Key Insights

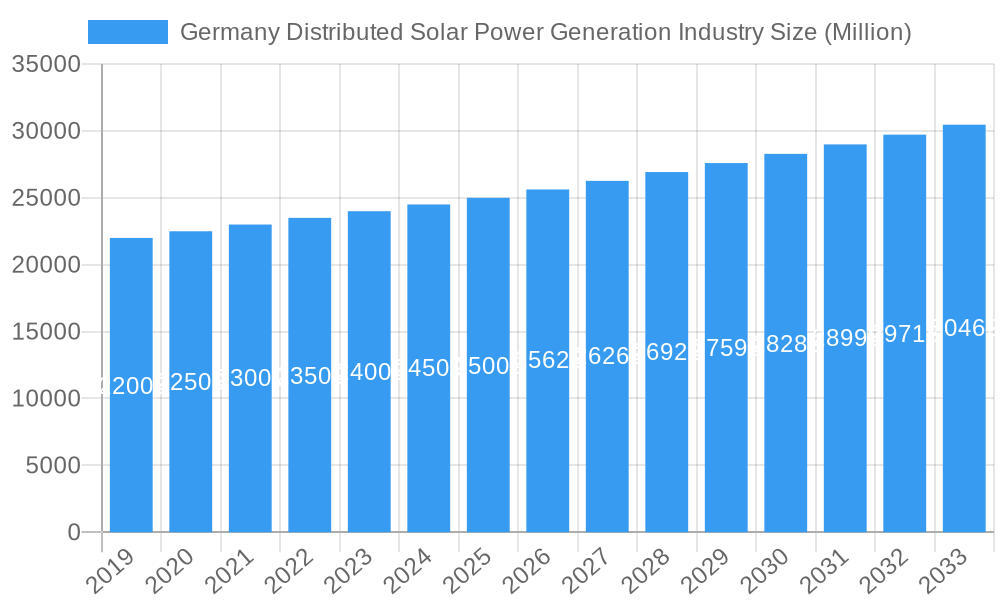

The German distributed solar power generation industry is poised for robust growth, driven by a strong commitment to renewable energy and a favorable policy landscape. With a market size estimated to reach approximately $25,000 million by 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 2.50% through 2033. This growth is underpinned by several key drivers, including increasing electricity prices, a growing consumer awareness of climate change, and supportive government incentives such as feed-in tariffs and tax credits, which encourage both residential and commercial adoption of solar photovoltaic (PV) systems. The trend towards energy independence and the desire to reduce carbon footprints further bolster this expansion.

Germany Distributed Solar Power Generation Industry Market Size (In Billion)

Despite the optimistic outlook, certain restraints could influence the pace of growth. These include potential challenges in grid integration for a rapidly increasing number of decentralized energy sources, the upfront cost of solar installations which, while declining, remains a consideration for some consumers, and the availability of skilled labor for installation and maintenance. However, ongoing technological advancements in solar panel efficiency, battery storage solutions, and smart grid technologies are actively mitigating these concerns. The market segmentation reveals a strong focus on production and consumption analysis, with Germany also maintaining a significant role in import and export markets for solar components and systems, reflecting its established position in the global solar value chain. Key players like JinkoSolar, Canadian Solar, and Tesla are actively participating in this dynamic market.

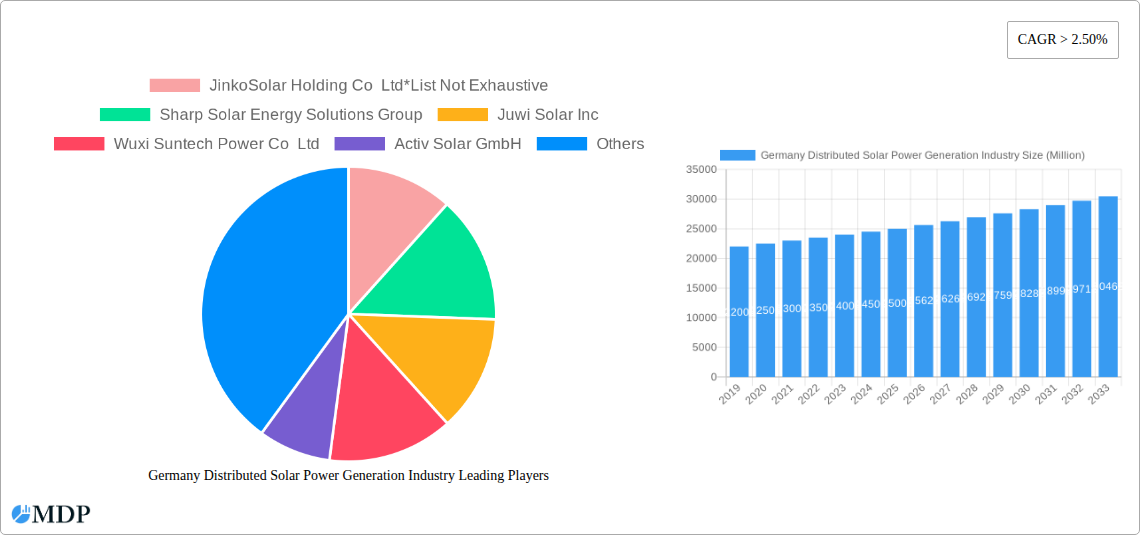

Germany Distributed Solar Power Generation Industry Company Market Share

Here's the SEO-optimized and engaging report description for the Germany Distributed Solar Power Generation Industry, incorporating high-traffic keywords and adhering to your structural and content requirements:

Germany Distributed Solar Power Generation Industry Market Dynamics & Concentration

The Germany Distributed Solar Power Generation Industry is characterized by a moderate market concentration, with a significant presence of both established global players and agile domestic manufacturers. Innovation drivers are primarily fueled by government incentives for renewable energy adoption, advancements in solar panel efficiency, and the increasing demand for decentralized energy solutions. The regulatory framework in Germany, particularly the Renewable Energy Sources Act (EEG), plays a pivotal role in shaping market dynamics, providing stability and predictable revenue streams for solar installations. Product substitutes, such as wind power and battery storage systems, are present but currently do not pose a significant threat to the core distributed solar market due to specific advantages like rooftop installation and energy independence. End-user trends are shifting towards greater self-consumption, smart grid integration, and the desire for carbon-neutral energy sources, especially among residential and commercial sectors. Mergers and acquisitions (M&A) activities are actively shaping the landscape, with strategic partnerships and consolidations aiming to enhance market share and technological capabilities. For instance, the acquisition of wind portfolios by energy giants signifies a broader trend towards integrated renewable energy solutions. The market share of leading companies is dynamic, influenced by technological innovation and policy shifts. While specific M&A deal counts are proprietary, the industry has witnessed several strategic integrations over the historical period, indicating a consolidation drive.

Germany Distributed Solar Power Generation Industry Industry Trends & Analysis

The Germany Distributed Solar Power Generation Industry is poised for substantial growth and transformation throughout the study period of 2019–2033, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year 2025. This robust expansion is propelled by a confluence of factors including increasing environmental consciousness, supportive government policies, and declining solar technology costs. The market penetration of distributed solar in Germany is already high, but significant untapped potential remains in commercial, industrial, and residential sectors, especially with the integration of advanced energy storage solutions. Technological disruptions, such as the development of higher-efficiency photovoltaic cells, bifacial solar panels, and integrated battery storage systems, are key market growth drivers. These innovations not only improve energy yield but also enhance the economic viability of solar installations. Consumer preferences are increasingly leaning towards sustainable energy sources, driven by a desire to reduce carbon footprints and achieve energy independence. This has led to a surge in demand for rooftop solar installations and smart home energy management systems. Competitive dynamics within the industry are intense, with a mix of large-scale manufacturers and installers competing on price, quality, and service offerings. The industry is also witnessing a trend towards digitalization and the use of AI for system design, performance monitoring, and grid integration, further optimizing the efficiency and reliability of distributed solar power generation. The ongoing energy transition in Germany, coupled with ambitious climate targets, ensures a sustained demand for renewable energy solutions, making distributed solar a cornerstone of the nation's future energy landscape. The integration of electric vehicles and the increasing adoption of smart grids will further amplify the demand for localized and renewable energy generation, creating a virtuous cycle of growth for the distributed solar power market.

Leading Markets & Segments in Germany Distributed Solar Power Generation Industry

The Production Analysis within the Germany Distributed Solar Power Generation Industry is heavily influenced by global manufacturing hubs, with significant contributions from Asian economies, though domestic assembly and R&D capabilities are growing. Key drivers for production include access to raw materials, skilled labor, and technological innovation. The Consumption Analysis showcases Germany as a leading market, driven by strong policy support and high electricity prices making solar generation economically attractive for both residential and commercial users. A dominant segment within consumption is the residential rooftop solar PV market, fueled by feed-in tariffs and self-consumption incentives.

- Import Market Analysis (Value & Volume): Germany is a significant importer of solar modules and components, particularly from China. Key drivers for imports include cost-effectiveness and the scale of production in exporting nations. The value of imports is substantial, reflecting the high volume of installations. The volume of imported solar panels has steadily increased to meet domestic demand.

- Key Drivers: Favorable import duties, economies of scale in manufacturing countries, and a robust domestic installation market.

- Export Market Analysis (Value & Volume): While Germany is a net importer of solar panels, it excels in exporting high-value services, engineering expertise, and integrated solar solutions, particularly for large-scale and complex projects. The value of these specialized exports is significant. The volume of direct solar panel exports from Germany is relatively lower compared to imports.

- Key Drivers: Technological leadership in solar project development, specialized installation services, and expertise in grid integration.

- Price Trend Analysis: The price trend analysis for distributed solar power generation in Germany reveals a consistent downward trajectory for panel prices over the historical period, driven by technological advancements and increased manufacturing efficiency. However, the overall cost of installed systems has seen more moderate decreases due to the rising share of balance-of-system (BoS) costs and labor. The average price per Watt for residential installations has declined significantly, making solar more accessible.

- Key Drivers: Reduced manufacturing costs, increased competition, and advancements in solar cell technology.

Germany Distributed Solar Power Generation Industry Product Developments

Product developments in the Germany Distributed Solar Power Generation Industry are rapidly advancing. Innovations are focused on enhancing energy conversion efficiency, improving durability, and integrating smart capabilities. Bifacial solar panels, which capture sunlight from both sides, are gaining traction, offering increased energy yield. Advances in perovskite solar cells promise higher efficiencies and greater flexibility in application. Furthermore, the integration of advanced inverters and battery storage systems is a key trend, enabling greater self-consumption, grid stability, and energy independence. The development of AI-powered monitoring and diagnostic tools is also improving system performance and reducing maintenance needs, ensuring optimal market fit and competitive advantage.

Key Drivers of Germany Distributed Solar Power Generation Industry Growth

Several key drivers are propelling the growth of the Germany Distributed Solar Power Generation Industry. Strong government support through feed-in tariffs and tax incentives remains a primary catalyst, making solar investments economically viable. Technological advancements, leading to higher efficiency solar panels and more affordable battery storage solutions, are crucial enablers. The growing public awareness and demand for sustainable energy and reduced carbon emissions are significant consumer-driven factors. Furthermore, the increasing cost of conventional electricity and the desire for energy independence are encouraging more households and businesses to adopt distributed solar solutions, fostering a robust market for renewable energy.

Challenges in the Germany Distributed Solar Power Generation Industry Market

Despite its strong growth, the Germany Distributed Solar Power Generation Industry faces several challenges. Regulatory hurdles and changes in feed-in tariff structures can create uncertainty for investors and project developers. Grid integration limitations and the need for grid upgrades to accommodate increasing distributed generation capacity pose technical challenges. Supply chain volatility for key components, such as polysilicon, and potential trade disputes can impact material costs and availability. Intense competition from both domestic and international players can put pressure on profit margins. Furthermore, the initial capital investment for solar installations, though declining, can still be a barrier for some consumers.

Emerging Opportunities in Germany Distributed Solar Power Generation Industry

Emerging opportunities in the Germany Distributed Solar Power Generation Industry are diverse and promising. The expansion of energy storage solutions, including residential and grid-scale batteries, presents a significant growth avenue, enhancing the reliability and dispatchability of solar power. The development of smart grids and demand-response programs creates opportunities for optimized energy management and grid services. Strategic partnerships between solar installers, battery manufacturers, and electric vehicle charging infrastructure providers are fostering integrated energy ecosystems. Furthermore, the increasing focus on green hydrogen production powered by solar energy represents a long-term, transformative opportunity for the industry, aligning with Germany's ambitious climate goals.

Leading Players in the Germany Distributed Solar Power Generation Industry Sector

- JinkoSolar Holding Co Ltd

- Sharp Solar Energy Solutions Group

- Juwi Solar Inc

- Wuxi Suntech Power Co Ltd

- Activ Solar GmbH

- Canadian Solar Inc

- Tesla Inc

- Yingli Solar

- Trina Solar Limited

Key Milestones in Germany Distributed Solar Power Generation Industry Industry

- October 2021: Statkraft acquired the wind power portfolio of wind farm operator Breeze Three Energy in Germany and France, marking its market entry as an owner of a wind farm portfolio in these regions and strengthening its European presence. This highlights a broader trend towards integrated renewable energy portfolios, indirectly influencing the distributed solar market by shaping the competitive landscape and energy infrastructure.

- 2019-2023 (Ongoing Trend): Continuous decrease in solar PV module prices due to technological advancements and increased global manufacturing capacity, making distributed solar more accessible and economically attractive for consumers.

- 2020-2024 (Increasing Focus): Significant growth in the integration of battery storage systems with solar PV installations, driven by the desire for enhanced energy independence, self-consumption optimization, and grid stability services.

- 2021-2025 (Policy Evolution): Ongoing adjustments and refinements to Germany's Renewable Energy Sources Act (EEG) and other support mechanisms, aiming to balance market incentives with long-term sustainability and grid integration.

- 2022-2024 (Technological Advancements): Increased market adoption of bifacial solar panels and other high-efficiency PV technologies, leading to improved energy yields and reduced space requirements for installations.

Strategic Outlook for Germany Distributed Solar Power Generation Industry Market

The strategic outlook for the Germany Distributed Solar Power Generation Industry is overwhelmingly positive, characterized by sustained growth and innovation. The continued commitment to renewable energy targets by the German government will ensure ongoing policy support and market demand. The integration of advanced energy storage solutions is expected to be a key growth accelerator, transforming distributed solar into a more reliable and dispatchable energy source. Strategic partnerships and technological advancements in areas like smart grids and digital energy management will further enhance efficiency and profitability. Opportunities in green hydrogen production powered by solar energy present a long-term transformative potential, positioning Germany as a leader in the decarbonization of heavy industries. The market is poised to benefit from increased electrification of transport and heating sectors, creating synergistic demand for clean energy.

Germany Distributed Solar Power Generation Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

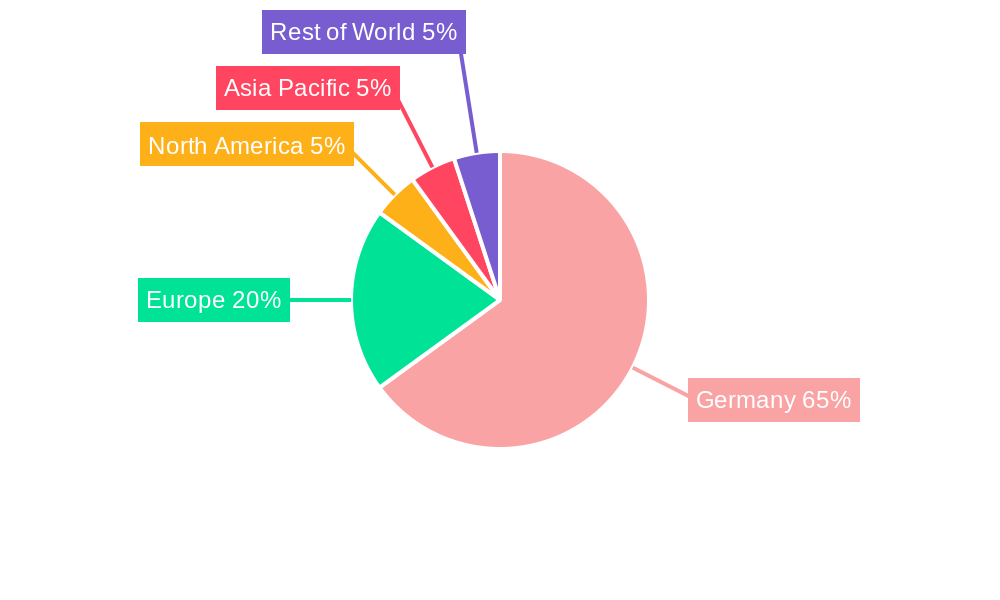

Germany Distributed Solar Power Generation Industry Segmentation By Geography

- 1. Germany

Germany Distributed Solar Power Generation Industry Regional Market Share

Geographic Coverage of Germany Distributed Solar Power Generation Industry

Germany Distributed Solar Power Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Clean Energy to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharp Solar Energy Solutions Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Juwi Solar Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wuxi Suntech Power Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Activ Solar GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canadian Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yingli Solar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trina Solar Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: Germany Distributed Solar Power Generation Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Distributed Solar Power Generation Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Distributed Solar Power Generation Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Distributed Solar Power Generation Industry?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Germany Distributed Solar Power Generation Industry?

Key companies in the market include JinkoSolar Holding Co Ltd*List Not Exhaustive, Sharp Solar Energy Solutions Group, Juwi Solar Inc, Wuxi Suntech Power Co Ltd, Activ Solar GmbH, Canadian Solar Inc, Tesla Inc, Yingli Solar, Trina Solar Limited.

3. What are the main segments of the Germany Distributed Solar Power Generation Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Increase in Demand for Clean Energy to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In October 2021, Statkraft acquired the wind power portfolio of wind farm operator Breeze Three Energy in Germany and France to further strengthen its position in Europe. The acquisition had marked the market entry of the company as an owner of a wind farm portfolio in Germany and France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Distributed Solar Power Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Distributed Solar Power Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Distributed Solar Power Generation Industry?

To stay informed about further developments, trends, and reports in the Germany Distributed Solar Power Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence