Key Insights

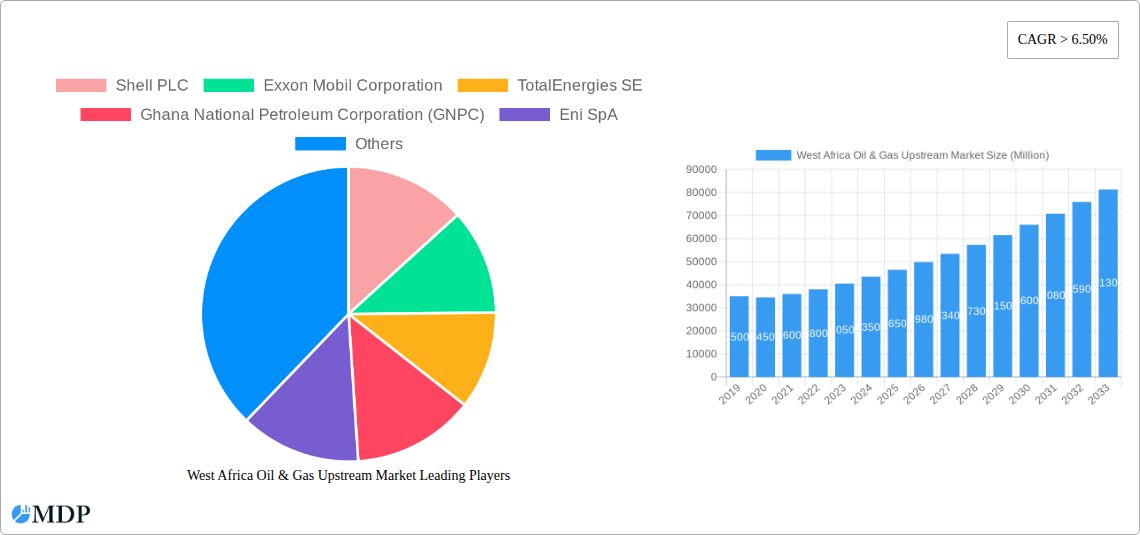

The West Africa Oil & Gas Upstream Market is poised for significant expansion, projected to surpass $50,000 million in size by 2025 and maintain a robust Compound Annual Growth Rate (CAGR) exceeding 6.50% through 2033. This growth is primarily fueled by substantial untapped reserves and ongoing exploration activities across the region, particularly in Nigeria and Ghana. Key drivers include rising global energy demand, technological advancements in extraction and exploration, and supportive government policies aimed at attracting foreign investment in the sector. The market is experiencing a notable shift towards both onshore and offshore deployments, with offshore operations becoming increasingly sophisticated and economically viable due to improved infrastructure and deep-water exploration technologies. Furthermore, the strategic importance of West Africa as a reliable energy supplier continues to bolster investment and development in its upstream sector.

West Africa Oil & Gas Upstream Market Market Size (In Billion)

However, the market also faces inherent challenges that require strategic navigation. Restraints such as fluctuating global oil prices, geopolitical instability in certain regions, and the increasing global focus on energy transition pose potential headwinds. Nevertheless, the persistent demand for hydrocarbons, coupled with substantial proven reserves, provides a strong foundation for sustained growth. The market's segmentation by location of deployment (onshore and offshore) and by geography (Nigeria, Ghana, Ivory Coast, Senegal, and the Rest of West Africa) highlights distinct opportunities and challenges within each segment. Major players like Shell PLC, Exxon Mobil Corporation, and TotalEnergies SE, alongside national oil companies such as the Nigerian National Petroleum Corporation and Ghana National Petroleum Corporation, are actively investing and innovating, driving competition and technological progress within this dynamic energy landscape.

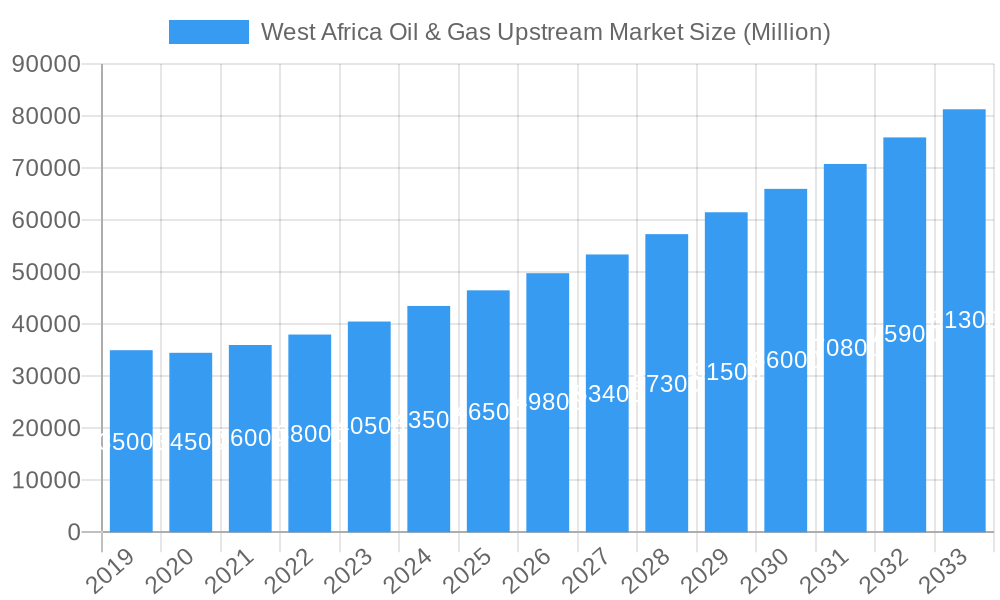

West Africa Oil & Gas Upstream Market Company Market Share

Dive deep into the dynamic West Africa Oil & Gas Upstream Market with this authoritative report, covering the period from 2019 to 2033. This essential resource provides unparalleled insights into market size, growth drivers, and future trajectories for industry leaders, investors, and policymakers. Discover the immense opportunities within this strategically vital region, characterized by significant exploration and production activities.

West Africa Oil & Gas Upstream Market Market Dynamics & Concentration

The West Africa Oil & Gas Upstream Market is characterized by a moderate to high concentration of key players, with companies like Shell PLC, Exxon Mobil Corporation, TotalEnergies SE, and Chevron Corporation holding substantial market shares, estimated to be over 60% combined. Innovation drivers are primarily centered around enhanced oil recovery techniques, deepwater exploration technologies, and the development of efficient production infrastructure to maximize yields from existing and newly discovered reserves. The regulatory frameworks across West African nations are evolving, with a growing emphasis on local content policies and revenue maximization, creating both opportunities and complexities for operators. Product substitutes, while present in the broader energy mix, have minimal direct impact on the upstream sector's core activities of exploration and production. End-user trends in the global energy market, particularly the demand for oil and gas, directly influence upstream investment decisions and production levels. Mergers & Acquisitions (M&A) activities, though not at a fever pitch, are strategic, focusing on consolidating acreage and acquiring advanced technological capabilities. In the historical period (2019-2024), approximately 15 significant M&A deals were recorded, with an average transaction value exceeding $500 Million.

West Africa Oil & Gas Upstream Market Industry Trends & Analysis

The West Africa Oil & Gas Upstream Market is poised for significant expansion, driven by a confluence of factors including substantial untapped hydrocarbon reserves, increasing global energy demand, and favorable investment climates in select nations. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be a robust 5.2%, with an estimated market size of $120 Billion by 2033. Technological disruptions are playing a pivotal role, with the adoption of advanced seismic imaging, subsea processing, and digital twin technologies enhancing exploration success rates and optimizing production efficiency, thereby reducing operational costs by an estimated 15%. Consumer preferences are increasingly leaning towards cleaner energy solutions, but the immediate demand for oil and gas in emerging economies and for industrial applications continues to underpin the upstream market's relevance. Competitive dynamics are intense, with established supermajors vying for prime exploration blocks against national oil companies and emerging independent producers. Market penetration of new technologies is steadily increasing, with offshore deepwater projects leading the charge in adopting cutting-edge solutions.

Leading Markets & Segments in West Africa Oil & Gas Upstream Market

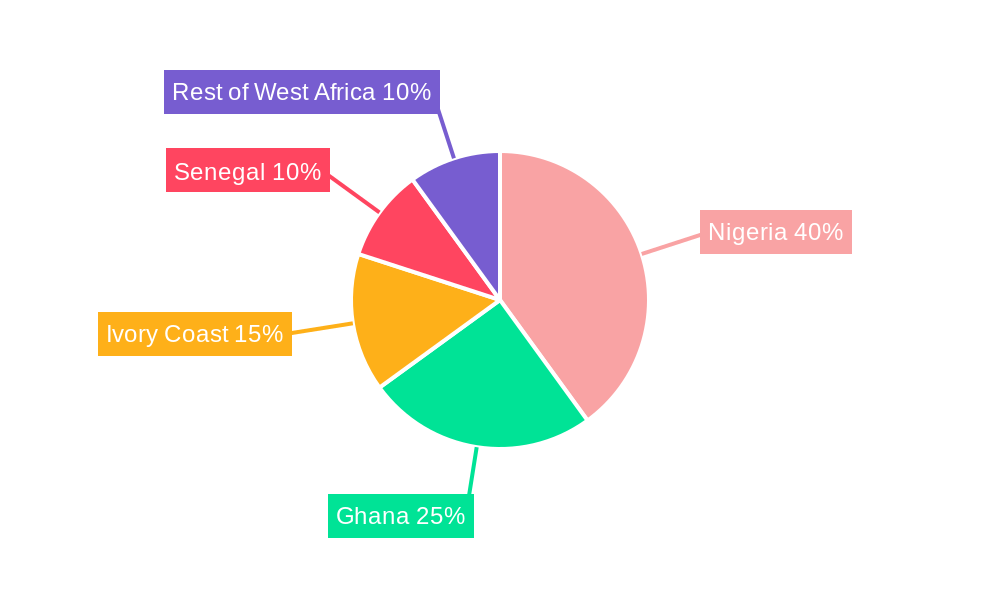

Nigeria stands as the dominant market within the West Africa Oil & Gas Upstream sector, accounting for an estimated 45% of the region's total production and exploration activities. This dominance is underpinned by its extensive proven reserves and established infrastructure, coupled with supportive government policies aimed at attracting foreign investment. Offshore deployment represents the most significant segment, contributing approximately 70% of the total production, driven by the vast deepwater and ultra-deepwater discoveries that promise substantial yields. Key drivers for Nigeria's leadership include economic policies that offer attractive fiscal terms for exploration and production, significant government investments in offshore infrastructure, and the presence of major international oil companies with extensive operational experience. Ghana is emerging as a rapidly growing market, with its offshore fields demonstrating considerable potential, contributing around 15% to the regional upstream market. Ivory Coast and Senegal are also experiencing renewed interest and investment, particularly in their offshore basins, collectively accounting for approximately 10% of the market. The "Rest of West Africa" segment, encompassing countries like Mauritania and Equatorial Guinea, is also showing promising exploration prospects, contributing the remaining 10% and representing significant future growth potential.

West Africa Oil & Gas Upstream Market Product Developments

Product developments in the West Africa Oil & Gas Upstream Market are largely focused on enhancing the efficiency and sustainability of exploration and production operations. Innovations in seismic data processing are leading to more accurate subsurface imaging, reducing exploration risks. Advancements in subsea technology are enabling the development of deeper and more complex fields, while floating production storage and offloading (FPSO) units are becoming more sophisticated, increasing production capacity and flexibility. Furthermore, the development of digital solutions, including AI-powered predictive maintenance and remote monitoring systems, is crucial for optimizing asset performance and reducing operational downtime. These technological advancements provide a significant competitive advantage by lowering extraction costs and improving safety standards, thereby attracting substantial investment in new projects.

Key Drivers of West Africa Oil & Gas Upstream Market Growth

Several key factors are propelling the growth of the West Africa Oil & Gas Upstream Market. Firstly, the region boasts substantial untapped hydrocarbon reserves, particularly in its deepwater offshore basins, attracting significant exploration investment. Secondly, the persistent global demand for oil and gas, especially from emerging economies, ensures continued interest in developing these resources. Thirdly, the implementation of favorable fiscal regimes and local content policies in countries like Nigeria and Ghana is creating an attractive environment for international oil companies. Technological advancements in exploration and production techniques, such as advanced seismic imaging and subsea technology, are also critical enablers, making previously challenging reserves economically viable.

Challenges in the West Africa Oil & Gas Upstream Market Market

Despite its potential, the West Africa Oil & Gas Upstream Market faces several challenges. Regulatory hurdles, including inconsistencies in policy implementation and prolonged approval processes, can hinder project timelines and increase operational costs. Supply chain disruptions, exacerbated by logistical complexities in remote offshore locations and global events, can lead to significant delays and cost overruns, impacting project economics. Furthermore, intense competition for exploration blocks and the capital-intensive nature of upstream projects present financial barriers for smaller players. Security concerns in certain regions can also impact operational continuity and investor confidence, requiring substantial security investments.

Emerging Opportunities in West Africa Oil & Gas Upstream Market

Emerging opportunities in the West Africa Oil & Gas Upstream Market are primarily driven by technological breakthroughs and strategic market expansion. The increasing adoption of digitalization and automation promises to enhance operational efficiency and reduce costs, making marginal fields more viable. Furthermore, the discovery of new hydrocarbon reserves, particularly in ultra-deepwater environments, presents significant long-term growth potential. Strategic partnerships between national oil companies and international majors are crucial for sharing expertise and capital, fostering collaborative development. Market expansion into previously underexplored frontier areas within West Africa also represents a significant avenue for future growth and resource development.

Leading Players in the West Africa Oil & Gas Upstream Market Sector

- Shell PLC

- Exxon Mobil Corporation

- TotalEnergies SE

- Ghana National Petroleum Corporation (GNPC)

- Eni SpA

- BP PLC

- Nigerian National Petroleum Corporation

- Chevron Corporation

- Cairn Energy PLC

Key Milestones in West Africa Oil & Gas Upstream Market Industry

- July 2022: Tullow Energy announced the finalization of the development concept for its Tweneboa-Enyenra-Ntomme (TEN) field offshore Ghana, aiming to tap 750 million barrels of oil, signaling a significant step towards enhanced production in the region.

- July 2022: TotalEnergies SE commenced production from the Ikike field in Nigeria, with an expected peak production of 50,000 barrels of oil equivalent per day by the end of 2022, demonstrating continued upstream investment and success in Nigeria.

Strategic Outlook for West Africa Oil & Gas Upstream Market Market

The strategic outlook for the West Africa Oil & Gas Upstream Market is one of sustained growth and evolving opportunities. The region's rich endowment of hydrocarbon resources, coupled with ongoing technological advancements, positions it as a critical player in the global energy landscape for the foreseeable future. Increased focus on natural gas development, driven by its role as a transition fuel, presents a significant avenue for expansion. The market is expected to witness continued investment in deepwater exploration and production, supported by favorable regulatory environments and strategic partnerships. Companies that can effectively navigate regulatory complexities, embrace innovative technologies, and prioritize sustainable practices will be best positioned to capitalize on the immense potential of this dynamic market.

West Africa Oil & Gas Upstream Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Nigeria

- 2.2. Ghana

- 2.3. Ivory Coast

- 2.4. Senegal

- 2.5. Rest of West Africa

West Africa Oil & Gas Upstream Market Segmentation By Geography

- 1. Nigeria

- 2. Ghana

- 3. Ivory Coast

- 4. Senegal

- 5. Rest of West Africa

West Africa Oil & Gas Upstream Market Regional Market Share

Geographic Coverage of West Africa Oil & Gas Upstream Market

West Africa Oil & Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. The Offshore Segment is Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ghana

- 5.2.3. Ivory Coast

- 5.2.4. Senegal

- 5.2.5. Rest of West Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ghana

- 5.3.3. Ivory Coast

- 5.3.4. Senegal

- 5.3.5. Rest of West Africa

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Nigeria West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ghana

- 6.2.3. Ivory Coast

- 6.2.4. Senegal

- 6.2.5. Rest of West Africa

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Ghana West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ghana

- 7.2.3. Ivory Coast

- 7.2.4. Senegal

- 7.2.5. Rest of West Africa

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Ivory Coast West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ghana

- 8.2.3. Ivory Coast

- 8.2.4. Senegal

- 8.2.5. Rest of West Africa

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Senegal West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ghana

- 9.2.3. Ivory Coast

- 9.2.4. Senegal

- 9.2.5. Rest of West Africa

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Rest of West Africa West Africa Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Nigeria

- 10.2.2. Ghana

- 10.2.3. Ivory Coast

- 10.2.4. Senegal

- 10.2.5. Rest of West Africa

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shell PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Exxon Mobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TotalEnergies SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ghana National Petroleum Corporation (GNPC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eni SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BP PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nigerian National Petroleum Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chevron Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cairn Energy PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Shell PLC

List of Figures

- Figure 1: West Africa Oil & Gas Upstream Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: West Africa Oil & Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 5: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 8: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 11: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 14: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 17: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: West Africa Oil & Gas Upstream Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Oil & Gas Upstream Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the West Africa Oil & Gas Upstream Market?

Key companies in the market include Shell PLC, Exxon Mobil Corporation, TotalEnergies SE, Ghana National Petroleum Corporation (GNPC), Eni SpA, BP PLC, Nigerian National Petroleum Corporation, Chevron Corporation*List Not Exhaustive, Cairn Energy PLC.

3. What are the main segments of the West Africa Oil & Gas Upstream Market?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

The Offshore Segment is Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

July 2022: Tullow Energy announced that the company was finalizing the development concept for its Tweneboa-Enyenra-Ntomme (TEN) field offshore Ghana. The development concept aims to tap 750 million barrels of oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Oil & Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Oil & Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Oil & Gas Upstream Market?

To stay informed about further developments, trends, and reports in the West Africa Oil & Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence