Key Insights

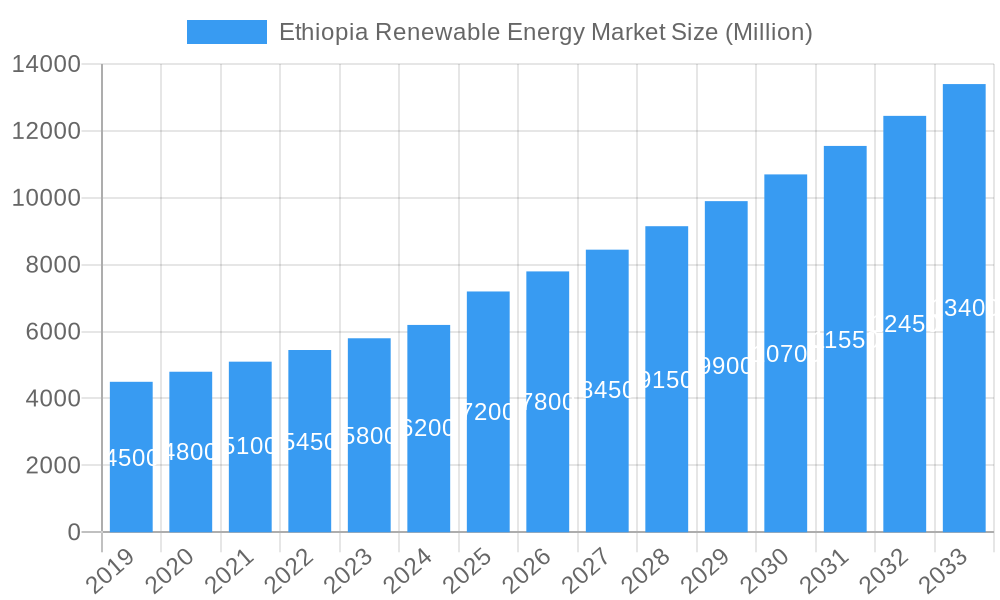

The Ethiopian renewable energy market is poised for significant expansion, projected to surpass \$7,200 million in value by 2025 with a robust Compound Annual Growth Rate (CAGR) exceeding 7.00%. This dynamic growth is propelled by a confluence of strategic drivers, including the nation's ambitious electrification targets, a strong governmental commitment to sustainable development, and abundant natural resources ideal for renewable energy generation. Hydropower, long a cornerstone of Ethiopia's energy landscape, continues to play a vital role, however, the market is witnessing a pronounced shift towards diversification. Wind and solar power, in particular, are emerging as dominant forces, attracting substantial investment and technological advancements. The government's supportive policies, such as tax incentives and streamlined permitting processes, further catalyze this transition. This burgeoning renewable energy sector is critical for meeting the escalating energy demand from a rapidly growing population and industrializing economy, promising greater energy security and reduced reliance on traditional, often volatile, energy sources.

Ethiopia Renewable Energy Market Market Size (In Billion)

The market's expansion is further shaped by evolving trends that underscore a move towards decentralized energy solutions and enhanced grid integration. Innovations in battery storage technology are increasingly being adopted to address the intermittency of solar and wind power, thereby improving grid stability and reliability. Geothermal energy also presents a considerable untapped potential, with ongoing exploration and development activities suggesting it will contribute meaningfully to the energy mix. Despite the promising outlook, certain restraints, such as the need for substantial upfront capital investment and infrastructure development, particularly in remote areas, warrant attention. However, the strong momentum, coupled with international financial support and private sector engagement from key players like Siemens Gamesa Renewable Energy SA and ANDRITZ AG, is expected to overcome these hurdles. The market's segmentation, heavily favoring hydropower and wind, is anticipated to see a significant surge in solar's contribution in the coming years, creating a more balanced and resilient renewable energy ecosystem in Ethiopia.

Ethiopia Renewable Energy Market Company Market Share

Ethiopia Renewable Energy Market: Unlocking Massive Growth Potential and Investment Opportunities (2019–2033)

This comprehensive report provides an in-depth analysis of the Ethiopia Renewable Energy Market, forecasting significant expansion driven by ambitious national targets and abundant natural resources. Explore the burgeoning Ethiopian solar energy market, the untapped Ethiopian geothermal energy potential, and the established Ethiopian hydropower sector. Gain actionable insights into market dynamics, industry trends, key players, and strategic outlooks, crucial for renewable energy investment in Ethiopia. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report is your essential guide to navigating the opportunities within Ethiopia's rapidly evolving green energy landscape.

Ethiopia Renewable Energy Market Market Dynamics & Concentration

The Ethiopia Renewable Energy Market is characterized by a growing but still relatively fragmented landscape, with significant potential for future consolidation and innovation. While hydropower has historically dominated the energy mix, the increasing focus on diversification is leading to a more balanced market. Innovation drivers are primarily centered around cost reduction for solar photovoltaic (PV) technologies and advancements in geothermal extraction techniques to harness Ethiopia's vast Rift Valley resources. Regulatory frameworks are evolving rapidly, with the government demonstrating a strong commitment to attracting foreign direct investment and fostering local participation. Product substitutes are limited within the core renewable energy sources, but advancements in energy storage solutions are becoming increasingly important to address intermittency. End-user trends are shifting towards a greater demand for reliable and affordable electricity, both for industrial growth and rural electrification. Merger and acquisition (M&A) activities are anticipated to increase as larger international players seek to capitalize on the market's immense potential. Currently, market share is heavily skewed towards existing hydropower facilities, but the projected growth in solar and geothermal segments will significantly alter this distribution. The number of M&A deals is expected to rise significantly in the coming years, driven by both domestic and international interest in the country's renewable energy prospects.

Ethiopia Renewable Energy Market Industry Trends & Analysis

The Ethiopia Renewable Energy Market is poised for explosive growth, driven by a confluence of factors including a strong government mandate for clean energy and a wealth of untapped natural resources. The nation's ambitious target to invest USD 40 billion in renewable energy infrastructure by 2031 underscores its commitment to a sustainable energy future. This investment will fuel the expansion across various segments, with a notable surge expected in Ethiopian solar power projects and the development of Ethiopian geothermal energy resources. Technological disruptions, particularly in solar PV efficiency and battery storage, are making renewable energy solutions increasingly competitive against traditional power sources. Consumer preferences are aligning with the global trend towards cleaner energy, as both industrial and residential users seek more sustainable and cost-effective electricity options. Competitive dynamics are intensifying, with international developers and local enterprises vying for market share. The projected Compound Annual Growth Rate (CAGR) for the renewable energy market in Ethiopia is substantial, estimated to be in the double digits, propelled by declining technology costs and supportive government policies. Market penetration of renewable energy, beyond existing hydropower, is still in its nascent stages but is expected to accelerate rapidly, especially in the solar and geothermal sectors. The government's proactive approach in facilitating private sector participation through Power Purchase Agreements (PPAs) and competitive bidding processes is a key growth driver, attracting significant foreign investment and expertise. The development of robust grid infrastructure to integrate these new capacities is also a critical trend, ensuring reliable power delivery across the nation.

Leading Markets & Segments in Ethiopia Renewable Energy Market

The Ethiopia Renewable Energy Market is characterized by a dynamic interplay between its established and emerging segments. While Hydropower has historically been the dominant source, contributing the largest share of installed capacity, the future growth trajectory points towards significant expansion in Solar and Geothermal energy.

Hydropower:

- Dominance: Remains the backbone of Ethiopia's electricity generation, leveraging the country's extensive river systems and significant dam infrastructure.

- Key Drivers: Favorable geography, existing large-scale project development expertise, and established grid integration.

- Detailed Analysis: Ethiopia's vast network of rivers, particularly the Blue Nile basin, provides immense potential for hydropower generation. Projects like the Grand Ethiopian Renaissance Dam (GERD) exemplify the scale of current and future hydropower development, crucial for both domestic consumption and regional export.

Solar:

- Emerging Powerhouse: Ethiopia possesses exceptionally high solar irradiation levels, making it an ideal location for solar PV development. The government's agreement with Masdar for 500 MW of solar projects signals a major push in this segment.

- Key Drivers: Declining solar panel costs globally, abundant sunshine, and the government's commitment to diversifying the energy mix.

- Detailed Analysis: The recent agreement for 500 MW of solar power projects, covering development through operation and maintenance, highlights the accelerating pace of solar energy adoption. This segment is expected to see substantial investment and rapid capacity additions in the coming years, playing a pivotal role in meeting future energy demands.

Geothermal:

- Untapped Potential: The Ethiopian Rift Valley is a globally recognized geothermal hotspot, offering significant, consistent baseload power generation opportunities.

- Key Drivers: Vast geothermal reserves, government initiatives to tap into this resource, and the strategic advantage of providing stable, 24/7 power.

- Detailed Analysis: Projects at Tulu Moye, Aluto Langano, and Corbetti are at the forefront of unlocking Ethiopia's geothermal potential. The country's plan to build 17 geothermal projects and achieve 35,000 MW of installed capacity by 2037 signifies a long-term strategic focus on this segment, positioning it as a critical component of Ethiopia's future energy security.

Others (Wind, Biomass):

- Complementary Sources: Wind energy, particularly in specific regions, offers another valuable renewable resource. Biomass, derived from agricultural waste, also presents localized energy generation possibilities.

- Key Drivers: Geographical suitability for wind and availability of biomass resources.

- Detailed Analysis: While currently smaller contributors, wind power projects are gaining traction in favorable locations. These segments, though not as prominent as solar or geothermal in current expansion plans, contribute to the overall diversification of Ethiopia's renewable energy portfolio.

Ethiopia Renewable Energy Market Product Developments

Product developments in the Ethiopia Renewable Energy Market are focused on enhancing efficiency and affordability. Innovations in solar PV technology, including higher energy conversion rates and more robust designs for diverse climatic conditions, are key. For geothermal energy, advancements in drilling techniques and exploration technologies are crucial for optimizing extraction from the Rift Valley's complex geological formations. Energy storage solutions, such as advanced battery systems, are also seeing development to complement the intermittent nature of some renewable sources. The competitive advantage lies in deploying technologies that are cost-effective, reliable, and scalable, aligning with Ethiopia's urgent need for increased and sustainable energy access.

Key Drivers of Ethiopia Renewable Energy Market Growth

The growth of the Ethiopia Renewable Energy Market is propelled by a robust combination of factors. Technologically, the falling costs of solar PV panels and advancements in geothermal exploration are making these sources increasingly viable. Economically, the strong government commitment to invest USD 40 billion in new renewable energy infrastructure over the next decade, coupled with the potential for significant foreign investment, creates a favorable financial landscape. Regulatorily, supportive policies, including attractive Power Purchase Agreements and streamlined investment processes, are crucial for attracting private sector participation and accelerating project development. The immense untapped potential of the country's natural resources, particularly its solar irradiation and geothermal reserves, serves as a fundamental driver for sustained expansion.

Challenges in the Ethiopia Renewable Energy Market Market

Despite the immense potential, the Ethiopia Renewable Energy Market faces several challenges. Regulatory hurdles, though improving, can still present complexities in project approvals and land acquisition. Supply chain issues, including the logistics of importing specialized equipment and the development of local manufacturing capabilities, can impact project timelines and costs. Furthermore, competitive pressures from established energy sources and the need for significant upfront capital investment for large-scale projects remain key restraints. The integration of variable renewable energy sources into the existing grid infrastructure also requires substantial investment and upgrades to ensure stability and reliability, presenting an ongoing challenge for widespread adoption.

Emerging Opportunities in Ethiopia Renewable Energy Market

Catalysts driving long-term growth in the Ethiopia Renewable Energy Market are multifaceted. Technological breakthroughs in energy storage solutions are poised to significantly enhance the dispatchability and reliability of solar and wind power. Strategic partnerships between Ethiopian entities and international renewable energy developers are crucial for knowledge transfer, capital infusion, and project execution. Market expansion strategies, particularly in rural electrification through off-grid and mini-grid solar solutions, represent a significant opportunity to uplift communities and drive economic development. The government's ambitious targets for installed capacity by 2037 present a clear roadmap for sustained investment and development across all renewable energy segments.

Leading Players in the Ethiopia Renewable Energy Market Sector

- Tulu Moye Geothermal Operations PLC

- Vergnet Groupe

- Solar Tech PLC

- Green Scene Energy PLC

- Siemens Gamesa Renewable Energy SA

- ANDRITZ AG

Key Milestones in Ethiopia Renewable Energy Market Industry

- September 2021: Ethiopia announces plans to invest USD 40 billion in new renewable energy infrastructure over the next ten years.

- Ongoing: Ethiopia actively taps into the Rift Valley's geothermal potential with projects at Tulu Moye, Aluto Langano, and Corbetti.

- Future (Post-2021 announcement): Country plans to build 17 geothermal projects and aims for 35,000 MW of installed capacity by 2037.

- March 2021: Government of Ethiopia and Masdar reach an agreement to develop 500 MW of solar power projects and related grid infrastructure.

- By End of 2022: Solar power projects from the Masdar agreement are expected to begin commercial operations.

Strategic Outlook for Ethiopia Renewable Energy Market Market

The strategic outlook for the Ethiopia Renewable Energy Market is exceptionally positive, characterized by strong growth accelerators. The government's clear vision and substantial investment plans, coupled with the nation's rich endowment of renewable resources, create a fertile ground for development. Continued focus on attracting foreign direct investment and fostering local capacity building will be crucial. The ongoing development of grid infrastructure will unlock the full potential of intermittent renewable sources like solar and wind. Strategic partnerships and technology transfer will further enhance the efficiency and sustainability of energy projects, positioning Ethiopia as a regional leader in green energy generation and a compelling destination for renewable energy investment.

Ethiopia Renewable Energy Market Segmentation

-

1. Source

- 1.1. Hydropower

- 1.2. Wind

- 1.3. Geothermal

- 1.4. Solar

- 1.5. Others

Ethiopia Renewable Energy Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Renewable Energy Market Regional Market Share

Ethiopia Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Cleaner Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Underdeveloped Power Grid

- 3.4. Market Trends

- 3.4.1. Wind Energy to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Hydropower

- 5.1.2. Wind

- 5.1.3. Geothermal

- 5.1.4. Solar

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tulu Moye Geothermal Operations PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vergnet Groupe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solar Tech PLC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Green Scene Energy PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANDRITZ AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Tulu Moye Geothermal Operations PLC

List of Figures

- Figure 1: Ethiopia Renewable Energy Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ethiopia Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Ethiopia Renewable Energy Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Ethiopia Renewable Energy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Ethiopia Renewable Energy Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Ethiopia Renewable Energy Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Renewable Energy Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Ethiopia Renewable Energy Market?

Key companies in the market include Tulu Moye Geothermal Operations PLC, Vergnet Groupe, Solar Tech PLC*List Not Exhaustive, Green Scene Energy PLC, Siemens Gamesa Renewable Energy SA, ANDRITZ AG.

3. What are the main segments of the Ethiopia Renewable Energy Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Cleaner Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Wind Energy to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Underdeveloped Power Grid.

8. Can you provide examples of recent developments in the market?

In September 2021, Ethiopia has announced plans to invest USD 40 billion in constructing new renewable energy infrastructure over the next ten years. Ethiopia has already begun to tap into the Rift Valley's geothermal potential with projects at Tulu Moye, Aluto Langano, and Corbetti. In the subsequent years, the country plans to build 17 geothermal projects and plans to have 35,000 MW of installed capacity by 2037.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Ethiopia Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence