Key Insights

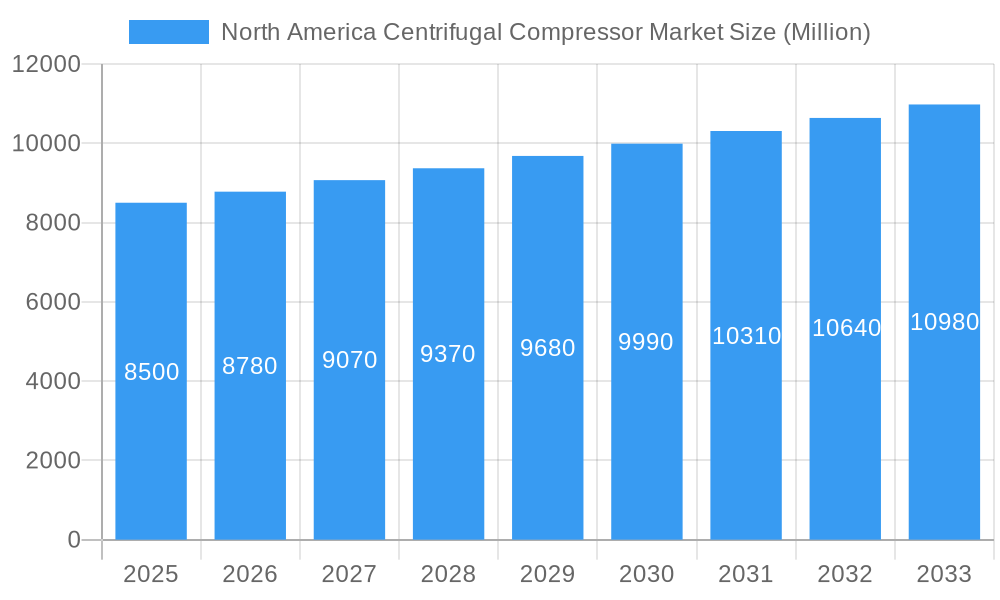

The North American centrifugal compressor market is poised for robust expansion, driven by escalating demand across critical industrial sectors. With a projected market size estimated to be in the billions and a Compound Annual Growth Rate (CAGR) exceeding 3.00%, the market is set to witness sustained value growth, reaching significant figures by 2033. Key drivers fueling this expansion include the burgeoning oil and gas industry's need for efficient gas processing and transportation, the increasing focus on reliable power generation through modern turbine technologies, and the continuous growth of the chemical sector's production capacities. The United States, Canada, and Mexico represent the primary geographical focus, with substantial investments in infrastructure and industrial modernization. Emerging trends such as the adoption of advanced, energy-efficient centrifugal compressor designs, the integration of smart technologies for predictive maintenance and operational optimization, and a growing emphasis on emission reduction technologies are further shaping market dynamics. These advancements are crucial for industries aiming to enhance operational efficiency while adhering to stringent environmental regulations, thereby creating substantial opportunities for market participants.

North America Centrifugal Compressor Market Market Size (In Billion)

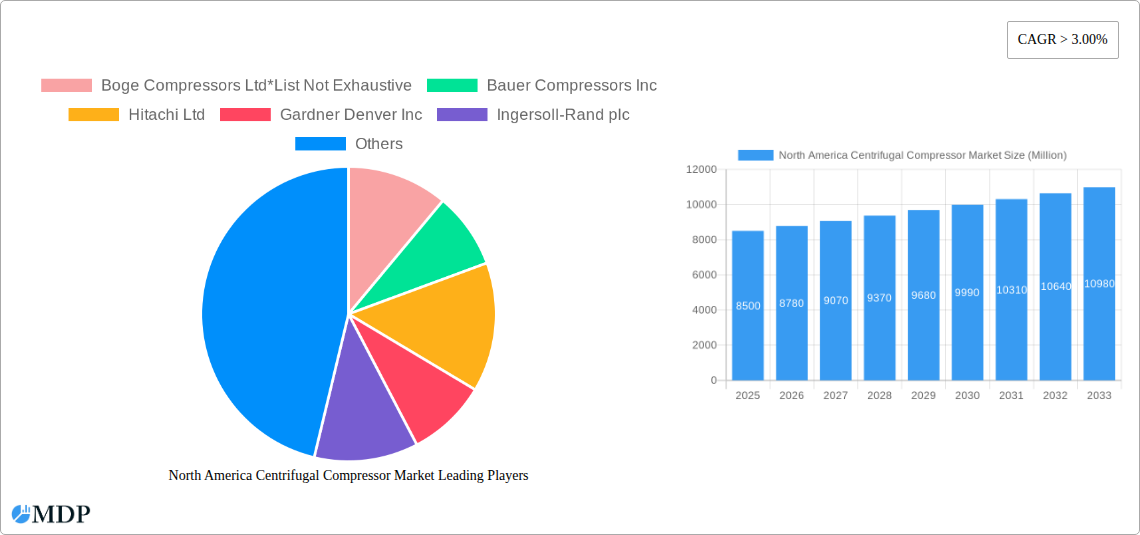

Despite the strong growth trajectory, certain restraints could influence the market's pace. High initial capital investment for advanced centrifugal compressor systems, coupled with the availability of alternative compression technologies, may pose challenges. Furthermore, fluctuating energy prices and geopolitical uncertainties can impact investment decisions within the oil and gas sector, a significant end-user. However, the inherent advantages of centrifugal compressors, including their high flow rates, reliability, and suitability for large-scale operations, are expected to outweigh these concerns. The market landscape features a competitive array of established players and innovative entrants, including Boge Compressors Ltd., Bauer Compressors Inc., Hitachi Ltd., Gardner Denver Inc., Ingersoll-Rand plc, Kaeser Compressors Inc., Campbell Hausfeld LLC, General Electric Company, and Atlas Copco Ltd. These companies are actively engaged in research and development to offer tailored solutions that address the evolving needs of sectors like oil and gas, power generation, and chemicals, ensuring the market's continued vitality and resilience.

North America Centrifugal Compressor Market Company Market Share

North America Centrifugal Compressor Market: Comprehensive Analysis & Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the North America centrifugal compressor market, offering crucial insights for stakeholders navigating this dynamic sector. With a forecast period extending from 2025 to 2033 and a base year of 2025, this study covers historical trends (2019-2024) and future projections. We delve into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, industry milestones, and strategic outlooks, utilizing high-traffic keywords to maximize visibility for centrifugal compressors, oil and gas compressors, power generation compressors, and chemical industry compressors across the United States, Canada, and the rest of North America.

North America Centrifugal Compressor Market Market Dynamics & Concentration

The North America centrifugal compressor market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Innovation drivers such as the demand for energy efficiency, the development of advanced control systems, and the integration of IoT for predictive maintenance are propelling technological advancements. Regulatory frameworks, particularly concerning emissions and safety standards in the oil and gas and power generation sectors, play a crucial role in shaping product development and market entry. While direct product substitutes are limited, advancements in alternative compression technologies and process optimization strategies can influence demand. End-user trends indicate robust growth in the oil and gas sector due to ongoing exploration and production activities, as well as sustained demand from power generation and the expanding chemical industry. Mergers and acquisitions (M&A) activities, with an estimated X M&A deal counts observed historically, continue to consolidate the market, allowing key players to expand their product portfolios and geographical reach. For instance, the market share of the top five players is estimated to be around 65% in 2025, with M&A activities expected to further influence this concentration.

North America Centrifugal Compressor Market Industry Trends & Analysis

The North America centrifugal compressor market is poised for significant growth, driven by escalating demand for industrial gases, advancements in manufacturing processes, and the crucial role these compressors play in critical infrastructure development. The projected Compound Annual Growth Rate (CAGR) for the market is estimated at approximately 5.5% from 2025 to 2033. Technological disruptions are a key theme, with a growing emphasis on variable speed drives (VSDs) that enhance energy efficiency by optimizing compressor speed according to real-time demand. This not only reduces operational costs but also aligns with increasing sustainability mandates. The integration of digital technologies, including AI-powered diagnostics and remote monitoring, is transforming maintenance strategies, moving towards predictive rather than reactive approaches. This trend enhances uptime and reduces the total cost of ownership for end-users. Consumer preferences are shifting towards integrated solutions and customized compressor packages designed for specific applications, particularly in the oil and gas sector for enhanced oil recovery and in the chemical industry for diverse processing needs. Competitive dynamics are characterized by intense price competition, a focus on after-sales service and support, and the continuous development of more robust, reliable, and energy-efficient compressor designs. Market penetration of advanced centrifugal compressors is steadily increasing, driven by their superior performance characteristics and lower lifecycle costs compared to older technologies. The market size is projected to reach approximately $9,500 Million by 2033, up from an estimated $6,200 Million in 2025.

Leading Markets & Segments in North America Centrifugal Compressor Market

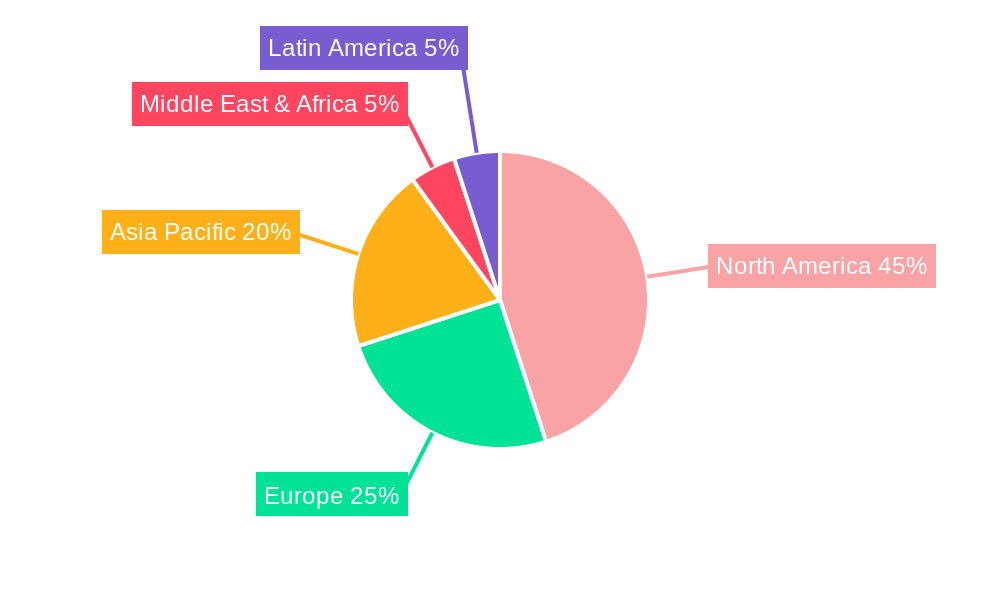

The United States stands as the dominant market within North America's centrifugal compressor landscape, driven by its vast industrial base and significant investments across key sectors. The Oil and Gas segment, in particular, is a primary demand driver, fueled by continued exploration and production activities, liquefied natural gas (LNG) export projects, and the need for efficient compression in downstream refining processes. Economic policies supporting energy independence and infrastructure development further bolster this demand.

- United States Dominance:

- Drivers: Extensive oil and gas reserves, significant petrochemical manufacturing capacity, substantial power generation needs, and favorable investment climates for industrial expansion.

- Impact: The US accounts for an estimated 70% of the total North America centrifugal compressor market revenue in 2025.

- Oil and Gas Segment:

- Key Drivers: Upstream exploration and production, midstream transportation and processing, downstream refining, and the growing LNG export market. The need for high-pressure and large-volume gas handling makes centrifugal compressors indispensable.

- Market Share: This segment is projected to hold approximately 45% of the total market share in 2025.

- Power Generation Segment:

- Key Drivers: Increasing demand for electricity, the expansion of renewable energy integration (requiring stable baseload power), and the ongoing modernization of existing power plants.

- Market Share: Expected to represent around 25% of the market in 2025.

- Chemical Segment:

- Key Drivers: Growth in specialty chemicals, petrochemical production, and the increasing use of industrial gases in various manufacturing processes. The demand for specialized, corrosion-resistant compressors is high.

- Market Share: Estimated at 20% of the market in 2025.

- Canada's Role: Canada, while a smaller market, contributes significantly through its robust oil and gas sector, particularly in the oil sands, and its burgeoning chemical industry. Infrastructure projects and environmental regulations also influence demand.

- Rest of North America: This segment encompasses Mexico and other smaller markets, where industrialization and specific sector needs, such as mining and food processing, create niche demands for centrifugal compressors.

North America Centrifugal Compressor Market Product Developments

Recent product developments in the North America centrifugal compressor market are characterized by a strong focus on enhanced energy efficiency and digital integration. Manufacturers are introducing advanced impeller designs and aerodynamic optimizations to minimize power consumption, leading to significant operational cost savings for end-users. The integration of smart sensors and IoT capabilities allows for real-time performance monitoring, predictive maintenance, and remote diagnostics, enhancing reliability and reducing downtime. Furthermore, the development of compact and modular compressor units caters to space-constrained applications and offers greater flexibility in deployment. These innovations are crucial for meeting stringent environmental regulations and the growing demand for sustainable industrial operations.

Key Drivers of North America Centrifugal Compressor Market Growth

The growth of the North America centrifugal compressor market is propelled by several key factors. Firstly, sustained demand from the oil and gas industry for exploration, production, and processing operations remains a primary driver. Secondly, the power generation sector's increasing need for reliable and efficient power supply, coupled with the integration of renewables, necessitates robust compression solutions. Thirdly, the expansion of the chemical and petrochemical industries, driven by growing demand for various chemical products and feedstocks, is a significant contributor. Finally, technological advancements focusing on energy efficiency, reduced emissions, and smart monitoring are creating new market opportunities and driving the adoption of advanced centrifugal compressors.

Challenges in the North America Centrifugal Compressor Market Market

Despite robust growth prospects, the North America centrifugal compressor market faces several challenges. Stringent environmental regulations related to emissions and energy consumption can increase compliance costs and necessitate significant investment in new technologies. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact manufacturing timelines and cost-effectiveness. Intense price competition among market players, especially for standardized solutions, can put pressure on profit margins. Furthermore, the high initial capital investment for advanced centrifugal compressor systems can be a barrier for some smaller enterprises, particularly in developing regions.

Emerging Opportunities in North America Centrifugal Compressor Market

Emerging opportunities in the North America centrifugal compressor market are primarily driven by the global push for decarbonization and the expansion of emerging industries. The growing demand for hydrogen production as a clean energy source presents a significant opportunity for specialized centrifugal compressors. Furthermore, the carbon capture, utilization, and storage (CCUS) initiatives require robust compression technology for gas transport and injection. Strategic partnerships between compressor manufacturers and technology providers focusing on AI and digitalization are expected to unlock new service-based revenue streams. Market expansion into sectors like biotechnology and pharmaceuticals, where high-purity gas compression is critical, also represents a promising avenue for growth.

Leading Players in the North America Centrifugal Compressor Market Sector

- Boge Compressors Ltd

- Bauer Compressors Inc

- Hitachi Ltd

- Gardner Denver Inc

- Ingersoll-Rand plc

- Kaeser Compressors Inc

- Campbell Hausfeld LLC

- General Electric Company

- Atlas Copco Ltd

Key Milestones in North America Centrifugal Compressor Market Industry

- 2019: Increased adoption of variable speed drives (VSDs) in centrifugal compressors for enhanced energy efficiency across industries.

- 2020: Growing emphasis on predictive maintenance solutions powered by IoT in the oil and gas sector.

- 2021: Significant investments in expanding petrochemical infrastructure driving demand for large-scale centrifugal compressors.

- 2022: Introduction of advanced aerodynamic designs leading to substantial power savings in new compressor models.

- 2023: Heightened focus on digital twins and remote monitoring capabilities for industrial compressor fleets.

- 2024: Anticipated surge in demand for specialized compressors for emerging hydrogen production facilities.

- 2025 (Base Year): Estimated market size of $6,200 Million, with continued integration of AI for process optimization.

Strategic Outlook for North America Centrifugal Compressor Market Market

The strategic outlook for the North America centrifugal compressor market is overwhelmingly positive, characterized by sustained innovation and expanding applications. Growth accelerators will include the continued digitalization of industrial operations, leading to more intelligent and autonomous compressor systems. The increasing focus on sustainability and the transition to cleaner energy sources will further fuel demand for high-efficiency and specialized compression technologies. Strategic opportunities lie in developing advanced solutions for burgeoning sectors like hydrogen and CCUS, as well as in forging stronger partnerships for integrated service offerings. The market is set to witness a robust CAGR, driven by the indispensable role of centrifugal compressors in powering modern industry and enabling the energy transition.

North America Centrifugal Compressor Market Segmentation

-

1. End-User

- 1.1. Oil and Gas

- 1.2. Power Generation

- 1.3. Chemical

- 1.4. Others

-

2. Geogrpahy

- 2.1. The United States

- 2.2. Canada

- 2.3. Rest of North America

North America Centrifugal Compressor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Centrifugal Compressor Market Regional Market Share

Geographic Coverage of North America Centrifugal Compressor Market

North America Centrifugal Compressor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Replacement of Existing Grids and the Expansion of Distribution Networks

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Costs

- 3.4. Market Trends

- 3.4.1. Oil and Gas Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Centrifugal Compressor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Oil and Gas

- 5.1.2. Power Generation

- 5.1.3. Chemical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. The United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Boge Compressors Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bauer Compressors Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gardner Denver Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ingersoll-Rand plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kaeser Compressors Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Campbell Hausfeld LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlas Copco Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Boge Compressors Ltd*List Not Exhaustive

List of Figures

- Figure 1: North America Centrifugal Compressor Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Centrifugal Compressor Market Share (%) by Company 2025

List of Tables

- Table 1: North America Centrifugal Compressor Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 2: North America Centrifugal Compressor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 3: North America Centrifugal Compressor Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 4: North America Centrifugal Compressor Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 5: North America Centrifugal Compressor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Centrifugal Compressor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Centrifugal Compressor Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: North America Centrifugal Compressor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 9: North America Centrifugal Compressor Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 10: North America Centrifugal Compressor Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 11: North America Centrifugal Compressor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: North America Centrifugal Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Centrifugal Compressor Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the North America Centrifugal Compressor Market?

Key companies in the market include Boge Compressors Ltd*List Not Exhaustive, Bauer Compressors Inc, Hitachi Ltd, Gardner Denver Inc, Ingersoll-Rand plc, Kaeser Compressors Inc, Campbell Hausfeld LLC, General Electric Company, Atlas Copco Ltd.

3. What are the main segments of the North America Centrifugal Compressor Market?

The market segments include End-User, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Replacement of Existing Grids and the Expansion of Distribution Networks.

6. What are the notable trends driving market growth?

Oil and Gas Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Centrifugal Compressor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Centrifugal Compressor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Centrifugal Compressor Market?

To stay informed about further developments, trends, and reports in the North America Centrifugal Compressor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence