Key Insights

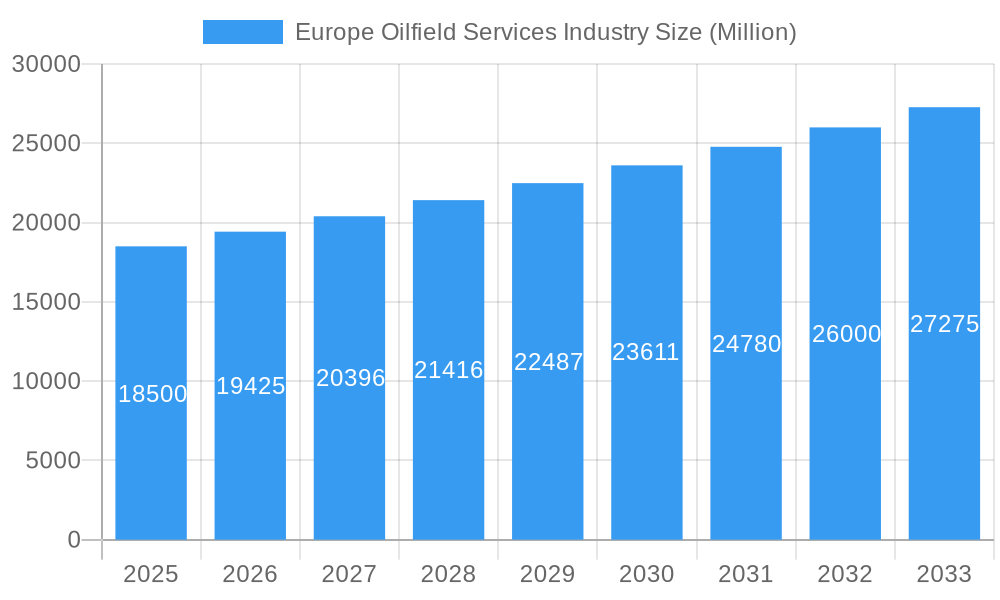

The European oilfield services market is poised for robust growth, projected to exceed USD 20,000 million by the end of the forecast period, driven by a compound annual growth rate (CAGR) of over 5.00%. This expansion is underpinned by several critical factors. Firstly, increasing energy demand in Europe, coupled with the imperative to secure domestic energy supplies, is stimulating exploration and production activities. The ongoing geopolitical landscape further accentuates the need for stable and reliable energy sources, prompting investments in both conventional and unconventional oil and gas fields. Key drivers include advancements in drilling and completion technologies, enabling more efficient extraction from mature fields and access to challenging reserves. Furthermore, the increasing focus on optimizing production from existing assets and extending their lifespan through intervention services is a significant growth catalyst. The services segment, encompassing drilling, completion, production, and intervention services, will witness substantial investment as companies strive for operational excellence and cost efficiency. Both onshore and offshore deployments are expected to contribute to market expansion, with offshore regions potentially seeing accelerated activity due to larger reserve potential.

Europe Oilfield Services Industry Market Size (In Billion)

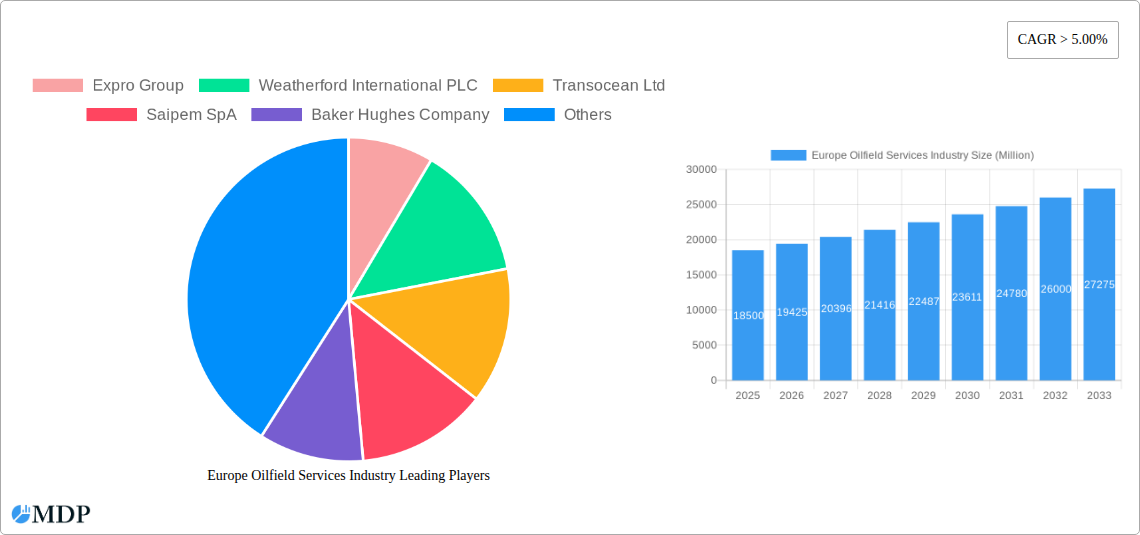

The competitive landscape of the Europe oilfield services industry is characterized by the presence of major global players such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Saipem SpA, Weatherford International PLC, Transocean Ltd, and Expro Group. These companies are actively engaged in strategic collaborations, mergers, and acquisitions to enhance their service portfolios and expand their geographical reach. Technological innovation remains a crucial differentiator, with companies investing heavily in digital solutions, automation, and environmentally sustainable practices to meet evolving industry standards and client demands. While the market exhibits strong growth potential, certain restraints may impact its trajectory. These include stringent environmental regulations, fluctuating oil prices, and the increasing global shift towards renewable energy sources, which could dampen long-term investment in fossil fuels. However, the immediate and medium-term outlook remains positive, fueled by Europe's continued reliance on oil and gas and the ongoing need for efficient and advanced services to maintain production levels and optimize resource extraction.

Europe Oilfield Services Industry Company Market Share

Europe Oilfield Services Industry Market Dynamics & Concentration

The Europe Oilfield Services Industry is characterized by a moderately concentrated market, with a few dominant players like Schlumberger Limited, Halliburton Company, and Baker Hughes Company holding significant market share. However, a dynamic landscape of mid-sized and niche service providers fosters healthy competition, particularly in specialized segments. Innovation drivers are primarily fueled by the increasing demand for efficiency, cost reduction, and enhanced safety in exploration and production (E&P) activities. Stringent regulatory frameworks across European nations, focusing on environmental protection and operational safety, also play a crucial role in shaping market dynamics. Product substitutes, while limited in core E&P operations, are emerging in areas like digital solutions for data analytics and automation. End-user trends are shifting towards integrated service offerings and digital transformation, demanding advanced technologies and sustainable practices. Mergers and acquisitions (M&A) activities are a key feature, with an estimated XX M&A deal count during the historical period (2019-2024) as companies seek to expand their portfolios, gain technological expertise, and achieve economies of scale. For instance, the estimated XX% market share held by the top three players underscores the strategic importance of M&A for competitive positioning.

Europe Oilfield Services Industry Industry Trends & Analysis

The Europe Oilfield Services Industry is poised for robust growth, projected to experience a Compound Annual Growth Rate (CAGR) of xx% over the forecast period of 2025–2033. This expansion is propelled by several key market growth drivers, including the ongoing need to meet energy demands, particularly from established oil and gas fields requiring extensive production and intervention services. Technological disruptions are at the forefront, with a strong emphasis on digital solutions, automation, and advanced analytics aimed at improving operational efficiency and reducing costs. The industry is witnessing a significant market penetration of AI-powered predictive maintenance, IoT-enabled monitoring systems, and advanced reservoir characterization techniques. Consumer preferences are increasingly leaning towards sustainable practices and technologies that minimize environmental impact, driving demand for services that support cleaner operations and carbon capture initiatives. Competitive dynamics are intense, with companies actively investing in R&D and forming strategic alliances to offer comprehensive, integrated solutions. The shift towards offshore exploration in certain regions, coupled with the mature onshore market requiring specialized workover and decommissioning services, further diversifies the competitive landscape. The overall market penetration for specialized oilfield services is estimated to reach xx% by 2033, reflecting the industry's vital role in the European energy ecosystem.

Leading Markets & Segments in Europe Oilfield Services Industry

The Offshore segment is anticipated to be the dominant location of deployment within the Europe Oilfield Services Industry, driven by significant exploration and production activities in regions like the North Sea. This dominance is further supported by substantial investments in advanced offshore technologies and infrastructure. The Production and Intervention Services segment is expected to hold the largest market share by services type, reflecting the ongoing need for mature field maintenance, enhanced oil recovery (EOR), and specialized intervention operations. Economic policies supporting domestic energy production and infrastructure development, such as investments in offshore wind farms that often share subsea infrastructure with oil and gas projects, also play a pivotal role in bolstering offshore activities.

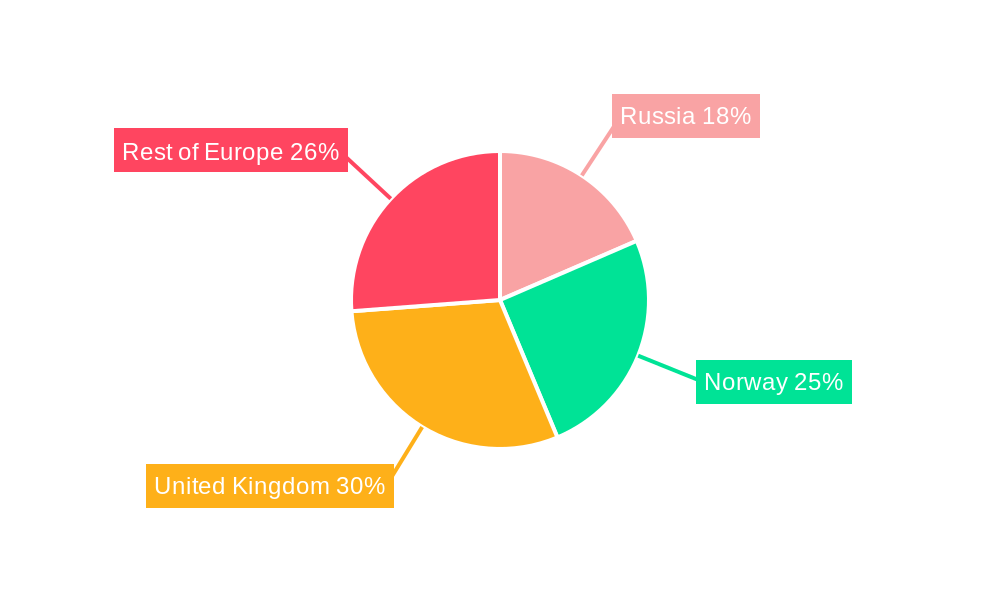

- Dominant Region/Country: The United Kingdom and Norway are projected to remain leading markets due to their established offshore oil and gas infrastructure and ongoing exploration efforts.

- Key Drivers for Offshore Dominance:

- Significant mature offshore reserves requiring continuous production and intervention.

- Technological advancements in subsea technologies, floating production systems, and drilling technologies.

- Government incentives and regulatory frameworks supporting offshore E&P activities.

- Strategic importance of energy security for these nations.

- Dominance of Production and Intervention Services:

- Aging oil and gas fields necessitate ongoing maintenance, repair, and optimization.

- Demand for artificial lift systems, well stimulation, and artificial lift solutions.

- Growth in enhanced oil recovery techniques to maximize hydrocarbon extraction.

- Increased focus on well integrity and integrity management services.

- Other Significant Segments: While Offshore and Production and Intervention Services are leading, Drilling Services remain crucial for new field developments and exploration, and Completion Services are vital for bringing new wells online efficiently. The Onshore segment, while mature in some areas, sees consistent demand for specialized services like coiled tubing and hydraulic fracturing in specific regions.

Europe Oilfield Services Industry Product Developments

Innovations in the Europe Oilfield Services Industry are heavily focused on digitalization, automation, and sustainability. Companies are developing advanced drilling fluids and cements designed for challenging well conditions and improved environmental profiles. In the realm of completion services, smart well technologies with remote monitoring and control capabilities are gaining traction. Production and intervention services are benefiting from the advent of robotics for subsea operations and AI-driven predictive maintenance for offshore equipment, enhancing safety and reducing downtime. These developments offer competitive advantages by improving operational efficiency, reducing environmental impact, and lowering overall project costs, aligning with evolving industry demands for safer and more sustainable energy extraction.

Key Drivers of Europe Oilfield Services Industry Growth

Several key drivers are fueling the growth of the Europe Oilfield Services Industry. Technologically, the push for digitalization and automation is paramount, leading to the development of AI-powered analytics, IoT sensors for real-time monitoring, and advanced robotics for remote operations, all aimed at boosting efficiency and safety. Economically, the persistent global demand for oil and gas, coupled with efforts to enhance energy security within Europe, necessitates continued investment in E&P activities. Regulatory factors, such as evolving environmental standards and safety regulations, are also driving the adoption of innovative and sustainable service solutions. For example, the increasing focus on reducing emissions is spurring demand for services related to carbon capture and storage.

Challenges in the Europe Oilfield Services Industry Market

The Europe Oilfield Services Industry faces significant challenges. Stringent and evolving environmental regulations across various European countries can increase operational costs and compliance burdens. Volatile oil prices continue to pose a risk, impacting investment decisions and project viability. Supply chain disruptions, exacerbated by geopolitical events, can lead to delays and increased material costs. Intense competition, particularly from emerging players offering lower-cost solutions, pressures profit margins. Furthermore, the ongoing energy transition and the increasing focus on renewable energy sources may lead to reduced long-term investment in traditional oil and gas exploration and production in some regions.

Emerging Opportunities in Europe Oilfield Services Industry

Emerging opportunities in the Europe Oilfield Services Industry are driven by a confluence of technological advancements and strategic market shifts. The burgeoning demand for renewable energy infrastructure, particularly offshore wind, presents opportunities for service providers to leverage their subsea expertise and offshore logistical capabilities for installation, maintenance, and related services. Furthermore, the increasing emphasis on decarbonization and the circular economy is creating a market for carbon capture, utilization, and storage (CCUS) solutions, as well as decommissioning services for aging oil and gas assets. Strategic partnerships and mergers focused on integrating digital technologies and developing advanced environmental solutions are poised to unlock significant long-term growth potential.

Leading Players in the Europe Oilfield Services Industry Sector

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International PLC

- Expro Group

- Transocean Ltd

- Saipem SpA

Key Milestones in Europe Oilfield Services Industry Industry

- April 2021: Halliburton signed an 8-year contract with the Norwegian Petroleum Directorate to deploy and operate Diskos, the Norwegian national repository of seismic, well, and production data for the oil and gas industry, enhancing data accessibility and analysis capabilities.

- January 2021: Safe Influx Ltd received a patent from the UK Patent Office for its Automated Well Control technology, which automates the detection of fluid influx and well shut-in procedures, significantly improving well control safety and reaction times.

Strategic Outlook for Europe Oilfield Services Industry Market

The strategic outlook for the Europe Oilfield Services Industry is characterized by a dual focus on optimizing existing hydrocarbon production and embracing the energy transition. Growth accelerators will stem from the continued deployment of advanced digital technologies, including AI and IoT, to enhance operational efficiency, reduce costs, and improve safety across both onshore and offshore operations. Strategic opportunities lie in expanding service offerings into renewable energy sectors, particularly offshore wind, and developing specialized solutions for carbon capture and storage (CCS) and decommissioning. Companies that can effectively integrate sustainability into their business models and offer innovative solutions for the evolving energy landscape are best positioned for long-term success.

Europe Oilfield Services Industry Segmentation

-

1. Services Type

- 1.1. Drilling Services

- 1.2. Completion Services

- 1.3. Production and Intervention Services

- 1.4. Other Services

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

Europe Oilfield Services Industry Segmentation By Geography

- 1. Russia

- 2. Norway

- 3. United Kingdom

- 4. Rest of Europe

Europe Oilfield Services Industry Regional Market Share

Geographic Coverage of Europe Oilfield Services Industry

Europe Oilfield Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services Type

- 5.1.1. Drilling Services

- 5.1.2. Completion Services

- 5.1.3. Production and Intervention Services

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Norway

- 5.3.3. United Kingdom

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Services Type

- 6. Russia Europe Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services Type

- 6.1.1. Drilling Services

- 6.1.2. Completion Services

- 6.1.3. Production and Intervention Services

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Services Type

- 7. Norway Europe Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services Type

- 7.1.1. Drilling Services

- 7.1.2. Completion Services

- 7.1.3. Production and Intervention Services

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Services Type

- 8. United Kingdom Europe Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services Type

- 8.1.1. Drilling Services

- 8.1.2. Completion Services

- 8.1.3. Production and Intervention Services

- 8.1.4. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Services Type

- 9. Rest of Europe Europe Oilfield Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services Type

- 9.1.1. Drilling Services

- 9.1.2. Completion Services

- 9.1.3. Production and Intervention Services

- 9.1.4. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Services Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Expro Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Weatherford International PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Transocean Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saipem SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baker Hughes Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Halliburton Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schlumberger Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Expro Group

List of Figures

- Figure 1: Europe Oilfield Services Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Oilfield Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Oilfield Services Industry Revenue undefined Forecast, by Services Type 2020 & 2033

- Table 2: Europe Oilfield Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 3: Europe Oilfield Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Oilfield Services Industry Revenue undefined Forecast, by Services Type 2020 & 2033

- Table 5: Europe Oilfield Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 6: Europe Oilfield Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Oilfield Services Industry Revenue undefined Forecast, by Services Type 2020 & 2033

- Table 8: Europe Oilfield Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 9: Europe Oilfield Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Oilfield Services Industry Revenue undefined Forecast, by Services Type 2020 & 2033

- Table 11: Europe Oilfield Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 12: Europe Oilfield Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Oilfield Services Industry Revenue undefined Forecast, by Services Type 2020 & 2033

- Table 14: Europe Oilfield Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 15: Europe Oilfield Services Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oilfield Services Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Europe Oilfield Services Industry?

Key companies in the market include Expro Group, Weatherford International PLC, Transocean Ltd, Saipem SpA, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Europe Oilfield Services Industry?

The market segments include Services Type, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In April 2021, Halliburton signed an 8-year contract with the Norwegian Petroleum Directorate to deploy and operate Diskos, the Norwegian national repository of seismic, well, and production data for the oil and gas industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oilfield Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oilfield Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oilfield Services Industry?

To stay informed about further developments, trends, and reports in the Europe Oilfield Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence