Key Insights

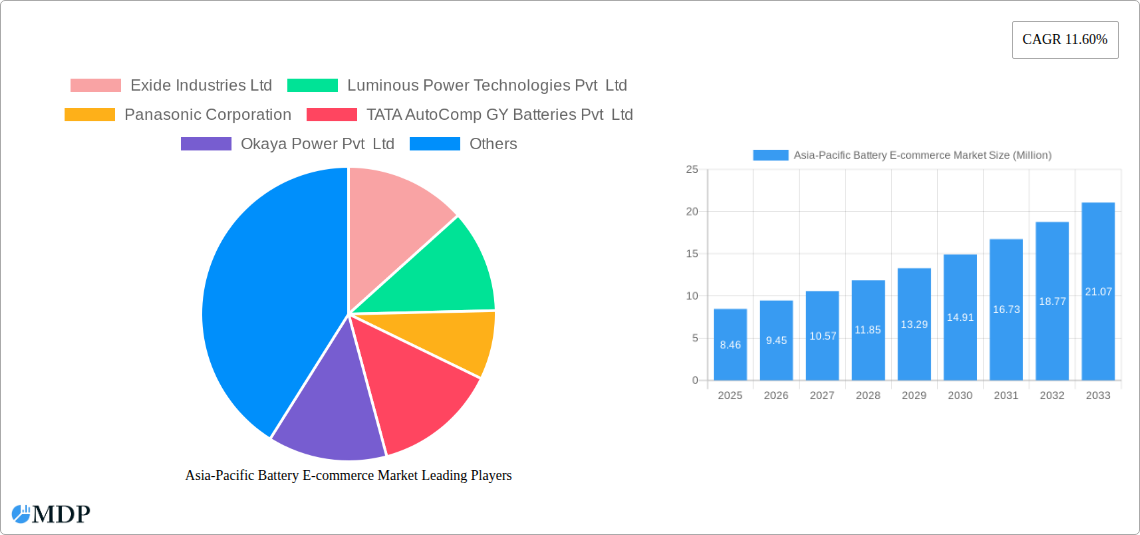

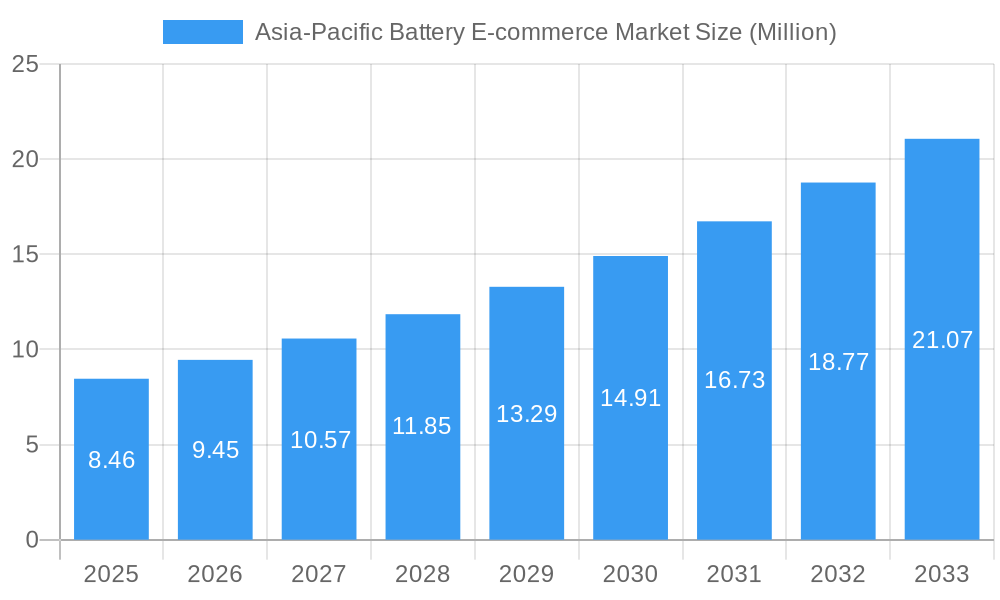

The Asia-Pacific battery e-commerce market is poised for substantial expansion, with a current estimated market size of 7.48 million value units. This robust growth is propelled by a compelling CAGR of 11.60%, indicating a dynamic and rapidly evolving landscape. Key drivers fueling this surge include the burgeoning electric vehicle (EV) adoption across the region, a significant increase in renewable energy storage solutions, and the growing consumer preference for online purchasing of automotive and industrial batteries. The convenience of online platforms, coupled with competitive pricing and a wider product selection, is redefining how consumers and businesses acquire battery solutions. The dominance of lithium-ion batteries within this e-commerce ecosystem is a notable trend, driven by their superior performance and suitability for modern applications, from electric mobility to portable electronics.

Asia-Pacific Battery E-commerce Market Market Size (In Million)

Further analysis reveals that the market's expansion is significantly influenced by government initiatives promoting electric mobility and clean energy, alongside increasing industrial automation requiring reliable battery backup systems. While the market exhibits strong upward momentum, potential restraints such as logistical challenges in delivering bulky battery products across vast geographical areas and the need for robust battery recycling infrastructure could present hurdles. However, the sheer scale and rapid digitalization of economies within the Asia-Pacific, particularly in countries like India and China, are expected to largely overshadow these challenges. The e-commerce segment is also witnessing innovation in customer service, including battery diagnostics and installation support, further enhancing the online battery purchasing experience and solidifying its growth trajectory.

Asia-Pacific Battery E-commerce Market Company Market Share

This comprehensive report delves into the burgeoning Asia-Pacific Battery E-commerce Market, providing in-depth analysis and actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages high-traffic keywords and detailed segment analysis to offer a clear view of market dynamics, trends, and future opportunities. Discover the key drivers of growth, leading players, and the evolving e-commerce landscape for batteries across this vital region.

Asia-Pacific Battery E-commerce Market Market Dynamics & Concentration

The Asia-Pacific battery e-commerce market exhibits a dynamic blend of concentration and fragmentation, influenced by rapidly evolving technological advancements and a robust digital adoption rate. Market concentration is moderately high within specific segments, particularly for lithium-ion batteries driven by the electric vehicle (EV) boom and consumer electronics. However, the broader battery e-commerce landscape, encompassing lead-acid batteries for backup power and automotive applications, demonstrates a more dispersed market structure. Innovation drivers are primarily centered around battery technology improvements, such as enhanced energy density, faster charging capabilities, and improved safety features for lithium-ion variants. Regulatory frameworks play a crucial role, with governments across the Asia-Pacific region implementing policies to promote renewable energy adoption and EV manufacturing, thereby indirectly boosting battery demand and e-commerce channels. Product substitutes, while present in the form of alternative energy storage solutions, are yet to significantly impact the core battery market due to cost-effectiveness and established infrastructure. End-user trends are shifting towards online purchasing due to convenience, competitive pricing, and the availability of detailed product information and customer reviews. Mergers and acquisitions (M&A) activities are on the rise, indicating a consolidation phase for key players seeking to expand their market reach and technological capabilities. Over the study period, an estimated XX M&A deals are projected, with an average deal value of USD XX Million, further indicating market consolidation and strategic investments. Market share analysis reveals that major players hold significant portions of specialized battery segments, with an estimated XX% of the lithium-ion battery market share concentrated among the top five companies.

Asia-Pacific Battery E-commerce Market Industry Trends & Analysis

The Asia-Pacific battery e-commerce market is experiencing robust growth, fueled by a confluence of factors that are reshaping the energy storage landscape. The primary market growth driver is the unprecedented surge in electric vehicle adoption across countries like China, India, and Southeast Asian nations. This exponential rise in EVs directly translates to a heightened demand for lithium-ion batteries, which are predominantly purchased through online channels due to the specialized nature of the product and the availability of tailored solutions. Technological disruptions are a constant theme, with continuous innovation in battery chemistry and manufacturing processes leading to improved performance, reduced costs, and enhanced sustainability. The development of solid-state batteries, for instance, holds immense potential to revolutionize the market in the coming years, offering greater safety and energy density. Consumer preferences are increasingly leaning towards digital platforms for battery purchases, driven by the convenience of home delivery, competitive pricing, and access to a wider selection of brands and specifications. Online marketplaces provide a transparent platform for consumers to compare battery types, read expert reviews, and make informed decisions, thereby enhancing market penetration of various battery solutions. The competitive dynamics are intensifying, with both established battery manufacturers and new e-commerce entrants vying for market share. The increasing penetration of smartphones and internet connectivity across the region further facilitates online accessibility and transactional ease. The CAGR for the Asia-Pacific battery e-commerce market is projected to be approximately XX% during the forecast period (2025-2033), signifying substantial expansion. Market penetration for online battery sales is expected to reach XX% by 2033, indicating a significant shift in consumer purchasing behavior. Furthermore, the growing awareness surrounding climate change and the push towards sustainable energy solutions are acting as powerful catalysts for the adoption of electric mobility and renewable energy storage, both of which rely heavily on the battery e-commerce ecosystem. The increasing prevalence of battery-as-a-service (BaaS) models also presents new avenues for online battery sales and management.

Leading Markets & Segments in Asia-Pacific Battery E-commerce Market

The Asia-Pacific battery e-commerce market is characterized by distinct regional strengths and segment dominance. China stands out as the leading market, driven by its position as a global manufacturing hub for EVs and consumer electronics, and a highly developed e-commerce infrastructure. India is rapidly emerging as a significant player, propelled by government initiatives promoting local manufacturing and the adoption of electric vehicles.

Dominant Segments:

Battery Type:

- Lithium-Ion Batteries: This segment dominates the Asia-Pacific battery e-commerce market, primarily due to the insatiable demand from the electric vehicle sector and the widespread use in consumer electronics such as smartphones, laptops, and wearable devices. The ongoing advancements in lithium-ion technology, including improvements in energy density, charging speed, and lifespan, further solidify its leadership. The e-commerce channels are instrumental in catering to the specific requirements of EV manufacturers and the aftermarket demand.

- Lead-Acid Batteries: While facing competition from lithium-ion, lead-acid batteries continue to hold a significant market share, particularly in automotive starting applications and uninterruptible power supply (UPS) systems. Their cost-effectiveness and established recycling infrastructure contribute to their sustained relevance. E-commerce platforms offer a convenient way for consumers to purchase replacement batteries for their vehicles and backup power solutions.

- Others: This category encompasses emerging battery technologies such as Nickel-Metal Hydride (NiMH) and next-generation battery chemistries. While currently holding a smaller market share, these segments are expected to witness growth driven by niche applications and ongoing research and development.

Geography:

- China: As the world's largest EV market and a powerhouse in consumer electronics manufacturing, China leads the Asia-Pacific battery e-commerce market. Its robust online retail ecosystem and advanced logistics network facilitate seamless transactions for a vast array of battery products.

- India: India's rapidly growing EV market, coupled with increasing consumer spending power and widespread internet penetration, positions it as a key growth market. Government incentives for EV manufacturing and adoption are significantly boosting demand for batteries, with e-commerce playing a crucial role in distribution.

- Australia: Driven by a growing interest in renewable energy storage solutions and the adoption of EVs, Australia presents a steady market for battery e-commerce. Government policies supporting solar energy and battery storage further contribute to market expansion.

- Malaysia, Thailand, Indonesia, Vietnam: These Southeast Asian nations are witnessing increasing adoption of EVs and a growing reliance on battery-powered devices. E-commerce channels are crucial for reaching these diverse markets, especially in areas with developing retail infrastructure. Economic policies promoting electric mobility and investments in renewable energy are key drivers in these regions.

- Rest of Asia-Pacific: This includes countries like South Korea, Japan, Taiwan, and the Philippines, which contribute to the overall market through their established technology sectors, automotive industries, and growing e-commerce penetration.

Asia-Pacific Battery E-commerce Market Product Developments

The Asia-Pacific battery e-commerce market is witnessing a wave of product innovations driven by the pursuit of enhanced performance, safety, and sustainability. Key developments include the introduction of higher energy-density lithium-ion battery packs for electric vehicles, enabling longer ranges and faster charging. Advancements in battery management systems (BMS) are also crucial, ensuring optimal performance and longevity of batteries sold online. Furthermore, the market is seeing a rise in batteries designed for specific applications, such as deep-cycle batteries for off-grid solar systems and specialized batteries for consumer electronics, all readily available through e-commerce platforms. The emphasis on eco-friendly materials and improved recyclability in battery production is another significant trend, aligning with growing consumer and regulatory demands.

Key Drivers of Asia-Pacific Battery E-commerce Market Growth

The Asia-Pacific battery e-commerce market growth is primarily propelled by the rapid electrification of transportation, with government incentives and a growing consumer preference for electric vehicles. The burgeoning consumer electronics sector, encompassing smartphones, laptops, and wearables, continuously fuels demand for compact and efficient batteries, with e-commerce platforms serving as a convenient procurement channel. Technological advancements in battery chemistry, leading to improved energy density, faster charging, and enhanced safety, are also critical drivers. Furthermore, the increasing adoption of renewable energy sources, such as solar power, necessitates robust battery storage solutions, creating a significant e-commerce opportunity for grid-scale and residential battery systems.

Challenges in the Asia-Pacific Battery E-commerce Market Market

Despite its robust growth, the Asia-Pacific battery e-commerce market faces several challenges. Regulatory complexities and varying standards across different countries can hinder cross-border sales and logistics. Supply chain disruptions, exacerbated by geopolitical factors and raw material availability, can impact product availability and pricing. The high cost of some advanced battery technologies, particularly lithium-ion for certain applications, can be a barrier to wider adoption. Intense competition among numerous online retailers and manufacturers also poses a challenge in maintaining profitability and market differentiation. Furthermore, the safe handling and transportation of batteries, especially lithium-ion, present logistical and safety considerations for e-commerce businesses.

Emerging Opportunities in Asia-Pacific Battery E-commerce Market

Emerging opportunities in the Asia-Pacific battery e-commerce market are predominantly linked to the continued expansion of electric mobility and the integration of renewable energy sources. The development of battery recycling infrastructure and the circular economy model presents a significant avenue for growth, with e-commerce platforms potentially facilitating the collection and resale of refurbished batteries. The increasing demand for energy storage solutions for smart grids and residential applications, driven by smart home technology and energy independence aspirations, offers substantial potential. Strategic partnerships between battery manufacturers, e-commerce giants, and logistics providers are crucial for optimizing delivery networks and customer service, thereby unlocking further market penetration.

Leading Players in the Asia-Pacific Battery E-commerce Market Sector

- Exide Industries Ltd

- Luminous Power Technologies Pvt Ltd

- Panasonic Corporation

- TATA AutoComp GY Batteries Pvt Ltd

- Okaya Power Pvt Ltd

- LG Chem Ltd

- Samsung SDI Co Ltd

- BYD Co Ltd

- East Penn Manufacturing Company

- Hitachi Ltd

Key Milestones in Asia-Pacific Battery E-commerce Market Industry

- June 2023: Tata Group signed an outline deal for building a lithium-ion cell factory with an investment of about USD 1.58 billion. The EV battery plant will help the nation create its electric vehicle supply chain rather than rely on imports. The plant will be located in Gujarat and have an initial manufacturing capacity of 20 gigawatt hours (GWh). Similarly, state-owned companies such as BHEL are establishing a lithium-ion battery production facility near Bangalore, Karnataka.

- May 2023: Pan Asia Metals signed a non-binding memorandum of understanding (MoU) with VinES Energy Solutions to explore a standalone lithium conversion project in Vietnam. Under the terms of the agreement, Pan Asia and VinES will collaborate to assess the viability of a standalone lithium conversion facility near VinES' Vietnamese battery plant. The study will consider an initial capacity of 20,000 to 25,000 tonnes of lithium carbonate or hydroxide per year.

Strategic Outlook for Asia-Pacific Battery E-commerce Market Market

The strategic outlook for the Asia-Pacific battery e-commerce market is exceptionally bright, driven by sustained demand from the EV revolution and the growing integration of renewable energy. Future growth accelerators will include the continuous innovation in battery technology, leading to more affordable and higher-performing products. E-commerce platforms will play an increasingly vital role in democratizing access to these advanced batteries, particularly in emerging markets. Strategic opportunities lie in developing specialized online marketplaces for industrial and consumer batteries, fostering partnerships for efficient last-mile delivery, and leveraging data analytics to personalize customer experiences and optimize inventory management. The focus on sustainability and battery recycling will also be a key strategic differentiator.

Asia-Pacific Battery E-commerce Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid

- 1.2. Lithium-Ion

- 1.3. Others

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. India

- 2.1.2. China

- 2.1.3. Australia

- 2.1.4. Malaysia

- 2.1.5. Thailand

- 2.1.6. Indonesia

- 2.1.7. Vietnam

- 2.1.8. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Battery E-commerce Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Australia

- 1.4. Malaysia

- 1.5. Thailand

- 1.6. Indonesia

- 1.7. Vietnam

- 1.8. Rest of Asia Pacific

Asia-Pacific Battery E-commerce Market Regional Market Share

Geographic Coverage of Asia-Pacific Battery E-commerce Market

Asia-Pacific Battery E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.4. Market Trends

- 3.4.1. The Lithium-Ion Battery Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Battery E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid

- 5.1.2. Lithium-Ion

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. India

- 5.2.1.2. China

- 5.2.1.3. Australia

- 5.2.1.4. Malaysia

- 5.2.1.5. Thailand

- 5.2.1.6. Indonesia

- 5.2.1.7. Vietnam

- 5.2.1.8. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exide Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luminous Power Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TATA AutoComp GY Batteries Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okaya Power Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Chem Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung SDI Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East Penn Manufacturing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Exide Industries Ltd

List of Figures

- Figure 1: Global Asia-Pacific Battery E-commerce Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia-Pacific Battery E-commerce Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 4: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 5: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 6: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 7: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Geography 2025 & 2033

- Figure 9: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 11: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: India Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: China Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: China Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Australia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Malaysia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Thailand Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Indonesia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Indonesia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Vietnam Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Vietnam Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Battery E-commerce Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Asia-Pacific Battery E-commerce Market?

Key companies in the market include Exide Industries Ltd, Luminous Power Technologies Pvt Ltd, Panasonic Corporation, TATA AutoComp GY Batteries Pvt Ltd, Okaya Power Pvt Ltd, LG Chem Ltd, Samsung SDI Co Ltd, BYD Co Ltd, East Penn Manufacturing Company, Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the Asia-Pacific Battery E-commerce Market?

The market segments include Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.48 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

6. What are the notable trends driving market growth?

The Lithium-Ion Battery Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

8. Can you provide examples of recent developments in the market?

June 2023: Tata Group signed an outline deal for building a lithium-ion cell factory with an investment of about USD 1.58 billion. The EV battery plant will help the nation create its electric vehicle supply chain rather than rely on imports. The plant will be located in Gujarat and have an initial manufacturing capacity of 20 gigawatt hours (GWh). Similarly, state-owned companies such as BHEL are establishing a lithium-ion battery production facility near Bangalore, Karnataka.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Battery E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Battery E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Battery E-commerce Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Battery E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence