Key Insights

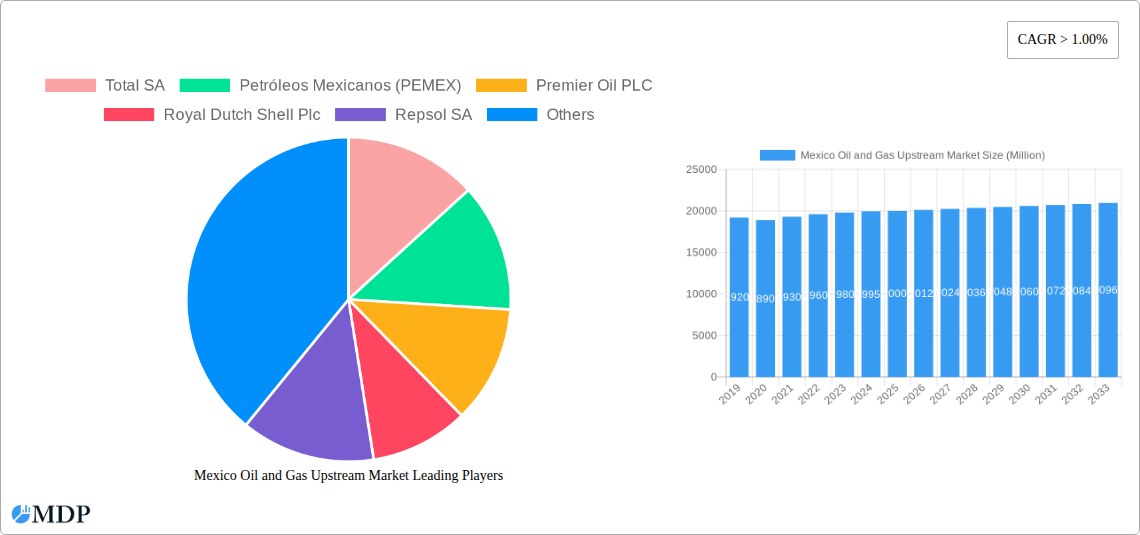

The Mexico Oil and Gas Upstream Market is projected for robust expansion, with an estimated market size of USD 4847.93 billion in 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This growth is fueled by substantial upstream investments targeting the revitalization of mature fields and the exploration of new hydrocarbon reserves across onshore and offshore regions. Key drivers include the Mexican government's strategic focus on energy security and the attraction of foreign direct investment, complemented by technological advancements enhancing recovery rates and operational efficiency. The competitive landscape features national oil companies like Petróleos Mexicanos (PEMEX) alongside major international players including TotalEnergies, Shell, and Repsol, all vying to leverage Mexico's significant hydrocarbon potential. Robust domestic and export demand for oil and gas further reinforces this positive market trajectory.

Mexico Oil and Gas Upstream Market Market Size (In Million)

While demonstrating resilience, the market faces challenges such as evolving regulatory frameworks, environmental considerations, and the global shift towards renewable energy, which may impact long-term investment. Nevertheless, the immediate imperative is to maximize economic returns from current and prospective oil and gas resources. The offshore segment, particularly shallow and deepwater areas, presents considerable untapped potential, attracting significant exploration and production initiatives. Onshore activities remain crucial, especially in established basins. Emerging trends, including advanced seismic imaging, enhanced oil recovery (EOR) techniques, and digital technologies, are poised to be instrumental in optimizing production and addressing operational challenges, ensuring the market's continued evolution and contribution to Mexico's economy.

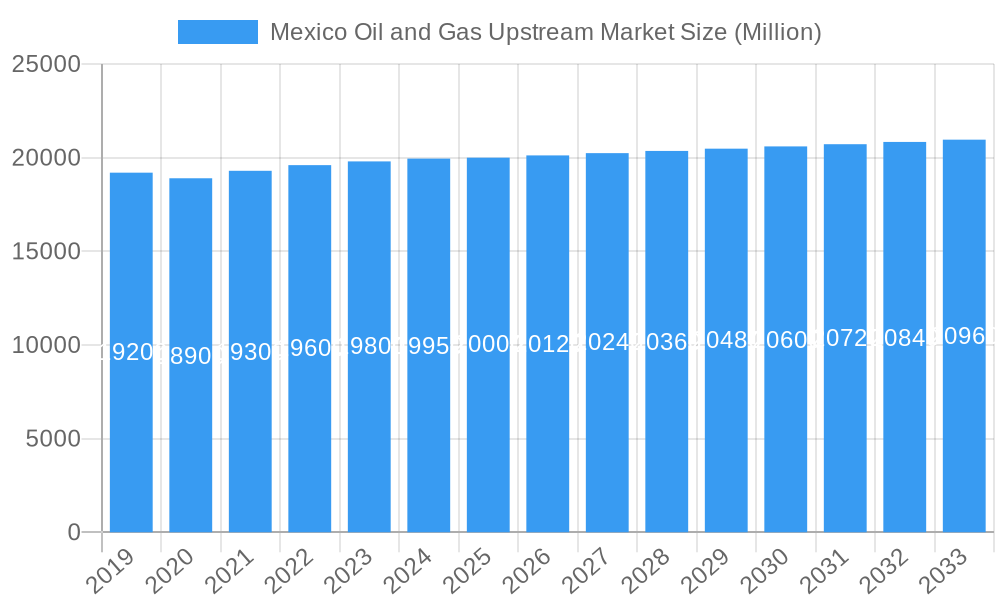

Mexico Oil and Gas Upstream Market Company Market Share

Gain comprehensive insights into the dynamic Mexico Oil and Gas Upstream sector with this in-depth report. Spanning the analysis period from 2019 to 2033, this study offers critical intelligence on market dynamics, industry trends, key players, and emerging opportunities. This essential resource is designed for stakeholders aiming to navigate and capitalize on the evolving Mexican energy landscape.

Mexico Oil and Gas Upstream Market Market Dynamics & Concentration

The Mexico Oil and Gas Upstream Market is characterized by a moderate concentration, with Petróleos Mexicanos (PEMEX) holding a significant, though evolving, market share. Regulatory frameworks, particularly those enacted in recent years, continue to shape investment and operational strategies. Innovation drivers are increasingly focused on enhancing recovery rates from mature fields and exploring new, technically challenging reserves. Product substitutes, while not directly impacting the upstream extraction of crude oil and natural gas, are influencing long-term demand outlooks for fossil fuels. End-user trends are demonstrating a growing demand for energy, necessitating sustained upstream activity. Mergers and acquisitions (M&A) activities have been relatively subdued but are expected to see an uptick as companies seek to consolidate their positions and acquire specialized technologies. PEMEX's market share, estimated at 65% in the base year 2025, is subject to competitive pressures from both national and international players. M&A deal counts in the historical period (2019-2024) averaged 3 per year, indicating a cautious approach to consolidation.

Mexico Oil and Gas Upstream Market Industry Trends & Analysis

The Mexico Oil and Gas Upstream Market is experiencing a dynamic phase of transformation driven by several key factors. A projected Compound Annual Growth Rate (CAGR) of approximately 4.2% during the forecast period (2025–2033) underscores the robust expansion anticipated. Market growth is significantly fueled by the Mexican government's strategic initiatives aimed at revitalizing the national oil and gas industry, including efforts to attract foreign direct investment and streamline regulatory processes. Technological disruptions are playing a pivotal role, with advancements in seismic imaging, horizontal drilling, and hydraulic fracturing enabling the efficient extraction of hydrocarbons from previously inaccessible reserves. The adoption of digital technologies, such as AI-powered analytics and IoT sensors, is enhancing operational efficiency, reducing downtime, and improving safety standards across onshore and offshore operations. Consumer preferences, globally and domestically, are increasingly leaning towards cleaner energy sources, presenting both a challenge and an opportunity for the upstream sector to invest in lower-carbon extraction technologies and explore natural gas as a transitional fuel. Competitive dynamics are intensifying, with national oil company PEMEX working to maintain its dominance while international players like Total SA, Royal Dutch Shell Plc, and Repsol SA vie for a larger footprint. The market penetration of advanced extraction techniques is steadily rising, particularly in offshore deepwater exploration and mature onshore fields requiring enhanced oil recovery (EOR) methods. The estimated market size for the upstream segment in 2025 is projected to be around $55 Billion, with a significant portion attributed to both crude oil and natural gas production.

Leading Markets & Segments in Mexico Oil and Gas Upstream Market

The Offshore segment is poised to dominate the Mexico Oil and Gas Upstream Market during the forecast period (2025–2033), driven by significant untapped deepwater reserves and strategic government focus on this area. The economic policies enacted to encourage foreign investment in offshore exploration and production, particularly in the Gulf of Mexico, have been instrumental in this projected dominance. Infrastructure development, including the expansion of offshore platforms, subsea pipelines, and specialized support vessels, is a crucial enabler for the offshore sector's growth. The discovery of new hydrocarbon reserves in deepwater and ultra-deepwater regions, coupled with advancements in offshore drilling and production technologies, further solidifies its leading position.

- Key Drivers for Offshore Dominance:

- Untapped Reserves: Significant reserves of crude oil and natural gas are estimated to be present in Mexico's deepwater offshore regions, presenting substantial exploration opportunities.

- Government Incentives: Favorable regulatory frameworks and fiscal terms designed to attract international oil companies (IOCs) to participate in offshore licensing rounds and exploration projects.

- Technological Advancements: Innovations in floating production systems, subsea processing, and advanced drilling techniques are making offshore exploration and production more economically viable and safer.

- Infrastructure Investment: Continued investment in port facilities, offshore construction yards, and logistical support services crucial for large-scale offshore operations.

The Onshore segment, while historically significant, will experience steady growth, with a particular focus on optimizing production from mature fields and developing unconventional resources. The economic viability of onshore projects is enhanced by the proximity to existing infrastructure and a more predictable operational environment compared to some offshore ventures.

- Key Drivers for Onshore Growth:

- Mature Field Optimization: Application of Enhanced Oil Recovery (EOR) techniques to boost production from existing onshore fields.

- Unconventional Resource Potential: Exploration and development of shale gas and tight oil formations, requiring specialized drilling and fracturing technologies.

- Existing Infrastructure: Leverage of established pipelines, processing facilities, and transportation networks, reducing capital expenditure.

- Domestic Demand: Steady domestic demand for natural gas for power generation and industrial use, supporting onshore production.

In 2025, the estimated market share for the Offshore segment is projected to be 58%, with the Onshore segment holding 42%. The total market value for these segments in 2025 is estimated to be approximately $55 Billion.

Mexico Oil and Gas Upstream Market Product Developments

Product developments in the Mexico Oil and Gas Upstream Market are increasingly focused on efficiency, environmental sustainability, and unlocking challenging reserves. Innovations in drilling technologies, such as high-performance drill bits and advanced directional drilling systems, are enabling operators to access complex geological formations more effectively. Enhanced Oil Recovery (EOR) techniques, including chemical injection and CO2 flooding, are crucial for maximizing output from mature fields. For offshore operations, advancements in subsea processing and floating production, storage, and offloading (FPSO) units are reducing reliance on fixed infrastructure and improving cost-effectiveness. The competitive advantage of these developments lies in their ability to lower extraction costs, increase recovery rates, and minimize environmental impact. The market penetration of digital solutions, including AI for reservoir simulation and predictive maintenance, is also a key area of innovation, promising significant gains in operational efficiency.

Key Drivers of Mexico Oil and Gas Upstream Market Growth

The Mexico Oil and Gas Upstream Market is propelled by a confluence of powerful drivers. Technological advancements in exploration and extraction, such as sophisticated seismic imaging and hydraulic fracturing, are unlocking previously inaccessible reserves, particularly in offshore deepwater and onshore unconventional plays. Government policies aimed at attracting foreign investment and fostering private sector participation are creating a more conducive environment for upstream activities. Sustained global energy demand, despite the energy transition, ensures a continued need for crude oil and natural gas. Furthermore, Mexico's significant untapped reserves provide a strong foundation for future production growth. The estimated investment in new exploration and production projects is expected to reach $15 Billion by 2025.

Challenges in the Mexico Oil and Gas Upstream Market Market

Despite robust growth potential, the Mexico Oil and Gas Upstream Market faces several significant challenges. Regulatory complexities and policy uncertainties can deter long-term investment and create operational hurdles. Infrastructure limitations, particularly in remote onshore regions and for developing deepwater fields, require substantial capital infusion and time to overcome. Environmental concerns and societal pressure to transition to cleaner energy sources necessitate increased investment in sustainable practices and technologies, which can add to operational costs. Securing adequate financing for large-scale, capital-intensive upstream projects remains a challenge, especially in a fluctuating global commodity price environment. Supply chain disruptions, while improving, can still impact project timelines and costs, estimated to add up to 5% to project budgets in some instances.

Emerging Opportunities in Mexico Oil and Gas Upstream Market

Emerging opportunities in the Mexico Oil and Gas Upstream Market are multifaceted, driven by innovation and strategic collaborations. The exploration of unconventional resources, such as shale gas and tight oil, presents a significant untapped potential that can be unlocked with advanced technologies. Strategic partnerships and joint ventures between national and international oil companies are fostering knowledge transfer, technological sharing, and risk mitigation, accelerating project development. The growing demand for natural gas as a cleaner transitional fuel offers substantial opportunities for upstream producers. Furthermore, digital transformation and the adoption of Industry 4.0 technologies are creating opportunities for enhanced operational efficiency, cost reduction, and improved safety standards across the value chain. The potential for carbon capture, utilization, and storage (CCUS) technologies also presents a long-term opportunity for environmentally responsible hydrocarbon extraction.

Leading Players in the Mexico Oil and Gas Upstream Market Sector

- Petróleos Mexicanos (PEMEX)

- Total SA

- Premier Oil PLC

- Royal Dutch Shell Plc

- Repsol SA

Key Milestones in Mexico Oil and Gas Upstream Market Industry

- 2019: Mexican government announces reforms aimed at boosting energy production and attracting investment.

- 2020: Several major upstream contracts awarded to international companies, marking increased private sector participation.

- 2021: Significant deepwater discoveries announced, signaling renewed potential in offshore exploration.

- 2022: Increased investment in technological upgrades for enhanced oil recovery (EOR) in mature onshore fields.

- 2023: Focus on natural gas exploration and production to meet domestic demand and reduce import reliance.

- 2024: Continued efforts to streamline regulatory processes and encourage foreign direct investment in the upstream sector.

Strategic Outlook for Mexico Oil and Gas Upstream Market Market

The strategic outlook for the Mexico Oil and Gas Upstream Market is characterized by a balanced approach to maximizing existing resources while strategically investing in future growth. Key growth accelerators include the continued exploration and development of deepwater offshore reserves, leveraging advanced technologies for efficient extraction. Optimizing production from mature onshore fields through Enhanced Oil Recovery (EOR) techniques will remain a critical strategy. Furthermore, the increasing focus on natural gas as a transitional fuel presents a significant opportunity to meet domestic energy needs and potentially for export. The government's commitment to creating a stable and attractive investment climate, coupled with the ongoing digital transformation of operations, will be crucial for realizing the full potential of Mexico's upstream sector. The market is projected to see sustained investment, with estimated capital expenditure reaching $20 Billion by 2030.

Mexico Oil and Gas Upstream Market Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

Mexico Oil and Gas Upstream Market Segmentation By Geography

- 1. Mexico

Mexico Oil and Gas Upstream Market Regional Market Share

Geographic Coverage of Mexico Oil and Gas Upstream Market

Mexico Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petróleos Mexicanos (PEMEX)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Premier Oil PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Repsol SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Mexico Oil and Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Oil and Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Location 2020 & 2033

- Table 3: Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Location 2020 & 2033

- Table 6: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Location 2020 & 2033

- Table 7: Mexico Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Mexico Oil and Gas Upstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Oil and Gas Upstream Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Mexico Oil and Gas Upstream Market?

Key companies in the market include Total SA, Petróleos Mexicanos (PEMEX), Premier Oil PLC, Royal Dutch Shell Plc, Repsol SA.

3. What are the main segments of the Mexico Oil and Gas Upstream Market?

The market segments include Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 4847.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Mexico Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence