Key Insights

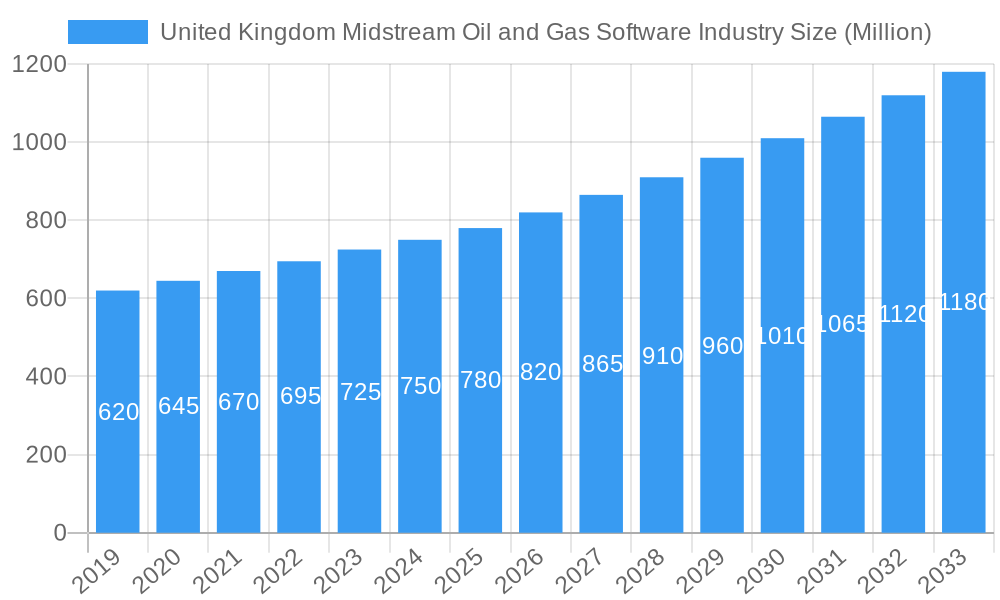

The United Kingdom's midstream oil and gas software market is projected for substantial growth, driven by the escalating need for operational efficiency, stringent regulatory adherence, and heightened safety protocols across the sector. With a current market size of 335.95 billion, the industry is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 1.65% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the ongoing digital transformation within the oil and gas value chain, where advanced software solutions are vital for managing intricate logistics, optimizing pipeline operations, and ensuring the secure transport of hydrocarbons. Additionally, increasing environmental regulations and the imperative to reduce operational costs are prompting midstream companies to invest in sophisticated software for real-time monitoring, predictive maintenance, and data analytics, thereby minimizing downtime and maximizing asset utilization. The historical performance from 2019 to 2024 indicates a consistent expansion, a trend expected to accelerate with the integration of emerging technologies like AI and IoT into existing and new software platforms.

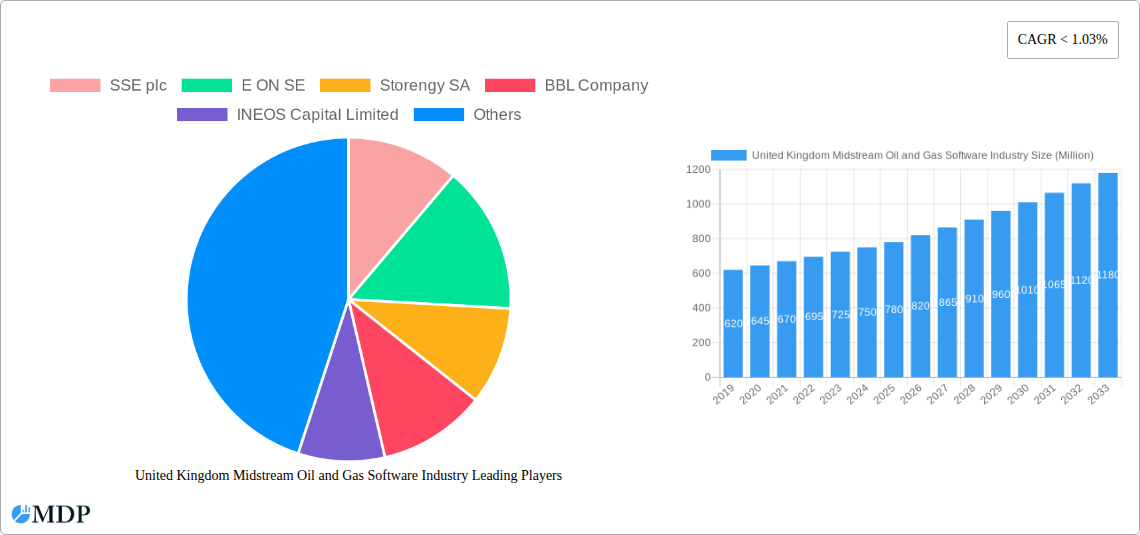

United Kingdom Midstream Oil and Gas Software Industry Market Size (In Billion)

The forecast period of 2025-2033 foresees sustained market expansion, with the industry size expected to surpass a significant milestone by 2033. Key growth drivers include the adoption of scalable and accessible cloud-based solutions, the critical need for robust cybersecurity to safeguard vital infrastructure, and the development of integrated software suites offering end-to-end midstream operational management. The UK's strategic importance as a global energy hub, coupled with its dedication to energy sector innovation, further strengthens this positive outlook. Companies are increasingly recognizing that investing in advanced midstream software is crucial not only for enhancing current operations but also for building resilience and adaptability for the evolving energy landscape, which includes a growing emphasis on cleaner energy sources and modernized transportation networks. This digital imperative is creating significant opportunities for software providers addressing the specific requirements of the UK's midstream oil and gas sector.

United Kingdom Midstream Oil and Gas Software Industry Company Market Share

This report delivers a comprehensive analysis of the United Kingdom's Midstream Oil and Gas Software industry. Covering the historical period from 2019 to 2024, with a base year of 2025, and a detailed forecast spanning 2025 to 2033, this study offers critical insights into market dynamics, technological advancements, competitive intelligence, and strategic opportunities. The UK midstream sector, essential for the transportation, storage, and processing of oil and gas, is undergoing profound digital transformation. This report examines how software solutions are revolutionizing operations, boosting efficiency, and ensuring compliance within this pivotal industry.

United Kingdom Midstream Oil and Gas Software Industry Market Dynamics & Concentration

The United Kingdom's midstream oil and gas software market exhibits a moderate concentration, characterized by a mix of established enterprise software providers and agile, specialized technology firms. Innovation is primarily driven by the increasing demand for operational efficiency, predictive maintenance, and enhanced safety protocols. Regulatory frameworks, such as those governing pipeline integrity and environmental emissions, are significant adoption drivers for specialized software solutions. Product substitutes are emerging from advancements in AI, IoT, and cloud computing, offering integrated solutions that can potentially displace standalone legacy systems. End-user trends lean towards cloud-based, scalable platforms that facilitate real-time data analytics and remote asset monitoring. Mergers and acquisitions (M&A) are anticipated to shape the market, with an estimated XX M&A deals expected over the forecast period as larger players seek to acquire niche technologies and expand their portfolios. Market share is currently fragmented, with key players holding approximately 15-20% each, leaving substantial room for growth and consolidation.

United Kingdom Midstream Oil and Gas Software Industry Industry Trends & Analysis

The United Kingdom's midstream oil and gas software industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. This expansion is fueled by several key market growth drivers, including the imperative to optimize existing infrastructure, the growing adoption of digitalization for improved operational efficiency, and the increasing need for stringent safety and environmental compliance. Technological disruptions are at the forefront of this evolution, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and anomaly detection playing a pivotal role. Internet of Things (IoT) devices are enabling real-time data collection from pipelines, storage facilities, and LNG terminals, providing unprecedented visibility into operational performance. Cloud computing platforms are facilitating scalable data storage, advanced analytics, and remote accessibility, democratizing access to sophisticated software solutions for a wider range of operators. Consumer preferences are shifting towards user-friendly interfaces, integrated dashboards, and end-to-end solutions that can manage the entire midstream value chain. Competitive dynamics are intensifying, with both established software vendors and newer, innovative startups vying for market share by offering advanced functionalities such as digital twins, cybersecurity solutions, and supply chain optimization tools. Market penetration for advanced analytics and automation software is estimated to reach 45% by 2033, up from 25% in 2024, indicating a significant uptake of these transformative technologies. The industry is also seeing a strong push towards sustainability, with software solutions that help monitor and reduce carbon emissions and optimize energy consumption becoming increasingly critical.

Leading Markets & Segments in United Kingdom Midstream Oil and Gas Software Industry

The United Kingdom midstream oil and gas software market is dominated by the Transportation segment, particularly due to the extensive existing infrastructure and ongoing projects.

Transportation:

- Existing Infrastructure: The UK boasts a mature network of oil and gas pipelines, requiring sophisticated software for their monitoring, maintenance, and integrity management. This includes leak detection, corrosion monitoring, and pressure management systems.

- Projects in Pipeline: Significant investments are being made in upgrading and expanding the existing pipeline network, as well as developing new cross-border pipelines to enhance energy security and facilitate trade. Software solutions are crucial for project management, simulation, and operational readiness.

- Upcoming Projects: Future projects are likely to focus on repurposing existing infrastructure for hydrogen transport and carbon capture, utilization, and storage (CCUS) pipelines, creating a demand for adaptive and versatile software platforms. Economic policies promoting energy independence and net-zero targets are key drivers. The sheer volume of operational data generated by the extensive pipeline network necessitates advanced software for efficient processing and analysis.

Storage:

- Existing Infrastructure: The UK possesses considerable underground gas storage facilities and tank farms for crude oil and refined products. Software is essential for inventory management, volumetric calculations, and operational safety.

- Projects in Pipeline: There is a growing interest in developing new gas storage solutions, including depleted gas fields and salt caverns, to ensure energy security and grid stability. Software for reservoir simulation, production forecasting, and facility management is vital for these projects.

- Upcoming Projects: The transition towards renewable energy sources may lead to increased demand for flexible energy storage solutions, including hydrogen storage. Software capable of managing diverse storage mediums will become increasingly important.

LNG Terminals:

- Existing Infrastructure: The UK operates several key Liquefied Natural Gas (LNG) terminals, vital for importing natural gas. Software for terminal operations, cargo management, and logistics is already well-established.

- Projects in Pipeline: Expansion of existing LNG terminal capacity and the potential development of new terminals are driven by the need for diversified gas supply. Software for process optimization, safety management, and supply chain integration is in demand.

- Upcoming Projects: The role of LNG as a transitional fuel, coupled with the potential for regasification infrastructure supporting hydrogen imports, will sustain demand for advanced LNG terminal management software.

The dominance of the Transportation segment is driven by the continuous need for robust asset integrity management, real-time monitoring, and compliance software for its extensive and critical infrastructure.

United Kingdom Midstream Oil and Gas Software Industry Product Developments

Product developments in the UK midstream oil and gas software sector are increasingly focused on AI-powered predictive analytics for asset maintenance, enhancing operational uptime and reducing costs. Cloud-native solutions are gaining traction, offering scalability and accessibility for data management and real-time monitoring. Blockchain technology is being explored for supply chain transparency and secure transaction management. Furthermore, advanced visualization tools, including digital twins, are emerging to provide comprehensive operational insights and enable remote collaboration. These innovations offer significant competitive advantages by improving safety, optimizing efficiency, and ensuring regulatory compliance in the complex midstream environment.

Key Drivers of United Kingdom Midstream Oil and Gas Software Industry Growth

Key drivers of growth in the UK midstream oil and gas software industry are multifaceted. Technological advancements, particularly in AI, IoT, and cloud computing, are enabling more sophisticated operational management and predictive analytics. The persistent drive for operational efficiency and cost reduction within the sector compels companies to adopt software solutions that automate processes and optimize asset performance. Stringent regulatory requirements related to safety, environmental protection, and pipeline integrity necessitate the use of advanced compliance and monitoring software. Furthermore, the ongoing energy transition and the need for flexible infrastructure are creating opportunities for new software applications in areas like hydrogen transport and storage.

Challenges in the United Kingdom Midstream Oil and Gas Software Industry Market

The UK midstream oil and gas software market faces several challenges. High initial implementation costs for advanced software solutions can be a barrier for some operators. Cybersecurity threats pose a significant risk, requiring robust and continuously updated security protocols within software systems. The availability of skilled IT professionals capable of implementing and managing these complex software solutions is also a concern. Furthermore, legacy infrastructure and the need for integration with existing systems can complicate software adoption and development. Finally, fluctuating oil and gas prices can impact investment decisions, potentially delaying the adoption of new technologies.

Emerging Opportunities in United Kingdom Midstream Oil and Gas Software Industry

Emerging opportunities in the UK midstream oil and gas software industry are primarily driven by the global energy transition and the UK's net-zero ambitions. The burgeoning hydrogen economy presents a significant avenue for growth, with demand for software to manage hydrogen production, transportation, and storage infrastructure. Carbon Capture, Utilization, and Storage (CCUS) projects require sophisticated software for monitoring and managing CO2 pipelines and storage sites. The increasing focus on data analytics for optimizing operations and predictive maintenance will continue to fuel demand for AI and ML-powered solutions. Strategic partnerships between traditional oil and gas companies and innovative tech providers will be crucial for developing and deploying these next-generation software solutions.

Leading Players in the United Kingdom Midstream Oil and Gas Software Industry Sector

- SSE plc

- E ON SE

- Storengy SA

- BBL Company

- INEOS Capital Limited

- Interconnector Limited

- GASSCO

Key Milestones in United Kingdom Midstream Oil and Gas Software Industry Industry

- 2019: Increased adoption of cloud-based SCADA systems for remote pipeline monitoring.

- 2020: Launch of AI-driven predictive maintenance platforms by several software vendors.

- 2021: Growing emphasis on cybersecurity solutions for midstream infrastructure following high-profile cyber incidents globally.

- 2022: Pilot projects exploring blockchain for supply chain traceability in refined product movements.

- 2023: Significant investment in digital twin technology for asset performance management and scenario planning.

- 2024: Increased integration of IoT sensors across pipeline networks for real-time data acquisition.

Strategic Outlook for United Kingdom Midstream Oil and Gas Software Industry Market

The strategic outlook for the UK midstream oil and gas software market is exceptionally positive, driven by ongoing digitalization and the imperative to support the UK's energy transition. Future growth accelerators include the expanded implementation of AI and ML for predictive analytics and operational optimization, the development of specialized software for hydrogen and CCUS infrastructure, and the continued migration to cloud-based, integrated software platforms. Strategic investments in cybersecurity and data analytics capabilities will be paramount. Collaboration between technology providers and midstream operators will be key to unlocking the full potential of digital transformation, ensuring a secure, efficient, and sustainable energy future for the United Kingdom.

United Kingdom Midstream Oil and Gas Software Industry Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in pipeline

- 3.1.3. Upcoming projects

-

3.1. Overview

United Kingdom Midstream Oil and Gas Software Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Midstream Oil and Gas Software Industry Regional Market Share

Geographic Coverage of United Kingdom Midstream Oil and Gas Software Industry

United Kingdom Midstream Oil and Gas Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. 4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in pipeline

- 5.3.1.3. Upcoming projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SSE plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 E ON SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Storengy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BBL Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS Capital Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Interconnector Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GASSCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 SSE plc

List of Figures

- Figure 1: United Kingdom Midstream Oil and Gas Software Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Midstream Oil and Gas Software Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Transportation 2020 & 2033

- Table 2: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Storage 2020 & 2033

- Table 3: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 4: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Transportation 2020 & 2033

- Table 6: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Storage 2020 & 2033

- Table 7: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 8: United Kingdom Midstream Oil and Gas Software Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Midstream Oil and Gas Software Industry?

The projected CAGR is approximately 1.65%.

2. Which companies are prominent players in the United Kingdom Midstream Oil and Gas Software Industry?

Key companies in the market include SSE plc, E ON SE, Storengy SA, BBL Company, INEOS Capital Limited, Interconnector Limited, GASSCO.

3. What are the main segments of the United Kingdom Midstream Oil and Gas Software Industry?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD 335.95 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Transportation Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Midstream Oil and Gas Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Midstream Oil and Gas Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Midstream Oil and Gas Software Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Midstream Oil and Gas Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence