Key Insights

The Gulf of Mexico Oil and Gas Upstream Market is projected for robust growth, with an estimated market size of $52.2 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4.4%. This expansion is propelled by technological advancements in exploration and production, facilitating access to deepwater reserves, and increasing demand for oil and gas in industrial and transportation sectors. Strategic investments by major energy corporations leverage the region's significant hydrocarbon potential, while innovations in enhanced oil recovery and seismic imaging drive efficiency and investment.

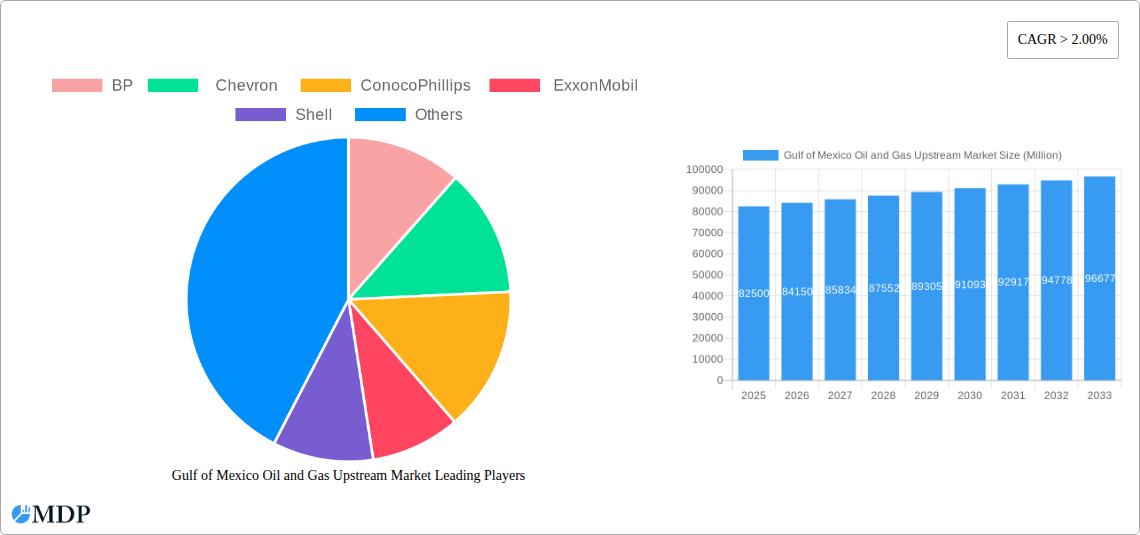

Gulf of Mexico Oil and Gas Upstream Market Market Size (In Billion)

Challenges include volatile global oil prices and stringent environmental regulations, necessitating investment in sustainable and lower-carbon solutions. However, substantial untapped reserves, supportive government policies in select areas, and the Gulf of Mexico's critical role in global energy supply chains are expected to sustain market growth. The market is segmented by production, consumption, import/export, and price trends, with key players including BP, Chevron, ConocoPhillips, ExxonMobil, Shell, and TotalEnergies. The United States leads regional activity, with Mexico and other emerging markets also contributing.

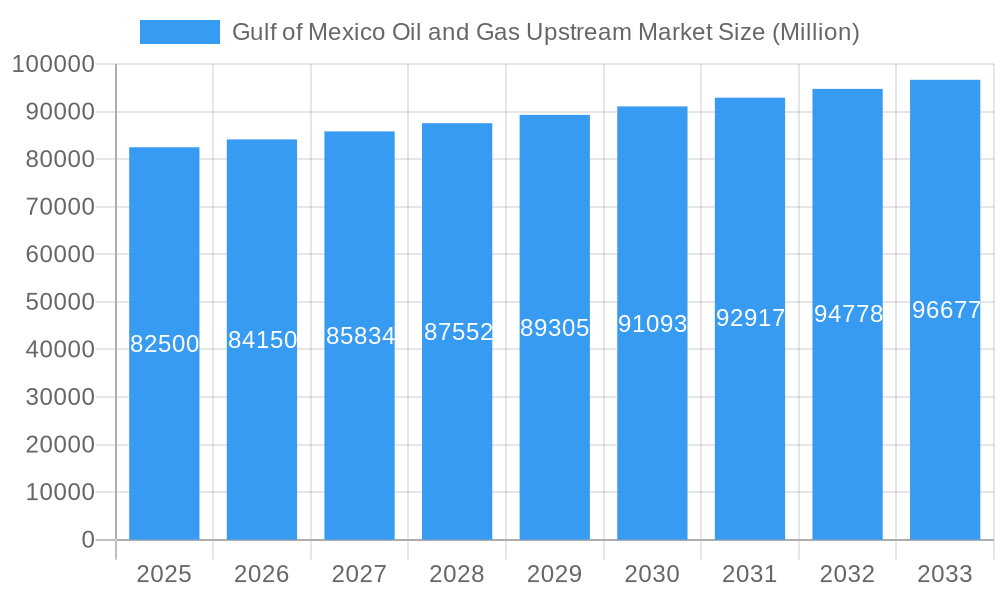

Gulf of Mexico Oil and Gas Upstream Market Company Market Share

This report offers a strategic analysis of the Gulf of Mexico oil and gas upstream market, detailing dynamics, trends, key segments, and future outlook from 2019 to 2033. It provides comprehensive insights into production, consumption, trade, pricing, and pivotal industry developments, crucial for stakeholders operating in this dynamic market.

Gulf of Mexico Oil and Gas Upstream Market Market Dynamics & Concentration

The Gulf of Mexico oil and gas upstream market is characterized by significant market concentration, with major international oil companies (IOCs) and national oil companies (NOCs) dominating exploration and production activities. Innovation drivers are primarily focused on enhancing recovery rates from mature fields, developing advanced subsea technologies, and optimizing offshore drilling efficiency to reduce operational costs and environmental impact. The regulatory frameworks, primarily driven by the U.S. Department of the Interior's Bureau of Ocean Energy Management (BOEM) and Bureau of Safety and Environmental Enforcement (BSEE), play a crucial role in shaping licensing, environmental protection, and safety standards, influencing investment decisions and operational viability. Product substitutes, while present in the broader energy landscape (e.g., renewables), have a limited direct impact on the upstream extraction of oil and gas in the Gulf of Mexico due to the specialized nature of the infrastructure and existing demand for hydrocarbons. End-user trends indicate a sustained demand for crude oil and natural gas for power generation, industrial processes, and petrochemical feedstock, underpinning the continued economic importance of this sector. Mergers and acquisitions (M&A) activities are a recurring feature, driven by the pursuit of economies of scale, portfolio optimization, and access to new reserves, with recent M&A deal counts indicating ongoing consolidation within the sector. Market share among key players like BP, Chevron, ConocoPhillips, ExxonMobil, Shell, and TotalEnergies fluctuates based on production levels, asset acquisitions, and strategic divestments, reflecting a competitive yet concentrated landscape.

Gulf of Mexico Oil and Gas Upstream Market Industry Trends & Analysis

The Gulf of Mexico oil and gas upstream market is undergoing a transformative period driven by a confluence of technological advancements, evolving environmental regulations, and fluctuating global energy demand. Market growth is intrinsically linked to sustained high oil and gas prices, which incentivize further exploration and development of complex offshore reserves. The CAGR of the market is estimated to be approximately 4.5% over the forecast period (2025-2033), reflecting a steady expansion driven by both existing production and new project sanctioning. Technological disruptions are at the forefront, with the increasing adoption of artificial intelligence (AI) and machine learning (ML) for seismic data interpretation, reservoir modeling, and predictive maintenance of offshore assets. Advances in subsea processing and floating production, storage, and offloading (FPSO) units are enabling the economic extraction of hydrocarbons from deeper waters and more challenging geological formations, significantly expanding the accessible resource base. Consumer preferences, while increasingly leaning towards cleaner energy sources, still exhibit a strong and persistent demand for oil and gas products, particularly for transportation and industrial applications, which directly fuels the upstream sector. Competitive dynamics are intensifying, with companies continuously seeking to optimize their operational efficiency, reduce their carbon footprint through emission reduction technologies, and secure strategic acreage through auctions and acquisitions. Market penetration of digital technologies is rapidly increasing, enhancing operational safety and productivity. The ongoing focus on carbon capture, utilization, and storage (CCUS) technologies within the offshore environment is also a significant trend, aiming to mitigate the environmental impact of traditional oil and gas extraction and align with broader decarbonization goals. The interplay between these factors dictates the trajectory of the Gulf of Mexico upstream market, balancing the need for energy security with the imperative of environmental sustainability.

Leading Markets & Segments in Gulf of Mexico Oil and Gas Upstream Market

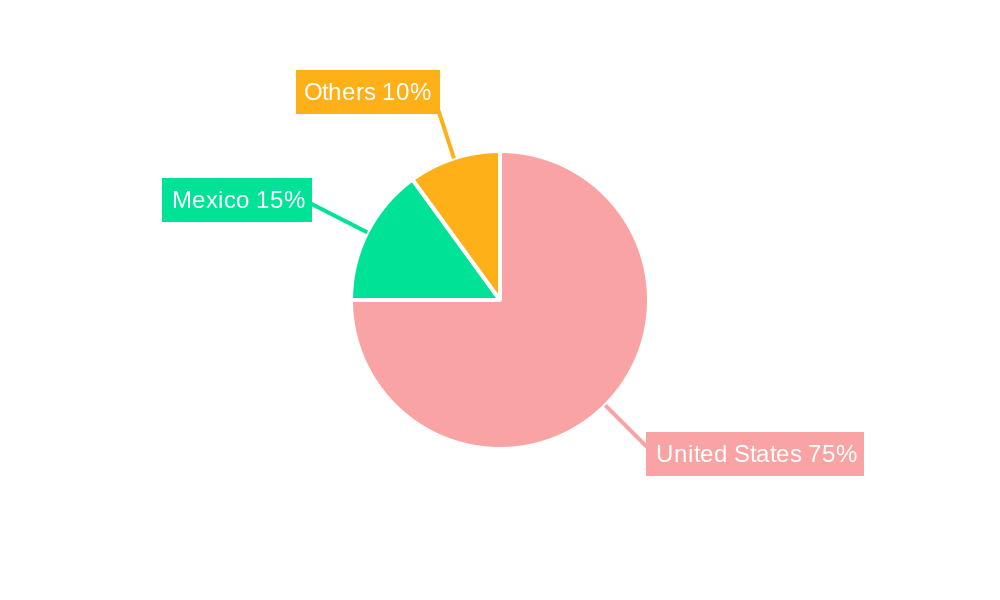

The United States segment of the Gulf of Mexico oil and gas upstream market stands as the dominant force, driven by its extensive offshore acreage, advanced technological capabilities, and robust regulatory framework that encourages private investment. Within this dominant region, the deepwater segment commands significant attention due to the substantial hydrocarbon reserves it holds and the technological innovation it spurs.

Production Analysis: The U.S. Gulf of Mexico is a cornerstone of North American oil and gas supply.

- Key Drivers: Rich geological formations, prolific offshore basins, and continuous technological advancements in deepwater exploration and production are primary drivers. The presence of major oil companies with substantial capital and expertise ensures consistent production levels.

- Dominance: The region's deepwater fields are responsible for a significant portion of U.S. oil and gas production, often contributing over 15% of total U.S. crude oil output and a substantial percentage of natural gas production.

Consumption Analysis: While the direct consumption of upstream products is localized at processing facilities, the ultimate demand originates from the broader U.S. and global markets.

- Key Drivers: The insatiable demand for energy in the United States, for power generation, transportation fuels, and petrochemical feedstock, directly fuels the need for continued upstream production from the Gulf of Mexico.

- Dominance: The U.S. domestic market's consumption patterns are the primary determinant of the demand for oil and gas extracted from the Gulf of Mexico.

Import Market Analysis (Value & Volume): The Gulf of Mexico primarily acts as a producer and exporter rather than a significant importer of crude oil and natural gas for its own upstream operations.

- Key Drivers: While the U.S. is a net importer of crude oil, the Gulf of Mexico's production contributes to meeting domestic demand, thereby influencing import volumes.

- Dominance: The import analysis is less relevant for the upstream segment within the Gulf itself, as the focus is on extraction and subsequent distribution.

Export Market Analysis (Value & Volume): The Gulf of Mexico is a crucial source of oil and gas exports, particularly for the United States.

- Key Drivers: The U.S. has become a major exporter of crude oil and liquefied natural gas (LNG). The output from the Gulf of Mexico plays a vital role in meeting international demand, particularly in the Americas and Europe. Infrastructure like LNG export terminals further facilitates this.

- Dominance: The Gulf of Mexico's contribution to U.S. oil and gas exports is substantial, with estimated export values in the tens of billions of dollars annually.

Price Trend Analysis: Prices are largely dictated by global benchmarks like West Texas Intermediate (WTI) for crude oil and Henry Hub for natural gas, influenced by regional supply-demand dynamics.

- Key Drivers: Geopolitical events, global economic growth, OPEC+ production decisions, and the U.S. domestic supply picture all impact price trends.

- Dominance: The Gulf of Mexico's price trends are intrinsically linked to broader global energy markets, making it a sensitive indicator of international oil and gas price fluctuations.

Gulf of Mexico Oil and Gas Upstream Market Product Developments

Product developments in the Gulf of Mexico upstream market are centered on enhancing efficiency, reducing environmental impact, and unlocking previously uneconomical reserves. Innovations in subsea processing and multiphase pumping technologies allow for the separation and transport of oil, gas, and water at the seabed, reducing the need for surface platforms and lowering capital expenditure. Advanced seismic imaging and reservoir simulation techniques are improving the accuracy of hydrocarbon discovery and well placement. Furthermore, the development of more robust and resilient offshore drilling equipment, capable of withstanding extreme weather conditions, is crucial. The integration of digitalization and AI for real-time data analysis and predictive maintenance optimizes production and minimizes downtime, offering a competitive advantage in this demanding environment.

Key Drivers of Gulf of Mexico Oil and Gas Upstream Market Growth

The growth of the Gulf of Mexico oil and gas upstream market is propelled by several key drivers. Technologically, advancements in deepwater exploration and production, including enhanced oil recovery (EOR) techniques and floating production systems, are unlocking vast untapped reserves. Economically, sustained global demand for oil and gas, coupled with favorable price environments, incentivizes continued investment in exploration and development. Regulatory support, through lease sales and a clear permitting process, also plays a vital role, encouraging companies to pursue new projects. Furthermore, the ongoing modernization of offshore infrastructure and the integration of digital technologies contribute to operational efficiency and cost reduction, making new projects more viable.

Challenges in the Gulf of Mexico Oil and Gas Upstream Market Market

The Gulf of Mexico oil and gas upstream market faces several significant challenges. Regulatory hurdles, including complex environmental permitting processes and evolving safety standards, can lead to project delays and increased compliance costs. Supply chain disruptions, exacerbated by global events, can impact the availability of specialized equipment and skilled labor, leading to higher operational expenses. Intense competitive pressures, both from other offshore regions and alternative energy sources, require continuous innovation and cost optimization. Moreover, the increasing scrutiny on environmental performance and the transition towards lower-carbon economies present long-term challenges for the continued viability of fossil fuel extraction. The inherent risks and high capital expenditures associated with offshore operations also pose a constant barrier.

Emerging Opportunities in Gulf of Mexico Oil and Gas Upstream Market

Emerging opportunities in the Gulf of Mexico oil and gas upstream market are predominantly driven by technological breakthroughs and strategic partnerships. The development and implementation of advanced carbon capture, utilization, and storage (CCUS) technologies offer a pathway to decarbonize existing operations and potentially create new revenue streams from CO2 sequestration. Enhanced subsea technologies, including advanced robotics and AI-powered autonomous underwater vehicles (AUVs), are enabling more efficient and safer offshore operations, reducing costs and expanding exploration frontiers. Strategic partnerships between established players and technology providers can accelerate the adoption of innovative solutions. Furthermore, the increasing demand for natural gas as a transition fuel presents opportunities for further exploration and development of gas reserves in the region.

Leading Players in the Gulf of Mexico Oil and Gas Upstream Market Sector

- BP

- Chevron

- ConocoPhillips

- ExxonMobil

- Shell

- TotalEnergies

Key Milestones in Gulf of Mexico Oil and Gas Upstream Market Industry

- 2020: Major oil companies continue to invest in deepwater exploration despite market volatility, with several significant discoveries announced.

- 2021: Increased focus on offshore wind energy development in the Gulf of Mexico begins to emerge as a parallel energy initiative.

- 2022: A record number of lease sales are held for the Gulf of Mexico outer continental shelf, indicating continued government support for offshore oil and gas development.

- 2023: Advancements in subsea technology lead to more efficient production from existing fields, extending their economic lifespan.

- 2024: Several companies announce strategic investments in carbon capture technologies to reduce their operational emissions in the Gulf of Mexico.

Strategic Outlook for Gulf of Mexico Oil and Gas Upstream Market Market

The strategic outlook for the Gulf of Mexico oil and gas upstream market remains robust, driven by the region's vast hydrocarbon potential and the ongoing demand for energy. Future growth will be shaped by the industry's ability to embrace technological innovation, particularly in areas of digital transformation and emissions reduction, to enhance operational efficiency and meet evolving environmental standards. Strategic investments in deepwater exploration, coupled with the optimization of existing assets, will be crucial for maintaining production levels. Furthermore, the industry's proactive approach to developing and integrating CCUS technologies will be vital in securing its long-term license to operate and contributing to a balanced energy transition. The continued participation of major industry players signals sustained confidence in the region's upstream prospects.

Gulf of Mexico Oil and Gas Upstream Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Gulf of Mexico Oil and Gas Upstream Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Others

Gulf of Mexico Oil and Gas Upstream Market Regional Market Share

Geographic Coverage of Gulf of Mexico Oil and Gas Upstream Market

Gulf of Mexico Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Intermittent Nature of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Deep-Water and Ultra Deep-Water Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Mexico

- 5.6.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mexico Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Others Gulf of Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ConocoPhillips

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ExxonMobil

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Shell

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 TotalEnergies

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 BP

List of Figures

- Figure 1: Gulf of Mexico Oil and Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Gulf of Mexico Oil and Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Gulf of Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gulf of Mexico Oil and Gas Upstream Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Gulf of Mexico Oil and Gas Upstream Market?

Key companies in the market include BP, Chevron , ConocoPhillips , ExxonMobil , Shell , TotalEnergies.

3. What are the main segments of the Gulf of Mexico Oil and Gas Upstream Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies4.; Technological Innovation in Renewable Energy.

6. What are the notable trends driving market growth?

Deep-Water and Ultra Deep-Water Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Intermittent Nature of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gulf of Mexico Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gulf of Mexico Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gulf of Mexico Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Gulf of Mexico Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence