Key Insights

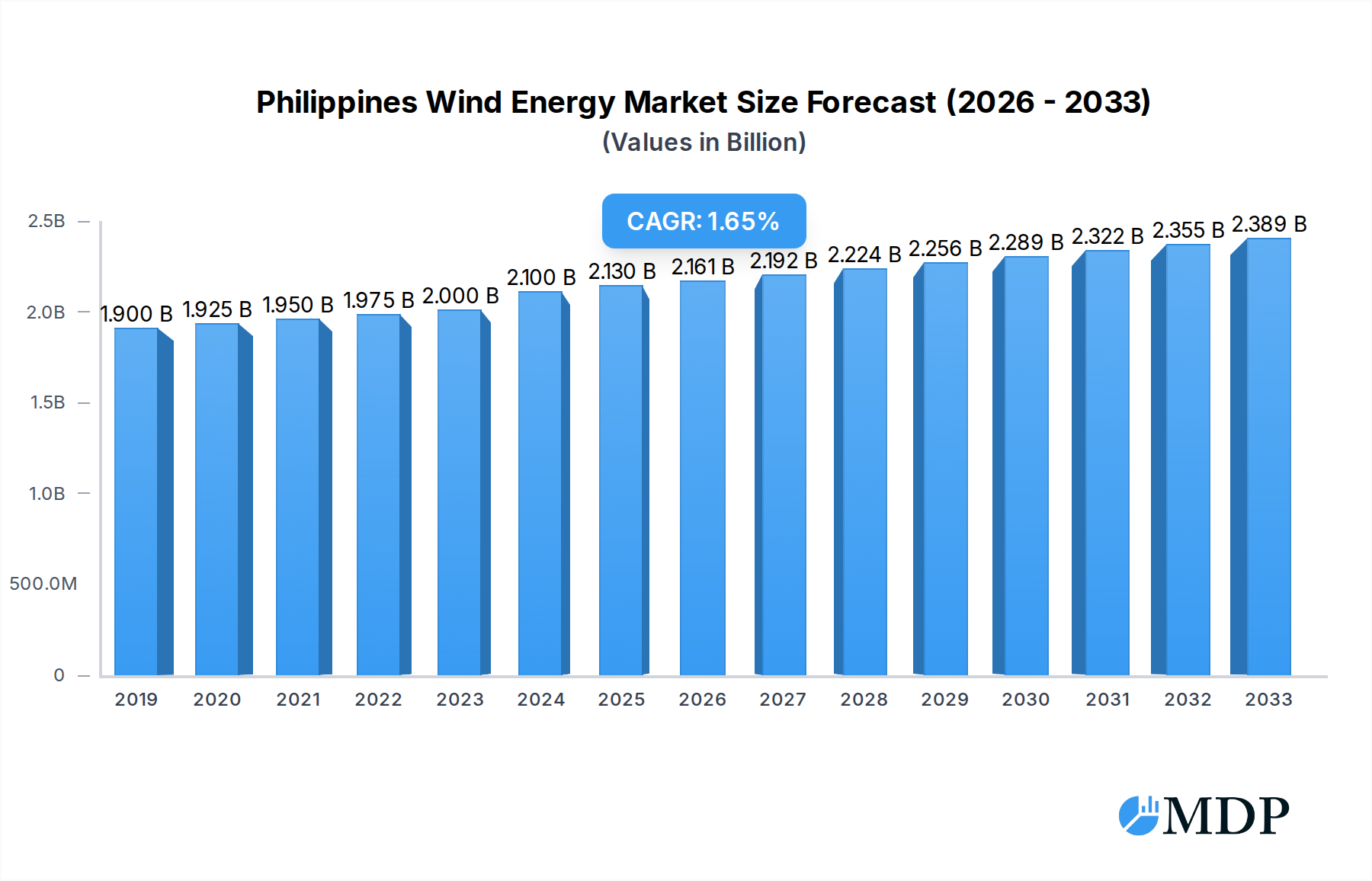

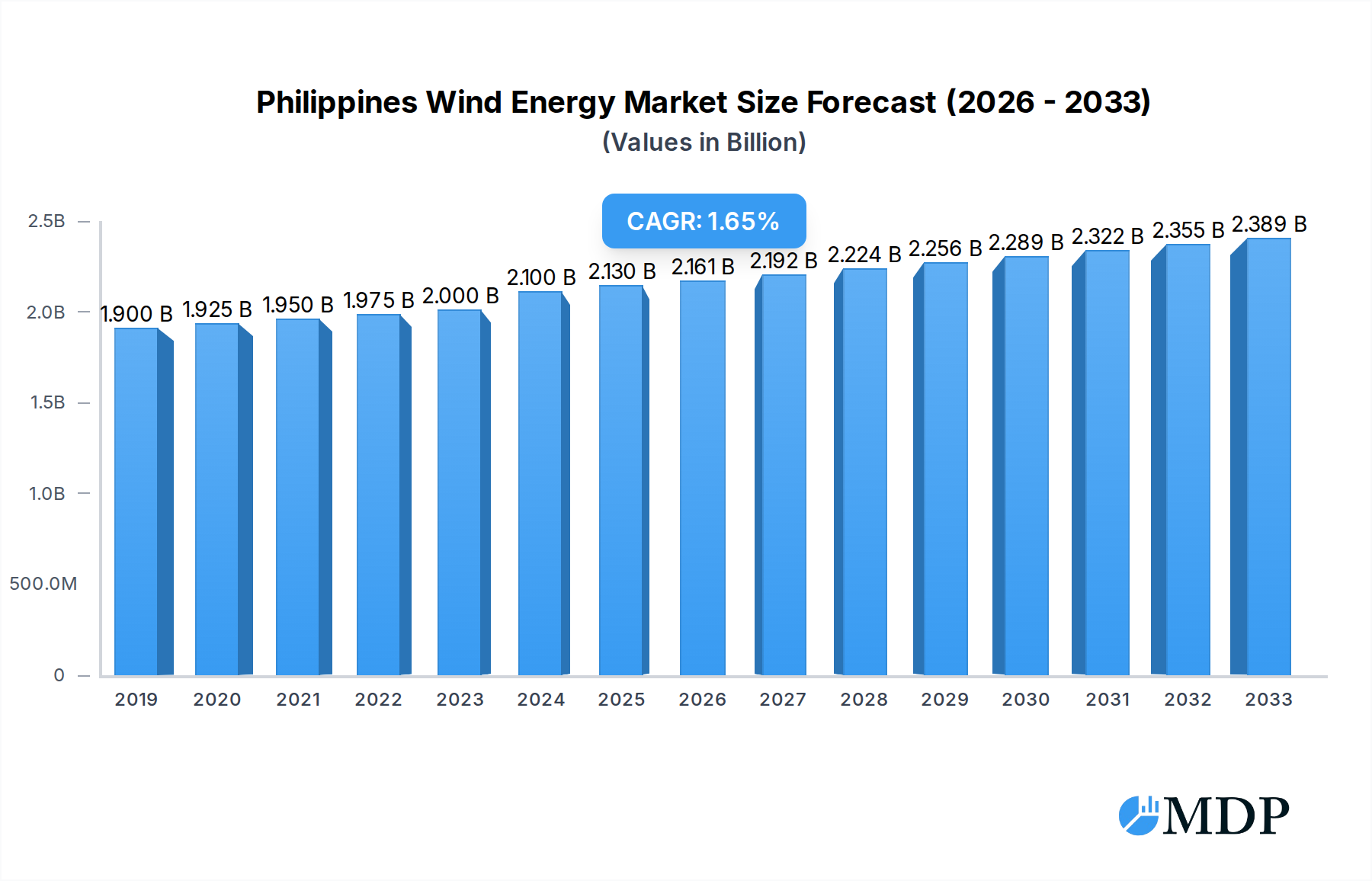

The Philippines wind energy market is poised for steady growth, projected to reach USD 2.1 billion in 2024 and expand at a Compound Annual Growth Rate (CAGR) of 1.5% from 2025 to 2033. This expansion is primarily driven by the nation's ambitious renewable energy targets and a growing need for clean, reliable power to fuel its developing economy. Favorable government policies, including incentives for renewable energy developers and streamlined permitting processes, are crucial catalysts. The increasing cost-competitiveness of wind power technology compared to fossil fuels further bolsters investor confidence. Furthermore, the country's extensive coastlines and consistent wind resources, particularly in regions like the Visayas and Northern Luzon, present significant untapped potential for both onshore and offshore wind farm development. As energy demand rises with industrialization and urbanization, wind energy is positioned as a key component of the Philippines' diversified energy mix.

Philippines Wind Energy Market Market Size (In Billion)

The market is characterized by significant opportunities in both onshore and offshore deployments, with onshore facilities currently dominating due to established infrastructure and lower initial investment requirements. However, offshore wind holds immense long-term promise, leveraging the country's archipelagic nature to harness stronger and more consistent wind speeds. Key players like PetroEnergy Resources Corporation, AC Energy Inc., and Alternergy Ltd. are actively investing and developing projects across the Philippines. While the market benefits from strong drivers, it faces certain restraints, including challenges related to grid integration, land acquisition complexities for onshore projects, and the high upfront capital expenditure associated with offshore developments. Nevertheless, the overarching trend towards decarbonization and energy security, coupled with technological advancements, is expected to propel the Philippines wind energy sector forward, making it an attractive landscape for further investment and innovation.

Philippines Wind Energy Market Company Market Share

Philippines Wind Energy Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a definitive analysis of the Philippines wind energy market, offering critical insights for stakeholders seeking to capitalize on this rapidly expanding sector. Covering the historical period from 2019-2024 and projecting to 2033, with a base year of 2025, this report delves into market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and the competitive landscape. We leverage high-traffic keywords such as "Philippines wind power," "offshore wind Philippines," "renewable energy Philippines," "wind energy investment Philippines," and "Philippine energy sector" to ensure maximum search visibility and reach.

Philippines Wind Energy Market Market Dynamics & Concentration

The Philippines wind energy market is experiencing dynamic growth, driven by a confluence of innovation, supportive regulatory frameworks, and increasing end-user demand for clean energy solutions. Market concentration is shifting, with a notable rise in offshore wind development commanding significant attention. Innovation drivers include advancements in turbine technology, enhanced grid integration solutions, and sophisticated energy storage systems. Regulatory frameworks, such as the Renewable Energy Act, are crucial in fostering investment and streamlining project development. While product substitutes like solar and geothermal energy exist, the superior capacity factor and land efficiency of wind power, particularly offshore, position it as a preferred choice for large-scale power generation. End-user trends highlight a growing preference for sustainable energy sources among corporations and government entities, pushing for greater wind energy adoption. Mergers and acquisitions (M&A) activities are on the rise, signaling consolidation and strategic expansion by key players aiming to secure market share. We estimate the market share of leading companies and track M&A deal counts to provide a quantitative understanding of market concentration.

Philippines Wind Energy Market Industry Trends & Analysis

The Philippines wind energy market is poised for substantial expansion, projected to witness a remarkable Compound Annual Growth Rate (CAGR) over the forecast period of 2025-2033. This growth is underpinned by several key trends. Technological disruptions are at the forefront, with the development of larger, more efficient wind turbines capable of operating in diverse wind conditions, including deep offshore environments. These advancements are significantly boosting the feasibility and economic viability of wind power projects across the archipelago. Consumer preferences are increasingly leaning towards renewable energy, driven by environmental consciousness and the desire for energy independence. Governments and large corporations are actively setting ambitious renewable energy targets, further accelerating market penetration. The competitive dynamics are intensifying, with both domestic and international players vying for a larger share of this burgeoning market. This includes significant foreign direct investment flowing into the sector, attracted by the Philippines' abundant wind resources and government incentives. The market penetration of wind energy is expected to see a significant uplift as more large-scale projects come online, contributing substantially to the national energy mix and supporting the country's decarbonization goals.

Leading Markets & Segments in Philippines Wind Energy Market

The Offshore segment is emerging as the dominant force in the Philippines wind energy market, driven by the nation's extensive coastline and the availability of world-class wind resources. While onshore wind development has been established, the untapped potential of offshore locations presents a significant opportunity for large-scale power generation.

- Economic Policies: Government incentives, feed-in tariffs, and auction mechanisms specifically designed to promote offshore wind development are critical catalysts. These policies de-risk investments and provide a stable revenue stream for project developers.

- Infrastructure Development: The development of port facilities capable of handling large offshore wind components, coupled with enhancements to transmission infrastructure to connect offshore farms to the national grid, are crucial for segment growth. Investments in these areas are crucial.

- Resource Availability: The Philippines boasts exceptionally high average wind speeds in its offshore regions, making it one of the most attractive locations globally for offshore wind farm development. This natural advantage is a primary driver of segment dominance.

The dominance of the offshore segment is further underscored by the sheer scale of planned projects. For instance, a single Spanish offshore wind developer is expected to build a 7.6 GW portfolio of offshore wind projects, strategically located in Central Luzon, South Luzon, Northern Luzon, and Southern Mindoro. These projects, ranging in size from 1.5 GW to 3.5 GW, illustrate the immense potential and the significant investment being channeled into this sector. The Department of Energy's commitment, evidenced by the ink of contracts for offshore wind energy development projects totaling 2,000 megawatts with a Danish fund manager, further solidifies offshore wind's leading position. The 25-year operational lifetime of these service contracts with Copenhagen Infrastructure New Markets Fund (CINMF) highlights the long-term vision and commitment to offshore wind. The establishment of a 1.2 GW offshore wind project in Bulalacao, Oriental Mindoro, featuring 100 turbines with a unit capacity of 12 MW, further exemplifies the growing trend towards larger and more sophisticated offshore installations. This clear focus on offshore development signifies its pivotal role in the future of the Philippines' renewable energy landscape.

Philippines Wind Energy Market Product Developments

Product innovation in the Philippines wind energy market is primarily focused on enhancing turbine efficiency and reliability for both onshore and offshore applications. This includes the development of larger rotor diameters and taller towers for onshore turbines to capture more wind energy, even in lower wind speed areas. For offshore wind, advancements in foundation technologies, such as floating platforms, are enabling development in deeper waters, unlocking new geographical areas. These innovations lead to higher capacity factors, reduced levelized cost of energy (LCOE), and improved environmental performance, creating significant competitive advantages for developers and manufacturers in a market increasingly driven by cost-effectiveness and sustainability.

Key Drivers of Philippines Wind Energy Market Growth

The Philippines wind energy market growth is propelled by a potent combination of factors. Technological advancements in turbine design and manufacturing are making wind power more efficient and cost-competitive. Supportive government policies and regulations, including renewable energy targets and investment incentives, create a favorable environment for project development. Furthermore, increasing global and domestic demand for clean energy, driven by climate change concerns and energy security objectives, is a significant catalyst. The abundant and consistent wind resources available across the Philippines, particularly in offshore locations, present a natural advantage that underpins sustained growth.

Challenges in the Philippines Wind Energy Market Market

Despite its promising outlook, the Philippines wind energy market faces several challenges. Regulatory hurdles and bureaucratic processes can sometimes lead to project delays. Supply chain limitations, particularly for specialized components and skilled labor, can impact the pace of development and increase costs. Grid integration complexities and infrastructure limitations require substantial investment to accommodate the influx of variable renewable energy sources. Furthermore, financing challenges and the perceived risk associated with large-scale renewable projects, especially in newer offshore areas, can deter some investors.

Emerging Opportunities in Philippines Wind Energy Market

Emerging opportunities in the Philippines wind energy market are centered around technological breakthroughs, strategic partnerships, and market expansion. The development of advanced energy storage solutions will be crucial to address intermittency and enhance grid stability, unlocking further potential for wind power integration. Strategic partnerships between international developers with offshore expertise and local companies will facilitate knowledge transfer and accelerate project execution. Furthermore, exploring hybrid renewable energy projects that combine wind with solar or battery storage presents a compelling opportunity to optimize resource utilization and provide more reliable power.

Leading Players in the Philippines Wind Energy Market Sector

- PetroEnergy Resources Corporation

- AC Energy Inc

- Alternergy Ltd

- Vestas Wind Systems AS

- General Electric Company

Key Milestones in Philippines Wind Energy Market Industry

- June 2023: BlueFloat Energy, a Spanish offshore wind developer, is expected to build a 7.6 GW portfolio of offshore wind projects in the Philippines. Central Luzon, South Luzon, Northern Luzon, and Southern Mindoro would be the locations for the portfolio. The company has acquired wind energy service contracts for the installations, which range in size from 1.5 GW to 3.5 GW.

- March 2023: The Department of Energy of the Philippines inked three contracts with a Danish fund manager for offshore wind energy development projects totaling 2,000 megawatts. The service contracts with Copenhagen Infrastructure New Markets Fund (CINMF) would have a 25-year operational lifetime, the first foreign corporation permitted to own a 100% stake in Philippine offshore wind energy.

- January 2022: The Blue Circle and its partner CleanTech Global Renewables Inc. signed a contract to construct an offshore wind project in the Philippines with a capacity of 1.2 GW located in Bulalacao, Oriental Mindoro. The wind farm will feature 100 turbines with a unit capacity of 12 MW.

Strategic Outlook for Philippines Wind Energy Market Market

The strategic outlook for the Philippines wind energy market is exceptionally robust, driven by accelerating investment and supportive policy frameworks. The nation's commitment to transitioning towards a greener energy future positions wind power, particularly offshore wind, as a cornerstone of its long-term energy security strategy. Future growth will be fueled by the successful execution of large-scale projects, further advancements in turbine technology, and the development of critical infrastructure. Strategic opportunities lie in fostering greater collaboration between government, industry, and local communities to ensure sustainable and equitable development. The continued influx of foreign investment, coupled with growing domestic capabilities, will solidify the Philippines' position as a leading wind energy market in Southeast Asia.

Philippines Wind Energy Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Philippines Wind Energy Market Segmentation By Geography

- 1. Philippines

Philippines Wind Energy Market Regional Market Share

Geographic Coverage of Philippines Wind Energy Market

Philippines Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Demand for Renewable Energy and Favorable Government Policies4.; The Reduced Wind Power Tariff

- 3.3. Market Restrains

- 3.3.1. 4.; The Increasing Adoption of Alternate Clean Power Sources Such as Solar and Biomass

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Wind Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PetroEnergy Resources Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AC Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alternergy Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vestas Wind Systems AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 PetroEnergy Resources Corporation

List of Figures

- Figure 1: Philippines Wind Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Philippines Wind Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Wind Energy Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Philippines Wind Energy Market Volume gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 3: Philippines Wind Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Philippines Wind Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Philippines Wind Energy Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: Philippines Wind Energy Market Volume gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 7: Philippines Wind Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Philippines Wind Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Wind Energy Market?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the Philippines Wind Energy Market?

Key companies in the market include PetroEnergy Resources Corporation, AC Energy Inc, Alternergy Ltd, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the Philippines Wind Energy Market?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Demand for Renewable Energy and Favorable Government Policies4.; The Reduced Wind Power Tariff.

6. What are the notable trends driving market growth?

Onshore Wind Energy Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Increasing Adoption of Alternate Clean Power Sources Such as Solar and Biomass.

8. Can you provide examples of recent developments in the market?

June 2023: BlueFloat Energy, a Spanish offshore wind developer, is expected to build a 7.6GW portfolio of offshore wind projects in the Philippines. Central Luzon, South Luzon, Northern Luzon, and Southern Mindoro would be the locations for the portfolio. The company has acquired wind energy service contracts for the installations, which range in size from 1.5GW to 3.5GW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Wind Energy Market?

To stay informed about further developments, trends, and reports in the Philippines Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence