Key Insights

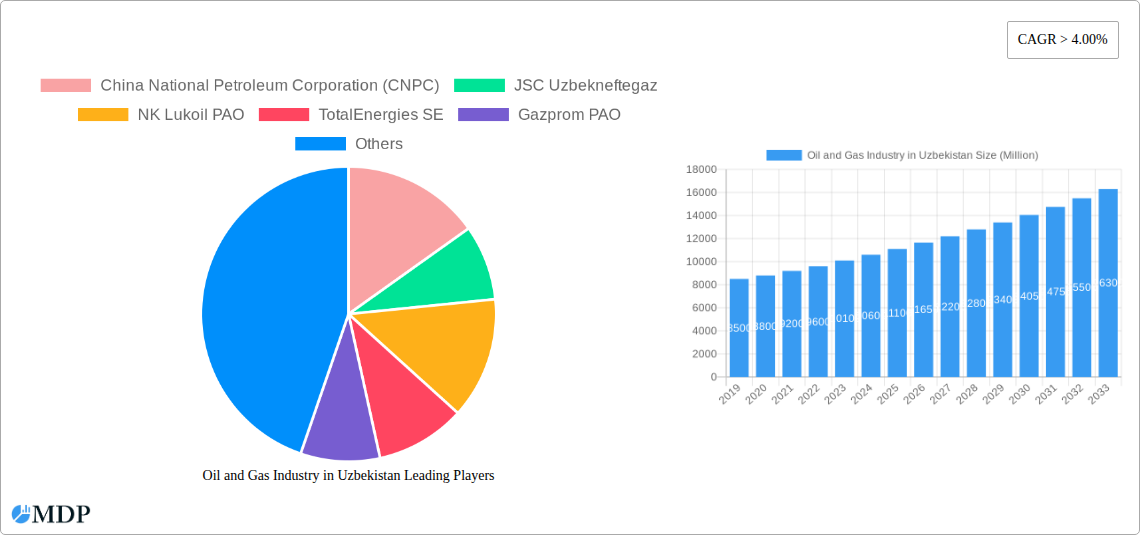

Uzbekistan's oil and gas industry is experiencing robust expansion, with a projected market size of $10.3 billion by 2024, driven by a compound annual growth rate (CAGR) of 4% through 2033. This growth is propelled by significant upstream exploration and production, substantial midstream infrastructure investments in transportation and storage, and advanced downstream refining and petrochemical processing. The nation's strategic location and abundant hydrocarbon reserves are attracting considerable foreign direct investment from key players including China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, and Gazprom PAO. These investments are crucial for modernizing facilities and developing new fields, enhancing production and operational efficiency. Government-led energy sector reforms are further fostering a favorable investment climate and promoting sustained growth and technological innovation. Growing domestic and regional energy demand, coupled with Uzbekistan's efforts to diversify its energy mix and export capacity, underpin a positive sector outlook.

Oil and Gas Industry in Uzbekistan Market Size (In Billion)

Key market trends include the integration of advanced exploration technologies for accessing previously untapped reserves and the development of value-added petrochemical products for optimized resource utilization. A notable emphasis is placed on expanding gas processing capabilities to facilitate the production of liquefied natural gas (LNG) and other derivatives for export. However, the industry faces challenges such as the substantial capital investment required for aging infrastructure, geopolitical uncertainties impacting global energy prices and investment flows, and the global decarbonization imperative potentially influencing long-term fossil fuel demand. Despite these hurdles, the near- to medium-term outlook remains strong, supported by ongoing development of significant gas fields and strategic partnerships. The upstream segment is anticipated to lead market value generation, followed by midstream infrastructure development and downstream processing, all contributing to Uzbekistan's aspiration of becoming a key regional energy supplier.

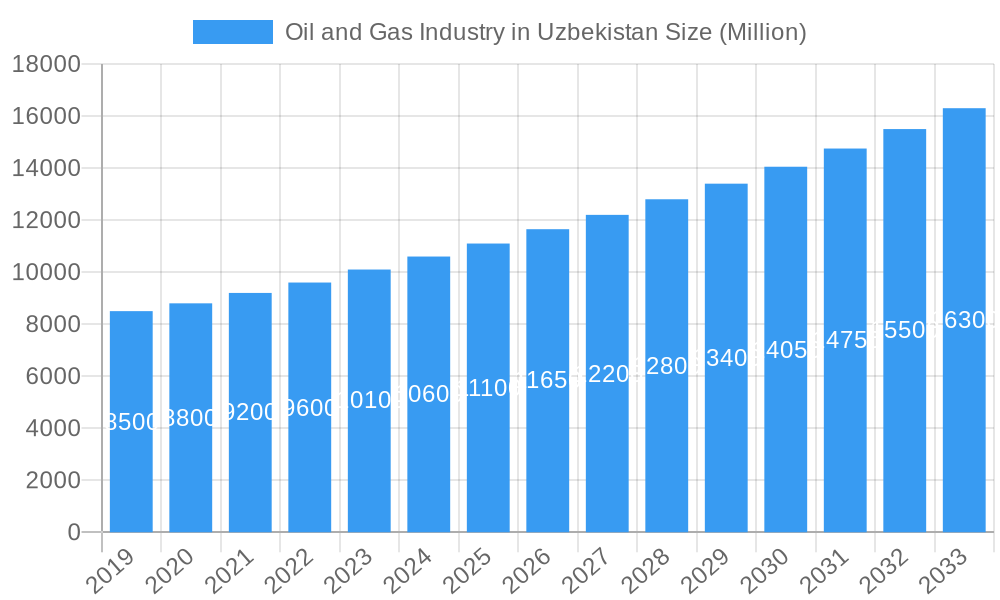

Oil and Gas Industry in Uzbekistan Company Market Share

This comprehensive market analysis provides in-depth insights into Uzbekistan's dynamic oil and gas sector. Spanning the historical period of 2019-2024, with a base year of 2024 and a forecast extending to 2033, this report is an essential resource for understanding market concentration, innovation drivers, regulatory frameworks, and opportunities across the upstream, midstream, and downstream segments. Examine critical industry developments, including export strategies and logistics agreements, and gain a competitive advantage by analyzing the strategies of leading companies such as CNPC, JSC Uzbekneftegaz, Lukoil, TotalEnergies, and Gazprom. This report delivers actionable intelligence for stakeholders aiming to capitalize on Uzbekistan's evolving energy market.

Oil and Gas Industry in Uzbekistan Market Dynamics & Concentration

The oil and gas industry in Uzbekistan exhibits a moderate market concentration, with a few key national and international players dominating production and exploration activities. JSC Uzbekneftegaz holds a significant market share, particularly in domestic refining and distribution. International giants like China National Petroleum Corporation (CNPC) and NK Lukoil PAO have substantial investments in upstream operations, contributing to a competitive yet somewhat consolidated landscape. Innovation drivers are primarily focused on enhanced oil recovery techniques and the exploration of new reserves, aiming to offset declining production from mature fields. The regulatory framework is increasingly geared towards attracting foreign direct investment, with the government actively reforming policies to streamline operations and improve transparency. Product substitutes, while limited in the immediate energy supply chain, are a growing consideration with the long-term push towards renewable energy sources, though their impact on the core oil and gas market remains nascent. End-user trends are characterized by a steady domestic demand for refined products and increasing gas utilization for power generation. Merger and acquisition (M&A) activities have been relatively modest, with most significant investments stemming from Greenfield projects or joint ventures. Historically, M&A deal counts have been in the low single digits annually, reflecting a cautious investment climate. The market's future concentration will likely be influenced by the success of ongoing exploration initiatives and the government's privatization strategies for state-owned assets, potentially leading to a slight decentralization of market power.

Oil and Gas Industry in Uzbekistan Industry Trends & Analysis

Uzbekistan's oil and gas industry is experiencing a transformative period, driven by a confluence of factors including robust domestic demand, strategic government initiatives, and increasing foreign investment. The sector's Compound Annual Growth Rate (CAGR) is projected to be approximately 3.5% during the forecast period (2025–2033). Market penetration of advanced exploration and production technologies is steadily increasing, particularly in challenging geological formations, enabling the unlocking of previously uneconomical reserves. Technological disruptions are playing a pivotal role, with the adoption of digital solutions for operational efficiency, predictive maintenance, and enhanced safety protocols becoming more prevalent. This includes the implementation of AI-driven analytics for seismic data interpretation and the deployment of IoT sensors for real-time monitoring of pipelines and production facilities. Consumer preferences are shifting towards cleaner energy alternatives, but the immediate demand for traditional fuels remains strong, especially for transportation and industrial processes. The government's focus on energy security and economic diversification further bolsters the industry's growth trajectory. Competitive dynamics are intensifying as both national oil companies and international energy majors vie for exploration licenses and production sharing agreements. The regulatory environment, while undergoing reforms, continues to present both opportunities and challenges, with a clear emphasis on attracting substantial capital investment to modernize infrastructure and boost output. The downstream sector, encompassing refining and petrochemicals, is poised for significant expansion, driven by Uzbekistan's ambition to become a regional processing hub. This expansion is crucial for meeting rising domestic consumption and for developing export markets for higher-value refined products. The upstream segment is focusing on optimizing existing assets and exploring new frontiers, with a particular emphasis on natural gas. The midstream sector, vital for transportation and storage, is undergoing significant upgrades to support increased production volumes and enhance logistical efficiency. The overall trend is towards greater integration and value chain optimization, with a strategic imperative to maximize the economic benefits derived from the nation's hydrocarbon resources.

Leading Markets & Segments in Oil and Gas Industry in Uzbekistan

The Upstream segment stands out as the dominant force within Uzbekistan's oil and gas industry, driven by extensive exploration efforts and significant reserves of natural gas. The country possesses vast untapped hydrocarbon potential, particularly in its western regions, making upstream activities the primary focus for both domestic and international investors. Economic policies enacted by the Uzbek government have consistently prioritized the exploration and production of oil and gas, offering attractive incentives and Production Sharing Agreements (PSAs) to foreign companies. This has led to substantial capital inflows and technological expertise being deployed in the upstream sector.

- Key Drivers of Upstream Dominance:

- Abundant Natural Gas Reserves: Uzbekistan is one of the largest gas producers in Central Asia, with proven reserves estimated in the trillions of cubic meters.

- Government Incentives: Favorable PSA terms, tax breaks, and streamlined licensing processes encourage upstream investment.

- Strategic Location: Proximity to major energy-consuming markets in Asia, such as China and India, fuels demand for Uzbek gas exports.

- Technological Advancement: The adoption of advanced exploration techniques is unlocking previously inaccessible reserves.

- Infrastructure Development: Ongoing investment in pipeline networks facilitates the transport of extracted resources.

While the upstream segment garners the most attention and investment, the Midstream sector is experiencing crucial development to support this growth. This includes the expansion and modernization of pipelines for transporting crude oil and natural gas, as well as the enhancement of storage facilities. The strategic importance of the midstream is amplified by the government's aim to diversify export routes and increase the efficiency of resource delivery.

The Downstream segment, encompassing refining and petrochemicals, is also a critical area of development, albeit currently less dominant than upstream. Uzbekistan has a significant refining capacity, but there is a strong push to upgrade these facilities and expand petrochemical production to create higher-value products and reduce reliance on imported refined goods. Initiatives to develop new petrochemical complexes are underway, aiming to leverage the country's abundant natural gas feedstock.

- Dominance Analysis: The dominance of the upstream sector is a direct consequence of Uzbekistan's rich natural resource endowment and the strategic emphasis placed on resource extraction as a cornerstone of its economic development strategy. The government's commitment to fostering a conducive investment climate for exploration and production activities, coupled with the inherent potential of its geological basins, solidifies upstream's leading position. The midstream and downstream sectors, while vital for value chain integration, are currently in a growth and modernization phase, largely driven by the output and demand generated by the upstream activities. The future trajectory will see a more balanced development as investments in refining and petrochemicals mature, but for the foreseeable future, upstream will remain the engine of growth and the most significant segment in terms of investment and production.

Oil and Gas Industry in Uzbekistan Product Developments

Product development in Uzbekistan's oil and gas industry is increasingly focused on maximizing the value derived from its abundant natural gas reserves. Innovations are geared towards advanced petrochemical products, such as polymers and fertilizers, which have strong export potential and can substitute imports. Enhanced oil recovery techniques are also being developed to boost production from mature fields, employing novel chemical and thermal methods. The emphasis is on creating higher-margin products and ensuring energy efficiency throughout the value chain. These developments leverage the country's resource base to move beyond basic commodity exports and establish a more diversified and competitive product portfolio, catering to both domestic needs and international market demands for specialized chemical intermediates and fuels.

Key Drivers of Oil and Gas Industry in Uzbekistan Growth

The growth of Uzbekistan's oil and gas industry is propelled by several key factors. Firstly, the nation's substantial reserves of natural gas provide a foundational advantage, particularly for its increasing role as an energy exporter. Secondly, the Uzbek government's proactive economic reforms and commitment to attracting foreign direct investment through attractive production sharing agreements and streamlined regulatory processes are crucial. Technological advancements in exploration and extraction are unlocking previously inaccessible reserves, boosting production capacity. Furthermore, growing regional demand for energy resources, coupled with Uzbekistan's strategic geographical location, creates significant export opportunities. The continuous modernization of existing infrastructure and the development of new pipelines and processing facilities also underpin industry expansion.

Challenges in the Oil and Gas Industry in Uzbekistan Market

Despite its potential, the oil and gas industry in Uzbekistan faces several significant challenges. One primary restraint is the aging infrastructure in certain older fields, which necessitates substantial investment for modernization and efficiency improvements. Environmental concerns and the need for sustainable practices are also growing, requiring stricter compliance and investment in greener technologies. Fluctuations in global energy prices can impact revenue streams and investment decisions, creating market volatility. Additionally, the complex geopolitical landscape and the need for robust international partnerships to ensure market access and technological transfer present ongoing hurdles. Supply chain disruptions, though less prevalent recently, remain a potential risk, particularly for specialized equipment and services.

Emerging Opportunities in Oil and Gas Industry in Uzbekistan

Emerging opportunities in Uzbekistan's oil and gas sector are multifaceted. The ongoing exploration and development of new gas fields present significant upstream opportunities. The government's focus on downstream diversification offers considerable potential for investments in petrochemical plants, aiming to produce higher-value products like polypropylene and polyethylene, thereby reducing import dependency and boosting export revenue. The development of liquefied natural gas (LNG) capabilities for enhanced export flexibility is another promising avenue. Furthermore, strategic partnerships with international energy companies can facilitate access to cutting-edge technology, capital, and global markets, driving sustainable growth and innovation across all segments of the industry.

Leading Players in the Oil and Gas Industry in Uzbekistan Sector

- China National Petroleum Corporation (CNPC)

- JSC Uzbekneftegaz

- NK Lukoil PAO

- TotalEnergies SE

- Gazprom PAO

- Sanoat Energetika Guruhi (SEG)

Key Milestones in Oil and Gas Industry in Uzbekistan Industry

- December 2022: Uzbekistan ordered state-run gas producer Uzbekneftegaz and Russia's Lukoil, the second-largest gas producer in the country, to temporarily halt natural gas exports to China as the country deals with a wave of blackouts and disruptions to local gas networks. This decision highlighted the prioritization of domestic energy security over immediate export revenues.

- July 2022: Sanoat Energetika Guruhi (SEG) signed a joint agreement with AD Ports Group. The company aims to develop logistics infrastructure and services to enable Uzbekistan and SEG's refined products to reach global markets. This partnership signals a strategic move towards enhancing export capabilities and integrating Uzbekistan's refined products into international supply chains.

Strategic Outlook for Oil and Gas Industry in Uzbekistan Market

The strategic outlook for Uzbekistan's oil and gas industry is one of sustained growth and increasing sophistication. The focus will remain on leveraging its significant natural gas reserves while simultaneously expanding downstream capabilities to capture greater value. Investments in modern exploration technologies will continue to unlock new reserves, ensuring a robust supply base. The government's commitment to economic liberalization and attracting foreign investment will be pivotal in driving this growth. Furthermore, opportunities exist in developing infrastructure for gas monetization and in the production of petrochemicals and fertilizers, transforming Uzbekistan into a more integrated and competitive player in the global energy and chemical markets, with a projected market expansion of over 15% by 2033.

Oil and Gas Industry in Uzbekistan Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Uzbekistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

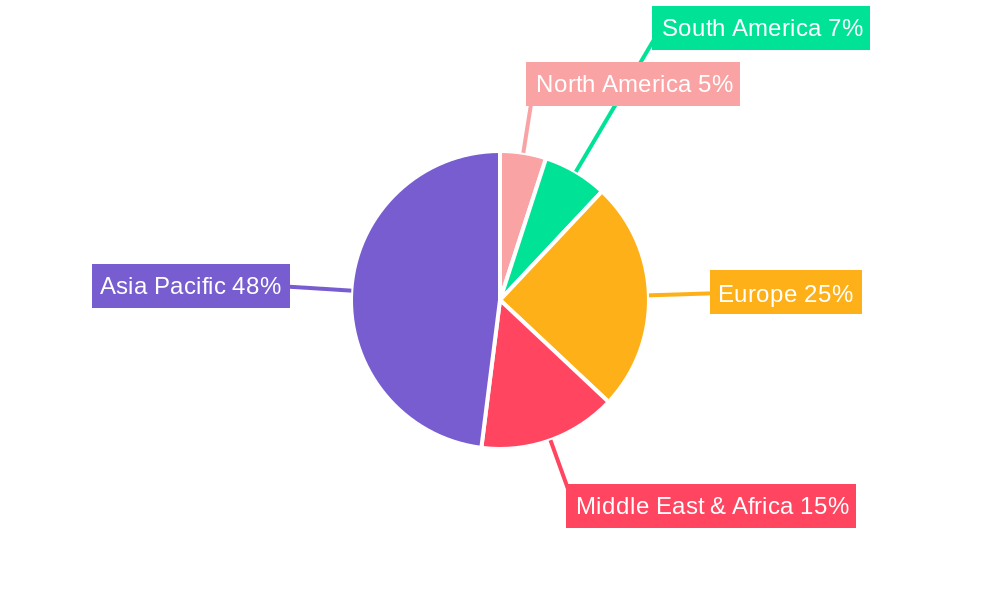

Oil and Gas Industry in Uzbekistan Regional Market Share

Geographic Coverage of Oil and Gas Industry in Uzbekistan

Oil and Gas Industry in Uzbekistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China National Petroleum Corporation (CNPC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JSC Uzbekneftegaz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NK Lukoil PAO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TotalEnergies SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gazprom PAO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 China National Petroleum Corporation (CNPC)

List of Figures

- Figure 1: Global Oil and Gas Industry in Uzbekistan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 3: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 7: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 11: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 19: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 9: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 25: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 33: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Uzbekistan?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Oil and Gas Industry in Uzbekistan?

Key companies in the market include China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, Gazprom PAO.

3. What are the main segments of the Oil and Gas Industry in Uzbekistan?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

December 2022: Uzbekistan ordered state-run gas producer Uzbekneftegaz and Russia's Lukoil, the second-largest gas producer in the country, to temporarily halt natural gas exports to China as the country deals with a wave of blackouts and disruptions to local gas networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Uzbekistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Uzbekistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Uzbekistan?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Uzbekistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence