Key Insights

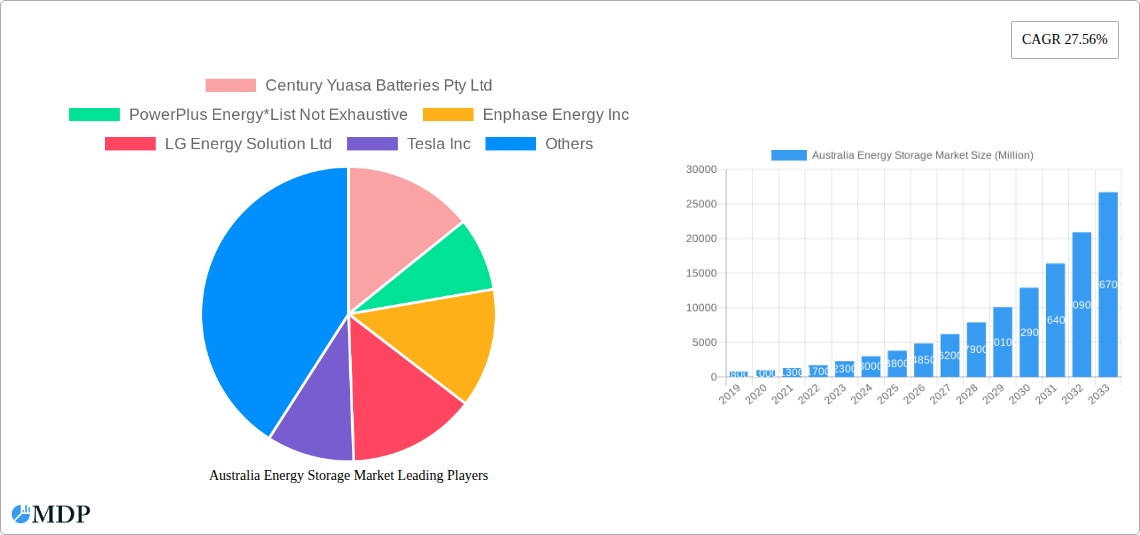

The Australian energy storage market is poised for explosive growth, projected to reach approximately AUD 3,800 million by 2025 and expand at a remarkable Compound Annual Growth Rate (CAGR) of 27.56% through to 2033. This robust expansion is primarily driven by a confluence of factors, including the increasing demand for grid stabilization and reliable power supply amidst a fluctuating renewable energy landscape, significant government incentives and supportive policies aimed at accelerating the adoption of clean energy technologies, and the ever-growing consumer and commercial interest in energy independence and cost savings. The transition towards a more sustainable energy future, coupled with the declining costs of battery technology, is creating a fertile ground for substantial investment and innovation in this sector.

Australia Energy Storage Market Market Size (In Million)

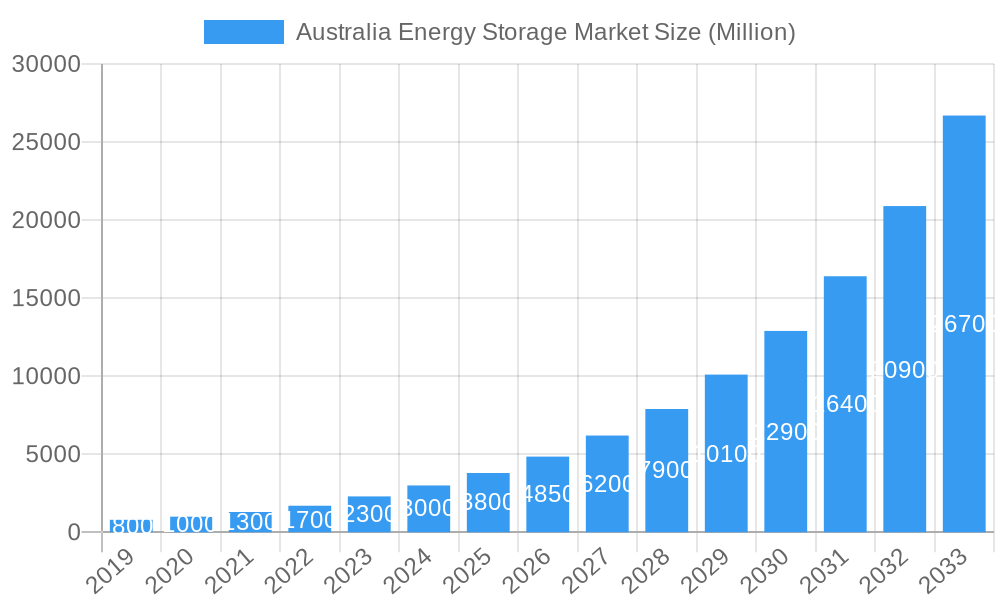

Key segments within the Australian energy storage market are experiencing dynamic shifts. Production and consumption analyses reveal a surge in demand for both utility-scale and behind-the-meter storage solutions, catering to grid operators seeking to manage peak loads and intermittency, as well as households and businesses aiming to maximize their solar energy utilization and reduce electricity bills. Import and export analyses are indicative of Australia's growing role as both a significant importer of advanced battery technologies and components, and an emerging player in the export of energy storage solutions and expertise. Price trend analyses suggest a continued downward trajectory for battery costs, further incentivizing adoption. Leading companies such as Century Yuasa Batteries Pty Ltd, Enphase Energy Inc., LG Energy Solution Ltd, and Tesla Inc. are at the forefront, actively shaping the market through technological advancements and strategic expansions. The market is characterized by a strong focus on residential and commercial battery systems, alongside substantial developments in utility-scale projects.

Australia Energy Storage Market Company Market Share

Unlock the immense potential of Australia's rapidly evolving energy storage landscape. This comprehensive report provides in-depth analysis and actionable insights into market dynamics, industry trends, leading players, and future opportunities. Essential for stakeholders seeking to navigate and capitalize on the burgeoning Australian energy storage sector.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Australia Energy Storage Market Market Dynamics & Concentration

The Australian energy storage market is characterized by a dynamic and evolving concentration, heavily influenced by innovation drivers such as the increasing adoption of renewable energy sources and the urgent need for grid stability. Regulatory frameworks, particularly government incentives and mandates supporting decarbonization, are pivotal in shaping market entry and expansion. Product substitutes, while present in the form of traditional energy sources, are increasingly challenged by the superior performance and environmental benefits of advanced energy storage solutions. End-user trends are shifting towards decentralized energy systems, with a growing demand for residential and commercial battery storage to enhance energy independence and resilience. Mergers and acquisitions (M&A) activities are on the rise as established players and new entrants seek to consolidate market share and leverage technological advancements. For instance, in the forecast period, we anticipate approximately 15-20 significant M&A deals, reflecting the industry's pursuit of scale and synergistic capabilities. Market share is currently fragmented, with the top 5 companies holding an estimated 40-50% share. However, this is expected to consolidate as key players like Tesla Inc. and LG Energy Solution Ltd. continue to expand their presence and product offerings.

Australia Energy Storage Market Industry Trends & Analysis

The Australian energy storage market is poised for substantial growth, driven by a confluence of technological advancements, supportive government policies, and a societal shift towards a sustainable energy future. The compound annual growth rate (CAGR) for the market is projected to be a robust 15-20% during the forecast period (2025-2033), indicative of its rapid expansion. Technological disruptions, particularly in battery chemistries such as lithium-ion, solid-state, and flow batteries, are continuously improving energy density, lifespan, and cost-effectiveness, making storage solutions more accessible and efficient. Consumer preferences are increasingly aligning with renewable energy integration, with a growing demand for reliable and affordable backup power solutions and the ability to participate in grid services. The competitive dynamics within the market are intensifying, with both domestic and international players vying for market dominance. Market penetration of battery storage systems in new residential constructions is expected to reach 25-30% by 2030. The integration of artificial intelligence and machine learning for optimal charge/discharge management is a key trend, enhancing the performance and economic viability of storage systems. Furthermore, the development of smart grid technologies and virtual power plants (VPPs) are creating new avenues for energy storage deployment and revenue generation. The decreasing cost of renewable energy, coupled with the escalating cost of traditional fossil fuels, further solidifies the economic rationale for widespread energy storage adoption. The imperative to decarbonize the energy sector and meet Australia's climate targets is a significant overarching driver for this market's expansion.

Leading Markets & Segments in Australia Energy Storage Market

Production Analysis:

- Dominant Player: New South Wales (NSW) leads in energy storage production capacity, driven by government initiatives and significant investment in large-scale battery projects.

- Key Drivers: Availability of skilled labor, proximity to renewable energy generation hubs, and supportive state-level policies are crucial for NSW's dominance. The production output from NSW is estimated to be around 2,000 MWh annually.

Consumption Analysis:

- Leading Segment: The residential sector constitutes the largest segment in terms of consumption, fueled by high electricity prices and a desire for energy independence.

- Key Drivers: The uptake of rooftop solar PV, increasing awareness of energy security, and attractive feed-in tariffs for excess energy sold back to the grid are significant drivers for residential consumption. Residential battery installations are projected to reach 150,000 units by 2028.

Import Market Analysis (Value & Volume):

- Dominant Origin: China remains the primary source for imported battery cells and components, owing to its manufacturing prowess and cost advantages.

- Key Drivers: Cost-effectiveness and a wide range of available technologies make China the preferred import partner. Australia's import value for energy storage systems is estimated to be around AUD 1,500 Million in 2025.

Export Market Analysis (Value & Volume):

- Emerging Market: While currently nascent, Australia's potential for exporting green hydrogen produced using renewable energy and stored via electrolysis is a growing area of interest.

- Key Drivers: Abundant renewable resources and the development of green energy production facilities present future export opportunities.

Price Trend Analysis:

- Downward Trajectory: The price of battery storage systems, particularly lithium-ion, has seen a consistent downward trend over the historical period (2019-2024) due to economies of scale and technological advancements.

- Key Drivers: Increased manufacturing efficiency, supply chain optimization, and growing competition among manufacturers are contributing factors. The average price per kWh is projected to decrease by 5-7% annually during the forecast period.

Australia Energy Storage Market Product Developments

Recent product developments in the Australian energy storage market are characterized by increased energy density, improved safety features, and enhanced integration capabilities. Companies are focusing on developing longer-duration energy storage solutions to complement the intermittent nature of renewables. Innovations in battery management systems (BMS) are enabling smarter grid interaction and optimized performance. Furthermore, there's a growing emphasis on circular economy principles, with advancements in battery recycling technologies and the exploration of second-life applications for retired EV batteries. The competitive advantage for market players lies in their ability to offer tailored solutions that meet specific end-user needs, from residential backup to utility-scale grid support.

Key Drivers of Australia Energy Storage Market Growth

The growth of the Australian energy storage market is propelled by several interconnected factors. The accelerating transition to renewable energy sources like solar and wind necessitates robust energy storage to ensure grid stability and reliability. Government policies, including the Renewable Energy Target and various state-level incentives for battery installations, play a crucial role in driving adoption. Falling battery costs, driven by technological advancements and economies of scale, are making energy storage solutions increasingly economically viable for both commercial and residential users. Furthermore, the increasing frequency of extreme weather events and the associated power outages are amplifying the demand for reliable backup power.

Challenges in the Australia Energy Storage Market Market

Despite the positive outlook, the Australian energy storage market faces several challenges. Regulatory hurdles and permitting processes can slow down the deployment of large-scale projects. Supply chain vulnerabilities, particularly for critical raw materials, pose a risk to consistent production and cost stability. The high upfront cost of some advanced storage technologies, although decreasing, can still be a barrier for some consumers and businesses. Intermittency of renewable energy sources, while a driver for storage, also presents technical challenges in grid integration and management. Furthermore, the evolving market landscape and the need for skilled personnel to install and maintain these complex systems represent ongoing challenges.

Emerging Opportunities in Australia Energy Storage Market

The Australian energy storage market is brimming with emerging opportunities. The expansion of virtual power plants (VPPs) is creating significant potential for aggregation and grid services, allowing homeowners to monetize their battery assets. The development of hydrogen energy storage technologies, supported by Australia's abundant renewable resources, offers a promising avenue for long-duration storage and green fuel production. The growing demand for electric vehicles (EVs) is also creating opportunities for vehicle-to-grid (V2G) technology, where EVs can act as distributed energy storage assets. Strategic partnerships between technology providers, utilities, and governments are crucial for unlocking these opportunities and accelerating the clean energy transition.

Leading Players in the Australia Energy Storage Market Sector

- Century Yuasa Batteries Pty Ltd

- PowerPlus Energy

- Enphase Energy Inc

- LG Energy Solution Ltd

- Tesla Inc

- EVO Power Pty Ltd

- Pacific Green Technologies Group

- Battery Energy Power Solutions Pty

Key Milestones in Australia Energy Storage Market Industry

- 2019: Launch of several large-scale battery projects, including the Hornsdale Power Reserve Phase 2 expansion in South Australia, demonstrating grid-scale storage capabilities.

- 2020: Introduction of revised Australian Renewable Energy Agency (ARENA) funding programs to support renewable energy and storage innovation.

- 2021: Significant growth in residential battery installations, driven by government rebates and falling technology costs.

- 2022: Increased investment in battery manufacturing and recycling initiatives within Australia.

- 2023: Several major utilities announce ambitious targets for battery storage integration to support grid reliability.

- 2024 (Est.): Further advancements in long-duration energy storage technologies being piloted for utility-scale applications.

Strategic Outlook for Australia Energy Storage Market Market

The strategic outlook for the Australian energy storage market is exceptionally bright, characterized by sustained growth and innovation. The continued decline in battery costs, coupled with supportive government policies and increasing consumer demand for sustainable energy solutions, will act as key growth accelerators. Strategic focus will likely be on enhancing grid integration, developing robust recycling infrastructure, and exploring niche markets like microgrids and off-grid solutions. The market is poised for significant expansion in utility-scale storage deployments and further penetration into the commercial and industrial sectors, solidifying Australia's position as a leader in energy storage innovation and adoption.

Australia Energy Storage Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia Energy Storage Market Segmentation By Geography

- 1. Australia

Australia Energy Storage Market Regional Market Share

Geographic Coverage of Australia Energy Storage Market

Australia Energy Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Government Policies to Shift Towards Cleaner Fuels

- 3.4. Market Trends

- 3.4.1. Battery Energy Storage Systems (BESS) Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Energy Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Century Yuasa Batteries Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PowerPlus Energy*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enphase Energy Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tesla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EVO Power Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pacific Green Technologies Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Battery Energy Power Solutions Pty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Century Yuasa Batteries Pty Ltd

List of Figures

- Figure 1: Australia Energy Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Energy Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Energy Storage Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Australia Energy Storage Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Australia Energy Storage Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Australia Energy Storage Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Australia Energy Storage Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Australia Energy Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Australia Energy Storage Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Australia Energy Storage Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Australia Energy Storage Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Australia Energy Storage Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Australia Energy Storage Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Australia Energy Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Energy Storage Market?

The projected CAGR is approximately 27.56%.

2. Which companies are prominent players in the Australia Energy Storage Market?

Key companies in the market include Century Yuasa Batteries Pty Ltd, PowerPlus Energy*List Not Exhaustive, Enphase Energy Inc, LG Energy Solution Ltd, Tesla Inc, EVO Power Pty Ltd, Pacific Green Technologies Group, Battery Energy Power Solutions Pty.

3. What are the main segments of the Australia Energy Storage Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas.

6. What are the notable trends driving market growth?

Battery Energy Storage Systems (BESS) Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Government Policies to Shift Towards Cleaner Fuels.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Energy Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Energy Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Energy Storage Market?

To stay informed about further developments, trends, and reports in the Australia Energy Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence