Key Insights

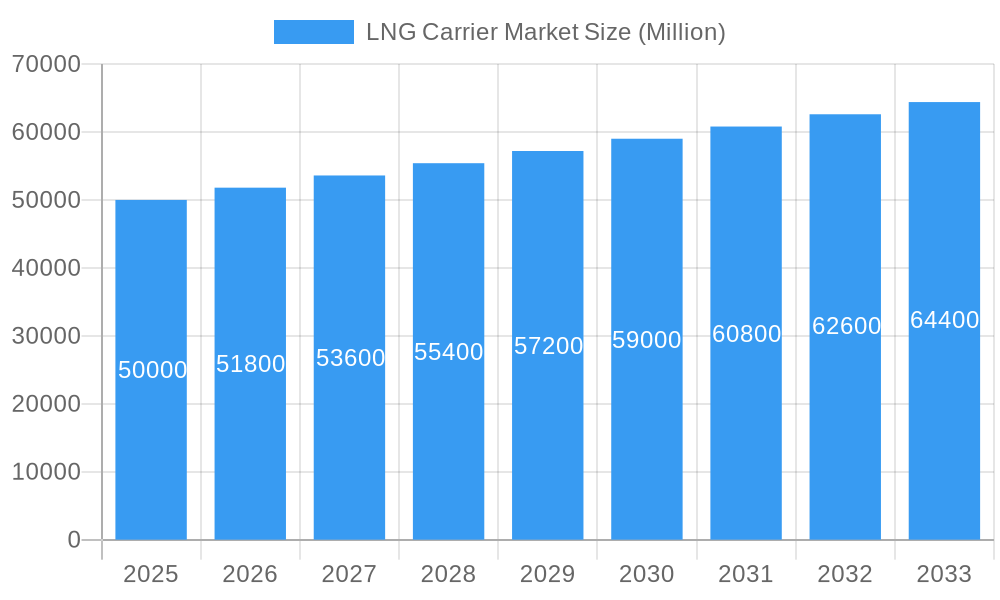

The global LNG carrier market is poised for significant expansion, driven by increasing worldwide demand for liquefied natural gas (LNG) as a cleaner and more versatile energy source. With a projected market size of $50,000 million and a robust CAGR exceeding 3.60%, the industry is expected to witness substantial growth throughout the forecast period of 2025-2033. This upward trajectory is fueled by several key drivers, including the escalating need for energy security, the ongoing transition from coal and oil to cleaner fuels in many economies, and the strategic investments in LNG infrastructure by major consuming nations. Furthermore, technological advancements in carrier design, such as the adoption of more efficient propulsion systems like XDF two-stroke engines and steam re-heat technologies, are enhancing operational efficiency and reducing environmental impact, thereby bolstering market confidence and investment.

LNG Carrier Market Market Size (In Billion)

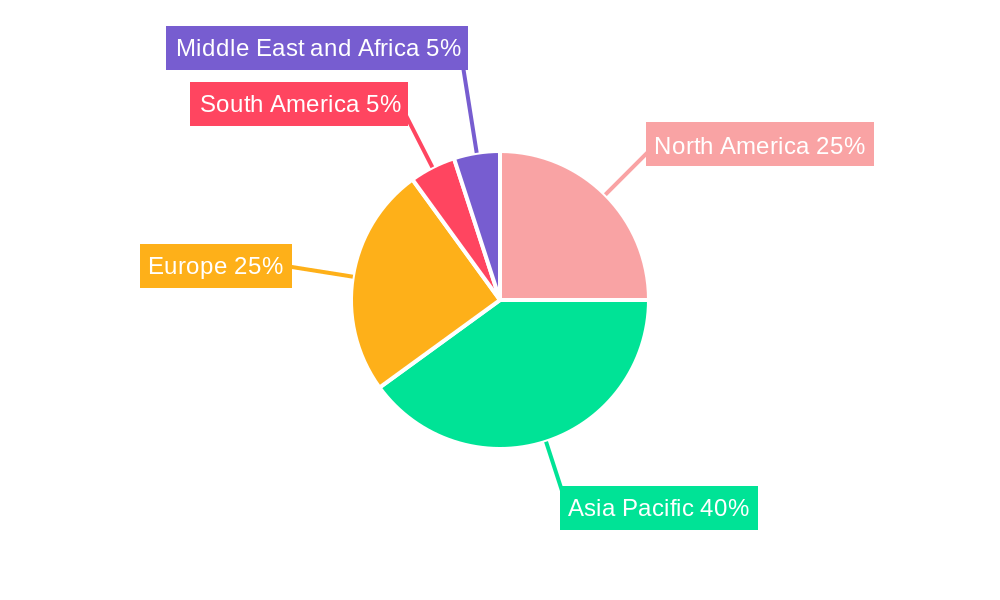

The market is characterized by a dynamic interplay of supply and demand, with shipbuilders and operators at the forefront of innovation and capacity expansion. Key segments include containment types like Moss and Membrane, and propulsion types such as Steam Turbines, Dual Fuel, Slow-Speed Diesel (SSD), and advanced XDF engines. Geographically, the Asia Pacific region, particularly China, India, Japan, and South Korea, is expected to remain a dominant force due to its burgeoning energy consumption. North America and Europe also present considerable opportunities, supported by their significant LNG production and consumption capacities. While the market benefits from strong growth drivers, it also faces restraints such as the high capital expenditure required for new vessel construction, volatile LNG prices, and the complex regulatory landscape surrounding maritime emissions. Nonetheless, the overarching trend towards decarbonization and the continued reliance on LNG as a transitional fuel ensure a favorable outlook for the LNG carrier market.

LNG Carrier Market Company Market Share

Here's the SEO-optimized, engaging report description for the LNG Carrier Market, structured as requested:

Report Title: LNG Carrier Market: Comprehensive Analysis, Growth Drivers, and Future Outlook (2019-2033)

Report Description:

Dive into the dynamic LNG Carrier Market with this in-depth report, providing a comprehensive analysis of market dynamics, industry trends, leading players, and future projections. Explore the intricate ecosystem of liquefied natural gas shipping, examining the pivotal role of LNG carriers in the global energy landscape. This report is an indispensable resource for ship builders, ship operators, gas logistics companies, financial institutions, and energy policymakers seeking to understand the current state and anticipate the future trajectory of this critical sector.

The global LNG carrier market is experiencing robust growth, fueled by increasing demand for cleaner energy sources and expanding LNG import/export infrastructure worldwide. This report meticulously analyzes the market from 2019 to 2033, with a base year of 2025 and an extensive forecast period extending to 2033. Gain critical insights into containment types like Moss and Membrane, and understand the impact of evolving propulsion technologies such as Steam Turbines, Dual Fuel, Slow-Speed Diesel (SSD), M-type E, XDF Two-stroke Engine, and Steam Re-heat and Stage.

Understand the competitive landscape, identify key market drivers, and assess emerging opportunities within the LNG shipping industry. This report offers actionable intelligence on market concentration, innovation drivers, and the impact of regulatory frameworks. Discover product developments, strategic initiatives, and the competitive advantages shaping the LNG transport market. With meticulous data and expert analysis, this report equips stakeholders with the knowledge to navigate challenges and capitalize on the substantial growth potential of the LNG carrier market.

LNG Carrier Market Market Dynamics & Concentration

The LNG Carrier Market exhibits a moderate to high level of concentration, with a significant portion of market share held by a few dominant shipbuilders and operators. Innovation plays a crucial role in shaping market dynamics, with ongoing advancements in vessel design, propulsion systems, and containment technologies driving efficiency and environmental compliance. Regulatory frameworks, particularly concerning emissions and safety standards, continue to influence shipbuilding decisions and operational practices. Product substitutes, such as pipeline gas for certain regional demands, exist but are largely superseded by the flexibility and global reach of LNG carriers. End-user trends are strongly driven by the global shift towards cleaner energy sources, increasing LNG import dependency in various regions, and the expansion of liquefaction and regasification terminals. Mergers and acquisitions (M&A) activities are sporadic but significant, often aimed at consolidating market presence, acquiring advanced technologies, or securing long-term charter agreements. For instance, the acquisition of advanced containment systems can lead to enhanced market penetration. While specific M&A deal counts are dynamic, the trend indicates a strategic consolidation in certain sub-segments of the market.

- Market Share: While not exhaustively detailed here, key players dominate significant portions of the shipbuilding and operating segments.

- M&A Activities: Sporadic but impactful, with a focus on technological integration and market consolidation.

LNG Carrier Market Industry Trends & Analysis

The LNG Carrier Market is characterized by robust growth, propelled by several interconnected industry trends. The overarching driver is the escalating global demand for natural gas as a cleaner-burning alternative to coal and oil, particularly in emerging economies seeking to meet their burgeoning energy needs while adhering to environmental commitments. This surge in demand for liquefied natural gas (LNG) directly translates into a greater requirement for efficient and specialized LNG carriers to transport this commodity across vast oceanic distances. The CAGR for the LNG carrier market is projected to be substantial over the forecast period, reflecting this sustained demand.

Technological disruptions are continuously reshaping the industry. The development of more fuel-efficient propulsion systems, such as Dual Fuel engines and XDF Two-stroke Engine technology, is driven by the imperative to reduce operational costs and comply with increasingly stringent environmental regulations like those set by the International Maritime Organization (IMO). Innovations in containment types, such as advancements in Membrane technology and the refinement of Moss spherical tanks, aim to maximize cargo capacity and enhance safety during transit. These technological evolutions contribute to higher market penetration of advanced vessels, pushing older, less efficient fleets towards retirement.

Consumer preferences within the energy sector are increasingly prioritizing sustainability and cost-effectiveness. This translates into a preference for carriers that offer lower emissions and predictable operating costs, incentivizing shipowners to invest in newer, more advanced vessel designs. Competitive dynamics are intense, with a focus on securing long-term charter contracts, optimizing fleet utilization, and gaining a competitive edge through technological superiority and operational excellence. The expansion of liquefaction capacity in major exporting regions and the development of new import terminals globally are creating new trade routes and opportunities for LNG carriers. The ongoing energy transition and the strategic importance of natural gas in diversifying energy portfolios are expected to sustain the upward trajectory of the LNG carrier market.

Leading Markets & Segments in LNG Carrier Market

The dominance within the LNG Carrier Market is dictated by a confluence of regional demand, shipbuilding capabilities, and the adoption of specific technological segments. Asia-Pacific, particularly countries like China, Japan, and South Korea, stands as a leading market due to its significant LNG import volumes and advanced shipbuilding infrastructure. South Korea, in particular, has established itself as a powerhouse in the construction of sophisticated LNG carriers.

Within Containment Type, the Membrane containment system has seen significant adoption due to its efficiency in cargo loading and unloading, and its ability to maximize cargo volume within a given hull size. While Moss containment systems, with their iconic spherical tanks, continue to be a reliable choice, newer membrane technologies are often favored for their integration capabilities and potential cost efficiencies in construction and operation.

The evolution of Propulsion Type is a critical determinant of market leadership and future trends. Dual Fuel and XDF Two-stroke Engine technologies are increasingly dominating the market. These advanced engines offer the flexibility to run on both natural gas (LNG) and conventional marine fuels, significantly reducing greenhouse gas emissions and sulphur oxides. This aligns with the global push for decarbonization in the shipping industry. Slow-Speed Diesel (SSD) engines, while historically prevalent, are gradually being supplemented by these more environmentally friendly and efficient alternatives. Steam Re-heat and Stage technologies represent older but still operational propulsion methods, but their market share is declining in favor of newer, cleaner options. The strategic advantage lies in vessels equipped with these advanced propulsion systems, enabling them to meet stringent environmental regulations and secure long-term charters from energy majors focused on sustainability.

- Dominant Regions: Asia-Pacific (China, Japan, South Korea) leads in both import demand and shipbuilding.

- Key Containment Type Trends: Increasing adoption of Membrane technology for its operational efficiencies.

- Dominant Propulsion Type Trends: Strong shift towards Dual Fuel and XDF Two-stroke Engines due to emissions reduction mandates.

LNG Carrier Market Product Developments

Product developments in the LNG Carrier Market are primarily focused on enhancing efficiency, safety, and environmental performance. A key innovation is the continuous refinement of containment systems, with advancements in Membrane designs offering improved cargo capacity and reduced boil-off rates. Furthermore, the development of more robust and efficient propulsion systems, such as advanced Dual Fuel engines and the XDF Two-stroke Engine, allows for significant reductions in fuel consumption and emissions. Approvals in Principle (AiP) for revolutionary designs, like the three-tank LNG tanker concept that reduces construction costs by eliminating components and associated cryogenic equipment, are indicative of the industry's drive for innovation and cost-effectiveness. These developments provide shipyards with more competitive offerings and ship operators with more economical and environmentally compliant vessels.

Key Drivers of LNG Carrier Market Growth

The LNG Carrier Market is propelled by a confluence of significant growth drivers. The escalating global demand for natural gas as a transitional fuel towards cleaner energy sources is a primary catalyst. Expanding LNG import and export infrastructure worldwide, including new liquefaction plants and regasification terminals, directly fuels the need for a larger and more modern LNG carrier fleet. Technological advancements in vessel design and propulsion systems, such as the widespread adoption of Dual Fuel engines and more efficient Membrane containment technologies, reduce operational costs and environmental impact, making LNG transport more viable. Favorable government policies and international agreements promoting cleaner energy and reducing carbon emissions further incentivize investment in LNG infrastructure and shipping.

Challenges in the LNG Carrier Market Market

Despite robust growth, the LNG Carrier Market faces several significant challenges. Regulatory hurdles, particularly the evolving and increasingly stringent environmental regulations concerning emissions (e.g., IMO 2020 and future decarbonization targets), necessitate substantial investment in new, compliant vessels or retrofitting existing ones, which can be costly. Supply chain issues, including the availability of skilled labor for shipbuilding and the sourcing of specialized components, can lead to project delays and cost overruns. Intense competitive pressures among shipbuilders and operators, coupled with cyclical charter rates, can impact profitability and investment decisions. The high capital expenditure required for constructing LNG carriers and the long lead times for new builds also present financial challenges.

Emerging Opportunities in LNG Carrier Market

Emerging opportunities within the LNG Carrier Market are primarily driven by the global energy transition and ongoing technological advancements. The growing emphasis on decarbonization is creating a demand for LNG carriers equipped with Dual Fuel or other low-emission propulsion systems, opening avenues for shipbuilders and engine manufacturers specializing in these technologies. Strategic partnerships between shipowners, charterers, and technology providers are crucial for developing and deploying next-generation LNG carriers. Market expansion strategies, such as tapping into new or growing LNG import markets in regions like Asia and Europe, present significant growth potential. Furthermore, the development of specialized LNG carriers for niche applications, such as small-scale LNG bunkering vessels, represents an expanding segment.

Leading Players in the LNG Carrier Market Sector

- 4 MISC Berhad

- 8 Japan Marine United Corporation

- 3 GasLog Ltd

- 8 Mitsui OSK Lines Ltd

- 4 BW LPG

- 3 STX Offshore and Shipbuilding CO LTD

- 6 Daewoo Shipbuilding and Marine Engineering Co Ltd

- 1 Kawasaki Heavy Industries Ltd

- 2 Royal

Ship Operators

- 1 Nippon Yusen Kabushiki Kaisha

- 6 Maran Gas Maritime Inc

- 5 Seapeak

- 1 Samsung Heavy Industries Co Ltd

- 7 China Shipbuilding Trading Co Ltd

- 5 Mitsubishi Heavy Industries Ltd

- 7 Golar LNG

- 10 Kawasaki Kisen Kaisha Ltd

- 2 Hyundai Samho Heavy Industries Co Ltd

- 9 HJ Shipbuilding & Construction Company Ltd

Key Milestones in LNG Carrier Market Industry

- December 2022: GAIL (India) Ltd agreed to time charter a new liquefied natural gas (LNG) carrier with Japan's Mitsui O. S. K. Lines Ltd (MOL) and acquired a stake in an existing LNG carrier. The new LNG carrier, built by South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd, will be the second MOL Group LNG ship to serve GAIL and will commence time chartering in 2023.

- October 2022: GTT announced that it earned two Approvals in Principle (AiP) from DNV and Bureau Veritas for its revolutionary three-tank LNG tanker design (BV). The three-tank LNG carrier concept reduces construction costs by eliminating one cofferdam, one pump tower, and all related cryogenic equipment (liquid and gas domes, valves, piping, radars, etc.).

Strategic Outlook for LNG Carrier Market Market

The strategic outlook for the LNG Carrier Market is overwhelmingly positive, driven by the sustained global demand for natural gas as a crucial component of the ongoing energy transition. Growth accelerators include the increasing number of new LNG liquefaction and regasification projects coming online, which will necessitate a significant expansion of the global LNG carrier fleet. The continuous push for decarbonization will further bolster the demand for advanced LNG carriers equipped with low-emission propulsion technologies, such as Dual Fuel and XDF Two-stroke Engine systems. Strategic partnerships and technological collaborations will be pivotal in developing and deploying the next generation of more efficient and environmentally friendly vessels. Investment in specialized LNG carriers for smaller-scale operations and bunkering services also presents a considerable growth avenue. The market is poised for sustained expansion, offering substantial opportunities for stakeholders who can adapt to evolving technological demands and regulatory landscapes.

LNG Carrier Market Segmentation

-

1. Containment Type

- 1.1. Moss

- 1.2. Membrane

-

2. Propulsion Type

- 2.1. Steam Turbines

- 2.2. Dual Fue

- 2.3. Slow-Speed Diesel (SSD)

- 2.4. M-type E

- 2.5. XDF Two-stroke Engine

- 2.6. Steam Re-heat and Stage

LNG Carrier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Spain

- 3.4. United Kingdom

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Nigeria

- 5.3. Saudi Arabia

- 5.4. Rest of the Middle East and Africa

LNG Carrier Market Regional Market Share

Geographic Coverage of LNG Carrier Market

LNG Carrier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Membrane-Type Containment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 5.1.1. Moss

- 5.1.2. Membrane

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Steam Turbines

- 5.2.2. Dual Fue

- 5.2.3. Slow-Speed Diesel (SSD)

- 5.2.4. M-type E

- 5.2.5. XDF Two-stroke Engine

- 5.2.6. Steam Re-heat and Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 6. North America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 6.1.1. Moss

- 6.1.2. Membrane

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Steam Turbines

- 6.2.2. Dual Fue

- 6.2.3. Slow-Speed Diesel (SSD)

- 6.2.4. M-type E

- 6.2.5. XDF Two-stroke Engine

- 6.2.6. Steam Re-heat and Stage

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 7. Asia Pacific LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 7.1.1. Moss

- 7.1.2. Membrane

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Steam Turbines

- 7.2.2. Dual Fue

- 7.2.3. Slow-Speed Diesel (SSD)

- 7.2.4. M-type E

- 7.2.5. XDF Two-stroke Engine

- 7.2.6. Steam Re-heat and Stage

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 8. Europe LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 8.1.1. Moss

- 8.1.2. Membrane

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Steam Turbines

- 8.2.2. Dual Fue

- 8.2.3. Slow-Speed Diesel (SSD)

- 8.2.4. M-type E

- 8.2.5. XDF Two-stroke Engine

- 8.2.6. Steam Re-heat and Stage

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 9. South America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 9.1.1. Moss

- 9.1.2. Membrane

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Steam Turbines

- 9.2.2. Dual Fue

- 9.2.3. Slow-Speed Diesel (SSD)

- 9.2.4. M-type E

- 9.2.5. XDF Two-stroke Engine

- 9.2.6. Steam Re-heat and Stage

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 10. Middle East and Africa LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 10.1.1. Moss

- 10.1.2. Membrane

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Steam Turbines

- 10.2.2. Dual Fue

- 10.2.3. Slow-Speed Diesel (SSD)

- 10.2.4. M-type E

- 10.2.5. XDF Two-stroke Engine

- 10.2.6. Steam Re-heat and Stage

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ship Builders

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 4 MISC Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 8 Japan Marine United Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 9 GasLog Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 Mitsui OSK Lines Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 8 BW LPG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ship Operators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 4 STX Offshore and Shipbuilding CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 Daewoo Shipbuilding and Marine Engineering Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 6 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 1 Royal Dutch Shell PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 2 Nippon Yusen Kabushiki Kaisha

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Maran Gas Maritime Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 5 Seapeak

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 1 Samsung Heavy Industries Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 7 China Shipbuilding Trading Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 5 Mitsubishi Heavy Industries Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 7 Golar LNG

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 2 Hyundai Samho Heavy Industries Co Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 9 HJ Shipbuilding & Construction Company Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Ship Builders

List of Figures

- Figure 1: Global LNG Carrier Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 3: North America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 4: North America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 5: North America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 9: Asia Pacific LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 10: Asia Pacific LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 11: Asia Pacific LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: Asia Pacific LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 15: Europe LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 16: Europe LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 17: Europe LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Europe LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 21: South America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 22: South America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 23: South America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: South America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 27: Middle East and Africa LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 28: Middle East and Africa LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 29: Middle East and Africa LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Middle East and Africa LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 2: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global LNG Carrier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 5: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of the North America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 11: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Japan LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Korea LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Asia Pacific LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 19: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of the Europe LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 27: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 28: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of the South America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 33: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 34: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Nigeria LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of the Middle East and Africa LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LNG Carrier Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the LNG Carrier Market?

Key companies in the market include Ship Builders, 4 MISC Berhad, 8 Japan Marine United Corporation, 9 GasLog Ltd, 3 Mitsui OSK Lines Ltd, 8 BW LPG, Ship Operators, 4 STX Offshore and Shipbuilding CO LTD, 3 Daewoo Shipbuilding and Marine Engineering Co Ltd, 6 Kawasaki Heavy Industries Ltd, 1 Royal Dutch Shell PLC, 2 Nippon Yusen Kabushiki Kaisha, 6 Maran Gas Maritime Inc, 5 Seapeak, 1 Samsung Heavy Industries Co Ltd, 7 China Shipbuilding Trading Co Ltd, 5 Mitsubishi Heavy Industries Ltd, 7 Golar LNG, 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive, 2 Hyundai Samho Heavy Industries Co Ltd, 9 HJ Shipbuilding & Construction Company Ltd.

3. What are the main segments of the LNG Carrier Market?

The market segments include Containment Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Membrane-Type Containment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

December 2022: GAIL (India) Ltd agreed to time charter a new liquefied natural gas (LNG) carrier with Japan's Mitsui O. S. K. Lines Ltd (MOL) and acquired a stake in an existing LNG carrier. The new LNG carrier, built by South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd, will be the second MOL Group LNG ship to serve GAIL and will commence time chartering in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LNG Carrier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LNG Carrier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LNG Carrier Market?

To stay informed about further developments, trends, and reports in the LNG Carrier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence