Key Insights

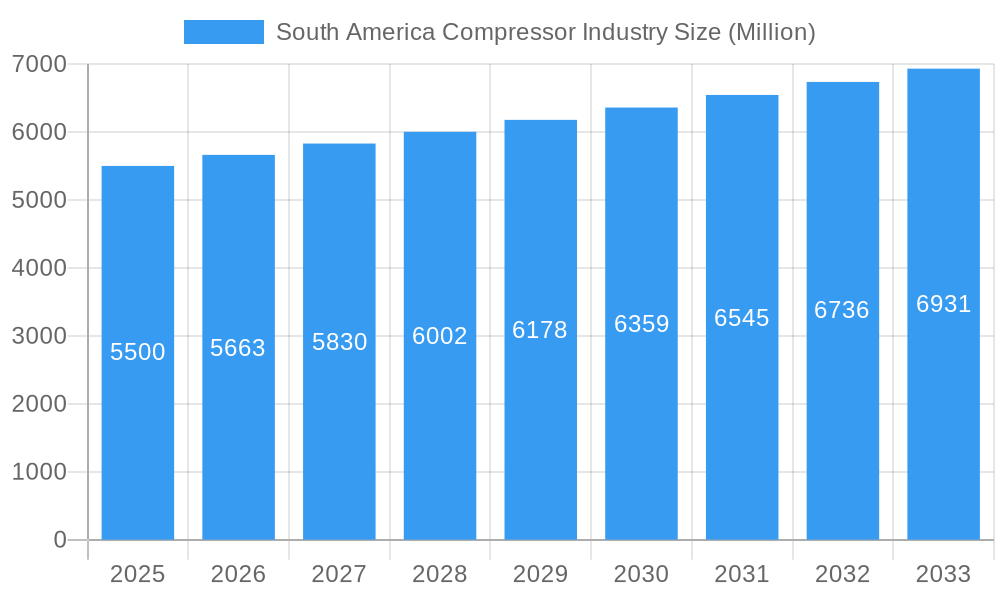

The South America compressor market is projected for substantial growth, anticipated to reach a market size of 1445.4 million with a Compound Annual Growth Rate (CAGR) of 4% from the base year 2024 to 2033. This expansion is driven by robust demand from critical sectors, including oil and gas, power generation, manufacturing, and chemicals & petrochemicals. Brazil leads this market, supported by its significant industrial base and natural resource investments, while Argentina and the wider South American region also contribute to growing demand for diverse compressor types.

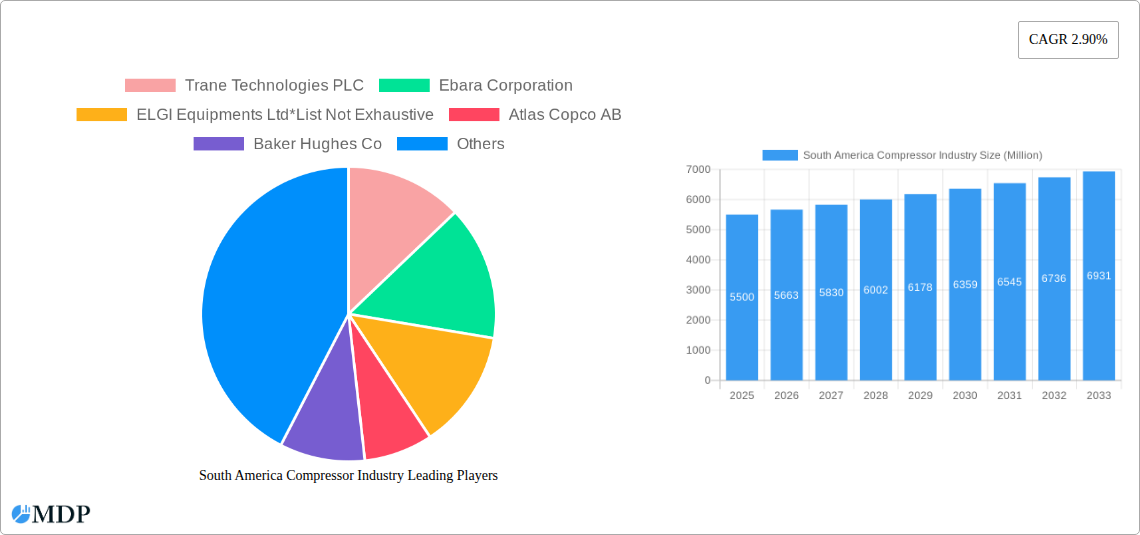

South America Compressor Industry Market Size (In Billion)

Key growth drivers include technological advancements in energy-efficient compressor solutions and supportive government initiatives for industrial development. Challenges such as high initial investment costs and economic volatility are present but are outweighed by the overall positive market trajectory. Leading companies are actively engaging in this dynamic region, focusing on efficiency, reliability, and specialized solutions for key industries.

South America Compressor Industry Company Market Share

South America Compressor Market Analysis: Growth, Trends & Forecast (2024-2033)

This comprehensive market report offers deep insights into the South America Compressor Industry from 2019 to 2033, with a base year of 2024. It details market dynamics, key trends, and growth strategies for Positive Displacement and Dynamic compressors across the Oil and Gas, Power, Manufacturing, and Chemicals & Petrochemical sectors in Brazil, Argentina, and the broader South American region. Understand critical industry developments, competitive strategies, and growth drivers impacting a market valued in the millions of USD.

South America Compressor Industry Market Dynamics & Concentration

The South America compressor industry is characterized by a moderate to high market concentration, with a few dominant players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for energy efficiency, stringent environmental regulations, and the ongoing technological advancements in compressor design and functionality. Regulatory frameworks across various South American nations are becoming increasingly sophisticated, influencing manufacturing standards, emissions controls, and energy consumption requirements, thereby shaping product development and market entry strategies. Product substitutes, such as alternative energy sources or process optimizations that reduce the need for compression, present a limited but growing challenge. End-user trends are heavily influenced by the region's robust economic development, particularly in the Oil and Gas Industry and the Power Sector, which continue to drive substantial demand for advanced compression solutions. Mergers and Acquisitions (M&A) activities, while not at peak levels, are strategically focused on consolidating market presence, acquiring new technologies, and expanding geographic reach. For instance, recent M&A deals in the broader industrial equipment sector in South America indicate a growing appetite for strategic consolidation to enhance competitive positioning and operational efficiencies. The market share of key players in specific segments like Dynamic compressors for large-scale Oil and Gas applications is substantial, often exceeding 30% for leading entities. The number of M&A deals in the industrial equipment sector relevant to compressors has averaged around 5-10 significant transactions annually over the historical period, signaling strategic realignments.

South America Compressor Industry Industry Trends & Analysis

The South America compressor industry is poised for robust growth, propelled by a confluence of significant market growth drivers and transformative technological disruptions. The overarching trend is a sustained increase in demand across key end-user sectors, driven by economic expansion and industrial development throughout the region. The Oil and Gas Industry remains a primary engine, with ongoing exploration and production activities, particularly in offshore and unconventional resources, necessitating high-performance and reliable compression solutions. Furthermore, the burgeoning Power Sector, fueled by investments in both conventional and renewable energy generation, creates substantial demand for compressors in power plant operations and gas transmission infrastructure. The Manufacturing Sector is also a key contributor, with increasing industrial automation and production capacities requiring efficient compressed air systems for various applications. Chemicals and Petrochemical Industry expansion, driven by global demand and local resource processing, further bolsters the market for specialized compressors. Technological disruptions are transforming the industry, with a notable shift towards variable speed drives (VSDs), oil-free compressors, and advanced digital monitoring and predictive maintenance solutions. These innovations enhance energy efficiency, reduce operational costs, and improve reliability, aligning with increasing environmental consciousness and the pursuit of sustainability. Consumer preferences are increasingly leaning towards integrated solutions that offer not only compression but also intelligent control, remote diagnostics, and minimal environmental impact. Competitive dynamics are intense, with leading global players vying for market share against established regional manufacturers. The market penetration of advanced compressor technologies is steadily rising, particularly in more developed economies within South America. The compound annual growth rate (CAGR) for the South America compressor market is projected to be in the range of 5% to 7% over the forecast period, driven by these multifaceted trends. Investments in infrastructure projects, such as pipelines for natural gas distribution and LNG terminals, are direct catalysts for compressor demand, underpinning market expansion.

Leading Markets & Segments in South America Compressor Industry

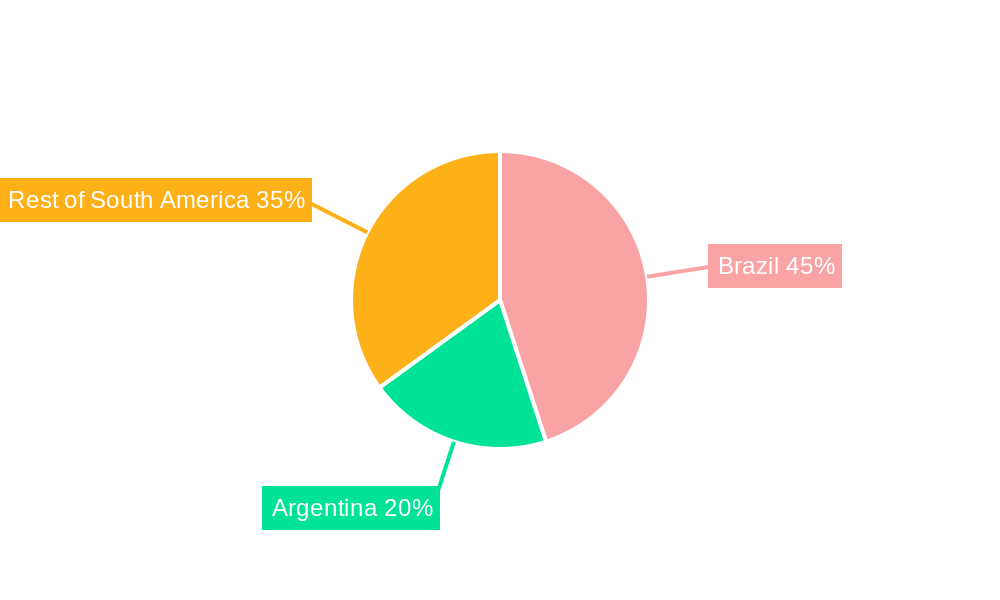

The Oil and Gas Industry stands as the dominant end-user segment within the South America compressor market, exhibiting significant demand driven by extensive exploration, production, and processing activities across the continent. Countries like Brazil and Argentina are at the forefront of this demand, owing to their substantial hydrocarbon reserves. Within this sector, both Positive Displacement and Dynamic compressors play critical roles, with Dynamic compressors, particularly centrifugal and axial types, being crucial for large-scale applications like gas transmission pipelines and LNG facilities. The Power Sector also represents a significant and growing market, propelled by increased electricity demand and investments in new power generation capacity, including natural gas-fired plants and compressed air energy storage (CAES) initiatives. Economic policies promoting energy independence and diversification further enhance the demand for compressors in this segment. Brazil emerges as the leading market geographically, owing to its large industrial base, extensive oil and gas reserves, and significant investments in energy infrastructure. Argentina’s oil and gas sector, particularly the Vaca Muerta formation, also contributes substantially to regional compressor demand. The Rest of South America, encompassing countries like Colombia, Peru, and Venezuela, collectively forms a substantial market driven by their respective energy and industrial sectors. The Manufacturing Sector is another key segment, with increasing automation and the growing industrialization of various economies driving demand for compressed air systems for diverse applications, from assembly lines to pneumatic tools. The Chemicals and Petrochemical Industry is also a crucial end-user, relying on compressors for various process applications, including feedstock handling and product separation. Key drivers of dominance in these segments include:

- Resource Abundance: South America's vast oil and gas reserves fuel significant demand for compressors in extraction, processing, and transportation.

- Infrastructure Development: Investments in pipelines, LNG terminals, and power generation facilities directly translate to higher compressor sales.

- Industrial Growth: The expanding manufacturing and petrochemical sectors create a consistent need for compressed air and process gas compression.

- Government Support: Favorable policies and incentives for energy production and industrial development stimulate market activity.

- Technological Adoption: Increasing acceptance of advanced and energy-efficient compressor technologies enhances market penetration in leading segments.

South America Compressor Industry Product Developments

Product development in the South America compressor industry is increasingly focused on enhancing energy efficiency, reducing emissions, and integrating smart technologies. Innovations in Positive Displacement compressors include advancements in screw and reciprocating designs for improved performance and lower energy consumption in smaller to medium-sized applications. For Dynamic compressors, advancements are seen in the development of high-efficiency centrifugal and axial compressors tailored for large-scale industrial processes in the Oil and Gas and Power Sectors. The integration of variable speed drives (VSDs) across a wide range of compressor types is a significant trend, allowing for precise control of output and substantial energy savings. Furthermore, the market is witnessing a rise in oil-free compressor technologies, crucial for sensitive applications in the chemical and pharmaceutical industries. Competitive advantages are being gained through the development of modular designs for easier installation and maintenance, as well as robust digital monitoring and predictive maintenance capabilities that enhance operational uptime and reduce lifecycle costs.

Key Drivers of South America Compressor Industry Growth

The South America compressor industry's growth is primarily driven by several key factors. Firstly, the expanding Oil and Gas Industry, fueled by ongoing exploration and production activities, particularly in offshore reserves and unconventional resources, creates sustained demand for robust and high-capacity compressors. Secondly, significant investments in the Power Sector, including the development of new natural gas-fired power plants and the expansion of renewable energy infrastructure requiring grid stabilization, are major growth catalysts. Thirdly, the increasing industrialization and manufacturing output across countries like Brazil and Argentina necessitate greater adoption of compressed air systems for various industrial processes. Technological advancements, such as the widespread integration of energy-efficient Variable Speed Drives (VSDs) and the growing demand for oil-free compressors, also contribute significantly by offering improved operational economics and meeting stricter environmental standards.

Challenges in the South America Compressor Industry Market

Despite robust growth prospects, the South America compressor industry faces several significant challenges. Economic volatility and political instability in certain regions can lead to fluctuating capital expenditure by end-users, impacting order volumes. Stringent and evolving regulatory frameworks regarding emissions and energy efficiency, while driving innovation, can also increase compliance costs for manufacturers and operators. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities within the vast South American continent, can lead to increased lead times and material costs. Furthermore, intense competition from both international and local players puts pressure on pricing and profit margins. The availability of skilled labor for the installation, operation, and maintenance of advanced compressor systems also presents a localized challenge in some areas.

Emerging Opportunities in South America Compressor Industry

Emerging opportunities within the South America compressor industry are largely driven by the growing emphasis on energy transition and sustainability, coupled with ongoing industrial expansion. The increasing adoption of liquefied natural gas (LNG) as a cleaner fuel source presents a substantial opportunity, particularly for compressors used in LNG liquefaction, regasification terminals, and transportation. Significant investments in renewable energy projects, such as wind and solar farms, are also indirectly boosting the compressor market through the demand for ancillary equipment and infrastructure development. The digitalization trend is creating opportunities for advanced compressor systems equipped with IoT capabilities for predictive maintenance, remote monitoring, and process optimization, offering enhanced operational efficiency and reduced downtime. Strategic partnerships between compressor manufacturers and energy companies for localized production or specialized solutions also represent a significant growth avenue.

Leading Players in the South America Compressor Industry Sector

- Trane Technologies PLC

- Ebara Corporation

- ELGI Equipments Ltd

- Atlas Copco AB

- Baker Hughes Co

- Aerzener Maschinenfabrik GmbH

- Siemens AG

- Schulz S A

- General Electric Company

Key Milestones in South America Compressor Industry Industry

- September 2022: YPF and Petronas signed a deal to build a liquefied natural gas (LNG) plant and a pipeline to transport the fuel. The project's initial investment is estimated at around USD 10 billion. It is expected to have a capacity of a power output of 5 million tonnes of LNG during the first year of operation. This development signifies a substantial boost for the demand of high-capacity compressors, particularly for LNG processing and transportation.

- January 2023: Compass Gás e Energia announced that the company plans to start operations at its liquefied natural gas (LNG) regasification terminal in São Paulo state in late June 2023. The regasification terminal was built at the cost of USD 140 million and will have the capacity to regasify 14Mm3/d. This milestone highlights the growing infrastructure for LNG import and distribution, directly impacting the need for specialized regasification compressors.

Strategic Outlook for South America Compressor Industry Market

The strategic outlook for the South America compressor industry is characterized by sustained growth driven by energy security initiatives and industrial modernization. Key accelerators include the continued expansion of the Oil and Gas Industry, particularly in natural gas production and processing, and the significant investments in the Power Sector to meet rising energy demands and integrate cleaner energy sources. The growing adoption of digitalization and Industry 4.0 principles will foster demand for smart compressors with advanced monitoring and control capabilities, offering enhanced efficiency and reliability. Furthermore, the increasing focus on sustainability and energy efficiency will continue to drive the adoption of Variable Speed Drives (VSDs) and oil-free technologies. Strategic opportunities lie in developing localized manufacturing capabilities, offering comprehensive after-sales services, and forging partnerships to cater to the specific needs of emerging projects like large-scale LNG infrastructure.

South America Compressor Industry Segmentation

-

1. Type

- 1.1. Positive Diplacement

- 1.2. Dynamic

-

2. End User

- 2.1. Oil and Gas Industry

- 2.2. Power Sector

- 2.3. Manufacturing Sector

- 2.4. Chemicals and Petrochemical Industry

- 2.5. Other End Users

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Compressor Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Compressor Industry Regional Market Share

Geographic Coverage of South America Compressor Industry

South America Compressor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Diplacement

- 5.1.2. Dynamic

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas Industry

- 5.2.2. Power Sector

- 5.2.3. Manufacturing Sector

- 5.2.4. Chemicals and Petrochemical Industry

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Positive Diplacement

- 6.1.2. Dynamic

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas Industry

- 6.2.2. Power Sector

- 6.2.3. Manufacturing Sector

- 6.2.4. Chemicals and Petrochemical Industry

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Positive Diplacement

- 7.1.2. Dynamic

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas Industry

- 7.2.2. Power Sector

- 7.2.3. Manufacturing Sector

- 7.2.4. Chemicals and Petrochemical Industry

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Positive Diplacement

- 8.1.2. Dynamic

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas Industry

- 8.2.2. Power Sector

- 8.2.3. Manufacturing Sector

- 8.2.4. Chemicals and Petrochemical Industry

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Trane Technologies PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ebara Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ELGI Equipments Ltd*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Atlas Copco AB

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Baker Hughes Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Aerzener Maschinenfabrik GmbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Schulz S A

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Trane Technologies PLC

List of Figures

- Figure 1: South America Compressor Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Compressor Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Compressor Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: South America Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 3: South America Compressor Industry Revenue million Forecast, by End User 2020 & 2033

- Table 4: South America Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 5: South America Compressor Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: South America Compressor Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: South America Compressor Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: South America Compressor Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America Compressor Industry Revenue million Forecast, by Type 2020 & 2033

- Table 10: South America Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 11: South America Compressor Industry Revenue million Forecast, by End User 2020 & 2033

- Table 12: South America Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 13: South America Compressor Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 14: South America Compressor Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: South America Compressor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: South America Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: South America Compressor Industry Revenue million Forecast, by Type 2020 & 2033

- Table 18: South America Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 19: South America Compressor Industry Revenue million Forecast, by End User 2020 & 2033

- Table 20: South America Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 21: South America Compressor Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 22: South America Compressor Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: South America Compressor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: South America Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: South America Compressor Industry Revenue million Forecast, by Type 2020 & 2033

- Table 26: South America Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 27: South America Compressor Industry Revenue million Forecast, by End User 2020 & 2033

- Table 28: South America Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 29: South America Compressor Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 30: South America Compressor Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: South America Compressor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: South America Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Compressor Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the South America Compressor Industry?

Key companies in the market include Trane Technologies PLC, Ebara Corporation, ELGI Equipments Ltd*List Not Exhaustive, Atlas Copco AB, Baker Hughes Co, Aerzener Maschinenfabrik GmbH, Siemens AG, Schulz S A, General Electric Company.

3. What are the main segments of the South America Compressor Industry?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1445.4 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Oil and Gas Industry Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

September 2022: YPF and Petronas signed a deal to build a liquefied natural gas (LNG) plant and a pipeline to transport the fuel. The project's initial investment is estimated at around USD 10 billion. It is expected to have a capacity of a power output of 5 million tonnes of LNG during the first year of operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Compressor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Compressor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Compressor Industry?

To stay informed about further developments, trends, and reports in the South America Compressor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence