Key Insights

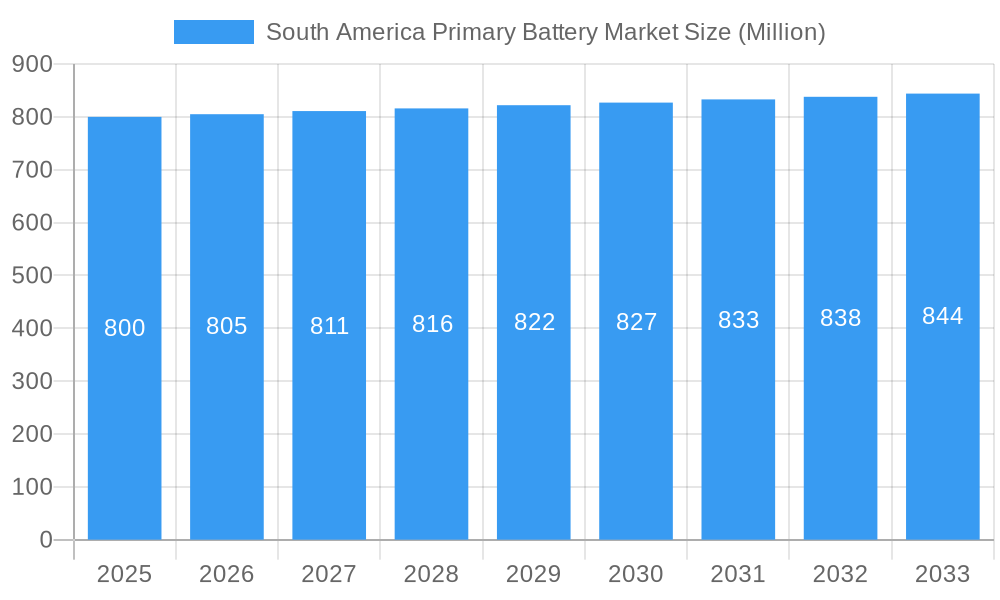

The South America primary battery market is set for substantial growth, projected to reach $5.3 billion by 2024, with a CAGR of 6.6% from 2024 to 2033. Key growth drivers include increasing demand for portable electronics, wider adoption of battery-powered medical equipment, and the expanding consumer electronics sector in Brazil, Argentina, and Colombia. The market's expansion is also supported by the growing reliance on dependable, long-lasting power sources for various applications. Alkaline batteries are expected to retain their leading position due to cost-effectiveness and availability. However, a gradual shift towards rechargeable batteries like NiCD and NiMH is anticipated in specific segments, driven by sustainability and reusability preferences.

South America Primary Battery Market Market Size (In Billion)

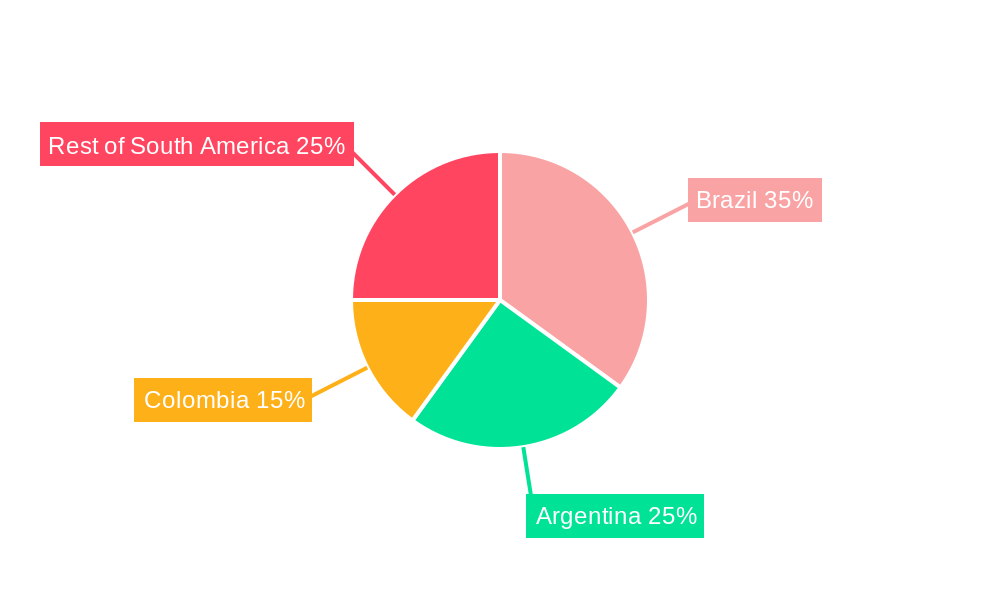

Factors influencing the South America primary battery market's growth include a rising middle class in emerging economies, leading to increased disposable income and electronics consumption. Government initiatives promoting digitalization and smart city development also indirectly boost demand for battery-powered solutions. Conversely, market restraints include the growing popularity and affordability of rechargeable alternatives, alongside rising raw material costs impacting production pricing. Intense competition among established players and emerging regional manufacturers fosters innovation and competitive pricing. Brazil leads the market, followed by Argentina and Colombia, with the "Rest of South America" representing a fragmented but significant segment. Stakeholders must address evolving demands for both primary and rechargeable battery solutions to achieve sustained growth.

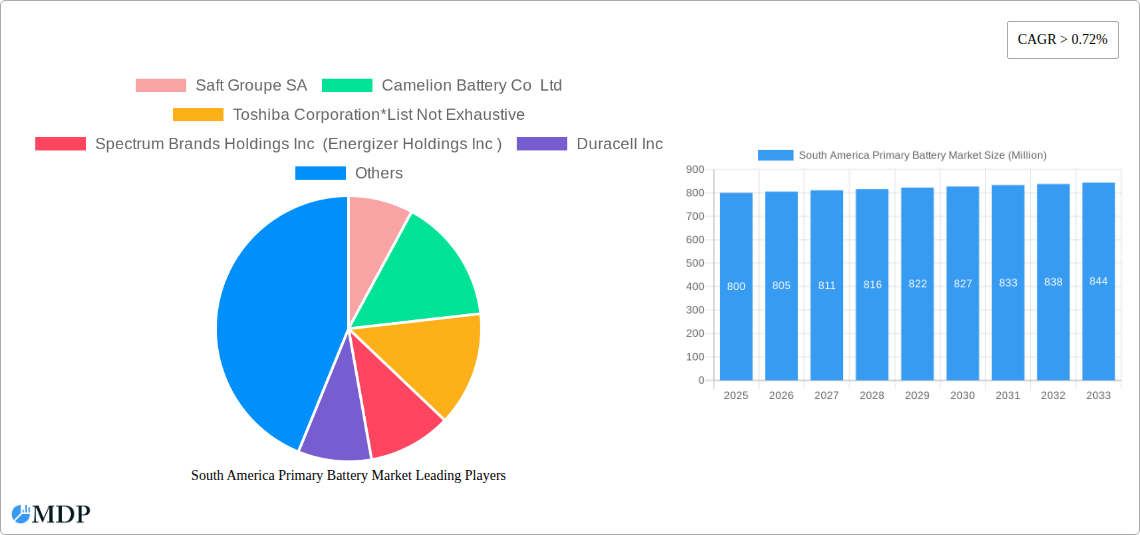

South America Primary Battery Market Company Market Share

Gain in-depth insights into the South America primary battery market. This comprehensive analysis covers market dynamics, industry trends, key segments, and future opportunities from 2019 to 2033, with a base year of 2024. We examine the primary battery market in South America, including alkaline, NiCD, NiMH, and other primary battery types. The report offers granular data and strategic recommendations for stakeholders seeking to capitalize on the growth of portable power solutions in Brazil, Argentina, Colombia, and the Rest of South America.

South America Primary Battery Market Market Dynamics & Concentration

The South America Primary Battery Market is characterized by a moderate level of concentration, with key players vying for market share. Innovation drivers are primarily fueled by the increasing demand for portable electronics and a growing awareness of battery efficiency and longevity. Regulatory frameworks are evolving, with a focus on environmental compliance and product safety, impacting manufacturing processes and material sourcing. Product substitutes, while present in the form of rechargeable batteries, still cede ground to primary batteries in specific applications due to their convenience and immediate availability. End-user trends indicate a rising demand for higher energy density and longer shelf life in primary batteries. Merger and acquisition (M&A) activities are anticipated to increase as established players seek to expand their geographical footprint and product portfolios within the region. The market share distribution is dynamic, with leading companies continuously adapting their strategies to maintain and grow their positions. While specific M&A deal counts are not readily available, the strategic importance of the South American market suggests potential for consolidation.

South America Primary Battery Market Industry Trends & Analysis

The South America Primary Battery Market is poised for significant expansion, driven by a confluence of robust growth drivers and transformative technological advancements. The increasing penetration of portable electronic devices, ranging from consumer gadgets to critical medical equipment, is a primary catalyst, creating a sustained demand for reliable and accessible power sources. Furthermore, the growing electrification of remote areas and the expanding reach of off-grid solutions are augmenting the need for primary alkaline batteries and other non-rechargeable power solutions. The market is witnessing a gradual yet impactful shift in consumer preferences towards batteries that offer extended life cycles and enhanced performance, pushing manufacturers to invest in research and development for superior energy storage capabilities. Nickel-cadmium (NiCD) batteries, despite their historical significance, are gradually being phased out in many applications due to environmental concerns, paving the way for more sustainable alternatives. Simultaneously, Nickel-metal hydride (NiMH) batteries are gaining traction as a greener option, offering a better balance of performance and environmental impact. The competitive landscape is intensifying, with both global giants and emerging regional players battling for market dominance. Key players are focusing on optimizing their supply chains, reducing manufacturing costs, and developing localized distribution networks to cater to the diverse needs of South American consumers. The CAGR for the South America Primary Battery Market is projected to be in the healthy range of 4-6% during the forecast period. Market penetration of primary batteries remains high in sectors where convenience and immediate deployment are paramount, underscoring their continued relevance. The evolving economic landscape across South America, coupled with rising disposable incomes in certain segments, is also contributing to increased consumer spending on devices powered by primary batteries.

Leading Markets & Segments in South America Primary Battery Market

Brazil stands out as the dominant market within the South America Primary Battery Market, driven by its large consumer base, robust industrial sector, and significant adoption of portable electronics. The economic policies fostering manufacturing and technological integration further bolster Brazil's leading position. The Primary Alkaline Battery segment exhibits the strongest dominance, owing to its widespread use in everyday consumer electronics such as remote controls, toys, and portable lighting. This segment benefits from cost-effectiveness, broad availability, and a long shelf life, making it the go-to choice for a vast array of applications. The demand for Primary Alkaline Batteries in Brazil is intrinsically linked to the country's growing middle class and increasing urbanization, which fuels the consumption of electronic devices.

Argentina presents a substantial and growing market for primary batteries, with significant potential for expansion. Government initiatives aimed at bolstering domestic manufacturing and technological advancements are key drivers. The recent industry developments, such as the planned lithium battery manufacturing plant by Y-TEC YPF, signal a strategic shift towards advanced battery technologies, which could indirectly influence the broader battery market by fostering a more innovation-conducive environment. The Primary Alkaline Battery segment also leads in Argentina, mirroring the global trend. However, there's a discernible growth trajectory for Nickel-metal Hydride (NiMH) Batteries as environmental consciousness and demand for rechargeable alternatives gain momentum. The infrastructure development across Argentina, while uneven, is gradually improving connectivity and access to consumer goods, thereby supporting battery sales.

Colombia is an emerging powerhouse in the South America Primary Battery Market, characterized by a young demographic and a rapidly expanding digital economy. The increasing adoption of smartphones, portable gaming devices, and other battery-dependent gadgets is a major growth factor. Economic policies promoting foreign investment and industrial diversification are attracting battery manufacturers and distributors. Similar to its regional counterparts, Primary Alkaline Batteries command a significant market share. However, the rising trend of eco-friendly products is creating a favorable environment for the adoption of NiMH Batteries, especially in consumer applications where rechargeable options are increasingly preferred. The government's focus on improving infrastructure and connectivity across Colombia is crucial for expanding the reach of battery products to underserved regions.

The Rest of South America, encompassing countries like Chile, Peru, and Ecuador, collectively represents a significant and diverse market. While individual countries might have varying levels of market maturity, the aggregate demand for primary batteries is substantial. Economic growth, coupled with the increasing availability of consumer electronics, is a common thread across these nations. Primary Alkaline Batteries are the cornerstone of this segment's demand. However, as these economies develop, the demand for more advanced battery chemistries like NiMH Batteries is expected to rise, driven by a growing awareness of sustainability and a desire for enhanced product performance. Infrastructure development and improved access to retail channels are critical for unlocking the full potential of the primary battery market in these regions.

South America Primary Battery Market Product Developments

Product developments in the South America Primary Battery Market are focused on enhancing energy density, extending shelf life, and improving environmental sustainability. Manufacturers are investing in advanced materials and manufacturing processes to create batteries that power devices for longer durations and perform optimally in varying conditions. The emphasis is on producing Primary Alkaline Batteries with superior capacity and leak-proof designs, catering to the high demand from consumer electronics. Concurrently, there is a growing interest in developing more efficient and eco-friendlier NiMH Batteries and exploring novel chemistries for "other types" of primary batteries that offer distinct advantages in specialized applications, such as high-drain devices or extreme temperature environments.

Key Drivers of South America Primary Battery Market Growth

The South America Primary Battery Market is propelled by several key drivers. The burgeoning demand for portable electronic devices, including smartphones, laptops, and wearables, is a primary growth accelerator. Increasing consumer disposable income in various South American nations translates to higher purchasing power for these devices, subsequently boosting the demand for their power sources. Furthermore, the expanding telecommunications infrastructure and the growing internet penetration across the region are creating a larger user base for internet-enabled portable devices. Government initiatives promoting technological adoption and digital transformation also play a crucial role. For instance, advancements in renewable energy integration in remote areas are creating niche demands for reliable primary battery backup solutions.

Challenges in the South America Primary Battery Market Market

Despite its growth potential, the South America Primary Battery Market faces several challenges. Regulatory hurdles related to battery disposal and recycling can increase operational costs and complexity for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities within the region, can lead to price volatility and availability issues. Intense competition from both established global brands and local manufacturers puts pressure on profit margins. Additionally, the increasing adoption of rechargeable battery technologies, particularly for high-usage applications, poses a long-term threat to the market share of primary batteries, necessitating continuous innovation and a focus on niche applications where primary batteries excel.

Emerging Opportunities in South America Primary Battery Market

Emerging opportunities in the South America Primary Battery Market lie in the increasing demand for specialized primary batteries. The expansion of the Internet of Things (IoT) is creating a significant market for small, long-lasting primary batteries for sensors and connected devices. Advancements in battery technology are also enabling the development of high-performance primary batteries for critical applications like medical devices and emergency equipment, where reliability is paramount. Strategic partnerships with local distributors and retailers can help manufacturers expand their reach into underserved markets. Furthermore, the growing consumer awareness regarding environmental sustainability presents an opportunity for manufacturers to develop and market eco-friendly primary battery options.

Leading Players in the South America Primary Battery Market Sector

- Saft Groupe SA

- Camelion Battery Co Ltd

- Toshiba Corporation

- Spectrum Brands Holdings Inc (Energizer Holdings Inc)

- Duracell Inc

- Energizer Holdings Inc

- Panasonic Corporation

Key Milestones in South America Primary Battery Market Industry

- December 2022: Argentina's state-run Y-TEC YPF announced its plans to install a lithium battery manufacturing plant in Catamarca. According to the deal signed, the company will produce cells, lithium-ion batteries, and active materials to add to the current work by the provincial mining company CAMYEN in Fiambal. This signifies a strategic move towards indigenous battery production and advanced battery technologies in the region.

- November 2022: Argentina announced its plans to begin operations at its first lithium battery plant after the necessary equipment arrived in the city of La Plata from China. The plant will be constructed by Universidad Nacional de La Plata (UNLP), YPF-Tecnología (Y-TEC), and the National Scientific and Technical Research Council, with the support of the Ministry of Science, Technology, and Innovation (MSTI). This development highlights Argentina's commitment to developing its battery manufacturing capabilities and reducing reliance on imports.

Strategic Outlook for South America Primary Battery Market Market

The strategic outlook for the South America Primary Battery Market is one of sustained growth and evolving opportunities. The market is expected to be driven by the continued proliferation of portable electronics and the increasing demand for reliable power in off-grid and remote applications. Manufacturers should focus on innovation in areas such as extended shelf life, enhanced energy density, and environmentally responsible product development. Strategic partnerships with local players will be crucial for navigating diverse market landscapes and expanding distribution networks. The growing emphasis on sustainability also presents an opportunity to develop and market advanced primary battery solutions that align with environmental consciousness.

South America Primary Battery Market Segmentation

-

1. Type

- 1.1. Primary Alkaline Battery

- 1.2. Nickel-cadmium (NiCD) Battery

- 1.3. Nickel-metal Hydride (NiMH) Battery

- 1.4. Other Types

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Primary Battery Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Primary Battery Market Regional Market Share

Geographic Coverage of South America Primary Battery Market

South America Primary Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure

- 3.3. Market Restrains

- 3.3.1. Limited Investments to Support Medium-voltage Transmission Network

- 3.4. Market Trends

- 3.4.1. Primary Alkaline Battery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Alkaline Battery

- 5.1.2. Nickel-cadmium (NiCD) Battery

- 5.1.3. Nickel-metal Hydride (NiMH) Battery

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Alkaline Battery

- 6.1.2. Nickel-cadmium (NiCD) Battery

- 6.1.3. Nickel-metal Hydride (NiMH) Battery

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Alkaline Battery

- 7.1.2. Nickel-cadmium (NiCD) Battery

- 7.1.3. Nickel-metal Hydride (NiMH) Battery

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Alkaline Battery

- 8.1.2. Nickel-cadmium (NiCD) Battery

- 8.1.3. Nickel-metal Hydride (NiMH) Battery

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Alkaline Battery

- 9.1.2. Nickel-cadmium (NiCD) Battery

- 9.1.3. Nickel-metal Hydride (NiMH) Battery

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Saft Groupe SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Camelion Battery Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Spectrum Brands Holdings Inc (Energizer Holdings Inc )

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Duracell Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Energizer Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Panasonic Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Saft Groupe SA

List of Figures

- Figure 1: South America Primary Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Primary Battery Market Share (%) by Company 2025

List of Tables

- Table 1: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: South America Primary Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Primary Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Primary Battery Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the South America Primary Battery Market?

Key companies in the market include Saft Groupe SA, Camelion Battery Co Ltd, Toshiba Corporation*List Not Exhaustive, Spectrum Brands Holdings Inc (Energizer Holdings Inc ), Duracell Inc, Energizer Holdings Inc, Panasonic Corporation.

3. What are the main segments of the South America Primary Battery Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure.

6. What are the notable trends driving market growth?

Primary Alkaline Battery to Dominate the Market.

7. Are there any restraints impacting market growth?

Limited Investments to Support Medium-voltage Transmission Network.

8. Can you provide examples of recent developments in the market?

December 2022: Argentina's state-run Y-TEC YPF announced its plans to install a lithium battery manufacturing plant in the Catamarca. According to the deal signed, the company will produce cells, lithium-ion batteries, and active materials to add to the current work by the provincial mining company CAMYEN in Fiambal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Primary Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Primary Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Primary Battery Market?

To stay informed about further developments, trends, and reports in the South America Primary Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence