Key Insights

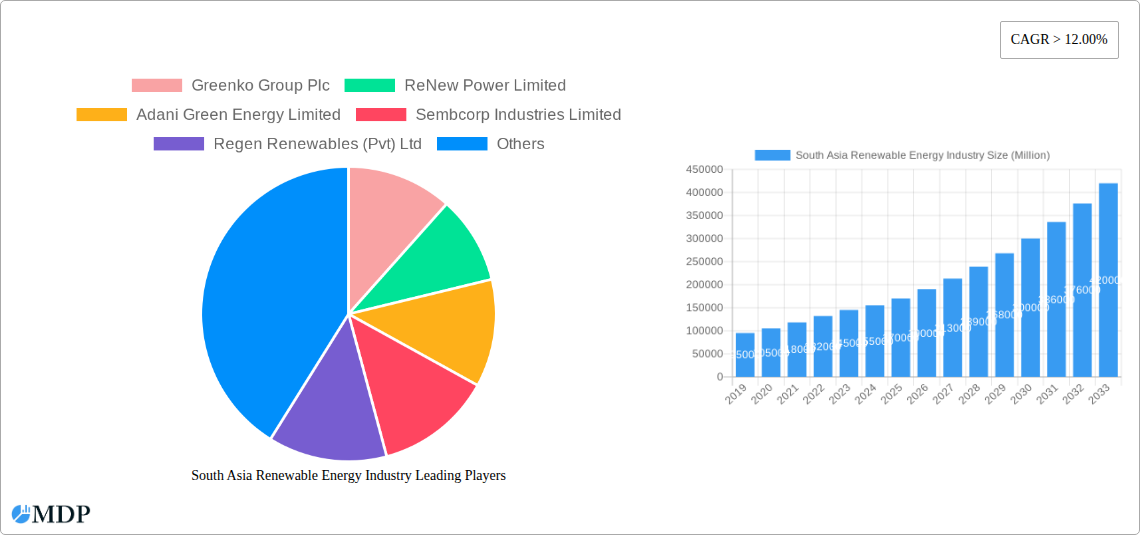

The South Asia renewable energy market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 6.1%. Valued at $128.5 billion in the base year 2024, the market is propelled by escalating energy consumption, supportive governmental initiatives, and a heightened focus on environmental sustainability throughout the region. Critical growth factors include the imperative to transition from fossil fuels, mitigate carbon emissions, and bolster energy independence. Advancements in regulatory environments, incentives for renewable energy adoption, and decreasing costs for solar and wind technologies further catalyze market expansion. The region's extensive solar irradiance and substantial wind potential offer significant development opportunities.

South Asia Renewable Energy Industry Market Size (In Billion)

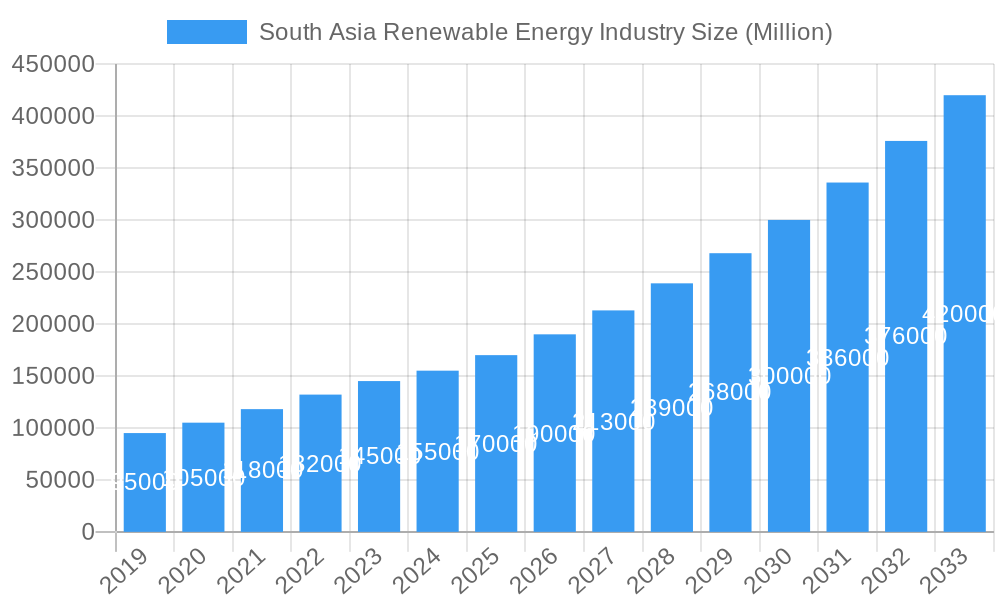

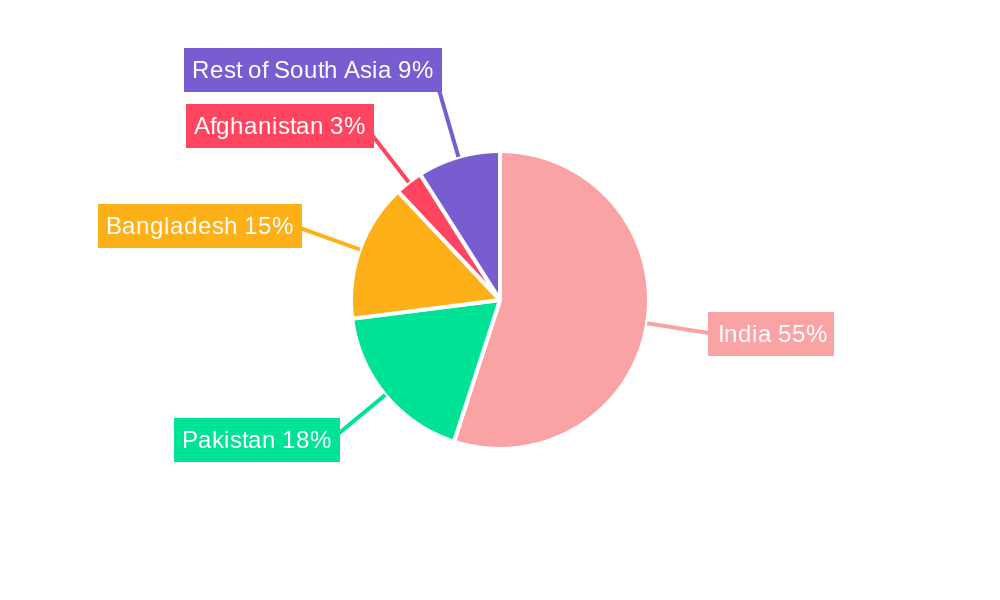

South Asia's renewable energy sector features a diverse competitive landscape, with key contributors including Greenko Group Plc, ReNew Power Limited, and Adani Green Energy Limited spearheading large-scale project development. The market is segmented by technology, with Hydro, Solar, and Wind power being the primary segments. Solar energy, notably, is witnessing accelerated deployment owing to its adaptability and reduced installation expenses. Geographically, India dominates the market, followed by Pakistan and Bangladesh, with Afghanistan and other South Asian nations also demonstrating considerable growth potential. While market drivers are strong, challenges such as land acquisition complexities, grid infrastructure constraints, and the intermittent nature of certain renewable sources necessitate strategic interventions and innovative solutions for sustained and significant market development. The forecast period, 2024-2031, is expected to witness continued advancements in energy storage and smart grid integration to address these challenges.

South Asia Renewable Energy Industry Company Market Share

South Asia Renewable Energy Industry: Unlocking Sustainable Growth in a Dynamic Market

This comprehensive report provides an in-depth analysis of the South Asia renewable energy industry, projecting significant growth and evolving market dynamics from 2019 to 2033. Focusing on 2025 as the base and estimated year, with a forecast period of 2025-2033 and historical data from 2019-2024, this study offers actionable insights for stakeholders seeking to capitalize on the region's burgeoning green energy sector. Discover the key drivers, leading players, emerging opportunities, and challenges shaping the future of renewable energy across India, Pakistan, Bangladesh, Afghanistan, and the rest of South Asia.

South Asia Renewable Energy Industry Market Dynamics & Concentration

The South Asian renewable energy market is characterized by increasing concentration driven by ambitious government policies and escalating foreign investment. Regulatory frameworks in countries like India have been instrumental in fostering growth, with initiatives such as renewable purchase obligations (RPOs) and competitive bidding mechanisms driving down costs and attracting significant players. Innovation drivers are primarily focused on enhancing the efficiency of solar PV technologies, advancements in wind turbine technology, and the integration of energy storage solutions. Product substitutes, while present in the form of fossil fuels, are steadily losing ground due to environmental concerns and cost competitiveness of renewables. End-user trends reveal a growing demand from commercial and industrial sectors for reliable, cost-effective, and sustainable power. Mergers and acquisitions (M&A) activities are on the rise, with prominent companies consolidating their market positions. For instance, the market has witnessed over 50 significant M&A deals in the past two years, indicating a strong trend towards consolidation. Key players like Greenko Group Plc and Adani Green Energy Limited are actively pursuing strategic acquisitions to expand their portfolios and achieve economies of scale, aiming for market shares exceeding 15% in their respective segments.

South Asia Renewable Energy Industry Industry Trends & Analysis

The South Asia renewable energy industry is poised for remarkable growth, driven by a confluence of economic, environmental, and technological factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period. This expansion is fueled by supportive government policies aimed at reducing carbon emissions and enhancing energy security, coupled with increasing international climate finance. Technological disruptions, particularly in solar photovoltaic (PV) and wind energy, are continuously improving efficiency and reducing the levelized cost of energy (LCOE), making renewables increasingly competitive against traditional energy sources. Consumer preferences are shifting towards sustainable energy solutions, with both corporate and residential sectors actively seeking cleaner power options. The competitive landscape is intensifying, with a mix of established global players and emerging local champions vying for market share. Market penetration for solar energy has already surpassed 10% in several key South Asian markets, with wind energy closely following. The demand for decentralized renewable energy solutions and hybrid power projects is also on the rise, indicating a sophisticated evolution of the market. Furthermore, the integration of digital technologies like AI and IoT for grid management and predictive maintenance is enhancing the reliability and efficiency of renewable energy systems.

Leading Markets & Segments in South Asia Renewable Energy Industry

India stands out as the dominant market within the South Asia renewable energy landscape, driven by its sheer scale, proactive policy environment, and substantial investment in green energy infrastructure. The solar segment, in particular, exhibits unparalleled dominance in India, accounting for over 60% of the total renewable energy capacity installed. This leadership is underpinned by robust government targets, incentives like the Production Linked Incentive (PLI) scheme for solar manufacturing, and favorable economic policies.

- India's Dominance:

- Economic Policies: Favorable feed-in tariffs, tax incentives, and renewable purchase obligations have created a strong investment climate.

- Infrastructure Development: Significant investments in grid infrastructure and transmission lines are facilitating the integration of large-scale renewable projects.

- Government Targets: Ambitious national targets for renewable energy capacity, such as achieving 500 GW by 2030, are a primary growth accelerant.

- Market Size: India's large population and rapidly growing energy demand necessitate significant renewable energy deployment.

The wind energy segment also holds a significant share, particularly in states like Tamil Nadu and Gujarat, owing to favorable wind speeds and supportive policies. While Pakistan and Bangladesh are also making substantial strides, their market sizes and growth rates currently trail India's. Afghanistan and the rest of South Asia represent emerging markets with significant untapped potential, primarily in hydro and solar, contingent on geopolitical stability and infrastructure development. The "Others" segment, encompassing biomass and small hydro, contributes to diversification but remains a smaller contributor compared to solar and wind.

South Asia Renewable Energy Industry Product Developments

Recent product developments in the South Asian renewable energy sector are focused on enhancing efficiency, reducing costs, and improving grid integration. Innovations in bifacial solar modules are increasing energy yield by capturing sunlight from both sides, while advancements in perovskite solar cell technology promise higher efficiencies at lower manufacturing costs. In the wind sector, larger and more efficient turbine designs are being deployed, capable of capturing more energy even at lower wind speeds. The integration of advanced battery storage solutions is crucial for ensuring grid stability and reliability, addressing the intermittency challenges of solar and wind power. These product innovations are directly contributing to market fit by making renewable energy more competitive and accessible for a wider range of applications, from utility-scale projects to distributed generation.

Key Drivers of South Asia Renewable Energy Industry Growth

The robust growth of the South Asia renewable energy industry is propelled by a potent combination of factors. Firstly, supportive government policies and ambitious targets for renewable energy deployment, exemplified by India's goal of 500 GW by 2030, are creating a favorable investment climate. Secondly, declining technology costs, particularly for solar PV and wind power, have made renewables economically competitive with fossil fuels. Thirdly, increasing global and regional focus on climate change mitigation and energy security is driving investment and policy reform. Technological advancements in energy storage solutions are also a critical driver, addressing the intermittency of renewable sources.

Challenges in the South Asia Renewable Energy Industry Market

Despite the promising growth trajectory, the South Asia renewable energy market faces several significant challenges. Grid infrastructure limitations and the need for substantial upgrades to accommodate the increasing influx of renewable energy remain a hurdle. Land acquisition for large-scale projects can be a protracted and complex process. Policy intermittency and regulatory uncertainty in some countries can deter long-term investment. Furthermore, supply chain disruptions, particularly for critical components like solar panels and battery cells, can impact project timelines and costs. Intense competition, while driving down prices, can also lead to pressure on profit margins for developers.

Emerging Opportunities in South Asia Renewable Energy Industry

The South Asia renewable energy industry presents a wealth of emerging opportunities for growth and innovation. The increasing demand for green hydrogen production, powered by renewable energy, offers a significant future market. The development of smart grids and the integration of digital technologies like AI and IoT for enhanced grid management and energy efficiency are critical areas of expansion. Opportunities also lie in the development of decentralized renewable energy solutions for rural electrification and off-grid applications, particularly in regions with limited grid access. Strategic partnerships between international technology providers and local developers are fostering knowledge transfer and accelerating market penetration.

Leading Players in the South Asia Renewable Energy Industry Sector

- Greenko Group Plc

- ReNew Power Limited

- Adani Green Energy Limited

- Sembcorp Industries Limited

- Regen Renewables (Pvt) Ltd

- Tata Power Solar Systems Ltd

- Sindicatum Renewable Energy India Private Limited

- Zularistan Ltd

- Suzlon Energy Ltd

- ACME Solar Holding Limited

Key Milestones in South Asia Renewable Energy Industry Industry

- September 2022: Amazon India announced plans for the first set of utility-scale renewable energy projects in India. The three solar farms in Rajasthan total a combined clean energy capacity of 420 MW. These include a 210 MW project to be developed by ReNew Power, a 100MW project by Amp Energy India, and a 110MW project to be developed by Brookfield Renewable.

- August 2022: The Bangladesh Power Development Board (BPDB) revealed that a 30 MW solar project began commercial operation in northern Bangladesh. The project is owned by Intraco Solar Power Ltd. (ISPL), a publicly listed Paramount Textile Ltd. (PTL) unit. The BPDB will buy electricity from the power plant at a rate of USD 0.16/kWh over 20 years. The company invested USD 55 million in 110 acres to set up the power plant.

Strategic Outlook for South Asia Renewable Energy Industry Market

The strategic outlook for the South Asia renewable energy industry remains exceptionally positive, driven by a clear imperative for decarbonization and energy independence. The market will continue to witness substantial investments in solar and wind power, alongside growing interest in emerging technologies like green hydrogen and advanced energy storage. Focus will shift towards enhancing grid integration capabilities, fostering innovation in manufacturing, and developing robust policy frameworks that promote long-term investment. Strategic partnerships and collaborations will be crucial for leveraging global expertise and addressing local challenges, ensuring the sustainable and rapid expansion of the renewable energy sector across the region.

South Asia Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Wind

- 1.4. Others

-

2. Geography

- 2.1. India

- 2.2. Pakistan

- 2.3. Bangladesh

- 2.4. Afghanistan

- 2.5. Rest of South Asia

South Asia Renewable Energy Industry Segmentation By Geography

- 1. India

- 2. Pakistan

- 3. Bangladesh

- 4. Afghanistan

- 5. Rest of South Asia

South Asia Renewable Energy Industry Regional Market Share

Geographic Coverage of South Asia Renewable Energy Industry

South Asia Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. Pakistan

- 5.2.3. Bangladesh

- 5.2.4. Afghanistan

- 5.2.5. Rest of South Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. Pakistan

- 5.3.3. Bangladesh

- 5.3.4. Afghanistan

- 5.3.5. Rest of South Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. Pakistan

- 6.2.3. Bangladesh

- 6.2.4. Afghanistan

- 6.2.5. Rest of South Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Pakistan South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. Pakistan

- 7.2.3. Bangladesh

- 7.2.4. Afghanistan

- 7.2.5. Rest of South Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Bangladesh South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. Pakistan

- 8.2.3. Bangladesh

- 8.2.4. Afghanistan

- 8.2.5. Rest of South Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Afghanistan South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydro

- 9.1.2. Solar

- 9.1.3. Wind

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. Pakistan

- 9.2.3. Bangladesh

- 9.2.4. Afghanistan

- 9.2.5. Rest of South Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of South Asia South Asia Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hydro

- 10.1.2. Solar

- 10.1.3. Wind

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. India

- 10.2.2. Pakistan

- 10.2.3. Bangladesh

- 10.2.4. Afghanistan

- 10.2.5. Rest of South Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Greenko Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ReNew Power Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adani Green Energy Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sembcorp Industries Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Regen Renewables (Pvt) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tata Power Solar Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sindicatum Renewable Energy India Private Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zularistan Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suzlon Energy Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACME Solar Holding Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Greenko Group Plc

List of Figures

- Figure 1: South Asia Renewable Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Asia Renewable Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: South Asia Renewable Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 9: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: South Asia Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: South Asia Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 21: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: South Asia Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 27: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: South Asia Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 31: South Asia Renewable Energy Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 33: South Asia Renewable Energy Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 35: South Asia Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: South Asia Renewable Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Asia Renewable Energy Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the South Asia Renewable Energy Industry?

Key companies in the market include Greenko Group Plc, ReNew Power Limited, Adani Green Energy Limited, Sembcorp Industries Limited, Regen Renewables (Pvt) Ltd, Tata Power Solar Systems Ltd, Sindicatum Renewable Energy India Private Limited, Zularistan Ltd, Suzlon Energy Ltd, ACME Solar Holding Limited.

3. What are the main segments of the South Asia Renewable Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 128.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Solar Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

September 2022: Amazon India announced plans for the first set of utility-scale renewable energy projects in India. The three solar farms in Rajasthan total a combined clean energy capacity of 420 megawatts (MW). These include a 210 MW project to be developed by ReNew Power, a 100MW project by Amp Energy India, and a 110MW project to be developed by Brookfield Renewable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Asia Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Asia Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Asia Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the South Asia Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence