Key Insights

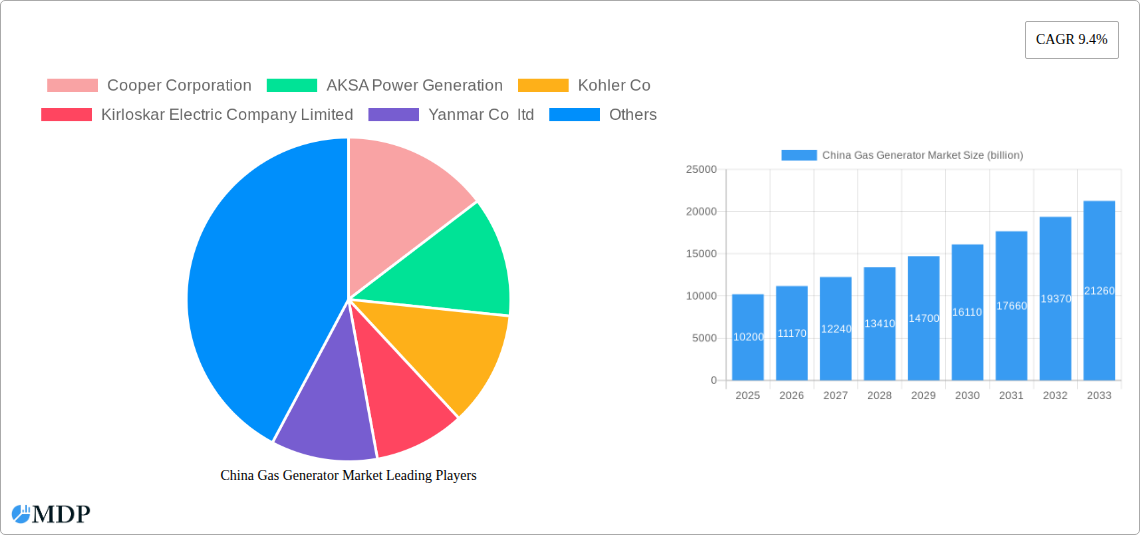

The China Gas Generator Market is poised for robust expansion, driven by increasing industrialization, a growing commercial sector demanding reliable backup power, and the ongoing residential electrification efforts. The market is projected to reach USD 10.2 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 9.4% from 2025 to 2033. This impressive growth trajectory is primarily fueled by the critical need for uninterrupted power supply in manufacturing facilities and commercial enterprises, where downtime translates directly into significant financial losses. Furthermore, government initiatives promoting energy efficiency and the adoption of cleaner fuel sources like natural gas are providing a significant tailwind. The strategic advantages of gas generators, including their lower emissions compared to diesel alternatives and competitive fuel costs, are making them an increasingly attractive option for a wide spectrum of end-users.

China Gas Generator Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. The 75-375 kVA capacity rating is expected to dominate, catering to the needs of medium-sized industrial and commercial establishments. However, the Above 375 kVA segment will witness significant growth due to the increasing power demands of large-scale industrial operations and critical infrastructure projects. The Industrial end-user segment will remain the largest contributor, followed closely by the Commercial sector. While residential adoption is on an upward trend, it currently represents a smaller but promising segment. Key market restraints include the initial capital investment for some high-capacity units and the availability of natural gas infrastructure in remote areas, though these are being addressed through policy interventions and technological advancements. Leading companies like Cummins Inc., Caterpillar Inc., and Kirloskar Electric Company Limited are actively innovating and expanding their presence to capture this burgeoning market.

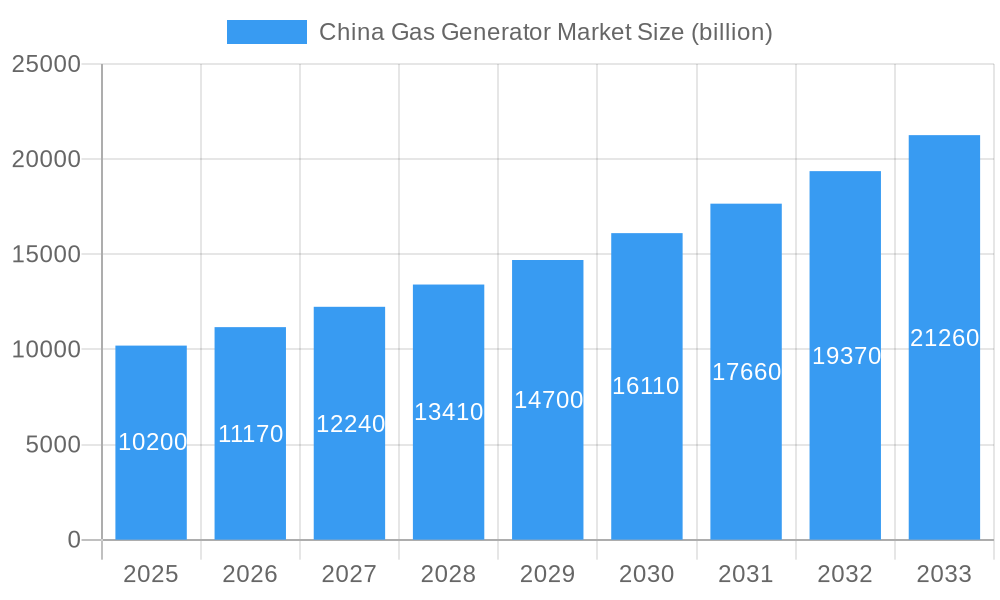

China Gas Generator Market Company Market Share

China Gas Generator Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock insights into China's burgeoning gas generator market with this in-depth report. Covering a comprehensive study period from 2019 to 2033, with a 2025 base and estimated year, this report provides critical data on market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. Analyze the strategies of key players and understand the pivotal milestones shaping this dynamic sector. This report is your essential guide to navigating the China gas generator market, forecasting a market size of XX billion in 2025 and a significant CAGR of XX% from 2025-2033, fueled by robust demand across industrial, commercial, and residential end-users.

China Gas Generator Market Market Dynamics & Concentration

The China gas generator market is characterized by a moderate to high concentration, driven by a few dominant global and domestic manufacturers. Innovation is a key driver, with companies continuously investing in research and development to enhance fuel efficiency, reduce emissions, and improve the reliability of their natural gas generator offerings. Regulatory frameworks, particularly those focused on environmental protection and energy efficiency, are increasingly shaping market trends. While product substitutes like diesel generators and renewable energy solutions exist, gas generators offer a compelling balance of cost-effectiveness, reliability, and lower emissions compared to traditional alternatives. End-user trends indicate a growing preference for cleaner energy solutions, especially in industrial and commercial sectors seeking to meet sustainability goals. Merger and acquisition (M&A) activities are anticipated to play a role in market consolidation, with major players looking to expand their market share and technological capabilities. The market share of leading players is estimated to be around XX%, with an average of XX M&A deals recorded annually during the historical period.

China Gas Generator Market Industry Trends & Analysis

The China gas generator market is poised for substantial expansion, driven by escalating industrialization, rapid urbanization, and an increasing focus on energy security and environmental sustainability. A significant growth driver is the government's commitment to reducing carbon emissions and promoting cleaner energy sources. This policy shift is directly impacting the demand for natural gas generators, which offer a more environmentally friendly alternative to diesel-powered units. Technological advancements are also playing a pivotal role. Manufacturers are developing more efficient and compact gas generators, incorporating smart technologies for remote monitoring and predictive maintenance, thus enhancing operational reliability and reducing downtime. Consumer preferences are shifting towards reliable and cost-effective power backup solutions, particularly in sectors like healthcare, data centers, and manufacturing, where uninterrupted power supply is critical. The competitive landscape is evolving, with both established international players and emerging domestic manufacturers vying for market dominance. This competition fosters innovation and drives down costs, making gas generators more accessible. The market penetration of gas generators, while still growing, is projected to increase significantly as their benefits become more widely recognized and as natural gas infrastructure continues to expand across the country. The market is expected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033.

Leading Markets & Segments in China Gas Generator Market

The Industrial end-user segment is projected to be the dominant force in the China gas generator market, driven by robust economic policies and ongoing infrastructure development. This segment's dominance is underpinned by the constant need for reliable and efficient power backup solutions in manufacturing plants, petrochemical facilities, and mining operations. The Above 375 kVA capacity rating segment also holds significant sway, catering to the high power demands of large industrial complexes and commercial enterprises.

Industrial End-User Dominance:

- Economic Policies: Government initiatives promoting industrial growth and manufacturing output directly translate to increased demand for reliable power.

- Infrastructure Development: Expansion of industrial zones and the establishment of new manufacturing hubs necessitate robust power backup systems.

- Operational Efficiency: Industrial processes often require uninterrupted power supply to avoid costly downtime. Gas generators offer a dependable solution.

- Environmental Regulations: Stricter emission standards are pushing industries towards cleaner power alternatives like natural gas.

Above 375 kVA Capacity Rating Dominance:

- Large-Scale Operations: This segment caters to the substantial power requirements of heavy industries, data centers, and large commercial facilities.

- Critical Infrastructure: Essential services like hospitals and telecommunication networks, which fall under the industrial and commercial umbrella, often require generators in this higher capacity range for their primary or backup power needs.

- Scalability: The ability to power multiple operations simultaneously makes these larger units highly attractive for expanding businesses.

While the Industrial segment and the Above 375 kVA capacity rating are expected to lead, the Commercial and Residential segments, along with the 75-375 kVA and Less than 75 kVA capacity ratings, are also poised for considerable growth. The Commercial segment benefits from the expansion of retail, hospitality, and healthcare sectors, all of which rely on consistent power. The Residential segment, while smaller, is seeing an uptick due to increasing awareness of the need for backup power in the face of grid instability and growing demand for smart homes.

China Gas Generator Market Product Developments

The China gas generator market is witnessing continuous innovation focused on enhancing efficiency, reducing environmental impact, and expanding application ranges. Key product developments include the introduction of more compact and portable natural gas generators, making them suitable for a wider array of commercial and smaller industrial applications. Manufacturers are also integrating advanced control systems and IoT capabilities, enabling remote monitoring, diagnostics, and predictive maintenance, thereby improving operational uptime and reducing total cost of ownership. Furthermore, there's a growing emphasis on dual-fuel capabilities, allowing generators to operate on both natural gas and other alternative fuels, offering greater flexibility. These advancements not only cater to evolving customer needs but also provide a competitive edge in the rapidly growing Chinese market.

Key Drivers of China Gas Generator Market Growth

The China gas generator market's growth is propelled by a confluence of significant drivers. Government initiatives promoting cleaner energy and reducing carbon footprints are a primary catalyst, encouraging the adoption of natural gas as a more sustainable power source. The ever-increasing demand for reliable and uninterrupted power across industrial and commercial sectors, crucial for maintaining operational continuity, further fuels market expansion. Technological advancements in generator efficiency, emissions control, and smart operational features are making natural gas generators more attractive and cost-effective. Additionally, the expansion of natural gas infrastructure across China, facilitating easier access to fuel, plays a critical role in driving adoption.

Challenges in the China Gas Generator Market Market

Despite robust growth prospects, the China gas generator market faces several challenges. High initial capital investment for gas generator systems can be a deterrent for some potential buyers, particularly small and medium-sized enterprises. Variability in natural gas prices and supply chain disruptions, while decreasing, can still impact operational costs and availability. Stringent environmental regulations and permitting processes, though a driver for adoption, can also pose bureaucratic hurdles for manufacturers and end-users. Furthermore, competition from established diesel generator technologies and the increasing viability of renewable energy solutions present ongoing competitive pressures.

Emerging Opportunities in China Gas Generator Market

The China gas generator market is ripe with emerging opportunities driven by forward-looking strategies and market trends. The increasing adoption of distributed power generation and microgrids presents a significant avenue for growth, with gas generators playing a crucial role in ensuring grid stability and providing localized power solutions. Strategic partnerships between generator manufacturers, natural gas suppliers, and technology providers are expected to unlock new markets and enhance product offerings. Furthermore, the development and deployment of highly efficient and low-emission gas generators, including those utilizing biogas or syngas, cater to a growing niche for sustainable and off-grid power generation. The expansion of smart city initiatives and the demand for reliable power in emerging sectors like electric vehicle charging infrastructure also offer substantial long-term growth potential.

Leading Players in the China Gas Generator Market Sector

- Cooper Corporation

- AKSA Power Generation

- Kohler Co

- Kirloskar Electric Company Limited

- Yanmar Co ltd

- Caterpillar Inc

- Cummins Inc

- General Electric Company

Key Milestones in China Gas Generator Market Industry

- February 2023: Cummins Inc. announced the launch of two new natural gas generators, the C175N6B and C200N6B, targeting applications in government buildings, water wastewater treatment plants, healthcare facilities, commercial buildings, and public infrastructure.

- March 2022: Industrial gases giant Messer expanded its China operations with the start-up of a new generator in Xiangtan, serving its customer Hunan Yuneng New Energy Battery Materials Co., Ltd. (Yuneng) for remote-controlled on-site nitrogen supply.

Strategic Outlook for China Gas Generator Market Market

The strategic outlook for the China gas generator market is exceptionally promising, fueled by a robust demand for reliable, efficient, and environmentally conscious power solutions. The market is set to benefit from continued government support for cleaner energy adoption and the ongoing expansion of industrial and commercial infrastructure. Key growth accelerators include the integration of advanced digital technologies for enhanced operational efficiency and the development of more compact and versatile generator models. Strategic investments in research and development, coupled with strategic collaborations, will be crucial for manufacturers to capture market share and meet the evolving needs of diverse end-users. The increasing awareness of energy security and the economic advantages offered by natural gas power generation position the market for sustained and significant growth in the coming years.

China Gas Generator Market Segmentation

-

1. Capacity Rating

- 1.1. Less than 75 kVA

- 1.2. 75-375 kVA

- 1.3. Above 375 kVA

-

2. End-User

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Residential

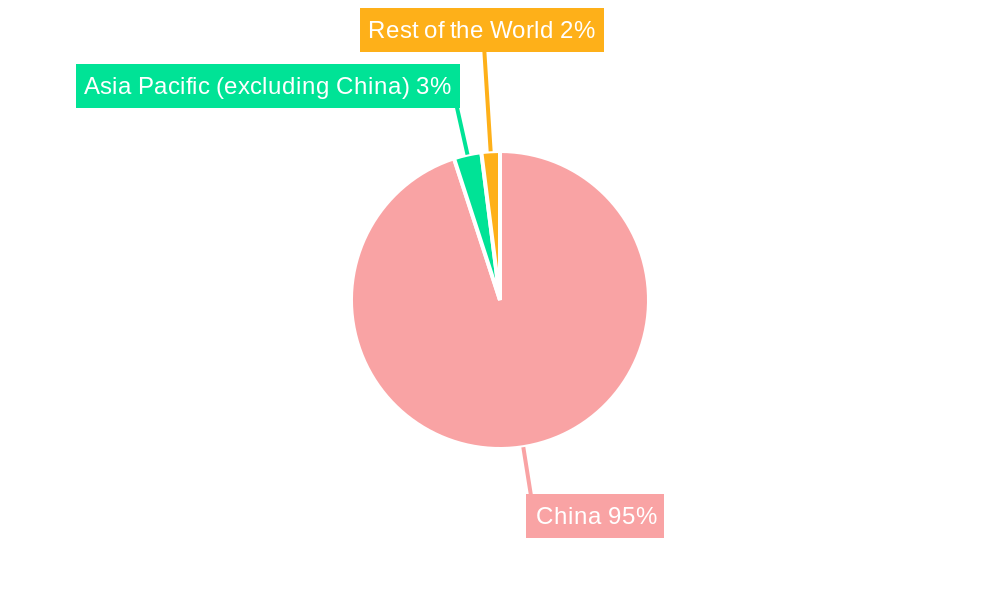

China Gas Generator Market Segmentation By Geography

- 1. China

China Gas Generator Market Regional Market Share

Geographic Coverage of China Gas Generator Market

China Gas Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Industrialization4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Below 75 kVA Capacity Gas Generator to Witness Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gas Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity Rating

- 5.1.1. Less than 75 kVA

- 5.1.2. 75-375 kVA

- 5.1.3. Above 375 kVA

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Capacity Rating

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cooper Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AKSA Power Generation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kohler Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kirloskar Electric Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yanmar Co ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cummins Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cooper Corporation

List of Figures

- Figure 1: China Gas Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Gas Generator Market Share (%) by Company 2025

List of Tables

- Table 1: China Gas Generator Market Revenue billion Forecast, by Capacity Rating 2020 & 2033

- Table 2: China Gas Generator Market Volume K Unit Forecast, by Capacity Rating 2020 & 2033

- Table 3: China Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: China Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: China Gas Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Gas Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Gas Generator Market Revenue billion Forecast, by Capacity Rating 2020 & 2033

- Table 8: China Gas Generator Market Volume K Unit Forecast, by Capacity Rating 2020 & 2033

- Table 9: China Gas Generator Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: China Gas Generator Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: China Gas Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Gas Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gas Generator Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the China Gas Generator Market?

Key companies in the market include Cooper Corporation, AKSA Power Generation, Kohler Co, Kirloskar Electric Company Limited, Yanmar Co ltd, Caterpillar Inc, Cummins Inc, General Electric Company.

3. What are the main segments of the China Gas Generator Market?

The market segments include Capacity Rating, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Industrialization4.; Government Initiatives.

6. What are the notable trends driving market growth?

Below 75 kVA Capacity Gas Generator to Witness Significant Growth in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

February 2023: Cummins Inc. announced the launch of two new natural gas generators. The C175N6B and C200N6B will be used in government buildings, water wastewater treatment plants, healthcare facilities, commercial buildings, public infrastructure, and many more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gas Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gas Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gas Generator Market?

To stay informed about further developments, trends, and reports in the China Gas Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence