Key Insights

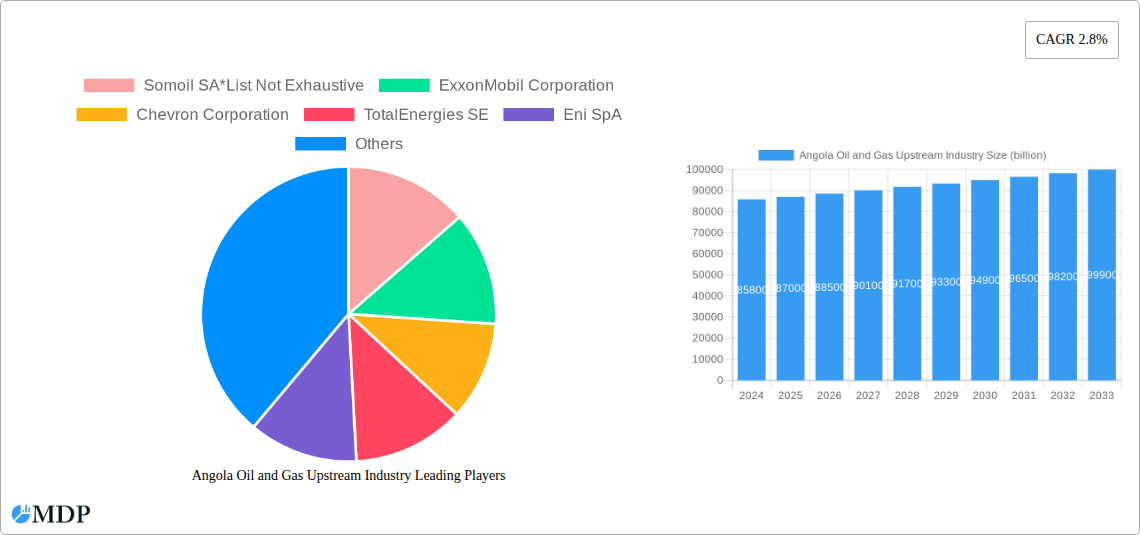

The Angola Oil and Gas Upstream Industry is poised for steady growth, projected to reach an estimated $85.8 billion in 2024. This robust market is driven by several key factors. Angola possesses vast untapped hydrocarbon reserves, particularly offshore, attracting significant investment from major international oil companies like ExxonMobil, Chevron, TotalEnergies, Eni, BP, and Sonangol. The government's commitment to fostering exploration and production through favorable policies and licensing rounds further fuels this expansion. Furthermore, technological advancements in exploration and extraction techniques, especially for deepwater and ultra-deepwater fields, are unlocking new production potentials and improving recovery rates. The increasing global demand for oil and gas, while undergoing a transition, remains a strong underlying driver for Angola's upstream sector, ensuring continued revenue streams and investment in the coming years.

Angola Oil and Gas Upstream Industry Market Size (In Billion)

The industry is expected to experience a Compound Annual Growth Rate (CAGR) of 2.8% from 2025 to 2033, indicating a consistent upward trajectory. While onshore operations remain significant, the future growth of Angola's upstream sector will be heavily influenced by its prolific offshore reserves. Trends point towards increased investment in enhanced oil recovery (EOR) techniques for mature fields, alongside the exploration of new deepwater blocks. Challenges, such as the fluctuating global oil prices and the increasing pressure to decarbonize the energy sector, present strategic considerations. However, the sheer volume of discoverable resources and the established infrastructure position Angola to remain a key player in the global oil and gas market, adapting to evolving energy landscapes and prioritizing sustainable production practices.

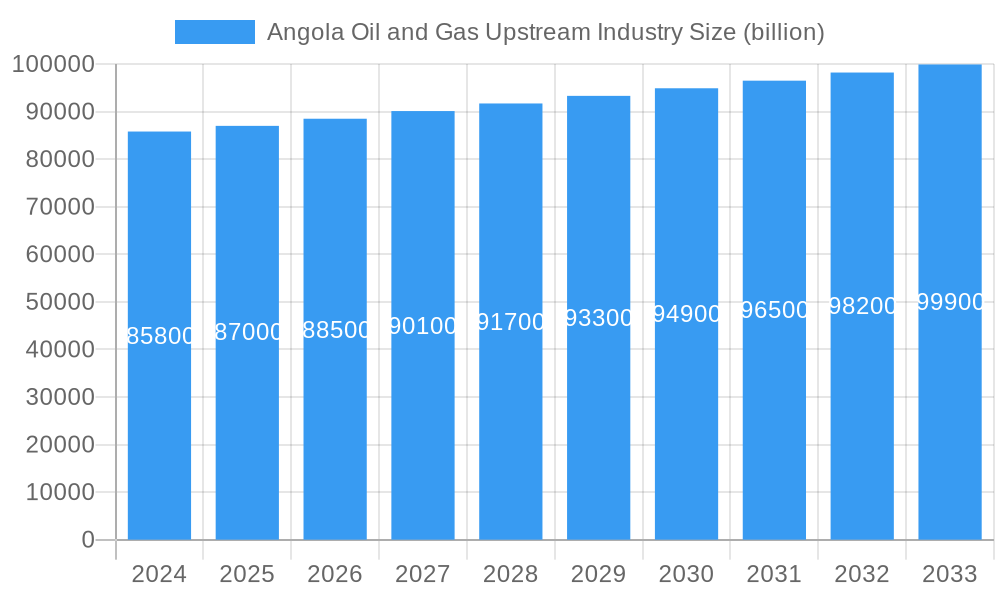

Angola Oil and Gas Upstream Industry Company Market Share

Here's an SEO-optimized and engaging report description for the Angola Oil and Gas Upstream Industry, incorporating your specified details and structure:

Angola Oil and Gas Upstream Industry: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Angola Oil and Gas Upstream Industry, offering critical insights for stakeholders navigating this vital sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this analysis provides a deep dive into market concentration, innovation drivers, regulatory frameworks, and the competitive landscape. We meticulously examine both historical performance (2019-2024) and future projections, empowering businesses with actionable intelligence to capitalize on emerging opportunities and mitigate potential challenges within Angola's burgeoning upstream oil and gas sector.

Angola Oil and Gas Upstream Industry Market Dynamics & Concentration

The Angola Oil and Gas Upstream Industry is characterized by a moderately concentrated market, with a few dominant international oil companies (IOCs) and state-owned entities holding significant acreage and production. Major players like ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, and Eni SpA are key contributors to Angola's hydrocarbon output. Sonangol P&P, the national concessionaire, plays a pivotal role in managing exploration and production licenses. The market is driven by innovation, particularly in deepwater exploration and enhanced oil recovery techniques, as companies strive to maximize existing reserves and discover new ones. Regulatory frameworks, spearheaded by the National Agency of Petroleum, Gas and Biofuels (ANPG), are crucial in shaping investment decisions and ensuring resource management. While product substitutes are limited in the immediate upstream context, long-term shifts towards renewable energy sources represent a broader industry consideration. End-user trends are primarily dictated by global energy demand, with a focus on secure and stable supply chains. Mergers and acquisitions (M&A) activities, though not at peak levels, remain a strategic tool for portfolio optimization and market consolidation, with approximately 3-5 significant deal counts projected within the forecast period, involving asset divestments and acquisitions valued in the billions of dollars.

Angola Oil and Gas Upstream Industry Industry Trends & Analysis

The Angola Oil and Gas Upstream Industry is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period (2025–2033), driven by a confluence of technological advancements, evolving global energy demand, and strategic investments. Market penetration in deepwater exploration continues to expand, with advanced seismic imaging and drilling technologies enabling access to previously unreachable reserves. The resurgence of interest in onshore exploration, particularly for unconventional resources, is also a notable trend, albeit at a slower pace than offshore. Consumer preferences, globally, are leaning towards cleaner energy sources, but the immediate demand for oil and gas as a primary energy source for industrial and transportation sectors remains robust. Competitive dynamics are intense, with IOCs leveraging their expertise and capital to secure profitable exploration blocks and optimize production from existing fields. Government initiatives aimed at attracting foreign investment and fostering local content development are also shaping the industry's trajectory. Technological disruptions, such as the increasing adoption of artificial intelligence (AI) for reservoir characterization and predictive maintenance, are enhancing operational efficiency and reducing costs, with investments in these technologies estimated to be in the billions of dollars annually. The industry's commitment to reducing its environmental footprint through improved flaring reduction technologies and carbon capture initiatives is also gaining momentum, reflecting a growing awareness of sustainability imperatives, with a projected market penetration of these technologies reaching xx% by 2033.

Leading Markets & Segments in Angola Oil and Gas Upstream Industry

The Offshore segment undeniably dominates the Angola Oil and Gas Upstream Industry, driven by its prolific deepwater and ultra-deepwater fields that have historically been the cornerstone of the nation's hydrocarbon production. This dominance is underpinned by significant economic policies that have prioritized the development of these technically challenging but highly rewarding offshore reserves, attracting substantial foreign direct investment worth billions of dollars.

- Economic Policies and Investment: Government policies have historically favored the development of offshore blocks through favorable fiscal terms and production-sharing agreements, making Angola an attractive destination for major IOCs. This has led to sustained investment, amounting to billions of dollars annually, in exploration, appraisal, and production activities in offshore regions.

- Technological Advancements: The offshore segment benefits immensely from continuous technological innovation. Advancements in subsea technologies, floating production, storage, and offloading (FPSO) vessels, and seismic imaging allow for efficient exploration and extraction from extreme depths, a key factor in maintaining production levels.

- Infrastructure Development: Significant investment has been channeled into developing world-class offshore infrastructure, including pipelines, subsea manifolds, and sophisticated processing facilities. This robust infrastructure is critical for transporting and processing the vast quantities of oil and gas extracted from offshore fields.

- Resource Potential: Angola possesses immense proven and prospective offshore hydrocarbon reserves, particularly in the pre-salt and ultra-deepwater frontiers. The potential for new discoveries and the successful exploitation of these reserves continues to fuel the dominance of the offshore segment.

While the Onshore segment is a significant contributor and holds substantial potential, its development has been more gradual and often faces different logistical and geological challenges compared to the established offshore operations. However, renewed interest in developing onshore gas reserves for domestic consumption and potential export, coupled with advancements in onshore exploration techniques, suggests a growing importance for this segment in the coming years. Efforts to unlock these onshore potentials are estimated to require billions in investment over the forecast period.

Angola Oil and Gas Upstream Industry Product Developments

Product developments in the Angola Oil and Gas Upstream Industry are primarily focused on enhancing extraction efficiency and minimizing environmental impact. Innovations in subsea processing technologies are enabling the extraction of hydrocarbons from deeper and more challenging reservoirs, improving recovery rates. Furthermore, the development of advanced drilling fluids and techniques is crucial for overcoming complex geological formations, particularly in deepwater environments. There's also a growing emphasis on technologies that reduce flaring and methane emissions, aligning with global sustainability goals. These developments are critical for maintaining Angola's competitive edge in the global energy market, with investments in R&D valued in the hundreds of millions of dollars annually.

Key Drivers of Angola Oil and Gas Upstream Industry Growth

The Angola Oil and Gas Upstream Industry's growth is propelled by several key drivers. Firstly, significant untapped hydrocarbon reserves, particularly in deepwater and ultra-deepwater offshore basins, present immense exploration opportunities. Secondly, technological advancements in exploration and production techniques are making previously inaccessible reserves economically viable, unlocking billions in potential value. Thirdly, a supportive regulatory environment that encourages foreign investment and offers favorable fiscal terms is attracting substantial capital, estimated to be in the billions of dollars. Finally, the persistent global demand for oil and gas, driven by industrial and transportation sectors, ensures continued market appetite for Angolan crude.

Challenges in the Angola Oil and Gas Upstream Industry Market

Despite its potential, the Angola Oil and Gas Upstream Industry faces considerable challenges. Regulatory hurdles, including changes in fiscal regimes and local content requirements, can create uncertainty for investors and impact project timelines, potentially costing billions in delayed development. Supply chain disruptions, exacerbated by global events, can lead to increased operational costs and project delays. Furthermore, intense competitive pressures from other oil-producing nations vying for investment and market share require continuous innovation and cost optimization, estimated to impact profit margins by up to xx% if not managed effectively. The declining trend of conventional crude oil production in mature fields also presents a challenge, necessitating a focus on enhanced oil recovery techniques.

Emerging Opportunities in Angola Oil and Gas Upstream Industry

Emerging opportunities in the Angola Oil and Gas Upstream Industry are centered on leveraging new technologies and expanding into less-explored frontiers. The increasing focus on natural gas exploration and development presents a significant opportunity, driven by both domestic demand for power generation and potential export markets. Strategic partnerships between IOCs and national oil companies are crucial for sharing expertise and mitigating risks in high-cost deepwater projects. Furthermore, technological breakthroughs in carbon capture, utilization, and storage (CCUS) offer avenues for developing fields with lower environmental impact, attracting ESG-conscious investment worth billions. The potential for developing marginal fields through innovative solutions also represents a significant untapped opportunity.

Leading Players in the Angola Oil and Gas Upstream Industry Sector

- Somoil SA

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- Eni SpA

- BP PLC

- Sonangol P&P

Key Milestones in Angola Oil and Gas Upstream Industry Industry

- 2019: Signing of new production-sharing agreements (PSAs) for offshore blocks, aimed at revitalizing exploration activities and attracting new investment.

- 2020: ExxonMobil announces significant deepwater discovery, underscoring Angola's continued potential in frontier exploration.

- 2021: The Angolan government establishes the National Agency of Petroleum, Gas and Biofuels (ANPG) to oversee the sector, streamlining regulatory processes and promoting transparency.

- 2022: TotalEnergies commences production from a major deepwater field, contributing significantly to Angola's crude oil output.

- 2023: Increased focus on natural gas development with plans for new LNG projects and domestic gas utilization initiatives.

- 2024 (Estimated): Chevron announces plans for enhanced oil recovery (EOR) projects in existing offshore fields, aiming to extend their productive life.

- 2025 (Projected): Launch of new licensing rounds for both onshore and offshore blocks, signaling continued commitment to exploration and production.

Strategic Outlook for Angola Oil and Gas Upstream Industry Market

The strategic outlook for the Angola Oil and Gas Upstream Industry is one of cautious optimism and continued development. The market is expected to be driven by sustained investment in deepwater exploration and production, supported by technological advancements and favorable fiscal policies. A growing emphasis on natural gas development presents a significant avenue for diversification and meeting domestic energy needs. Strategic partnerships, a focus on operational efficiency, and a commitment to sustainable practices will be crucial for navigating market volatility and attracting long-term investment in the billions of dollars. The industry's ability to adapt to evolving global energy dynamics while maximizing its existing resource base will determine its trajectory for decades to come.

Angola Oil and Gas Upstream Industry Segmentation

- 1. Onshore

- 2. Offshore

Angola Oil and Gas Upstream Industry Segmentation By Geography

- 1. Angola

Angola Oil and Gas Upstream Industry Regional Market Share

Geographic Coverage of Angola Oil and Gas Upstream Industry

Angola Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Angola Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Angola

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Somoil SA*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonangol P&P

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Somoil SA*List Not Exhaustive

List of Figures

- Figure 1: Angola Oil and Gas Upstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Angola Oil and Gas Upstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Onshore 2020 & 2033

- Table 2: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Offshore 2020 & 2033

- Table 3: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Onshore 2020 & 2033

- Table 5: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Offshore 2020 & 2033

- Table 6: Angola Oil and Gas Upstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Angola Oil and Gas Upstream Industry?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Angola Oil and Gas Upstream Industry?

Key companies in the market include Somoil SA*List Not Exhaustive, ExxonMobil Corporation, Chevron Corporation, TotalEnergies SE, Eni SpA, BP PLC, Sonangol P&P.

3. What are the main segments of the Angola Oil and Gas Upstream Industry?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Angola Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Angola Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Angola Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Angola Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence