Key Insights

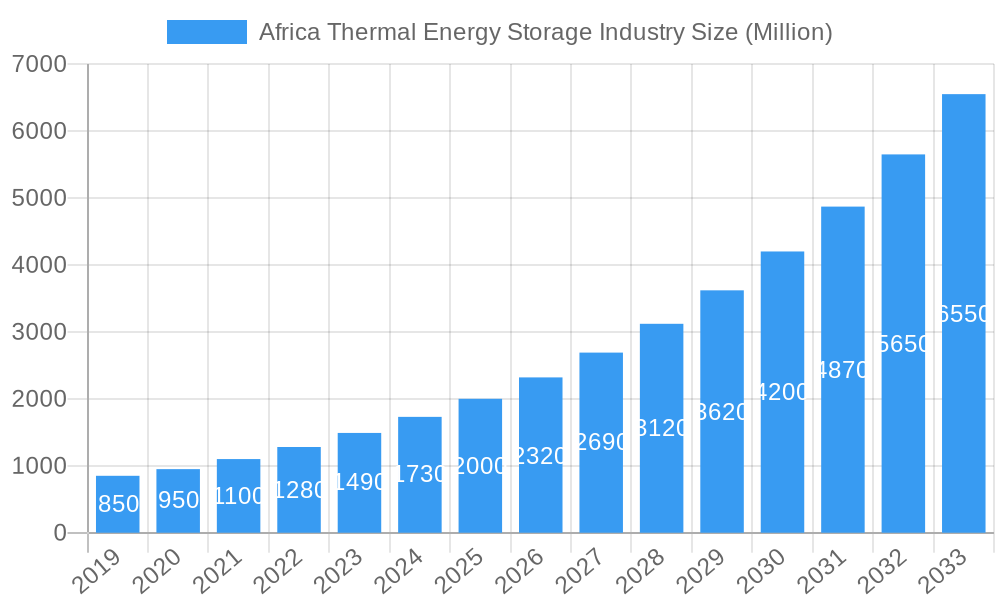

The Africa Thermal Energy Storage (TES) market is poised for substantial growth, driven by the increasing demand for renewable energy integration and the need for reliable power generation across the continent. With a projected Compound Annual Growth Rate (CAGR) exceeding 10.00%, the market is expected to expand significantly from its current valuation. Key drivers include the burgeoning renewable energy sector, particularly solar power, which necessitates efficient energy storage solutions to overcome intermittency issues. Furthermore, growing investments in infrastructure development, industrialization, and the demand for stable heating and cooling systems in commercial and residential sectors are fueling market expansion. The adoption of thermal energy storage technologies is crucial for enhancing grid stability, reducing reliance on fossil fuels, and achieving energy security objectives in many African nations.

Africa Thermal Energy Storage Industry Market Size (In Million)

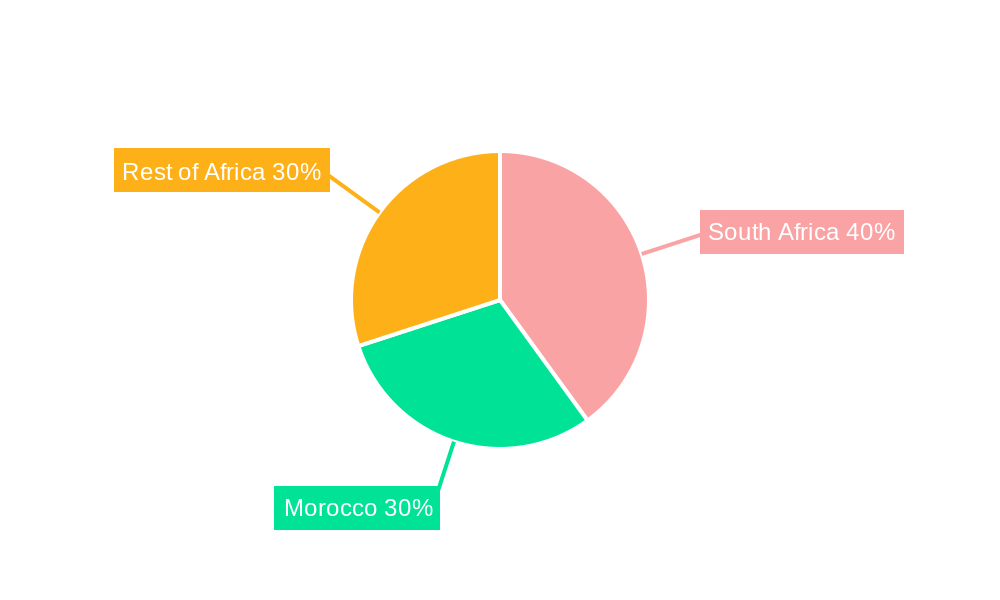

The market segmentation reveals diverse opportunities. In terms of applications, Power Generation is a dominant segment, leveraging TES for grid-scale energy balancing and dispatchable renewable power. Heating and Cooling applications are also gaining traction, driven by the need for energy-efficient climate control in buildings and industrial processes. Molten salt stands out as a leading storage type, particularly for high-temperature applications in concentrated solar power (CSP) plants, while heat and ice storage solutions are finding niches in various commercial and residential applications. Geographically, South Africa and Morocco are spearheading the adoption of TES technologies due to their significant investments in CSP and robust renewable energy policies. The "Rest of Africa" segment is anticipated to witness accelerated growth as more countries recognize the strategic importance of TES in their energy transition journeys, attracting substantial investment and fostering innovation in this dynamic market.

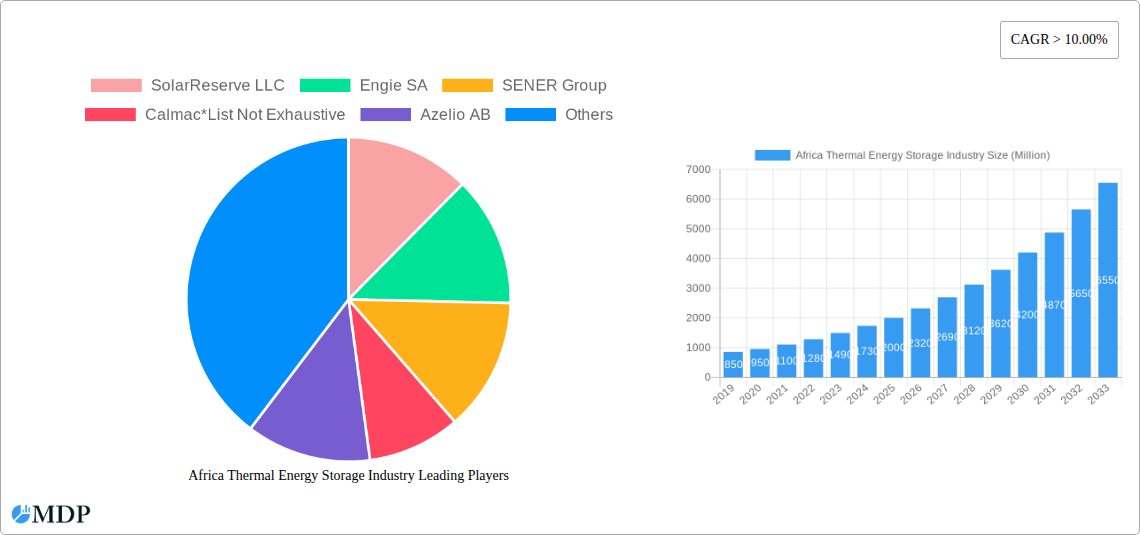

Africa Thermal Energy Storage Industry Company Market Share

Africa Thermal Energy Storage Industry Market: A Comprehensive Analysis and Growth Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the burgeoning Africa Thermal Energy Storage (TES) industry, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033. Delve into critical market dynamics, explore emerging trends, identify leading segments, and gain actionable insights into the strategies of key players. With a focus on high-traffic keywords such as "thermal energy storage Africa," "CSP storage," "molten salt energy storage," "energy storage solutions Africa," and "renewable energy storage," this report is an indispensable resource for industry stakeholders seeking to capitalize on Africa's rapidly expanding energy storage landscape.

Africa Thermal Energy Storage Industry Market Dynamics & Concentration

The Africa Thermal Energy Storage market is characterized by moderate concentration, with a few dominant players influencing innovation and project development. Key innovation drivers include the increasing demand for grid stability, the integration of intermittent renewable energy sources like solar and wind, and governmental mandates for energy security. Regulatory frameworks are evolving, with supportive policies and incentives being introduced in countries like South Africa and Morocco to promote renewable energy adoption and storage solutions. Product substitutes, such as battery energy storage systems (BESS), present a competitive challenge, though TES offers distinct advantages in certain applications, particularly for large-scale, long-duration storage. End-user trends highlight a growing preference for reliable and cost-effective energy solutions, driving demand for TES in both utility-scale power generation and industrial heating/cooling applications. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation and expansion. While specific market share data for individual TES technologies is still nascent, the overall thermal energy storage market in Africa is projected to see significant growth. M&A activities are expected to increase as larger energy companies seek to integrate TES capabilities into their portfolios to meet the growing demand for renewable energy solutions.

Africa Thermal Energy Storage Industry Industry Trends & Analysis

The Africa Thermal Energy Storage industry is poised for substantial growth, driven by a confluence of factors and technological advancements. The primary market growth driver is the continent's escalating demand for reliable and sustainable electricity, fueled by population growth, industrialization, and the widespread adoption of renewable energy sources. Concentrated Solar Power (CSP) with integrated thermal energy storage is emerging as a pivotal technology, offering dispatchable solar power that overcomes the intermittency inherent in solar energy generation. This capability is crucial for grid stability and for meeting peak electricity demand, particularly in regions with abundant solar resources. Technological disruptions are evident in the ongoing research and development of more efficient and cost-effective TES materials and systems, including advanced molten salt formulations and improved heat and ice storage technologies. Consumer preferences are shifting towards energy solutions that provide cost savings, enhanced grid reliability, and reduced environmental impact. Businesses and utilities are increasingly recognizing the strategic advantage of thermal energy storage in buffering renewable energy generation and ensuring a consistent power supply. Competitive dynamics are intensifying as established energy companies and specialized TES providers vie for market share. The anticipated Compound Annual Growth Rate (CAGR) for the African TES market is robust, reflecting its significant potential. Market penetration for TES is expected to deepen, particularly in key markets prioritizing renewable energy integration and energy security.

Leading Markets & Segments in Africa Thermal Energy Storage Industry

The South Africa region stands as a dominant market for thermal energy storage in Africa, driven by its early adoption of renewable energy policies and significant investments in concentrated solar power (CSP) projects. The country's commitment to diversifying its energy mix away from coal has created a fertile ground for TES solutions.

Application Dominance:

- Power Generation: This segment is the primary driver of the TES market in South Africa and other leading African nations. The need for grid-scale energy storage to integrate intermittent renewables like solar and wind is paramount. CSP plants with molten salt storage are particularly prominent in this application, offering reliable baseload power.

- Heating and Cooling: While currently a smaller segment, this application is projected to see significant growth, especially in industrial processes and commercial buildings seeking efficient thermal management solutions.

Storage Type Dominance:

- Molten Salt: This storage type is the most prevalent and advanced within the African TES market, largely due to its synergy with CSP technology. Its ability to store large amounts of thermal energy at high temperatures makes it ideal for power generation applications.

- Heat Storage: Directly related to molten salt, but also encompassing other mediums, heat storage is critical for industrial processes requiring sustained thermal energy.

- Ice Storage: Primarily used for cooling applications, ice storage is gaining traction in commercial and institutional sectors for peak load shifting and energy efficiency.

Geographical Influence:

- South Africa: Leads due to established policies, existing CSP infrastructure, and ongoing tenders for large-scale energy storage projects.

- Morocco: A rapidly growing market driven by ambitious renewable energy targets and significant solar power development, with a growing interest in TES integration.

- Rest of Africa: This segment represents a significant future growth potential, with countries like Namibia, Egypt, and Kenya showing increasing interest and initiating projects in renewable energy and energy storage. Economic policies encouraging foreign investment and advancements in grid infrastructure are key enablers for expansion in these regions.

Africa Thermal Energy Storage Industry Product Developments

Product development in the Africa Thermal Energy Storage industry is focused on enhancing efficiency, reducing costs, and expanding application versatility. Innovations in advanced molten salt compositions are yielding higher energy densities and improved thermal stability, crucial for CSP plants. Furthermore, research into novel heat storage materials, such as phase change materials (PCMs) and thermochemical storage, promises to unlock new possibilities for efficient heating and cooling solutions in industrial and commercial settings. The integration of TES with emerging renewable energy technologies and smart grid systems is also a key trend, enabling seamless energy management and grid stability. These advancements are tailored to meet the specific demands of African markets, addressing challenges like grid intermittency and the need for reliable, cost-effective energy.

Key Drivers of Africa Thermal Energy Storage Industry Growth

Several key factors are propelling the growth of the Africa Thermal Energy Storage industry. Firstly, the significant investment in renewable energy sources, particularly solar power, necessitates robust energy storage solutions to ensure grid stability and dispatchability. Secondly, the growing demand for reliable and affordable electricity across the continent, driven by economic development and population growth, makes TES a crucial component of energy security strategies. Thirdly, supportive government policies and incentives aimed at promoting clean energy adoption and reducing carbon emissions are creating a favorable market environment. Technological advancements leading to improved efficiency and reduced costs of TES systems further contribute to their attractiveness.

Challenges in the Africa Thermal Energy Storage Industry Market

Despite the immense growth potential, the Africa Thermal Energy Storage industry faces several challenges. Regulatory hurdles and inconsistencies across different countries can slow down project development and investment. High upfront capital costs for large-scale TES installations remain a significant barrier, particularly in markets with limited access to financing. Supply chain issues and the availability of specialized components and skilled labor can also impede project execution. Furthermore, competition from established and rapidly evolving battery energy storage technologies presents a continuous challenge, requiring TES solutions to demonstrate clear cost-effectiveness and performance advantages.

Emerging Opportunities in Africa Thermal Energy Storage Industry

Emerging opportunities in the Africa Thermal Energy Storage industry are primarily catalysts for long-term growth. Technological breakthroughs in advanced materials and system designs are expected to further improve efficiency and reduce the cost of TES, making it more competitive. Strategic partnerships between local energy developers, international technology providers, and financial institutions are crucial for unlocking project financing and accelerating deployment. Market expansion into underserved regions and the development of hybrid energy storage solutions, combining TES with other technologies, represent significant growth avenues. The increasing focus on decarbonization and the need for flexible grid solutions will continue to drive demand for innovative TES applications across the continent.

Leading Players in the Africa Thermal Energy Storage Industry Sector

- SolarReserve LLC

- Engie SA

- SENER Group

- Calmac

- Azelio AB

- Eskom Holdings SOC Ltd

- Abengoa SA

- ACWA Power International

- BrightSource Energy Inc

Key Milestones in Africa Thermal Energy Storage Industry Industry

- December 2021: Namibia Power Corporation Ltd (NamPower) announced a tender for a project combining concentrated solar power (CSP) with energy storage of 50MW-130MW. This project is anticipated to cost between USD 600 Million and USD 1 Billion, signaling significant investment interest in the region.

- November 2021: ENGIE completed the acquisition of Abengoa's indirect stake in Xina Solar One (Pty) Ltd. Following this transaction, ENGIE owns 40% of the Xina Solar One 100 MW Concentrated Solar Power (CSP) plant and 46% of the Xina Operations & Maintenance Company (Pty) Ltd company, demonstrating consolidation and strategic investment in existing CSP assets with integrated storage.

Strategic Outlook for Africa Thermal Energy Storage Industry Market

The strategic outlook for the Africa Thermal Energy Storage industry is exceptionally positive, characterized by sustained growth and expanding applications. The increasing global and continental emphasis on renewable energy integration and energy independence will continue to be the primary growth accelerator. Future market potential lies in the widespread adoption of TES for grid-scale power generation, industrial process heat, and the development of decentralized energy systems. Strategic opportunities include leveraging advancements in molten salt technology, exploring the potential of new thermal storage mediums, and fostering collaborations to overcome financing and infrastructure challenges. The continued support from governments, coupled with innovation from leading players, will solidify TES as a cornerstone of Africa's sustainable energy future.

Africa Thermal Energy Storage Industry Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Heating and Cooling

-

2. Storage Type

- 2.1. Molten Salt

- 2.2. Heat

- 2.3. Ice

- 2.4. Other Storage Types

-

3. Geography

- 3.1. South Africa

- 3.2. Morocco

- 3.3. Rest of Africa

Africa Thermal Energy Storage Industry Segmentation By Geography

- 1. South Africa

- 2. Morocco

- 3. Rest of Africa

Africa Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of Africa Thermal Energy Storage Industry

Africa Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Secure

- 3.2.2 Sustainable

- 3.2.3 and Clean Energy

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Production of Biofuels

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Heating and Cooling

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Molten Salt

- 5.2.2. Heat

- 5.2.3. Ice

- 5.2.4. Other Storage Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Morocco

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Morocco

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Generation

- 6.1.2. Heating and Cooling

- 6.2. Market Analysis, Insights and Forecast - by Storage Type

- 6.2.1. Molten Salt

- 6.2.2. Heat

- 6.2.3. Ice

- 6.2.4. Other Storage Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Morocco

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Morocco Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Generation

- 7.1.2. Heating and Cooling

- 7.2. Market Analysis, Insights and Forecast - by Storage Type

- 7.2.1. Molten Salt

- 7.2.2. Heat

- 7.2.3. Ice

- 7.2.4. Other Storage Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Morocco

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Generation

- 8.1.2. Heating and Cooling

- 8.2. Market Analysis, Insights and Forecast - by Storage Type

- 8.2.1. Molten Salt

- 8.2.2. Heat

- 8.2.3. Ice

- 8.2.4. Other Storage Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Morocco

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Engie SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 SENER Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Calmac*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Azelio AB

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eskom Holdings SOC Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ACWA Power International

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: Africa Thermal Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 3: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 7: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 11: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 15: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Thermal Energy Storage Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Africa Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Engie SA, SENER Group, Calmac*List Not Exhaustive, Azelio AB, Eskom Holdings SOC Ltd, Abengoa SA, ACWA Power International, BrightSource Energy Inc.

3. What are the main segments of the Africa Thermal Energy Storage Industry?

The market segments include Application, Storage Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Secure. Sustainable. and Clean Energy.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Production of Biofuels.

8. Can you provide examples of recent developments in the market?

In December 2021, Namibia Power Corporation Ltd (NamPower), the national electric power utility of the country, announced a tender for a project combining concentrated solar power (CSP) with energy storage of 50MW-130MW. It is anticipated that the proposed project will cost between USD 600 million and USD 1 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Africa Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence