Key Insights

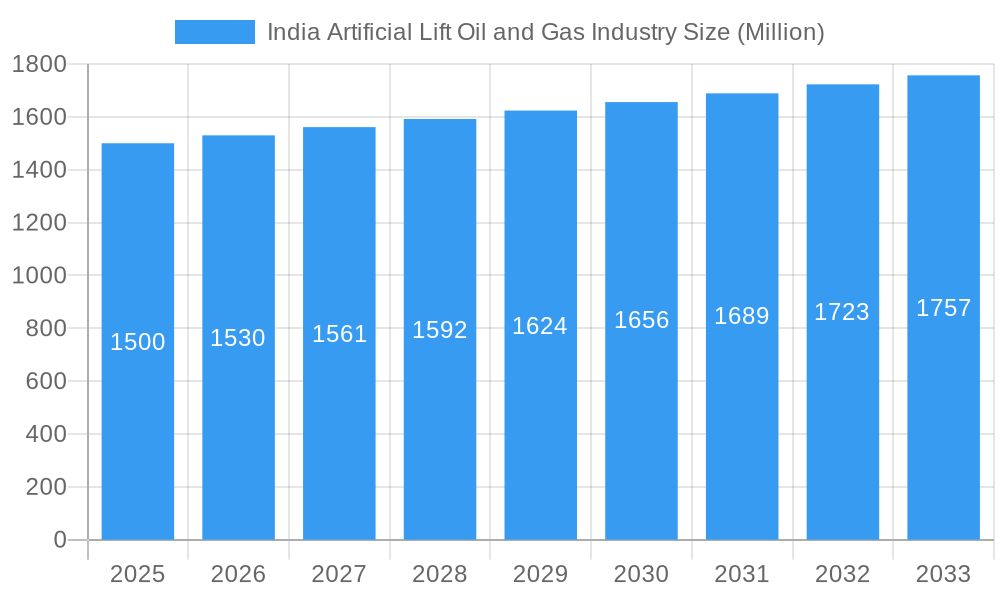

The India Artificial Lift Oil and Gas market is poised for significant expansion, projected to reach an estimated XX million USD by 2025, and is anticipated to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 2.00% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the nation's increasing energy demands and the imperative to enhance production from aging and mature oil and gas fields. Artificial lift systems are crucial for optimizing oil extraction efficiency, particularly as reservoir pressures decline. The market is being driven by substantial investments in upstream exploration and production activities, coupled with government initiatives aimed at boosting domestic oil and gas output and reducing import dependency. Technological advancements in artificial lift solutions, offering improved reliability, efficiency, and remote monitoring capabilities, are also playing a pivotal role in market expansion.

India Artificial Lift Oil and Gas Industry Market Size (In Billion)

The market is segmented into several key artificial lift technologies, including Gas-Lift Systems, Sucker Rod Pumps, Electric Submersible Pumps (ESPs), Progressive Cavity Pump (PCP) Lifting Systems, and Jet Pumps. ESPs and Sucker Rod Pumps are expected to dominate the market share due to their proven efficacy and widespread application in various well conditions. Emerging technologies like PCPs are also gaining traction for their suitability in handling viscous and high-solid-content fluids. Key players such as Schlumberger NV, Weatherford International PLC, Baker Hughes Company, and Halliburton Company are actively engaged in research and development, alongside strategic collaborations and acquisitions, to strengthen their market presence and offer comprehensive artificial lift solutions. The Indian market, as a significant contributor to this sector, will witness increased adoption of these advanced technologies to maximize hydrocarbon recovery and operational efficiency.

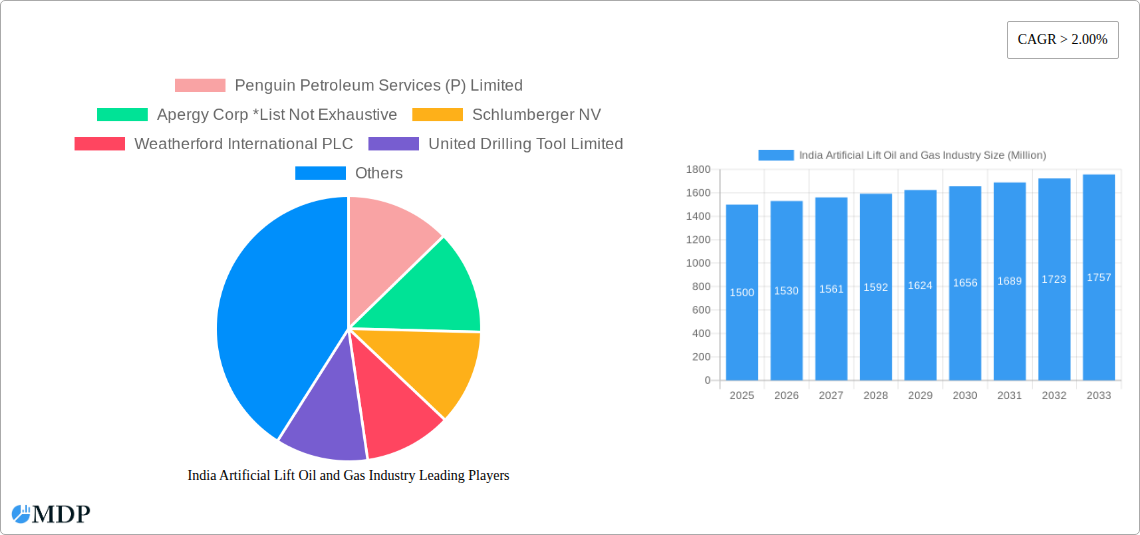

India Artificial Lift Oil and Gas Industry Company Market Share

India Artificial Lift Oil and Gas Industry Market Dynamics & Concentration

The India Artificial Lift Oil and Gas Industry is experiencing a dynamic shift, characterized by increasing demand for enhanced oil recovery (EOR) solutions and a growing focus on optimizing production from mature fields. Market concentration is relatively moderate, with a few major global players like Schlumberger NV, Weatherford International PLC, and Baker Hughes Company holding significant market share, alongside prominent domestic entities such as United Drilling Tool Limited and Novomet Oilfield Services Company. Innovation drivers are primarily centered around developing more energy-efficient and cost-effective artificial lift technologies, including advanced Electric Submersible Pumps (ESPs) and intelligent Gas-Lift Systems. The regulatory framework, guided by government initiatives to boost domestic oil and gas production, plays a crucial role in shaping market access and investment. Product substitutes are limited in the core artificial lift segment, though advancements in upstream processing and digitalization offer indirect alternatives for optimizing overall field performance. End-user trends are leaning towards greater automation, remote monitoring capabilities, and solutions that minimize operational downtime. Mergers and acquisition (M&A) activities, while not excessively high, have seen consolidation of smaller service providers to enhance capabilities and market reach. For instance, the integration of specialized artificial lift technologies into broader EOR solutions represents a key strategic move. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033, driven by the necessity to extract more from existing reserves.

India Artificial Lift Oil and Gas Industry Industry Trends & Analysis

The India Artificial Lift Oil and Gas Industry is poised for substantial growth, driven by a confluence of factors aimed at bolstering the nation's energy security and production capabilities. A primary growth driver is the increasing reliance on artificial lift systems to sustain and enhance production from India's aging oil and gas fields. As conventional reservoirs deplete, the imperative to employ sophisticated techniques for extracting remaining hydrocarbons becomes paramount. This trend is supported by government policies promoting energy independence and incentivizing investment in exploration and production activities. Technological disruptions are at the forefront, with a continuous evolution in artificial lift technologies. Innovations in Electric Submersible Pumps (ESPs) are focused on improving their efficiency, reliability, and ability to operate in harsh downhole conditions, while advancements in Gas-Lift Systems are enabling more precise control and optimization of gas injection. Progressive Cavity Pump (PCP) Lifting Systems are gaining traction for their effectiveness in handling viscous and high-solids content crude, further expanding their market penetration. Consumer preferences are shifting towards integrated solutions that offer not just the equipment but also comprehensive service packages, including installation, maintenance, and performance monitoring. This demand for end-to-end solutions is fostering strategic partnerships between technology providers and oilfield service companies. Competitive dynamics are characterized by intense rivalry among global majors and emerging domestic players, each vying for market share through technological superiority, competitive pricing, and localized service networks. The market penetration of advanced artificial lift solutions is projected to rise significantly, reaching an estimated 65% by 2033, a testament to their increasing indispensability. The market is projected to reach a valuation of approximately 2,500 Million by the end of the forecast period, with a CAGR of 5.2% from 2025 to 2033. The historical period from 2019 to 2024 has seen steady growth, laying the foundation for accelerated expansion.

Leading Markets & Segments in India Artificial Lift Oil and Gas Industry

The Indian Artificial Lift Oil and Gas Industry is dominated by the Electric Submersible Pumps (ESPs) segment, which consistently commands the largest market share due to its efficiency and suitability for a wide range of well conditions. ESPs are the preferred choice for many of India's onshore and offshore mature fields requiring high production rates and deeper lifting capabilities. The economic policies favoring increased domestic oil production and the government's focus on maximizing output from existing hydrocarbon reserves directly fuel the demand for ESPs. Furthermore, the ongoing development of new fields and the need for reliable artificial lift solutions in challenging geological formations further solidify ESPs' leading position.

Gas-Lift Systems represent another significant segment, driven by their cost-effectiveness and adaptability in wells with declining reservoir pressure. The development of advanced gas injection technologies and optimized control systems enhances their efficiency, making them a viable option for a broad spectrum of applications. The availability of natural gas as a lifting medium, coupled with ongoing EOR initiatives, provides a strong impetus for the growth of this segment.

Sucker Rod Pumps (SRPs), while a more traditional technology, continue to hold a considerable market share, particularly in mature onshore fields where simplicity, reliability, and lower upfront costs are prioritized. The extensive installed base of SRPs in India ensures a steady demand for maintenance, upgrades, and replacements.

Progressive Cavity Pump (PCP) Lifting Systems are experiencing robust growth, especially in wells with high viscosity crude oil, significant sand production, and artificial lift challenges that conventional methods struggle to address. Their ability to handle difficult fluid properties makes them increasingly attractive for specific field developments.

Jet Pumps, though a smaller segment, find niche applications in specific well conditions where their unique operational characteristics offer advantages. Their role in specialized EOR projects and unconventional reservoir development contributes to their sustained presence in the market. The overall dominance of ESPs is underpinned by their versatility, technological advancements, and alignment with the national agenda of boosting oil and gas output, expected to be valued at over 1,200 Million by 2033.

India Artificial Lift Oil and Gas Industry Product Developments

Product developments in the India Artificial Lift Oil and Gas Industry are increasingly focused on enhancing efficiency, reliability, and automation. Innovations in Electric Submersible Pumps (ESPs) include the development of advanced materials for longer run-life in corrosive environments, variable speed drives for optimized energy consumption, and intelligent monitoring systems for predictive maintenance. Gas-Lift Systems are benefiting from advancements in digital control platforms and specialized injection valves for precise gas management. Furthermore, there is a growing emphasis on integrated solutions that combine artificial lift equipment with data analytics and remote operational capabilities, offering improved production optimization and reduced downtime for operators like Penguin Petroleum Services (P) Limited. These advancements are designed to improve the overall economic viability of production from mature and complex reservoirs.

Key Drivers of India Artificial Lift Oil and Gas Industry Growth

The growth of the India Artificial Lift Oil and Gas Industry is propelled by several key factors. Firstly, the nation's strategic imperative to reduce its import dependency on crude oil and enhance energy security is a primary driver, leading to increased investment in domestic exploration and production. Secondly, the aging of existing oil fields necessitates the deployment of advanced artificial lift technologies to maximize hydrocarbon recovery from mature reservoirs, thereby extending their productive life. Technological advancements in artificial lift systems, focusing on efficiency, reliability, and cost-effectiveness, are making them more accessible and attractive to operators. Furthermore, supportive government policies and fiscal incentives aimed at boosting oil and gas production provide a favorable environment for industry expansion. The ongoing development of discovered small fields also contributes to the demand for a wide range of artificial lift solutions.

Challenges in the India Artificial Lift Oil and Gas Industry Market

Despite its growth potential, the India Artificial Lift Oil and Gas Industry faces several challenges. The complex geological formations and harsh operating conditions in some Indian fields can necessitate highly specialized and expensive artificial lift solutions, impacting project economics. Regulatory hurdles and delays in obtaining permits for new projects can sometimes hinder rapid deployment. Supply chain disruptions and the availability of skilled personnel for installation and maintenance of advanced artificial lift equipment can also pose significant challenges. Moreover, intense competition among global and domestic players can put pressure on pricing and profit margins. The fluctuating global oil prices also introduce an element of uncertainty, impacting investment decisions and the demand for artificial lift services.

Emerging Opportunities in India Artificial Lift Oil and Gas Industry

Emerging opportunities in the India Artificial Lift Oil and Gas Industry are largely centered around technological innovation and strategic market expansion. The increasing adoption of digitalization and the Internet of Things (IoT) in the oilfield sector presents a significant opportunity for developing intelligent and remotely managed artificial lift systems, offering enhanced operational efficiency and predictive maintenance capabilities. Strategic partnerships between global technology providers and domestic oilfield service companies can leverage combined expertise to offer comprehensive solutions tailored to the Indian market. The government's continued focus on optimizing production from existing fields and exploring unconventional hydrocarbon resources also opens up new avenues for advanced artificial lift technologies. Furthermore, the growing emphasis on enhanced oil recovery (EOR) techniques presents a substantial market for specialized artificial lift applications.

Leading Players in the India Artificial Lift Oil and Gas Industry Sector

- Penguin Petroleum Services (P) Limited

- Apergy Corp

- Schlumberger NV

- Weatherford International PLC

- United Drilling Tool Limited

- Baker Hughes Company

- Novomet Oilfield Services Company

- Halliburton Company

Key Milestones in India Artificial Lift Oil and Gas Industry Industry

- May 2022: Oil and Natural Gas Corporation (ONGC) awarded two enhanced oil recovery (EOR) projects on separate assets in India featuring polymer flooding to SNF Flopam, highlighting a growing focus on EOR technologies.

- November 2022: The Indian government signed contracts for 31 discovered small fields under the third round of bidding, signaling continued efforts to unlock marginal hydrocarbon reserves and subsequently increasing the demand for artificial lift solutions.

- June 2021: The government launched the third round for discovered small fields, where 75 fields were offered under 31 contract areas, laying the groundwork for future production and the need for artificial lift infrastructure.

Strategic Outlook for India Artificial Lift Oil and Gas Industry Market

The strategic outlook for the India Artificial Lift Oil and Gas Industry is robust, driven by the nation's unwavering commitment to energy self-sufficiency. Growth accelerators will be primarily fueled by the continued integration of advanced digital technologies for smart operations and predictive analytics, enabling greater efficiency and reliability in artificial lift systems. Strategic collaborations between global leaders like Schlumberger NV and local players will foster innovation and expand service offerings. The increasing focus on EOR techniques and the development of marginal fields will continue to drive demand for specialized and cost-effective artificial lift solutions. Investments in research and development for more sustainable and energy-efficient technologies will also be crucial, positioning the Indian market for sustained growth and technological leadership in the coming years.

India Artificial Lift Oil and Gas Industry Segmentation

- 1. Gas-Lift Systems

- 2. Sucker Rod Pumps

- 3. Electric Submersible Pumps

- 4. Progressive Cavity Pump Lifting Systems

- 5. Jet Pumps

India Artificial Lift Oil and Gas Industry Segmentation By Geography

- 1. India

India Artificial Lift Oil and Gas Industry Regional Market Share

Geographic Coverage of India Artificial Lift Oil and Gas Industry

India Artificial Lift Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Electric Submersible Pumps (ESP) to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Artificial Lift Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Gas-Lift Systems

- 5.2. Market Analysis, Insights and Forecast - by Sucker Rod Pumps

- 5.3. Market Analysis, Insights and Forecast - by Electric Submersible Pumps

- 5.4. Market Analysis, Insights and Forecast - by Progressive Cavity Pump Lifting Systems

- 5.5. Market Analysis, Insights and Forecast - by Jet Pumps

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Gas-Lift Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Penguin Petroleum Services (P) Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apergy Corp *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schlumberger NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Weatherford International PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Drilling Tool Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baker Hughes Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novomet Oilfield Services Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Halliburton Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Penguin Petroleum Services (P) Limited

List of Figures

- Figure 1: India Artificial Lift Oil and Gas Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Artificial Lift Oil and Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Gas-Lift Systems 2020 & 2033

- Table 2: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Sucker Rod Pumps 2020 & 2033

- Table 3: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Electric Submersible Pumps 2020 & 2033

- Table 4: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Progressive Cavity Pump Lifting Systems 2020 & 2033

- Table 5: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Jet Pumps 2020 & 2033

- Table 6: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Gas-Lift Systems 2020 & 2033

- Table 8: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Sucker Rod Pumps 2020 & 2033

- Table 9: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Electric Submersible Pumps 2020 & 2033

- Table 10: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Progressive Cavity Pump Lifting Systems 2020 & 2033

- Table 11: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Jet Pumps 2020 & 2033

- Table 12: India Artificial Lift Oil and Gas Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Artificial Lift Oil and Gas Industry?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the India Artificial Lift Oil and Gas Industry?

Key companies in the market include Penguin Petroleum Services (P) Limited, Apergy Corp *List Not Exhaustive, Schlumberger NV, Weatherford International PLC, United Drilling Tool Limited, Baker Hughes Company, Novomet Oilfield Services Company, Halliburton Company.

3. What are the main segments of the India Artificial Lift Oil and Gas Industry?

The market segments include Gas-Lift Systems, Sucker Rod Pumps, Electric Submersible Pumps, Progressive Cavity Pump Lifting Systems, Jet Pumps.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration.

6. What are the notable trends driving market growth?

Electric Submersible Pumps (ESP) to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In May 2022, Oil and Natural Gas Corporation (ONGC) recently awarded two enhanced oil recovery (EOR) projects on separate assets in India that will feature polymer flooding to SNF Flopam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Artificial Lift Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Artificial Lift Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Artificial Lift Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the India Artificial Lift Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence