Key Insights

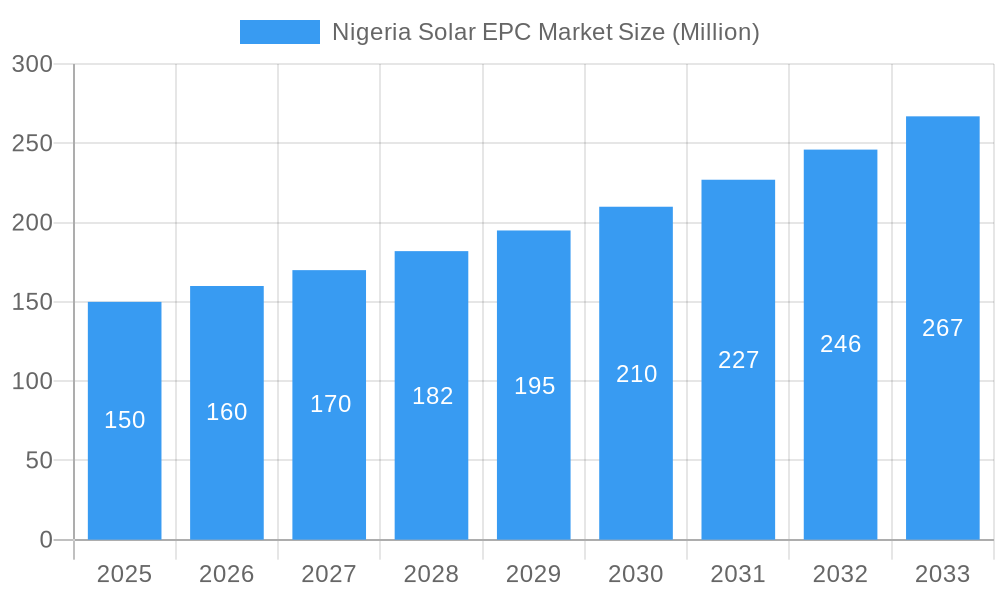

The Nigeria Solar EPC Market is projected for significant expansion, driven by Nigeria's increasing commitment to renewable energy. With an estimated market size of 407.6 billion USD, the sector is expected to achieve a Compound Annual Growth Rate (CAGR) of 8.1% during the study period. This growth is fueled by the escalating demand for dependable and affordable electricity, a critical need unmet by traditional power sources. Government policies promoting energy diversification and substantial investments in solar infrastructure are key catalysts. Declining solar technology costs enhance economic viability for both utility-scale and distributed generation projects. Growing awareness of solar power's environmental benefits and long-term cost savings also drives adoption. The "Other Power Generation Sources" segment, encompassing emerging and decentralized solutions alongside solar, indicates a dynamic energy landscape.

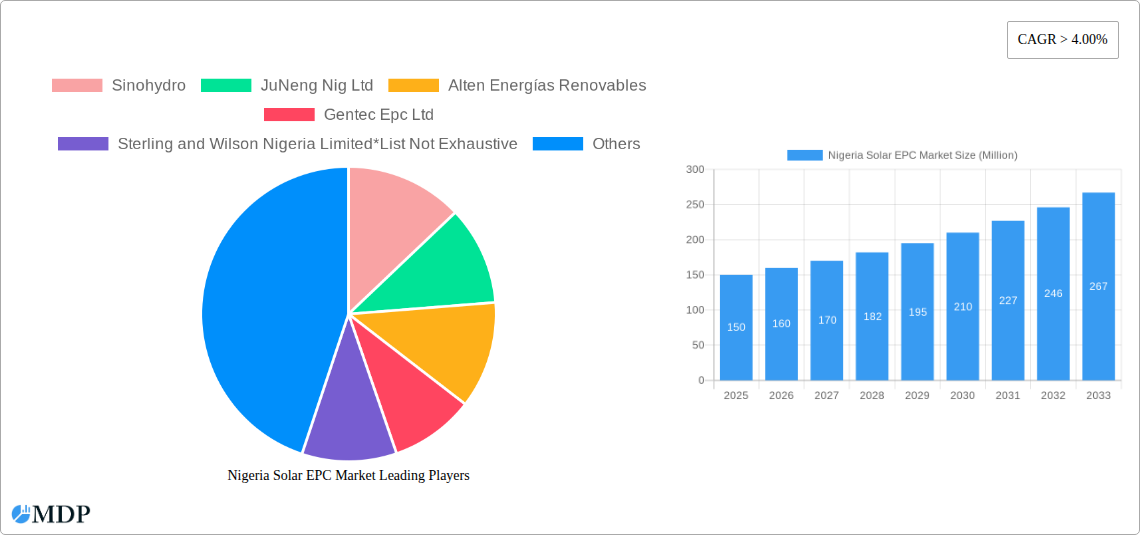

Nigeria Solar EPC Market Market Size (In Billion)

Prevailing trends, including a global emphasis on green energy solutions and increased participation from domestic and international players in the solar EPC sector, are shaping the market. Leading companies are at the forefront of delivering large-scale solar projects. However, challenges such as the need for robust grid infrastructure upgrades, complex regulatory frameworks, and potential financing hurdles require attention. Despite these constraints, the inherent demand for sustainable energy solutions in Nigeria is poised to propel the solar EPC market forward. The focus on renewables signals a clear shift towards a cleaner energy future, with a segmented approach to address diverse energy needs.

Nigeria Solar EPC Market Company Market Share

Explore the Nigeria Solar EPC Market with this comprehensive report, designed to illuminate growth trajectories, competitive landscapes, and investment opportunities. Our analysis covers a significant period, providing crucial insights for stakeholders. This report is an indispensable resource for those seeking to understand the dynamics of solar Engineering, Procurement, and Construction (EPC) services in Nigeria. We leverage high-traffic keywords such as "Nigeria solar power," "solar EPC Nigeria," "renewable energy Nigeria," "power generation Nigeria," and "EPC companies Nigeria" for maximum visibility.

Nigeria Solar EPC Market Market Dynamics & Concentration

The Nigeria Solar EPC Market exhibits a moderate concentration, driven by a confluence of increasing demand for reliable power and supportive government policies. Innovation in solar technology, including advancements in panel efficiency and energy storage solutions, is a key driver, pushing market players to adopt cutting-edge solutions. Regulatory frameworks, while evolving, are becoming more conducive to renewable energy investments, attracting both domestic and international players. Product substitutes, primarily from traditional thermal power generation, still pose a challenge, but the declining cost of solar technology and environmental concerns are shifting end-user preferences towards cleaner energy sources. Merger and acquisition (M&A) activities are on the rise as established companies seek to expand their portfolios and new entrants aim to secure market share. We anticipate xx number of M&A deals in the forecast period, contributing to market consolidation. Market share for leading EPC companies is projected to reach xx% by 2033, indicating a competitive yet consolidating environment.

- Market Concentration: Moderate, with key players vying for market dominance.

- Innovation Drivers: Technological advancements in solar panels, inverters, and battery storage.

- Regulatory Frameworks: Evolving policies encouraging renewable energy adoption.

- Product Substitutes: Traditional thermal power remains a substitute, but its influence is diminishing.

- End-User Trends: Growing preference for sustainable and cost-effective energy solutions.

- M&A Activities: Expected increase in strategic acquisitions and partnerships.

Nigeria Solar EPC Market Industry Trends & Analysis

The Nigeria Solar EPC Market is poised for substantial growth, fueled by a critical need to bridge the nation's persistent electricity deficit and a growing global push towards decarbonization. The market's expansion is directly linked to increasing investments in solar photovoltaic (PV) projects, ranging from utility-scale solar farms to distributed rooftop installations for commercial and industrial (C&I) sectors. Key growth drivers include government incentives, international development funding, and the decreasing levelized cost of electricity (LCOE) for solar power, making it increasingly competitive with fossil fuel-based generation. Technological disruptions, such as the integration of AI for predictive maintenance and the development of more efficient solar cells, are enhancing project viability and operational efficiency. Consumer preferences are rapidly shifting towards reliable, clean, and affordable energy, driving demand for solar EPC services across residential, commercial, and industrial segments. Competitive dynamics are characterized by a mix of local EPC firms and international developers, each bringing unique expertise and market access. Market penetration of solar energy is expected to grow from xx% in 2024 to xx% by 2033. The projected Compound Annual Growth Rate (CAGR) for the Nigeria Solar EPC Market is xx% over the forecast period.

Leading Markets & Segments in Nigeria Solar EPC Market

Within the Nigeria Solar EPC Market, the Renewables segment of Power Generation is the undisputed leader, driven by the nation's abundant solar resources and its commitment to diversifying its energy mix. This dominance is underpinned by several key drivers:

- Economic Policies: Favorable government policies such as tax incentives, import duty waivers for solar equipment, and the establishment of dedicated renewable energy agencies are creating a conducive investment climate. The Renewable Energy Policy of Nigeria and other related frameworks are crucial in this regard.

- Infrastructure Development: The urgent need for reliable electricity supply across the country, especially in off-grid and underserved areas, makes solar power an attractive and scalable solution. Investments in grid modernization also support the integration of solar power.

- Environmental Imperatives: Nigeria, like the rest of the world, is increasingly focused on mitigating climate change. Shifting away from fossil fuels towards cleaner energy sources like solar is a strategic priority.

- Cost Competitiveness: The decreasing global cost of solar technology, including solar panels and associated balance of system components, has made solar power generation economically viable and competitive with traditional power sources.

- International Funding and Partnerships: Access to funding from international financial institutions and bilateral development agencies further bolsters investment in renewable energy projects.

While Thermal power generation currently holds a significant share of Nigeria's energy mix, the growth trajectory for renewables, particularly solar, is far more pronounced. Other Power Generation Sources, which might include hydro and wind, also contribute but solar EPC services are projected to see the most rapid expansion due to its decentralized deployment potential and falling costs.

Nigeria Solar EPC Market Product Developments

Product developments in the Nigeria Solar EPC Market are largely focused on enhancing the efficiency, durability, and cost-effectiveness of solar energy systems. Innovations in higher-efficiency solar panels, such as PERC and bifacial modules, are gaining traction, allowing for greater energy generation from smaller footprints. The integration of advanced inverters with smart grid capabilities and improved battery storage solutions for enhanced reliability and grid stability are also key trends. These developments offer significant competitive advantages by reducing the overall cost of solar projects, increasing energy yields, and providing greater energy independence for end-users. The market is witnessing a trend towards more integrated and intelligent solar solutions, catering to diverse needs from residential to large-scale industrial applications.

Key Drivers of Nigeria Solar EPC Market Growth

The Nigeria Solar EPC Market is propelled by a powerful combination of factors. Technologically, the continuous improvement in solar panel efficiency and the decreasing cost of battery storage are making solar power more accessible and reliable. Economically, the growing demand for affordable and stable electricity, coupled with the desire to reduce reliance on expensive and often unreliable grid power and fossil fuels, is a significant driver. Regulatory frameworks are becoming increasingly supportive, with government policies aimed at encouraging renewable energy adoption and investment. Furthermore, the growing awareness of environmental sustainability and the global commitment to reducing carbon emissions are pushing Nigeria towards cleaner energy solutions.

Challenges in the Nigeria Solar EPC Market Market

Despite its promising outlook, the Nigeria Solar EPC Market faces several significant challenges. Regulatory hurdles, including bureaucratic complexities in project approvals and inconsistent policy implementation, can create uncertainty for investors and developers. Supply chain issues, such as the availability and cost of imported solar components and the lack of local manufacturing capacity, can lead to project delays and increased costs. Furthermore, financing challenges, including access to affordable long-term capital and currency fluctuations, remain a barrier for many projects. The underdeveloped transmission and distribution infrastructure can also limit the efficient integration of solar power into the national grid, and insufficient skilled labor for installation and maintenance poses a constraint.

Emerging Opportunities in Nigeria Solar EPC Market

Emerging opportunities in the Nigeria Solar EPC Market are abundant and diverse, driven by the nation's vast untapped solar potential. Technological breakthroughs in areas like perovskite solar cells and advanced energy storage systems offer the potential for even more efficient and cost-effective solar solutions. Strategic partnerships between local EPC firms and international technology providers are crucial for knowledge transfer and capacity building. The growing demand for off-grid and mini-grid solutions in rural and peri-urban areas presents a significant market expansion opportunity. Furthermore, the increasing adoption of electric vehicles (EVs) in Nigeria will likely drive demand for integrated solar charging infrastructure, opening up new avenues for EPC service providers.

Leading Players in the Nigeria Solar EPC Market Sector

- Sinohydro

- JuNeng Nig Ltd

- Alten Energías Renovables

- Gentec Epc Ltd

- Sterling and Wilson Nigeria Limited

- Energo Nigeria Ltd

- Andritz AG

Key Milestones in Nigeria Solar EPC Market Industry

- February 2023: GE Gas Power announced plans to invest in power assets that will add nearly 500 megawatts (MW) to Nigeria's national electricity grid by the second quarter of 2023. This includes the 240 MW Afam III power plant in Port Harcourt, the 50 MW Maiduguri project with the Nigerian National Petroleum Company Limited (NNPC), and another 50 MW project for the Dangote Group.

- December 2022: The Federal Government of Nigeria announced that 11 hydropower projects with a total capacity of 3,750 MW of electricity had been initiated, with work ongoing at various project sites.

Strategic Outlook for Nigeria Solar EPC Market Market

The strategic outlook for the Nigeria Solar EPC Market is exceptionally bright, fueled by a confluence of supportive government initiatives, declining technology costs, and an ever-increasing demand for reliable and sustainable energy. Growth accelerators include enhanced public-private partnerships for large-scale solar farms, the expansion of distributed generation solutions for industrial and commercial users, and increased investment in local solar manufacturing capabilities. The strategic imperative for Nigeria to achieve energy independence and its climate change commitments will continue to drive robust growth in the solar EPC sector. Companies that focus on technological innovation, robust project execution, and strategic partnerships will be well-positioned to capitalize on the immense opportunities within this dynamic market.

Nigeria Solar EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Other Power Generation Sources

Nigeria Solar EPC Market Segmentation By Geography

- 1. Niger

Nigeria Solar EPC Market Regional Market Share

Geographic Coverage of Nigeria Solar EPC Market

Nigeria Solar EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. 4.; The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Solar EPC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sinohydro

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JuNeng Nig Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alten Energías Renovables

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gentec Epc Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sterling and Wilson Nigeria Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Energo Nigeria Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andritz AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sinohydro

List of Figures

- Figure 1: Nigeria Solar EPC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Solar EPC Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Solar EPC Market Revenue billion Forecast, by Power Generation 2020 & 2033

- Table 2: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Power Generation 2020 & 2033

- Table 3: Nigeria Solar EPC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Nigeria Solar EPC Market Revenue billion Forecast, by Power Generation 2020 & 2033

- Table 6: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Power Generation 2020 & 2033

- Table 7: Nigeria Solar EPC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Nigeria Solar EPC Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Solar EPC Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Nigeria Solar EPC Market?

Key companies in the market include Sinohydro, JuNeng Nig Ltd, Alten Energías Renovables, Gentec Epc Ltd, Sterling and Wilson Nigeria Limited*List Not Exhaustive, Energo Nigeria Ltd, Andritz AG.

3. What are the main segments of the Nigeria Solar EPC Market?

The market segments include Power Generation.

4. Can you provide details about the market size?

The market size is estimated to be USD 407.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

February 2023: GE Gas Power, an American energy company, revealed plans to invest in power assets that will add nearly 500 megawatts (MW) to Nigeria's national electricity grid by the second quarter of 2023. The 240 MW Afam III power plant in Port Harcourt, the 50 MW Maiduguri project with the Nigerian National Petroleum Company Limited (NNPC), and another 50 MW project for the Dangote Group to serve its cement and refinery plants are among them, according to the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Solar EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Solar EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Solar EPC Market?

To stay informed about further developments, trends, and reports in the Nigeria Solar EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence