Key Insights

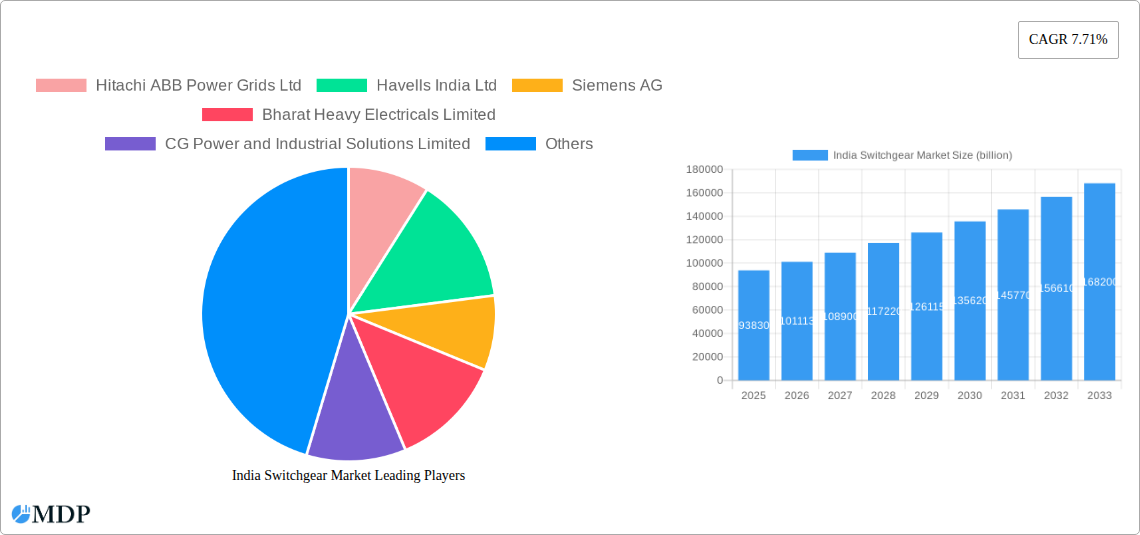

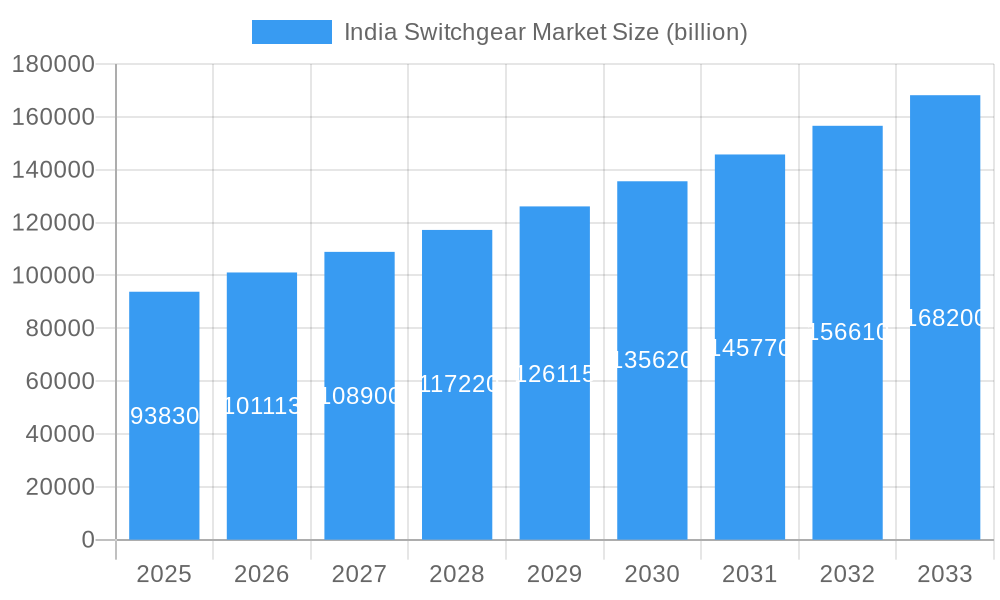

The India Switchgear Market is poised for substantial growth, projected to reach USD 93.83 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.71% over the forecast period from 2025 to 2033. This significant expansion is fueled by the nation's accelerating infrastructure development, increasing demand for reliable power distribution in both urban and rural areas, and the ongoing integration of renewable energy sources. The government's focus on enhancing grid modernization, smart grid initiatives, and a growing emphasis on energy efficiency are key tailwinds. Furthermore, rising industrialization and the burgeoning commercial and residential sectors are continuously augmenting the need for advanced and efficient switchgear solutions for safe and uninterrupted power supply.

India Switchgear Market Market Size (In Billion)

The market is segmented across various voltage levels, including low, medium, and high voltage, catering to a diverse range of applications. In terms of insulation, both Gas Insulated Switchgear (GIS) and Air Insulated Switchgear (AIS) are witnessing adoption, with GIS gaining traction for its space-saving and enhanced safety features, particularly in congested urban environments and high-voltage applications. End-user segments like commercial, residential, and industrial all represent significant avenues for growth, each with specific requirements and adoption patterns. Leading global and domestic players such as Hitachi ABB Power Grids Ltd, Siemens AG, and Havells India Ltd are actively investing in research and development, product innovation, and expanding their manufacturing capacities to meet this escalating demand, further solidifying the market's growth trajectory.

India Switchgear Market Company Market Share

Unlocking Growth: India Switchgear Market Report 2025-2033

Dive deep into the dynamic India Switchgear Market, a critical component of the nation's burgeoning energy infrastructure. This comprehensive report provides an in-depth analysis of market dynamics, industry trends, and future trajectories from 2019 to 2033, with a focus on the base year 2025 and a robust forecast period.

**Gain actionable insights into the *India Switchgear Market*, a rapidly expanding sector projected to reach *XX billion* by 2033. This report is essential for switchgear manufacturers, power distribution companies, EPC contractors, investors, and government bodies seeking to understand and capitalize on the immense opportunities within this vital industry. We meticulously analyze key segments including Low Voltage Switchgear, Medium Voltage Switchgear, and High Voltage Switchgear, alongside insulation types like Gas Insulated Switchgear (GIS) and Air Insulated Switchgear (AIS). Furthermore, we explore end-user industries such as Commercial, Residential, and Industrial, offering a granular view of demand drivers and adoption patterns. Leverage high-traffic keywords like "India Switchgear Market," "Power Distribution India," "Low Voltage Switchgear," "Medium Voltage Switchgear," "High Voltage Switchgear," "Gas Insulated Switchgear," "ABB India," "Siemens India," and "Schneider Electric India" to maximize your search visibility.**

India Switchgear Market Market Dynamics & Concentration

The India Switchgear Market is characterized by a moderately concentrated landscape, with a few key global and domestic players holding significant market share. However, the presence of numerous regional manufacturers fosters competitive intensity and drives innovation. Innovation is primarily propelled by the increasing demand for smart grid technologies, enhanced safety features, and greater operational efficiency. Stringent regulatory frameworks, guided by standards from organizations like the Bureau of Indian Standards (BIS), are shaping product development and market entry strategies. Product substitutes, while limited in core functionality, emerge in the form of advanced digital solutions and integrated protection systems that enhance the value proposition of traditional switchgear. End-user trends indicate a growing preference for reliable, energy-efficient, and digitally-enabled switchgear solutions, driven by sectors like renewable energy integration, data centers, and smart city initiatives. Merger and acquisition (M&A) activities, though not yet at peak levels, are anticipated to increase as larger entities seek to consolidate market presence and acquire technological capabilities. For instance, the market has witnessed XX significant M&A deals in the historical period, indicating a strategic consolidation trend. The market share distribution sees key players like Siemens AG and Hitachi ABB Power Grids Ltd commanding substantial portions, while Havells India Ltd and Bharat Heavy Electricals Limited are strong domestic contenders.

India Switchgear Market Industry Trends & Analysis

The India Switchgear Market is poised for substantial growth, exhibiting a projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is primarily fueled by the relentless push towards strengthening India's power infrastructure, a critical enabler for its economic aspirations. The government's focus on enhancing electricity access, promoting renewable energy integration, and modernizing existing grids directly translates into increased demand for a wide array of switchgear products. Technological disruptions are playing a pivotal role, with the advent of smart grids, IoT-enabled switchgear, and advanced monitoring and control systems revolutionizing how electricity is managed. These innovations offer predictive maintenance capabilities, real-time fault detection, and remote operational control, significantly improving grid reliability and efficiency. Consumer preferences are increasingly leaning towards sophisticated solutions that offer higher energy efficiency, enhanced safety features, and a lower total cost of ownership. The growing adoption of electric vehicles (EVs) and the expansion of data centers are creating new demand pockets for specialized switchgear. Competitive dynamics within the market are intensifying, with both global giants and agile domestic players vying for market share. This competition is spurring continuous product development and price optimization, benefiting end-users. Market penetration for advanced switchgear solutions is steadily increasing, driven by stricter safety regulations and the growing awareness of the economic benefits derived from reliable power supply. The overall market penetration for switchgear solutions is estimated to be around XX% in 2025, with significant room for growth as electrification efforts intensify across all sectors. The industrial segment, in particular, is a significant contributor to market growth, driven by the expansion of manufacturing facilities and the adoption of automation.

Leading Markets & Segments in India Switchgear Market

Within the India Switchgear Market, the Low Voltage (LV) segment demonstrates significant dominance, driven by its ubiquitous application across residential, commercial, and small industrial sectors. The escalating demand for housing, commercial complexes, and the rapid urbanization of Tier 2 and Tier 3 cities are primary catalysts for LV switchgear. Economical policies promoting affordable housing and the government’s vision for smart cities further bolster the demand for reliable and cost-effective LV solutions.

Gas Insulated Switchgear (GIS) is emerging as a critical growth segment, particularly within Medium and High Voltage (MV & HV) applications. The increasing need for space-saving, highly reliable, and maintenance-free switchgear solutions in densely populated urban areas and critical infrastructure projects, such as metro rail, airports, and data centers, fuels GIS adoption. Furthermore, the inherent safety advantages of GIS in harsh environmental conditions make it a preferred choice.

The Industrial end-user segment represents a substantial and growing market for switchgear. This is attributed to the expansion of manufacturing capabilities across sectors like automotive, pharmaceuticals, and heavy industries, all of which require robust and dependable power distribution and control systems. Government initiatives like "Make in India" and the Production Linked Incentive (PLI) schemes are stimulating industrial growth, consequently driving the demand for advanced industrial switchgear.

- Low Voltage (LV) Switchgear Dominance: Driven by residential construction, commercial real estate development, and the expansion of micro, small, and medium enterprises (MSMEs).

- Gas Insulated Switchgear (GIS) Growth: Fueled by the need for compact, reliable, and safe solutions in urban expansion, critical infrastructure, and space-constrained environments.

- Industrial End-User Demand: Supported by manufacturing sector growth, automation adoption, and the establishment of new industrial parks.

- Medium and High Voltage (MV & HV) Significance: Critical for power transmission, distribution networks, and large-scale industrial applications, with an increasing focus on upgrading aging infrastructure.

The dominance of these segments is further amplified by strategic government investments in infrastructure development, renewable energy integration projects, and the modernization of the national grid. The increasing penetration of smart grid technologies is also creating new avenues for advanced MV and HV switchgear solutions.

India Switchgear Market Product Developments

The India Switchgear Market is witnessing a surge in product innovations, driven by the imperative to enhance safety, efficiency, and connectivity. Manufacturers are focusing on developing smart switchgear solutions integrated with IoT capabilities for remote monitoring, diagnostics, and predictive maintenance. Compact and modular designs are gaining traction, especially for Gas Insulated Switchgear (GIS), to optimize space utilization in urban environments and critical facilities like data centers. Increased adoption of advanced materials and insulation technologies is leading to improved performance and extended product lifespans. The competitive advantage is increasingly being derived from the integration of digital features, enhanced cybersecurity measures, and adherence to international safety standards, catering to the evolving demands of sectors like renewable energy, transportation, and smart cities.

Key Drivers of India Switchgear Market Growth

The India Switchgear Market is experiencing robust growth propelled by several key factors. Foremost among these is the significant government push towards electrification and the expansion of the power infrastructure across the nation, driven by initiatives like the Deendayal Upadhyaya Gram Jyoti Yojana and Saubhagya. The rapid integration of renewable energy sources, such as solar and wind power, necessitates advanced switchgear for grid stabilization and efficient power management. Furthermore, the booming industrial sector, particularly manufacturing and data centers, demands reliable and high-capacity switchgear solutions. Technological advancements, including the development of smart grids and IoT-enabled switchgear, are also creating new market opportunities and driving demand for sophisticated products. Economic growth and increased disposable incomes are fueling residential and commercial construction, further boosting the demand for low-voltage switchgear.

- Government Initiatives for Electrification and Infrastructure Development: Programs aimed at universal electricity access and grid modernization.

- Renewable Energy Integration: The growing reliance on solar and wind power requires sophisticated grid management solutions.

- Industrial Expansion and Automation: Increased manufacturing output and the adoption of automated processes drive demand for robust switchgear.

- Technological Advancements: The rise of smart grids, IoT, and digital monitoring systems.

- Urbanization and Real Estate Growth: Expansion of residential and commercial infrastructure.

Challenges in the India Switchgear Market Market

Despite the promising growth trajectory, the India Switchgear Market faces several challenges. Intense price competition, particularly in the low-voltage segment, can impact profit margins for manufacturers. Stringent and evolving regulatory compliance requirements can lead to increased development costs and extended product launch timelines. Fluctuations in raw material prices, such as copper and aluminum, can affect manufacturing costs and supply chain stability. Issues related to the availability of skilled labor for installation and maintenance of complex switchgear systems can also pose a hurdle. Furthermore, the threat of counterfeit products entering the market can undermine the reputation of genuine manufacturers and compromise safety standards. Supply chain disruptions, as evidenced during global events, can also lead to delays and increased costs.

- Intense Price Competition: Particularly in the LV segment, impacting profitability.

- Evolving Regulatory Landscape: Demands constant adaptation and investment in compliance.

- Raw Material Price Volatility: Affecting manufacturing costs and supply chain predictability.

- Shortage of Skilled Labor: For installation, commissioning, and maintenance of advanced systems.

- Counterfeit Products: Threatening market integrity and user safety.

Emerging Opportunities in India Switchgear Market

The India Switchgear Market is ripe with emerging opportunities, particularly driven by the nation's ambitious renewable energy targets and the push towards a digitalized economy. The rapid expansion of electric vehicle (EV) charging infrastructure presents a significant new demand avenue for specialized switchgear. The ongoing development of smart cities necessitates the deployment of advanced, interconnected switchgear solutions for efficient urban utility management. Growing investments in smart grid technologies, including smart meters and automated substations, will further propel the demand for intelligent switchgear. Moreover, the increasing adoption of digital twins and AI-powered analytics for grid management offers opportunities for manufacturers to provide value-added services and solutions. Strategic partnerships between technology providers and switchgear manufacturers can accelerate the development and adoption of cutting-edge products.

- Electric Vehicle (EV) Charging Infrastructure: A burgeoning sector requiring robust charging solutions.

- Smart City Initiatives: Driving demand for interconnected and intelligent grid management.

- Smart Grid Technology Adoption: Focus on automation, data analytics, and remote control.

- Digitalization and IoT Integration: Opportunities for enhanced functionality and predictive maintenance.

- Strategic Alliances: Collaboration to foster innovation and market penetration.

Leading Players in the India Switchgear Market Sector

- Hitachi ABB Power Grids Ltd

- Havells India Ltd

- Siemens AG

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Limited

- HPL Electric and Power Limited

- Schneider Electric SE

- Kirloskar Electric Company

- General Electric Company

Key Milestones in India Switchgear Market Industry

- February 2023: Elmeasure announced its participation in ELECRAMA 2023, showcasing its comprehensive range of low-voltage switchgear. This move signals a focus on product innovation and market visibility within the domestic sector.

- February 2023: ABB India inaugurated its new factory in Nashik, significantly expanding its Gas Insulated Switchgear (GIS) production capacity. This strategic expansion aims to cater to the growing demand for GIS across various critical industries including power distribution, smart cities, data centers, transport, and infrastructure development.

Strategic Outlook for India Switchgear Market Market

The strategic outlook for the India Switchgear Market is exceptionally positive, driven by strong governmental support for infrastructure development and the accelerating pace of digitalization across all economic sectors. The increasing focus on renewable energy integration and grid modernization presents a substantial opportunity for advanced switchgear solutions. Manufacturers are advised to invest in research and development to enhance their offerings with smart functionalities, cybersecurity features, and improved energy efficiency. Strategic collaborations with technology firms and a focus on catering to niche market demands, such as those in the rapidly growing data center and EV charging infrastructure segments, will be crucial for sustained growth. Furthermore, expanding production capabilities and strengthening the domestic supply chain will be key to meeting the escalating demand and mitigating potential disruptions.

Report Period:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

India Switchgear Market Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium and High Voltage

-

2. Insulation

- 2.1. Gas Insulated Switchgear(GIS)

- 2.2. Air Insulated Switchgear(AIS)

-

3. End-User

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

India Switchgear Market Segmentation By Geography

- 1. India

India Switchgear Market Regional Market Share

Geographic Coverage of India Switchgear Market

India Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Industrialization4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Gas Insulated Switchgear Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium and High Voltage

- 5.2. Market Analysis, Insights and Forecast - by Insulation

- 5.2.1. Gas Insulated Switchgear(GIS)

- 5.2.2. Air Insulated Switchgear(AIS)

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi ABB Power Grids Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Havells India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bharat Heavy Electricals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CG Power and Industrial Solutions Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HPL Electric and Power Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kirloskar Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi ABB Power Grids Ltd

List of Figures

- Figure 1: India Switchgear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: India Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: India Switchgear Market Volume Kv Forecast, by Voltage 2020 & 2033

- Table 3: India Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 4: India Switchgear Market Volume Kv Forecast, by Insulation 2020 & 2033

- Table 5: India Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: India Switchgear Market Volume Kv Forecast, by End-User 2020 & 2033

- Table 7: India Switchgear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: India Switchgear Market Volume Kv Forecast, by Region 2020 & 2033

- Table 9: India Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 10: India Switchgear Market Volume Kv Forecast, by Voltage 2020 & 2033

- Table 11: India Switchgear Market Revenue billion Forecast, by Insulation 2020 & 2033

- Table 12: India Switchgear Market Volume Kv Forecast, by Insulation 2020 & 2033

- Table 13: India Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: India Switchgear Market Volume Kv Forecast, by End-User 2020 & 2033

- Table 15: India Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India Switchgear Market Volume Kv Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Switchgear Market?

The projected CAGR is approximately 7.71%.

2. Which companies are prominent players in the India Switchgear Market?

Key companies in the market include Hitachi ABB Power Grids Ltd, Havells India Ltd, Siemens AG, Bharat Heavy Electricals Limited, CG Power and Industrial Solutions Limited, HPL Electric and Power Limited, Schneider Electric SE, Kirloskar Electric Company, General Electric Company.

3. What are the main segments of the India Switchgear Market?

The market segments include Voltage, Insulation, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.83 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Industrialization4.; Government Initiatives.

6. What are the notable trends driving market growth?

Gas Insulated Switchgear Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; High Initial Investment.

8. Can you provide examples of recent developments in the market?

February 2023: Elmeasure announced that it would be participating in ELECRAMA 2023 and would be launching its entire range of low-voltage switchgear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kv.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Switchgear Market?

To stay informed about further developments, trends, and reports in the India Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence