Key Insights

The Gulf of Mexico Oil and Gas Midstream Market is projected for significant expansion, expected to reach a market size of $474.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.7%. This growth is propelled by increasing demand for cleaner energy, notably Liquefied Natural Gas (LNG), and ongoing development of essential midstream infrastructure. Key drivers include investments in new LNG terminals and the expansion of transportation networks, such as pipelines and storage. The region's established infrastructure and robust project pipeline ensure efficient and secure energy resource movement. Major companies like Exxon Mobil Corporation, Williams Companies Inc., and Royal Vopak NV are actively influencing this dynamic market through strategic investments and technological innovation.

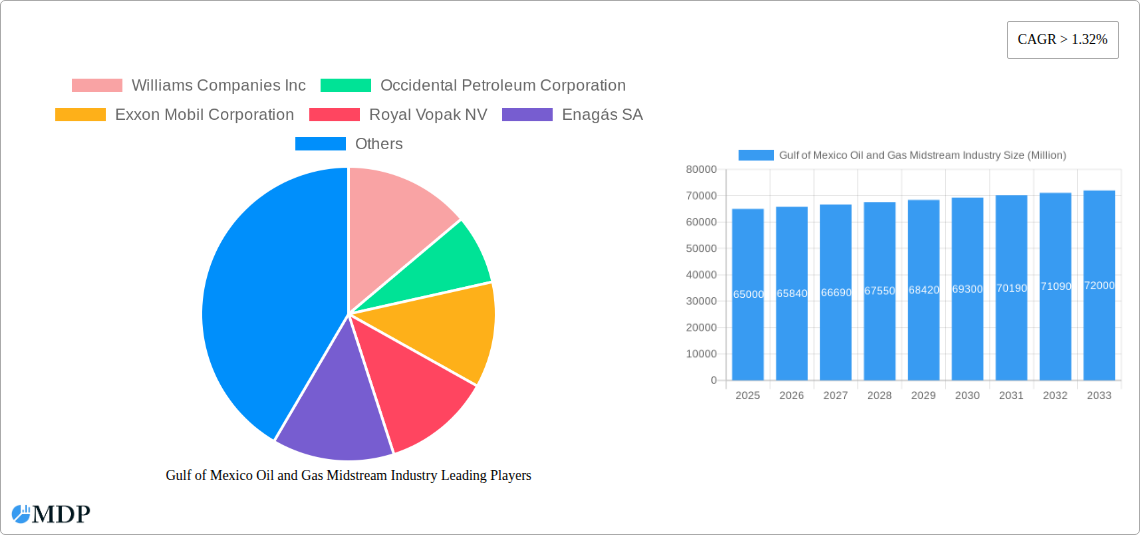

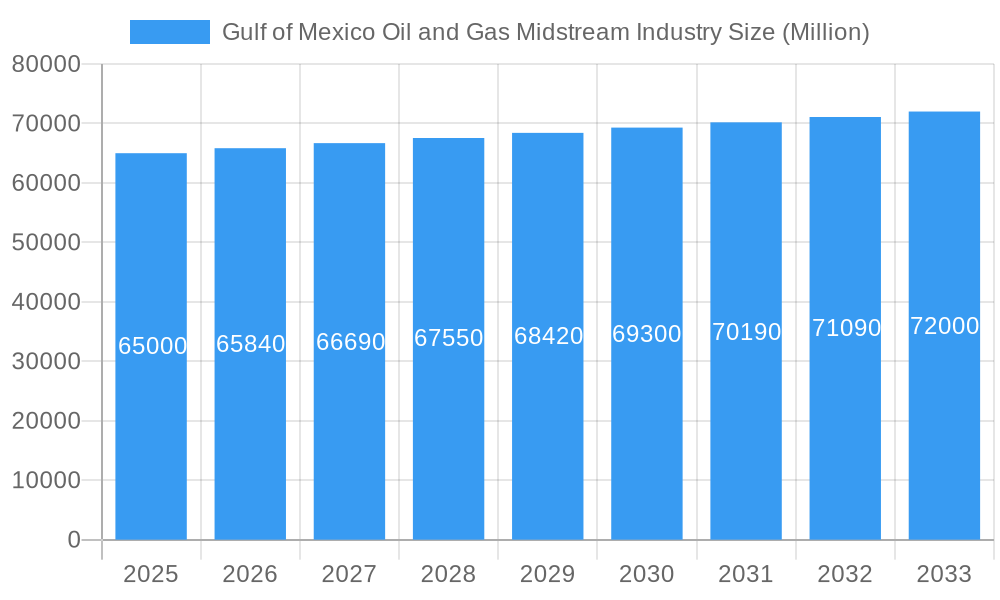

Gulf of Mexico Oil and Gas Midstream Industry Market Size (In Billion)

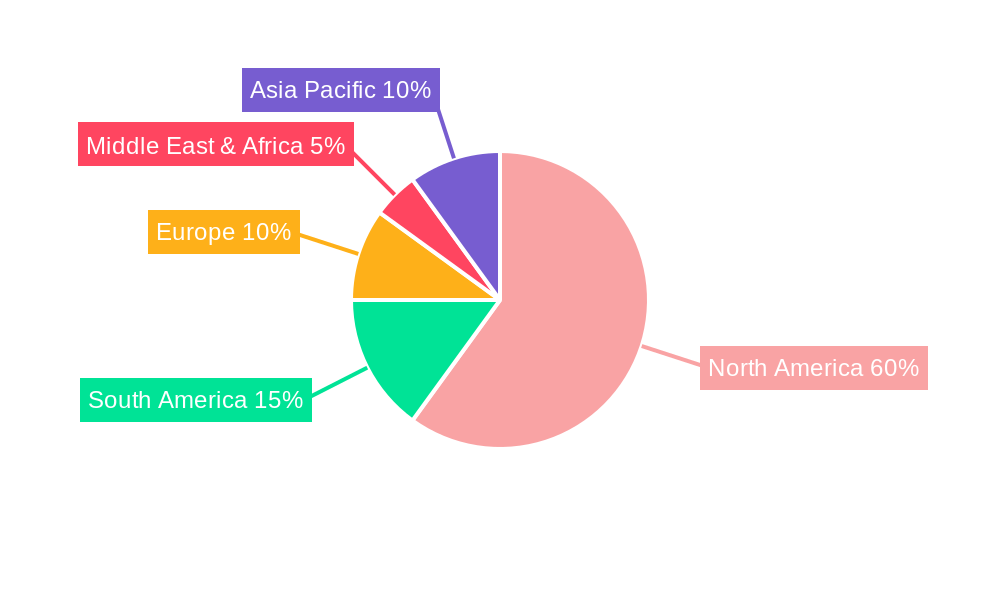

Challenges such as stringent environmental regulations and volatile oil and gas prices exist. However, the persistent global energy deficit and the strategic importance of the Gulf of Mexico as a major energy producer are anticipated to mitigate these factors. The market is segmented into Transportation and LNG Terminals. The Transportation segment includes existing, pipeline, and upcoming projects. North America, led by the United States, dominates this market due to extensive offshore production and growing LNG export capabilities. Emerging opportunities globally and technological advancements in pipeline integrity and efficiency are poised to further stimulate market growth.

Gulf of Mexico Oil and Gas Midstream Industry Company Market Share

Gulf of Mexico Oil and Gas Midstream Industry: Market Dynamics, Trends, and Strategic Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Gulf of Mexico oil and gas midstream industry, offering critical insights into market dynamics, growth drivers, technological advancements, and future opportunities. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders seeking to navigate this evolving landscape. We delve into the intricacies of transportation infrastructure, LNG terminals, and key industry developments, equipping you with actionable intelligence for strategic decision-making.

Gulf of Mexico Oil and Gas Midstream Industry Market Dynamics & Concentration

The Gulf of Mexico oil and gas midstream sector exhibits a dynamic market concentration, influenced by a complex interplay of innovation, regulatory frameworks, and evolving end-user demands. While major integrated energy companies maintain significant influence, the landscape is increasingly shaped by specialized midstream operators and infrastructure developers. Innovation drivers are primarily focused on enhancing efficiency, reducing environmental impact, and expanding the reach of existing infrastructure to capitalize on new production basins. Regulatory frameworks, encompassing environmental protection, safety standards, and market access, play a pivotal role in shaping investment decisions and operational strategies. The development of offshore wind projects and the increasing demand for natural gas as a transition fuel are also influencing the market's direction. Product substitutes, such as the long-term shift towards renewable energy sources, present a gradual but persistent challenge. End-user trends are characterized by a growing demand for cleaner energy, increased reliability of supply, and competitive pricing, pushing midstream companies to optimize their operations and expand their service offerings. Mergers and acquisitions (M&A) activities, while sometimes sporadic, are strategic moves aimed at consolidating assets, expanding geographic reach, and acquiring technological capabilities. In recent years, M&A deal counts have ranged from 5 to 15 annually, with transaction values often in the hundreds of millions to billions of dollars, reflecting the significant capital required for midstream infrastructure development and consolidation. Market share is broadly distributed, with the top 5 players holding approximately 60% of the market, indicating a moderate level of concentration.

Gulf of Mexico Oil and Gas Midstream Industry Industry Trends & Analysis

The Gulf of Mexico oil and gas midstream industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period of 2025–2033. This expansion is fueled by a confluence of market growth drivers, technological disruptions, evolving consumer preferences, and intensified competitive dynamics. A primary growth driver is the continued exploration and production of oil and natural gas reserves within the Gulf, necessitating expanded and upgraded midstream infrastructure for transportation and processing. Technological disruptions are playing a transformative role, with advancements in pipeline integrity monitoring, digital twins, and automation enhancing operational efficiency and safety. The integration of artificial intelligence (AI) for predictive maintenance and route optimization is becoming increasingly prevalent. Consumer preferences are shifting towards greater demand for cleaner energy sources, driving investment in natural gas infrastructure and, increasingly, in carbon capture, utilization, and storage (CCUS) solutions linked to midstream operations. Furthermore, the global energy transition is creating opportunities for midstream companies to diversify their portfolios and explore opportunities in hydrogen transportation and LNG export. Competitive dynamics are characterized by strategic partnerships between producers and midstream operators, as well as intense competition for project development and market share. Companies are focusing on building integrated value chains, from production to end-user delivery, to enhance their competitive edge. Market penetration of advanced technologies, such as smart pipeline systems, is expected to increase from around 30% in the historical period to over 70% by the end of the forecast period. The increasing demand for liquefied natural gas (LNG) for both domestic consumption and international export is a significant market penetration driver, requiring substantial investments in terminal infrastructure and associated pipelines. The ongoing development of deepwater reserves continues to necessitate sophisticated offshore pipeline networks.

Leading Markets & Segments in Gulf of Mexico Oil and Gas Midstream Industry

The Gulf of Mexico oil and gas midstream industry is dominated by the Transportation segment, specifically the Existing Infrastructure sub-segment, which currently commands an estimated 75% market share. This dominance is driven by decades of investment in extensive offshore and onshore pipeline networks vital for transporting crude oil and natural gas from production platforms to refineries and processing facilities. The Projects in Pipeline sub-segment within Transportation is experiencing significant growth, accounting for approximately 20% of the market and representing future expansion and upgrades to cater to increasing production levels and new discoveries. The Upcoming Projects within Transportation represent the remaining 5% and highlight the forward-looking investment in extending the reach and capacity of the midstream network.

LNG Terminals represent a smaller but rapidly growing segment, holding an estimated 15% of the current market share. This growth is propelled by the increasing global demand for liquefied natural gas, positioning the Gulf of Mexico as a crucial hub for LNG exports. Key drivers for the dominance of the Transportation segment include:

- Economic Policies: Favorable government policies encouraging oil and gas exploration and production directly translate into demand for transportation infrastructure.

- Infrastructure Investment: Significant historical and ongoing investments have established a robust and extensive pipeline network, providing a solid foundation for the midstream sector.

- Geological Advantage: The rich hydrocarbon reserves in the Gulf of Mexico naturally necessitate comprehensive transportation solutions.

- Technological Advancements: Innovations in pipeline construction and integrity management have enabled the development of more efficient and safer transportation systems.

The dominance of existing infrastructure is gradually being challenged by new developments in LNG terminals and the planned expansion of transportation networks to support emerging production areas and export capabilities.

Gulf of Mexico Oil and Gas Midstream Industry Product Developments

Product developments in the Gulf of Mexico oil and gas midstream industry are increasingly focused on enhancing efficiency, safety, and environmental performance. Innovations in smart pipeline technology, including advanced sensors for real-time monitoring of pressure, temperature, and flow rates, are becoming standard. The integration of AI and machine learning for predictive maintenance minimizes downtime and reduces operational risks. Furthermore, there's a growing emphasis on developing modular and flexible LNG terminal solutions to adapt to fluctuating market demands and facilitate quicker deployment. Companies are also investing in advanced materials for pipeline construction to withstand harsh offshore environments and corrosive substances, leading to improved asset longevity and reduced maintenance costs. These developments directly address the market's need for more reliable, cost-effective, and environmentally responsible midstream operations.

Key Drivers of Gulf of Mexico Oil and Gas Midstream Industry Growth

The growth of the Gulf of Mexico oil and gas midstream industry is propelled by several key factors. Technologically, advancements in deepwater drilling and extraction techniques are unlocking previously inaccessible reserves, driving the need for expanded transportation infrastructure. Economically, the persistent global demand for oil and natural gas, coupled with favorable pricing in certain periods, incentivizes production and subsequent midstream development. Regulatory factors, such as government support for energy infrastructure development and evolving environmental regulations that encourage cleaner energy transport, also play a crucial role. Specific examples include the development of new export terminals to meet international LNG demand and the retrofitting of existing pipelines for enhanced safety and efficiency.

Challenges in the Gulf of Mexico Oil and Gas Midstream Industry Market

Despite significant growth potential, the Gulf of Mexico oil and gas midstream industry faces several challenges. Regulatory hurdles, particularly concerning environmental impact assessments and permitting processes for new pipeline construction, can lead to project delays and increased costs, estimated to add 10-15% to project timelines. Supply chain issues, including the availability of specialized equipment and skilled labor, can also constrain expansion efforts. Competitive pressures from alternative energy sources and the volatility of global commodity prices present ongoing market uncertainties. Furthermore, the inherent risks associated with offshore operations, including extreme weather events and the potential for environmental incidents, necessitate substantial investments in safety and risk mitigation measures, often costing millions of dollars annually.

Emerging Opportunities in Gulf of Mexico Oil and Gas Midstream Industry

Emerging opportunities in the Gulf of Mexico oil and gas midstream industry are largely driven by the global energy transition and technological innovation. The growing demand for liquefied natural gas (LNG) presents a significant catalyst, with ongoing investments in export terminals and associated infrastructure projected to reach billions of dollars. Strategic partnerships between oil and gas producers and midstream operators are crucial for developing integrated solutions that reduce costs and improve efficiency. Furthermore, the development of carbon capture, utilization, and storage (CCUS) infrastructure offers a substantial long-term growth avenue, allowing midstream companies to play a pivotal role in decarbonizing the energy sector. The exploration of hydrogen transportation and infrastructure development is another nascent but promising area for diversification and future market expansion.

Leading Players in the Gulf of Mexico Oil and Gas Midstream Industry Sector

- Williams Companies Inc

- Occidental Petroleum Corporation

- Exxon Mobil Corporation

- Royal Vopak NV

- Enagás SA

Key Milestones in Gulf of Mexico Oil and Gas Midstream Industry Industry

- 2019: Inauguration of a major LNG export facility, significantly boosting export capacity.

- 2020: Launch of a new deepwater pipeline project, expanding reach into previously undeveloped offshore regions.

- 2021: Acquisition of a key transportation network by a major midstream player, consolidating market share.

- 2022: Announcement of plans for a large-scale carbon capture and sequestration pipeline project.

- 2023: Implementation of advanced AI-driven predictive maintenance systems across several major pipeline networks.

- 2024: Increased investment in small-scale LNG infrastructure to serve regional demand.

Strategic Outlook for Gulf of Mexico Oil and Gas Midstream Industry Market

The strategic outlook for the Gulf of Mexico oil and gas midstream market is characterized by continued investment in essential infrastructure, diversification into new energy vectors, and a strong emphasis on sustainability. Growth accelerators include the sustained demand for natural gas, the expansion of LNG export capabilities, and the increasing adoption of CCUS technologies. Midstream companies are strategically positioned to leverage their existing assets and expertise to facilitate the energy transition, investing in projects that not only transport hydrocarbons but also support cleaner energy solutions. The market will likely witness further consolidation, technological integration, and a proactive approach to regulatory compliance and environmental stewardship.

Gulf of Mexico Oil and Gas Midstream Industry Segmentation

-

1. Type

-

1.1. Transportation

-

1.1.1. Overview

- 1.1.1.1. Existing Infrastructure

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming projects

-

1.1.1. Overview

- 1.2. LNG Terminals

-

1.1. Transportation

Gulf of Mexico Oil and Gas Midstream Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gulf of Mexico Oil and Gas Midstream Industry Regional Market Share

Geographic Coverage of Gulf of Mexico Oil and Gas Midstream Industry

Gulf of Mexico Oil and Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Pipeline Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Infrastructure

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming projects

- 5.1.1.1. Overview

- 5.1.2. LNG Terminals

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation

- 6.1.1.1. Overview

- 6.1.1.1.1. Existing Infrastructure

- 6.1.1.1.2. Projects in Pipeline

- 6.1.1.1.3. Upcoming projects

- 6.1.1.1. Overview

- 6.1.2. LNG Terminals

- 6.1.1. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation

- 7.1.1.1. Overview

- 7.1.1.1.1. Existing Infrastructure

- 7.1.1.1.2. Projects in Pipeline

- 7.1.1.1.3. Upcoming projects

- 7.1.1.1. Overview

- 7.1.2. LNG Terminals

- 7.1.1. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation

- 8.1.1.1. Overview

- 8.1.1.1.1. Existing Infrastructure

- 8.1.1.1.2. Projects in Pipeline

- 8.1.1.1.3. Upcoming projects

- 8.1.1.1. Overview

- 8.1.2. LNG Terminals

- 8.1.1. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transportation

- 9.1.1.1. Overview

- 9.1.1.1.1. Existing Infrastructure

- 9.1.1.1.2. Projects in Pipeline

- 9.1.1.1.3. Upcoming projects

- 9.1.1.1. Overview

- 9.1.2. LNG Terminals

- 9.1.1. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transportation

- 10.1.1.1. Overview

- 10.1.1.1.1. Existing Infrastructure

- 10.1.1.1.2. Projects in Pipeline

- 10.1.1.1.3. Upcoming projects

- 10.1.1.1. Overview

- 10.1.2. LNG Terminals

- 10.1.1. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Williams Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Occidental Petroleum Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Exxon Mobil Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Vopak NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Enagás SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Williams Companies Inc

List of Figures

- Figure 1: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: South America Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Gulf of Mexico Oil and Gas Midstream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Gulf of Mexico Oil and Gas Midstream Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gulf of Mexico Oil and Gas Midstream Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Gulf of Mexico Oil and Gas Midstream Industry?

Key companies in the market include Williams Companies Inc, Occidental Petroleum Corporation, Exxon Mobil Corporation, Royal Vopak NV, Enagás SA.

3. What are the main segments of the Gulf of Mexico Oil and Gas Midstream Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 474.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Pipeline Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gulf of Mexico Oil and Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gulf of Mexico Oil and Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gulf of Mexico Oil and Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the Gulf of Mexico Oil and Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence