Key Insights

The Indian solar tracker market is projected for substantial growth, driven by ambitious renewable energy mandates and the improving economic viability of solar power. The market is estimated at $286.8 million in 2024 and is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.21%. This expansion is primarily supported by government initiatives, including Production Linked Incentives (PLI) and Viability Gap Funding (VGF), alongside increasing environmental consciousness. Advances in solar panel technology, cost reductions, and the significant energy yield improvements offered by solar trackers are making them essential for utility-scale solar developments.

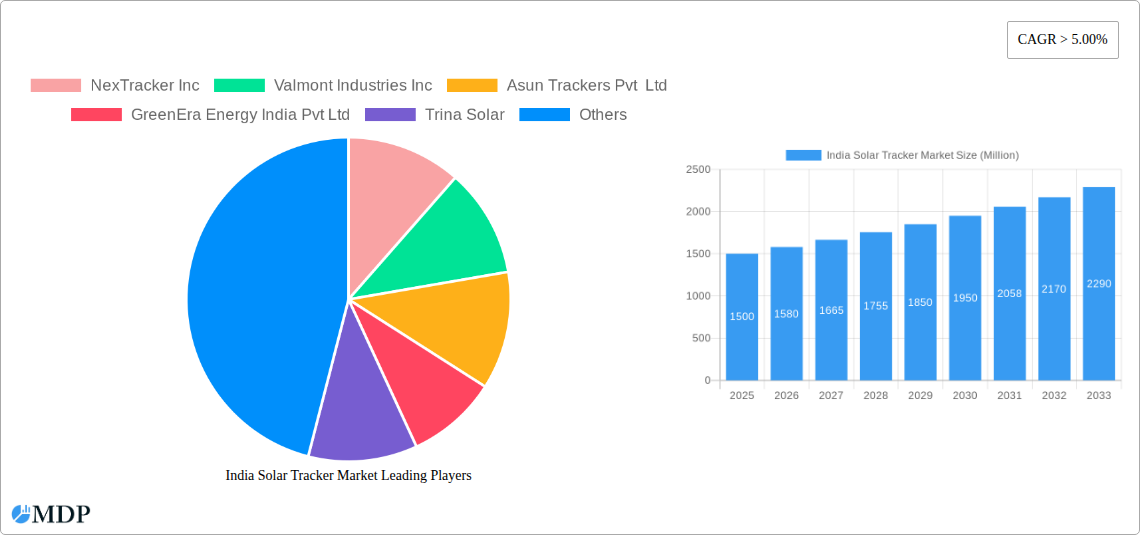

India Solar Tracker Market Market Size (In Million)

The market is segmented by technology and application. Photovoltaic (PV) trackers are the dominant technology, outpacing Concentrated Solar Power (CSP). Both single-axis and dual-axis trackers are seeing increased adoption. Single-axis trackers are favored for utility-scale projects due to their cost-effectiveness and performance. Dual-axis trackers, offering maximum energy harvest, are employed in specific applications where space is not a limiting factor. Key applications include residential, commercial, and utility-scale segments, with utility-scale expected to lead market expansion due to large-scale solar park development. Key players such as NexTracker Inc, Valmont Industries Inc, and Tata Power Solar Systems Limited are enhancing their manufacturing and product offerings to meet the growing demand.

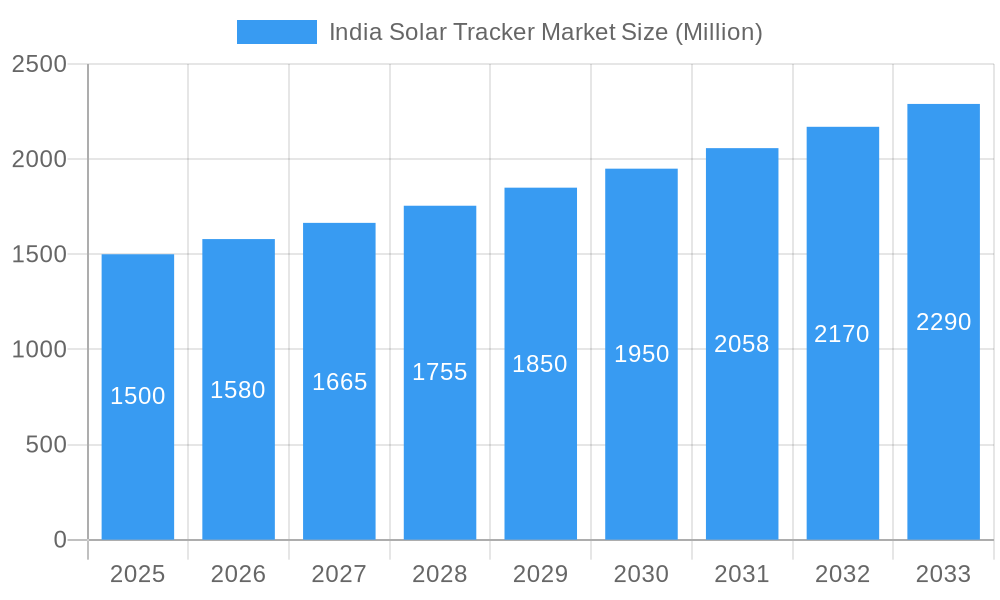

India Solar Tracker Market Company Market Share

India Solar Tracker Market Report: Unleashing Renewable Energy Efficiency

Gain comprehensive insights into the rapidly expanding India solar tracker market, a crucial segment driving the nation's clean energy revolution. This in-depth report analyzes market dynamics, technological advancements, and key players shaping the future of solar power generation in India.

This report is essential for solar project developers, EPC contractors, equipment manufacturers, investors, policymakers, and anyone seeking to understand the growth trajectory and investment potential of solar tracking solutions in India.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

India Solar Tracker Market Market Dynamics & Concentration

The India solar tracker market is characterized by moderate to high concentration, with a few prominent global and domestic players dominating the landscape. NexTracker Inc., Valmont Industries Inc., Arctech Solar Holding Co Ltd., and Tata Power Solar Systems Limited are key contributors, holding significant market share through their advanced technology offerings and strong project execution capabilities. Innovation drivers are primarily focused on enhancing energy yield, reducing installation costs, and improving the durability and reliability of solar tracking systems in diverse Indian climatic conditions. Regulatory frameworks, including government incentives and renewable energy mandates, play a pivotal role in stimulating market growth. Product substitutes, such as fixed-tilt solar mounting systems, continue to be present, but the superior energy generation benefits of trackers are increasingly displacing them, especially in utility-scale projects. End-user trends indicate a growing preference for dual-axis trackers in commercial and utility applications where maximizing energy output is paramount, while single-axis trackers remain popular for their cost-effectiveness. Mergers and acquisitions (M&A) activities are expected to increase as companies aim to consolidate their market position, expand their product portfolios, and gain access to new geographical regions. Recent M&A deals, though specific counts are xx, have indicated a strategic push for market expansion and technological integration. The market share of leading players is estimated to be substantial, with the top five companies collectively holding over 60% of the market.

India Solar Tracker Market Industry Trends & Analysis

The India solar tracker market is poised for robust growth, driven by the nation's ambitious renewable energy targets and the increasing need for efficient solar power generation. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033, fueled by a confluence of technological advancements, supportive government policies, and evolving consumer preferences. Technological disruptions are at the forefront, with continuous innovation in tracker design, including the development of more robust and weather-resistant systems, intelligent control algorithms for optimizing solar energy capture, and integration of IoT for remote monitoring and predictive maintenance. The demand for solar trackers is significantly propelled by the increasing efficiency of photovoltaic (PV) modules and the rising cost of land, making it imperative to maximize energy yield from available space. Consumer preferences are shifting towards higher energy generation solutions, particularly for utility-scale projects and large commercial installations where the incremental cost of trackers is offset by substantial increases in electricity output. Market penetration of solar trackers, currently estimated at around 45% for new utility-scale installations, is expected to rise steadily. Competitive dynamics are intense, with global leaders competing against emerging domestic players, fostering an environment of price competition and product differentiation. The rising adoption of artificial intelligence and machine learning in tracker control systems is a significant trend, enabling real-time adjustments based on weather forecasts and site-specific conditions, thereby maximizing the efficiency of solar power plants. The report estimates that by 2025, the market value will reach approximately $2,500 Million, with a significant portion attributed to utility-scale applications.

Leading Markets & Segments in India Solar Tracker Market

The Utility segment is the dominant force within the India solar tracker market, driven by large-scale solar power plant development and government initiatives to boost renewable energy capacity. This segment accounts for an estimated 70% of the total market share. Single-axis trackers are the most prevalent movement type, comprising approximately 65% of installations due to their favorable balance of cost-effectiveness and energy yield enhancement, especially for extensive solar farms. In terms of application, Photovoltaic (PV) technology overwhelmingly leads, representing over 95% of the solar tracker market, as it is the primary solar technology being deployed across India.

- Dominance of Utility Scale: Government policies such as the National Solar Mission and Renewable Purchase Obligations (RPOs) have spurred massive investments in utility-scale solar projects, necessitating efficient tracking solutions to maximize power generation and achieve economic viability. The availability of large tracts of land in states like Rajasthan, Gujarat, and Tamil Nadu further supports the development of these large projects.

- Single-Axis Tracker Preference: The lower capital expenditure compared to dual-axis trackers, coupled with a significant improvement in energy yield (typically 15-25% higher than fixed-tilt systems), makes single-axis trackers the preferred choice for utility-scale projects. Their simpler design also translates to lower maintenance requirements.

- Photovoltaic Technology Supremacy: The widespread adoption and technological maturity of PV technology, alongside falling module prices, have made it the cornerstone of India's solar energy expansion. Concentrated Solar Power (CSP) technology, while offering thermal storage capabilities, has a smaller market share due to higher initial costs and specific operational requirements.

- Regional Influence: States like Gujarat, Rajasthan, and Andhra Pradesh, with their high solar irradiance and supportive policy environments, are leading markets for solar tracker deployment. Economic policies promoting solar investments and the development of robust transmission infrastructure are critical drivers for the dominance of these regions.

India Solar Tracker Market Product Developments

Product developments in the India solar tracker market are largely focused on enhancing energy yield, improving reliability, and reducing installation and maintenance costs. Innovations include the introduction of more robust designs to withstand India's diverse climatic conditions, advanced algorithms for intelligent tracking that optimize energy capture based on real-time weather data, and the integration of IoT for remote monitoring and predictive maintenance. Companies are also developing trackers with sleeker profiles and fewer moving parts to minimize wear and tear. Competitive advantages are being gained through features like higher load-bearing capacity, improved wind-stow strategies, and modular designs for faster installation. The market is seeing a trend towards trackers with integrated sensors and smart control systems that can learn and adapt to local environmental factors, thereby maximizing the performance of solar power plants.

Key Drivers of India Solar Tracker Market Growth

The India solar tracker market is propelled by several critical growth drivers. Technological advancements in tracker design and control systems are enhancing energy output and operational efficiency, making solar power more competitive. Supportive government policies, including favorable tariffs, incentives, and renewable energy mandates, are crucial in stimulating investment and project development. The declining cost of solar panels makes the overall investment in solar tracker systems more attractive, improving the return on investment for solar power projects. Furthermore, the increasing demand for clean energy to meet India's growing power needs and climate commitments is a significant catalyst. The push for greater energy independence and the desire to reduce reliance on fossil fuels also contribute to the market's expansion.

Challenges in the India Solar Tracker Market Market

Despite its promising growth, the India solar tracker market faces several challenges. High initial capital expenditure for tracker systems compared to fixed-tilt structures can be a barrier for some projects, especially smaller-scale ones. Land acquisition complexities and the associated costs can also impede the deployment of large-scale solar farms requiring extensive tracking systems. Supply chain disruptions and the reliance on imported components for certain tracker technologies can lead to delays and increased costs. Technical expertise and skilled labor for installation and maintenance of advanced tracking systems can be a constraint in certain regions. Grid integration challenges and the need for stable power evacuation infrastructure also pose hurdles.

Emerging Opportunities in India Solar Tracker Market

Emerging opportunities in the India solar tracker market lie in several key areas. The growing adoption of bifacial solar panels presents a significant opportunity, as bifacial modules can benefit from light reflected from the ground onto the back of the panel, which trackers can further optimize. Technological breakthroughs in energy storage integration with solar trackers can provide more consistent power supply and enhance the value proposition of solar projects. Expansion into new geographies within India and the development of trackers specifically designed for challenging terrains or high-wind areas offer untapped potential. Strategic partnerships and collaborations between tracker manufacturers, solar developers, and EPC companies can lead to innovative solutions and broader market reach. The increasing focus on digitalization and smart grid integration opens avenues for trackers with advanced IoT capabilities and data analytics.

Leading Players in the India Solar Tracker Market Sector

- NexTracker Inc.

- Valmont Industries Inc.

- Asun Trackers Pvt Ltd

- GreenEra Energy India Pvt Ltd

- Trina Solar

- Tata Power Solar Systems Limited

- PV Hardware Solutions SLU

- Arctech Solar Holding Co Ltd

Key Milestones in India Solar Tracker Market Industry

- April 2022: Tata Power Solar Systems commissioned India's largest single-axis solar tracker system in the 300 MW Dholera Solar Power Plant. This project is set to generate 774 MUs annually and reduce approximately 704,340 MT/year of carbon emissions.

- August 2021: GameChange Solar supplied its single-axis Genius Tracker equipment to a 394 MW PV project set up by Tata Power in Gujarat, highlighting the growing adoption of advanced tracking technologies in large-scale projects.

Strategic Outlook for India Solar Tracker Market Market

The strategic outlook for the India solar tracker market is exceptionally positive, driven by India's unwavering commitment to renewable energy and the increasing need for optimized solar energy generation. Growth accelerators include the continuous technological innovation in tracker design, leading to higher energy yields and improved cost-effectiveness. The supportive policy environment, with ongoing government incentives and targets for renewable energy capacity, will continue to fuel demand. The market is expected to witness significant expansion in utility-scale projects, driven by falling solar panel costs and the economic viability offered by trackers. Furthermore, the rising adoption of bifacial solar modules will create new opportunities for advanced tracking solutions that can maximize the performance of these highly efficient panels. Strategic partnerships and a focus on local manufacturing could further enhance market competitiveness and reduce dependence on imports, solidifying India's position as a global leader in solar energy deployment. The market value is projected to reach approximately $8,000 Million by 2033.

India Solar Tracker Market Segmentation

-

1. Type

- 1.1. Photovoltaic

- 1.2. Concentrated Solar Power

-

2. Movement

- 2.1. Single Axis

- 2.2. Dual Axis

-

3. Application

- 3.1. Residential

- 3.2. Commercial

- 3.3. Utility

India Solar Tracker Market Segmentation By Geography

- 1. India

India Solar Tracker Market Regional Market Share

Geographic Coverage of India Solar Tracker Market

India Solar Tracker Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Photovoltaic Segment to Dominate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Tracker Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Photovoltaic

- 5.1.2. Concentrated Solar Power

- 5.2. Market Analysis, Insights and Forecast - by Movement

- 5.2.1. Single Axis

- 5.2.2. Dual Axis

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Utility

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NexTracker Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valmont Industries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Asun Trackers Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GreenEra Energy India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trina Solar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Power Solar Systems Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PV Hardware Solutions SLU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arctech Solar Holding Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NexTracker Inc

List of Figures

- Figure 1: India Solar Tracker Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Solar Tracker Market Share (%) by Company 2025

List of Tables

- Table 1: India Solar Tracker Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: India Solar Tracker Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: India Solar Tracker Market Revenue million Forecast, by Movement 2020 & 2033

- Table 4: India Solar Tracker Market Volume Gigawatt Forecast, by Movement 2020 & 2033

- Table 5: India Solar Tracker Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Solar Tracker Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 7: India Solar Tracker Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Solar Tracker Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: India Solar Tracker Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: India Solar Tracker Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: India Solar Tracker Market Revenue million Forecast, by Movement 2020 & 2033

- Table 12: India Solar Tracker Market Volume Gigawatt Forecast, by Movement 2020 & 2033

- Table 13: India Solar Tracker Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: India Solar Tracker Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 15: India Solar Tracker Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Solar Tracker Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Tracker Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the India Solar Tracker Market?

Key companies in the market include NexTracker Inc, Valmont Industries Inc, Asun Trackers Pvt Ltd, GreenEra Energy India Pvt Ltd, Trina Solar, Tata Power Solar Systems Limited, PV Hardware Solutions SLU, Arctech Solar Holding Co Ltd.

3. What are the main segments of the India Solar Tracker Market?

The market segments include Type, Movement, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 286.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Photovoltaic Segment to Dominate.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In April 2022, Tata Power Solar Systems commissioned India's largest single axis solar tracker system in the 300 MW Dholera Solar Power Plant. This project will generate 774 MUs annually. Along with this it will reduce approximately 704340 MT/year of carbon emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Tracker Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Tracker Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Tracker Market?

To stay informed about further developments, trends, and reports in the India Solar Tracker Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence