Key Insights

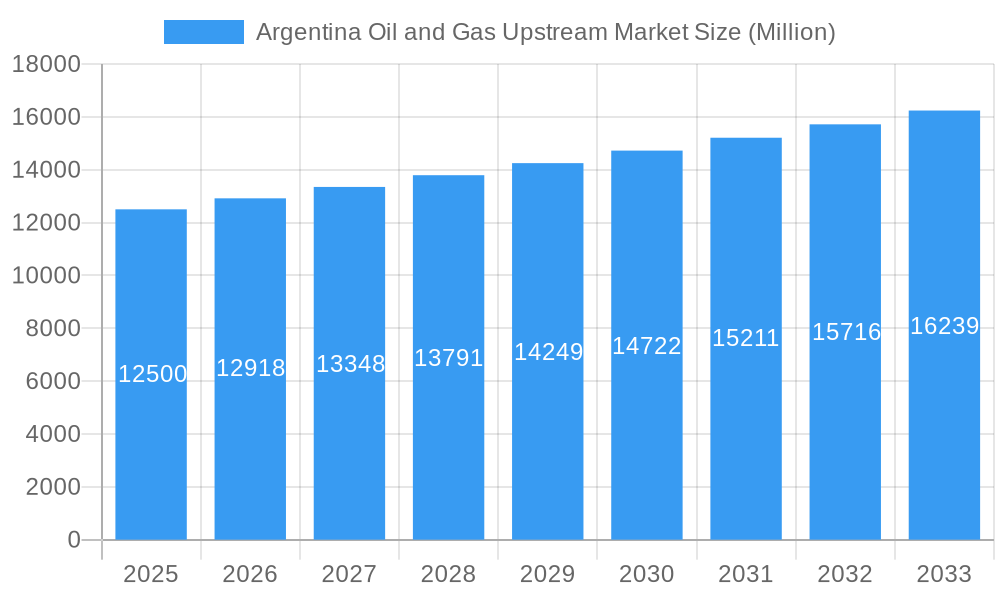

The Argentina Oil and Gas Upstream Market is projected to achieve significant growth, reaching approximately USD 4847.93 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5%. This expansion is driven by extensive exploration and production activities, leveraging Argentina's substantial hydrocarbon reserves, particularly in unconventional resources such as the Vaca Muerta shale play. Increased investment from both domestic and international entities, attracted by the region's discovery and extraction potential, is a primary catalyst. Supportive government policies aimed at enhancing energy production and achieving self-sufficiency further bolster market confidence and encourage capital allocation. Technological advancements in extraction, especially for unconventional resources, are improving efficiency and profitability, contributing to the market's upward trajectory.

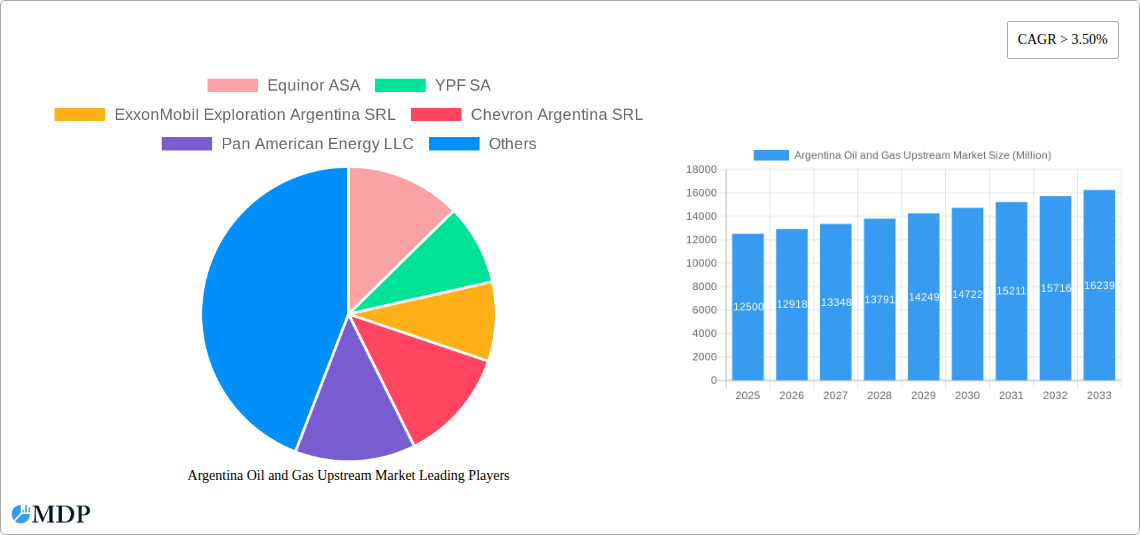

Argentina Oil and Gas Upstream Market Market Size (In Million)

While the market exhibits strong growth potential, key restraints include fluctuations in global oil prices impacting investment decisions and project profitability. Infrastructural challenges in remote exploration areas can also impede rapid development and increase operational costs. Nevertheless, Argentina's inherent hydrocarbon potential, coupled with ongoing technological innovation and strategic investments, is expected to overcome these hurdles. The market is segmented into onshore and offshore operations, with onshore activities currently leading due to the accessibility and established infrastructure for shale gas and oil extraction in regions like Vaca Muerta. However, offshore exploration is anticipated to grow as technological capabilities and investment expand to frontier areas. Key industry participants, including Equinor ASA, YPF SA, and ExxonMobil Exploration Argentina SRL, are actively shaping the market through substantial investments and operational expertise.

Argentina Oil and Gas Upstream Market Company Market Share

Gain comprehensive insights into Argentina's expanding oil and gas upstream sector with this detailed market analysis. Covering 2019-2033, this report provides critical data on market dynamics, industry trends, leading companies, and future opportunities. Explore key investment drivers in the Vaca Muerta shale formation and offshore exploration, supported by data-driven analysis of market concentration, regulatory frameworks, and technological progress. This is an indispensable guide for navigating and capitalizing on the substantial growth within Argentina's upstream oil and gas industry.

Argentina Oil and Gas Upstream Market Market Dynamics & Concentration

The Argentina oil and gas upstream market is characterized by a dynamic interplay of regulatory evolution, technological innovation, and significant investment inflow, particularly into unconventional resources like the Vaca Muerta shale formation. Market concentration is influenced by the presence of both state-owned entities and major international oil companies, though a clear trend towards increased private sector participation and joint ventures is evident. Innovation drivers are heavily focused on enhanced oil recovery (EOR) techniques, advanced drilling technologies for shale, and the development of offshore capabilities. Regulatory frameworks, while evolving to attract foreign investment and ensure resource development, remain a key consideration for market players. Product substitutes are currently limited in their ability to replace crude oil and natural gas in the immediate term for energy needs, though renewable energy integration is a growing long-term factor. End-user trends are driven by domestic energy demand and the potential for export, while mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate assets and expand their footprint. Based on historical data and current trends, the market is projected to see approximately 3-5 significant M&A deals annually over the forecast period, with market shares being reshaped by successful project development and strategic acquisitions.

Argentina Oil and Gas Upstream Market Industry Trends & Analysis

The Argentina oil and gas upstream market is experiencing robust growth, fueled by a confluence of factors including substantial hydrocarbon reserves, favorable fiscal policies for certain projects, and the relentless pursuit of energy self-sufficiency. The Vaca Muerta shale formation stands as a primary engine of this growth, attracting considerable investment for its vast unconventional oil and gas potential. Technological advancements in horizontal drilling and hydraulic fracturing are critical enablers, significantly improving extraction efficiency and reducing operational costs, which are key to unlocking the economic viability of these resources. The CAGR for the upstream sector is projected to be approximately 7.5% during the forecast period (2025-2033), reflecting sustained expansion. Market penetration of advanced extraction technologies is rapidly increasing, with a notable surge in the adoption of digital oilfield solutions aimed at optimizing production and enhancing safety. Consumer preferences, in the broader energy context, are slowly shifting towards cleaner energy sources, but the immediate demand for oil and gas, particularly for industrial and transportation sectors, remains high. Competitive dynamics are intensifying, with major international oil companies (IOCs) and independent producers vying for prime acreage and technological superiority. The analysis indicates a strong trend towards collaborative ventures and strategic partnerships to share risks and leverage expertise, especially in the development of complex offshore fields and extensive shale plays. The current market penetration for advanced shale extraction techniques in key formations like Vaca Muerta is estimated to be around 60%, with a projected increase to 85% by 2030.

Leading Markets & Segments in Argentina Oil and Gas Upstream Market

The dominant segment within the Argentina oil and gas upstream market is undeniably Onshore, primarily driven by the immense potential and ongoing development of the Vaca Muerta Shale formation. This world-class unconventional resource basin is attracting significant capital and technological expertise, positioning it as the cornerstone of Argentina's upstream production strategy.

- Economic Policies: The Argentine government has implemented policies aimed at incentivizing investment in Vaca Muerta, including tax benefits, streamlined regulatory processes, and the development of dedicated infrastructure corridors. These policies are crucial for attracting both domestic and international investment, ensuring the continued expansion of onshore operations.

- Infrastructure Development: Significant investments are being channeled into improving road networks, pipeline systems, and power grids to support the logistical demands of large-scale onshore extraction. This includes projects focused on transporting extracted hydrocarbons to processing facilities and export terminals.

- Technological Advancements: The onshore segment benefits immensely from continuous innovation in horizontal drilling, hydraulic fracturing, and multi-stage stimulation techniques, which are essential for efficiently tapping into the tight shale reservoirs of Vaca Muerta.

- Resource Abundance: Vaca Muerta holds some of the largest shale oil and gas reserves globally, providing a long-term outlook for sustained production and exploration activities.

While the onshore segment currently leads, the Offshore segment is steadily gaining prominence, particularly in the Austral Basin. Developments in this region are crucial for diversifying Argentina's energy portfolio and tapping into potentially significant deepwater resources.

- Exploration Potential: The offshore frontier, particularly off the coast of Tierra del Fuego, presents substantial untapped hydrocarbon potential, attracting interest from major exploration and production companies.

- Technological Sophistication: Offshore exploration and production require advanced technologies, including deepwater drilling rigs, subsea production systems, and sophisticated seismic imaging, driving innovation in this segment.

- Government Support: Regulatory frameworks are being developed to encourage offshore exploration, with bid rounds and licensing agreements designed to attract specialized offshore expertise and investment.

- Strategic Importance: Successful offshore projects can contribute significantly to Argentina's energy security and export capabilities, complementing onshore production.

The dominance of the onshore segment, particularly Vaca Muerta, is projected to continue throughout the forecast period due to the established infrastructure, ongoing investment, and proven resource potential. However, strategic offshore developments will play an increasingly vital role in the long-term growth and diversification of Argentina's oil and gas upstream sector.

Argentina Oil and Gas Upstream Market Product Developments

Product developments in Argentina's oil and gas upstream market are largely centered on enhancing the efficiency and economic viability of unconventional resource extraction. Innovations in drilling fluids, proppants, and completion techniques are crucial for optimizing hydrocarbon recovery from shale formations like Vaca Muerta. Furthermore, advancements in artificial lift systems and digital monitoring technologies are improving production uptime and reducing operational costs across both onshore and offshore operations. The competitive advantage lies in the adoption of cutting-edge technologies that can lower extraction costs, increase recovery rates, and ensure environmental compliance, thereby attracting further investment and securing market share.

Key Drivers of Argentina Oil and Gas Upstream Market Growth

The growth of the Argentina oil and gas upstream market is primarily propelled by the vast, untapped reserves within the Vaca Muerta shale formation, which offers significant unconventional oil and gas potential. Favorable government policies, including tax incentives and infrastructure development initiatives, are attracting substantial domestic and international investment. Technological advancements in horizontal drilling and hydraulic fracturing are crucial for unlocking these resources economically. Furthermore, the growing global demand for energy and Argentina's ambition for energy self-sufficiency are strong economic drivers, positioning the country as a potential key supplier in the regional and global markets.

Challenges in the Argentina Oil and Gas Upstream Market Market

Despite significant growth potential, the Argentina oil and gas upstream market faces several challenges. Navigating evolving regulatory frameworks and potential policy shifts can create uncertainty for investors. Infrastructure limitations, particularly in remote exploration areas, can hinder efficient production and transportation. Supply chain disruptions, including the availability of specialized equipment and skilled labor, can impact project timelines and costs. Intense competition among operators for prime acreage and resources also presents a competitive pressure. Furthermore, external economic factors and global commodity price volatility can influence investment decisions and project profitability.

Emerging Opportunities in Argentina Oil and Gas Upstream Market

Emerging opportunities in the Argentina oil and gas upstream market are abundant, driven by technological breakthroughs and strategic market expansion. The continued optimization of shale extraction techniques in Vaca Muerta promises sustained production growth. Offshore exploration, particularly in underexplored basins, presents significant untapped potential for both oil and gas discoveries. Strategic partnerships and joint ventures are key catalysts for mitigating risks and pooling resources, especially for large-scale projects. Furthermore, the growing global demand for natural gas as a transition fuel creates opportunities for Argentina to expand its LNG export capabilities, leveraging its significant unconventional gas reserves.

Leading Players in the Argentina Oil and Gas Upstream Market Sector

- Equinor ASA

- YPF SA

- ExxonMobil Exploration Argentina SRL

- Chevron Argentina SRL

- Pan American Energy LLC

- Techint Group

- TotalEnergies SE

- Tullow Oil PLC

Key Milestones in Argentina Oil and Gas Upstream Market Industry

- October 2022: Vista Energy and Trafigura Argentina announced an investment of approximately USD 150 million into the Vaca Muerta Shale formation, following their 2021 joint venture to develop 20 wells.

- September 2022: TotalEnergies SE approved the final investment decision (FID) for the Fenix gas development project, located offshore Tierra del Fuego. The project, with an FID amount of USD 706 million, is expected to commence operations in 2025. TotalEnergies operates with a 37.5% interest, partnered with Pan American Sur (25%) and Wintershall Dea (37.5%).

Strategic Outlook for Argentina Oil and Gas Upstream Market Market

The strategic outlook for the Argentina oil and gas upstream market is exceptionally positive, driven by a robust foundation of vast hydrocarbon reserves and an increasingly supportive investment climate. Continued advancements in EOR technologies and digital integration will further enhance production efficiency and cost-effectiveness in mature fields and shale plays. The development of offshore frontiers represents a significant long-term growth accelerator, offering the potential for substantial new discoveries. Strategic partnerships between domestic and international players will be crucial for unlocking these complex projects and sharing the associated risks and rewards. Argentina's position as a potential major energy exporter, particularly in natural gas, underscores the significant opportunities for market expansion and increased global influence within the energy sector.

Argentina Oil and Gas Upstream Market Segmentation

- 1. Onshore

- 2. Offshore

Argentina Oil and Gas Upstream Market Segmentation By Geography

- 1. Argentina

Argentina Oil and Gas Upstream Market Regional Market Share

Geographic Coverage of Argentina Oil and Gas Upstream Market

Argentina Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YPF SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Exploration Argentina SRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Argentina SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pan American Energy LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Techint Group*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergies SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tullow Oil PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Argentina Oil and Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Argentina Oil and Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Onshore 2020 & 2033

- Table 2: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 3: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Offshore 2020 & 2033

- Table 4: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 5: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 7: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Onshore 2020 & 2033

- Table 8: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 9: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Offshore 2020 & 2033

- Table 10: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 11: Argentina Oil and Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Oil and Gas Upstream Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Argentina Oil and Gas Upstream Market?

Key companies in the market include Equinor ASA, YPF SA, ExxonMobil Exploration Argentina SRL, Chevron Argentina SRL, Pan American Energy LLC, Techint Group*List Not Exhaustive, TotalEnergies SE, Tullow Oil PLC.

3. What are the main segments of the Argentina Oil and Gas Upstream Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD 4847.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, Vista Energy and Trafigura Argentina announced that the companies would invest around USD 150 million into the Vaca Muerta Shale formation. This announcement comes after the companies formed a joint venture in 2021 to jointly develop 20 wells in Vista's main oil development concessions in Vaca Muerta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Argentina Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence