machinery, further strengthening its offerings in predictive maintenance for turbomachinery.

Strategic Outlook for North America Turbomachinery Control Systems Market Market

The strategic outlook for the North America Turbomachinery Control Systems Market remains exceptionally positive. Growth is expected to be fueled by continued investment in energy infrastructure, the ongoing digitalization of industrial processes, and the increasing emphasis on sustainable operations. Companies that can offer integrated, intelligent, and secure control solutions will be best positioned to capture market share. The strategic focus for market participants will be on developing innovative technologies that address evolving customer needs for enhanced efficiency, reduced environmental impact, and greater operational resilience. Expansion into emerging applications within the renewable energy sector and advanced manufacturing will also be key growth accelerators.

North America Turbomachinery Control Systems Market Segmentation

-

1. Application

- 1.1. Turbine Controls

- 1.2. Compressor Controls

-

2. End-use Industry

- 2.1. Power

- 2.2. Oil and Gas

- 2.3. Chemical

- 2.4. Metals and Mining

- 2.5. Other End-use Industries

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Turbomachinery Control Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Turbomachinery Control Systems Market Regional Market Share

Geographic Coverage of North America Turbomachinery Control Systems Market

North America Turbomachinery Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Worldwide4.; Rise In Electricity Demand Due Increase Industrial And Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Growth In Distributed Energy Generation

- 3.4. Market Trends

- 3.4.1. Power Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Turbomachinery Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Turbine Controls

- 5.1.2. Compressor Controls

- 5.2. Market Analysis, Insights and Forecast - by End-use Industry

- 5.2.1. Power

- 5.2.2. Oil and Gas

- 5.2.3. Chemical

- 5.2.4. Metals and Mining

- 5.2.5. Other End-use Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Turbomachinery Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Turbine Controls

- 6.1.2. Compressor Controls

- 6.2. Market Analysis, Insights and Forecast - by End-use Industry

- 6.2.1. Power

- 6.2.2. Oil and Gas

- 6.2.3. Chemical

- 6.2.4. Metals and Mining

- 6.2.5. Other End-use Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Turbomachinery Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Turbine Controls

- 7.1.2. Compressor Controls

- 7.2. Market Analysis, Insights and Forecast - by End-use Industry

- 7.2.1. Power

- 7.2.2. Oil and Gas

- 7.2.3. Chemical

- 7.2.4. Metals and Mining

- 7.2.5. Other End-use Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America Turbomachinery Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Turbine Controls

- 8.1.2. Compressor Controls

- 8.2. Market Analysis, Insights and Forecast - by End-use Industry

- 8.2.1. Power

- 8.2.2. Oil and Gas

- 8.2.3. Chemical

- 8.2.4. Metals and Mining

- 8.2.5. Other End-use Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ABB Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Control-Care BV*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Emerson Electric Co

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schneider Electric SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hollysys Automation Technologies Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens Energy AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Rockwell Automation Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Yokogawa Electric Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 General Electric Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Turbomachinery Control Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Turbomachinery Control Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Turbomachinery Control Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: North America Turbomachinery Control Systems Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 3: North America Turbomachinery Control Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Turbomachinery Control Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Turbomachinery Control Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: North America Turbomachinery Control Systems Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 7: North America Turbomachinery Control Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Turbomachinery Control Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: North America Turbomachinery Control Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: North America Turbomachinery Control Systems Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 11: North America Turbomachinery Control Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Turbomachinery Control Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: North America Turbomachinery Control Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: North America Turbomachinery Control Systems Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 15: North America Turbomachinery Control Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: North America Turbomachinery Control Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Turbomachinery Control Systems Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the North America Turbomachinery Control Systems Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Control-Care BV*List Not Exhaustive, Emerson Electric Co, Schneider Electric SE, Hollysys Automation Technologies Ltd, Siemens Energy AG, Rockwell Automation Inc, Yokogawa Electric Corporation, General Electric Company.

3. What are the main segments of the North America Turbomachinery Control Systems Market?

The market segments include Application, End-use Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7073.5 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Worldwide4.; Rise In Electricity Demand Due Increase Industrial And Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Power Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growth In Distributed Energy Generation.

8. Can you provide examples of recent developments in the market?

In March 2022, Baker Hughes was awarded a contract to supply turbomachinery to Venture Global for the first phase of the Plaquemines LNG Project in Louisiana, United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Turbomachinery Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Turbomachinery Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Turbomachinery Control Systems Market?

To stay informed about further developments, trends, and reports in the North America Turbomachinery Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence