Key Insights

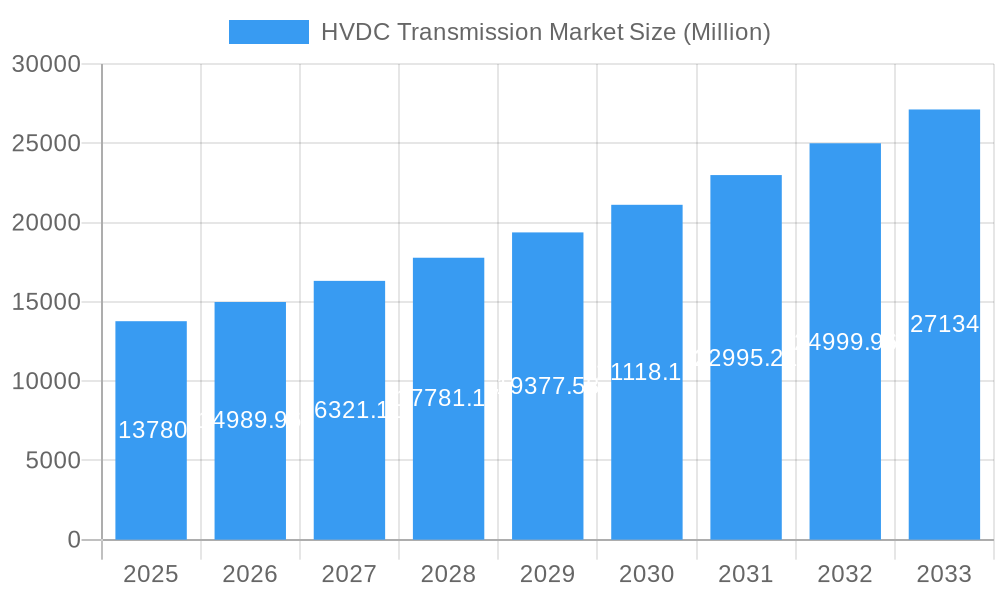

The High Voltage Direct Current (HVDC) transmission market is poised for substantial expansion, projected to reach a market size of approximately $13.78 billion by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 9.28% anticipated over the forecast period of 2025-2033. A primary driver for this expansion is the increasing global demand for efficient and long-distance power transmission, particularly as renewable energy sources like wind and solar become more integrated into national grids. HVDC technology offers significant advantages over traditional High Voltage Alternating Current (HVDC) in terms of reduced energy losses, smaller right-of-way requirements, and the ability to transmit power over much longer distances, making it an indispensable solution for connecting remote generation sites to load centers. Furthermore, the growing need for grid modernization, enhanced grid stability, and intercontinental power exchange are significant catalysts propelling market growth. The shift towards decarbonization and the electrification of various sectors also contribute to the rising adoption of HVDC systems.

HVDC Transmission Market Market Size (In Billion)

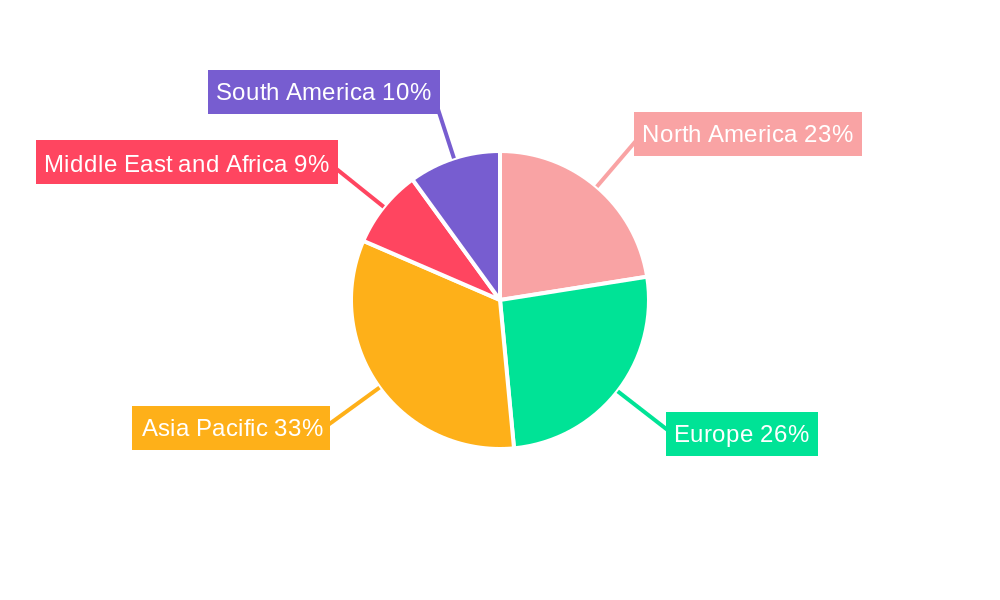

The market is segmented into distinct transmission types: Submarine HVDC Transmission Systems, HVDC Overhead Transmission Systems, and HVDC Underground Transmission Systems. Each segment caters to specific infrastructure needs, with submarine cables playing a crucial role in offshore wind farm connections and intercontinental links, while overhead and underground systems are vital for bulk power transmission across vast landmasses and urban environments. Key components such as converter stations and transmission cables are central to the functioning of these systems, with ongoing advancements in technology leading to increased efficiency and reliability. Major industry players like ABB Ltd, Siemens AG, and General Electric Company are at the forefront of innovation, investing heavily in research and development to offer cutting-edge solutions. Geographically, Asia Pacific, driven by China and India's rapid industrialization and renewable energy initiatives, is expected to be a dominant region. North America and Europe also represent significant markets due to grid upgrades and the integration of renewable energy sources.

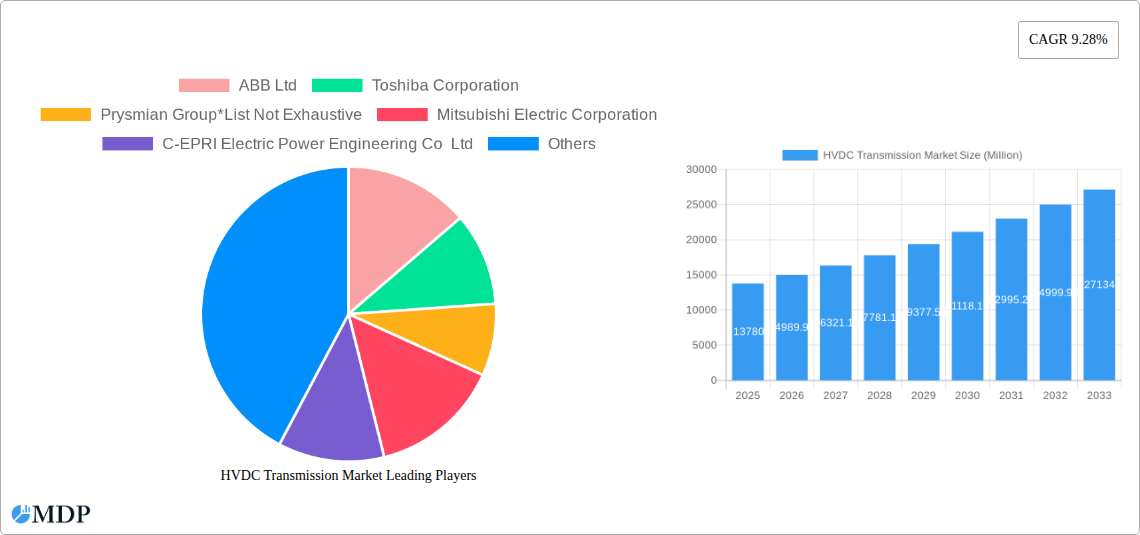

HVDC Transmission Market Company Market Share

This comprehensive HVDC Transmission Market report provides an in-depth analysis of the global high-voltage direct current transmission systems sector, meticulously examining trends, drivers, challenges, and opportunities from 2019 to 2033. With the base year set at 2025 and an extensive forecast period extending to 2033, this research offers invaluable insights for industry stakeholders, investors, and policymakers navigating this critical infrastructure market. Discover how HVDC technology is revolutionizing long-distance power transmission, supporting renewable energy integration, and enabling a more robust and efficient global grid.

The report delves into key segments including Submarine HVDC Transmission Systems, HVDC Overhead Transmission Systems, and HVDC Underground Transmission Systems, alongside essential components like Converter Stations and Transmission Medium (Cables). We explore the strategic initiatives of industry giants such as ABB Ltd, Toshiba Corporation, Prysmian Group, Mitsubishi Electric Corporation, C-EPRI Electric Power Engineering Co Ltd, Siemens AG, and General Electric Company, offering a clear picture of market concentration and competitive landscape.

HVDC Transmission Market Market Dynamics & Concentration

The global HVDC transmission market is characterized by moderate to high concentration, with a few key players holding significant market share. Innovation is a primary driver, fueled by the relentless pursuit of higher efficiency, reduced losses, and enhanced grid stability. Regulatory frameworks play a crucial role, with governments worldwide implementing policies to support the expansion of power transmission infrastructure and the integration of renewable energy sources, often mandating the use of advanced HVDC solutions. Product substitutes, such as High Voltage Alternating Current (HVAC) systems, are gradually being outpaced by HVDC for long-distance and high-capacity power transfer due to HVDC's inherent advantages in efficiency and lower transmission losses. End-user trends indicate a strong preference for HVDC systems in offshore wind farm connections, intercontinental power grids, and the stabilization of national grids with intermittent renewable generation. Mergers and acquisition (M&A) activities are moderate, primarily focused on consolidating expertise, expanding geographical reach, and acquiring innovative technologies. For instance, the acquisition of specialized HVDC cable manufacturers or control system developers could enhance a company's market position. The number of significant M&A deals in the past three years is estimated to be around 10-15, with deal values ranging from tens of millions to over a billion dollars.

HVDC Transmission Market Industry Trends & Analysis

The HVDC transmission market is experiencing robust growth, driven by the escalating global demand for electricity, the increasing penetration of renewable energy sources, and the need for efficient and reliable long-distance power transfer. The Compound Annual Growth Rate (CAGR) for the HVDC transmission market is projected to be approximately 6.5% during the forecast period of 2025-2033. This growth is primarily attributed to the expanding integration of remote renewable energy generation sites, such as offshore wind farms and large-scale solar projects, which often require efficient transmission over significant distances to load centers. Technological advancements in converter technologies, particularly Voltage Source Converters (VSCs), are enabling smaller, more efficient, and more flexible HVDC systems, making them increasingly viable for a wider range of applications. Consumer preferences are shifting towards cleaner energy and grid stability, which HVDC systems inherently support by enabling better control and integration of variable renewable energy. Competitive dynamics are intensifying as established players innovate and new entrants leverage emerging technologies. Market penetration of HVDC technology is steadily increasing, moving beyond traditional bulk power transmission to encompass grid stabilization, interconnecting asynchronous grids, and supporting the electrification of remote areas. The increasing complexity of power grids and the need to manage bidirectional power flow are also significant market drivers. The capacity of HVDC links installed globally is expected to reach over 500,000 MW by 2030, showcasing the substantial market penetration and ongoing expansion.

Leading Markets & Segments in HVDC Transmission Market

The HVDC Overhead Transmission System segment currently dominates the global market, owing to its cost-effectiveness for transmitting large amounts of power over very long distances, particularly in landlocked regions and for intercontinental connections. Key drivers for its dominance include supportive government policies for grid expansion, the need to connect remote resource-rich areas to consumption centers, and the development of large-scale hydropower projects. Asia Pacific, particularly China, leads in the adoption of HVDC overhead lines due to its vast geographical expanse and the imperative to transport electricity from its western power generation hubs to its densely populated eastern cities.

The Submarine HVDC Transmission System segment is experiencing the fastest growth, driven by the rapid expansion of offshore wind farms. Countries with extensive coastlines and ambitious renewable energy targets, such as the United Kingdom, Germany, Denmark, and increasingly countries in Asia and North America, are investing heavily in subsea HVDC cables. These systems are crucial for efficiently transmitting power generated far offshore to the onshore grid with minimal energy loss. Factors contributing to its rise include advancements in cable technology, improved installation techniques, and stringent environmental regulations favoring renewable energy.

The HVDC Underground Transmission System segment, while smaller, is crucial for urban environments and sensitive ecological areas where overhead lines are not feasible. Its growth is spurred by the need to upgrade aging urban power grids, enhance reliability, and accommodate increasing power demands in densely populated areas.

Converter Stations are integral to all HVDC systems, and their technological evolution, including the widespread adoption of VSC technology, is a key enabler for the entire market. Advancements in miniaturization and efficiency of converter stations are crucial for both overhead and submarine applications.

Transmission Medium (Cables) technology, particularly for submarine applications, is witnessing significant innovation, with higher voltage ratings and improved durability enabling longer and more complex subsea connections. The increasing demand for high-capacity, reliable power transfer underpins the growth across all these segments.

HVDC Transmission Market Product Developments

Product development in the HVDC transmission market is primarily focused on enhancing efficiency, reliability, and reducing the footprint of converter stations and transmission cables. Innovations in Voltage Source Converter (VSC) technology are leading to more compact, modular, and flexible systems capable of rapid power flow reversal, crucial for grid stability and renewable integration. Advancements in high-temperature superconducting (HTS) cables, though still in early stages of commercialization, promise significantly lower losses and higher power density for future underground and submarine applications. The development of advanced control systems and digital solutions for HVDC grids is also a key trend, enabling enhanced grid management, fault detection, and integration of distributed energy resources.

Key Drivers of HVDC Transmission Market Growth

Several key drivers are propelling the growth of the HVDC transmission market. The global surge in renewable energy adoption, particularly offshore wind and large-scale solar, necessitates efficient long-distance transmission solutions like HVDC to connect remote generation sites to consumption centers. Economic growth and rising energy demands, especially in developing nations, are spurring investments in robust and modern power grids, where HVDC excels. Aging grid infrastructure in developed economies requires upgrades and modernizations, with HVDC offering a superior solution for increased capacity and reliability. Furthermore, the growing emphasis on grid stability and the integration of decentralized energy sources are driving the adoption of HVDC's superior controllability.

Challenges in the HVDC Transmission Market Market

Despite its advantages, the HVDC transmission market faces several challenges. The initial capital investment for HVDC projects, particularly converter stations, is generally higher compared to HVAC systems, which can be a barrier, especially in regions with limited funding. Complex regulatory approvals and lengthy permitting processes for large-scale infrastructure projects can significantly delay project timelines. Supply chain constraints for critical components, such as specialized transformers and advanced semiconductors, can impact project execution and lead times. Finally, the availability of skilled labor for the design, installation, and maintenance of complex HVDC systems remains a concern in certain regions.

Emerging Opportunities in HVDC Transmission Market

Emerging opportunities in the HVDC transmission market are diverse and significant. The increasing interconnectedness of national and regional grids to create larger, more resilient power pools presents substantial opportunities for HVDC interconnections. The growing demand for energy storage solutions, such as grid-scale batteries, will require robust transmission infrastructure, including HVDC, to efficiently integrate these systems. The ongoing trend of grid modernization and digitalization is creating opportunities for smart HVDC grids with advanced control and monitoring capabilities. Furthermore, the development of new HVDC technologies, such as ±800 kV and higher voltage levels, will unlock new possibilities for ultra-long-distance power transmission and mega-project integration.

Leading Players in the HVDC Transmission Market Sector

Key Milestones in HVDC Transmission Market Industry

Strategic Outlook for HVDC Transmission Market Market

The strategic outlook for the HVDC transmission market is exceptionally positive, driven by the global imperative to decarbonize energy systems and ensure reliable power delivery. Investments in grid modernization, renewable energy integration, and the development of smart grids will continue to fuel demand. Companies that focus on technological innovation, particularly in VSC technology and advanced cable solutions, and that can navigate complex regulatory landscapes, are poised for significant growth. Strategic partnerships and collaborations will be crucial for addressing the scale and complexity of upcoming HVDC projects, especially those involving cross-border interconnections and offshore renewable energy hubs. The market is expected to witness continued expansion in both established and emerging economies as the world transitions towards a sustainable and resilient energy future.

- ABB Ltd

- Toshiba Corporation

- Prysmian Group

- Mitsubishi Electric Corporation

- C-EPRI Electric Power Engineering Co Ltd

- Siemens AG

- General Electric Company

- March 2023: OWC invites developers to do more site-specific research to examine HVDC as a potential export transmission method in connection with Poland's second phase of seabed leasing for far offshore wind farms.

- July 2022: Adani Transmission signed a contract with Hitachi Energy to address the growing demand for energy in Mumbai to provide a high-voltage direct current (HVDC) transmission system from Kudus to Mumbai on India's west coast. The new HVDC link will give the city 1,000MW of additional electricity.

- February 2022: McDermott International was awarded its largest-ever renewable energy contract from TenneT for the BorWin6 980 MW high-voltage direct current project. The project is for designing, manufacturing, installing, and commissioning an HVDC offshore converter platform located 118 miles offshore of Germany on the North Sea Cluster 7 platform.

HVDC Transmission Market Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

HVDC Transmission Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of the Asia Pacific

-

4. Middle East and Africa

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. South Africa

- 4.4. Rest of the Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of the South America

HVDC Transmission Market Regional Market Share

Geographic Coverage of HVDC Transmission Market

HVDC Transmission Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth of Utility-Scale Renewable Energy Plants4.; Rural Electrification Plans Worlwide

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Distributed and Off-Grid Power Generation

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission Systems to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. North America HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Overhead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Europe HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Overhead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Asia Pacific HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Overhead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. Middle East and Africa HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Submarine HVDC Transmission System

- 9.1.2. HVDC Overhead Transmission System

- 9.1.3. HVDC Underground Transmission System

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Converter Stations

- 9.2.2. Transmission Medium (Cables)

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. South America HVDC Transmission Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10.1.1. Submarine HVDC Transmission System

- 10.1.2. HVDC Overhead Transmission System

- 10.1.3. HVDC Underground Transmission System

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Converter Stations

- 10.2.2. Transmission Medium (Cables)

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Prysmian Group*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C-EPRI Electric Power Engineering Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global HVDC Transmission Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America HVDC Transmission Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 3: North America HVDC Transmission Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 4: North America HVDC Transmission Market Revenue (Million), by Component 2025 & 2033

- Figure 5: North America HVDC Transmission Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America HVDC Transmission Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America HVDC Transmission Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe HVDC Transmission Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 9: Europe HVDC Transmission Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 10: Europe HVDC Transmission Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe HVDC Transmission Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe HVDC Transmission Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe HVDC Transmission Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific HVDC Transmission Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 15: Asia Pacific HVDC Transmission Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 16: Asia Pacific HVDC Transmission Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Pacific HVDC Transmission Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Pacific HVDC Transmission Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific HVDC Transmission Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa HVDC Transmission Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 21: Middle East and Africa HVDC Transmission Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 22: Middle East and Africa HVDC Transmission Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Middle East and Africa HVDC Transmission Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Middle East and Africa HVDC Transmission Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa HVDC Transmission Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America HVDC Transmission Market Revenue (Million), by Transmission Type 2025 & 2033

- Figure 27: South America HVDC Transmission Market Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 28: South America HVDC Transmission Market Revenue (Million), by Component 2025 & 2033

- Figure 29: South America HVDC Transmission Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: South America HVDC Transmission Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America HVDC Transmission Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 2: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global HVDC Transmission Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 5: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global HVDC Transmission Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States of America HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of the North America HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 11: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global HVDC Transmission Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Europe HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 19: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global HVDC Transmission Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of the Asia Pacific HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 26: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global HVDC Transmission Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: United Arab Emirates HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Saudi Arabia HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of the Middle East and Africa HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global HVDC Transmission Market Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 33: Global HVDC Transmission Market Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global HVDC Transmission Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of the South America HVDC Transmission Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVDC Transmission Market?

The projected CAGR is approximately 9.28%.

2. Which companies are prominent players in the HVDC Transmission Market?

Key companies in the market include ABB Ltd, Toshiba Corporation, Prysmian Group*List Not Exhaustive, Mitsubishi Electric Corporation, C-EPRI Electric Power Engineering Co Ltd, Siemens AG, General Electric Company.

3. What are the main segments of the HVDC Transmission Market?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth of Utility-Scale Renewable Energy Plants4.; Rural Electrification Plans Worlwide.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission Systems to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Distributed and Off-Grid Power Generation.

8. Can you provide examples of recent developments in the market?

In March 2023, OWC invites developers to do more site-specific research to examine HVDC as a potential export transmission method in connection with Poland's second phase of seabed leasing for far offshore wind farms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVDC Transmission Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVDC Transmission Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVDC Transmission Market?

To stay informed about further developments, trends, and reports in the HVDC Transmission Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence