Key Insights

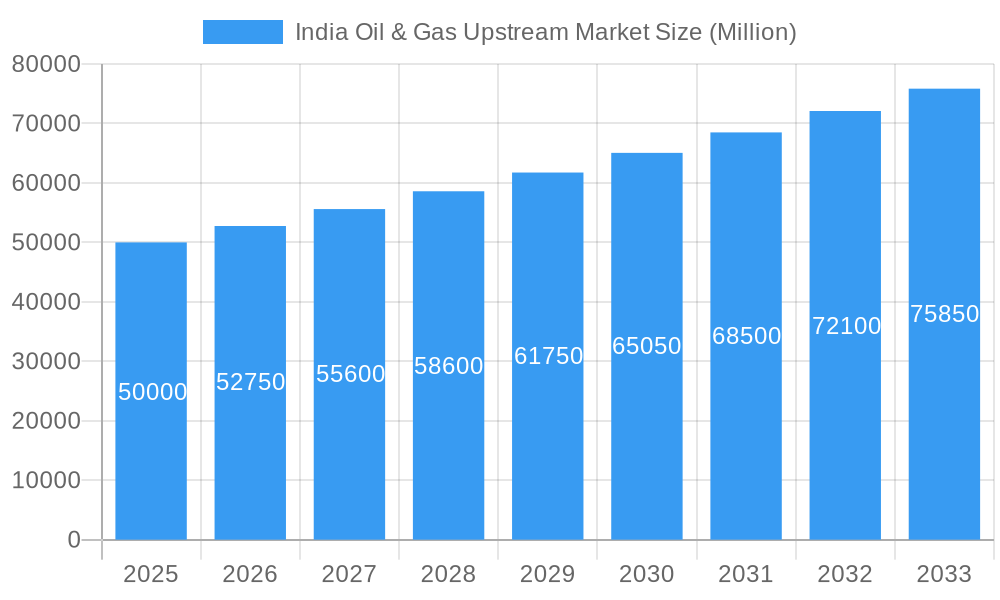

India's Oil & Gas Upstream Market is projected for substantial growth, driven by escalating energy needs and strategic domestic production initiatives. With a base year market size of USD 4847.93 billion in 2025, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately 5%. This growth is fueled by increased upstream investments, enhanced oil recovery (EOR) methods, and marginal field development. Government policy support, including fiscal incentives and streamlined regulations, further bolsters this expansion. As India prioritizes energy security and import reduction, the upstream segment is crucial for achieving these objectives. Technological advancements in seismic surveying, drilling, and reservoir management will unlock new reserves, contributing to sustained market growth and economic development.

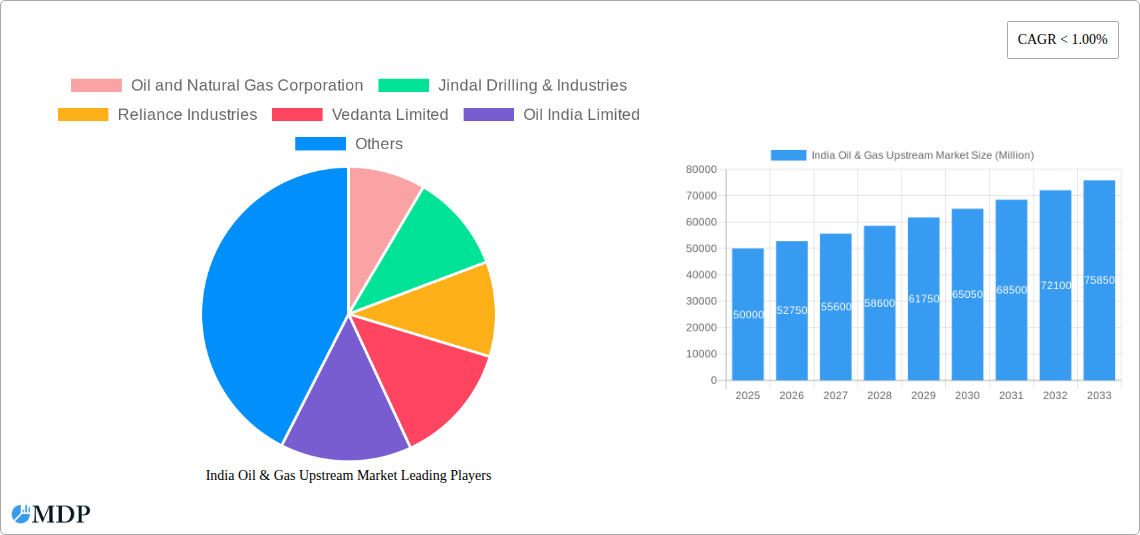

India Oil & Gas Upstream Market Market Size (In Million)

The period from 2019-2024 has established a solid foundation for current market dynamics, marked by consistent investments and production capacity increases. Despite global price volatility, India's inherent demand growth ensures market resilience. The base year 2025 represents a key juncture for capitalizing on past efforts and emerging opportunities. The forecast period anticipates a significant rise in exploration activities, particularly in frontier and deepwater blocks, leveraging new geological data and advanced technologies. Furthermore, optimizing output from existing fields through improved methodologies and digital integration will be a primary growth driver. This sustained upward trend highlights the vital role of India's Oil & Gas Upstream Market in powering the nation's economy and ensuring future energy independence.

India Oil & Gas Upstream Market Company Market Share

Gain critical insights into India's dynamic oil and gas upstream sector. This comprehensive report delivers market analysis and future projections essential for industry stakeholders, investors, and policymakers.

Study Period: 2019–2033 | Base Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

This report provides an exhaustive analysis of the India Oil & Gas Upstream Market, encompassing exploration, production, market trends, technological advancements, and regulatory frameworks. Explore leading company strategies, evolving segments, and emerging opportunities and challenges.

India Oil & Gas Upstream Market Market Dynamics & Concentration

The India Oil & Gas Upstream Market is characterized by a moderate concentration of key players, with Oil and Natural Gas Corporation (ONGC) and Oil India Limited (OIL) holding significant market share in terms of exploration acreage and production. Reliance Industries also plays a crucial role, particularly in offshore assets. Innovation drivers are primarily focused on enhancing exploration success rates, optimizing production from mature fields, and developing cost-effective extraction technologies for challenging reservoirs. The regulatory framework, driven by the Directorate General of Hydrocarbons (DGH) and the Ministry of Petroleum and Natural Gas, is continuously evolving to attract foreign investment and streamline licensing processes, exemplified by the Open Acreage Licensing Policy (OALP). Product substitutes are limited in the upstream sector, with the focus remaining on traditional hydrocarbons. End-user trends are influenced by India's growing energy demand, driving the need for increased domestic production. Merger and acquisition (M&A) activities are moderately prevalent, often involving strategic partnerships to share technological expertise and financial risk. For instance, ONGC's proactive approach in seeking partners for its deep-sea gas discoveries signifies a trend towards collaboration to unlock complex reserves. The market share distribution is dynamic, with major public sector undertakings dominating but private and international players gradually increasing their footprint. The number of M&A deals remains a key indicator of market consolidation and strategic realignments.

India Oil & Gas Upstream Market Industry Trends & Analysis

The India Oil & Gas Upstream Market is experiencing robust growth, driven by the nation's insatiable demand for energy to fuel its economic expansion. The CAGR is projected to be strong over the forecast period, underpinned by significant capital investments in exploration and production activities. Technological disruptions are playing a pivotal role, with the adoption of advanced seismic imaging, enhanced oil recovery (EOR) techniques, and digital technologies like AI and machine learning revolutionizing exploration success rates and operational efficiency. Consumer preferences, while indirect in the upstream segment, translate into a persistent demand for reliable and affordable energy sources, pushing for increased domestic output to reduce import dependency. Competitive dynamics are intensifying, with both established national oil companies and emerging private players vying for exploration blocks and technological advancements. Market penetration is steadily increasing as new discoveries are made and existing fields are optimized. The government's proactive policies, aimed at boosting domestic production and attracting foreign direct investment, are critical catalysts for this growth. Furthermore, the development of unconventional resources and the focus on reducing exploration timeframes are reshaping the industry landscape. The increasing focus on sustainability and environmental considerations is also driving innovation in cleaner extraction methods and the integration of renewable energy solutions within oil and gas operations.

Leading Markets & Segments in India Oil & Gas Upstream Market

The Onshore segment is currently the dominant force in the India Oil & Gas Upstream Market, accounting for a substantial portion of exploration and production activities. This dominance is driven by a combination of factors, including the established infrastructure, a higher number of exploratory prospects, and government focus on developing domestic reserves.

- Onshore Dominance Drivers:

- Existing Projects: A significant number of mature fields continue to contribute to production, supported by ongoing redevelopment and infill drilling programs.

- Projects in Pipeline: A robust pipeline of projects, fueled by government incentives and the exploration of new basins, ensures sustained activity.

- Upcoming Projects: Strategic initiatives and discoveries are paving the way for numerous future projects, promising continued growth in this segment.

- Economic Policies: Favorable government policies aimed at increasing domestic production and reducing import dependence actively promote onshore exploration and development.

- Infrastructure: Well-established pipeline networks, processing facilities, and logistical support systems make onshore operations more cost-effective and accessible.

- Geological Potential: India possesses significant, yet underexplored, onshore sedimentary basins with considerable hydrocarbon potential.

The Offshore segment, while currently representing a smaller share, is poised for substantial growth, particularly in ultra-deepwater and deepwater areas. Discoveries in the Krishna Godavari (KG) Basin and the Mumbai High region highlight the immense potential of India's offshore reserves. The government's focus on unlocking these complex offshore resources, coupled with advancements in offshore exploration and production technology, is a key driver for its future expansion.

- Offshore Growth Catalysts:

- Untapped Potential: Vast, unexplored offshore acreage holds the promise of significant hydrocarbon discoveries.

- Technological Advancements: Innovations in deepwater drilling, subsea technology, and floating production systems are making offshore exploration more feasible and cost-effective.

- Strategic Government Focus: Policies are actively encouraging investment in offshore exploration to meet growing energy demands.

- High-Value Discoveries: Recent discoveries, especially gas, in deepwater blocks have spurred further exploration efforts.

India Oil & Gas Upstream Market Product Developments

Product developments in the India Oil & Gas Upstream Market are largely centered on enhancing exploration success, optimizing production, and improving operational efficiency. Innovations in seismic data acquisition and processing, particularly for complex geological formations in both onshore and offshore terrains, are crucial. Furthermore, the development and application of advanced Enhanced Oil Recovery (EOR) techniques, such as chemical injection and CO2 flooding, are vital for maximizing recovery from mature fields. The integration of artificial intelligence and machine learning for reservoir characterization, predictive maintenance, and drilling optimization offers significant competitive advantages. These technological advancements directly translate into reduced exploration risks, lower production costs, and increased hydrocarbon recovery rates, making them critical for market players seeking to maintain and grow their market share.

Key Drivers of India Oil & Gas Upstream Market Growth

The India Oil & Gas Upstream Market is propelled by several interconnected drivers. Growing energy demand, fueled by India's robust economic growth and expanding population, necessitates increased domestic hydrocarbon production. Government initiatives like the Open Acreage Licensing Policy (OALP) and Hydrocarbon Exploration and Licensing Policy (HELP) are instrumental in attracting domestic and foreign investment by offering more attractive fiscal terms and exploration flexibility. Technological advancements, including sophisticated seismic imaging, advanced drilling techniques, and digital solutions, are enhancing exploration success rates and optimizing production from existing and new fields. Furthermore, the government's strategic objective of reducing import dependency is a powerful impetus for boosting domestic exploration and production activities.

Challenges in the India Oil & Gas Upstream Market Market

Despite its promising growth trajectory, the India Oil & Gas Upstream Market faces several significant challenges. Regulatory hurdles and policy uncertainties can sometimes slow down project execution and investment decisions, despite government efforts to streamline processes. Logistical complexities and infrastructure gaps, particularly in remote onshore regions and challenging deepwater offshore environments, can increase operational costs and timelines. Environmental concerns and social acceptance require careful management and adherence to stringent regulations. Geological complexities and the declining productivity of some mature fields necessitate continuous investment in advanced technologies and exploration for new reserves. Global price volatility of crude oil and natural gas can impact the profitability of upstream projects and investment decisions.

Emerging Opportunities in India Oil & Gas Upstream Market

Emerging opportunities in the India Oil & Gas Upstream Market are largely driven by technological breakthroughs, strategic partnerships, and the exploration of new frontiers. The exploration of deepwater and ultra-deepwater offshore blocks presents a significant opportunity, with substantial reserves yet to be discovered. The development of unconventional hydrocarbon resources, such as shale oil and gas, though in its nascent stages, holds long-term potential. Strategic partnerships and joint ventures between national oil companies, private players, and international oil companies are crucial for sharing expertise, technology, and financial risk, thereby accelerating exploration and production. The increasing focus on digital transformation and the adoption of advanced analytics offers opportunities to optimize operations, reduce costs, and enhance decision-making. Furthermore, the government's commitment to making India an energy hub creates a conducive environment for innovation and expansion.

Leading Players in the India Oil & Gas Upstream Market Sector

- Oil and Natural Gas Corporation

- Jindal Drilling & Industries

- Reliance Industries

- Vedanta Limited

- Oil India Limited

- Hindustan Construction Co Limited

- BP PLC

- Deep Industries Ltd

- Larsen & Toubro Limited

Key Milestones in India Oil & Gas Upstream Market Industry

- May 2022: Oil and Natural Gas Corporation (ONGC) initiated tenders to offer stakes to foreign companies in its ultra-deepsea gas discovery and a high-pressure, high-temperature block in the KG Basin, specifically for the Deen Dayal West (DDW) block and ultra-deep discoveries in Cluster-III of its KG-D5 area. This move signals a strategic effort to leverage foreign expertise and capital for complex resource development.

- May 2022: ONGC unveiled a comprehensive roadmap to intensify its exploration campaign, allocating approximately USD 4 Billion in capital expenditures for FY 2022-25. This includes exploration efforts in two blocks in the Andaman Basin under the Open Acreage Licensing Policy (OALP) and plans to drill six wells within three years, demonstrating a strong commitment to discovering new reserves.

Strategic Outlook for India Oil & Gas Upstream Market Market

The strategic outlook for the India Oil & Gas Upstream Market is overwhelmingly positive, characterized by a strong commitment to expanding domestic production and embracing technological innovation. The market is set to witness accelerated exploration and development activities, particularly in offshore deepwater and ultra-deepwater regions, driven by government policies and the pursuit of energy security. Strategic partnerships and the adoption of digital technologies will be crucial for unlocking complex reserves and enhancing operational efficiency. While challenges related to environmental regulations and price volatility persist, the overarching trend is towards greater investment, innovation, and the strategic diversification of energy sources. The focus on reducing import dependency and meeting the burgeoning energy needs of a growing economy positions the Indian upstream sector for sustained growth and significant contribution to the nation's energy landscape.

India Oil & Gas Upstream Market Segmentation

-

1. Location of Deployment

-

1.1. Onshore

-

1.1.1. Overview

- 1.1.1.1. Existing Projects

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming Projects

-

1.1.1. Overview

- 1.2. Offshore

-

1.1. Onshore

India Oil & Gas Upstream Market Segmentation By Geography

- 1. India

India Oil & Gas Upstream Market Regional Market Share

Geographic Coverage of India Oil & Gas Upstream Market

India Oil & Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Production to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Oil & Gas Upstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Projects

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming Projects

- 5.1.1.1. Overview

- 5.1.2. Offshore

- 5.1.1. Onshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oil and Natural Gas Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jindal Drilling & Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vedanta Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oil India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hindustan Construction Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BP PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deep Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Larsen & Toubro Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: India Oil & Gas Upstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Oil & Gas Upstream Market Share (%) by Company 2025

List of Tables

- Table 1: India Oil & Gas Upstream Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: India Oil & Gas Upstream Market Volume Billion Forecast, by Location of Deployment 2020 & 2033

- Table 3: India Oil & Gas Upstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Oil & Gas Upstream Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Oil & Gas Upstream Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: India Oil & Gas Upstream Market Volume Billion Forecast, by Location of Deployment 2020 & 2033

- Table 7: India Oil & Gas Upstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Oil & Gas Upstream Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Oil & Gas Upstream Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the India Oil & Gas Upstream Market?

Key companies in the market include Oil and Natural Gas Corporation, Jindal Drilling & Industries, Reliance Industries, Vedanta Limited, Oil India Limited, Hindustan Construction Co Limited, BP PLC, Deep Industries Ltd, Larsen & Toubro Limited.

3. What are the main segments of the India Oil & Gas Upstream Market?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 4847.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Offshore Production to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In May 2022, the State-owned Oil and Natural Gas Corporation (ONGC) is offering a stake to foreign companies in its ultra deepsea gas discovery and a high-pressure, high-temperature block in the KG basin. the company floated an initial tender for partners in the development of the Deen Dayal West (DDW) block as well as ultra-deep discoveries in Cluster-III of its KG-D5 area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Oil & Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Oil & Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Oil & Gas Upstream Market?

To stay informed about further developments, trends, and reports in the India Oil & Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence