Key Insights

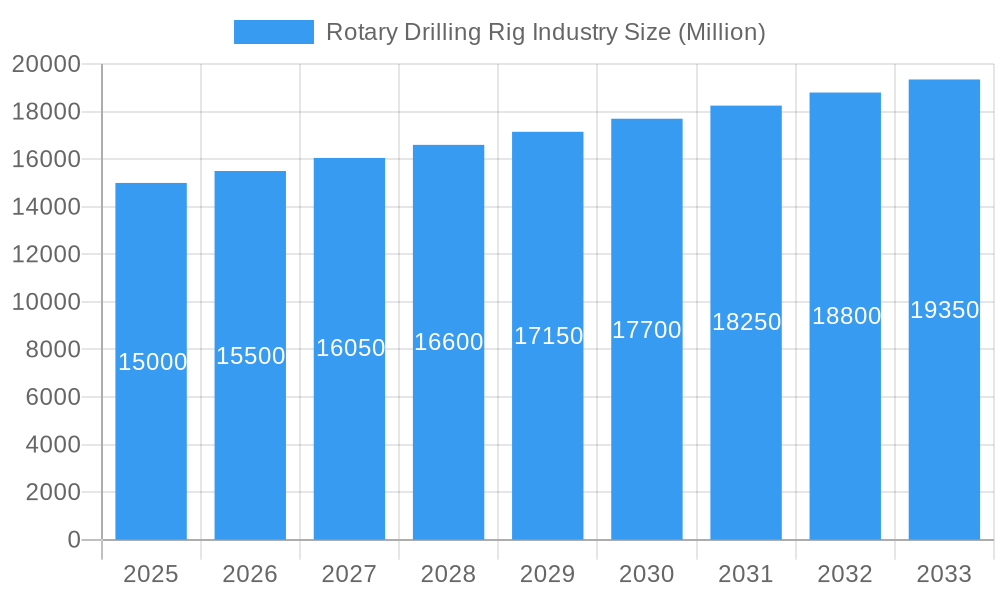

The global Rotary Drilling Rig Industry is poised for robust expansion, projecting a market size exceeding $XX billion with a Compound Annual Growth Rate (CAGR) of over 3.50% through 2033. This sustained growth is primarily fueled by increasing investments in oil and gas exploration and production activities, particularly in emerging economies with substantial hydrocarbon reserves. The demand for advanced drilling technologies capable of operating in challenging environments, both onshore and offshore, is a significant driver. Furthermore, the mining sector's continuous need for efficient extraction methods, coupled with infrastructure development projects requiring deep drilling, contributes to the positive market trajectory. Innovations in rig design, automation, and remote operation capabilities are also playing a crucial role in enhancing operational efficiency and safety, thereby stimulating market adoption.

Rotary Drilling Rig Industry Market Size (In Billion)

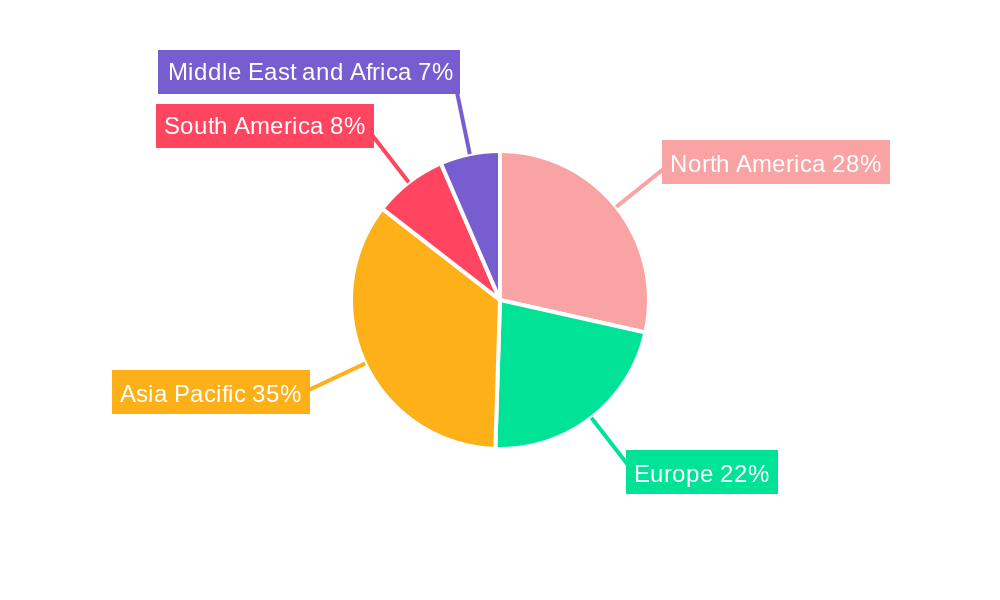

Despite the overall positive outlook, the industry faces certain restraints. Fluctuations in global energy prices can impact exploration budgets, leading to cautious investment decisions. Stringent environmental regulations and growing concerns regarding the impact of drilling operations necessitate the adoption of eco-friendly technologies, which can increase initial capital expenditure. However, the industry is actively addressing these challenges through the development of more sustainable drilling practices and equipment. The market is segmented by location of deployment, with onshore operations currently dominating but offshore drilling gaining traction due to the discovery of deep-sea reserves. Key applications span oil and gas, mining, and other specialized drilling needs. Leading companies such as Dando Drilling International Ltd, BAUER AG, Schramm Inc, Sandvik Drilling, Zoomlion Heavy Industry Science & Technology Co Ltd, SANY Group Co., Ltd., STREICHER Drilling Technology GmbH, Caterpillar, and Atlas Copco are at the forefront of innovation and market expansion. The Asia Pacific region is expected to witness the highest growth, driven by burgeoning energy demands and significant exploration activities.

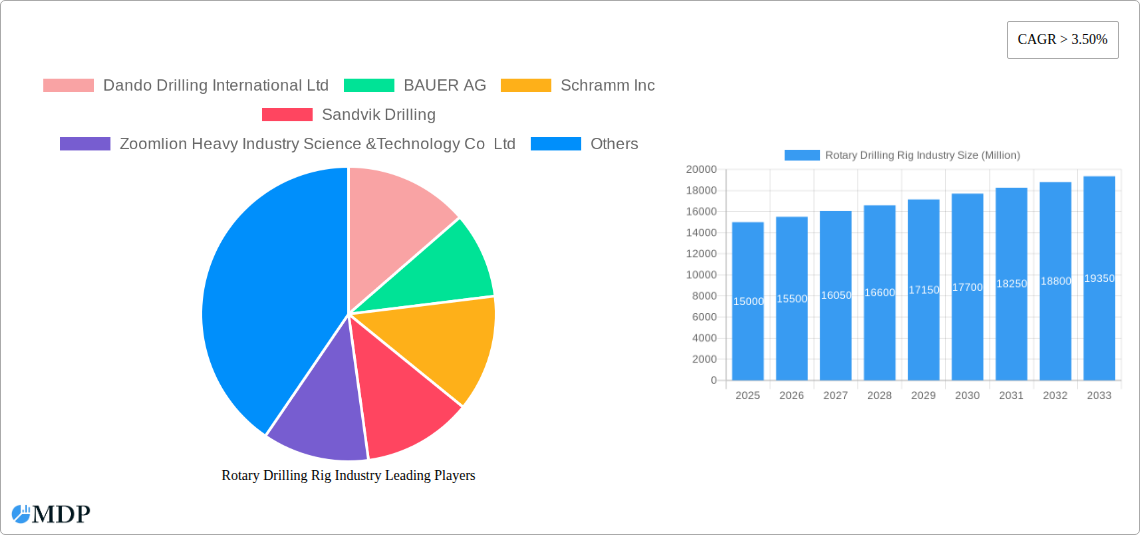

Rotary Drilling Rig Industry Company Market Share

Rotary Drilling Rig Industry Market Analysis Report: Unearthing Future Growth (2019-2033)

Gain unparalleled insights into the global Rotary Drilling Rig market with this comprehensive analysis. Covering the period from 2019 to 2033, with a base year of 2025, this report provides in-depth market dynamics, key trends, leading segments, and strategic outlooks. Discover critical growth drivers, emerging opportunities, and the competitive landscape shaped by industry giants like Dando Drilling International Ltd, BAUER AG, Schramm Inc, Sandvik Drilling, Zoomlion Heavy Industry Science & Technology Co Ltd, SANY Group Co Ltd, STREICHER Drilling Technology GmbH, Caterpillar, and Atlas Copco. Essential for oil and gas exploration, mining operations, and other critical applications, this report is your definitive guide to navigating the future of rotary drilling.

Rotary Drilling Rig Industry Market Dynamics & Concentration

The Rotary Drilling Rig industry exhibits a moderate to high level of market concentration, with a few prominent players holding significant market share. In the historical period (2019-2024), leading companies like Caterpillar and Atlas Copco have consistently dominated, driven by their extensive product portfolios and global service networks. Innovation remains a key differentiator, with ongoing advancements in drilling efficiency, safety features, and environmental sustainability. Regulatory frameworks, particularly in the oil and gas and mining sectors, play a crucial role in shaping market access and operational standards. Product substitutes, while not directly replacing the core functionality of rotary drilling rigs, can influence demand through alternative extraction or construction methods. End-user trends are heavily influenced by commodity prices and global infrastructure development projects, leading to cyclical demand patterns. Mergers and acquisitions (M&A) activities, while not rampant, have occurred strategically to consolidate market presence and enhance technological capabilities. For instance, a hypothetical M&A deal in 2023 involving a key competitor could have impacted market share by an estimated 5-7%. The market share of the top 5 players is estimated to be around 60% in 2025. The number of significant M&A deals in the last five years is approximately 8.

Rotary Drilling Rig Industry Industry Trends & Analysis

The Rotary Drilling Rig industry is poised for significant growth, driven by a confluence of factors including increasing energy demands and expanding infrastructure projects worldwide. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be a robust 6.8%. Technological disruptions are at the forefront, with the integration of AI-powered drilling optimization, advanced automation, and IoT connectivity transforming operational efficiency and predictive maintenance. Companies are investing heavily in R&D to develop lighter, more powerful, and versatile rigs capable of operating in challenging terrains and extreme conditions. Consumer preferences are leaning towards more sustainable drilling solutions, prompting manufacturers to focus on reducing emissions and enhancing energy efficiency. Competitive dynamics are intensifying, with established players vying for market dominance against agile new entrants offering specialized solutions. Market penetration is expected to deepen in developing economies as they expand their resource extraction and infrastructure development capabilities. For example, the adoption of advanced drilling technologies in emerging markets is estimated to increase by 15% annually. The ongoing global push for energy independence and diversification further fuels the demand for reliable and efficient drilling equipment.

Leading Markets & Segments in Rotary Drilling Rig Industry

The Onshore deployment segment, particularly for Oil and Gas applications, currently dominates the Rotary Drilling Rig market, accounting for an estimated 55% of the total market share in 2025. This dominance is fueled by sustained exploration and production activities in major oil-producing regions.

- Onshore Dominance:

- Economic Policies: Favorable government policies and incentives for domestic oil and gas production in regions like North America and the Middle East bolster onshore drilling activities.

- Infrastructure Development: Extensive existing infrastructure for oil and gas transportation and processing supports onshore operations.

- Technological Advancements: Innovations in horizontal drilling and hydraulic fracturing have unlocked previously inaccessible reserves, increasing the demand for advanced onshore rigs.

- Market Size: The onshore segment is projected to reach a value of approximately $15,000 million by 2033.

The Offshore segment, while currently smaller, is experiencing rapid growth, especially in deep-water exploration. This is driven by the increasing need to access hydrocarbon reserves in frontier areas.

- Offshore Growth Catalysts:

- Untapped Reserves: Significant unexplored hydrocarbon potential lies beneath offshore formations, attracting substantial investment.

- Technological Sophistication: Advancements in offshore drilling technology, including semi-submersible and drillship capabilities, enable operations in challenging deep-water environments.

- Regulatory Support: Evolving regulatory frameworks in various offshore basins are facilitating new exploration licenses.

Within applications, Oil and Gas remains the primary consumer, but the Mining segment is also a significant contributor and is expected to grow at a faster pace due to the increasing demand for critical minerals.

- Mining Sector Expansion:

- Demand for Minerals: Growing demand for metals like copper, lithium, and rare earth elements for renewable energy technologies and electric vehicles is driving mining exploration.

- Exploration Technology: Rotary drilling rigs are essential for mineral exploration and resource assessment in the mining industry.

- Geological Diversity: Diverse geological formations in mining regions necessitate specialized drilling equipment.

The Others application segment, encompassing water well drilling, geothermal energy exploration, and construction projects, presents niche but growing opportunities.

Rotary Drilling Rig Industry Product Developments

Product innovation in the Rotary Drilling Rig industry is characterized by a strong emphasis on enhanced efficiency, safety, and environmental performance. Manufacturers are actively developing rigs with higher penetration rates, reduced fuel consumption, and lower noise emissions. Automation and digital integration are key trends, enabling remote monitoring, data analytics for optimized drilling parameters, and predictive maintenance. The incorporation of advanced materials contributes to lighter and more durable rig designs. Competitive advantages are being forged through customizable modular designs, quick setup times, and specialized tooling for specific geological conditions, catering to diverse applications from oil and gas extraction to mining and infrastructure development.

Key Drivers of Rotary Drilling Rig Industry Growth

The Rotary Drilling Rig industry's growth is propelled by several key drivers. Firstly, the escalating global demand for energy, particularly from oil and gas, necessitates continuous exploration and production, directly fueling the need for drilling rigs. Secondly, significant investments in infrastructure development worldwide, including mining operations for critical minerals essential for the green energy transition, create substantial demand. Thirdly, technological advancements, such as the development of more efficient and automated drilling systems, are making operations more cost-effective and accessible, thereby stimulating market expansion. Finally, favorable government policies in various regions, aimed at boosting energy security and resource extraction, further contribute to the industry's upward trajectory.

Challenges in the Rotary Drilling Rig Industry Market

Despite robust growth prospects, the Rotary Drilling Rig industry faces several challenges. Stringent environmental regulations and increasing scrutiny over the carbon footprint of drilling operations can lead to higher compliance costs and operational restrictions. Fluctuations in commodity prices, especially for oil and gas, can impact investment decisions and consequently the demand for drilling rigs. Supply chain disruptions and the rising cost of raw materials can affect manufacturing timelines and profitability. Intense competition among manufacturers, coupled with price pressures, also poses a challenge. Furthermore, the scarcity of skilled labor required to operate and maintain sophisticated drilling equipment can hinder market expansion. The cost of advanced technological integration, estimated to increase operational expenditure by 10-15% in the short term, also presents a barrier for smaller players.

Emerging Opportunities in Rotary Drilling Rig Industry

Emerging opportunities in the Rotary Drilling Rig industry are primarily driven by the global energy transition and the growing demand for critical minerals. The expansion of renewable energy infrastructure, including geothermal projects, presents a nascent but promising market for specialized drilling rigs. Furthermore, advancements in digital drilling technologies, such as artificial intelligence and machine learning for real-time performance optimization and predictive maintenance, offer significant potential for increased efficiency and reduced operational costs. Strategic partnerships between drilling rig manufacturers and technology providers are expected to accelerate innovation and the adoption of cutting-edge solutions. Market expansion into regions with untapped resource potential, coupled with a focus on developing more sustainable and environmentally friendly drilling solutions, will also be key catalysts for long-term growth.

Leading Players in the Rotary Drilling Rig Industry Sector

- Dando Drilling International Ltd

- BAUER AG

- Schramm Inc

- Sandvik Drilling

- Zoomlion Heavy Industry Science & Technology Co Ltd

- SANY Group Co Ltd

- STREICHER Drilling Technology GmbH

- Caterpillar

- Atlas Copco

Key Milestones in Rotary Drilling Rig Industry Industry

- February 2021: Oceaneering's Subsea Robotics and Offshore Projects Group secured an integrated rig services contract for the Khaleesi/Mormont and Samurai fields in the United States Gulf of Mexico, including ROV services, remote positioning, and metrology surveys, commencing in early 2021 and extending into 2022.

- December 2021: Equinor announced plans to drill approximately 10 to 13 exploration wells in 2022 across the United States Gulf of Mexico and offshore Canada, indicating a strong pipeline of offshore drilling projects and a subsequent increase in demand for rotary drilling rigs.

Strategic Outlook for Rotary Drilling Rig Industry Market

The strategic outlook for the Rotary Drilling Rig industry remains overwhelmingly positive, driven by sustained demand from the oil and gas sector and a burgeoning need for mineral extraction to support global decarbonization efforts. Future growth will be accelerated by the continued integration of digital technologies, enabling smarter and more efficient drilling operations. Companies that invest in developing sustainable and environmentally conscious drilling solutions will gain a competitive edge. Strategic partnerships and collaborations will be crucial for tapping into new markets and developing innovative technologies. The industry is poised for significant expansion, particularly in areas focused on deep-water exploration and the extraction of critical minerals required for renewable energy technologies.

Rotary Drilling Rig Industry Segmentation

-

1. Location of Deployement

- 1.1. Onshore

- 1.2. Offshore

-

2. Application

- 2.1. Oil and Gas

- 2.2. Mining

- 2.3. Others

Rotary Drilling Rig Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Rotary Drilling Rig Industry Regional Market Share

Geographic Coverage of Rotary Drilling Rig Industry

Rotary Drilling Rig Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines

- 3.4. Market Trends

- 3.4.1. Offshore Rotary Drilling Rig Market to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oil and Gas

- 5.2.2. Mining

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 6. North America Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oil and Gas

- 6.2.2. Mining

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 7. Europe Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oil and Gas

- 7.2.2. Mining

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 8. Asia Pacific Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oil and Gas

- 8.2.2. Mining

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 9. South America Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Oil and Gas

- 9.2.2. Mining

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 10. Middle East and Africa Rotary Drilling Rig Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Oil and Gas

- 10.2.2. Mining

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dando Drilling International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BAUER AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schramm Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sandvik Drilling

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zoomlion Heavy Industry Science &Technology Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SANY Group Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STREICHER Drilling Technology GmbH*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Caterpillar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlas Copco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dando Drilling International Ltd

List of Figures

- Figure 1: Global Rotary Drilling Rig Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Rotary Drilling Rig Industry Revenue (Million), by Location of Deployement 2025 & 2033

- Figure 3: North America Rotary Drilling Rig Industry Revenue Share (%), by Location of Deployement 2025 & 2033

- Figure 4: North America Rotary Drilling Rig Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Rotary Drilling Rig Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Rotary Drilling Rig Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Rotary Drilling Rig Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Rotary Drilling Rig Industry Revenue (Million), by Location of Deployement 2025 & 2033

- Figure 9: Europe Rotary Drilling Rig Industry Revenue Share (%), by Location of Deployement 2025 & 2033

- Figure 10: Europe Rotary Drilling Rig Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Rotary Drilling Rig Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Rotary Drilling Rig Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Rotary Drilling Rig Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Rotary Drilling Rig Industry Revenue (Million), by Location of Deployement 2025 & 2033

- Figure 15: Asia Pacific Rotary Drilling Rig Industry Revenue Share (%), by Location of Deployement 2025 & 2033

- Figure 16: Asia Pacific Rotary Drilling Rig Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Rotary Drilling Rig Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Rotary Drilling Rig Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Rotary Drilling Rig Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Rotary Drilling Rig Industry Revenue (Million), by Location of Deployement 2025 & 2033

- Figure 21: South America Rotary Drilling Rig Industry Revenue Share (%), by Location of Deployement 2025 & 2033

- Figure 22: South America Rotary Drilling Rig Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Rotary Drilling Rig Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Rotary Drilling Rig Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Rotary Drilling Rig Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Rotary Drilling Rig Industry Revenue (Million), by Location of Deployement 2025 & 2033

- Figure 27: Middle East and Africa Rotary Drilling Rig Industry Revenue Share (%), by Location of Deployement 2025 & 2033

- Figure 28: Middle East and Africa Rotary Drilling Rig Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Rotary Drilling Rig Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Rotary Drilling Rig Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Rotary Drilling Rig Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 2: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 5: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 8: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 11: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 14: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Location of Deployement 2020 & 2033

- Table 17: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Rotary Drilling Rig Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rotary Drilling Rig Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Rotary Drilling Rig Industry?

Key companies in the market include Dando Drilling International Ltd, BAUER AG, Schramm Inc, Sandvik Drilling, Zoomlion Heavy Industry Science &Technology Co Ltd, SANY Group Co Ltd, STREICHER Drilling Technology GmbH*List Not Exhaustive, Caterpillar, Atlas Copco.

3. What are the main segments of the Rotary Drilling Rig Industry?

The market segments include Location of Deployement, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector.

6. What are the notable trends driving market growth?

Offshore Rotary Drilling Rig Market to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines.

8. Can you provide examples of recent developments in the market?

In February 2021, Oceaneering's Subsea Robotics and Offshore Projects Group were awarded an integrated rig services contract for covering the Khaleesi/Mormont and Samurai fields in the United States Gulf of Mexico. The work scope included the provision of remotely operated vehicles with collocated ROV tooling and technicians, remote positioning, and metrology survey resources. The project work is expected to begin in early 2021 and carry into 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rotary Drilling Rig Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rotary Drilling Rig Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rotary Drilling Rig Industry?

To stay informed about further developments, trends, and reports in the Rotary Drilling Rig Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence