Key Insights

The North America artificial lift systems market is experiencing robust expansion, driven by increasing upstream oil and gas production needs, particularly from mature and complex reservoirs requiring enhanced extraction methods. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 27.8% from 2024 to 2033, reaching a market size of 6.68 billion. Progressive Cavity Pumps (PCP) and Electric Submersible Pumps (ESP) are the dominant technologies, owing to their proven performance and efficiency across diverse well conditions. While onshore applications currently lead, offshore segments are poised for significant growth, fueled by exploration and development in deeper and more challenging marine environments. Technological innovations, including advanced pump designs, automation, and remote monitoring solutions, are accelerating market adoption. However, market growth faces potential headwinds from volatile oil and gas prices, stringent environmental regulations, and substantial upfront capital expenditure for artificial lift installations. Key industry leaders, such as Baker Hughes, Halliburton, Schlumberger, and NOV Inc., are actively pursuing R&D to refine their product portfolios and broaden their market reach, fostering a competitive landscape characterized by continuous technological advancement.

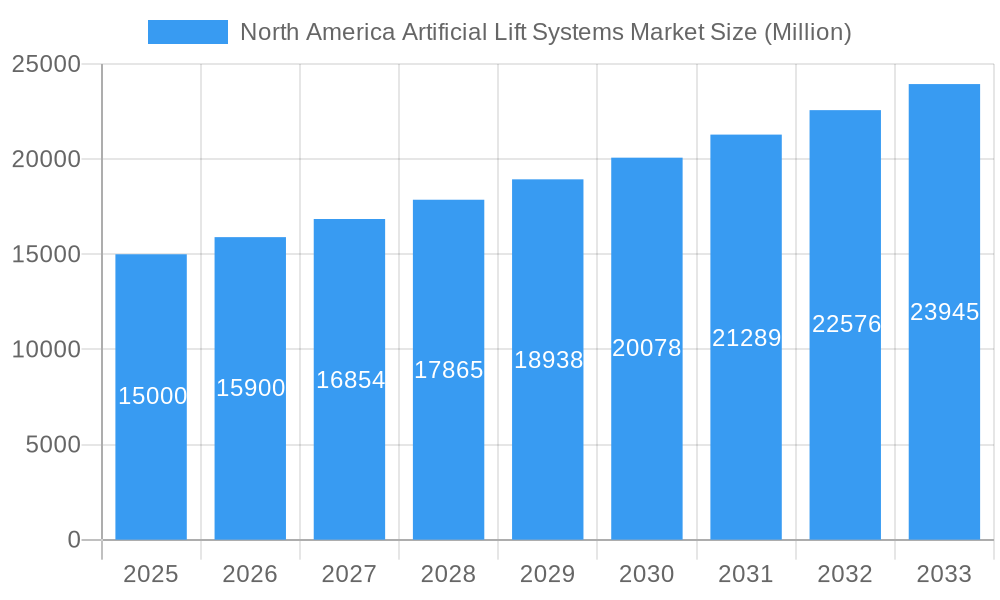

North America Artificial Lift Systems Market Market Size (In Billion)

The United States spearheads the North American market due to its extensive oil and gas reserves and well-established infrastructure. Canada represents another significant contributor, albeit with a smaller market share. The "Rest of North America" segment offers moderate growth prospects, driven by emerging exploration initiatives. Segmentation by artificial lift type confirms the strong market presence of PCPs and ESPs, attributed to their adaptability to varied well conditions. The industry's increasing focus on sustainable and efficient oil and gas extraction is stimulating advancements in artificial lift technologies and driving their widespread implementation across the region. This strategic shift, coupled with ongoing R&D investments, positions the North America artificial lift systems market for sustained expansion. Analysis of historical data from 2024 and the projected CAGR indicates consistent year-on-year growth throughout the forecast period.

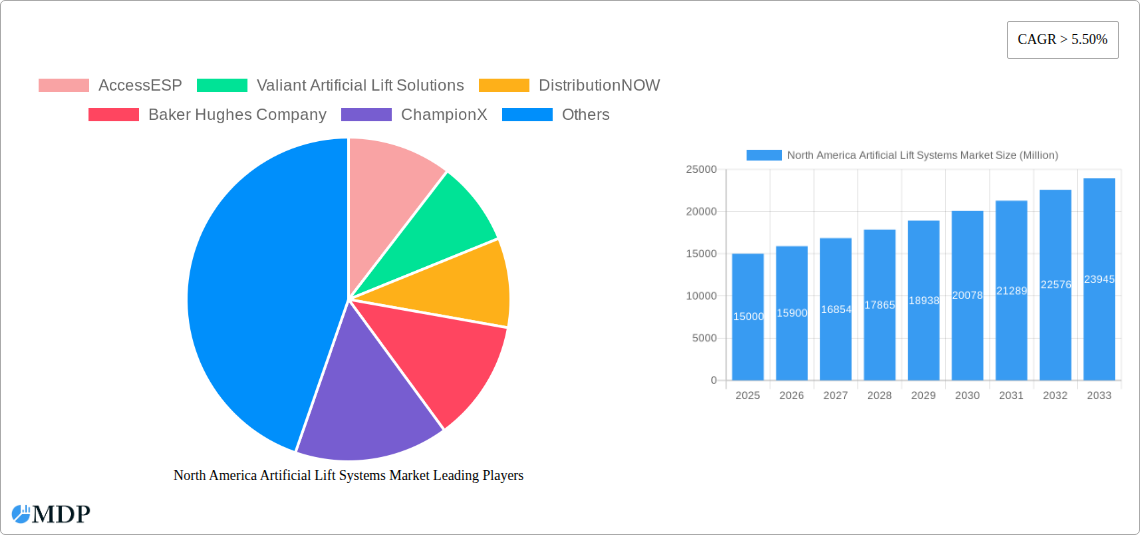

North America Artificial Lift Systems Market Company Market Share

North America Artificial Lift Systems Market Analysis: Size, Growth, and Forecast (2024-2033)

This comprehensive market analysis offers detailed insights into the North America Artificial Lift Systems market for the period 2024-2033. It provides critical perspectives on market dynamics, emerging trends, key market participants, and future growth opportunities, enabling stakeholders to formulate effective strategies. The report leverages data from the base year (2024) and forecasts the market's trajectory through the forecast period (2024-2033). The market size is valued in billions.

North America Artificial Lift Systems Market Market Dynamics & Concentration

The North American Artificial Lift Systems market is characterized by moderate concentration, with key players such as Baker Hughes Company, Halliburton Company, Schlumberger Limited, and NOV Inc holding significant market share. However, the market also features several smaller, specialized players like AccessESP, Valiant Artificial Lift Solutions, DistributionNOW, ChampionX, and JJ Tech, contributing to a dynamic competitive landscape. The market share of these key players collectively accounts for approximately xx% of the total market in 2025.

Market concentration is influenced by several factors:

- Technological innovation: Continuous advancements in Electric Submersible Pumps (ESPs) and Progressive Cavity Pumps (PCPs) are driving market evolution and impacting player positioning.

- Regulatory landscape: Stringent environmental regulations and safety standards impact operational costs and influence market players' strategies.

- Mergers and acquisitions (M&A): The sector has witnessed xx M&A deals in the past five years, indicating consolidation and strategic expansion efforts by major players. These acquisitions aim to expand geographical reach, technological capabilities, and service portfolios.

- Product substitutes: While artificial lift systems are crucial for oil and gas extraction, alternative techniques and evolving extraction methods pose a degree of competitive pressure.

- End-user trends: The increasing demand for enhanced oil recovery (EOR) techniques and the focus on optimizing production efficiency drive market growth and reshape the competitive landscape.

North America Artificial Lift Systems Market Industry Trends & Analysis

The North America Artificial Lift Systems market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is primarily driven by the increasing demand for oil and gas, coupled with the rising adoption of advanced artificial lift technologies in both onshore and offshore operations. Technological advancements, such as the integration of smart sensors and data analytics, are significantly boosting production efficiency and optimizing operational costs, thus fueling market expansion. The market penetration rate for ESPs is estimated to reach xx% by 2033, surpassing PCPs in market share.

Several factors contribute to this market expansion:

- Technological disruption: The integration of IoT, AI, and machine learning in artificial lift systems enhances predictive maintenance, reduces downtime, and increases operational efficiency, driving demand.

- Consumer preferences: Oil and gas producers are increasingly prioritizing solutions that improve production output, minimize environmental impact, and enhance operational safety.

- Competitive dynamics: Intense competition among established players and emerging technology providers is leading to continuous innovation and cost optimization, benefiting the end-users.

Leading Markets & Segments in North America Artificial Lift Systems Market

The United States dominates the North American Artificial Lift Systems market, accounting for approximately xx% of the total market revenue in 2025. This dominance is attributed to:

- Robust oil and gas production: The US possesses extensive oil and gas reserves, requiring substantial artificial lift solutions.

- Favorable regulatory environment: While stringent, the regulatory framework supports technological advancements and responsible resource extraction.

- Developed infrastructure: The existing infrastructure facilitates the deployment and maintenance of artificial lift systems.

Other key market segments include:

Type: ESPs hold the largest market share, driven by their superior efficiency and adaptability to various well conditions. PCP systems maintain a substantial presence due to their cost-effectiveness and suitability for specific applications. Gas lift systems are used mainly in high-pressure wells, with a smaller market share than ESP and PCP.

Area of Deployment: Onshore operations account for the larger share, owing to the higher number of onshore wells in North America. Offshore operations represent a smaller but growing segment.

Canada: While smaller than the US market, Canada displays significant growth potential due to its expanding oil sands production and ongoing investments in oil and gas infrastructure. The Rest of North America contributes a relatively smaller share.

North America Artificial Lift Systems Market Product Developments

Recent advancements focus on improving energy efficiency, reducing environmental impact, and increasing operational reliability. This includes the development of intelligent artificial lift systems incorporating advanced sensors, data analytics, and automation technologies. These systems enable predictive maintenance, optimize production performance, and minimize downtime, offering substantial competitive advantages to producers.

Key Drivers of North America Artificial Lift Systems Market Growth

Several factors drive market growth, including:

- Technological advancements: The continuous development of ESPs, PCPs, and gas lift systems with enhanced efficiency and reliability is a key driver.

- Rising oil and gas production: Increased demand for energy fuels greater exploration and production activities, boosting the need for artificial lift solutions.

- Government initiatives: Government support for technological advancements and responsible resource management contributes to market expansion.

Challenges in the North America Artificial Lift Systems Market Market

The market faces certain challenges:

- Fluctuating oil and gas prices: Price volatility influences investment decisions in oil and gas production and deployment of artificial lift technologies.

- Supply chain disruptions: Disruptions in the supply of critical components can affect production and deployment of artificial lift systems.

- High initial investment costs: The significant upfront capital investment needed for deploying artificial lift solutions can deter some smaller operators.

Emerging Opportunities in North America Artificial Lift Systems Market

Emerging opportunities include:

- Expansion into unconventional reservoirs: The increasing exploration and production of shale oil and gas present opportunities for artificial lift system deployments.

- Technological innovations: The integration of digitalization and automation offers vast opportunities for enhanced efficiency and production optimization.

- Strategic alliances and partnerships: Collaborations between artificial lift system providers and oil and gas companies can lead to cost reductions and optimized solutions.

Leading Players in the North America Artificial Lift Systems Market Sector

- AccessESP

- Valiant Artificial Lift Solutions

- DistributionNOW

- Baker Hughes Company

- ChampionX

- Halliburton Company

- Schlumberger Limited

- NOV Inc

- JJ Tech

Key Milestones in North America Artificial Lift Systems Market Industry

- September 2021: Vine Energy contracts with Baker Hughes to deploy ProductionLink Edge across 100 natural gas wells in Louisiana's Haynesville Shale, showcasing the adoption of smart technologies for enhanced production and emissions reduction.

Strategic Outlook for North America Artificial Lift Systems Market Market

The North America Artificial Lift Systems market holds substantial growth potential, driven by continued technological innovations, expanding oil and gas production, and supportive government policies. Strategic partnerships, focusing on technological advancements and cost-effective solutions, will be crucial for success in this competitive landscape. The market is poised for significant expansion in the coming years, offering substantial opportunities for both established players and emerging companies.

North America Artificial Lift Systems Market Segmentation

-

1. Type

- 1.1. Progressive Cavity Pumps (PCP)

- 1.2. Electric Submersible Pumps (ESP)

- 1.3. Gas Lift Systems

- 1.4. Other Types

-

2. Area of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

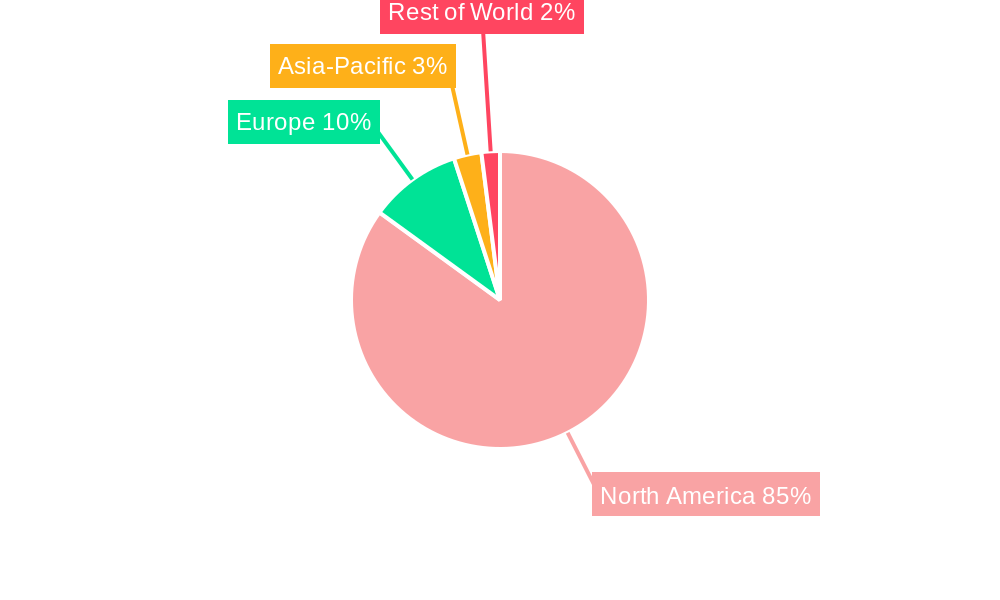

North America Artificial Lift Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Artificial Lift Systems Market Regional Market Share

Geographic Coverage of North America Artificial Lift Systems Market

North America Artificial Lift Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Application Segment to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Artificial Lift Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Progressive Cavity Pumps (PCP)

- 5.1.2. Electric Submersible Pumps (ESP)

- 5.1.3. Gas Lift Systems

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Area of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Artificial Lift Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Progressive Cavity Pumps (PCP)

- 6.1.2. Electric Submersible Pumps (ESP)

- 6.1.3. Gas Lift Systems

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Area of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Artificial Lift Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Progressive Cavity Pumps (PCP)

- 7.1.2. Electric Submersible Pumps (ESP)

- 7.1.3. Gas Lift Systems

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Area of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Artificial Lift Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Progressive Cavity Pumps (PCP)

- 8.1.2. Electric Submersible Pumps (ESP)

- 8.1.3. Gas Lift Systems

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Area of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 AccessESP

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Valiant Artificial Lift Solutions

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DistributionNOW

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Baker Hughes Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ChampionX

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Halliburton Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schlumberger Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 NOV Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 JJ Tech

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 AccessESP

List of Figures

- Figure 1: North America Artificial Lift Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Artificial Lift Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Artificial Lift Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Artificial Lift Systems Market Revenue billion Forecast, by Area of Deployment 2020 & 2033

- Table 3: North America Artificial Lift Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Artificial Lift Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Artificial Lift Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Artificial Lift Systems Market Revenue billion Forecast, by Area of Deployment 2020 & 2033

- Table 7: North America Artificial Lift Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Artificial Lift Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Artificial Lift Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Artificial Lift Systems Market Revenue billion Forecast, by Area of Deployment 2020 & 2033

- Table 11: North America Artificial Lift Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Artificial Lift Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Artificial Lift Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Artificial Lift Systems Market Revenue billion Forecast, by Area of Deployment 2020 & 2033

- Table 15: North America Artificial Lift Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Artificial Lift Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Artificial Lift Systems Market?

The projected CAGR is approximately 27.8%.

2. Which companies are prominent players in the North America Artificial Lift Systems Market?

Key companies in the market include AccessESP, Valiant Artificial Lift Solutions, DistributionNOW, Baker Hughes Company, ChampionX, Halliburton Company, Schlumberger Limited, NOV Inc, JJ Tech.

3. What are the main segments of the North America Artificial Lift Systems Market?

The market segments include Type, Area of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.68 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Offshore Application Segment to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

In September 2021, natural gas producer Vine Energy signed a contract with Baker Hughes to deploy its artificial lift solution, ProductionLink Edge, across 100 natural gas wells in Louisiana's Haynesville Shale. The automation solution uses advanced analytics and 'smart' edge technology to boost production and reduce associated methane emissions from oil and gas wells.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Artificial Lift Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Artificial Lift Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Artificial Lift Systems Market?

To stay informed about further developments, trends, and reports in the North America Artificial Lift Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence