Key Insights

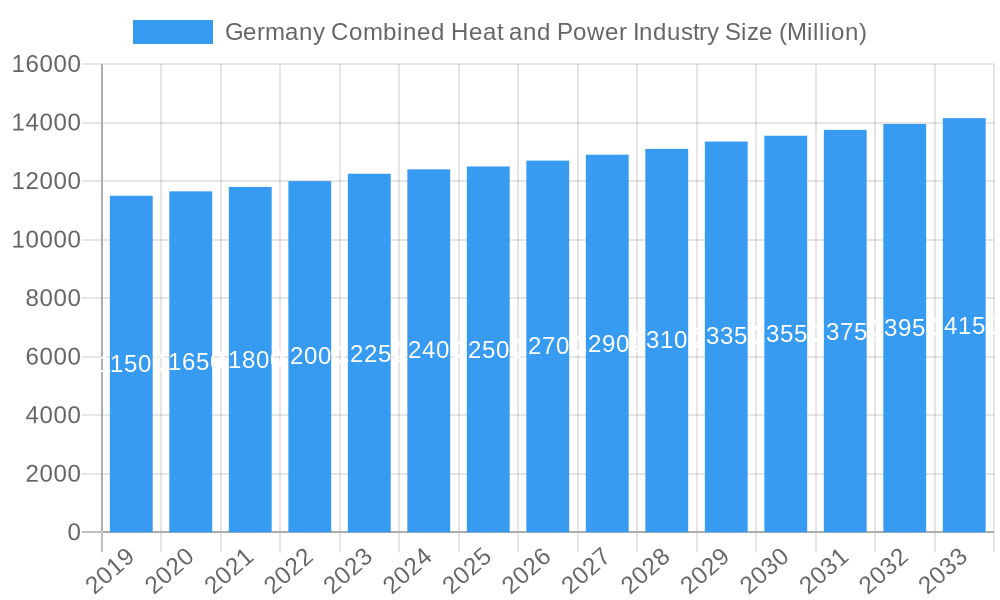

The German Combined Heat and Power (CHP) industry is projected for robust expansion. The market size was valued at €32.02 billion in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. This upward trajectory is propelled by Germany's strong dedication to energy efficiency and decarbonization mandates, alongside escalating demand for dependable and economical energy solutions across diverse sectors. The residential sector is a key driver, motivated by the pursuit of lower energy expenses and enhanced comfort. Similarly, the commercial sector benefits from reduced operational costs and fortified energy security. The industrial sector utilizes CHP for essential process heat and electricity, achieving significant efficiency improvements. Furthermore, the utility sector increasingly integrates CHP to supplement renewable energy sources and maintain grid stability, particularly during intermittent periods of solar and wind power generation. The ongoing shift towards cleaner energy sources also fuels opportunities for advanced CHP technologies, favoring cleaner fuels like natural gas and alternative types, moving away from traditional coal and oil dependency.

Germany Combined Heat and Power Industry Market Size (In Billion)

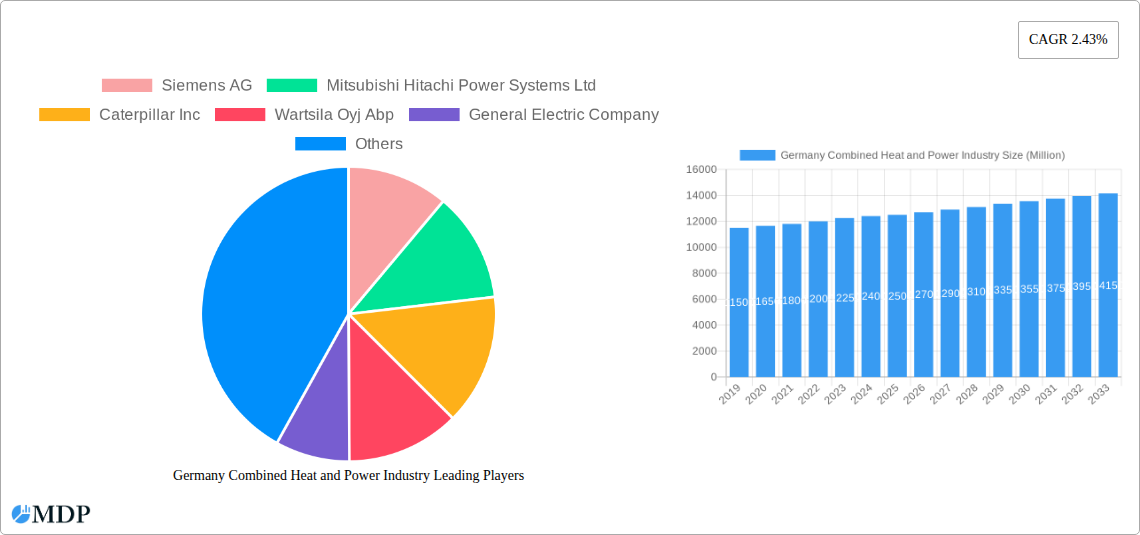

Key trends influencing the German CHP market include the rising adoption of modular and decentralized CHP systems, offering superior flexibility and scalability. Technological innovations are enhancing both electrical and thermal efficiencies, thereby amplifying the economic and environmental advantages of CHP. Growing awareness among consumers and businesses regarding the dual benefits of energy cost savings and reduced carbon emissions serves as a significant market catalyst. However, challenges such as substantial initial investment costs for certain advanced systems and the dynamic regulatory environment may pose limitations. Notwithstanding these factors, Germany's consistent emphasis on energy independence and the strategic imperative of energy security will continue to stimulate innovation and investment within the CHP sector. Leading companies such as Siemens AG, Mitsubishi Hitachi Power Systems Ltd., and General Electric Company are at the forefront, developing and deploying state-of-the-art CHP solutions specifically designed for the German market's unique requirements.

Germany Combined Heat and Power Industry Company Market Share

Germany Combined Heat and Power (CHP) Industry Market Analysis, Trends, and Forecast 2024–2033: Driving Energy Efficiency and Sustainable Solutions

This comprehensive report provides an in-depth analysis of the Germany Combined Heat and Power (CHP) industry, a vital sector advancing energy efficiency and decarbonization efforts. The study encompasses the historical period from 2019 to 2024, uses 2025 as the base year, and delivers a detailed forecast for 2025–2033. As the energy landscape undergoes rapid transformation, understanding CHP system dynamics—from residential applications to large-scale industrial and utility projects—is crucial for stakeholders aiming to leverage innovative solutions and adapt to regulatory changes. This report offers strategic insights into market concentration, technological advancements, primary growth drivers, emerging opportunities, and the competitive environment, presenting a roadmap for sustainable growth in the German CHP market.

Germany Combined Heat and Power Industry Market Dynamics & Concentration

The Germany Combined Heat and Power (CHP) industry is characterized by a moderate market concentration, with a blend of established global players and specialized domestic manufacturers. Innovation drivers are heavily influenced by stringent environmental regulations and ambitious renewable energy targets, pushing for higher efficiency and lower emissions in CHP systems. The regulatory framework, particularly policies supporting combined heat and power generation and carbon reduction initiatives, plays a pivotal role in shaping market dynamics. Product substitutes, while present in the form of standalone heating and power generation solutions, are increasingly less competitive against the inherent efficiency benefits of CHP. End-user trends are leaning towards decentralized energy generation, increased demand for smart grid integration, and a growing preference for systems utilizing renewable or low-carbon fuels. Mergers and Acquisitions (M&A) activities, while not overwhelming, are strategic, focusing on expanding service portfolios and technological capabilities. For instance, a notable M&A activity is the acquisition of Quadra Energy by TotalEnergies, indicating a significant push towards integrating renewable aggregation with existing energy infrastructure. The market share distribution highlights a competitive environment where technological expertise and cost-effectiveness are key differentiators. The M&A deal count indicates a steady interest in consolidating market presence and acquiring innovative technologies within the German CHP sector.

Germany Combined Heat and Power Industry Industry Trends & Analysis

The Germany Combined Heat and Power (CHP) industry is experiencing robust growth, propelled by a confluence of factors aimed at enhancing energy efficiency and reducing carbon footprints. The market growth drivers are strongly aligned with national and European Union energy policies that incentivize the adoption of CHP technologies. These policies often include financial support mechanisms, tax benefits, and feed-in tariffs, making CHP an economically attractive investment. Technological disruptions are a constant feature, with ongoing advancements in engine efficiency, waste heat recovery systems, and the integration of digital technologies for optimized operation and predictive maintenance. The increasing focus on Industry 4.0 principles is enabling smarter, more responsive CHP installations. Consumer preferences are evolving, with a growing awareness of the environmental benefits and cost savings associated with CHP systems. Both residential and commercial consumers are increasingly seeking integrated energy solutions that provide reliable heat and power while minimizing their environmental impact. Competitive dynamics within the German CHP market are intense, featuring a mix of large multinational corporations and agile local providers. Companies are competing on technology, service offerings, and the ability to cater to diverse application needs, from small-scale residential units to large industrial complexes. The market penetration of CHP systems is steadily increasing, particularly in sectors that have high thermal and electrical energy demands. The Compound Annual Growth Rate (CAGR) for the CHP market is projected to remain strong, reflecting sustained investment and policy support. The transition towards cleaner fuels and the integration of renewable energy sources into CHP systems are also significant trends shaping the industry's future trajectory. Furthermore, the increasing demand for grid stability and the role of CHP in providing ancillary services to the power grid are contributing to its market expansion.

Leading Markets & Segments in Germany Combined Heat and Power Industry

The Industrial segment stands out as a dominant force within the Germany Combined Heat and Power (CHP) industry, driven by its substantial and consistent demand for both heat and electricity. This dominance is underpinned by economic policies that encourage large energy consumers to invest in on-site generation for cost savings and operational reliability. Infrastructure development, including the availability of natural gas supply and the integration capabilities of existing industrial plants, further bolsters this segment.

Application Segment Dominance:

- Industrial: Large manufacturing facilities, chemical plants, and food processing industries require significant and continuous thermal energy for their processes. CHP systems offer a highly efficient solution by simultaneously producing heat and electricity, leading to substantial operational cost reductions and improved energy independence. The economic policies favoring industrial efficiency and the imperative to reduce operational expenditures make CHP a strategic investment for these entities. The established infrastructure for natural gas and the potential for integration with existing steam networks are also critical factors.

- Commercial: This segment, including large buildings, hotels, and data centers, is also a significant contributor, driven by rising energy costs and sustainability mandates. The demand for consistent heating and cooling, coupled with electricity needs, makes CHP a viable option for enhancing energy efficiency and reducing utility bills. Government incentives aimed at promoting energy-saving measures in commercial properties further accelerate adoption.

- Residential: While growing, the residential segment's contribution is generally smaller compared to industrial and commercial applications, often focusing on district heating networks or larger multi-unit dwellings. Growth here is influenced by subsidies for renewable heating and a desire for energy independence among homeowners.

- Utility: The utility segment, while potentially large in scale, is more influenced by grid modernization efforts and the integration of distributed energy resources. CHP can play a role in grid stability, but its primary adoption is driven by the other end-user segments.

Fuel Type Trends:

- Natural Gas: This remains the leading fuel type due to its availability, relatively cleaner combustion compared to coal and oil, and well-established infrastructure in Germany. Its efficiency in CHP applications makes it the preferred choice for many installations, especially where long-term operational cost is a key consideration.

- Other Fuel Types: This category is gaining traction, encompassing biogas, biomass, and increasingly, hydrogen blends. The drive towards decarbonization and the utilization of local, renewable resources are key factors promoting the adoption of these fuel types. Policies supporting the bioeconomy and the development of green hydrogen infrastructure will further enhance the importance of this segment.

- Coal: Its use in new CHP installations is declining significantly due to stringent environmental regulations and the coal phase-out policy in Germany. Existing coal-fired CHP plants are gradually being decommissioned or retrofitted.

- Oil: While still used in some niche applications or older installations, oil-fired CHP is less prevalent due to cost volatility and environmental concerns, with a clear trend towards cleaner alternatives.

Germany Combined Heat and Power Industry Product Developments

Product developments in the German Combined Heat and Power (CHP) industry are increasingly focused on enhancing efficiency, reducing emissions, and integrating with renewable energy sources. Innovations include advanced modular CHP units designed for faster installation and greater flexibility, catering to both residential and commercial needs. Enhanced heat recovery systems are being developed to maximize thermal energy utilization, thereby boosting overall system efficiency. Furthermore, there is a significant push towards integrating CHP with hydrogen fuel capabilities and incorporating smart control systems for optimized performance and grid interaction. These developments aim to provide competitive advantages by lowering operational costs, meeting stringent environmental standards, and offering versatile energy solutions that align with Germany's energy transition goals.

Key Drivers of Germany Combined Heat and Power Industry Growth

Several key factors are driving the growth of the Germany Combined Heat and Power (CHP) industry. Government policies and incentives, such as subsidies and favorable feed-in tariffs for CHP generation, are significant economic drivers. The increasing demand for energy efficiency and cost reduction, particularly from industrial and commercial sectors, is a major economic impetus. Technological advancements in CHP systems, leading to higher efficiency and lower emissions, are crucial enablers. Furthermore, Germany's strong commitment to decarbonization and its ambitious renewable energy targets are creating a favorable regulatory environment, encouraging the adoption of cleaner energy solutions like CHP. The growing focus on energy security and the desire for decentralized energy generation also contribute to market expansion.

Challenges in the Germany Combined Heat and Power Industry Market

Despite its growth potential, the Germany Combined Heat and Power (CHP) industry faces several challenges. The upfront capital investment for CHP systems can be substantial, posing a barrier for some potential adopters. Navigating complex regulatory frameworks and obtaining permits can be time-consuming and costly. Fluctuations in the price of natural gas, the primary fuel source for many CHP units, can impact operational economics. Competition from other renewable energy sources and the grid infrastructure's capacity to integrate decentralized CHP units also present challenges. Supply chain disruptions for key components and a shortage of skilled technicians for installation and maintenance can further hinder market expansion.

Emerging Opportunities in Germany Combined Heat and Power Industry

Emerging opportunities in the Germany Combined Heat and Power (CHP) industry are largely driven by the nation's unwavering commitment to a sustainable energy future. The increasing integration of renewable fuels, such as hydrogen and biogas, into CHP systems presents a significant avenue for growth, aligning with decarbonization goals. Advancements in digitalization and smart grid technologies enable the development of more sophisticated and responsive CHP solutions that can provide grid stabilization services. Strategic partnerships between CHP manufacturers, energy providers, and technology developers are fostering innovation and expanding market reach. Furthermore, the growing demand for localized and resilient energy generation solutions, particularly in light of global energy security concerns, is creating new market segments and opportunities for scalable CHP deployments across various applications.

Leading Players in the Germany Combined Heat and Power Industry Sector

- Siemens AG

- Mitsubishi Hitachi Power Systems Ltd

- Caterpillar Inc

- Wartsila Oyj Abp

- General Electric Company

- MAN Energy Solutions

- 2G Energy AG

- Viessmann Group

- BHKW-Infozentrum

- Bosch Thermotechnology

Key Milestones in Germany Combined Heat and Power Industry Industry

- 2023/Ongoing: TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This strategic move by TotalEnergies aims to significantly expand its footprint in Germany's dynamic renewable energy market, potentially integrating its growing renewable portfolio with existing energy infrastructure, including the latent potential of combined heat and power systems to enhance grid stability and efficiency.

- 2020s: Increased government focus and funding for hydrogen-ready CHP systems, signaling a future shift towards cleaner fuel integration and supporting the development of a hydrogen economy in Germany.

- 2020: Introduction of updated regulations and efficiency standards for CHP systems, encouraging the deployment of more advanced and environmentally compliant technologies.

- 2019: Significant investments in smart grid technologies and digital integration for CHP systems, enabling better performance monitoring, remote diagnostics, and optimized energy management.

Strategic Outlook for Germany Combined Heat and Power Industry Market

The strategic outlook for the Germany Combined Heat and Power (CHP) industry is exceptionally positive, driven by a confluence of supportive policies, technological advancements, and increasing market demand for energy efficiency and sustainability. The ongoing transition towards renewable fuels, including hydrogen and biogas, presents a significant growth accelerator, positioning CHP as a vital component of a diversified and decarbonized energy mix. Increased digitalization and smart grid integration will further enhance the value proposition of CHP by enabling greater operational flexibility and grid services. Strategic partnerships and potential for further M&A activities will likely consolidate the market and drive innovation. The market's future potential lies in its ability to seamlessly integrate with evolving energy infrastructures, offering reliable, efficient, and environmentally responsible energy solutions across residential, commercial, and industrial sectors, thereby cementing its role in achieving Germany's ambitious climate goals.

Germany Combined Heat and Power Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Coal

- 2.3. Oil

- 2.4. Other Fuel Types

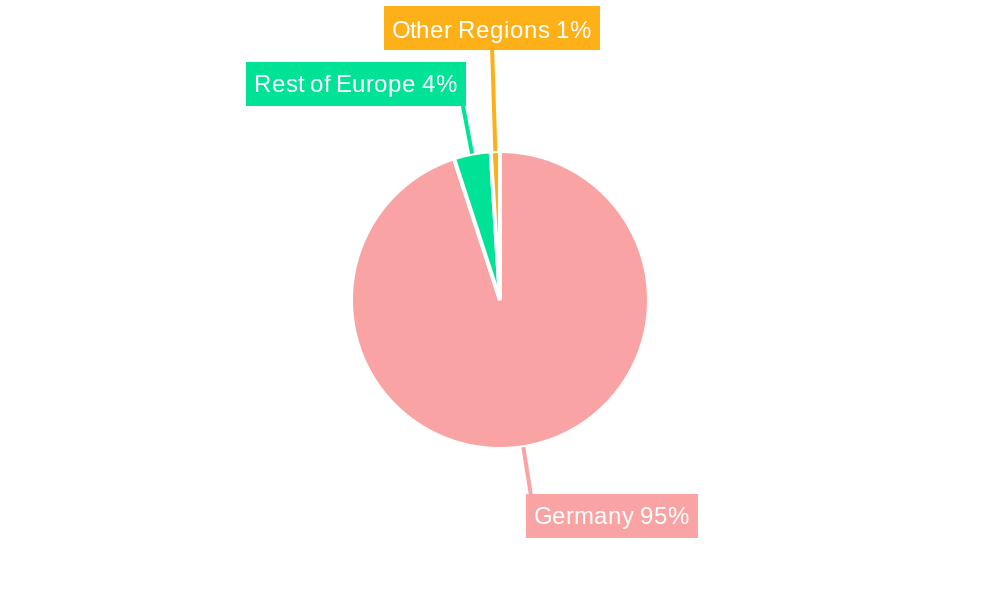

Germany Combined Heat and Power Industry Segmentation By Geography

- 1. Germany

Germany Combined Heat and Power Industry Regional Market Share

Geographic Coverage of Germany Combined Heat and Power Industry

Germany Combined Heat and Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as sugar

- 3.2.2 chemicals

- 3.2.3 and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat

- 3.2.4 enhancing operational efficiency and reducing energy costs.

- 3.3. Market Restrains

- 3.3.1 The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems

- 3.3.2 potentially deterring investment and adoption.

- 3.4. Market Trends

- 3.4.1 There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready

- 3.4.2 aligning with its broader energy transition goals.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Coal

- 5.2.3. Oil

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Hitachi Power Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Caterpillar Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wartsila Oyj Abp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAN Energy Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2G Energy AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viessmann Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BHKW-Infozentrum

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch Thermotechnology

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens AG

List of Figures

- Figure 1: Germany Combined Heat and Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Combined Heat and Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Germany Combined Heat and Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Germany Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Combined Heat and Power Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Germany Combined Heat and Power Industry?

Key companies in the market include Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Wartsila Oyj Abp, General Electric Company, MAN Energy Solutions, 2G Energy AG, Viessmann Group, BHKW-Infozentrum, Bosch Thermotechnology.

3. What are the main segments of the Germany Combined Heat and Power Industry?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Industries such as sugar. chemicals. and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat. enhancing operational efficiency and reducing energy costs..

6. What are the notable trends driving market growth?

There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready. aligning with its broader energy transition goals..

7. Are there any restraints impacting market growth?

The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems. potentially deterring investment and adoption..

8. Can you provide examples of recent developments in the market?

TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This move aligns with TotalEnergies' strategy to expand its footprint in Germany's renewable energy market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Combined Heat and Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Combined Heat and Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Combined Heat and Power Industry?

To stay informed about further developments, trends, and reports in the Germany Combined Heat and Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence