Key Insights

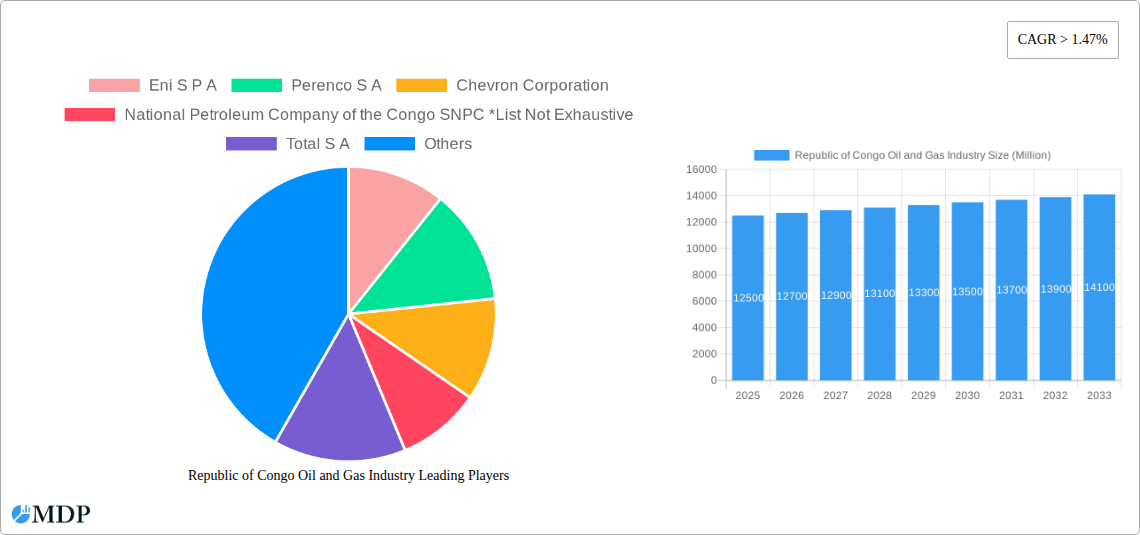

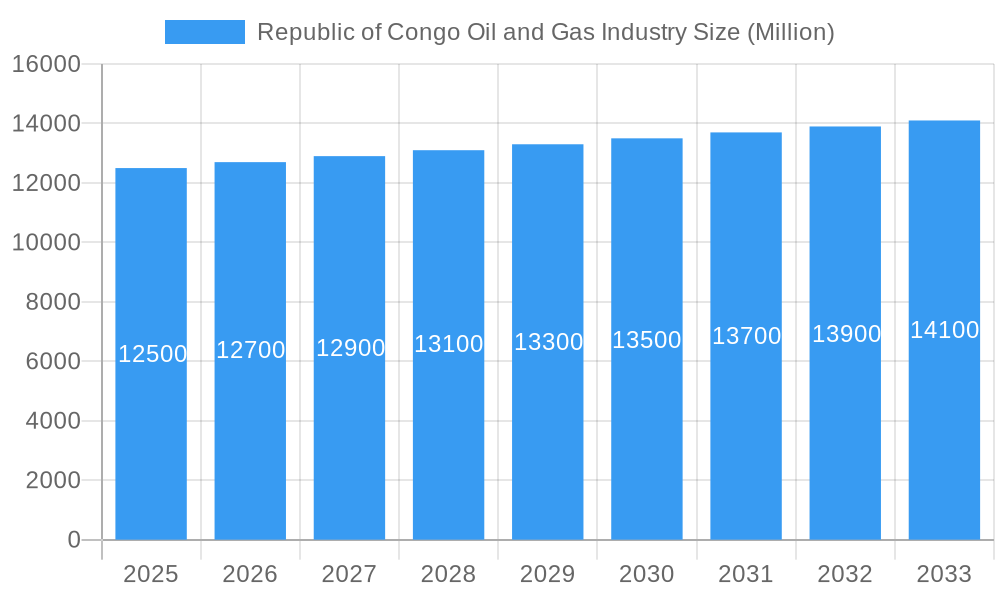

The Republic of Congo's oil and gas industry is poised for steady growth, driven by its significant hydrocarbon reserves and ongoing upstream exploration and development activities. The market, valued at approximately $12,500 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 1.47% through 2033. This growth is underpinned by a robust pipeline of projects, particularly in the onshore sector, which accounts for a substantial portion of current and future production. Key projects in both existing infrastructure and those in the pipeline, including new field developments and enhanced recovery initiatives, are crucial in maintaining and increasing output. The upstream segment, focusing on the location of deployment, is currently dominated by onshore operations, benefiting from established infrastructure and favorable geological conditions. However, the strategic development of offshore assets is also a growing area of interest for increasing reserves and production capacity.

Republic of Congo Oil and Gas Industry Market Size (In Billion)

The midstream and downstream sectors are critical for realizing the full value of the Congo's oil and gas resources. The midstream segment, encompassing transportation and storage, is set to see investments in upgrading existing infrastructure and developing new pipelines to efficiently move crude oil and natural gas to processing facilities. In the downstream segment, the focus is on enhancing refinery capabilities and expanding petrochemical plant operations. While the existing refinery infrastructure forms the backbone, there's a clear trend towards modernization and capacity expansion to meet domestic demand and potentially for export markets. Major players like Eni S.p.A., Perenco S.A., Chevron Corporation, and Total S.A. are actively involved, signaling confidence in the sector's long-term viability. Emerging opportunities lie in optimizing production, integrating advanced technologies for exploration and extraction, and potentially in the development of associated gas resources for power generation and industrial use.

Republic of Congo Oil and Gas Industry Company Market Share

Here is an SEO-optimized and engaging report description for the Republic of Congo Oil and Gas Industry, incorporating high-traffic keywords and structured as requested:

This comprehensive report provides an in-depth analysis of the Republic of Congo's burgeoning oil and gas industry, offering critical insights for stakeholders seeking to navigate this dynamic market. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report delves into market concentration, innovation drivers, regulatory frameworks, and key industry trends shaping the sector. Discover the market's growth potential, technological advancements, and strategic opportunities.

Republic of Congo Oil and Gas Industry Market Dynamics & Concentration

The Republic of Congo's oil and gas market exhibits a moderate concentration, with key players like Eni S.p.A., Perenco S.A., Chevron Corporation, Total S.A., and the National Petroleum Company of the Congo (SNPC) holding significant market shares. The upstream segment, particularly offshore exploration and production, dominates with an estimated xx% market share. Innovation is largely driven by the need for enhanced recovery techniques and the development of challenging deepwater reserves. The regulatory framework, managed by the Ministry of Hydrocarbons, is crucial for attracting foreign direct investment and ensuring sustainable resource management. Product substitutes, while a growing concern globally, have a relatively low impact on the immediate Congo market due to its established reliance on hydrocarbons. End-user trends are primarily influenced by global energy demand and national economic development priorities. Mergers and acquisitions (M&A) activity, while not exceptionally high, has seen strategic consolidation aimed at optimizing operational efficiency and expanding portfolios. For instance, the period saw xx major M&A deals valued at an aggregate of xx Million. Understanding these dynamics is paramount for successful market entry and expansion in the Republic of Congo oil and gas sector.

Republic of Congo Oil and Gas Industry Industry Trends & Analysis

The Republic of Congo's oil and gas industry is poised for significant growth, driven by increasing global energy demand and the country's vast untapped hydrocarbon reserves. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. Technological disruptions are playing a pivotal role, with advancements in seismic imaging, drilling technologies, and subsea infrastructure enabling access to deeper and more complex offshore fields. Consumer preferences, both domestically and internationally, are shifting towards cleaner energy sources, but the immediate demand for oil and gas remains robust, particularly for industrial and transportation purposes. The competitive landscape is characterized by the presence of major international oil companies (IOCs) and national oil companies (NOCs), all vying for exploration licenses and production concessions. Market penetration for new technologies is steadily increasing, especially in the upstream segment where efficiency gains are crucial for profitability. The downstream sector, though less developed, presents opportunities for expansion in refining and petrochemicals to add value to the country's crude oil exports. The overall trend indicates a maturing market with a focus on sustainable extraction and value chain enhancement, responding to global energy transition imperatives while capitalizing on existing strengths.

Leading Markets & Segments in Republic of Congo Oil and Gas Industry

The Upstream: Offshore segment is the undisputed leader within the Republic of Congo's oil and gas industry, driven by the nation's substantial deepwater reserves. This dominance is fueled by ongoing exploration activities and the successful deployment of advanced extraction technologies.

- Upstream: Offshore

- Overview: Characterized by significant deepwater hydrocarbon discoveries and substantial ongoing investment from major international oil companies. The geological formations in the Congolese deep offshore are rich, making it a prime target for exploration and production.

- Key Projects:

- Existing Projects: Projects like the Eni-operated Marine XII block continue to be major production hubs, contributing significantly to national output. Perenco's offshore operations also represent substantial existing infrastructure.

- Projects in Pipeline: Significant new developments are in the pipeline, with several exploration and appraisal campaigns targeting previously undeveloped offshore blocks, promising substantial future production volumes.

- Upcoming Projects: Future offshore projects are expected to focus on further deepwater discoveries and the efficient development of these complex fields.

The Midstream segment, encompassing transportation and storage, is crucial for the effective delivery of crude oil and refined products, with its growth directly linked to upstream production levels.

- Midstream

- Overview: Essential for the export of crude oil and the domestic distribution of refined products. Infrastructure development is a continuous priority to support rising production volumes.

- Key Projects:

- Existing Infrastructure: Includes crucial pipelines, offshore loading buoys, and storage terminals facilitating the export of crude oil.

- Projects in Pipeline: Plans are underway to upgrade and expand existing pipeline networks and storage capacities to accommodate projected increases in production.

- Upcoming Projects: Focus on enhancing logistics for both crude export and potential refined product distribution.

The Downstream segment, including Refineries and Petrochemicals Plants, represents an area of significant untapped potential, with current infrastructure being limited but slated for future expansion.

- Downstream: Refineries

- Overview: Currently, the Republic of Congo has a limited refining capacity, primarily focused on meeting domestic fuel demand. There is a strong strategic impetus to expand and modernize these facilities.

- Key Projects:

- Existing Infrastructure: The country's primary refinery, the Congolaise de Raffinage (Coraf) refinery, forms the core of existing downstream processing.

- Projects in Pipeline: Ambitious plans are in motion to upgrade and potentially expand refining capacity to increase the value addition of crude oil and reduce import dependence.

- Upcoming Projects: Future developments will likely target enhanced refining capabilities and the introduction of more complex processing units.

- Petrochemicals Plants: While currently nascent, the development of petrochemical plants is a key strategic objective to leverage the abundant natural gas resources and crude oil byproducts, creating higher-value products and diversifying the economy.

Republic of Congo Oil and Gas Industry Product Developments

Product developments in the Republic of Congo's oil and gas sector are primarily focused on enhancing exploration and production efficiency, particularly in the challenging deep offshore environments. Innovations in subsea technologies, advanced seismic data processing, and enhanced oil recovery (EOR) techniques are crucial for maximizing output from existing fields and unlocking new reserves. The emphasis is on adopting proven, cost-effective technologies that improve recovery rates and reduce operational risks. While downstream product innovation is less pronounced currently, future developments in petrochemicals could lead to the production of higher-value chemicals derived from the nation's hydrocarbon resources.

Key Drivers of Republic of Congo Oil and Gas Industry Growth

Several key drivers are propelling the growth of the Republic of Congo's oil and gas industry. Firstly, significant untapped reserves, particularly in the offshore regions, present substantial exploration and production opportunities. Secondly, favorable government policies aimed at attracting foreign investment, coupled with streamlined regulatory processes, encourage continued exploration and development. Technological advancements in deepwater exploration and production are making previously inaccessible reserves economically viable. Furthermore, sustained global demand for crude oil and natural gas, driven by developing economies, ensures a robust market for Congolese exports.

Challenges in the Republic of Congo Oil and Gas Industry Market

Despite its potential, the Republic of Congo's oil and gas industry faces several challenges. Regulatory hurdles and potential inconsistencies can create uncertainty for investors. Infrastructure limitations, particularly in the midstream and downstream sectors, can hinder efficient product transportation and value addition. Supply chain disruptions, exacerbated by logistical complexities and global events, can impact operational continuity. Furthermore, increasing global pressure for energy transition and environmental regulations pose long-term strategic challenges, requiring adaptation and diversification. Competition from other major oil-producing nations also adds to the market's complexity.

Emerging Opportunities in Republic of Congo Oil and Gas Industry

Emerging opportunities in the Republic of Congo's oil and gas sector lie in leveraging advanced digital technologies for enhanced operational efficiency and predictive maintenance. The country's substantial natural gas reserves offer significant potential for developing integrated gas value chains, including petrochemical production and liquefied natural gas (LNG) export. Strategic partnerships with international technology providers and investors can facilitate the adoption of cutting-edge exploration and production methods. Furthermore, investments in offshore infrastructure upgrades and the expansion of downstream processing capabilities present avenues for diversification and increased revenue generation.

Leading Players in the Republic of Congo Oil and Gas Industry Sector

- Eni S.p.A.

- Perenco S.A.

- Chevron Corporation

- National Petroleum Company of the Congo SNPC

- Total S.A.

Key Milestones in Republic of Congo Oil and Gas Industry Industry

- 2019: Signing of new exploration and production agreements, opening up new offshore blocks.

- 2020: Successful appraisal of deepwater reserves, confirming significant potential.

- 2021: Increased investment in subsea infrastructure to support enhanced production.

- 2022: Progress in discussions for downstream sector expansion and refinery upgrades.

- 2023: Intensified exploration activities in previously underexplored offshore areas.

- 2024: Strategic partnerships explored for natural gas monetization and potential LNG projects.

- 2025: Expected commencement of new development phases for key offshore fields.

Strategic Outlook for Republic of Congo Oil and Gas Industry Market

The strategic outlook for the Republic of Congo's oil and gas industry is one of sustained growth and increasing sophistication. The focus will remain on capitalizing on deepwater offshore reserves through technological innovation and operational excellence. Diversification into gas monetization and downstream value addition, including petrochemicals, presents significant long-term opportunities. Government commitment to a stable regulatory environment and attracting further foreign direct investment will be critical accelerators. The industry is expected to adapt to global energy transition trends by exploring cleaner extraction methods and contributing to energy security while pursuing value chain enhancement strategies.

Republic of Congo Oil and Gas Industry Segmentation

-

1. Upstream

-

1.1. Location of Deployment

-

1.1.1. Onshore

- 1.1.1.1. Overview

-

1.1.1.2. Key Projects

- 1.1.1.2.1. Existing Projects

- 1.1.1.2.2. Projects in Pipeline

- 1.1.1.2.3. Upcoming Projects

- 1.1.2. Offshore

-

1.1.1. Onshore

-

1.1. Location of Deployment

-

2. Midstream

- 2.1. Overview

-

2.2. Key Projects

- 2.2.1. Existing Infrastructure

- 2.2.2. Projects in pipeline

- 2.2.3. Upcoming projects

-

3. Downstream

-

3.1. Refineries

- 3.1.1. Overview

-

3.1.2. Key Projects

- 3.1.2.1. Existing Infrastructure

- 3.1.2.2. Projects in pipeline

- 3.1.2.3. Upcoming projects

- 3.2. Petrochemicals Plants

-

3.1. Refineries

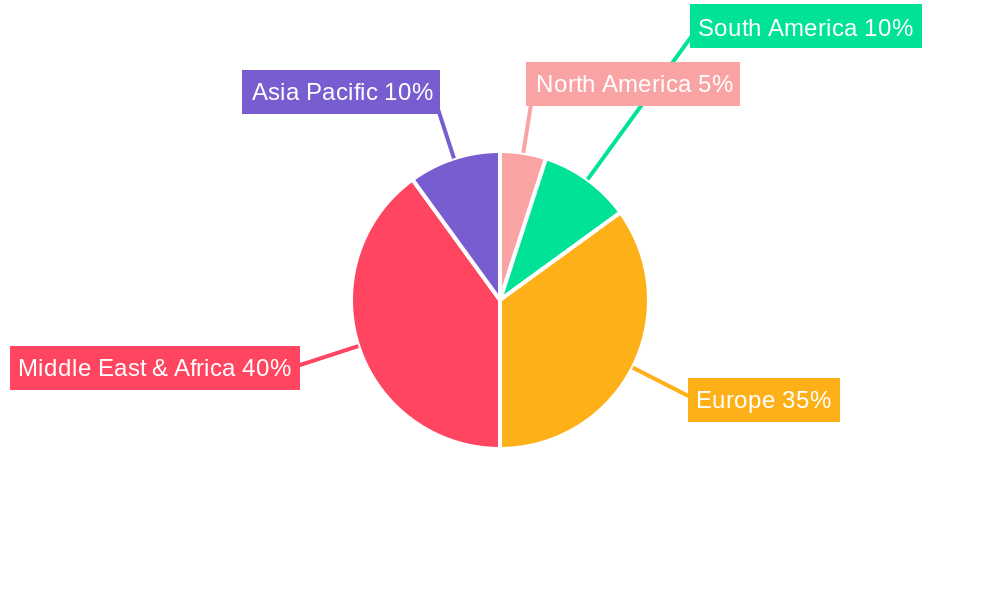

Republic of Congo Oil and Gas Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Republic of Congo Oil and Gas Industry Regional Market Share

Geographic Coverage of Republic of Congo Oil and Gas Industry

Republic of Congo Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.1.1. Location of Deployment

- 5.1.1.1. Onshore

- 5.1.1.1.1. Overview

- 5.1.1.1.2. Key Projects

- 5.1.1.1.2.1. Existing Projects

- 5.1.1.1.2.2. Projects in Pipeline

- 5.1.1.1.2.3. Upcoming Projects

- 5.1.1.2. Offshore

- 5.1.1.1. Onshore

- 5.1.1. Location of Deployment

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.2.1. Overview

- 5.2.2. Key Projects

- 5.2.2.1. Existing Infrastructure

- 5.2.2.2. Projects in pipeline

- 5.2.2.3. Upcoming projects

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.3.1. Refineries

- 5.3.1.1. Overview

- 5.3.1.2. Key Projects

- 5.3.1.2.1. Existing Infrastructure

- 5.3.1.2.2. Projects in pipeline

- 5.3.1.2.3. Upcoming projects

- 5.3.2. Petrochemicals Plants

- 5.3.1. Refineries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. North America Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Upstream

- 6.1.1. Location of Deployment

- 6.1.1.1. Onshore

- 6.1.1.1.1. Overview

- 6.1.1.1.2. Key Projects

- 6.1.1.1.2.1. Existing Projects

- 6.1.1.1.2.2. Projects in Pipeline

- 6.1.1.1.2.3. Upcoming Projects

- 6.1.1.2. Offshore

- 6.1.1.1. Onshore

- 6.1.1. Location of Deployment

- 6.2. Market Analysis, Insights and Forecast - by Midstream

- 6.2.1. Overview

- 6.2.2. Key Projects

- 6.2.2.1. Existing Infrastructure

- 6.2.2.2. Projects in pipeline

- 6.2.2.3. Upcoming projects

- 6.3. Market Analysis, Insights and Forecast - by Downstream

- 6.3.1. Refineries

- 6.3.1.1. Overview

- 6.3.1.2. Key Projects

- 6.3.1.2.1. Existing Infrastructure

- 6.3.1.2.2. Projects in pipeline

- 6.3.1.2.3. Upcoming projects

- 6.3.2. Petrochemicals Plants

- 6.3.1. Refineries

- 6.1. Market Analysis, Insights and Forecast - by Upstream

- 7. South America Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Upstream

- 7.1.1. Location of Deployment

- 7.1.1.1. Onshore

- 7.1.1.1.1. Overview

- 7.1.1.1.2. Key Projects

- 7.1.1.1.2.1. Existing Projects

- 7.1.1.1.2.2. Projects in Pipeline

- 7.1.1.1.2.3. Upcoming Projects

- 7.1.1.2. Offshore

- 7.1.1.1. Onshore

- 7.1.1. Location of Deployment

- 7.2. Market Analysis, Insights and Forecast - by Midstream

- 7.2.1. Overview

- 7.2.2. Key Projects

- 7.2.2.1. Existing Infrastructure

- 7.2.2.2. Projects in pipeline

- 7.2.2.3. Upcoming projects

- 7.3. Market Analysis, Insights and Forecast - by Downstream

- 7.3.1. Refineries

- 7.3.1.1. Overview

- 7.3.1.2. Key Projects

- 7.3.1.2.1. Existing Infrastructure

- 7.3.1.2.2. Projects in pipeline

- 7.3.1.2.3. Upcoming projects

- 7.3.2. Petrochemicals Plants

- 7.3.1. Refineries

- 7.1. Market Analysis, Insights and Forecast - by Upstream

- 8. Europe Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Upstream

- 8.1.1. Location of Deployment

- 8.1.1.1. Onshore

- 8.1.1.1.1. Overview

- 8.1.1.1.2. Key Projects

- 8.1.1.1.2.1. Existing Projects

- 8.1.1.1.2.2. Projects in Pipeline

- 8.1.1.1.2.3. Upcoming Projects

- 8.1.1.2. Offshore

- 8.1.1.1. Onshore

- 8.1.1. Location of Deployment

- 8.2. Market Analysis, Insights and Forecast - by Midstream

- 8.2.1. Overview

- 8.2.2. Key Projects

- 8.2.2.1. Existing Infrastructure

- 8.2.2.2. Projects in pipeline

- 8.2.2.3. Upcoming projects

- 8.3. Market Analysis, Insights and Forecast - by Downstream

- 8.3.1. Refineries

- 8.3.1.1. Overview

- 8.3.1.2. Key Projects

- 8.3.1.2.1. Existing Infrastructure

- 8.3.1.2.2. Projects in pipeline

- 8.3.1.2.3. Upcoming projects

- 8.3.2. Petrochemicals Plants

- 8.3.1. Refineries

- 8.1. Market Analysis, Insights and Forecast - by Upstream

- 9. Middle East & Africa Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Upstream

- 9.1.1. Location of Deployment

- 9.1.1.1. Onshore

- 9.1.1.1.1. Overview

- 9.1.1.1.2. Key Projects

- 9.1.1.1.2.1. Existing Projects

- 9.1.1.1.2.2. Projects in Pipeline

- 9.1.1.1.2.3. Upcoming Projects

- 9.1.1.2. Offshore

- 9.1.1.1. Onshore

- 9.1.1. Location of Deployment

- 9.2. Market Analysis, Insights and Forecast - by Midstream

- 9.2.1. Overview

- 9.2.2. Key Projects

- 9.2.2.1. Existing Infrastructure

- 9.2.2.2. Projects in pipeline

- 9.2.2.3. Upcoming projects

- 9.3. Market Analysis, Insights and Forecast - by Downstream

- 9.3.1. Refineries

- 9.3.1.1. Overview

- 9.3.1.2. Key Projects

- 9.3.1.2.1. Existing Infrastructure

- 9.3.1.2.2. Projects in pipeline

- 9.3.1.2.3. Upcoming projects

- 9.3.2. Petrochemicals Plants

- 9.3.1. Refineries

- 9.1. Market Analysis, Insights and Forecast - by Upstream

- 10. Asia Pacific Republic of Congo Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Upstream

- 10.1.1. Location of Deployment

- 10.1.1.1. Onshore

- 10.1.1.1.1. Overview

- 10.1.1.1.2. Key Projects

- 10.1.1.1.2.1. Existing Projects

- 10.1.1.1.2.2. Projects in Pipeline

- 10.1.1.1.2.3. Upcoming Projects

- 10.1.1.2. Offshore

- 10.1.1.1. Onshore

- 10.1.1. Location of Deployment

- 10.2. Market Analysis, Insights and Forecast - by Midstream

- 10.2.1. Overview

- 10.2.2. Key Projects

- 10.2.2.1. Existing Infrastructure

- 10.2.2.2. Projects in pipeline

- 10.2.2.3. Upcoming projects

- 10.3. Market Analysis, Insights and Forecast - by Downstream

- 10.3.1. Refineries

- 10.3.1.1. Overview

- 10.3.1.2. Key Projects

- 10.3.1.2.1. Existing Infrastructure

- 10.3.1.2.2. Projects in pipeline

- 10.3.1.2.3. Upcoming projects

- 10.3.2. Petrochemicals Plants

- 10.3.1. Refineries

- 10.1. Market Analysis, Insights and Forecast - by Upstream

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eni S P A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Perenco S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Petroleum Company of the Congo SNPC *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Total S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Eni S P A

List of Figures

- Figure 1: Global Republic of Congo Oil and Gas Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Republic of Congo Oil and Gas Industry Revenue (Million), by Upstream 2025 & 2033

- Figure 3: North America Republic of Congo Oil and Gas Industry Revenue Share (%), by Upstream 2025 & 2033

- Figure 4: North America Republic of Congo Oil and Gas Industry Revenue (Million), by Midstream 2025 & 2033

- Figure 5: North America Republic of Congo Oil and Gas Industry Revenue Share (%), by Midstream 2025 & 2033

- Figure 6: North America Republic of Congo Oil and Gas Industry Revenue (Million), by Downstream 2025 & 2033

- Figure 7: North America Republic of Congo Oil and Gas Industry Revenue Share (%), by Downstream 2025 & 2033

- Figure 8: North America Republic of Congo Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Republic of Congo Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Republic of Congo Oil and Gas Industry Revenue (Million), by Upstream 2025 & 2033

- Figure 11: South America Republic of Congo Oil and Gas Industry Revenue Share (%), by Upstream 2025 & 2033

- Figure 12: South America Republic of Congo Oil and Gas Industry Revenue (Million), by Midstream 2025 & 2033

- Figure 13: South America Republic of Congo Oil and Gas Industry Revenue Share (%), by Midstream 2025 & 2033

- Figure 14: South America Republic of Congo Oil and Gas Industry Revenue (Million), by Downstream 2025 & 2033

- Figure 15: South America Republic of Congo Oil and Gas Industry Revenue Share (%), by Downstream 2025 & 2033

- Figure 16: South America Republic of Congo Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Republic of Congo Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Republic of Congo Oil and Gas Industry Revenue (Million), by Upstream 2025 & 2033

- Figure 19: Europe Republic of Congo Oil and Gas Industry Revenue Share (%), by Upstream 2025 & 2033

- Figure 20: Europe Republic of Congo Oil and Gas Industry Revenue (Million), by Midstream 2025 & 2033

- Figure 21: Europe Republic of Congo Oil and Gas Industry Revenue Share (%), by Midstream 2025 & 2033

- Figure 22: Europe Republic of Congo Oil and Gas Industry Revenue (Million), by Downstream 2025 & 2033

- Figure 23: Europe Republic of Congo Oil and Gas Industry Revenue Share (%), by Downstream 2025 & 2033

- Figure 24: Europe Republic of Congo Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Republic of Congo Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue (Million), by Upstream 2025 & 2033

- Figure 27: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue Share (%), by Upstream 2025 & 2033

- Figure 28: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue (Million), by Midstream 2025 & 2033

- Figure 29: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue Share (%), by Midstream 2025 & 2033

- Figure 30: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue (Million), by Downstream 2025 & 2033

- Figure 31: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue Share (%), by Downstream 2025 & 2033

- Figure 32: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Republic of Congo Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Republic of Congo Oil and Gas Industry Revenue (Million), by Upstream 2025 & 2033

- Figure 35: Asia Pacific Republic of Congo Oil and Gas Industry Revenue Share (%), by Upstream 2025 & 2033

- Figure 36: Asia Pacific Republic of Congo Oil and Gas Industry Revenue (Million), by Midstream 2025 & 2033

- Figure 37: Asia Pacific Republic of Congo Oil and Gas Industry Revenue Share (%), by Midstream 2025 & 2033

- Figure 38: Asia Pacific Republic of Congo Oil and Gas Industry Revenue (Million), by Downstream 2025 & 2033

- Figure 39: Asia Pacific Republic of Congo Oil and Gas Industry Revenue Share (%), by Downstream 2025 & 2033

- Figure 40: Asia Pacific Republic of Congo Oil and Gas Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Republic of Congo Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 2: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 3: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 4: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 6: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 7: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 8: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 13: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 14: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 15: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 20: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 21: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 22: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 33: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 34: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 35: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Upstream 2020 & 2033

- Table 43: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Midstream 2020 & 2033

- Table 44: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Downstream 2020 & 2033

- Table 45: Global Republic of Congo Oil and Gas Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Republic of Congo Oil and Gas Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Republic of Congo Oil and Gas Industry?

The projected CAGR is approximately > 1.47%.

2. Which companies are prominent players in the Republic of Congo Oil and Gas Industry?

Key companies in the market include Eni S P A, Perenco S A, Chevron Corporation, National Petroleum Company of the Congo SNPC *List Not Exhaustive, Total S A.

3. What are the main segments of the Republic of Congo Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Upstream Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Republic of Congo Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Republic of Congo Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Republic of Congo Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Republic of Congo Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence