Key Insights

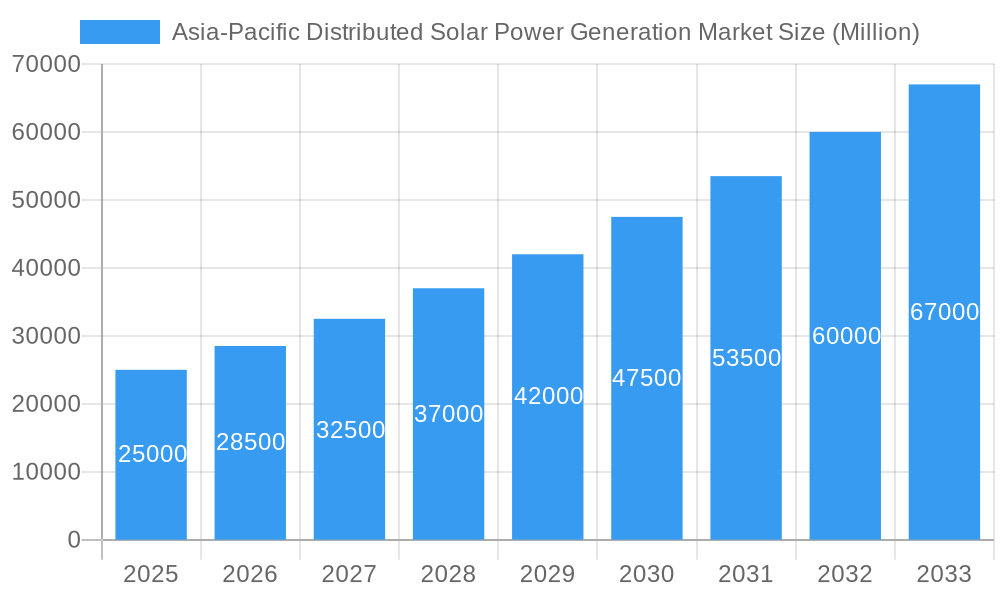

The Asia-Pacific Distributed Solar Power Generation Market is projected to experience substantial growth, reaching an estimated market size of 481.42 billion by 2025. The market is expected to maintain a robust Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033. This expansion is propelled by supportive government policies, increasing environmental consciousness, and declining solar photovoltaic (PV) technology costs across the region. Key economies like China and India are spearheading this growth, driven by aggressive renewable energy objectives and rising demand for decentralized power solutions in both urban and rural areas. Significant adoption within the commercial and industrial sectors, coupled with a surge in residential installations due to favorable incentives and net-metering policies, are primary growth catalysts. Advancements in solar panel efficiency and energy storage solutions are further enhancing the reliability and economic feasibility of distributed solar systems, positioning them as a compelling alternative to conventional energy sources.

Asia-Pacific Distributed Solar Power Generation Market Market Size (In Billion)

Market dynamics are also influenced by emerging trends, including the integration of smart grid technologies and the increasing popularity of community solar projects, promoting enhanced energy independence and resilience. While significant growth is anticipated, challenges such as grid integration complexities, varying regulatory frameworks in certain sub-regions, and intermittent supply due to weather conditions warrant strategic consideration. Nevertheless, the overwhelmingly positive market sentiment and strategic investments from leading entities including JinkoSolar, First Solar, and JA Solar underscore the immense potential of this market. The Asia-Pacific region, with its vast population and developing economies, represents a crucial area for distributed solar power, promising significant contributions to energy security and climate change mitigation efforts. The forecast period from 2025 to 2033 anticipates continued innovation and market penetration, solidifying distributed solar's pivotal role in the region's future energy infrastructure.

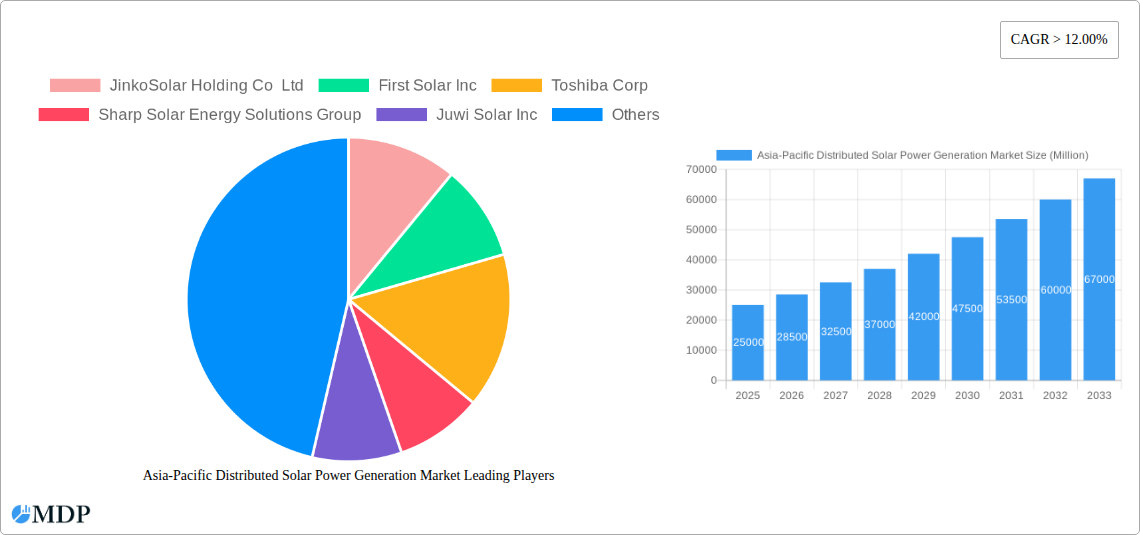

Asia-Pacific Distributed Solar Power Generation Market Company Market Share

Asia-Pacific Distributed Solar Power Generation Market: Comprehensive Industry Analysis and Growth Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia-Pacific Distributed Solar Power Generation Market, providing critical insights for stakeholders navigating this rapidly evolving sector. Covering a study period from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period from 2025 to 2033, this report delivers actionable intelligence on market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, opportunities, key players, and strategic outlook. Leveraging high-traffic keywords like "distributed solar power," "Asia-Pacific solar market," "renewable energy growth," "solar panel innovation," and "energy transition," this report maximizes search visibility and engagement for industry professionals, investors, and policymakers.

Asia-Pacific Distributed Solar Power Generation Market Market Dynamics & Concentration

The Asia-Pacific distributed solar power generation market exhibits a moderately concentrated structure, with key players dominating significant portions of the market share. Innovation drivers are primarily fueled by advancements in photovoltaic (PV) cell efficiency, energy storage solutions, and smart grid integration technologies. Regulatory frameworks across the region are increasingly supportive, with government incentives, net metering policies, and renewable energy targets acting as significant catalysts for growth. Product substitutes, such as centralized solar farms and other renewable energy sources, present competition, but the unique advantages of distributed solar, including grid resilience and localized energy generation, continue to drive adoption. End-user trends reflect a growing demand for energy independence, reduced electricity bills, and a commitment to sustainability, particularly among residential and commercial sectors. Mergers and acquisitions (M&A) activities have been steadily increasing, indicating consolidation and strategic partnerships aimed at expanding market reach and technological capabilities. For instance, the past three years have seen an estimated XX M&A deals, with major players acquiring smaller technology providers or regional distributors to strengthen their market position. Key companies like JinkoSolar Holding Co Ltd and Trina Solar Limited hold substantial market share, estimated at XX% and XX% respectively in 2025.

Asia-Pacific Distributed Solar Power Generation Market Industry Trends & Analysis

The Asia-Pacific distributed solar power generation market is poised for robust expansion, driven by a confluence of technological advancements, supportive policies, and escalating environmental consciousness. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This impressive growth is underpinned by several key factors. Firstly, the increasing cost-competitiveness of solar photovoltaic (PV) technology, coupled with declining battery storage prices, is making distributed solar solutions more accessible and economically viable for a wider range of consumers. Secondly, governments across the region are actively promoting renewable energy adoption through favorable policies such as feed-in tariffs, tax incentives, and net metering schemes, thereby reducing the payback period for solar investments. For example, China's ambitious renewable energy targets and India's focus on energy security are significant drivers. Thirdly, technological disruptions, including the development of higher-efficiency solar panels, bifacial modules, and advanced inverters, are enhancing the performance and reliability of distributed solar systems. The integration of artificial intelligence (AI) and the Internet of Things (IoT) in managing solar assets is further optimizing energy generation and consumption patterns. Consumer preferences are shifting towards decentralized energy solutions, driven by a desire for energy independence, reduced reliance on grid electricity, and a growing awareness of climate change. The commercial and industrial (C&I) sector is a major growth engine, with businesses increasingly adopting rooftop solar to reduce operational costs and meet sustainability goals. Residential adoption is also on an upward trajectory, spurred by declining system costs and a growing interest in home energy management. The competitive landscape is characterized by the presence of both established global players and emerging regional manufacturers, all vying for market share through product innovation, strategic partnerships, and competitive pricing. Market penetration of distributed solar in the residential sector is expected to reach XX% by 2033, while the C&I segment is projected to account for XX% of the total market share. The continued evolution of smart grid technologies and the increasing demand for resilient energy infrastructure further bolster the long-term outlook for this dynamic market.

Leading Markets & Segments in Asia-Pacific Distributed Solar Power Generation Market

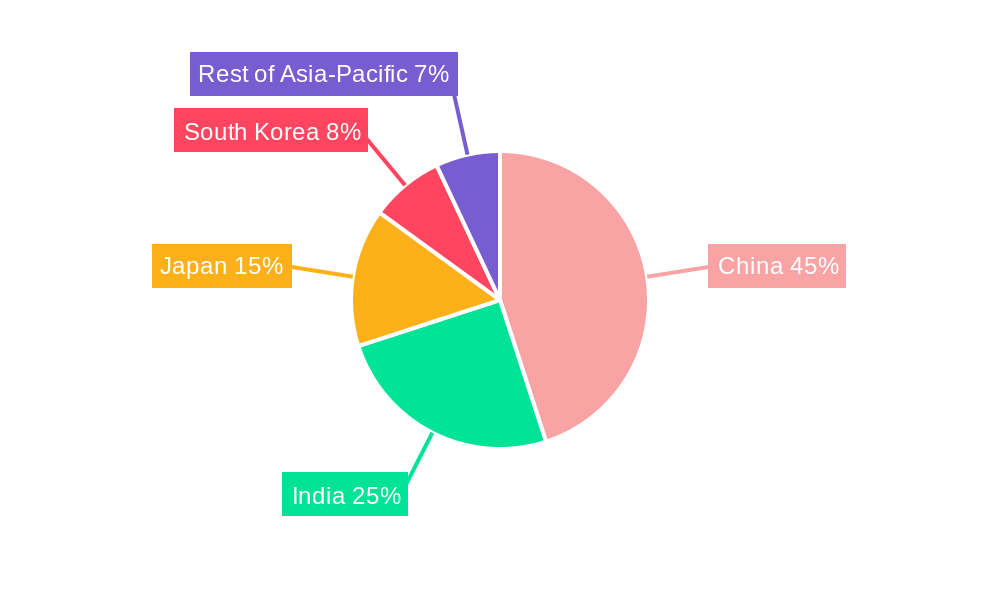

China stands as the undisputed leader in the Asia-Pacific distributed solar power generation market, commanding a substantial market share estimated at over XX% in 2025. The dominance of China is attributed to a robust combination of government support, aggressive manufacturing capabilities, and a massive domestic market. Key drivers for China's leadership include:

- Ambitious National Policies: China has consistently set ambitious targets for solar capacity deployment, providing strong policy backing and financial incentives that have spurred unprecedented growth in both utility-scale and distributed solar projects.

- Manufacturing Prowess: The country is the world's largest manufacturer of solar panels and related components, leading to economies of scale and highly competitive pricing that benefits distributed solar installations.

- Urbanization and Industrialization: Rapid urbanization and ongoing industrialization have created a significant demand for electricity, with distributed solar offering a viable solution for meeting localized energy needs and reducing grid strain.

- Technological Advancements: Significant investment in research and development has led to continuous improvements in solar panel efficiency and system integration, making distributed solar more attractive for a wider range of applications.

Following China, India emerges as another pivotal market, driven by its vast energy deficit, government initiatives like the National Solar Mission, and a growing demand for affordable and accessible electricity. India's distributed solar market is characterized by rapid growth in both rooftop solar for residential and commercial segments, with supportive policies aimed at achieving its renewable energy targets.

Japan represents a mature yet significant market for distributed solar, largely propelled by strong government incentives and feed-in tariffs that were instrumental in the early growth of the solar sector. The country's focus on energy security and the integration of solar with energy storage solutions continues to drive demand for distributed systems, particularly in the residential sector.

South Korea is also a key contributor, with government policies promoting renewable energy adoption and technological innovation. The nation's advanced manufacturing base and focus on smart grid development are contributing to the growth of sophisticated distributed solar solutions.

The Rest of Asia-Pacific region, encompassing countries like Australia, Southeast Asian nations (e.g., Vietnam, Thailand, the Philippines), and Taiwan, presents a dynamic and rapidly expanding segment. Diverse economic conditions, varying regulatory landscapes, and increasing awareness of climate change are fostering significant opportunities for distributed solar. Growth in this segment is often driven by falling solar costs, the need for energy access in remote areas, and corporate sustainability commitments. For instance, Vietnam has seen an explosion in rooftop solar installations due to favorable policies and a surge in industrial demand. Australia's high rooftop solar penetration rate, driven by a combination of economic incentives and consumer demand for energy independence, also contributes significantly to this segment's growth.

Asia-Pacific Distributed Solar Power Generation Market Product Developments

The Asia-Pacific distributed solar power generation market is witnessing a wave of innovative product developments aimed at enhancing efficiency, reliability, and user experience. Advances in photovoltaic cell technology, such as the widespread adoption of PERC (Passivated Emitter and Rear Cell) and the increasing commercialization of TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction) technologies, are pushing module power outputs higher and improving performance in low-light conditions. The integration of energy storage solutions, including advanced lithium-ion batteries and emerging technologies like flow batteries, is becoming standard, enabling greater energy independence and grid stabilization. Smart inverters with enhanced grid-forming capabilities and remote monitoring features are transforming distributed systems into intelligent energy assets. Furthermore, the development of building-integrated photovoltaics (BIPV) and aesthetically pleasing solar solutions is catering to evolving consumer preferences and architectural integration needs. These product advancements are crucial for expanding market penetration across residential, commercial, and industrial segments by offering more cost-effective, efficient, and user-friendly solar energy solutions.

Key Drivers of Asia-Pacific Distributed Solar Power Generation Market Growth

The Asia-Pacific distributed solar power generation market is propelled by a powerful combination of technological advancements, economic imperatives, and supportive regulatory frameworks. Decreasing costs of solar PV modules and battery storage systems are making distributed solar increasingly affordable and economically attractive for both residential and commercial consumers, leading to a faster return on investment. Government policies, including feed-in tariffs, tax incentives, net metering, and ambitious renewable energy targets, are crucial in de-risking investments and encouraging adoption. For example, India's renewable energy targets and China's supportive policies have been significant growth accelerators. Technological innovations, such as higher-efficiency solar cells, advanced inverters, and integrated energy management systems, are enhancing system performance and reliability. Furthermore, a growing global and regional emphasis on sustainability and climate change mitigation is driving demand for clean energy solutions, further bolstering the market's expansion. The desire for energy security and independence is also a key driver, particularly in regions with volatile energy prices or unreliable grid infrastructure.

Challenges in the Asia-Pacific Distributed Solar Power Generation Market Market

Despite its promising growth trajectory, the Asia-Pacific distributed solar power generation market faces several significant challenges that could impede its full potential. Regulatory fragmentation and policy uncertainty across different countries can create hurdles for market players seeking to operate or invest regionally. Intermittency of solar power necessitates reliable and affordable energy storage solutions, which are still relatively expensive in some markets, impacting system economics. Grid integration challenges, including the capacity of existing grids to handle distributed generation and the implementation of smart grid technologies, can limit widespread adoption, especially in older infrastructure. Supply chain disruptions and fluctuating raw material prices, particularly for components like polysilicon and rare earth metals, can affect manufacturing costs and project timelines. Lastly, competition from other energy sources, including subsidized fossil fuels in some regions, and the need for ongoing consumer education regarding the benefits and financing of solar systems present ongoing competitive pressures.

Emerging Opportunities in Asia-Pacific Distributed Solar Power Generation Market

The Asia-Pacific distributed solar power generation market is rife with emerging opportunities that promise to drive long-term growth. Technological breakthroughs in areas such as perovskite solar cells, bifacial modules, and advanced battery chemistries are expected to further reduce costs and enhance efficiency, making solar even more competitive. Strategic partnerships between solar developers, technology providers, and financial institutions are facilitating innovative financing models and project deployments. The increasing demand for microgrids and off-grid solutions in remote or developing areas presents a significant opportunity for distributed solar to provide essential power. Furthermore, the growing trend of corporate power purchase agreements (PPAs) for distributed solar installations is enabling businesses to secure long-term, stable electricity prices while meeting their sustainability objectives. The convergence of distributed solar with electric vehicles (EVs) and smart home technologies also opens new avenues for integrated energy management and value creation.

Leading Players in the Asia-Pacific Distributed Solar Power Generation Market Sector

- JinkoSolar Holding Co Ltd

- First Solar Inc

- Toshiba Corp

- Sharp Solar Energy Solutions Group

- Juwi Solar Inc

- Wuxi Suntech Power Co Ltd

- Mitsubishi Electric Corporation

- Shenzhen Yingli New Energy Resources Co Ltd

- Motech Industries Inc

- JA Solar Holdings Co Ltd

- Trina Solar Limited

Key Milestones in Asia-Pacific Distributed Solar Power Generation Market Industry

- 2019: Significant increase in distributed solar installations in India driven by favorable policies and declining costs.

- 2020: China surpasses XX GW of cumulative distributed solar capacity, highlighting its manufacturing and deployment leadership.

- 2021: Major players like JinkoSolar and Trina Solar announce advancements in high-efficiency solar cell technologies, such as TOPCon and HJT.

- 2022: Growing focus on energy storage integration with distributed solar systems across Japan and South Korea to enhance grid stability and energy independence.

- 2023: Several Southeast Asian nations, including Vietnam and the Philippines, introduce new policies to accelerate rooftop solar adoption in the commercial and industrial sectors.

- 2024: Increased M&A activity as larger companies acquire smaller innovators and regional distributors to expand their market footprint.

- 2025 (Estimated): Anticipated further decline in the cost of battery storage, making hybrid solar-plus-storage solutions more economically viable and driving adoption in the residential segment across the region.

Strategic Outlook for Asia-Pacific Distributed Solar Power Generation Market Market

The strategic outlook for the Asia-Pacific distributed solar power generation market is exceptionally strong, driven by a sustained commitment to renewable energy and ongoing technological advancements. Key growth accelerators include the continued reduction in solar and storage costs, which will further democratize access to clean energy. Governments across the region are expected to maintain and strengthen supportive policies, recognizing the dual benefits of energy security and environmental protection. The increasing adoption of smart grid technologies will facilitate seamless integration of distributed generation, enhancing grid reliability and flexibility. Furthermore, the growing demand from the commercial and industrial sectors for cost-effective and sustainable energy solutions will continue to fuel significant growth. Emerging opportunities in areas like microgrids, electric vehicle integration, and the development of advanced BIPV solutions will also contribute to market expansion, positioning distributed solar as a cornerstone of the Asia-Pacific's energy future.

Asia-Pacific Distributed Solar Power Generation Market Segmentation

-

1. Geography

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia-Pacific

Asia-Pacific Distributed Solar Power Generation Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Distributed Solar Power Generation Market Regional Market Share

Geographic Coverage of Asia-Pacific Distributed Solar Power Generation Market

Asia-Pacific Distributed Solar Power Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Electricity to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. China

- 5.1.2. India

- 5.1.3. Japan

- 5.1.4. South Korea

- 5.1.5. Rest of Asia-Pacific

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. China Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. China

- 6.1.2. India

- 6.1.3. Japan

- 6.1.4. South Korea

- 6.1.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. India Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. China

- 7.1.2. India

- 7.1.3. Japan

- 7.1.4. South Korea

- 7.1.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Japan Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. China

- 8.1.2. India

- 8.1.3. Japan

- 8.1.4. South Korea

- 8.1.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. South Korea Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. China

- 9.1.2. India

- 9.1.3. Japan

- 9.1.4. South Korea

- 9.1.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Rest of Asia Pacific Asia-Pacific Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. China

- 10.1.2. India

- 10.1.3. Japan

- 10.1.4. South Korea

- 10.1.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JinkoSolar Holding Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 First Solar Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sharp Solar Energy Solutions Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Juwi Solar Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wuxi Suntech Power Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shenzhen Yingli New Energy Resources Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Motech Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JA Solar Holdings Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Trina Solar Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Asia-Pacific Distributed Solar Power Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Distributed Solar Power Generation Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 2: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Distributed Solar Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Distributed Solar Power Generation Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Asia-Pacific Distributed Solar Power Generation Market?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, Toshiba Corp, Sharp Solar Energy Solutions Group, Juwi Solar Inc, Wuxi Suntech Power Co Ltd, Mitsubishi Electric Corporation, Shenzhen Yingli New Energy Resources Co Ltd, Motech Industries Inc, JA Solar Holdings Co Ltd, Trina Solar Limited.

3. What are the main segments of the Asia-Pacific Distributed Solar Power Generation Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 481.42 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Electricity to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Distributed Solar Power Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Distributed Solar Power Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Distributed Solar Power Generation Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Distributed Solar Power Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence