Key Insights

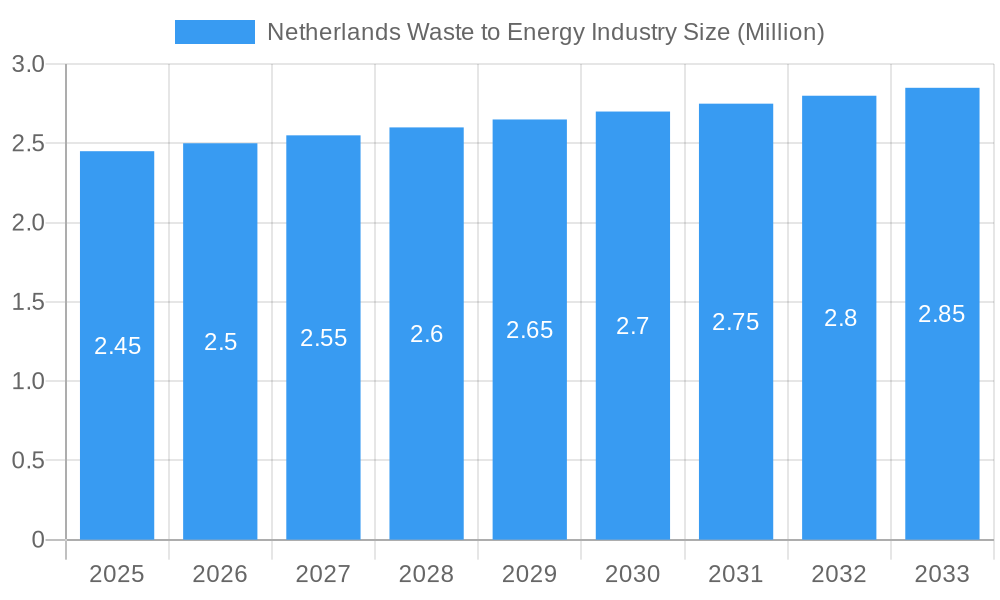

The Netherlands Waste to Energy (WtE) industry is poised for steady growth, projected to reach a market size of approximately USD 2.45 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.10% anticipated through the forecast period. This expansion is primarily driven by the nation's robust commitment to circular economy principles and stringent waste management regulations. The increasing need to manage municipal solid waste, industrial byproducts, and agricultural residues efficiently fuels demand for advanced WtE technologies such as incineration and anaerobic digestion. Refuse-derived fuel (RDF) also plays a significant role in the Dutch WtE landscape, offering a viable solution for energy recovery from non-recyclable waste streams. The industrial and commercial sectors are the leading end-users, leveraging WtE facilities to reduce landfill reliance and generate reliable energy sources, thereby contributing to the decarbonization efforts.

Netherlands Waste to Energy Industry Market Size (In Million)

Further analysis reveals that the Dutch WtE market is characterized by a strong focus on technological innovation and operational efficiency. While incineration remains a dominant technology due to its established infrastructure and high waste processing capacity, there's a growing interest in gasification and pyrolysis for producing higher-value energy and materials. The market also faces certain restraints, including the high initial capital investment required for advanced WtE facilities and public perception challenges related to emissions. However, ongoing government support, investments in research and development, and the strategic presence of key players like Attero BV, Indaver BV, and Mitsubishi Heavy Industries Ltd are expected to mitigate these challenges. The country's strategic location and established trade networks also support the export of WtE technologies and expertise, positioning the Netherlands as a leader in sustainable waste management solutions.

Netherlands Waste to Energy Industry Company Market Share

Netherlands Waste to Energy Industry Report: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Netherlands Waste to Energy (WtE) industry, providing an in-depth analysis of market dynamics, key trends, leading segments, and future strategic outlook. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and policymakers seeking to navigate this crucial sector. The report includes detailed analysis of market share, CAGR, and penetration rates, alongside specific company profiles and recent industry milestones.

Netherlands Waste to Energy Industry Market Dynamics & Concentration

The Netherlands Waste to Energy industry exhibits a moderate to high concentration, with key players dominating the market share, estimated at over 70% held by the top five companies. Innovation drivers are primarily fueled by the EU's stringent environmental regulations and the nation's commitment to a circular economy, pushing for advanced waste processing technologies. The regulatory framework, characterized by robust waste management directives and incentives for renewable energy production, plays a pivotal role in shaping market dynamics. Product substitutes, such as material recycling and direct landfilling (though increasingly restricted), pose a constant challenge, necessitating continuous technological advancement in WtE processes. End-user trends are shifting towards greater demand for sustainable energy solutions and reduced landfill reliance, particularly from industrial and commercial sectors seeking to meet ESG targets. Mergers and acquisitions (M&A) activities are present, though sporadic, reflecting a maturing market consolidation phase; recent deal counts indicate a steady pace of strategic partnerships and smaller-scale acquisitions rather than large-scale mergers.

- Market Concentration: Moderate to High

- Innovation Drivers: EU Environmental Regulations, Circular Economy Initiatives

- Regulatory Framework: Stringent Waste Management Directives, Renewable Energy Incentives

- Product Substitutes: Material Recycling, Limited Landfilling

- End-User Trends: Demand for Sustainable Energy, ESG Compliance

- M&A Activities: Sporadic, Strategic Partnerships

Netherlands Waste to Energy Industry Industry Trends & Analysis

The Netherlands Waste to Energy industry is poised for substantial growth, driven by a confluence of technological advancements, supportive government policies, and increasing public awareness regarding sustainable waste management. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at a healthy 4.5%, indicating a robust expansion trajectory. Market penetration is expected to deepen as more municipalities and industrial facilities adopt WtE solutions to manage their waste streams effectively and contribute to national renewable energy targets. Technological disruptions are a significant trend, with a move towards more efficient and environmentally friendly processes like advanced incineration with energy recovery, gasification, and anaerobic digestion, all of which are crucial for converting diverse waste types into valuable energy. Consumer preferences are increasingly aligning with sustainability, demanding cleaner energy sources and responsible waste disposal, which directly benefits the WtE sector. Competitive dynamics are characterized by established players investing in R&D to enhance efficiency and reduce emissions, alongside emerging technologies seeking market entry.

Leading Markets & Segments in Netherlands Waste to Energy Industry

Within the Netherlands Waste to Energy industry, the Municipal Solid Waste (MSW) segment is a dominant force, driven by the sheer volume of household and commercial waste generated across the country. The Incineration technology segment leads in market share due to its established infrastructure and proven efficiency in energy recovery from mixed waste streams. Economical policies, such as waste-to-energy incentives and landfill taxes, significantly bolster the dominance of these segments. Furthermore, robust infrastructure development for waste collection and processing across major urban centers facilitates the widespread adoption of WtE solutions for MSW.

- Dominant Waste Type: Municipal Solid Waste (MSW)

- Key Drivers: High generation volume, urbanisation, stringent landfill regulations.

- Dominance Analysis: MSW constitutes the largest portion of waste input for WtE facilities in the Netherlands due to population density and consumption patterns. Government initiatives promoting waste diversion from landfills further solidify MSW's position.

- Dominant Technology: Incineration

- Key Drivers: Established technology, high energy recovery rates, proven track record.

- Dominance Analysis: Incineration, particularly mass burn systems, remains the most prevalent WtE technology in the Netherlands due to its cost-effectiveness and reliability in processing large volumes of heterogeneous waste.

- Dominant End-User: Industrial & Commercial

- Key Drivers: Corporate sustainability goals, energy cost reduction, regulatory compliance.

- Dominance Analysis: Industrial and commercial sectors are increasingly opting for WtE solutions to manage their waste responsibly, meet stringent environmental targets, and potentially reduce their energy expenditure through co-generation.

Netherlands Waste to Energy Industry Product Developments

Product developments in the Netherlands WtE industry are focused on enhancing energy efficiency, reducing emissions, and diversifying waste processing capabilities. Innovations in advanced incineration technologies, such as those incorporating improved flue gas cleaning systems, are critical for meeting stricter environmental standards. The development of more efficient gasification and pyrolysis units aims to unlock greater value from various waste fractions. Furthermore, advancements in anaerobic digestion are enabling better utilization of organic waste for biogas production. These developments offer competitive advantages by improving operational performance, reducing environmental impact, and expanding the range of treatable waste types, aligning with the market's demand for sustainable and cost-effective waste management solutions.

Key Drivers of Netherlands Waste to Energy Industry Growth

The growth of the Netherlands Waste to Energy industry is primarily propelled by a robust policy framework encouraging waste diversion from landfills and promoting renewable energy generation. The EU's circular economy initiatives and the Dutch government's commitment to achieving ambitious climate targets create a fertile ground for WtE expansion. Technological advancements in waste processing, leading to higher energy recovery rates and reduced environmental footprints, are also significant drivers. Furthermore, increasing industrial and commercial demand for sustainable waste management solutions, driven by corporate social responsibility and cost-efficiency considerations, further fuels market growth.

- Regulatory Push: EU and Dutch government policies mandating waste reduction and promoting renewable energy.

- Technological Advancements: Improved efficiency and environmental performance of WtE technologies.

- Circular Economy Focus: Emphasis on resource recovery and waste valorization.

- Growing Waste Volumes: Continued generation of municipal and industrial waste.

- Corporate Sustainability Goals: Increasing adoption of WtE for ESG compliance.

Challenges in the Netherlands Waste to Energy Industry Market

Despite its growth, the Netherlands Waste to Energy industry faces several challenges. Public perception and concerns regarding emissions from incineration plants, though largely addressed by modern technologies, can still pose a hurdle. Fluctuations in the price of renewable energy and fossil fuels can impact the economic viability of WtE projects. Furthermore, the increasing emphasis on material recycling can potentially reduce the volume of waste available for WtE, requiring WtE facilities to focus on non-recyclable fractions. Supply chain complexities for specialized components and skilled labor shortages for operation and maintenance of advanced facilities can also present obstacles.

- Public Perception & Emissions Concerns: Lingering concerns about environmental impact.

- Market Price Volatility: Fluctuations in energy prices affecting project economics.

- Competition from Recycling: Potential reduction in waste feedstock due to increased recycling rates.

- Supply Chain Complexities: Challenges in sourcing specialized equipment and parts.

- Skilled Labor Shortages: Difficulty in finding qualified operational and maintenance personnel.

Emerging Opportunities in Netherlands Waste to Energy Industry

Emerging opportunities in the Netherlands Waste to Energy industry lie in the development and integration of advanced technologies for higher value extraction from waste. The growing interest in carbon capture and utilization (CCU) presents a significant avenue for WtE plants to further reduce their environmental impact and potentially generate new revenue streams. Strategic partnerships between WtE operators and industries requiring CO2 as a feedstock for new products, such as in the chemical or agricultural sectors, offer substantial growth potential. Expansion into more niche waste streams, such as certain hazardous wastes, with specialized WtE processes, also represents an untapped market segment.

Leading Players in the Netherlands Waste to Energy Industry Sector

- Attero BV

- Ingenia Consultants & Engineers BV

- AEB Bio-energiecentrale BV

- Axpo Holdings AG

- Indaver BV

- Dutch Incinerators BV

- AEB Amsterdam

- Mitsubishi Heavy Industries Ltd

Key Milestones in Netherlands Waste to Energy Industry Industry

- January 2023: RWE received USD 117 million from the European Union's Innovation Fund to support the development of a waste-to-hydrogen project in a Dutch industrial cluster, highlighting advancements in WtE and hydrogen production integration.

- May 2022: At Twence's waste-to-energy plant in Hengelo, Netherlands, Aker Carbon Capture commenced construction of its Just Catch modular carbon capture plant. This initiative aims to reduce CO2 emissions from non-recyclable waste incineration and is projected to capture 100,000 metric tons of CO2 annually by late 2023, with captured carbon intended for use as liquid fertilizer in horticulture.

Strategic Outlook for Netherlands Waste to Energy Industry Market

The strategic outlook for the Netherlands Waste to Energy industry is exceptionally positive, driven by the imperative for sustainable waste management and renewable energy production. The ongoing transition towards a circular economy will continue to propel demand for advanced WtE solutions. Future growth will be significantly influenced by the successful implementation of carbon capture technologies and the development of hydrogen production from waste, aligning with broader energy transition goals. Strategic opportunities include fostering greater collaboration between WtE operators, technology providers, and end-users of recovered energy and by-products. Investment in research and development for novel WtE processes, alongside potential consolidation through strategic partnerships, will shape a resilient and innovative future for the sector.

Netherlands Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Incineration

- 1.2. Gasification

- 1.3. Pyrolysis

- 1.4. Anaerobic Digestion

- 1.5. Refuse-Derived Fuel

-

2. Waste Type

- 2.1. Municipal Solid Waste

- 2.2. Industrial Waste

- 2.3. Hazardous Waste

- 2.4. Agricultural Waste

-

3. End-User

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

Netherlands Waste to Energy Industry Segmentation By Geography

- 1. Netherlands

Netherlands Waste to Energy Industry Regional Market Share

Geographic Coverage of Netherlands Waste to Energy Industry

Netherlands Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Thermal Technologies Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Waste to Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Incineration

- 5.1.2. Gasification

- 5.1.3. Pyrolysis

- 5.1.4. Anaerobic Digestion

- 5.1.5. Refuse-Derived Fuel

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Municipal Solid Waste

- 5.2.2. Industrial Waste

- 5.2.3. Hazardous Waste

- 5.2.4. Agricultural Waste

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Attero BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingenia Consultants & Engineers BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AEB Bio-energiecentrale BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axpo Holdings AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indaver BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dutch Incinerators BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AEB Amsterdam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Heavy Industries Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Attero BV

List of Figures

- Figure 1: Netherlands Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Waste to Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 3: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Netherlands Waste to Energy Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Netherlands Waste to Energy Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Netherlands Waste to Energy Industry Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 7: Netherlands Waste to Energy Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Netherlands Waste to Energy Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Waste to Energy Industry?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Netherlands Waste to Energy Industry?

Key companies in the market include Attero BV, Ingenia Consultants & Engineers BV, AEB Bio-energiecentrale BV, Axpo Holdings AG, Indaver BV, Dutch Incinerators BV, AEB Amsterdam, Mitsubishi Heavy Industries Ltd *List Not Exhaustive.

3. What are the main segments of the Netherlands Waste to Energy Industry?

The market segments include Technology, Waste Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Thermal Technologies Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

January 2023: RWE received USD 117 million from the European Union's Innovation Fund to help build a waste-to-hydrogen project in an industrial cluster in the Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the Netherlands Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence