Key Insights

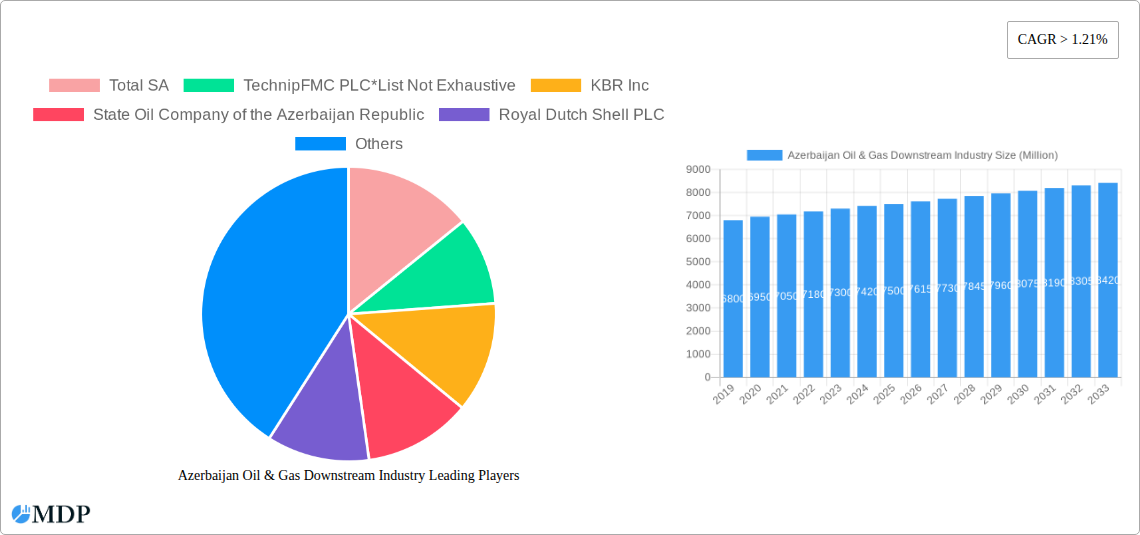

The Azerbaijan Oil & Gas Downstream Industry is projected to experience robust expansion. The market is estimated at 76.41 billion in the base year 2025 and is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.2% through 2033. This growth is propelled by strategic investments in refinery modernization and expansion, alongside the development of new petrochemical projects. Enhanced product distribution efficiency and increasing demand for refined petroleum products and petrochemicals are supported by crucial pipeline investments. Government initiatives aimed at economic diversification and maximizing value from hydrocarbon reserves are key drivers of this downstream development. Emerging trends include a heightened focus on high-value petrochemical derivatives, improved energy efficiency in refining, and the adoption of advanced technologies to meet environmental standards.

Azerbaijan Oil & Gas Downstream Industry Market Size (In Billion)

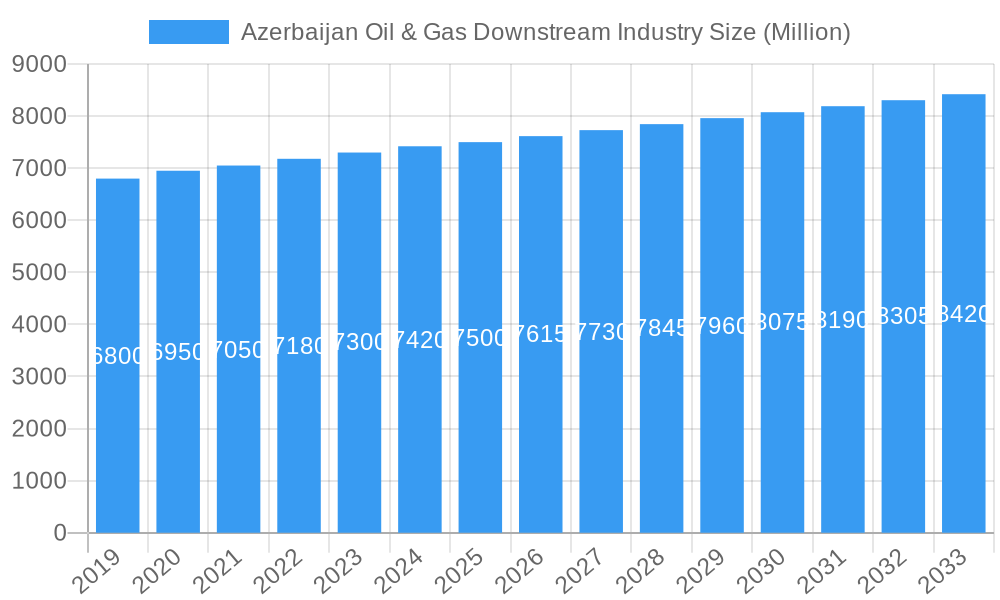

Significant planned investments in refineries and petrochemical plants underpin the industry's growth trajectory, indicating a long-term vision for upstream integration. While strong government support and abundant feedstock are beneficial, potential challenges include global crude oil and refined product price volatility, and the growing global emphasis on decarbonization and cleaner energy transitions. Nevertheless, the strategic importance of oil and gas downstream activities for Azerbaijan's economy, coupled with continuous facility upgrades and capacity development, suggests a resilient market outlook. Major industry participants, including TotalEnergies, TechnipFMC, KBR Inc., SOCAR, and Shell plc, are actively contributing expertise and capital. The expansion of petrochemical capabilities is particularly vital for developing new export markets and fostering domestic industrial growth.

Azerbaijan Oil & Gas Downstream Industry Company Market Share

Gain critical insights into the dynamic Azerbaijan Oil & Gas Downstream Industry. This comprehensive report, covering the period from 2019 to 2033 with a base year of 2025, offers an in-depth analysis of market dynamics, key trends, leading players, and future outlook. Discover investment opportunities and strategic advantages within Azerbaijan's evolving refining and petrochemical sectors. This report is essential for industry stakeholders, investors, and policymakers seeking to navigate this vital energy market.

Azerbaijan Oil & Gas Downstream Industry Market Dynamics & Concentration

The Azerbaijan Oil & Gas Downstream Industry is characterized by a moderate to high concentration, with key players like the State Oil Company of the Azerbaijan Republic (SOCAR) holding a significant market share. Innovation drivers are primarily focused on enhancing refinery efficiency, expanding petrochemical production capabilities, and adopting cleaner technologies to meet evolving environmental regulations and global demand. The regulatory framework, supported by government initiatives aimed at diversifying the economy and increasing value-added products from hydrocarbon resources, plays a crucial role in shaping market development. Product substitutes, while present in the broader energy market, are less of a direct threat to refined fuels and petrochemical feedstocks within Azerbaijan's domestic and export-oriented downstream operations. End-user trends are leaning towards higher-quality refined products and specialized petrochemicals, driven by industrial growth and consumer demand. Mergers and Acquisitions (M&A) activity, while not consistently high, represents a strategic avenue for consolidation and expansion, with past deals involving international collaborations to upgrade existing infrastructure and develop new facilities. The number of M&A deals has been approximately 5 in the historical period (2019-2024), with a projected 3 in the forecast period. The market share of the leading player, SOCAR, is estimated at 65% in the base year 2025.

Azerbaijan Oil & Gas Downstream Industry Industry Trends & Analysis

The Azerbaijan Oil & Gas Downstream Industry is experiencing robust growth, driven by strategic investments in infrastructure modernization and expansion of petrochemical capacities. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). Technological disruptions are increasingly influencing the sector, with a focus on advanced refining techniques for higher-value products and the adoption of state-of-the-art petrochemical processes. Azerbaijan's commitment to diversifying its economy and enhancing its role as a reliable energy supplier to Europe and beyond is a significant market growth driver. The development of new refining units and petrochemical plants, coupled with upgrades to existing facilities, is aimed at increasing the processing of crude oil and natural gas into refined fuels, lubricants, polymers, and other essential chemical products. Consumer preferences are shifting towards environmentally friendly and high-performance products, pushing downstream players to innovate and adopt sustainable practices. Competitive dynamics are intensifying as both domestic and international companies vie for market share through strategic investments and technological advancements. The market penetration of refined products is already high, with a focus now shifting towards increasing the value-added segment through sophisticated petrochemical derivatives. Efforts to improve energy efficiency and reduce emissions are also becoming paramount, aligning with global sustainability goals and potentially opening new avenues for green technologies within the downstream sector. Furthermore, the strategic geographical location of Azerbaijan, serving as a transit hub, provides a competitive edge in supplying regional and international markets. The continuous demand for energy and chemical products, coupled with government support for industrial development, underpins the sustained expansion of the Azerbaijan Oil & Gas Downstream Industry.

Leading Markets & Segments in Azerbaijan Oil & Gas Downstream Industry

The Refineries: Overview segment stands as a dominant force within the Azerbaijan Oil & Gas Downstream Industry, driven by substantial existing infrastructure and a clear pipeline of future projects. Azerbaijan possesses a foundational refining capacity, with key facilities undergoing continuous upgrades to meet international quality standards for fuels and to increase the yield of higher-value products. The Existing Infrastructure within refineries is substantial, supporting the domestic demand for gasoline, diesel, and aviation fuel. Projects in the Pipeline are focused on modernization and capacity enhancement, aiming to improve efficiency and reduce environmental impact. Upcoming Projects signify a strategic push towards producing cleaner fuels and specialized products, aligning with global energy transition trends and stringent environmental regulations.

In parallel, the Petrochemical Plants: Overview segment is experiencing significant growth and is poised to become a major contributor to the industry's overall value. Azerbaijan's rich natural gas reserves provide abundant feedstock for petrochemical production. The Existing Infrastructure in petrochemicals is being augmented, with existing plants producing essential chemicals like polymers and fertilizers. Projects in the Pipeline are ambitious, targeting the expansion of ethylene, propylene, and polyethylene production, aiming to capture a larger share of the regional and global petrochemical market. Upcoming Projects are particularly exciting, with plans for integrated complexes that will leverage cutting-edge technologies to produce a wider range of higher-value petrochemical derivatives, catering to sectors like automotive, construction, and packaging.

Key drivers for the dominance of the refining and petrochemical segments include Azerbaijan's abundant hydrocarbon resources, strategic government policies promoting industrialization and value addition, and significant foreign direct investment attracted by the sector's potential. The nation's advantageous geographical location further bolsters its position as a key supplier of refined products and petrochemicals to European and Asian markets.

Azerbaijan Oil & Gas Downstream Industry Product Developments

Product development in Azerbaijan's Oil & Gas Downstream Industry is increasingly focused on high-value, specialized outputs. Refineries are concentrating on producing cleaner fuels that meet stringent Euro V and VI emission standards, alongside advanced lubricants and bitumen for infrastructure projects. In the petrochemical realm, innovation is geared towards producing advanced polymers with enhanced properties for the automotive, packaging, and construction industries. The competitive advantage lies in leveraging Azerbaijan's ample feedstock, adopting cutting-edge processing technologies, and aligning production with international quality benchmarks and sustainability requirements.

Key Drivers of Azerbaijan Oil & Gas Downstream Industry Growth

Several key factors are propelling the growth of Azerbaijan's Oil & Gas Downstream Industry. Technological advancements in refining and petrochemical processing are enhancing efficiency and enabling the production of higher-value products. Economic policies promoting foreign investment and industrial diversification are crucial, attracting significant capital for infrastructure development and capacity expansion. Furthermore, the strategic importance of Azerbaijan as an energy supplier to Europe, particularly in light of global energy security concerns, is a major catalyst for increased downstream activity and investment. The ongoing expansion of gas export infrastructure also indirectly supports downstream investments by ensuring reliable feedstock availability.

Challenges in the Azerbaijan Oil & Gas Downstream Industry Market

Despite strong growth prospects, the Azerbaijan Oil & Gas Downstream Industry faces several challenges. Regulatory hurdles, including evolving environmental standards and the need for continuous compliance, can impact operational costs and development timelines. Supply chain complexities, particularly for specialized equipment and chemicals, can lead to project delays. Competitive pressures from established global players and fluctuating international commodity prices also present significant challenges. Furthermore, the global transition towards cleaner energy sources necessitates a proactive approach to diversify product portfolios and invest in sustainable technologies to mitigate long-term risks.

Emerging Opportunities in Azerbaijan Oil & Gas Downstream Industry

Emerging opportunities in Azerbaijan's Oil & Gas Downstream Industry are driven by several catalysts. Technological breakthroughs in areas like carbon capture, utilization, and storage (CCUS), and the development of biofuels, offer pathways for more sustainable operations and new product lines. Strategic partnerships with international companies can facilitate knowledge transfer, access to advanced technologies, and joint ventures for large-scale projects. Market expansion strategies, particularly focusing on high-growth Asian markets and further penetration into European demand centers, represent significant long-term growth potential. The increasing demand for specific petrochemical derivatives, such as those used in electric vehicle manufacturing, also presents a lucrative avenue for development.

Leading Players in the Azerbaijan Oil & Gas Downstream Industry Sector

- State Oil Company of the Azerbaijan Republic

- Total SA

- Royal Dutch Shell PLC

- TechnipFMC PLC

- KBR Inc

Key Milestones in Azerbaijan Oil & Gas Downstream Industry Industry

- September 2022: According to Azerbaijani Energy Minister Parviz Shahbazov, Azerbaijan would raise gas shipments to Europe by 40% in 2022 compared to 2021, reaching 11.5 billion cubic meters. Shahbazov discussed Azerbaijan's role in diversifying supply sources, which will help to balance energy markets and end the energy crisis.

- 2021: Completion of the STAR Refinery expansion project in Turkey, which is a significant outlet for Azerbaijani crude oil.

- 2020: SOCAR announced plans for the modernization of its Heydar Aliyev Baku Oil Refinery to enhance production of higher-quality fuels.

- 2019: Inauguration of the Southern Gas Corridor, a major energy infrastructure project that enhances Azerbaijan's capacity to export natural gas, indirectly supporting downstream petrochemical development.

Strategic Outlook for Azerbaijan Oil & Gas Downstream Industry Market

The strategic outlook for Azerbaijan's Oil & Gas Downstream Industry is characterized by continued expansion and diversification. Growth will be accelerated by ongoing investments in refinery upgrades and the ambitious development of integrated petrochemical complexes, aimed at increasing the production of higher-value chemical products. The focus on embracing cleaner technologies and aligning with international environmental standards will be crucial for long-term sustainability and market competitiveness. Azerbaijan's strategic geographical position, coupled with its commitment to energy security, positions it favorably to capitalize on regional and global demand for refined fuels and petrochemicals, solidifying its role as a key player in the international energy landscape.

Azerbaijan Oil & Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemical Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Azerbaijan Oil & Gas Downstream Industry Segmentation By Geography

- 1. Azerbaijan

Azerbaijan Oil & Gas Downstream Industry Regional Market Share

Geographic Coverage of Azerbaijan Oil & Gas Downstream Industry

Azerbaijan Oil & Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electricity Generation along with Energy Consumption Demand4.8.; Increasing adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing out of Coal-Based Power Plants

- 3.4. Market Trends

- 3.4.1. Petrochemicals Plants is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Azerbaijan Oil & Gas Downstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Azerbaijan

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TechnipFMC PLC*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KBR Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Oil Company of the Azerbaijan Republic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Dutch Shell PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Azerbaijan Oil & Gas Downstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Azerbaijan Oil & Gas Downstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 2: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemical Plants 2020 & 2033

- Table 3: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 5: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemical Plants 2020 & 2033

- Table 6: Azerbaijan Oil & Gas Downstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Azerbaijan Oil & Gas Downstream Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Azerbaijan Oil & Gas Downstream Industry?

Key companies in the market include Total SA, TechnipFMC PLC*List Not Exhaustive, KBR Inc, State Oil Company of the Azerbaijan Republic, Royal Dutch Shell PLC.

3. What are the main segments of the Azerbaijan Oil & Gas Downstream Industry?

The market segments include Refineries, Petrochemical Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.41 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electricity Generation along with Energy Consumption Demand4.8.; Increasing adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Petrochemicals Plants is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Phasing out of Coal-Based Power Plants.

8. Can you provide examples of recent developments in the market?

September 2022: According to Azerbaijani Energy Minister Parviz Shahbazov, Azerbaijan would raise gas shipments to Europe by 40% in 2022 compared to 2021, reaching 11.5 billion cubic meters. Shahbazov discussed Azerbaijan's role in diversifying supply sources, which will help to balance energy markets and end the energy crisis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Azerbaijan Oil & Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Azerbaijan Oil & Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Azerbaijan Oil & Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Azerbaijan Oil & Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence