Key Insights

The North America Aviation Fuel Market is projected for substantial growth, estimated at 43.81 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.4% through 2033. This expansion is driven by recovering air travel demand across commercial and general aviation, bolstered by increasing global connectivity. Key growth catalysts include a growing airline industry, rising cargo operations, and the increasing adoption of sustainable aviation fuels (SAFs) driven by environmental regulations.

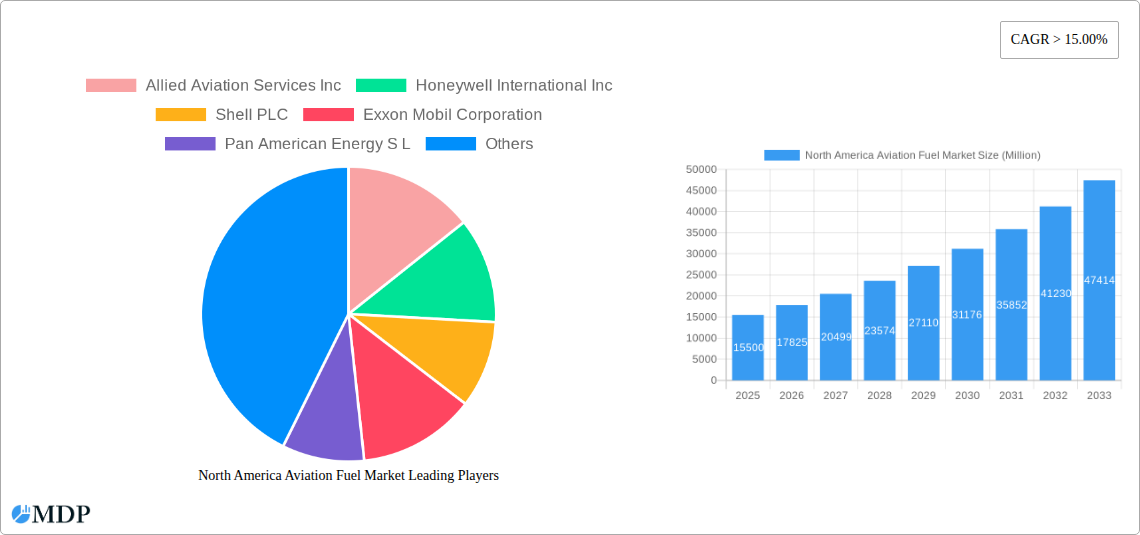

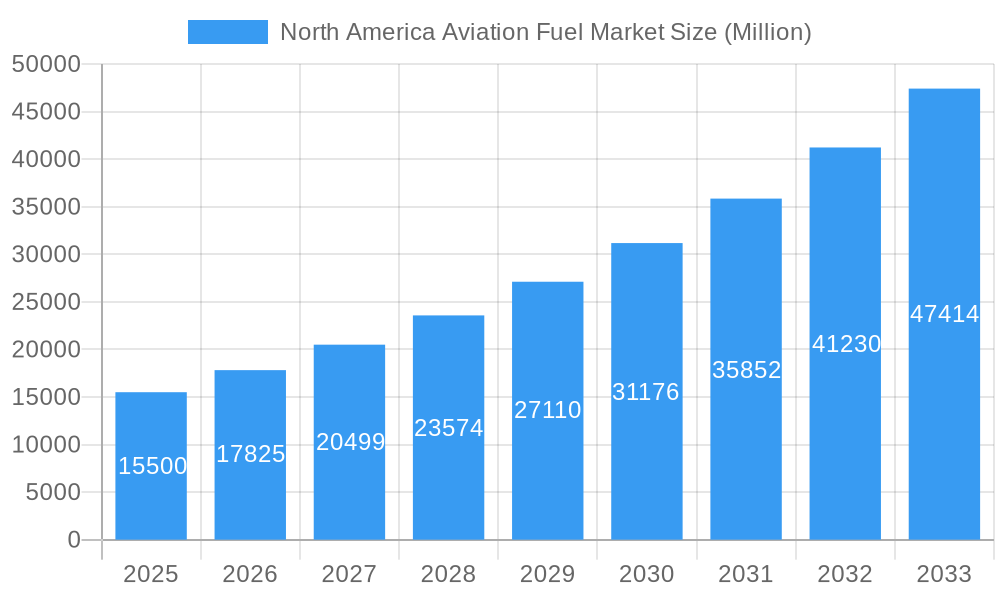

North America Aviation Fuel Market Market Size (In Billion)

Within North America, the United States leads the aviation fuel market due to its advanced aviation infrastructure and extensive commercial and defense operations. Canada and other North American regions are experiencing steady growth fueled by expanding regional air travel and infrastructure investments. Air Turbine Fuel (ATF) dominates demand for commercial airlines, while Aviation Biofuel is emerging as a key sustainable alternative. Potential challenges include volatile crude oil prices, high SAF production infrastructure investment, and the need for comprehensive regulatory frameworks for SAF widespread adoption. Nevertheless, the industry's commitment to decarbonization and sustainability will foster innovation and investment.

North America Aviation Fuel Market Company Market Share

This report offers a comprehensive analysis of the North America Aviation Fuel Market, detailing its trajectory from 2019 to 2033. It examines critical segments such as Air Turbine Fuel (ATF), Aviation Biofuel, and AVGAS, and applications in Commercial, Defense, and General Aviation across the United States, Canada, and the Rest of North America. With a 2025 base year and a forecast to 2033, this study provides strategic insights into market dynamics, technological advancements, and regulatory influences shaping the future of aviation fuel.

North America Aviation Fuel Market Market Dynamics & Concentration

The North America aviation fuel market exhibits a moderate to high concentration, with major integrated oil and gas companies and specialized aviation fuel suppliers dominating the landscape. Innovation drivers are primarily centered around sustainability, with a significant push towards Sustainable Aviation Fuel (SAF), driven by both regulatory mandates and corporate environmental, social, and governance (ESG) goals. Air Turbine Fuel (ATF), representing the largest share due to commercial and defense aviation demand, is experiencing intense competition and innovation in biofuel blends. Regulatory frameworks, particularly in the United States and Canada, are increasingly incentivizing SAF production and adoption, impacting market entry and expansion strategies. While direct product substitutes for aviation fuel are limited in the short to medium term, advancements in electric and hydrogen propulsion for aircraft could pose long-term disruptive threats, particularly for general aviation. End-user trends are characterized by a growing demand for cleaner fuels and a willingness to invest in SAF, even at a premium. Mergers and acquisition (M&A) activities are prevalent as companies seek to consolidate market share, secure supply chains, and acquire technological capabilities in the SAF space. For instance, recent years have seen several strategic partnerships and smaller acquisitions aimed at boosting SAF production capacity and distribution networks. The market share of major players like Shell PLC and Exxon Mobil Corporation remains substantial, but the rapid development of SAF technology is creating opportunities for new entrants and specialized biofuel producers.

North America Aviation Fuel Market Industry Trends & Analysis

The North America aviation fuel market is on an upward trajectory, fueled by robust demand from the commercial aviation sector, driven by increased air travel post-pandemic and the expansion of airline fleets. The CAGR for the overall market is projected to be approximately 6.5% during the forecast period. Technological disruptions are predominantly focused on the advancement and scaling of Sustainable Aviation Fuel (SAF). This includes research into diverse feedstocks, such as used cooking oil, agricultural waste, and synthetic fuels, aiming to reduce the carbon footprint of aviation significantly. Government initiatives and incentives in the United States and Canada are playing a crucial role in accelerating SAF adoption by providing tax credits and blending mandates. Consumer preferences, particularly among corporate clients and environmentally conscious travelers, are increasingly leaning towards airlines demonstrating a commitment to sustainability, thereby influencing fuel choices. Competitive dynamics are intensifying, with established oil majors investing heavily in SAF production and distribution, while innovative startups are emerging with novel biofuel technologies. Market penetration of SAF, though currently nascent, is expected to witness substantial growth as production capacity expands and costs become more competitive. The defense sector continues to be a stable consumer of aviation fuel, with a growing interest in exploring SAF for military operations to meet environmental targets and enhance energy security. The general aviation segment, while smaller in volume, is also witnessing a gradual shift towards cleaner fuel alternatives, including biofuels and high-octane low-lead (HOLL) AVGAS. The market size for aviation fuel in North America is estimated to reach $75.2 Billion by 2025.

Leading Markets & Segments in North America Aviation Fuel Market

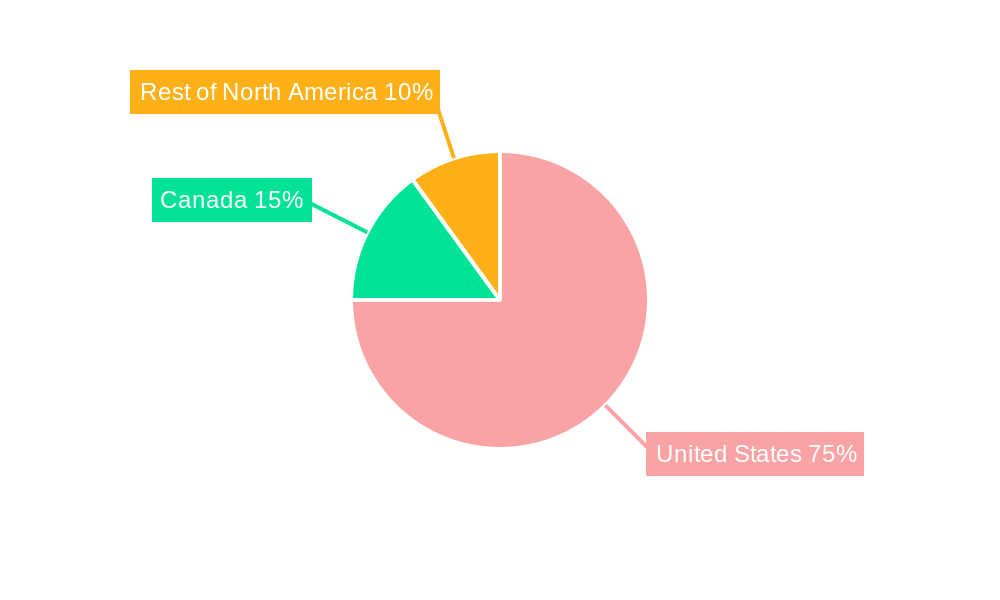

The United States stands as the dominant region in the North America aviation fuel market, accounting for over 70% of the total market value. This leadership is attributed to its extensive air travel infrastructure, large commercial airline fleets, and significant defense spending. Within the United States, the Commercial application segment is the largest consumer of aviation fuel, driven by a steady recovery and growth in air passenger and cargo traffic.

Fuel Type Dominance:

- Air Turbine Fuel (ATF): This is the largest and most critical fuel type, primarily used in jet engines for commercial and military aircraft. Its dominance is a direct consequence of the sheer volume of air travel and defense operations. Economic policies supporting aviation growth and infrastructure development contribute significantly to ATF demand. The market penetration of ATF is nearly 95% of the total aviation fuel consumption.

- Aviation Biofuel (SAF): While currently a smaller segment, Aviation Biofuel is experiencing the most rapid growth. Driven by ambitious sustainability goals and supportive regulatory frameworks, SAF is gaining traction, particularly among major airlines and for long-haul flights. Key drivers include government mandates, corporate sustainability targets, and technological advancements in feedstock conversion.

- AVGAS: Primarily used in piston-engine aircraft for general aviation, AVGAS demand is relatively stable but is seeing a gradual shift towards lower-leaded or unleaded alternatives due to environmental concerns.

Application Dominance:

- Commercial: This segment is the largest by volume and value, driven by passenger and cargo air transport. Economic recovery, growing global trade, and increasing disposable incomes are key drivers for this segment.

- Defense: Consistent government spending on military operations and the modernization of air forces contribute to a significant and stable demand for aviation fuel within this segment.

- General Aviation: This segment, though smaller, is crucial for regional connectivity and business travel. Its growth is influenced by the availability of aircraft and pilot training programs.

Geographical Analysis:

- The United States: Boasts extensive airport infrastructure, a highly developed airline industry, and significant government investment in both commercial aviation and defense. Economic policies promoting trade and tourism directly impact its demand.

- Canada: Exhibits a strong demand driven by its vast geography, resource extraction activities, and a growing airline sector. Government support for SAF initiatives is also a key factor.

- Rest of North America: This includes countries with developing aviation sectors, where growth is often tied to economic development and tourism.

North America Aviation Fuel Market Product Developments

Product developments in the North America aviation fuel market are heavily concentrated on enhancing the sustainability and efficiency of aviation fuels. A significant trend is the continuous innovation in Sustainable Aviation Fuel (SAF) production, with companies exploring diverse and scalable feedstocks like agricultural waste and advanced synthetic fuel technologies. These advancements aim to reduce the lifecycle greenhouse gas emissions of aviation significantly, offering a viable path towards decarbonization. Furthermore, research is ongoing to develop next-generation AVGAS alternatives that are lower in lead content or entirely lead-free, addressing environmental and health concerns within the general aviation sector. The competitive advantage for fuel suppliers lies in their ability to offer cost-effective, reliable, and certified sustainable fuel options that meet stringent aviation standards.

Key Drivers of North America Aviation Fuel Market Growth

The North America aviation fuel market is experiencing robust growth driven by several key factors. Firstly, the resurgence of air travel post-pandemic is a primary economic driver, leading to increased demand for Air Turbine Fuel (ATF) from commercial airlines. Secondly, government initiatives and regulatory frameworks in both the United States and Canada are actively promoting the adoption of Sustainable Aviation Fuel (SAF) through incentives, mandates, and research funding. For example, the U.S. Energy Department's strategic plan for SAF aims to ramp up production and use. Thirdly, corporate sustainability commitments by airlines and cargo operators are creating a strong pull for cleaner aviation fuels, even at a premium, as they strive to meet environmental, social, and governance (ESG) targets. Finally, technological advancements in SAF production, including new feedstock utilization and more efficient conversion processes, are improving the scalability and cost-competitiveness of these greener alternatives.

Challenges in the North America Aviation Fuel Market Market

Despite the positive growth outlook, the North America aviation fuel market faces significant challenges. A primary hurdle is the high cost of Sustainable Aviation Fuel (SAF) compared to conventional jet fuel, which can impact airline profitability and passenger fares. Limited production capacity and feedstock availability for SAF also pose a constraint on its widespread adoption, leading to supply chain vulnerabilities. Regulatory uncertainty and inconsistencies across different jurisdictions can create complexities for fuel producers and consumers. Furthermore, the long lifecycle of aircraft fleets means that the transition to SAF will be gradual, with conventional fuels remaining dominant for an extended period. Intense competitive pressures among established fuel suppliers and the emergence of new players in the SAF space also necessitate continuous innovation and cost optimization.

Emerging Opportunities in North America Aviation Fuel Market

The North America aviation fuel market is ripe with emerging opportunities, primarily driven by the accelerating demand for sustainable solutions. The growing focus on decarbonization presents a significant opportunity for companies involved in the production, distribution, and research of Sustainable Aviation Fuel (SAF). Strategic partnerships between fuel producers, airlines, and technology providers are crucial for scaling up SAF production and securing long-term supply agreements, as exemplified by United Airlines' purchase agreement with Neste. Market expansion strategies involving the development of new SAF production facilities and the diversification of feedstock sources are also key. Technological breakthroughs in areas like direct air capture for synthetic fuels and advanced biofuel conversion processes will unlock further potential. The increasing interest from defense sectors in exploring SAF for operational sustainability and energy security also represents a promising avenue for market growth.

Leading Players in the North America Aviation Fuel Market Sector

- Allied Aviation Services Inc

- Chevron Corporation

- Exxon Mobil Corporation

- Honeywell International Inc

- Pan American Energy S L

- Shell PLC

- BP PLC

- TotalEnergies SE

- Valero Marketing and Supply

Key Milestones in North America Aviation Fuel Market Industry

- May 2022: United Airlines became the first United States airline to sign an international purchase agreement for sustainable aviation fuel (SAF). The airline has signed a new purchase agreement with Neste that provides United the right to buy up to 52.5 million gallons over the next three years.

- September 2022: The U.S. Energy Department issued a plan detailing a government-wide strategy for ramping up the production and use of sustainable aviation fuels (SAF).

Strategic Outlook for North America Aviation Fuel Market Market

The strategic outlook for the North America aviation fuel market is characterized by a strong emphasis on sustainability and technological innovation. Growth accelerators will be predominantly driven by the increasing adoption of Sustainable Aviation Fuel (SAF), supported by favorable government policies and a growing demand from environmentally conscious stakeholders. Companies that can efficiently scale up SAF production, diversify feedstock options, and secure robust supply chains will be well-positioned for success. Strategic partnerships and collaborations across the aviation value chain will be crucial for de-risking investments and accelerating market penetration of cleaner fuels. The continuous development of advanced biofuels and synthetic fuels will further enhance the market's ability to meet ambitious decarbonization targets. The market is poised for significant evolution as the industry navigates towards a more sustainable future.

North America Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

-

2. Application

- 2.1. Commercial

- 2.2. Defense

- 2.3. General Aviation

-

3. Geography

- 3.1. The United States

- 3.2. Canada

- 3.3. Rest of North America

North America Aviation Fuel Market Segmentation By Geography

- 1. The United States

- 2. Canada

- 3. Rest of North America

North America Aviation Fuel Market Regional Market Share

Geographic Coverage of North America Aviation Fuel Market

North America Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in Oil and Gas Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Inclination towards renewable energy

- 3.4. Market Trends

- 3.4.1. Commercial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. The United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. The United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. The United States North America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.2.3. General Aviation

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. The United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Canada North America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.2.3. General Aviation

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. The United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Rest of North America North America Aviation Fuel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.2.3. General Aviation

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. The United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Allied Aviation Services Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Honeywell International Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Shell PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Exxon Mobil Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Pan American Energy S L

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Valero Marketing and Supply*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Chevron Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 TotalEnergies SE

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BP PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Allied Aviation Services Inc

List of Figures

- Figure 1: North America Aviation Fuel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Aviation Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: North America Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: North America Aviation Fuel Market Volume Liter Forecast, by Fuel Type 2020 & 2033

- Table 3: North America Aviation Fuel Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Aviation Fuel Market Volume Liter Forecast, by Application 2020 & 2033

- Table 5: North America Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Aviation Fuel Market Volume Liter Forecast, by Geography 2020 & 2033

- Table 7: North America Aviation Fuel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Aviation Fuel Market Volume Liter Forecast, by Region 2020 & 2033

- Table 9: North America Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: North America Aviation Fuel Market Volume Liter Forecast, by Fuel Type 2020 & 2033

- Table 11: North America Aviation Fuel Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: North America Aviation Fuel Market Volume Liter Forecast, by Application 2020 & 2033

- Table 13: North America Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Aviation Fuel Market Volume Liter Forecast, by Geography 2020 & 2033

- Table 15: North America Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Aviation Fuel Market Volume Liter Forecast, by Country 2020 & 2033

- Table 17: North America Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: North America Aviation Fuel Market Volume Liter Forecast, by Fuel Type 2020 & 2033

- Table 19: North America Aviation Fuel Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: North America Aviation Fuel Market Volume Liter Forecast, by Application 2020 & 2033

- Table 21: North America Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Aviation Fuel Market Volume Liter Forecast, by Geography 2020 & 2033

- Table 23: North America Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Aviation Fuel Market Volume Liter Forecast, by Country 2020 & 2033

- Table 25: North America Aviation Fuel Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: North America Aviation Fuel Market Volume Liter Forecast, by Fuel Type 2020 & 2033

- Table 27: North America Aviation Fuel Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: North America Aviation Fuel Market Volume Liter Forecast, by Application 2020 & 2033

- Table 29: North America Aviation Fuel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Aviation Fuel Market Volume Liter Forecast, by Geography 2020 & 2033

- Table 31: North America Aviation Fuel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Aviation Fuel Market Volume Liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aviation Fuel Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the North America Aviation Fuel Market?

Key companies in the market include Allied Aviation Services Inc, Honeywell International Inc, Shell PLC, Exxon Mobil Corporation, Pan American Energy S L, Valero Marketing and Supply*List Not Exhaustive, Chevron Corporation, TotalEnergies SE, BP PLC.

3. What are the main segments of the North America Aviation Fuel Market?

The market segments include Fuel Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.81 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in Oil and Gas Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Commercial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Inclination towards renewable energy.

8. Can you provide examples of recent developments in the market?

May 2022: United Airlines became the first United States airline to sign an international purchase agreement for sustainable aviation fuel (SAF). The airline has signed a new purchase agreement with Neste that provides United the right to buy up to 52.5 million gallons over the next three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Liter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the North America Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence