Key Insights

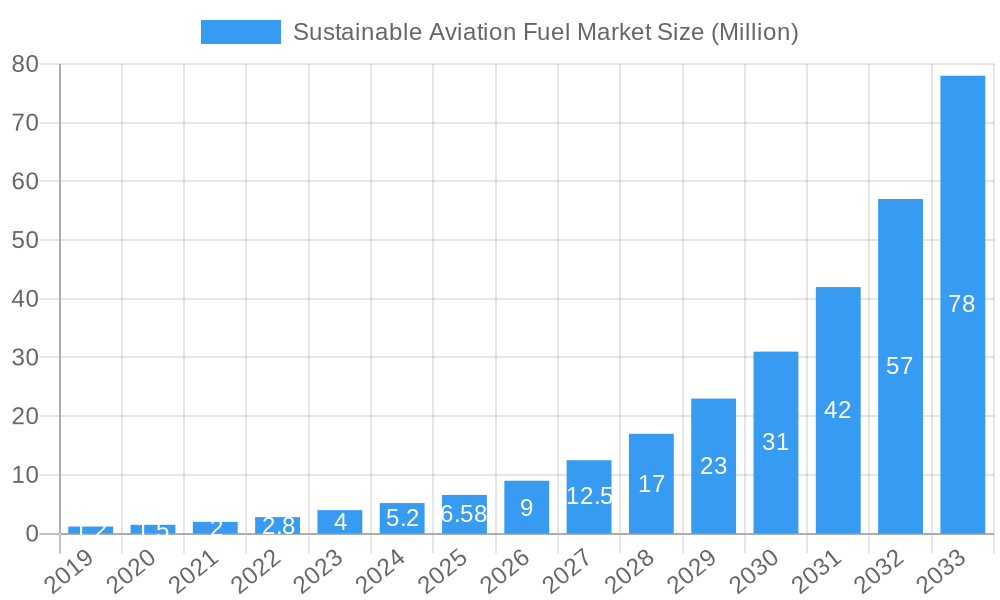

The Sustainable Aviation Fuel (SAF) market is poised for extraordinary growth, with a projected market size of USD 6.58 billion in 2025 and an astonishing Compound Annual Growth Rate (CAGR) of 47.16% anticipated through 2033. This robust expansion is primarily driven by escalating global efforts to decarbonize the aviation sector, stringent environmental regulations, and increasing consumer demand for eco-friendly travel solutions. The urgent need to reduce aviation's carbon footprint, a significant contributor to greenhouse gas emissions, is acting as a powerful catalyst, encouraging airlines, fuel producers, and governments to invest heavily in SAF technologies. Furthermore, advancements in production methods and the growing availability of sustainable feedstocks are making SAF more economically viable and accessible, further accelerating market adoption.

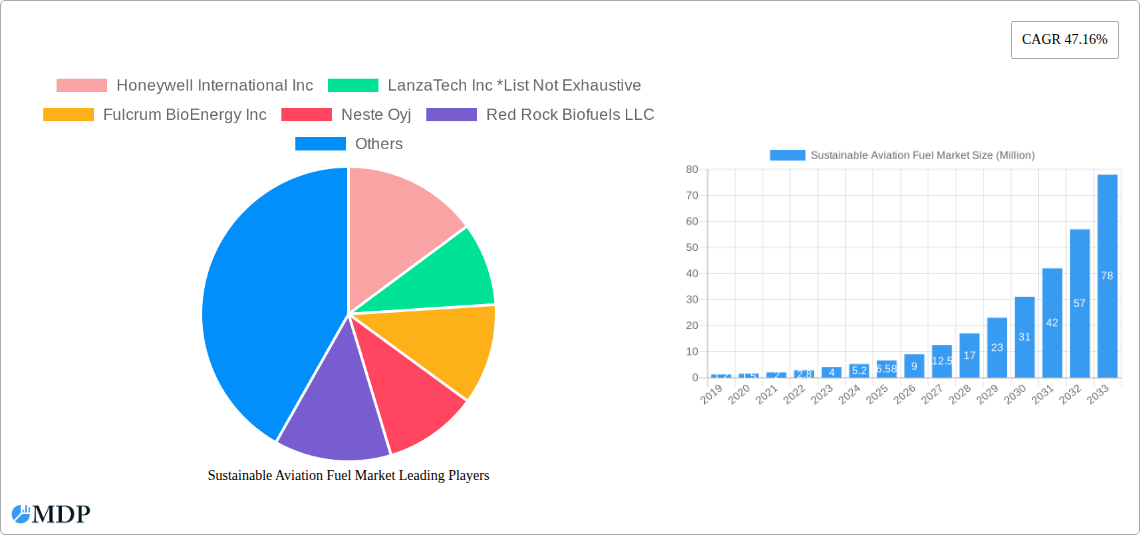

Sustainable Aviation Fuel Market Market Size (In Million)

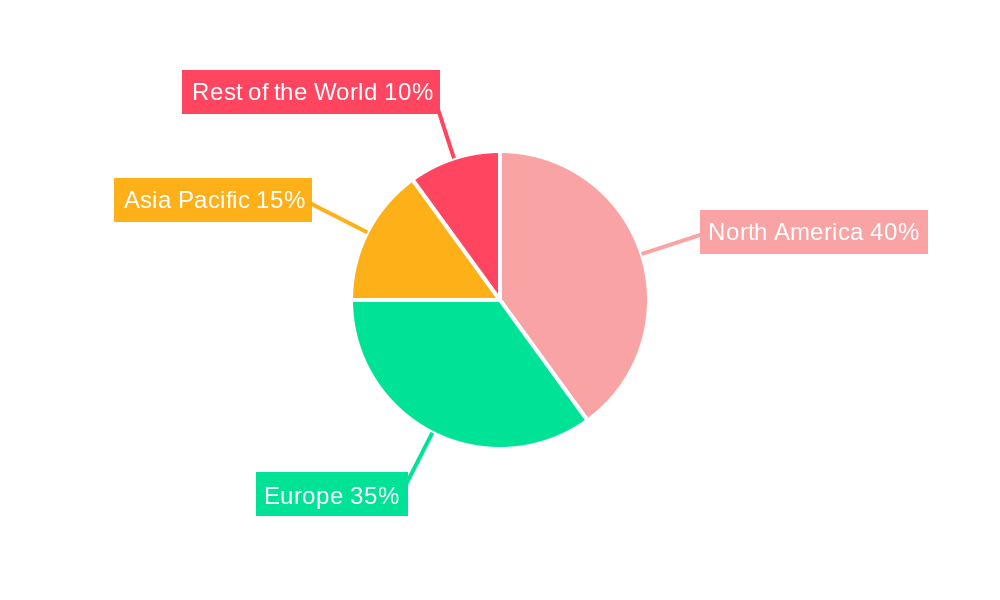

The market is segmented by key technologies such as Fischer-Tropsch (FT), Hydroprocessed Esters and Fatty Acids (HEFA), and Synthesis, with HEFA currently dominating due to its established production processes and readily available feedstocks like used cooking oil and animal fats. The application segments are bifurcated into commercial and defense, with the commercial sector holding a larger share owing to the vast number of passenger and cargo flights globally. Geographically, North America, particularly the United States, is a leading market, driven by supportive government policies and significant investments in SAF production facilities. Europe also plays a crucial role, with stringent emission reduction targets pushing for higher SAF blending mandates. Despite these positive drivers, the market faces restraints such as the high cost of SAF production compared to conventional jet fuel, limited feedstock availability in certain regions, and the need for significant infrastructure development for widespread distribution and uptake. However, ongoing research and development, coupled with strategic partnerships between fuel producers and airlines, are actively addressing these challenges, paving the way for a sustainable future in aviation.

Sustainable Aviation Fuel Market Company Market Share

Sustainable Aviation Fuel Market: Driving Decarbonization in Aerospace

This comprehensive report provides an in-depth analysis of the global Sustainable Aviation Fuel (SAF) market, a critical sector for achieving net-zero emissions in aviation. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study details market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. Gain actionable insights from expert analysis covering technological advancements, regulatory frameworks, and key player strategies shaping the future of green aviation fuel, biofuels for aviation, and SAF production. Explore market penetration of technologies like Fischer-Tropsch (FT) and Hydroprocessed Esters and Fatty Acids (HEFA), and understand demand drivers within commercial aviation and defense applications. With a focus on critical market shifts and investment outlooks, this report is essential for airlines, fuel producers, technology providers, investors, and policymakers navigating the evolving sustainable aviation landscape.

Sustainable Aviation Fuel Market Market Dynamics & Concentration

The Sustainable Aviation Fuel (SAF) market is characterized by a dynamic interplay of innovation drivers, evolving regulatory frameworks, and increasing end-user demand for sustainable solutions. Market concentration is gradually shifting as more players enter and invest in SAF production. Key innovation drivers include the urgent need for decarbonization, advancements in biofuel technologies, and government incentives. Regulatory frameworks, such as mandates and tax credits for SAF usage, are significantly influencing market growth and adoption. While direct product substitutes for conventional jet fuel are limited in immediate scalability, the long-term substitution potential lies in widespread SAF integration. End-user trends highlight a strong preference among airlines and corporations for demonstrably sustainable travel options, driven by corporate social responsibility goals and passenger expectations. Mergers, acquisitions (M&A), and strategic partnerships are becoming increasingly prevalent as companies seek to secure supply chains, acquire advanced technologies, and expand production capacity. We anticipate a significant increase in M&A deal counts over the forecast period as the industry matures. Honeywell International Inc., Neste Oyj, and Gevo Inc. are among the companies actively pursuing market expansion through various strategies.

Sustainable Aviation Fuel Market Industry Trends & Analysis

The Sustainable Aviation Fuel (SAF) market is experiencing robust growth, driven by a confluence of factors aimed at mitigating the aviation sector's environmental impact. The global push for decarbonization, underscored by ambitious climate targets and international agreements, is the primary growth engine. Technological disruptions, particularly in the development of advanced biofuels and synthetic fuels, are making SAF more accessible and cost-competitive. Consumer preferences are increasingly leaning towards environmentally conscious travel, compelling airlines to adopt and promote SAF usage. Competitive dynamics are intensifying, with both established energy giants and agile startups vying for market share.

Key trends include:

- Increasing production capacity: Significant investments are being channeled into building new SAF production facilities utilizing diverse feedstocks and technologies.

- Feedstock diversification: Beyond traditional sources like used cooking oil and agricultural waste, research and development are focusing on advanced feedstocks such as agricultural residues, forestry waste, and even captured carbon dioxide.

- Technological advancements: Innovations in Fischer-Tropsch (FT) and HEFA processes are enhancing efficiency and reducing production costs, while emerging synthetic fuel pathways are gaining traction.

- Policy support and mandates: Governments worldwide are implementing policies, mandates, and incentives to accelerate SAF adoption and bridge the price gap with conventional jet fuel.

- Corporate sustainability initiatives: A growing number of corporations are committing to offsetting their flight emissions through SAF purchases, creating significant demand.

The market is projected to witness a compound annual growth rate (CAGR) of approximately 25-30% over the forecast period, with market penetration expected to increase substantially as production scales up and cost efficiencies are realized. The estimated market size for 2025 is projected to be in the range of $15,000 Million to $20,000 Million, with substantial growth anticipated towards the end of the forecast period.

Leading Markets & Segments in Sustainable Aviation Fuel Market

The Sustainable Aviation Fuel (SAF) market is witnessing significant dominance in the commercial aviation application segment, driven by the sheer volume of air traffic and the industry's commitment to sustainability goals. Geographically, North America and Europe are leading the market, largely due to stringent environmental regulations, supportive government policies, and the presence of key industry players and research institutions.

Technology Segment Dominance:

Hydroprocessed Esters and Fatty Acids (HEFA): This is currently the dominant technology in SAF production due to its maturity, established feedstock availability (such as used cooking oil and animal fats), and relatively lower production costs. HEFA-based SAF is widely available and accepted by aircraft manufacturers. Key drivers for its dominance include:

- Established supply chains: Reliable access to a consistent supply of waste oils and fats.

- Proven scalability: Existing infrastructure and operational expertise for HEFA production.

- Cost-effectiveness: Lower initial capital investment and operational costs compared to some emerging technologies.

Fischer-Tropsch (FT): While currently holding a smaller market share, FT technology, which converts synthesis gas derived from various feedstocks (e.g., biomass, waste, natural gas) into liquid hydrocarbons, is gaining significant traction. Its ability to utilize a wider range of feedstocks and produce drop-in fuels makes it a promising area for future growth.

- Feedstock flexibility: Can utilize solid or gaseous feedstocks, including municipal solid waste and agricultural residues.

- Production of synthetic kerosene: Produces high-quality synthetic kerosene that is compatible with existing aircraft.

- Growing investment: Increasing R&D and commercialization efforts are expected to boost its market share.

Synthesi (Synthetic Fuels): This broad category encompasses various pathways, including Power-to-Liquid (PtL) and advanced FT processes. These technologies offer the potential for highly sustainable fuels, especially when powered by renewable electricity.

- Potential for ultra-low carbon footprint: Especially when produced using renewable energy and captured carbon.

- Future growth potential: Seen as a key technology for long-term decarbonization of aviation.

Application Segment Dominance:

Commercial Aviation: This segment accounts for the largest share of SAF demand due to the high volume of flights and increasing pressure from regulators, passengers, and corporate clients to reduce carbon emissions. The commitment of major airlines to SAF targets is a primary driver.

- High flight volumes: The sheer number of commercial flights creates substantial demand.

- Corporate sustainability goals: Companies are increasingly prioritizing sustainable travel for their employees.

- Regulatory mandates: Government regulations often focus on increasing SAF usage in commercial operations.

Defense: While currently a smaller segment, the defense sector is showing increasing interest in SAF due to its strategic importance in reducing reliance on fossil fuels and enhancing operational sustainability.

- Energy security: Reducing dependence on volatile fossil fuel markets.

- Environmental commitments: Military branches are also setting sustainability targets.

The market penetration of SAF is projected to grow significantly, particularly in the commercial sector, as production capacity expands and costs decrease.

Sustainable Aviation Fuel Market Product Developments

Product developments in the Sustainable Aviation Fuel (SAF) market are primarily focused on enhancing the sustainability credentials and cost-competitiveness of SAF. Innovations are centered on utilizing novel feedstocks, improving production efficiency, and developing advanced fuel blends. Twelve and Etihad Airways' collaboration on E-Jet® fuel, derived from CO2 and renewable energy, exemplifies the push for next-generation SAF. LanzaTech Inc. is pioneering the conversion of waste carbon into fuels, while Gevo Inc. is developing advanced biofuels from renewable resources. These developments aim to offer true "drop-in" fuels that are compatible with existing aircraft infrastructure and engines, thereby accelerating market adoption and providing airlines with viable pathways to reduce their carbon footprint. The competitive advantage lies in achieving a lower lifecycle carbon emission reduction and a more secure, diversified feedstock base.

Key Drivers of Sustainable Aviation Fuel Market Growth

Several key factors are propelling the growth of the Sustainable Aviation Fuel (SAF) market:

- Global Decarbonization Mandates: International agreements and national policies setting ambitious emissions reduction targets for the aviation sector are creating a strong regulatory push for SAF adoption.

- Technological Advancements: Continuous innovation in SAF production technologies, including HEFA, Fischer-Tropsch, and synthetic fuels, is leading to increased efficiency, lower costs, and greater feedstock flexibility.

- Airline and Corporate Sustainability Commitments: Major airlines are setting ambitious SAF usage targets, and corporations are increasingly purchasing SAF to offset their travel emissions, creating significant demand.

- Investor Interest and Funding: Growing investor confidence in the long-term viability of SAF is driving substantial investment in production facilities and research and development.

- Feedstock Availability and Diversification: The development of sustainable and scalable feedstock sources, moving beyond traditional waste streams, is crucial for meeting growing demand.

Challenges in the Sustainable Aviation Fuel Market Market

Despite the positive growth trajectory, the Sustainable Aviation Fuel (SAF) market faces several significant challenges:

- High Production Costs: SAF remains considerably more expensive than conventional jet fuel, creating a price premium that needs to be addressed through policy support, technological advancements, and economies of scale.

- Limited Production Capacity: Current global SAF production capacity is insufficient to meet the growing demand, necessitating substantial investment in new facilities.

- Feedstock Availability and Sustainability Concerns: Ensuring a consistent and sustainably sourced supply of diverse feedstocks is critical. Concerns around land use change and competition with food production can arise with certain feedstocks.

- Infrastructure and Logistics: Developing the necessary infrastructure for SAF blending, storage, and distribution at airports globally presents a logistical challenge.

- Regulatory Harmonization: Inconsistent or evolving regulatory frameworks across different regions can create uncertainty and hinder widespread adoption.

Emerging Opportunities in Sustainable Aviation Fuel Market

The Sustainable Aviation Fuel (SAF) market is ripe with emerging opportunities that are poised to drive long-term growth. Technological breakthroughs in areas like direct air capture of CO2 for synthetic fuel production and the utilization of advanced bio-based feedstocks are opening new avenues for sustainable fuel generation. Strategic partnerships between airlines, fuel producers, and technology developers are crucial for scaling up production and securing supply chains, as demonstrated by initiatives like the one between Twelve and Etihad Airways. Furthermore, market expansion strategies focusing on emerging aviation markets and the development of tailored SAF solutions for different flight types and operational needs will unlock further potential. The increasing integration of SAF into broader circular economy initiatives also presents a significant opportunity for cost reduction and environmental benefit.

Leading Players in the Sustainable Aviation Fuel Market Sector

- Honeywell International Inc.

- LanzaTech Inc.

- Fulcrum BioEnergy Inc.

- Neste Oyj

- Red Rock Biofuels LLC

- Swedish Biofuels AB

- SG Preston Company

- TotalEnergies SE

- Gevo Inc.

Key Milestones in Sustainable Aviation Fuel Market Industry

- May 2023: Twelve and Etihad Airways signed a Memorandum of Understanding (MOU) to collaborate on the advancement of E-Jet® fuel, Twelve's sustainable aviation fuel (SAF) made from CO2 and renewable energy, as well as plans for an international demonstration flight and a supply roadmap that will support Etihad's sustainability strategy.

- February 2022: Engie SA and the US engineering company Infinium Holdings announced a EUR 500-million project to produce renewable aviation and maritime fuels in northern France. The final investment decision for the project is planned for the end of 2023, with commercial operations expected to start in 2026.

- February 2022: Boeing announced a supply agreement for two million gallons of blended renewable aviation fuel with EPIC Fuels to power its commercial operations in Washington State and South Carolina by the end of 2022.

Strategic Outlook for Sustainable Aviation Fuel Market Market

The strategic outlook for the Sustainable Aviation Fuel (SAF) market is overwhelmingly positive, driven by an accelerated global commitment to decarbonization and continuous technological innovation. Future growth will be fueled by increased collaboration across the value chain, from feedstock development to end-user adoption. Investments in scaling up SAF production capacities and diversifying feedstock sources will be paramount. Furthermore, the development of robust policy frameworks and financial incentives will be crucial for bridging the cost gap and driving widespread market penetration. Opportunities lie in exploring novel fuel pathways, optimizing existing production technologies, and integrating SAF into broader energy transition strategies. The market is on a trajectory to become a cornerstone of sustainable aviation, with significant growth potential expected over the next decade as environmental pressures intensify and technological advancements mature.

Sustainable Aviation Fuel Market Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

Sustainable Aviation Fuel Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Rest of the Asia Pacific

-

3. Europe

- 3.1. United Kingdom

- 3.2. France

- 3.3. Germany

- 3.4. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. Rest of the Middle East and Africa

Sustainable Aviation Fuel Market Regional Market Share

Geographic Coverage of Sustainable Aviation Fuel Market

Sustainable Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Hydroprocessed Esters and Fatty Acids (HEFA) Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Asia Pacific Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fischer-Tropsch (FT)

- 9.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 9.1.3. Synthesi

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Defense

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Sustainable Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Fischer-Tropsch (FT)

- 10.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 10.1.3. Synthesi

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Defense

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LanzaTech Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fulcrum BioEnergy Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Neste Oyj

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Red Rock Biofuels LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Swedish Biofuels AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SG Preston Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TotalEnergies SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gevo Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Sustainable Aviation Fuel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Sustainable Aviation Fuel Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Sustainable Aviation Fuel Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Sustainable Aviation Fuel Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Sustainable Aviation Fuel Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Sustainable Aviation Fuel Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Sustainable Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Sustainable Aviation Fuel Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Asia Pacific Sustainable Aviation Fuel Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Asia Pacific Sustainable Aviation Fuel Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Sustainable Aviation Fuel Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Sustainable Aviation Fuel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Sustainable Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sustainable Aviation Fuel Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Europe Sustainable Aviation Fuel Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Europe Sustainable Aviation Fuel Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Sustainable Aviation Fuel Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Sustainable Aviation Fuel Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Sustainable Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Sustainable Aviation Fuel Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Sustainable Aviation Fuel Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Sustainable Aviation Fuel Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Sustainable Aviation Fuel Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Sustainable Aviation Fuel Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Sustainable Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sustainable Aviation Fuel Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Sustainable Aviation Fuel Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Sustainable Aviation Fuel Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Sustainable Aviation Fuel Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Sustainable Aviation Fuel Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sustainable Aviation Fuel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States of America Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of the North America Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: China Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Japan Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of the Asia Pacific Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of the Europe Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 25: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of the South America Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Sustainable Aviation Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of the Middle East and Africa Sustainable Aviation Fuel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainable Aviation Fuel Market?

The projected CAGR is approximately 47.16%.

2. Which companies are prominent players in the Sustainable Aviation Fuel Market?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, Swedish Biofuels AB, SG Preston Company, TotalEnergies SE, Gevo Inc.

3. What are the main segments of the Sustainable Aviation Fuel Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.58 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Hydroprocessed Esters and Fatty Acids (HEFA) Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

In May 2023, Twelve and Etihad Airways, the national carrier of the United Arab Emirates, signed a Memorandum of Understanding (MOU) to collaborate on the advancement of E-Jet® fuel, Twelve's sustainable aviation fuel (SAF) made from CO2 and renewable energy, as well as plans for an international demonstration flight and a supply roadmap that will support Etihad's sustainability strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sustainable Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sustainable Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sustainable Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the Sustainable Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence