Key Insights

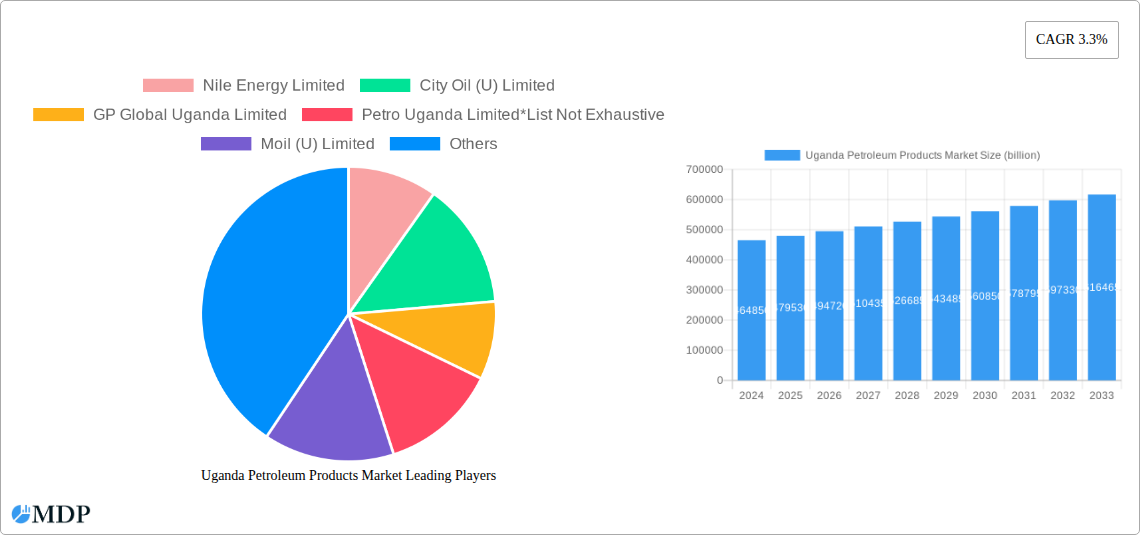

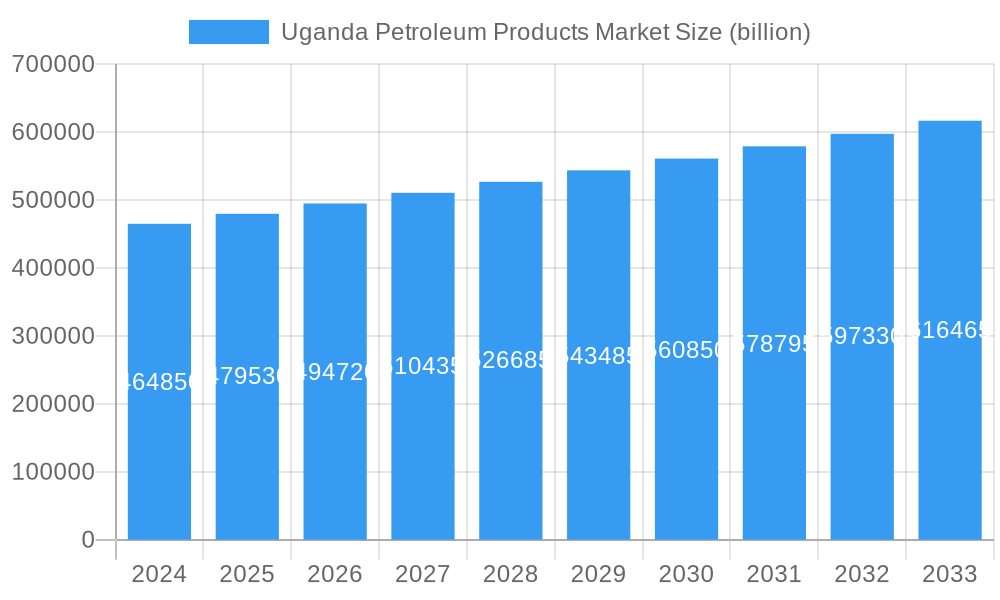

The Uganda petroleum products market is projected to demonstrate steady growth, with an estimated market size of USD 464.85 billion in 2024 and a projected CAGR of 3.3% from 2025 to 2033. This growth trajectory is primarily fueled by robust demand from the transport sector, driven by increasing vehicle ownership and ongoing infrastructure development projects that necessitate fuel consumption. The residential and commercial segments also contribute significantly, supported by the nation's expanding urbanization and industrial activities, which rely on petroleum products for energy generation and operational needs. Furthermore, the fishery sector, a vital contributor to Uganda's economy, continues to be a consistent consumer of diesel and kerosene. Emerging trends like the adoption of cleaner fuels and the exploration of new petroleum reserves are anticipated to shape the market landscape, presenting both opportunities and challenges for stakeholders.

Uganda Petroleum Products Market Market Size (In Billion)

The market is characterized by a diverse range of product segments, including gasoline, diesel, jet fuel, kerosene, and liquefied petroleum gas (LPG), catering to various end-user industries. While the transport sector remains the dominant consumer, the increasing use of LPG in residential and commercial kitchens, driven by environmental concerns and cost-effectiveness compared to traditional cooking fuels, represents a significant growth area. However, the market faces restraints such as price volatility of crude oil on the international market, which directly impacts domestic retail prices and consumer spending power. Additionally, evolving environmental regulations and a growing push towards renewable energy sources could pose long-term challenges to the sustained dominance of traditional petroleum products. Despite these hurdles, the market is expected to maintain a positive growth outlook due to Uganda's continued reliance on petroleum for its primary energy needs.

Uganda Petroleum Products Market Company Market Share

Uganda Petroleum Products Market: Comprehensive Analysis and Growth Forecast (2019-2033)

This in-depth report provides a granular analysis of the Uganda Petroleum Products Market, offering critical insights for stakeholders navigating this dynamic sector. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report delves into market size, segmentation, key players, and future trajectory. Our analysis covers gasoline, diesel, jet fuel, kerosene, and liquefied petroleum gas, catering to end-users in transport, residential, commercial, fishery, and other sectors. Discover actionable strategies, understand market drivers, and anticipate challenges in Uganda's vital petroleum landscape.

Uganda Petroleum Products Market Market Dynamics & Concentration

The Uganda petroleum products market exhibits a moderate to high concentration, with a few dominant players controlling a significant portion of the market share. Innovation drivers are primarily focused on improving supply chain efficiency, reducing costs, and ensuring product availability. Regulatory frameworks, overseen by entities like the Uganda Revenue Authority and the Ministry of Energy and Mineral Development, play a crucial role in shaping market operations, impacting pricing, import duties, and environmental standards. Product substitutes, while limited for core petroleum products, can emerge in the form of alternative energy sources or more efficient technologies that reduce consumption. End-user trends are increasingly influenced by economic growth, urbanization, and evolving consumer preferences, driving demand for specific product types. Mergers and acquisitions (M&A) activities, while not overtly frequent, are strategic moves by established companies to consolidate market presence, expand their distribution networks, and gain competitive advantages. The market share distribution is a key indicator of concentration, with detailed analysis presented within the full report. The number of M&A deals, while currently estimated to be in the low single digits annually, signals potential consolidation as the market matures.

Uganda Petroleum Products Market Industry Trends & Analysis

The Uganda petroleum products market is poised for significant growth, driven by a confluence of economic development, infrastructure expansion, and increasing energy demands across various end-user segments. Robust GDP growth historically, projected to continue, directly fuels demand for transportation fuels like gasoline and diesel, essential for both personal mobility and the logistics of goods. Furthermore, ongoing investments in infrastructure projects, including roads and potentially a nascent railway modernization, necessitate substantial fuel consumption. Technological disruptions are beginning to influence the market, not through a rapid shift to renewables in the immediate term, but through advancements in fuel efficiency technologies in vehicles and the increasing adoption of cleaner fuel alternatives for specific applications. Consumer preferences are evolving; while affordability remains paramount, there's a growing awareness and demand for higher quality fuels and more convenient access points. The competitive dynamics are characterized by both established multinational corporations and a growing number of local players vying for market share. The market penetration of refined petroleum products is already high due to their fundamental role in the economy, estimated to be over 95% for core segments like transport. The Compound Annual Growth Rate (CAGR) for the Uganda petroleum products market is projected to be in the range of 4.5% to 6.0% over the forecast period (2025-2033), reflecting sustained demand and economic expansion. This growth is underpinned by increasing disposable incomes, a growing formal economy, and a rising population. The expansion of the commercial sector, including retail and services, also contributes to the steady demand for fuels.

Leading Markets & Segments in Uganda Petroleum Products Market

The Transport end-user segment stands as the dominant market within Uganda's petroleum products landscape. This is primarily driven by the nation's reliance on road transportation for both passenger and freight movement, coupled with the expansion of the vehicle fleet. The economic backbone of Uganda, encompassing agriculture and trade, heavily depends on the efficient and affordable movement of goods, directly translating to a significant demand for Diesel and Gasoline.

Key drivers for the dominance of the transport segment and diesel/gasoline products include:

- Economic Policies: Government initiatives aimed at fostering trade and economic growth inherently boost transportation needs.

- Infrastructure Development: While still developing, ongoing improvements in road networks facilitate greater vehicle usage and fuel consumption.

- Urbanization: As cities expand, so does the demand for personal and public transportation, consuming substantial amounts of gasoline.

- Agricultural Sector: The extensive agricultural sector relies heavily on diesel-powered machinery and transportation for inputs and outputs.

- Cost-Effectiveness: Diesel and gasoline remain the most cost-effective and readily available fuel options for most transportation needs in the current infrastructure landscape.

The Commercial end-user segment also represents a significant and growing market. Businesses, ranging from manufacturing to hospitality, require reliable energy sources for their operations, often utilizing diesel for generators and heating, and gasoline for fleet vehicles. The Fishery sector, particularly in regions around Lake Victoria, exhibits a distinct demand for kerosene and sometimes diesel for fishing boats and associated activities. While Jet Fuel is crucial for aviation, its market size is comparatively smaller, catering to a niche but important segment. Liquefied Petroleum Gas (LPG) is experiencing a steady rise, driven by efforts to promote cleaner cooking solutions and reduce deforestation, increasingly finding its way into residential and some commercial applications.

Uganda Petroleum Products Market Product Developments

Product development in the Uganda petroleum products market is currently focused on enhancing fuel quality and optimizing supply chain logistics. Innovations are emerging in the form of advanced fuel additives that improve engine performance and reduce emissions for gasoline and diesel. There's also a growing emphasis on the development of more efficient and cost-effective distribution models for LPG, making it more accessible to a wider consumer base. Competitive advantages are being carved out through investments in modern retail infrastructure, loyalty programs for customers, and the introduction of convenience services at fuel stations, aligning with evolving consumer expectations and technological trends in the retail petroleum space.

Key Drivers of Uganda Petroleum Products Market Growth

The Uganda petroleum products market growth is propelled by several key factors. Economic expansion leading to increased disposable incomes and higher demand for transportation is a primary driver. Infrastructure development, including road networks, directly correlates with increased fuel consumption. Population growth and urbanization are also significant, expanding the consumer base and driving demand for fuels in both residential and commercial sectors. Furthermore, government policies supporting industrialization and trade indirectly boost the demand for petroleum products. The ongoing efforts to diversify energy sources and improve access to cleaner fuels like LPG also contribute to market evolution.

Challenges in the Uganda Petroleum Products Market Market

Despite its growth potential, the Uganda petroleum products market faces several challenges. Price volatility of crude oil on the international market significantly impacts domestic fuel prices, affecting affordability for consumers and businesses. Supply chain disruptions, including logistical bottlenecks and import reliance, can lead to shortages and price spikes. Regulatory hurdles and the complexity of import processes can also pose challenges for market participants. Furthermore, competition from informal markets and the presence of substandard fuel products can impact revenue and brand reputation for legitimate players. The ongoing need for substantial investment in infrastructure for storage and distribution remains a continuous challenge.

Emerging Opportunities in Uganda Petroleum Products Market

Emerging opportunities in the Uganda petroleum products market lie in several key areas. The growing demand for cleaner energy solutions presents a significant opportunity for the expansion of Liquefied Petroleum Gas (LPG) and potentially other alternative fuels. Investments in modernizing fuel storage and distribution infrastructure will be crucial for ensuring reliable supply and reducing costs. Strategic partnerships between local distributors and international suppliers can enhance product availability and quality. Furthermore, the exploration and potential production of Uganda's own oil reserves, though still in early stages, holds long-term potential for transforming the domestic market dynamics and reducing import dependence.

Leading Players in the Uganda Petroleum Products Market Sector

- Nile Energy Limited

- City Oil (U) Limited

- GP Global Uganda Limited

- Petro Uganda Limited

- Moil (U) Limited

- Vivo Energy Uganda Ltd

- Hass Petroleum (U) Limited

- TotalEnergies SE

- Stabex International Limited

- BE Energy Limited

Key Milestones in Uganda Petroleum Products Market Industry

- August 2021: Uganda planned to revive oil product imports via Tanzania to reduce its reliance on supply routes through Kenya, aiming to mitigate disruptions due to the 2022 general election in Kenya. This strategic move highlighted the country's focus on supply chain security and diversification.

- 2022: Continued development and investment in the country's oil and gas sector, with anticipation building towards potential crude oil production commencement in the coming years, influencing downstream product market strategies.

- 2023 - Ongoing: Increased focus on expanding LPG distribution networks and promoting its adoption as a cleaner cooking fuel, with government incentives and private sector investments contributing to market growth.

Strategic Outlook for Uganda Petroleum Products Market Market

The strategic outlook for the Uganda petroleum products market is one of sustained growth, driven by increasing demand and evolving energy landscapes. Key growth accelerators include ongoing economic development, the expansion of the transport and commercial sectors, and the increasing adoption of cleaner energy alternatives like LPG. Stakeholders should focus on investing in efficient supply chain management, embracing technological advancements in fuel distribution, and exploring opportunities in alternative fuels to capitalize on future market potential. Strategic partnerships and a keen understanding of regulatory shifts will be crucial for navigating the market successfully. The country's long-term vision for energy independence and economic diversification will continue to shape the petroleum products market, presenting both challenges and significant opportunities for growth.

Uganda Petroleum Products Market Segmentation

-

1. Type

- 1.1. Gasoline

- 1.2. Diesel

- 1.3. Jet Fuel

- 1.4. Kerosene

- 1.5. Liquefied Petroleum Gas

-

2. End-User

- 2.1. Transport

- 2.2. Residential

- 2.3. Commercial

- 2.4. Fishery

- 2.5. Others

Uganda Petroleum Products Market Segmentation By Geography

- 1. Uganda

Uganda Petroleum Products Market Regional Market Share

Geographic Coverage of Uganda Petroleum Products Market

Uganda Petroleum Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country

- 3.3. Market Restrains

- 3.3.1. 4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems

- 3.4. Market Trends

- 3.4.1. Diesel as a Significant Petroleum Product

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uganda Petroleum Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gasoline

- 5.1.2. Diesel

- 5.1.3. Jet Fuel

- 5.1.4. Kerosene

- 5.1.5. Liquefied Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Transport

- 5.2.2. Residential

- 5.2.3. Commercial

- 5.2.4. Fishery

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uganda

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nile Energy Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 City Oil (U) Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GP Global Uganda Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petro Uganda Limited*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moil (U) Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vivo Energy Uganda Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hass Petroleum (U) Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stabex International Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BE Energy Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nile Energy Limited

List of Figures

- Figure 1: Uganda Petroleum Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Uganda Petroleum Products Market Share (%) by Company 2025

List of Tables

- Table 1: Uganda Petroleum Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Uganda Petroleum Products Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Uganda Petroleum Products Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Uganda Petroleum Products Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 5: Uganda Petroleum Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Uganda Petroleum Products Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Uganda Petroleum Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Uganda Petroleum Products Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Uganda Petroleum Products Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Uganda Petroleum Products Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 11: Uganda Petroleum Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Uganda Petroleum Products Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uganda Petroleum Products Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Uganda Petroleum Products Market?

Key companies in the market include Nile Energy Limited, City Oil (U) Limited, GP Global Uganda Limited, Petro Uganda Limited*List Not Exhaustive, Moil (U) Limited, Vivo Energy Uganda Ltd, Hass Petroleum (U) Limited, TotalEnergies SE, Stabex International Limited, BE Energy Limited.

3. What are the main segments of the Uganda Petroleum Products Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 464.85 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country.

6. What are the notable trends driving market growth?

Diesel as a Significant Petroleum Product.

7. Are there any restraints impacting market growth?

4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems.

8. Can you provide examples of recent developments in the market?

In August 2021, Uganda planned to revive oil product imports via Tanzania to reduce its reliance on supply routes through Kenya. The country wants to omit disruption to the supply chain due to the 2022 general election in Kenya.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uganda Petroleum Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uganda Petroleum Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uganda Petroleum Products Market?

To stay informed about further developments, trends, and reports in the Uganda Petroleum Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence