Key Insights

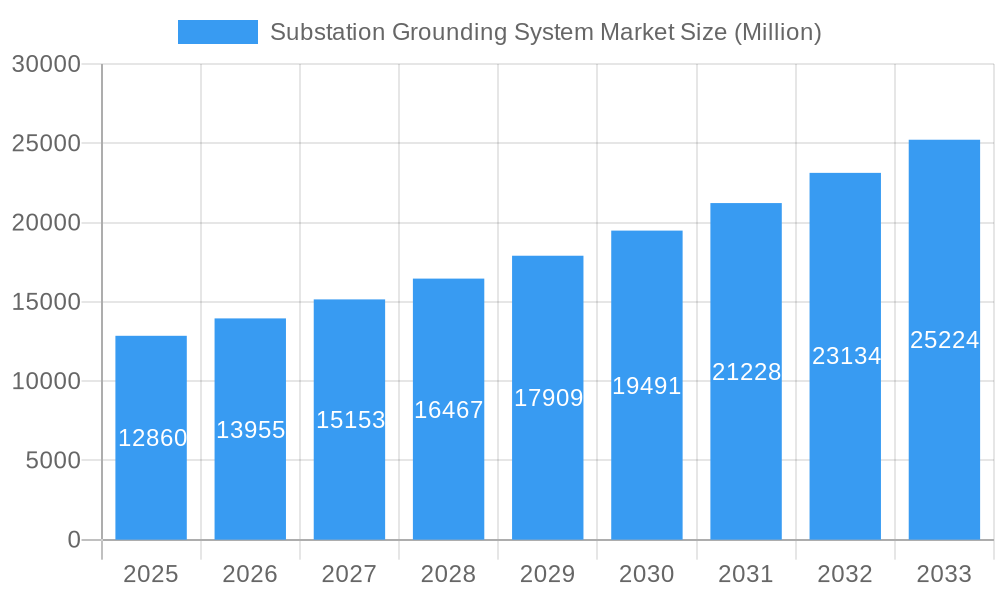

The global Substation Grounding System Market is poised for substantial growth, projected to reach $12.86 billion in 2025. This robust expansion is driven by a compound annual growth rate (CAGR) of 9.75% over the forecast period of 2025-2033. The increasing demand for reliable and safe electrical infrastructure, particularly with the growing complexity of power grids and the integration of renewable energy sources, is a primary catalyst. Furthermore, stringent safety regulations and the need to protect critical substation equipment from faults and lightning strikes are compelling utilities and industrial players to invest in advanced grounding solutions. The market’s expansion is further fueled by ongoing upgrades to existing substations and the construction of new ones to meet escalating electricity demand. The Power Transmission and Power Distribution segments are expected to dominate market share due to their direct application in ensuring grid stability and operational integrity.

Substation Grounding System Market Market Size (In Billion)

The market’s positive trajectory is supported by several key trends, including the adoption of advanced materials for enhanced conductivity and corrosion resistance in grounding components like connectors and conductors. Innovations in grounding system design that offer greater efficiency and longer lifespans are also gaining traction. While the market is experiencing significant growth, potential restraints such as the high initial cost of implementing sophisticated grounding systems and the availability of skilled labor for installation and maintenance could pose challenges. However, the long-term benefits of enhanced safety, reduced downtime, and extended equipment life are expected to outweigh these concerns. Regional insights indicate that the Asia Pacific region, with its rapid industrialization and expanding energy infrastructure, is likely to emerge as a significant growth engine, alongside established markets in North America and Europe.

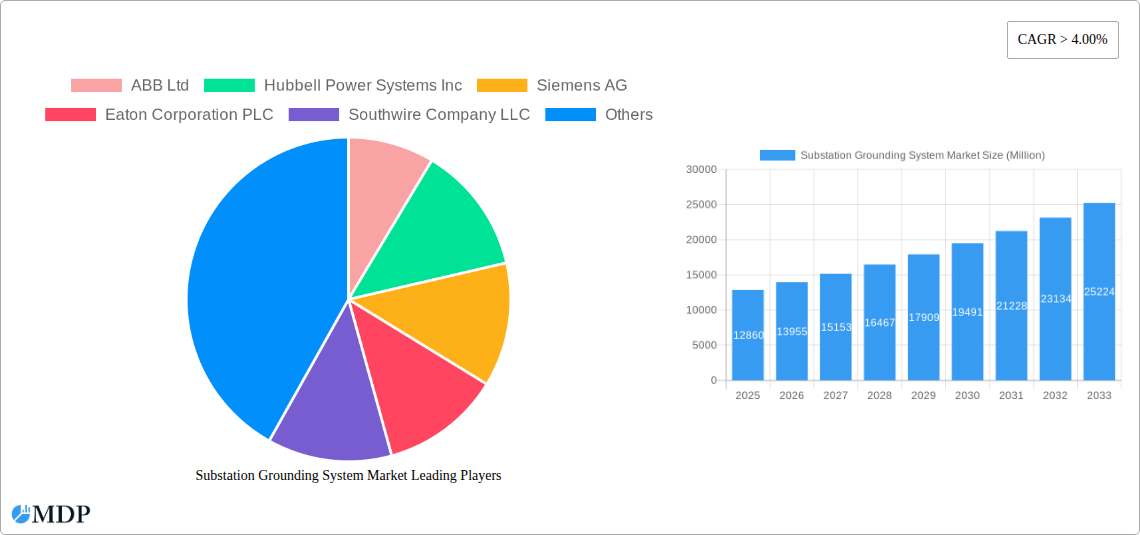

Substation Grounding System Market Company Market Share

This comprehensive report provides a detailed analysis of the global Substation Grounding System Market, encompassing market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. With a study period from 2019 to 2033, and focusing on the base year of 2025, this report offers invaluable insights for industry stakeholders, investors, and decision-makers. The market is projected to witness significant growth, driven by the increasing demand for reliable power infrastructure and stringent safety regulations. We delve into the competitive landscape, highlighting key players and their strategic initiatives, alongside crucial industry milestones that have shaped the market's trajectory.

Substation Grounding System Market Market Dynamics & Concentration

The global Substation Grounding System Market exhibits moderate to high concentration, with key players like ABB Ltd, Siemens AG, and Eaton Corporation PLC holding significant market share. Innovation is a primary driver, fueled by advancements in material science for enhanced conductivity and corrosion resistance, as well as sophisticated diagnostic tools for system health monitoring. Regulatory frameworks, emphasizing safety and grid stability, are paramount, compelling utilities to invest in robust grounding solutions. Product substitutes are limited due to the critical nature of grounding systems, but advancements in surge protection and advanced grounding techniques offer incremental improvements. End-user trends lean towards integrated smart grid solutions, demanding grounding systems that can seamlessly interface with digital monitoring and control platforms. Mergers and acquisitions (M&A) activities are moderate, with companies seeking to expand their product portfolios and geographical reach. For instance, recent M&A deals have focused on acquiring specialized grounding solution providers to enhance competitive advantage. The market is characterized by strategic alliances and partnerships aimed at developing next-generation grounding technologies.

Substation Grounding System Market Industry Trends & Analysis

The Substation Grounding System Market is poised for substantial expansion, driven by a confluence of technological advancements and escalating global electricity demand. The projected Compound Annual Growth Rate (CAGR) is estimated to be approximately 5.5% over the forecast period of 2025–2033. This growth is underpinned by the continuous modernization and expansion of power grids worldwide. Utilities are increasingly investing in upgrading existing substation grounding systems to meet higher fault current demands and enhance overall system reliability. Technological disruptions, such as the integration of advanced monitoring sensors and the use of highly conductive and corrosion-resistant materials like copper alloys and specialized coatings, are reshaping the market. Consumer preferences are shifting towards solutions that offer longevity, minimal maintenance, and superior performance in diverse environmental conditions. The competitive dynamics are intensifying, with established players focusing on product differentiation and expansion into emerging markets, while newer entrants are leveraging innovative technologies to capture market share. The penetration of smart substation technologies further necessitates sophisticated grounding solutions capable of supporting data acquisition and remote diagnostics. The development of advanced soil resistivity testing equipment and predictive maintenance algorithms are also contributing to the market's growth trajectory. Furthermore, the increasing adoption of renewable energy sources, such as solar and wind, which often require robust grid connections, is creating new avenues for grounding system suppliers. The global market size is projected to reach approximately $7.5 billion by 2033, a significant increase from its estimated value of $4.5 billion in 2025.

Leading Markets & Segments in Substation Grounding System Market

The Substation Grounding System Market is segmented by application and component, with distinct regional dominance and growth drivers.

Application Segment Dominance:

- Power Transmission: This segment holds the largest market share, accounting for an estimated 55% of the total market value in 2025. The expansion and upgrade of high-voltage transmission networks globally are the primary catalysts. Economic policies favoring infrastructure development and increased cross-border power exchange necessitate robust and reliable grounding for these critical systems.

- Power Distribution: This segment is projected to witness a steady growth rate of approximately 5.8% CAGR. The increasing demand for electricity in urban and rural areas, coupled with the need for grid modernization to improve reliability and reduce power outages, fuels this segment. Government initiatives for rural electrification and smart grid deployment are key drivers.

- Others: This segment, including industrial substations and specialized applications, represents a smaller but growing portion of the market. Increasing industrialization and the demand for reliable power in manufacturing facilities contribute to its expansion.

Component Segment Dominance:

- Conductor: This component is crucial for effective current dissipation and is expected to capture the largest market share, estimated at 40% in 2025. Advancements in conductor materials, offering higher conductivity and improved durability, drive this segment.

- Connector: Critical for ensuring secure and low-resistance connections within the grounding system, this segment is projected to grow at a CAGR of 5.3%. Innovations in corrosion-resistant and high-strength connectors are key.

- Wires: Essential for completing the grounding circuit, the demand for specialized grounding wires is on the rise, with an estimated market share of 25% in 2025.

- Others: This includes grounding rods, plates, and ancillary components, which collectively contribute to the overall grounding infrastructure.

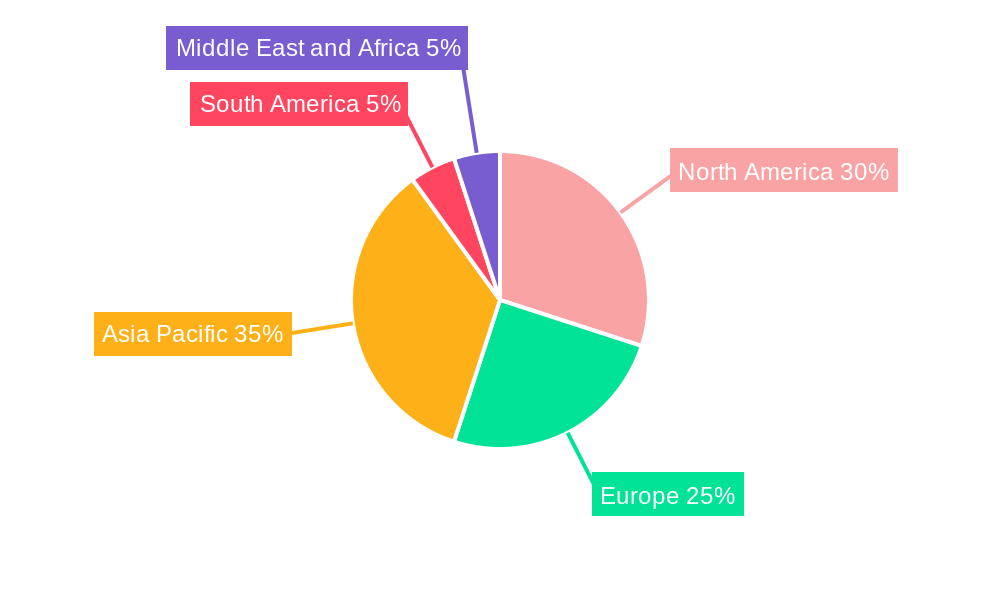

Regional Dominance:

- North America currently leads the market, with an estimated market share of 30% in 2025. This is attributed to a mature electricity infrastructure, significant investments in grid modernization, and stringent safety regulations. The United States, with its extensive transmission and distribution networks, is a key contributor.

- Asia Pacific is the fastest-growing region, driven by rapid industrialization, population growth, and substantial investments in new power generation and transmission projects. Countries like China and India are major growth engines. The region is expected to account for approximately 28% of the market by 2033.

Substation Grounding System Market Product Developments

Recent product developments in the Substation Grounding System Market focus on enhancing safety, reliability, and ease of installation. Innovations include advanced conductive coatings for improved corrosion resistance and extended lifespan of grounding components, such as copper-bonded grounding rods and conductors. Manufacturers are also introducing modular grounding systems for flexible deployment and quicker installation, reducing project timelines. Furthermore, the integration of smart sensors within grounding components allows for real-time monitoring of electrical parameters and early detection of potential faults, providing a significant competitive advantage and improving grid stability. These developments cater to the evolving needs of utility companies seeking more efficient and resilient power infrastructure.

Key Drivers of Substation Grounding System Market Growth

The Substation Grounding System Market growth is propelled by several key factors. The escalating global demand for electricity necessitates continuous expansion and modernization of power grids, requiring robust grounding solutions to ensure operational safety and reliability. Stringent safety regulations and standards set by regulatory bodies worldwide mandate the implementation of effective grounding systems to prevent electrical hazards and protect critical infrastructure. The increasing integration of renewable energy sources, such as solar and wind farms, into the existing power grid requires sophisticated grounding to manage intermittent power flows and ensure grid stability. Technological advancements in materials science and manufacturing processes are leading to the development of more durable, efficient, and cost-effective grounding components, further stimulating market growth.

Challenges in the Substation Grounding System Market

Despite the strong growth prospects, the Substation Grounding System Market faces several challenges. The initial high cost of installation and materials for advanced grounding systems can be a significant barrier, especially for utilities with budget constraints. The availability and fluctuating prices of raw materials, such as copper, can impact production costs and pricing strategies. The need for specialized knowledge and skilled labor for installation and maintenance can also pose challenges in certain regions. Furthermore, the long lifespan of existing grounding infrastructure can slow down the replacement cycle, impacting the adoption of new technologies. Regulatory hurdles and lengthy approval processes in some countries can also delay project execution.

Emerging Opportunities in Substation Grounding System Market

Emerging opportunities in the Substation Grounding System Market are abundant, driven by the global push towards decarbonization and grid modernization. The increasing adoption of electric vehicles (EVs) and the associated charging infrastructure will create a growing demand for reliable grounding systems in substations and charging stations. The development of smart grids and the deployment of advanced metering infrastructure (AMI) present opportunities for integrated grounding solutions with enhanced monitoring and diagnostic capabilities. Furthermore, the ongoing expansion of power infrastructure in developing economies, particularly in Asia Pacific and Africa, offers significant untapped market potential. Strategic partnerships between grounding system manufacturers and renewable energy developers are also creating new avenues for growth.

Leading Players in the Substation Grounding System Market Sector

- ABB Ltd

- Hubbell Power Systems Inc

- Siemens AG

- Eaton Corporation PLC

- Southwire Company LLC

- Littelfuse Inc

- E&S Grounding Solutions

Key Milestones in Substation Grounding System Market Industry

- 2019: Increased focus on research and development of advanced grounding materials with enhanced conductivity and corrosion resistance.

- 2020: Launch of modular grounding systems designed for faster installation and greater flexibility.

- 2021: Significant increase in demand for grounding solutions for renewable energy integration projects.

- 2022: Introduction of smart grounding components with integrated sensors for real-time monitoring.

- 2023: Growing adoption of copper-free grounding solutions due to price volatility of copper.

- 2024: Enhanced regulatory emphasis on grid resilience and safety driving investments in advanced grounding systems.

Strategic Outlook for Substation Grounding System Market Market

The strategic outlook for the Substation Grounding System Market remains exceptionally positive. The accelerated transition towards renewable energy, the continuous expansion of electricity grids to meet growing demand, and the imperative for enhanced grid resilience will act as significant growth accelerators. Companies that focus on developing smart, integrated grounding solutions with advanced monitoring capabilities will be well-positioned to capture market share. Furthermore, strategic collaborations with utility companies, renewable energy developers, and technology providers will be crucial for innovation and market penetration. The increasing emphasis on safety standards and the proactive replacement of aging infrastructure will create sustained demand. Expansion into emerging economies with developing power infrastructure presents a significant long-term growth opportunity.

Substation Grounding System Market Segmentation

-

1. Application

- 1.1. Power Tranmission

- 1.2. Power Distribution

- 1.3. Others

-

2. Component

- 2.1. Connector

- 2.2. Conductor

- 2.3. Wires

- 2.4. Others

Substation Grounding System Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Substation Grounding System Market Regional Market Share

Geographic Coverage of Substation Grounding System Market

Substation Grounding System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Worldwide4.; Rise In Electricity Demand Due Increase Industrial And Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Growth In Distributed Energy Generation

- 3.4. Market Trends

- 3.4.1. Power Transmission Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Tranmission

- 5.1.2. Power Distribution

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Connector

- 5.2.2. Conductor

- 5.2.3. Wires

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Tranmission

- 6.1.2. Power Distribution

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Connector

- 6.2.2. Conductor

- 6.2.3. Wires

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Tranmission

- 7.1.2. Power Distribution

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Connector

- 7.2.2. Conductor

- 7.2.3. Wires

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Tranmission

- 8.1.2. Power Distribution

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Connector

- 8.2.2. Conductor

- 8.2.3. Wires

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Tranmission

- 9.1.2. Power Distribution

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Connector

- 9.2.2. Conductor

- 9.2.3. Wires

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Substation Grounding System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Tranmission

- 10.1.2. Power Distribution

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Connector

- 10.2.2. Conductor

- 10.2.3. Wires

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hubbell Power Systems Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Southwire Company LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Littelfuse Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 E&S Grounding Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Substation Grounding System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Substation Grounding System Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Substation Grounding System Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Substation Grounding System Market Revenue (undefined), by Component 2025 & 2033

- Figure 5: North America Substation Grounding System Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Substation Grounding System Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Substation Grounding System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Substation Grounding System Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Substation Grounding System Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Substation Grounding System Market Revenue (undefined), by Component 2025 & 2033

- Figure 11: Europe Substation Grounding System Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Substation Grounding System Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Substation Grounding System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Substation Grounding System Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Substation Grounding System Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Substation Grounding System Market Revenue (undefined), by Component 2025 & 2033

- Figure 17: Asia Pacific Substation Grounding System Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Pacific Substation Grounding System Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Substation Grounding System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Substation Grounding System Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Substation Grounding System Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Substation Grounding System Market Revenue (undefined), by Component 2025 & 2033

- Figure 23: South America Substation Grounding System Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: South America Substation Grounding System Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Substation Grounding System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Substation Grounding System Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Substation Grounding System Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Substation Grounding System Market Revenue (undefined), by Component 2025 & 2033

- Figure 29: Middle East and Africa Substation Grounding System Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Middle East and Africa Substation Grounding System Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Substation Grounding System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 3: Global Substation Grounding System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: Global Substation Grounding System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 9: Global Substation Grounding System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 12: Global Substation Grounding System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 15: Global Substation Grounding System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Substation Grounding System Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Substation Grounding System Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 18: Global Substation Grounding System Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Substation Grounding System Market?

The projected CAGR is approximately 9.75%.

2. Which companies are prominent players in the Substation Grounding System Market?

Key companies in the market include ABB Ltd, Hubbell Power Systems Inc, Siemens AG, Eaton Corporation PLC, Southwire Company LLC, Littelfuse Inc *List Not Exhaustive, E&S Grounding Solutions.

3. What are the main segments of the Substation Grounding System Market?

The market segments include Application, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Worldwide4.; Rise In Electricity Demand Due Increase Industrial And Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Power Transmission Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growth In Distributed Energy Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Substation Grounding System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Substation Grounding System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Substation Grounding System Market?

To stay informed about further developments, trends, and reports in the Substation Grounding System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence