Key Insights

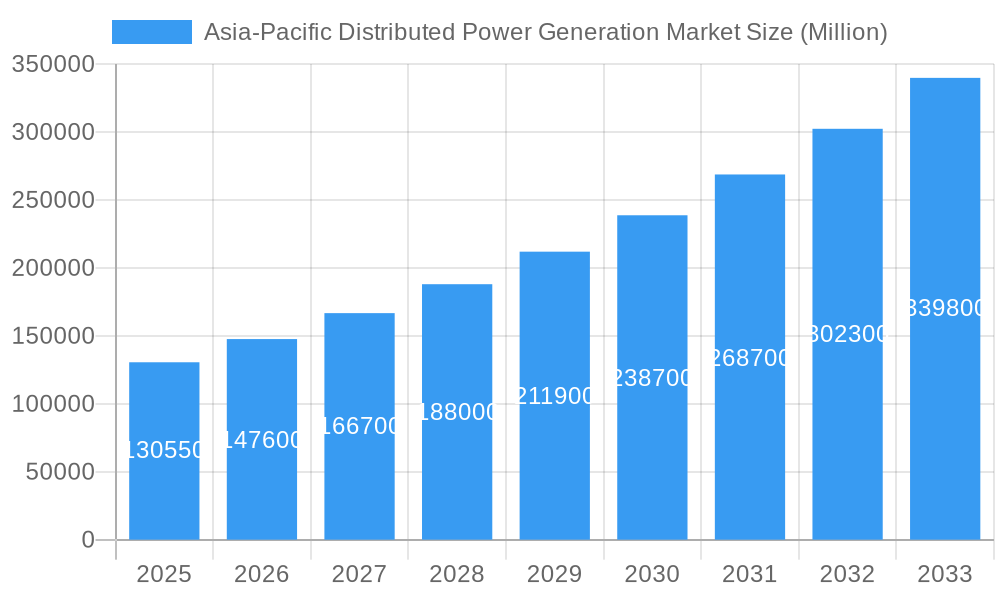

The Asia-Pacific distributed power generation market is poised for remarkable expansion, projected to reach an impressive USD 130.55 billion by 2025. This significant growth is underpinned by a robust compound annual growth rate (CAGR) of 13.2% throughout the forecast period. Key drivers propelling this surge include the escalating demand for reliable and resilient energy solutions, coupled with the imperative to diversify energy sources and reduce reliance on centralized grids, particularly in the face of increasing power outages and grid instability. Furthermore, favorable government policies promoting renewable energy adoption, such as solar photovoltaic (PV) and wind power, alongside initiatives to enhance energy efficiency and reduce carbon footprints, are creating a conducive environment for distributed generation technologies to thrive across the region. The burgeoning industrial sector and growing urbanization further amplify the need for localized power solutions that can meet the dynamic energy requirements of businesses and residential areas alike.

Asia-Pacific Distributed Power Generation Market Market Size (In Billion)

The market's trajectory is further shaped by critical trends like the increasing integration of advanced digital technologies, including smart grid solutions and IoT-enabled monitoring systems, which enhance the efficiency, reliability, and management of distributed power assets. The ongoing technological advancements in renewable energy sources, leading to improved efficiency and reduced costs, are making them increasingly competitive. Combined Heat and Power (CHP) systems are also gaining traction for their ability to provide both electricity and heat, optimizing energy utilization in commercial and industrial settings. While the market demonstrates strong growth potential, certain restraints need to be addressed. These include the high upfront capital investment for certain distributed generation technologies, the complexities associated with regulatory frameworks and grid interconnection policies in some countries, and the intermittent nature of renewable energy sources, necessitating robust energy storage solutions. However, the continuous innovation in battery storage and smart grid management is progressively mitigating these challenges, paving the way for sustained and dynamic market evolution.

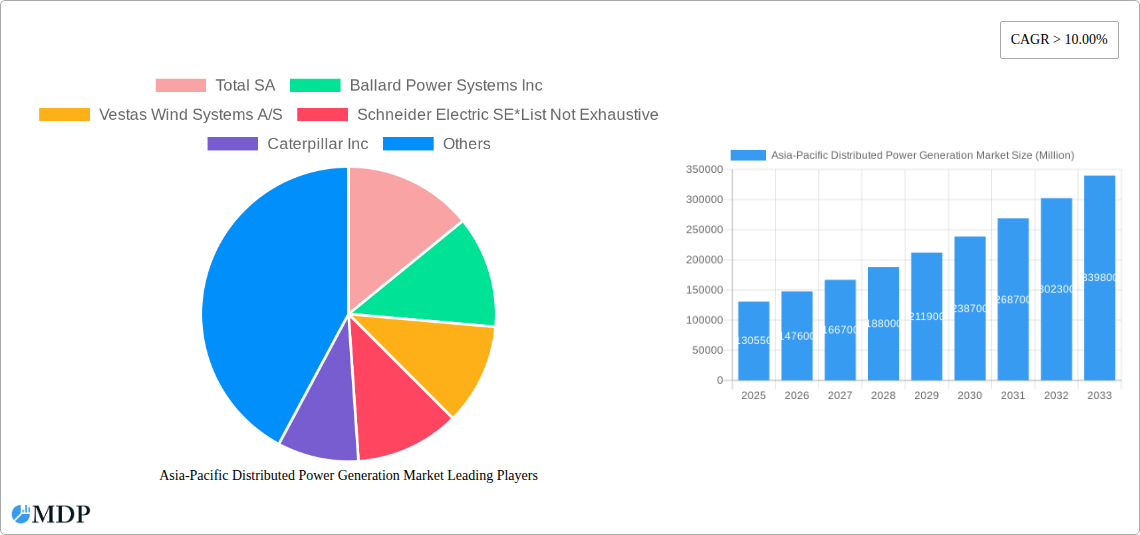

Asia-Pacific Distributed Power Generation Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Distributed Power Generation Market, providing critical insights into its dynamic landscape, growth trajectories, and key players. Navigating the complexities of renewable energy solutions and decentralized power systems, this study is essential for stakeholders seeking to capitalize on the region's burgeoning energy transition. The report covers the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033, and Historical Period: 2019–2024. Gain an unparalleled understanding of market drivers, challenges, and future opportunities within this vital sector.

Asia-Pacific Distributed Power Generation Market Market Dynamics & Concentration

The Asia-Pacific Distributed Power Generation Market is characterized by a moderate to high market concentration, with a growing number of companies actively participating. Innovation drivers such as the increasing demand for energy security, the urgent need for carbon emission reduction, and advancements in renewable energy technologies like Solar PV and Wind power are fueling market expansion. Supportive regulatory frameworks across key economies, including incentives for distributed generation and feed-in tariffs, are further stimulating investment. While direct product substitutes are limited, the escalating integration of grid-scale renewables can indirectly influence the adoption pace of certain distributed solutions. End-user trends reveal a strong preference for cost-effective, reliable, and sustainable energy sources, particularly from industrial and commercial sectors seeking to reduce operational expenses and meet corporate social responsibility goals. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, with an estimated XX deals recorded in the historical period, driven by the pursuit of synergistic technologies, market access, and economies of scale. For instance, strategic acquisitions by larger energy conglomerates aim to consolidate their position in the distributed power generation space. The market share distribution shows leading players focusing on specific technologies and geographies.

Asia-Pacific Distributed Power Generation Market Industry Trends & Analysis

The Asia-Pacific Distributed Power Generation Market is experiencing robust growth, projected to reach approximately USD 450 billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is primarily propelled by the increasing adoption of renewable energy sources, the growing demand for energy independence, and supportive government policies promoting decentralized power systems. Technological disruptions, particularly in Solar PV efficiency and battery storage solutions, are making distributed power generation more accessible and economically viable. Consumer preferences are shifting towards cleaner energy alternatives and greater control over their energy supply, leading to a surge in demand for rooftop solar installations and microgrids. Competitive dynamics are intensifying as both established energy giants and agile startups vie for market share. The penetration of distributed power generation in the region is steadily rising, driven by its ability to address the limitations of traditional grid infrastructure, particularly in remote or underserved areas. The market is also witnessing a growing interest in Combined Heat and Power (CHP) systems, especially from industrial facilities seeking to optimize energy utilization and reduce operational costs. Furthermore, advancements in digital grid technologies and smart energy management systems are enhancing the reliability and efficiency of distributed power networks, further stimulating market growth.

Leading Markets & Segments in Asia-Pacific Distributed Power Generation Market

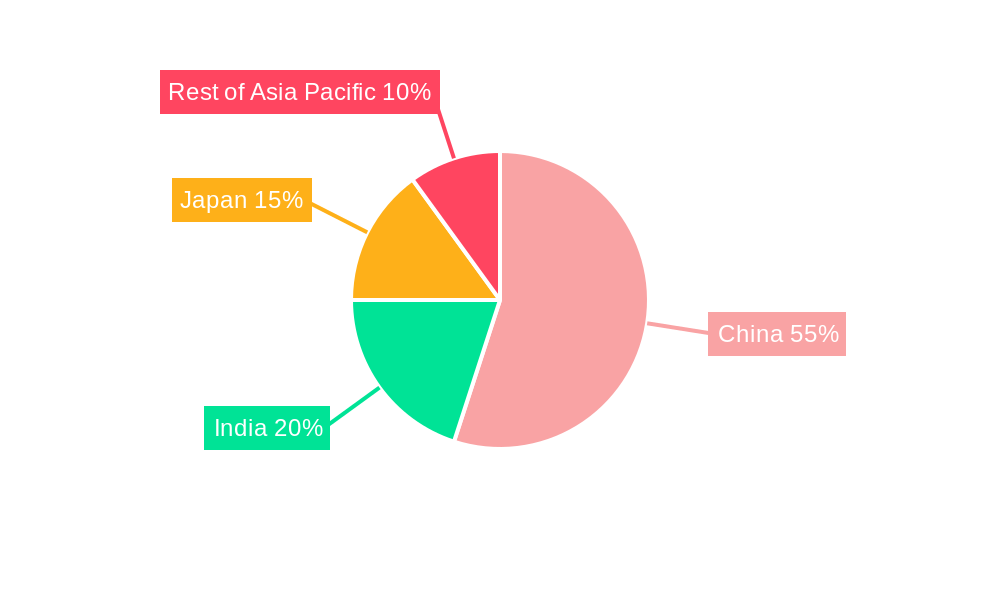

China stands as the dominant geography in the Asia-Pacific Distributed Power Generation Market, accounting for an estimated XX% of the total market value in 2025. This dominance is underpinned by aggressive government targets for renewable energy deployment, substantial investments in Solar PV and Wind power capacity, and a vast industrial and commercial base driving demand for decentralized energy solutions. Economic policies, including generous subsidies for solar installations and incentives for distributed generation projects, are key drivers. Infrastructure development, with a focus on expanding grid connectivity and enhancing energy storage capabilities, also plays a crucial role.

Technology Dominance:

- Solar PV is the leading technology segment, driven by declining module costs, high solar irradiance across the region, and supportive government policies. Its widespread applicability in both utility-scale and distributed settings makes it a cornerstone of the market.

- Wind power, particularly onshore wind, is another significant contributor, benefiting from favorable wind resources in countries like China and India, and ongoing technological advancements leading to increased efficiency.

- Combined Heat and Power (CHP) is gaining traction, especially in industrial zones and large commercial complexes, where simultaneous generation of heat and power offers substantial energy efficiency gains and cost savings.

- Other Technologies, including fuel cells and small-scale hydro, represent niche but growing segments, driven by specific industrial applications and emerging innovations.

Geographical Influence:

- India follows China as a key market, propelled by its ambitious renewable energy targets, growing energy demand, and government initiatives to improve energy access through distributed solutions.

- Japan exhibits strong growth due to its commitment to decarbonization, reliance on imported energy, and a mature market for distributed solar and energy storage.

- The Rest of Asia-Pacific, encompassing countries like South Korea, Southeast Asian nations, and Australia, presents diverse growth opportunities driven by specific national energy policies, resource endowments, and economic development.

Asia-Pacific Distributed Power Generation Market Product Developments

Product innovation in the Asia-Pacific Distributed Power Generation Market is primarily focused on enhancing efficiency, reducing costs, and improving the integration of renewable energy technologies. Advancements in Solar PV technology, including higher-efficiency solar cells and bifacial panels, are leading to increased energy yields. Battery storage solutions are becoming more compact, cost-effective, and durable, enabling better grid stability and reliable power supply from intermittent renewable sources. Furthermore, intelligent energy management systems and microgrid controllers are evolving to optimize the performance and integration of diverse distributed power assets. These developments are crucial for meeting the growing demand for reliable, sustainable, and resilient energy infrastructure across the region.

Key Drivers of Asia-Pacific Distributed Power Generation Market Growth

The Asia-Pacific Distributed Power Generation Market is propelled by several key drivers. Technological advancements, particularly in the cost reduction and efficiency of Solar PV and wind turbines, are making these sources increasingly competitive. Economic factors, including rising energy prices and the pursuit of energy independence, are encouraging investment in self-generation. Crucially, supportive government policies and regulations, such as renewable energy targets, feed-in tariffs, and tax incentives, are creating a favorable environment for distributed power adoption. The increasing demand for energy security and resilience, coupled with a growing awareness of climate change and the need for decarbonization, further fuels market expansion.

Challenges in the Asia-Pacific Distributed Power Generation Market Market

Despite its promising growth, the Asia-Pacific Distributed Power Generation Market faces several challenges. Regulatory hurdles, including complex permitting processes and grid interconnection policies, can hinder project development. Supply chain issues, such as the availability of key components and raw materials, can lead to cost volatility and project delays. Intermittency of renewable sources, while mitigated by storage, remains a concern requiring sophisticated grid management. Financing challenges, particularly for smaller projects or in emerging markets, can limit investment. Finally, competition from established fossil fuel-based power generation and the need for significant upfront investment can also act as restraints on widespread adoption.

Emerging Opportunities in Asia-Pacific Distributed Power Generation Market

Emerging opportunities in the Asia-Pacific Distributed Power Generation Market lie in the advancement of energy storage technologies, which will further enhance the reliability and dispatchability of renewables. Digitalization and smart grid integration offer significant potential for optimizing distributed energy resources and creating virtual power plants. Green hydrogen production powered by renewable energy presents a long-term opportunity for decarbonizing hard-to-abate sectors. Strategic partnerships between technology providers, utilities, and governments can accelerate market penetration. Furthermore, the increasing focus on energy transition and net-zero goals across the region opens avenues for innovative business models and market expansion into new applications.

Leading Players in the Asia-Pacific Distributed Power Generation Market Sector

- Total SA

- Ballard Power Systems Inc

- Vestas Wind Systems A/S

- Schneider Electric SE

- Caterpillar Inc

- Siemens AG

- Canadian Solar Inc

- Cummins Inc

- Toshiba Fuel Cell Power Systems Corporation

- Trina Solar Limited

- Capstone Turbine Corporation

Key Milestones in Asia-Pacific Distributed Power Generation Market Industry

- 2019: Significant increase in government incentives for rooftop solar installations in China and India.

- 2020: Major advancements in battery storage technology leading to reduced costs and improved performance.

- 2021: Launch of ambitious renewable energy targets by several Southeast Asian nations.

- 2022: Increased M&A activity as larger energy companies acquire smaller distributed generation firms.

- 2023: Growing focus on microgrid development for enhanced energy resilience in island nations and disaster-prone areas.

- 2024 (Estimated): Introduction of new policy frameworks promoting energy efficiency and demand-side management in conjunction with distributed generation.

Strategic Outlook for Asia-Pacific Distributed Power Generation Market Market

The strategic outlook for the Asia-Pacific Distributed Power Generation Market is exceptionally strong, driven by the region's commitment to sustainable energy solutions. Growth accelerators include the continued decline in renewable technology costs, increasing grid modernization efforts, and the burgeoning demand for energy independence and resilience. Future market potential will be significantly shaped by advancements in energy storage, the integration of digital technologies for smarter grid management, and the development of green hydrogen ecosystems. Strategic opportunities for stakeholders lie in focusing on innovation in hybrid systems, developing robust service and maintenance networks, and capitalizing on policy shifts towards decentralized and renewable energy frameworks.

Asia-Pacific Distributed Power Generation Market Segmentation

-

1. Technology

- 1.1. Solar PV

- 1.2. Wind

- 1.3. Combined Heat and Power (CHP)

- 1.4. Other Technologies

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Distributed Power Generation Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Distributed Power Generation Market Regional Market Share

Geographic Coverage of Asia-Pacific Distributed Power Generation Market

Asia-Pacific Distributed Power Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Solar PV Based Distributed Power Generation to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar PV

- 5.1.2. Wind

- 5.1.3. Combined Heat and Power (CHP)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia-Pacific Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Solar PV

- 6.1.2. Wind

- 6.1.3. Combined Heat and Power (CHP)

- 6.1.4. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. India Asia-Pacific Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Solar PV

- 7.1.2. Wind

- 7.1.3. Combined Heat and Power (CHP)

- 7.1.4. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Japan Asia-Pacific Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Solar PV

- 8.1.2. Wind

- 8.1.3. Combined Heat and Power (CHP)

- 8.1.4. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Asia Pacific Asia-Pacific Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Solar PV

- 9.1.2. Wind

- 9.1.3. Combined Heat and Power (CHP)

- 9.1.4. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Total SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ballard Power Systems Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vestas Wind Systems A/S

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Seimens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Canadian Solar Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cummins Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Toshiba Fuel Cell Power Systems Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Trina Solar Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Capstone Turbine Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Total SA

List of Figures

- Figure 1: Asia-Pacific Distributed Power Generation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Distributed Power Generation Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Distributed Power Generation Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Distributed Power Generation Market?

The projected CAGR is approximately 13.2%.

2. Which companies are prominent players in the Asia-Pacific Distributed Power Generation Market?

Key companies in the market include Total SA, Ballard Power Systems Inc, Vestas Wind Systems A/S, Schneider Electric SE*List Not Exhaustive, Caterpillar Inc, Seimens AG, Canadian Solar Inc, Cummins Inc, Toshiba Fuel Cell Power Systems Corporation, Trina Solar Limited, Capstone Turbine Corporation.

3. What are the main segments of the Asia-Pacific Distributed Power Generation Market?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar PV Based Distributed Power Generation to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Distributed Power Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Distributed Power Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Distributed Power Generation Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Distributed Power Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence