Key Insights

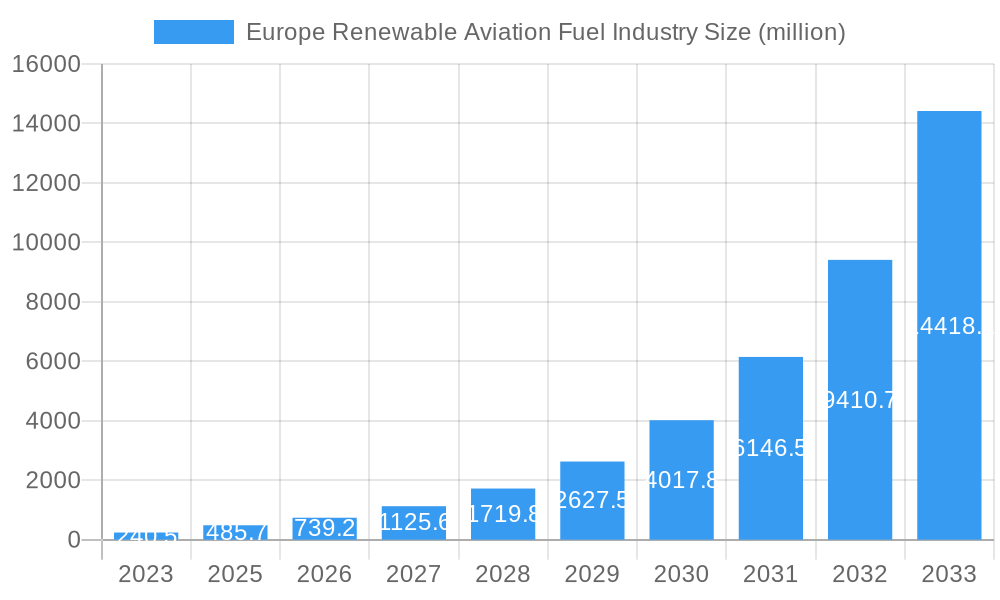

The European Renewable Aviation Fuel (RAF) industry is experiencing exceptional growth, projected to reach an estimated €240.5 million in 2023, with an astonishing CAGR of 43.2% during the forecast period. This rapid expansion is primarily driven by a confluence of robust regulatory support, increasing environmental consciousness among airlines and passengers, and significant technological advancements in sustainable fuel production. The urgency to decarbonize the aviation sector, a major contributor to greenhouse gas emissions, is pushing the adoption of RAF across Europe. Governments are implementing stringent policies and offering incentives to encourage investment and uptake, creating a favorable ecosystem for RAF development and deployment. Key drivers include mandates for biofuel blending, carbon pricing mechanisms, and corporate sustainability goals that are compelling airlines to seek greener alternatives.

Europe Renewable Aviation Fuel Industry Market Size (In Million)

The industry is witnessing a dynamic shift with the dominance of technologies like Fischer-Tropsch (FT) and Hydroprocessed Esters and Fatty Acids (HEFA), which are becoming increasingly efficient and cost-effective. The demand for RAF is escalating for both commercial and defense applications, as both sectors face increasing pressure to reduce their carbon footprint. While the market is poised for substantial growth, certain restraints, such as the high cost of sustainable feedstock, infrastructure limitations for production and distribution, and the need for greater public and private investment, need to be addressed. However, the strong commitment from major players like Honeywell International Inc., Total Energies SA, and Neste Oyj, coupled with ongoing research and development, is expected to overcome these challenges, paving the way for a truly sustainable aviation future in Europe.

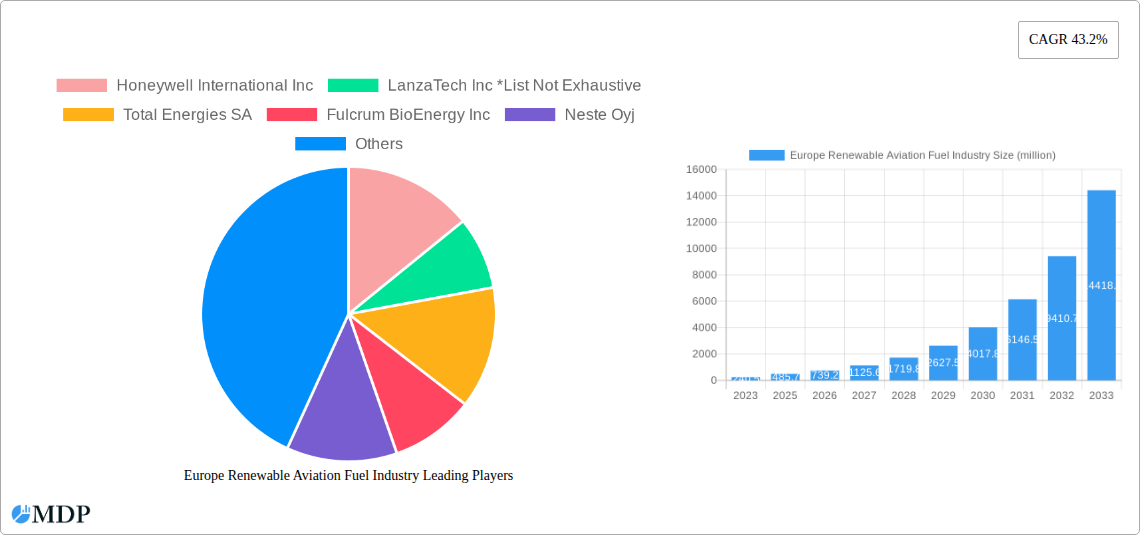

Europe Renewable Aviation Fuel Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Renewable Aviation Fuel (RAF) industry, covering market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this report offers unparalleled insights for industry stakeholders, investors, and policymakers navigating the rapidly evolving sustainable aviation fuel market. We delve into the critical factors shaping the industry, including technological advancements, regulatory support, and the increasing demand for greener aviation solutions.

Europe Renewable Aviation Fuel Industry Market Dynamics & Concentration

The Europe Renewable Aviation Fuel industry is characterized by a dynamic landscape with significant innovation drivers and a robust regulatory framework designed to accelerate SAF adoption. Market concentration is moderate, with key players investing heavily in research and development to scale up production. Innovation is primarily driven by the urgent need to decarbonize aviation, pushing for advanced technologies and sustainable feedstock sourcing. Regulatory frameworks, such as the EU's ReFuelEU Aviation initiative, are pivotal in mandating SAF blending targets and providing incentives, thereby influencing market share. Product substitutes, while nascent, include hydrogen and electric propulsion, but their widespread adoption in aviation remains long-term. End-user trends show a strong preference for RAF due to increasing environmental consciousness and corporate sustainability goals. Mergers and acquisitions (M&A) activity is on the rise as companies seek to consolidate their market position and secure feedstock supply chains. For instance, the past few years have seen several strategic partnerships and acquisitions aimed at bolstering production capacity. The M&A deal count is projected to increase as the market matures.

Europe Renewable Aviation Fuel Industry Industry Trends & Analysis

The Europe Renewable Aviation Fuel industry is experiencing a significant growth trajectory, primarily fueled by ambitious climate targets and a growing imperative for aviation decarbonization. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period, reflecting strong investor confidence and increasing governmental support. Technological disruptions are at the forefront, with advancements in Fischer-Tropsch (FT) and Hydroprocessed Esters and Fatty Acids (HEFA) technologies driving efficiency and scalability. Consumer preferences are shifting decisively towards airlines and travel providers demonstrating a commitment to sustainability, thereby creating a pull for SAF. Competitive dynamics are intensifying, with established energy giants and dedicated biofuel producers vying for market leadership through strategic investments, joint ventures, and capacity expansions. Market penetration of SAF is expected to grow exponentially as regulatory mandates come into full effect and production costs become more competitive. The industry is also witnessing a diversification of feedstock sources, moving beyond traditional oils to include waste materials and agricultural residues, which further enhances the sustainability profile of RAF.

Leading Markets & Segments in Europe Renewable Aviation Fuel Industry

The European market for Renewable Aviation Fuel is dominated by Western European nations, with significant leadership exhibited by countries like Germany, France, the Netherlands, and the UK. These regions benefit from strong governmental support, well-established infrastructure for biofuel production, and a higher concentration of major airlines with ambitious sustainability commitments.

Technology Dominance:

- Hydroprocessed Esters and Fatty Acids (HEFA): Currently, HEFA technology holds a leading position due to its maturity, cost-effectiveness, and the availability of suitable feedstock such as used cooking oil and animal fats. This segment is driven by its ability to produce drop-in fuels that can be readily integrated into existing aviation infrastructure.

- Fischer-Tropsch (FT): While currently having a smaller market share, FT technology, which converts synthesis gas into liquid hydrocarbons, is poised for significant growth. Its advantage lies in its versatility with various feedstocks, including municipal solid waste and biomass. Growing investments are focused on improving its efficiency and reducing production costs to compete with HEFA.

- Synthesi: This category represents emerging and less established technologies, which, while not yet dominant, are crucial for future innovation and diversification of SAF production pathways.

Application Dominance:

- Commercial Aviation: This segment represents the largest and fastest-growing application for RAF. Driven by increasing passenger demand for sustainable travel options and regulatory mandates for airlines, the commercial sector is the primary focus for SAF deployment. Economic policies supporting fleet modernization and carbon offsetting initiatives further bolster this segment.

- Defense Aviation: While currently a smaller segment, defense aviation is increasingly exploring and adopting RAF to meet its own sustainability goals and reduce reliance on fossil fuels, particularly in regions with strict environmental regulations. The strategic imperative for energy independence also plays a role.

Europe Renewable Aviation Fuel Industry Product Developments

Product developments in the Europe Renewable Aviation Fuel industry are centered on enhancing the sustainability and cost-competitiveness of SAF. Innovations are focused on expanding the range of viable feedstocks, including advanced waste streams and cultivated algae, to reduce reliance on first-generation biofuels. Companies are also investing in improving the efficiency of conversion processes for technologies like Fischer-Tropsch and HEFA, aiming for higher yields and lower energy consumption. The development of novel catalysts and biorefinery concepts are key areas of research. These advancements aim to create 'drop-in' fuels that seamlessly integrate into existing aircraft engines and fuel infrastructure, offering a direct pathway to emissions reduction with minimal retrofitting. The competitive advantage lies in achieving a balance between feedstock availability, conversion efficiency, and regulatory compliance, making RAF a viable and attractive alternative to conventional jet fuel.

Key Drivers of Europe Renewable Aviation Fuel Industry Growth

The growth of the Europe Renewable Aviation Fuel industry is propelled by a confluence of powerful drivers. Foremost is the stringent regulatory landscape, with mandates for increasing SAF blending percentages and ambitious emissions reduction targets for the aviation sector. Technologically, advancements in biofuel conversion processes, such as improved Fischer-Tropsch synthesis and HEFA technologies, are making SAF production more efficient and scalable. Economically, falling production costs, driven by technological innovation and increased investment, are making SAF more competitive with conventional jet fuel. Furthermore, growing corporate sustainability commitments from airlines and aviation stakeholders, coupled with increasing consumer demand for eco-friendly travel options, are creating a significant market pull for renewable aviation fuels.

Challenges in the Europe Renewable Aviation Fuel Industry Market

Despite its promising growth, the Europe Renewable Aviation Fuel industry faces several significant challenges. A primary hurdle is the current high cost of production compared to conventional jet fuel, which can deter widespread adoption. Feedstock availability and sustainability concerns also pose a challenge; ensuring a consistent and environmentally responsible supply of waste oils, biomass, and other advanced feedstocks is crucial. Regulatory uncertainties and the need for harmonized standards across different European countries can create complexity for producers and end-users. Moreover, the long-term infrastructure development required to support large-scale SAF production and distribution remains a considerable undertaking. Finally, the competitive pressure from alternative decarbonization technologies, while not immediate threats, necessitate continuous innovation and cost reduction efforts.

Emerging Opportunities in Europe Renewable Aviation Fuel Industry

Emerging opportunities in the Europe Renewable Aviation Fuel industry are abundant and are poised to accelerate its growth. Technological breakthroughs in areas such as advanced biofuels from waste streams, electrofuels (e-fuels), and synthetic fuels are opening up new pathways for SAF production with potentially lower costs and higher sustainability credentials. Strategic partnerships between fuel producers, airlines, and technology providers are crucial catalysts, fostering collaboration for feedstock sourcing, production scale-up, and market deployment. Government incentives and carbon pricing mechanisms are expected to further drive demand and investment. The expansion of RAF into new geographic markets within Europe, coupled with the development of innovative business models and funding mechanisms, will also be key to unlocking further potential and driving long-term growth in the sustainable aviation sector.

Leading Players in the Europe Renewable Aviation Fuel Industry Sector

- Honeywell International Inc

- LanzaTech Inc

- Total Energies SA

- Fulcrum BioEnergy Inc

- Neste Oyj

- Swedish Biofuels AB

- Gevo Inc

Key Milestones in Europe Renewable Aviation Fuel Industry Industry

- December 2022: TotalEnergies signed a memorandum of understanding to deliver more than one million cubic meters/800,000 tonnes of sustainable aviation fuel to Air France-KLM Group airlines over the ten years from 2023 to 2033, significantly boosting SAF supply commitment.

- January 2022: Cepsa signed an agreement with Iberia and Iberia Express for the development and large-scale production of sustainable aviation fuel. The agreement contemplates SAF production from waste, recycled oils, and second-generation plant-based bio feedstock, highlighting a focus on diversified and circular feedstock utilization.

Strategic Outlook for Europe Renewable Aviation Fuel Industry Market

The strategic outlook for the Europe Renewable Aviation Fuel industry is overwhelmingly positive, driven by an unwavering commitment to decarbonization and innovation. Future growth will be accelerated by continued policy support, including stricter blending mandates and potential carbon taxes, which will further incentivize SAF adoption. Investment in advanced biofuel technologies, such as those utilizing waste and residue streams, and the potential of electrofuels, will be critical for diversifying supply and reducing costs. Strategic collaborations between energy companies, aviation manufacturers, and governments will be essential for overcoming infrastructure challenges and ensuring scalable production. The market is poised for significant expansion as Europe aims to lead the global transition to sustainable aviation, making RAF a cornerstone of its environmental strategy.

Europe Renewable Aviation Fuel Industry Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

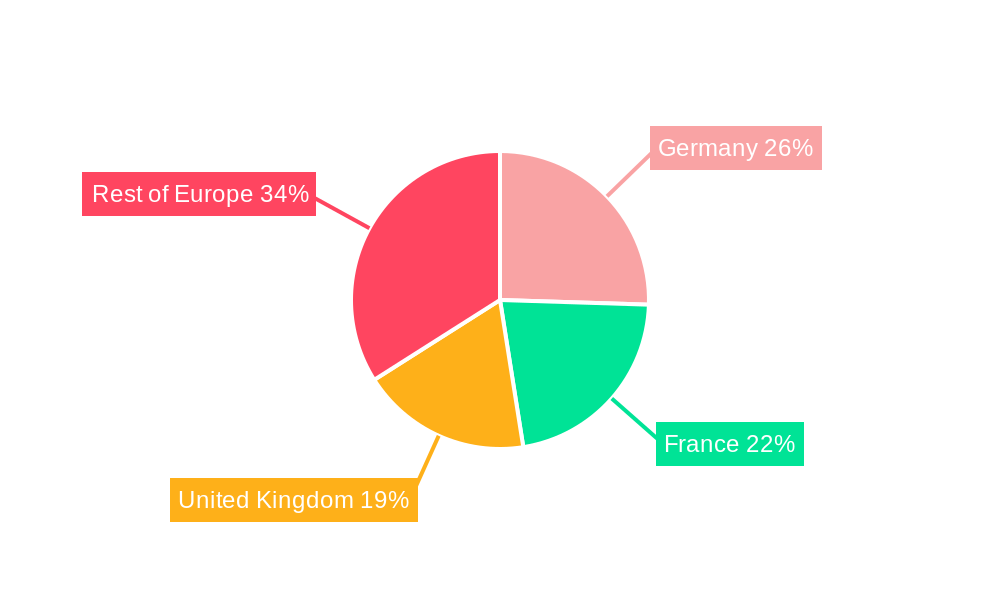

Europe Renewable Aviation Fuel Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Rest of Europe

Europe Renewable Aviation Fuel Industry Regional Market Share

Geographic Coverage of Europe Renewable Aviation Fuel Industry

Europe Renewable Aviation Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 43.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Commercial Sector to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. France Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. United Kingdom Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Europe Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fischer-Tropsch (FT)

- 9.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 9.1.3. Synthesi

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Defense

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LanzaTech Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Total Energies SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fulcrum BioEnergy Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Neste Oyj

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Swedish Biofuels AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gevo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Renewable Aviation Fuel Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Renewable Aviation Fuel Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 3: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 8: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 9: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 15: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 21: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 26: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 27: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Renewable Aviation Fuel Industry?

The projected CAGR is approximately 43.2%.

2. Which companies are prominent players in the Europe Renewable Aviation Fuel Industry?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Swedish Biofuels AB, Gevo Inc.

3. What are the main segments of the Europe Renewable Aviation Fuel Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 240.5 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Commercial Sector to be the Largest Segment.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

December 2022: TotalEnergies signed a memorandum of understanding to deliver more than one million cubic meters/800,000 tonnes of sustainable aviation fuel to Air France-KLM Group airlines over the ten years from 2023 to 2033.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Renewable Aviation Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Renewable Aviation Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Renewable Aviation Fuel Industry?

To stay informed about further developments, trends, and reports in the Europe Renewable Aviation Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence