Key Insights

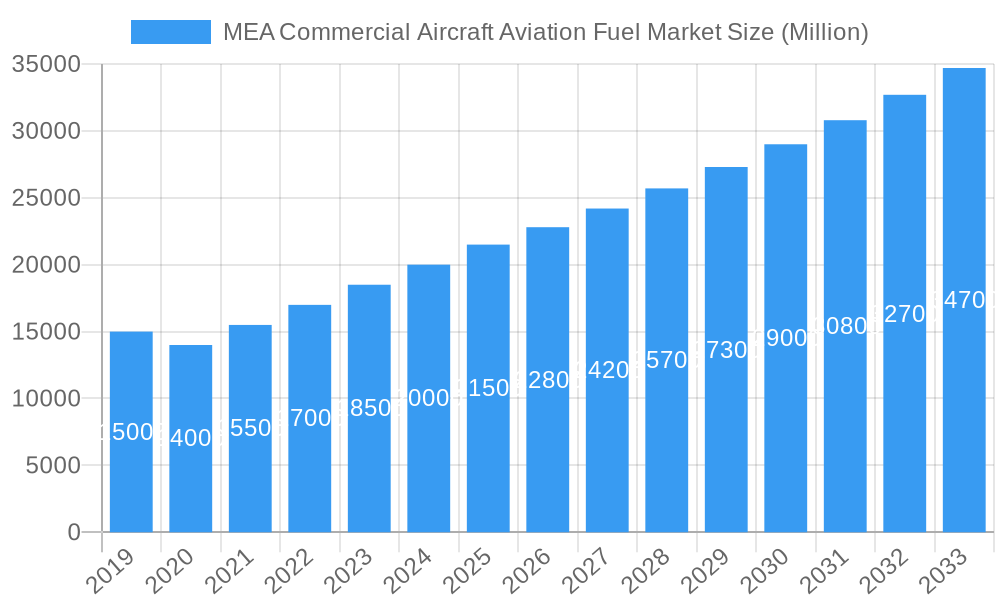

The Middle East and Africa (MEA) commercial aircraft aviation fuel market is set for substantial growth, projected to reach over 203.66 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 8.3%. This expansion is fueled by increasing air travel demand across the region, supported by rising disposable incomes, tourism growth, and enhanced trade activities. The UAE and Saudi Arabia are expected to lead this growth, with significant investments in aviation infrastructure and fleet expansion. The market is also influenced by the increasing adoption of biofuels and advancements in fuel efficiency technologies. Major industry players, including Shell PLC, Exxon Mobil Corporation, and TotalEnergies SE, are actively investing in sustainable aviation fuel (SAF) production and supply chains, signaling a strategic shift towards greener aviation.

MEA Commercial Aircraft Aviation Fuel Market Market Size (In Billion)

Challenges for the market include the volatility of crude oil prices, which directly impacts aviation fuel costs. The development and widespread adoption of advanced SAF technologies require substantial capital investment and robust regulatory frameworks. However, heightened environmental regulations and the global imperative for decarbonization are anticipated to create significant expansion opportunities. The MEA region's strategic position as a global air transit hub further supports sustained aviation fuel demand. The market is segmented by fuel type, with Air Turbine Fuel (ATF) currently dominating, though Aviation Biofuel's share is expected to grow as sustainability becomes a primary concern for airlines and governments.

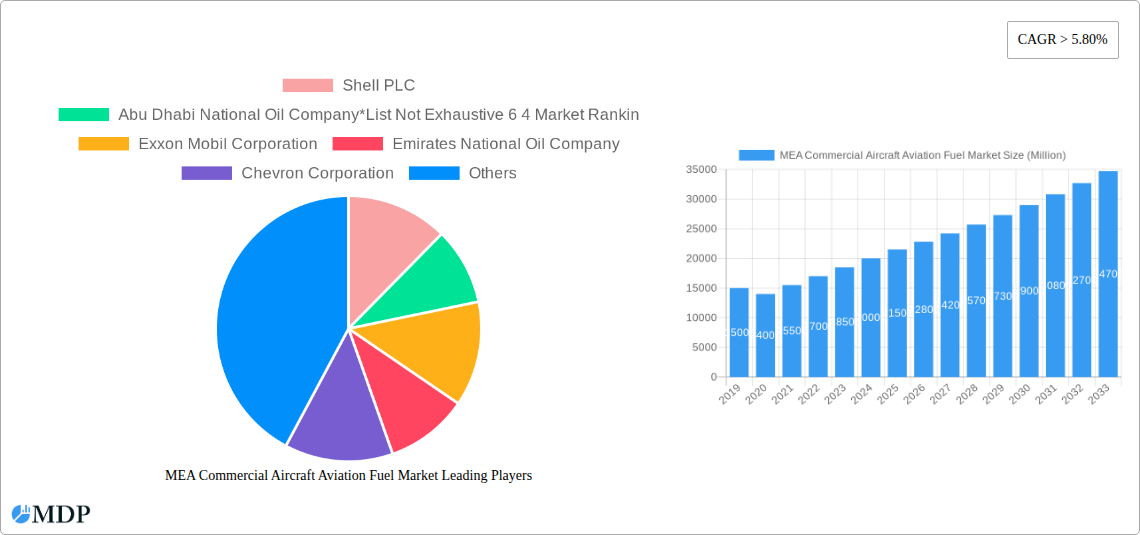

MEA Commercial Aircraft Aviation Fuel Market Company Market Share

This comprehensive market research report provides an in-depth analysis of the MEA commercial aircraft aviation fuel market dynamics, industry trends, key players, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders aiming to understand and capitalize on the evolving Middle East and Africa aviation fuel sector. We analyze key segments such as Air Turbine Fuel (ATF), Aviation Biofuel, and AVGAS, alongside critical industry developments, including significant sustainable aviation fuel (SAF) initiatives. This report utilizes high-traffic keywords such as "aviation fuel market," "MEA aviation," "sustainable aviation fuel," "ATF market," and "Middle East aerospace fuel" for optimal market visibility.

MEA Commercial Aircraft Aviation Fuel Market Market Dynamics & Concentration

The MEA Commercial Aircraft Aviation Fuel Market exhibits a moderate to high market concentration, driven by the presence of major energy corporations and a growing number of specialized aviation fuel suppliers. Innovation drivers are heavily influenced by the global push towards decarbonization, leading to increased investment in aviation biofuel research and development, alongside advancements in the supply and distribution of traditional jet fuels. Regulatory frameworks are becoming more stringent, particularly concerning emissions standards and the incentivization of sustainable fuel adoption. Product substitutes are limited for commercial aircraft, with Air Turbine Fuel (ATF) remaining the dominant requirement. However, the emergence of advanced aviation biofuels presents a significant long-term alternative. End-user trends are characterized by an increasing demand for cost-effectiveness, operational efficiency, and crucially, environmental sustainability. Mergers and acquisitions (M&A) activities are expected to rise as companies seek to consolidate their market positions and expand their SAF capabilities. Based on historical data and current trends, the M&A deal count is projected to see a significant increase in the forecast period, contributing to market consolidation.

MEA Commercial Aircraft Aviation Fuel Market Industry Trends & Analysis

The MEA Commercial Aircraft Aviation Fuel Market is poised for substantial growth, propelled by a confluence of factors including robust air travel demand, expanding airline fleets, and a strong governmental impetus towards diversifying energy sources and promoting sustainable aviation fuel (SAF). The Middle East and Africa aerospace market is witnessing a significant surge in passenger traffic, particularly from hubs in the UAE and Saudi Arabia, directly translating into a higher demand for aviation fuel. Technological disruptions are primarily centered around the production and integration of aviation biofuels and other renewable fuel alternatives. Companies are investing heavily in advanced refining processes and infrastructure to support the broader adoption of these greener fuels. Consumer preferences, largely dictated by airlines and cargo operators, are increasingly shifting towards fuels that offer competitive pricing, reliable supply chains, and a reduced environmental footprint. The competitive dynamics within the market are intensifying, with established oil and gas majors facing growing competition from emerging players focused on sustainable energy solutions. The CAGR for the MEA Commercial Aircraft Aviation Fuel Market is estimated to be in the range of 5.5% to 6.5% during the forecast period, indicating a healthy expansion. Market penetration of sustainable aviation fuels is currently low but is projected to accelerate significantly in the coming years, driven by regulatory mandates and corporate sustainability goals.

Leading Markets & Segments in MEA Commercial Aircraft Aviation Fuel Market

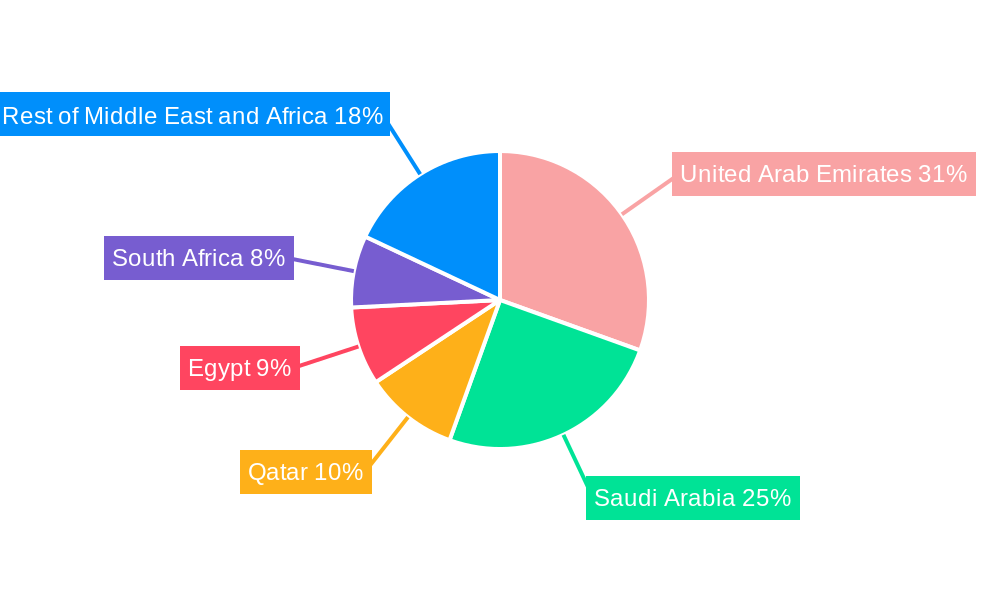

The dominant region within the MEA Commercial Aircraft Aviation Fuel Market is undeniably the Middle East, driven by its status as a major global aviation hub and the presence of leading airlines. Countries like the United Arab Emirates and Saudi Arabia are at the forefront, fueled by substantial investments in airport infrastructure and ambitious plans to expand their aviation sectors. Economic policies in these nations actively support the growth of the aviation industry, including favorable trade agreements and incentives for airlines.

Fuel Type Dominance:

Air Turbine Fuel (ATF): This segment continues to hold the largest market share due to its established infrastructure and widespread use across the commercial aviation fleet.

- Key Drivers: High volume demand from existing aircraft, extensive global supply networks, and continued reliance on conventional jet engines.

- Dominance Analysis: The sheer number of commercial flights operating within and through the MEA region makes ATF indispensable in the short to medium term. Investments in refining capacity and logistical networks further solidify its leading position.

Aviation Biofuel: This segment is experiencing the most rapid growth and innovation.

- Key Drivers: Global and regional commitments to reduce carbon emissions, government mandates for SAF blending, advancements in feedstock availability (e.g., agricultural waste, used cooking oil), and strategic partnerships between energy companies and aircraft manufacturers.

- Dominance Analysis: While currently holding a smaller market share compared to ATF, aviation biofuel is projected to witness exponential growth. Early adoption by forward-thinking airlines and significant R&D investments by major energy players are key indicators of its future prominence.

AVGAS: This fuel type is primarily used for piston-engine aircraft, particularly in general aviation and smaller commercial operations.

- Key Drivers: Growth in the general aviation sector, flight training schools, and smaller regional airlines.

- Dominance Analysis: While important for its specific niche, AVGAS represents a smaller fraction of the overall MEA Commercial Aircraft Aviation Fuel Market compared to ATF and the rapidly growing aviation biofuel segment. Its growth is more localized and dependent on the expansion of general aviation activities.

MEA Commercial Aircraft Aviation Fuel Market Product Developments

Product developments in the MEA Commercial Aircraft Aviation Fuel Market are increasingly focused on sustainability and performance enhancement. The primary trend is the innovation in aviation biofuel production, utilizing diverse feedstocks and advanced conversion technologies to create drop-in fuels that are compatible with existing aircraft engines. Companies are also investing in research to improve the energy density and cost-effectiveness of these sustainable alternatives. Furthermore, there's an ongoing refinement of Air Turbine Fuel (ATF) formulations to meet stricter environmental regulations and improve engine efficiency. The competitive advantage lies in developing scalable and affordable SAF solutions, alongside ensuring a robust and reliable supply chain for all aviation fuel types.

Key Drivers of MEA Commercial Aircraft Aviation Fuel Market Growth

The MEA Commercial Aircraft Aviation Fuel Market is propelled by several key drivers. Economically, the expansion of tourism and trade in the region fuels a consistent rise in air travel demand, directly increasing the need for aviation fuel. Technologically, advancements in sustainable aviation fuel (SAF) production, including the development of new conversion processes and feedstock utilization, are critical. Regulatory factors, such as government mandates for emissions reduction and incentives for SAF adoption, are playing an increasingly significant role. For example, the UAE's commitment to net-zero emissions by 2050 provides a strong impetus for the adoption of cleaner aviation fuels.

Challenges in the MEA Commercial Aircraft Aviation Fuel Market Market

Despite robust growth prospects, the MEA Commercial Aircraft Aviation Fuel Market faces several challenges. Regulatory hurdles can arise from the varying levels of SAF mandates and certification processes across different countries within the region, leading to fragmentation. Supply chain issues for aviation biofuel feedstock and infrastructure development for SAF blending and distribution remain significant barriers. Furthermore, the higher production cost of SAF compared to conventional jet fuel presents a substantial economic challenge, impacting airline profitability. Competitive pressures from established fossil fuel suppliers also influence market dynamics.

Emerging Opportunities in MEA Commercial Aircraft Aviation Fuel Market

Emerging opportunities in the MEA Commercial Aircraft Aviation Fuel Market are centered around technological breakthroughs and strategic partnerships. The increasing global focus on decarbonization is creating a strong demand for sustainable aviation fuel (SAF), presenting a vast market for producers and suppliers. Strategic collaborations between energy companies, aircraft manufacturers, airlines, and governments are crucial for scaling up SAF production and deployment. For instance, the development of local SAF production facilities utilizing regional agricultural waste could significantly reduce reliance on imports and foster economic growth. Market expansion strategies focused on developing robust SAF supply chains and investing in innovative fuel technologies will be key to unlocking long-term growth.

Leading Players in the MEA Commercial Aircraft Aviation Fuel Market Sector

- Shell PLC

- Abu Dhabi National Oil Company

- Exxon Mobil Corporation

- Emirates National Oil Company

- Chevron Corporation

- TotalEnergies SE

- BP PLC

- Repsol SA

Key Milestones in MEA Commercial Aircraft Aviation Fuel Market Industry

- May 2023: Abu Dhabi energy group Masdar, one of the leading clean energy companies, signed an agreement with Airbus, a leading aircraft manufacturing company in Europe, to develop a sustainable aviation fuel market for airplanes in the Middle East and Africa region. The agreement signed between the companies involves developing sustainable aviation fuels using biofuels, green hydrogen, and various other renewable energy sources.

- Jan 2023: Emirates, one of the major airline companies in the Middle East, became the first company to use GE 90 jet engines developed by General Electric, one of the major companies in the energy segment. The engines used other force engines developed by General Electric company that run on sustainable aviation fuels. The company announced that in the coming years, it expects the engines to be used in most of the commercial flights used by the Emirates.

Strategic Outlook for MEA Commercial Aircraft Aviation Fuel Market Market

The strategic outlook for the MEA Commercial Aircraft Aviation Fuel Market is overwhelmingly positive, driven by a strong commitment to sustainability and the continued expansion of air travel. Growth accelerators include ongoing investments in SAF research and development, leading to more cost-effective and scalable production methods. Strategic opportunities lie in the formation of robust public-private partnerships to support infrastructure development for SAF distribution and adoption. The region's growing capacity for renewable energy generation also presents an opportunity for the production of green hydrogen-based aviation fuels. By focusing on innovation, collaboration, and regulatory alignment, the MEA Commercial Aircraft Aviation Fuel Market is well-positioned for sustained and significant growth in the coming years.

MEA Commercial Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

MEA Commercial Aircraft Aviation Fuel Market Segmentation By Geography

- 1. The United Arab Emirates

- 2. Saudi Arabia

- 3. Qatar

- 4. Egypt

- 5. South Africa

- 6. Rest of the Middle East and Africa

MEA Commercial Aircraft Aviation Fuel Market Regional Market Share

Geographic Coverage of MEA Commercial Aircraft Aviation Fuel Market

MEA Commercial Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Airline Fleet4.; Economic Development

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility in Oil Price

- 3.4. Market Trends

- 3.4.1. Aviation Biofuel to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. The United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Qatar

- 5.2.4. Egypt

- 5.2.5. South Africa

- 5.2.6. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Qatar MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Egypt MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. AVGAS

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. South Africa MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Air Turbine Fuel (ATF)

- 10.1.2. Aviation Biofuel

- 10.1.3. AVGAS

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11.1.1. Air Turbine Fuel (ATF)

- 11.1.2. Aviation Biofuel

- 11.1.3. AVGAS

- 11.1. Market Analysis, Insights and Forecast - by Fuel Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shell PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Abu Dhabi National Oil Company*List Not Exhaustive 6 4 Market Rankin

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Emirates National Oil Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Chevron Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 TotalEnergies SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BP PLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Repsol SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Shell PLC

List of Figures

- Figure 1: Global MEA Commercial Aircraft Aviation Fuel Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global MEA Commercial Aircraft Aviation Fuel Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 4: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 5: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 7: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 8: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 9: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: The United Arab Emirates MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 12: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 13: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 14: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 15: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Qatar MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 20: Qatar MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 21: Qatar MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 22: Qatar MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 23: Qatar MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Qatar MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Qatar MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Egypt MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 28: Egypt MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 29: Egypt MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 30: Egypt MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 31: Egypt MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Egypt MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Egypt MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Egypt MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Africa MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 36: South Africa MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 37: South Africa MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 38: South Africa MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 39: South Africa MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 40: South Africa MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Africa MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Africa MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 44: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Fuel Type 2025 & 2033

- Figure 45: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 46: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 47: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the Middle East and Africa MEA Commercial Aircraft Aviation Fuel Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 7: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 11: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 15: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 19: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 22: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 23: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Fuel Type 2020 & 2033

- Table 27: Global MEA Commercial Aircraft Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global MEA Commercial Aircraft Aviation Fuel Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Commercial Aircraft Aviation Fuel Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the MEA Commercial Aircraft Aviation Fuel Market?

Key companies in the market include Shell PLC, Abu Dhabi National Oil Company*List Not Exhaustive 6 4 Market Rankin, Exxon Mobil Corporation, Emirates National Oil Company, Chevron Corporation, TotalEnergies SE, BP PLC, Repsol SA.

3. What are the main segments of the MEA Commercial Aircraft Aviation Fuel Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.66 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Airline Fleet4.; Economic Development.

6. What are the notable trends driving market growth?

Aviation Biofuel to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Volatility in Oil Price.

8. Can you provide examples of recent developments in the market?

May 2023: Abu Dhabi energy group Masdar, one of the leading clean energy companies, signed an agreement with Airbus, a leading aircraft manufacturing company in Europe, to develop a sustainable aviation fuel market for airplanes in the Middle East and Africa region. The agreement signed between the companies involves developing sustainable aviation fuels using biofuels, green hydrogen, and various other renewable energy sources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Commercial Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Commercial Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Commercial Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the MEA Commercial Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence