Key Insights

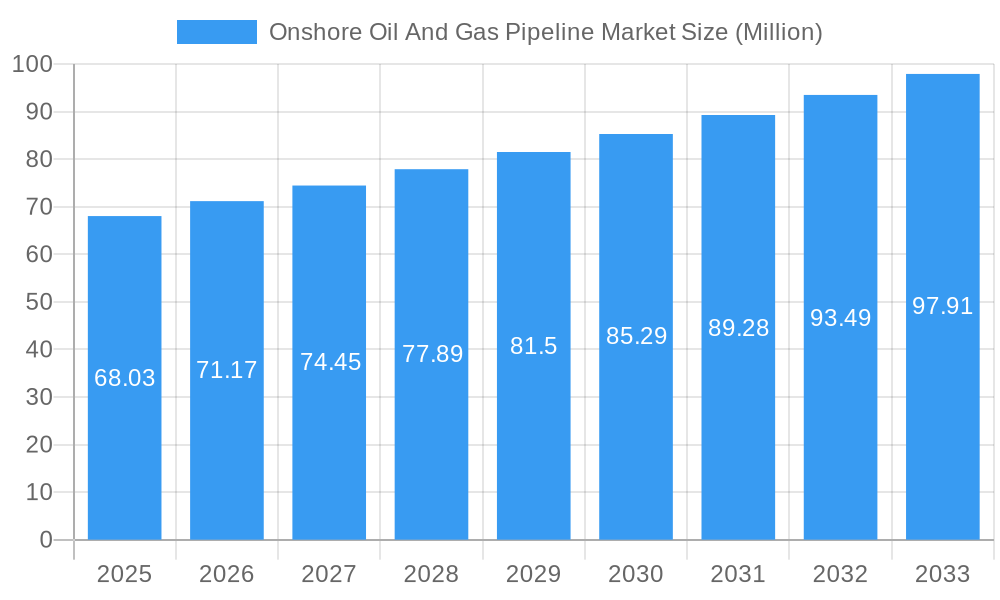

The global Onshore Oil and Gas Pipeline Market is poised for significant expansion, projected to reach $68.03 million by 2025 and continuing its upward trajectory at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This robust growth is primarily propelled by escalating global energy demands, necessitating efficient and extensive infrastructure for the transportation of oil and natural gas. Key market drivers include ongoing upstream and downstream project developments, particularly in emerging economies, and the critical need for transporting resources from remote extraction sites to processing facilities and end-users. Furthermore, the continuous investment in upgrading and expanding existing pipeline networks to enhance safety, capacity, and efficiency plays a pivotal role in sustaining market momentum. The market's resilience is also bolstered by governments' strategic focus on energy security and the economic imperative to leverage domestic hydrocarbon reserves.

Onshore Oil And Gas Pipeline Market Market Size (In Million)

The market landscape is characterized by evolving trends such as the increasing adoption of advanced technologies for pipeline monitoring and maintenance, including smart sensors, drones, and digital twins, aimed at improving operational efficiency and mitigating risks. There is also a growing emphasis on the development of pipelines designed to transport natural gas, driven by its role as a cleaner-burning fossil fuel and its increasing integration into the global energy mix. However, the market faces certain restraints, including stringent environmental regulations and permitting processes that can lead to project delays and increased costs. Geopolitical uncertainties and fluctuating crude oil and natural gas prices also introduce an element of risk and can impact investment decisions. Despite these challenges, the fundamental need for reliable energy transportation infrastructure ensures a consistently strong demand for onshore oil and gas pipelines.

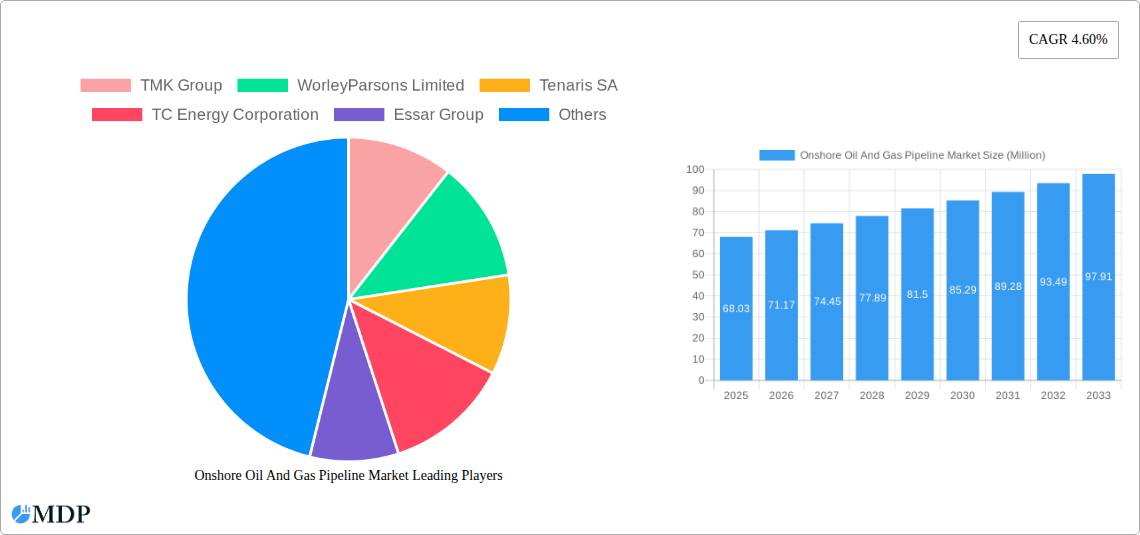

Onshore Oil And Gas Pipeline Market Company Market Share

Report Description:

Dive deep into the dynamic Onshore Oil and Gas Pipeline Market with this in-depth analysis covering the extensive study period of 2019 to 2033, with 2025 as the base and estimated year. This report provides unparalleled insights into the global market landscape, focusing on critical segments like Oil Pipelines and Gas Pipelines. Discover key industry developments, understand the competitive environment, and identify growth catalysts that will shape the future of onshore energy transportation.

The Onshore Oil and Gas Pipeline Market is a vital component of global energy infrastructure, facilitating the safe and efficient transport of crude oil and natural gas from extraction sites to refineries, processing plants, and end consumers. As global energy demand continues to rise, the importance of robust and expanding pipeline networks becomes paramount. This report offers a comprehensive overview of the market's current status, historical performance, and future trajectory, equipping industry stakeholders with actionable intelligence.

This meticulously researched report leverages high-traffic keywords such as "onshore oil pipeline," "natural gas pipeline," "pipeline construction," "oil transportation," "gas distribution," "pipeline infrastructure," "energy sector," "oil and gas industry," and "pipeline market analysis." Our analysis spans the historical period of 2019-2024 and forecasts growth through 2033, providing a 360-degree view of market evolution. The report is structured to deliver clear, concise, and actionable insights, empowering strategic decision-making for manufacturers, service providers, investors, and policymakers within the global onshore oil and gas pipeline ecosystem.

Onshore Oil And Gas Pipeline Market Market Dynamics & Concentration

The Onshore Oil and Gas Pipeline Market exhibits a moderate to high concentration, with a significant market share held by a few leading global players. This concentration is driven by the substantial capital investment required for pipeline construction, advanced technological expertise, and stringent regulatory compliance. Innovation drivers are primarily focused on enhancing pipeline integrity, reducing environmental impact, and improving operational efficiency. Key advancements include the development of smart pipeline technologies, advanced coatings, and real-time monitoring systems to detect leaks and prevent failures. Regulatory frameworks, encompassing environmental protection, safety standards, and land acquisition policies, play a crucial role in shaping market entry and operational procedures. Product substitutes, while limited for long-distance bulk transport of oil and gas, can include rail and truck for shorter hauls or specialized deliveries, though these are generally less cost-effective and carry higher environmental risks. End-user trends are heavily influenced by global energy demand, governmental policies promoting cleaner energy transitions, and the development of new extraction sites. Mergers and acquisitions (M&A) activities are a recurring theme, often driven by the need to consolidate market share, acquire technological capabilities, or expand geographic reach. Over the historical period (2019-2024), we observed approximately 15 significant M&A deals, totaling an estimated value of US$ 7,500 Million, indicating ongoing consolidation. Leading players, such as TMK Group and Tenaris SA, often dominate market share discussions, contributing to the market's concentrated nature.

Onshore Oil And Gas Pipeline Market Industry Trends & Analysis

The Onshore Oil and Gas Pipeline Market is currently experiencing robust growth, driven by escalating global energy demand and significant investments in infrastructure development. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025–2033). This growth is underpinned by the ongoing exploration and production of oil and gas reserves, necessitating the expansion and upgrade of existing pipeline networks. Technological disruptions are profoundly impacting the industry, with a strong emphasis on digital transformation. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance, real-time leak detection, and route optimization is becoming standard practice. Furthermore, advancements in materials science are leading to the development of more durable, corrosion-resistant, and environmentally friendly pipeline materials. Consumer preferences, while indirectly influencing the pipeline market, are geared towards reliable and affordable energy supply. Governments worldwide are also actively promoting the use of natural gas as a cleaner transition fuel, further stimulating the demand for gas pipeline infrastructure. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants, particularly from regions with rapidly growing energy sectors. Market penetration of advanced pipeline monitoring technologies is estimated to have reached 55% in 2024 and is expected to climb to over 70% by 2030. The push for renewable energy integration, while a long-term trend, is also influencing the pipeline sector, with discussions around repurposing existing pipelines for hydrogen transport and the development of new infrastructure for carbon capture and storage (CCS). The market penetration of specialized pipeline coatings designed for extreme environments is also a key trend, ensuring longevity and safety in challenging terrains.

Leading Markets & Segments in Onshore Oil And Gas Pipeline Market

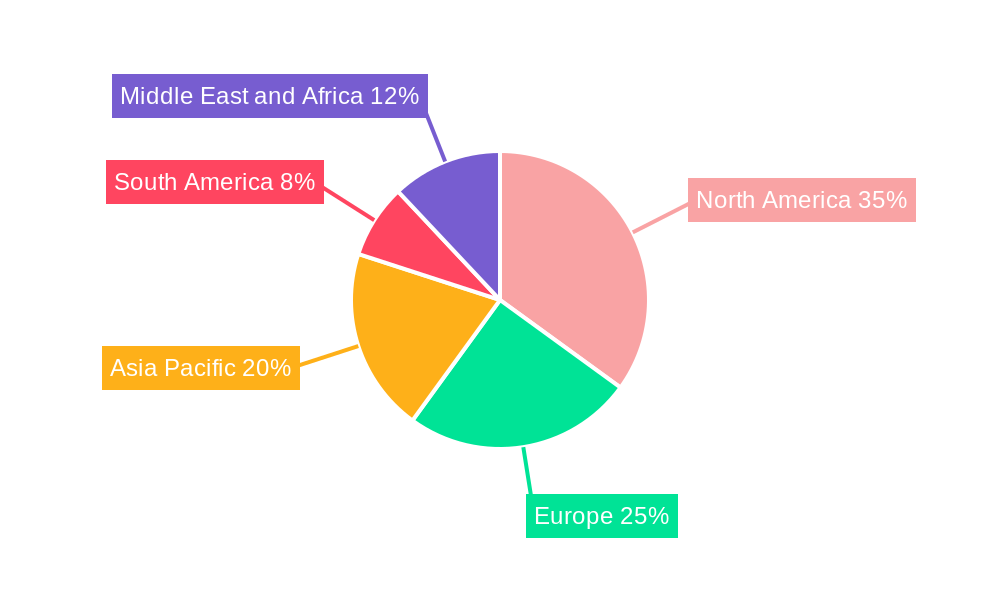

The Gas Pipeline segment is currently the dominant force within the Onshore Oil and Gas Pipeline Market, driven by the global shift towards natural gas as a cleaner and more versatile energy source. This dominance is particularly pronounced in regions with significant natural gas reserves and strong governmental policies supporting its widespread adoption, such as North America and parts of Asia.

- North America: This region leads the market due to extensive natural gas production, a well-established infrastructure, and ongoing projects for pipeline expansion to meet both domestic demand and export capabilities. Favorable economic policies and substantial investment in the oil and gas sector contribute to its leading position. The United States, in particular, has a vast network of gas pipelines, and new projects are continuously being commissioned to support shale gas production.

- Asia-Pacific: This region is witnessing rapid growth in its gas pipeline segment, fueled by increasing industrialization, urbanization, and a growing demand for cleaner energy. Countries like China and India are heavily investing in expanding their gas pipeline networks to reduce reliance on coal and improve air quality. Government initiatives supporting energy security and the development of liquefied natural gas (LNG) import terminals further boost the demand for onshore gas pipelines.

- Europe: While some European nations are transitioning rapidly towards renewable energy, natural gas remains a crucial transitional fuel. Investments in upgrading existing gas pipeline infrastructure and developing new cross-border pipelines to ensure energy security are significant drivers. Economic policies that promote gas as a bridge fuel are key here.

The dominance of the Gas Pipeline segment is further amplified by the increasing use of natural gas in power generation, industrial processes, and residential heating. While the Oil Pipeline segment remains critical for crude oil transportation, its growth is more closely tied to global crude oil demand fluctuations and the development of new oil fields, which are often in more remote or challenging terrains, leading to significant infrastructure investments. Economic policies supporting energy diversification and the strategic importance of reliable gas supply chains are key factors underpinning the sustained growth of the gas pipeline sector.

Onshore Oil And Gas Pipeline Market Product Developments

Product developments in the Onshore Oil and Gas Pipeline Market are predominantly focused on enhancing safety, efficiency, and environmental sustainability. Innovations include the development of high-strength, lightweight steel alloys that reduce transportation costs and improve structural integrity. Advanced internal and external coating technologies are being introduced to significantly extend pipeline lifespan by preventing corrosion and abrasion, even in harsh environmental conditions. Furthermore, the integration of smart sensors and real-time monitoring systems into pipeline materials is a significant trend, enabling proactive leak detection and predictive maintenance, thereby minimizing environmental risks and operational downtime. These technological advancements offer a competitive advantage by ensuring regulatory compliance, reducing operational expenditures, and improving the overall reliability of energy transportation.

Key Drivers of Onshore Oil And Gas Pipeline Market Growth

The Onshore Oil and Gas Pipeline Market is propelled by several key drivers. Firstly, the continuously rising global demand for energy, particularly natural gas as a cleaner transition fuel, necessitates the expansion of pipeline networks. Secondly, technological advancements in exploration and extraction are unlocking new reserves, requiring new transportation infrastructure. Thirdly, governmental support through favorable policies, infrastructure development initiatives, and energy security strategies plays a crucial role. For example, investments in cross-border pipelines and domestic distribution networks for shale gas in North America are significant growth catalysts. Furthermore, the ongoing need to replace aging infrastructure with modern, safer, and more efficient systems also contributes to sustained market growth.

Challenges in the Onshore Oil And Gas Pipeline Market Market

The Onshore Oil and Gas Pipeline Market faces several significant challenges. Stringent and evolving regulatory frameworks, particularly concerning environmental impact assessments and land acquisition, can lead to project delays and increased costs. Supply chain disruptions, exacerbated by global geopolitical events and material shortages, can impact project timelines and budgets. Competitive pressures from established players and the need for substantial upfront capital investment for new projects can act as barriers to entry. Furthermore, public opposition and social license to operate in certain regions can pose significant hurdles to pipeline development. The estimated impact of regulatory delays on project completion time can be as high as 30%, and supply chain volatility has led to an average cost increase of 15% for raw materials in the last two years.

Emerging Opportunities in Onshore Oil And Gas Pipeline Market

Emerging opportunities in the Onshore Oil and Gas Pipeline Market are poised to drive long-term growth. The increasing global focus on decarbonization presents opportunities for repurposing existing pipelines for the transport of hydrogen and carbon dioxide (for CCS projects), a trend expected to gain significant traction. Technological breakthroughs in smart pipeline monitoring and diagnostics are creating new service markets and revenue streams. Strategic partnerships between pipeline operators and technology providers are crucial for the development and deployment of these advanced solutions. Furthermore, the expansion of natural gas infrastructure in developing economies in Asia and Africa offers significant market expansion potential for pipeline construction and maintenance services. The global market for hydrogen pipeline infrastructure alone is projected to reach US$ 15,000 Million by 2030.

Leading Players in the Onshore Oil And Gas Pipeline Market Sector

- TMK Group

- WorleyParsons Limited

- Tenaris SA

- TC Energy Corporation

- Essar Group

- Jindal SAW Ltd

- Mastec Inc

- Europipe GmbH

- Baoshan Iron & Steel Co Ltd

- CPW America Co

Key Milestones in Onshore Oil And Gas Pipeline Market Industry

- 2019: Launch of enhanced corrosion-resistant coatings for offshore and onshore pipelines, significantly extending service life.

- 2020: Major oil and gas companies increase investment in digital pipeline monitoring technologies to improve safety and efficiency.

- 2021: Significant mergers and acquisitions activity as companies consolidate to gain market share and operational efficiencies, with an estimated 5 large deals.

- 2022: Development and pilot testing of AI-powered predictive maintenance systems for pipeline integrity management.

- 2023: Increased focus on regulatory approvals for new natural gas pipeline projects to support energy transition goals in North America and Asia.

- 2024: Growing discussions and early-stage projects exploring the repurposing of existing pipelines for hydrogen transport.

- 2025 (Estimated): Continued expansion of gas pipeline networks in Asia-Pacific driven by rising energy demand and environmental policies.

Strategic Outlook for Onshore Oil And Gas Pipeline Market Market

The strategic outlook for the Onshore Oil and Gas Pipeline Market is characterized by a dual focus on meeting continued demand for traditional hydrocarbons while strategically adapting to the evolving energy landscape. Growth accelerators will include the ongoing development of natural gas infrastructure, particularly in emerging economies, and the increasing adoption of advanced digital technologies for enhanced operational efficiency and safety. The market will also witness a growing emphasis on the development of infrastructure capable of supporting the transition to cleaner energy carriers, such as hydrogen and carbon capture solutions. Investments in upgrading existing pipelines and exploring new routes will remain critical. Strategic collaborations and a proactive approach to regulatory compliance will be paramount for sustained success in this dynamic sector. The projected market size for 2033 is estimated to reach approximately US$ 150,000 Million.

Onshore Oil And Gas Pipeline Market Segmentation

-

1. Type

- 1.1. Oil Pipeline

- 1.2. Gas Pipeline

Onshore Oil And Gas Pipeline Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Norway

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. NORDIC

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Malaysia

- 3.5. Vietnam

- 3.6. Thailand

- 3.7. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South Africa

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Nigeria

- 5.6. Qatar

- 5.7. Rest of Middle East and Africa

Onshore Oil And Gas Pipeline Market Regional Market Share

Geographic Coverage of Onshore Oil And Gas Pipeline Market

Onshore Oil And Gas Pipeline Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Natural Gas Pipeline Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Oil Pipeline

- 5.1.2. Gas Pipeline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Oil Pipeline

- 6.1.2. Gas Pipeline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Oil Pipeline

- 7.1.2. Gas Pipeline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Oil Pipeline

- 8.1.2. Gas Pipeline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Oil Pipeline

- 9.1.2. Gas Pipeline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Onshore Oil And Gas Pipeline Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Oil Pipeline

- 10.1.2. Gas Pipeline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TMK Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WorleyParsons Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tenaris SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TC Energy Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Essar Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jindal SAW Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mastec Inc *List Not Exhaustive 6 4 Market Ranking Analysi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Europipe GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baoshan Iron & Steel Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CPW America Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 TMK Group

List of Figures

- Figure 1: Global Onshore Oil And Gas Pipeline Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Onshore Oil And Gas Pipeline Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Onshore Oil And Gas Pipeline Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Onshore Oil And Gas Pipeline Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Onshore Oil And Gas Pipeline Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Onshore Oil And Gas Pipeline Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Onshore Oil And Gas Pipeline Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Onshore Oil And Gas Pipeline Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Onshore Oil And Gas Pipeline Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Onshore Oil And Gas Pipeline Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Onshore Oil And Gas Pipeline Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Onshore Oil And Gas Pipeline Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Onshore Oil And Gas Pipeline Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Onshore Oil And Gas Pipeline Market Revenue (Million), by Type 2025 & 2033

- Figure 15: South America Onshore Oil And Gas Pipeline Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America Onshore Oil And Gas Pipeline Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Onshore Oil And Gas Pipeline Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Onshore Oil And Gas Pipeline Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Onshore Oil And Gas Pipeline Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Onshore Oil And Gas Pipeline Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Onshore Oil And Gas Pipeline Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Norway Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: NORDIC Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Indonesia Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Thailand Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Colombia Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South Africa Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Onshore Oil And Gas Pipeline Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: United Arab Emirates Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Saudi Arabia Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Egypt Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nigeria Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Qatar Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Onshore Oil And Gas Pipeline Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Onshore Oil And Gas Pipeline Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Onshore Oil And Gas Pipeline Market?

Key companies in the market include TMK Group, WorleyParsons Limited, Tenaris SA, TC Energy Corporation, Essar Group, Jindal SAW Ltd, Mastec Inc *List Not Exhaustive 6 4 Market Ranking Analysi, Europipe GmbH, Baoshan Iron & Steel Co Ltd, CPW America Co.

3. What are the main segments of the Onshore Oil And Gas Pipeline Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.03 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand.

6. What are the notable trends driving market growth?

Natural Gas Pipeline Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Onshore Oil And Gas Pipeline Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Onshore Oil And Gas Pipeline Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Onshore Oil And Gas Pipeline Market?

To stay informed about further developments, trends, and reports in the Onshore Oil And Gas Pipeline Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence