Key Insights

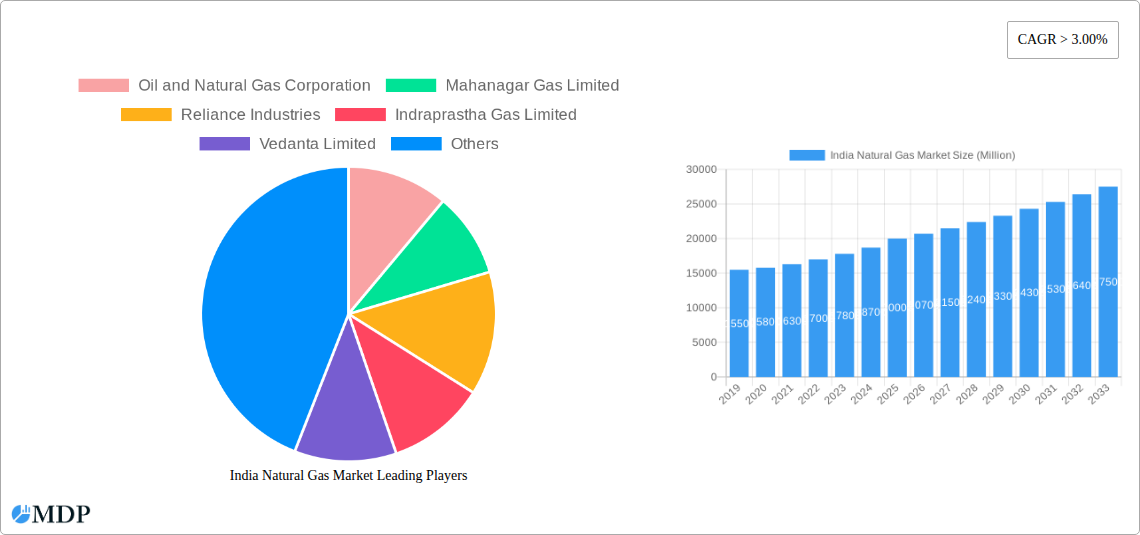

The Indian Natural Gas Market is projected for substantial growth, driven by the increasing demand for cleaner energy solutions and favorable government initiatives. With an estimated market size of 61.28 billion, the market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 3.62% between the base year 2024 and 2033. Key growth accelerators include escalating industrialization, expanding urbanization, and the government's objective to increase natural gas's contribution to the nation's energy portfolio. Enhanced pipeline infrastructure, encompassing city gas distribution networks and LNG import terminals, is vital for ensuring widespread natural gas availability and accessibility.

India Natural Gas Market Market Size (In Billion)

Market segmentation reveals the diverse applications of natural gas in India. Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) are expected to lead the urban domestic and vehicular fuel sectors, driven by stringent environmental regulations and cost-effectiveness. Liquefied Petroleum Gas (LPG) will maintain a significant market share, particularly in regions lacking extensive gas infrastructure. Leading companies such as Oil and Natural Gas Corporation (ONGC), Reliance Industries, Adani Total Gas Limited, and Indian Oil Corporation Limited are making significant investments in exploration, production, and distribution network development, fostering market consolidation and innovation. Emerging trends, including virtual pipeline development, the adoption of LNG as a marine fuel, and efforts to boost domestic production, will further shape the market. Challenges such as fluctuating global gas prices, substantial capital requirements for infrastructure development, and the need to expand domestic production capacity must be addressed to sustain this growth trajectory.

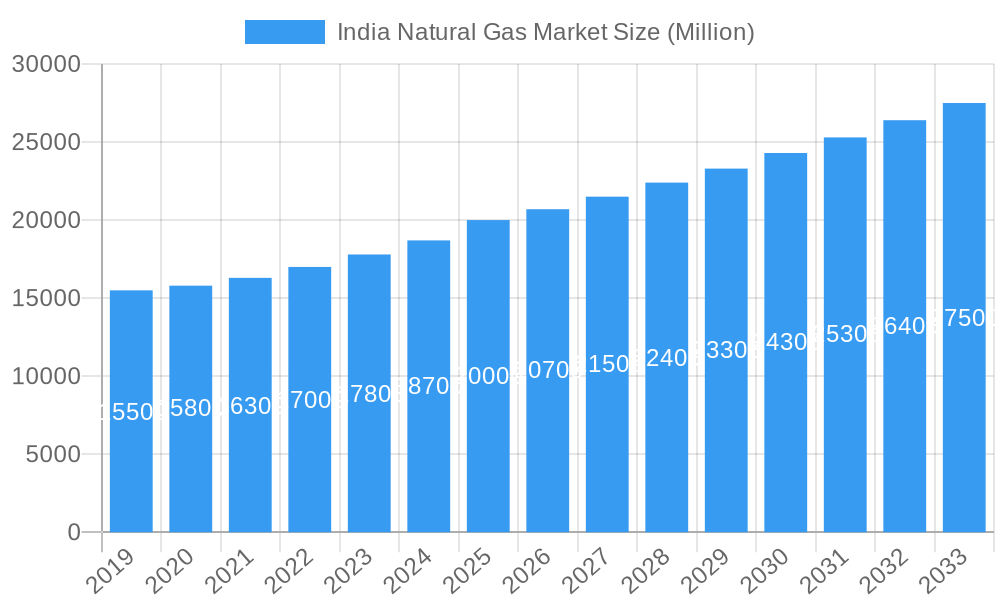

India Natural Gas Market Company Market Share

This comprehensive report provides an in-depth analysis of the India Natural Gas Market, covering the period from 2019 to 2033, with 2024 as the base year. It offers insights into market dynamics, industry trends, key segments, and strategic outlooks, essential for investors, policymakers, and industry stakeholders aiming to leverage India's expanding energy sector. The projected market size is 61.28 billion, with a CAGR of 3.62%.

India Natural Gas Market Market Dynamics & Concentration

The India Natural Gas Market is experiencing a dynamic shift driven by increasing demand, supportive government policies, and infrastructure development. Market concentration is moderate, with key players like Oil and Natural Gas Corporation, Reliance Industries, and Adani Total Gas Limited holding significant influence through integrated operations and expanding distribution networks. Innovation drivers are primarily focused on enhancing the efficiency of natural gas extraction, transportation, and end-use applications, alongside the development of cleaner energy solutions. The regulatory framework, guided by policies promoting gas-based economies and reducing carbon emissions, is a crucial determinant of market growth. Product substitutes, such as coal and petroleum products, are gradually being phased out in favor of natural gas due to its environmental advantages and cost-effectiveness. End-user trends show a strong preference for Piped Natural Gas (PNG) in residential and industrial sectors for its convenience and lower emissions, and Compressed Natural Gas (CNG) for the transportation sector to meet stringent emission norms. Merger and Acquisition (M&A) activities are on the rise as companies aim to consolidate their market position and expand their geographical reach. The number of M&A deals is projected to increase by approximately 15% over the forecast period. Market share distribution sees Oil and Natural Gas Corporation holding around 35%, Reliance Industries approximately 20%, and Adani Total Gas Limited around 15%, with other players contributing to the remaining share.

India Natural Gas Market Industry Trends & Analysis

The India Natural Gas Market is poised for significant expansion, fueled by robust growth drivers and transformative industry trends. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is largely attributed to the Indian government's ambitious target of increasing the share of natural gas in the country's energy mix to 15% by 2030, up from the current 6.7%. Technological disruptions are playing a pivotal role, with advancements in liquefied natural gas (LNG) regasification terminals, pipeline infrastructure development, and enhanced exploration and production techniques improving accessibility and affordability. Consumer preferences are increasingly leaning towards cleaner and more sustainable energy sources, making natural gas an attractive alternative to conventional fuels like coal and diesel, particularly in urban areas for domestic use and in the automotive sector for cleaner emissions. The competitive dynamics are intensifying, with existing players expanding their footprints and new entrants vying for market share, especially in city gas distribution (CGD) networks. Market penetration is steadily increasing across both urban and rural areas, driven by policy incentives and rising disposable incomes. The expansion of LNG import terminals and the development of a national gas grid are crucial for ensuring supply security and meeting the burgeoning demand. Furthermore, the focus on decarbonization and the adoption of a gas-based economy are creating a favorable environment for the natural gas sector. The report highlights the strategic initiatives by leading companies to invest in downstream infrastructure, including the establishment of CNG stations and PNG network expansion, to cater to the growing demand from residential, commercial, and industrial sectors. The increasing use of natural gas in industries such as petrochemicals, fertilizers, and power generation further underscores its growing importance in India's industrial landscape. The shift towards electric vehicles is anticipated, but CNG will continue to play a significant role in the interim.

Leading Markets & Segments in India Natural Gas Market

Within the India Natural Gas Market, the dominance of certain regions and segments is a critical aspect of market analysis. Piped Natural Gas (PNG) emerges as the leading segment, driven by its widespread adoption in residential, commercial, and industrial sectors across major urban centers. The economic policies encouraging the transition to cleaner fuels and the substantial government investment in developing robust PNG infrastructure, including extensive pipeline networks and distribution systems, have significantly propelled its market penetration. For instance, the expansion of CGD networks, as evidenced by the 11th round of bidding, signifies a concentrated effort to bring PNG access to more households and industries.

Key Drivers of PNG Dominance:

- Infrastructure Development: Extensive government and private sector investment in building and expanding the natural gas pipeline network across cities and industrial corridors.

- Urbanization and Population Growth: Increasing demand from a growing urban population for cleaner cooking fuels and industrial feedstock in densely populated areas.

- Environmental Regulations: Stringent emission norms and government mandates promoting the use of cleaner fuels, favoring PNG for its low carbon footprint.

- Cost-Effectiveness: Competitive pricing compared to alternative fuels like LPG and diesel, especially for bulk consumers in industrial and commercial establishments.

- Convenience and Safety: The inherent advantages of continuous supply, no need for storage, and enhanced safety measures associated with PNG.

Compressed Natural Gas (CNG) also holds substantial importance, particularly in the transportation sector. Its adoption is driven by government initiatives to curb vehicular emissions and promote cleaner mobility solutions. The increasing number of CNG stations and the availability of CNG-powered vehicles have made it a viable and preferred fuel for public transport and commercial fleets.

Liquefied Petroleum Gas (LPG), while traditionally a dominant cooking fuel, is increasingly facing competition from PNG in urban areas. However, it continues to be a significant segment, especially in rural and semi-urban regions where PNG infrastructure is still developing. Government subsidies and promotional schemes like Ujjwala Yojana have ensured its continued relevance.

Geographically, the western and northern regions of India, with their higher industrialization and urbanization rates, currently lead in natural gas consumption. However, the southern and eastern regions are rapidly emerging as growth corridors with significant investments in LNG import terminals and pipeline infrastructure.

India Natural Gas Market Product Developments

Product developments in the India Natural Gas Market are focused on enhancing the efficiency, accessibility, and application of natural gas. Innovations in LNG liquefaction and regasification technologies are crucial for improving import capabilities and reducing costs. The development of advanced natural gas vehicle (NGV) technologies, including more efficient engines and lighter-weight CNG cylinders, is enhancing their attractiveness for transportation. Furthermore, there is ongoing research into modular and distributed LNG regasification solutions to serve remote areas and smaller industrial clusters. Competitive advantages are being gained through optimized supply chain management and the development of smart metering solutions for seamless distribution and billing of PNG.

Key Drivers of India Natural Gas Market Growth

The India Natural Gas Market's growth is propelled by a confluence of powerful drivers. Firstly, the government's push for a gas-based economy, with ambitious targets to increase the share of natural gas in the energy mix, is a primary catalyst. This is supported by significant policy initiatives aimed at promoting cleaner fuels and reducing carbon emissions. Secondly, infrastructure development, particularly the expansion of the national gas grid and city gas distribution networks, is crucial for enhancing accessibility and reducing logistical costs. Thirdly, rising energy demand from a growing economy, coupled with increasing industrialization and urbanization, necessitates the adoption of cleaner and more efficient fuel sources. Lastly, technological advancements in exploration, production, and LNG regasification are improving supply reliability and reducing import costs, making natural gas more competitive.

Challenges in the India Natural Gas Market Market

Despite the promising outlook, the India Natural Gas Market faces several challenges. Infrastructure gaps, especially in remote and underdeveloped regions, limit the reach of natural gas networks. Volatile global gas prices can impact domestic affordability and competitiveness. Regulatory complexities and land acquisition issues can delay project timelines for pipeline expansions. Furthermore, competition from alternative fuels like coal and renewable energy sources, especially in sectors like power generation, poses a constraint. Supply chain disruptions, both domestically and internationally, can also pose significant risks to market stability and availability.

Emerging Opportunities in India Natural Gas Market

Emerging opportunities within the India Natural Gas Market are significant and poised to drive long-term growth. The increasing focus on decarbonization and cleaner energy transitions presents a vast opportunity for natural gas to substitute higher-emission fuels. Technological breakthroughs in areas like hydrogen blending with natural gas and the development of carbon capture, utilization, and storage (CCUS) technologies offer pathways for further environmental benefits. Strategic partnerships and joint ventures between domestic and international players are creating avenues for technology transfer and capital infusion for large-scale infrastructure projects. The expansion of city gas distribution networks into Tier-2 and Tier-3 cities, coupled with the growing demand from sectors like petrochemicals, fertilizers, and manufacturing, presents substantial market expansion opportunities.

Leading Players in the India Natural Gas Market Sector

- Oil and Natural Gas Corporation

- Mahanagar Gas Limited

- Reliance Industries

- Indraprastha Gas Limited

- Vedanta Limited

- Adani Total Gas Limited

- Indian Oil Corporation Limited

- Punj Lloyd Limited

Key Milestones in India Natural Gas Market Industry

- January 2022: Indian Oil Corporation (IOC) secures nine licenses, and Bharat Petroleum Corporation Ltd (BPCL) secures six, following the bid opening for the 11th round of city gas distribution (CGD) bidding, significantly expanding their reach and market presence.

- May 2022: Adani Total Private Limited withdraws its Expression of Interest (EoI) for building a natural gas pipeline from Haldia to Panitar due to objections from Hiranandani Energy and others, highlighting the competitive landscape and potential for project delays or restructuring.

Strategic Outlook for India Natural Gas Market Market

The strategic outlook for the India Natural Gas Market is highly positive, driven by strong government commitment and evolving energy needs. The focus will remain on expanding the national gas grid and city gas distribution networks to enhance accessibility and affordability across the country. Investments in LNG import infrastructure will continue to be crucial for ensuring supply security and meeting the escalating demand. The market is expected to witness increased adoption of natural gas in diverse sectors, including transportation, industrial feedstock, and power generation, as India progresses towards a cleaner energy future. Strategic alliances and technological collaborations will be key to unlocking new growth avenues and addressing market challenges effectively, ensuring sustained growth and market penetration in the coming years.

India Natural Gas Market Segmentation

-

1. Type

- 1.1. Compressed Natural Gas

- 1.2. Piped Natural Gas

- 1.3. Liquified Petroleum Gas

India Natural Gas Market Segmentation By Geography

- 1. India

India Natural Gas Market Regional Market Share

Geographic Coverage of India Natural Gas Market

India Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Piped Natural Gas (PNG) to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Compressed Natural Gas

- 5.1.2. Piped Natural Gas

- 5.1.3. Liquified Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oil and Natural Gas Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahanagar Gas Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indraprastha Gas Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vedanta Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Adani Total Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Punj Lloyd Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: India Natural Gas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 3: India Natural Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Natural Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 7: India Natural Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Natural Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Natural Gas Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the India Natural Gas Market?

Key companies in the market include Oil and Natural Gas Corporation, Mahanagar Gas Limited, Reliance Industries, Indraprastha Gas Limited, Vedanta Limited, Adani Total Gas Limited, Indian Oil Corporation Limited, Punj Lloyd Limited.

3. What are the main segments of the India Natural Gas Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.28 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Piped Natural Gas (PNG) to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In January 2022, According to the results of the bid opening for the 11th round of city gas distribution (CGD) bidding, Indian Oil Corporation (IOC) stands to get nine licences and Bharat Petroleum Corporation Ltd (BPCL) 6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Natural Gas Market?

To stay informed about further developments, trends, and reports in the India Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence