Key Insights

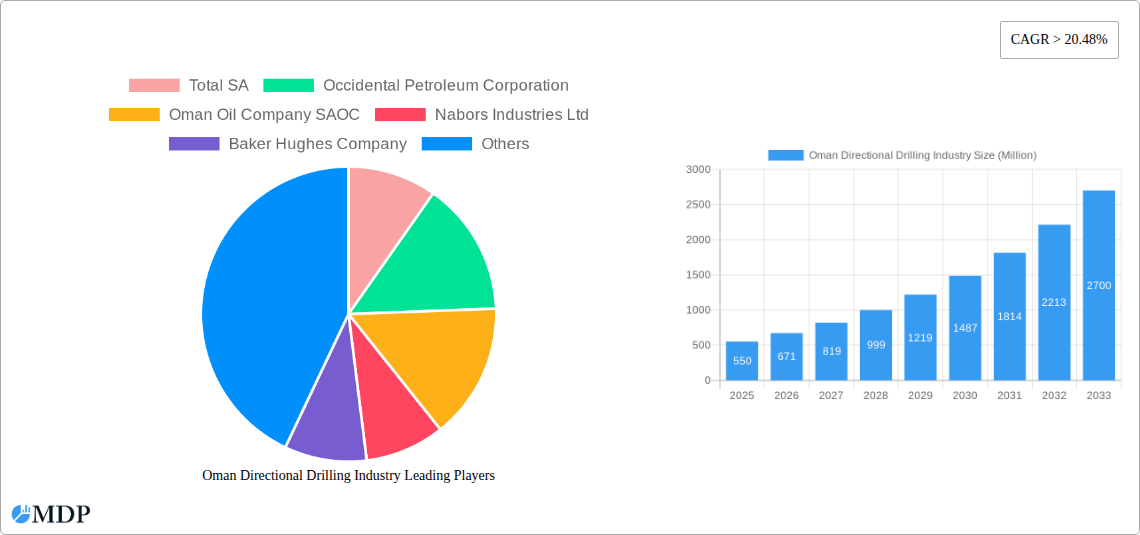

The Oman Directional Drilling Market is set for significant expansion, propelled by intensified oil and gas exploration and production. Forecasted at $17.01 billion in 2025, the market is projected to grow at a robust CAGR of 8.1% through 2033. This growth is driven by the rising demand for advanced oil recovery methods, the necessity to access intricate reservoirs, and Oman's strategic drive to maximize hydrocarbon output from both onshore and offshore operations. The adoption of cutting-edge technologies, especially Rotary Steerable Systems (RSS) for enhanced precision and efficiency in well construction, is a primary growth catalyst. Major energy companies' continued exploration investments in Oman further reinforce the sector's promising outlook.

Oman Directional Drilling Industry Market Size (In Billion)

Technological innovation and operational efficiency are hallmarks of the Omani directional drilling sector. While conventional methods remain prevalent, the adoption of Rotary Steerable Systems (RSS) is accelerating due to their superior performance in challenging geological conditions and complex well trajectories. Leading service providers are investing in advanced drilling technologies and skilled workforces to meet this demand. Key challenges include high capital expenditure for advanced equipment and the volatility of crude oil prices, impacting investment decisions. Nevertheless, strong government backing for the energy sector and economic diversification initiatives through oil and gas exploration will continue to fuel the Omani directional drilling market, positioning it as a vital component of the global energy landscape.

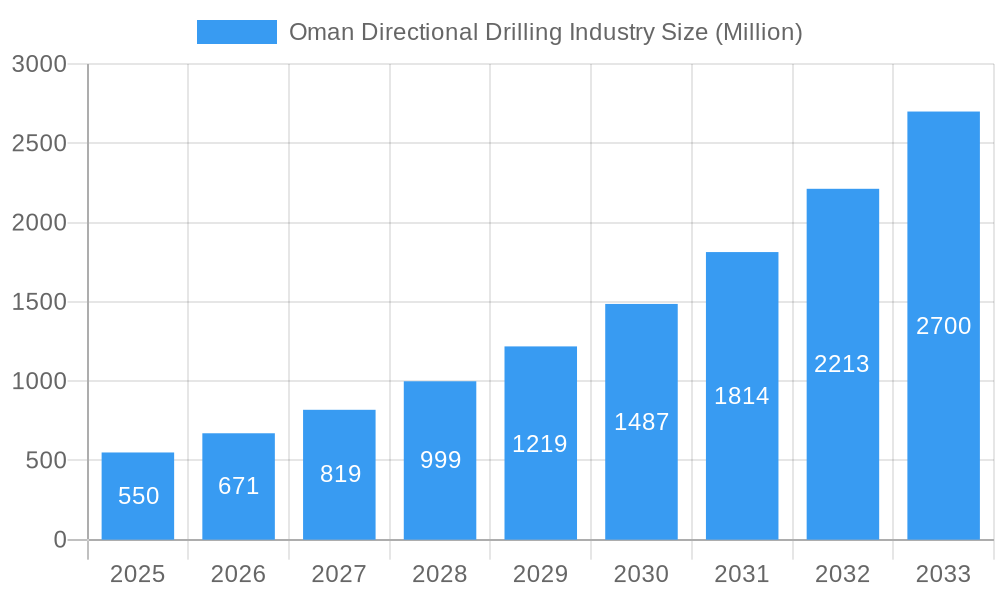

Oman Directional Drilling Industry Company Market Share

Oman Directional Drilling Industry Market Dynamics & Concentration

The Oman Directional Drilling Industry is characterized by a moderately concentrated market, driven by significant investments in oil and gas exploration and production. Innovation is a key differentiator, with companies investing heavily in advanced drilling technologies to enhance efficiency and access challenging reservoirs. Regulatory frameworks, overseen by entities such as the Ministry of Energy and Minerals, play a crucial role in shaping operational standards and environmental compliance. The availability of product substitutes, though limited in highly specialized directional drilling applications, is a consideration. End-user trends are increasingly focused on maximizing hydrocarbon recovery from mature fields and exploring new frontiers, necessitating sophisticated drilling solutions. Mergers and acquisition (M&A) activities are sporadic but significant, often aimed at consolidating market share or acquiring specialized technological capabilities. For instance, several M&A deals have been observed in the historical period (2019-2024), with an estimated xx deals impacting market concentration. The market share distribution sees major international oilfield service providers alongside prominent national entities.

Key Market Dynamics & Concentration Factors:

- Market Concentration: Moderately concentrated, with a few key players dominating a significant portion of the market share.

- Innovation Drivers: Advanced drilling technologies, efficiency improvements, reservoir access optimization, and environmental sustainability.

- Regulatory Frameworks: Strict adherence to environmental standards, safety regulations, and local content policies set by the Omani government.

- Product Substitutes: Limited availability of direct substitutes for highly specialized directional drilling services.

- End-User Trends: Focus on enhanced oil recovery (EOR), unconventional resource development, and cost optimization.

- M&A Activities: Sporadic but impactful M&A deals aimed at market consolidation and technological acquisition.

Oman Directional Drilling Industry Industry Trends & Analysis

The Oman Directional Drilling Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from the base year of 2025 through 2033. This robust growth is primarily fueled by Oman's ongoing commitment to maintaining and enhancing its oil and gas production levels, driven by national economic imperatives and global energy demand. The increasing complexity of newly discovered hydrocarbon reserves, often located in challenging geological formations both onshore and offshore, necessitates the application of advanced directional drilling techniques. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI) and machine learning into drilling operations for real-time optimization, predictive maintenance, and improved wellbore placement accuracy.

Consumer preferences within the sector are shifting towards integrated service offerings, where drilling operators seek comprehensive solutions that encompass planning, execution, and post-drilling analysis. This trend favors companies that can provide end-to-end services, thereby reducing operational complexity and improving cost-efficiency. The competitive landscape is intense, featuring a blend of global oilfield service giants and emerging regional players. Key players are continuously investing in research and development to offer superior performance and cost-effectiveness. For example, the penetration of Rotary Steerable Systems (RSS) is steadily increasing, displacing conventional drilling methods in more demanding applications due to its higher accuracy and efficiency. The historical period (2019-2024) has witnessed significant advancements in automated drilling technologies and data analytics, which are expected to accelerate market penetration in the forecast period. The estimated market size in the base year (2025) is expected to be $xxx Million, with a projected growth to $xxx Million by 2033.

Leading Markets & Segments in Oman Directional Drilling Industry

The Onshore segment currently represents the dominant market within the Oman Directional Drilling Industry, driven by extensive mature oil and gas fields that require enhanced recovery techniques and infill drilling. The favorable economic policies of the Omani government, focused on maximizing domestic hydrocarbon production, further bolster onshore activities. Significant investments in infrastructure development, including road networks and access to remote exploration sites, facilitate easier deployment of drilling rigs and associated equipment.

In terms of drilling Types, the Rotary Steerable System (RSS) segment is exhibiting the fastest growth and is increasingly favored for its superior accuracy, efficiency, and ability to perform complex wellbore trajectories. While conventional drilling methods remain prevalent in less demanding applications, the adoption of RSS is being propelled by the need to optimize production from increasingly challenging geological formations and to minimize formation damage. The economic advantages of RSS, such as reduced drilling time and fewer operational trips, are becoming more apparent to operators.

The Offshore segment, while currently smaller in terms of market share compared to onshore, holds significant untapped potential. Oman's offshore blocks are known for their complex geological structures and the presence of deep reservoirs, necessitating advanced directional drilling capabilities. Government initiatives to encourage exploration in offshore areas, coupled with technological advancements that improve the feasibility and cost-effectiveness of offshore operations, are expected to drive substantial growth in this segment during the forecast period (2025–2033).

Key Drivers of Segment Dominance:

- Onshore Dominance:

- Extensive mature fields requiring infill drilling and EOR.

- Established infrastructure and logistical support.

- Government focus on maximizing existing onshore reserves.

- Rotary Steerable System (RSS) Growth:

- Superior wellbore accuracy and trajectory control.

- Enhanced drilling efficiency and reduced non-productive time.

- Suitability for complex geological formations and extended reach drilling.

- Offshore Potential:

- Untapped deep-water and complex offshore reservoirs.

- Government incentives for offshore exploration.

- Advancements in offshore drilling technology.

Oman Directional Drilling Industry Product Developments

Product developments in the Oman Directional Drilling Industry are primarily focused on enhancing drilling efficiency, accuracy, and sustainability. Innovations in downhole motors, Measurement While Drilling (MWD) and Logging While Drilling (LWD) tools are enabling real-time data acquisition and superior wellbore placement. The development of advanced drilling fluids and specialized drill bits designed for abrasive formations and complex trajectories are also key areas of focus. Companies are investing in automation and remote operational capabilities to reduce human exposure to hazardous environments and improve operational consistency. These advancements are crucial for accessing more challenging reservoirs and optimizing hydrocarbon recovery, thereby offering a competitive edge to service providers. The market fit is strong as these developments directly address the evolving needs of Omani oil and gas operators seeking greater productivity and cost-effectiveness.

Key Drivers of Oman Directional Drilling Industry Growth

The growth of the Oman Directional Drilling Industry is propelled by a confluence of factors. Firstly, the sustained government commitment to maximizing oil and gas production, coupled with strategic investments in exploration and development projects, creates a consistent demand for advanced drilling services. Secondly, technological advancements, particularly in Rotary Steerable Systems (RSS), automation, and data analytics, enable more efficient and precise drilling operations, allowing access to complex reservoirs. Thirdly, the global energy landscape, which continues to rely on hydrocarbons for a significant portion of its energy mix, supports the ongoing exploration and production activities in Oman. Lastly, favorable economic policies and incentives aimed at boosting local content and attracting foreign investment further stimulate the market.

Challenges in the Oman Directional Drilling Industry Market

Despite strong growth prospects, the Oman Directional Drilling Industry faces several challenges. Regulatory hurdles, including stringent environmental compliance and local content requirements, can increase operational costs and complexity. Supply chain disruptions, both global and regional, can impact the availability of specialized equipment and personnel, leading to project delays. Intense competition among service providers can put downward pressure on pricing, affecting profitability. Furthermore, the inherent technical difficulties associated with drilling in challenging geological formations and the need for continuous investment in cutting-edge technology require substantial capital outlay. The reliance on a skilled workforce also presents a challenge, necessitating ongoing training and development programs.

Emerging Opportunities in Oman Directional Drilling Industry

Emerging opportunities in the Oman Directional Drilling Industry are primarily driven by technological breakthroughs and strategic market expansion. The increasing adoption of digital technologies, including AI, machine learning, and the Internet of Things (IoT), presents a significant opportunity for optimizing drilling operations, enhancing predictive maintenance, and improving decision-making processes. Strategic partnerships and collaborations between international service providers and local Omani companies are fostering knowledge transfer and capacity building, creating a more robust and self-sufficient industry. Furthermore, the exploration of unconventional resources and the development of marginal fields, which require sophisticated directional drilling techniques, offer substantial growth avenues. Oman's geographical location and its commitment to diversifying its economy also present opportunities for the country to become a regional hub for directional drilling expertise and technology.

Leading Players in the Oman Directional Drilling Industry Sector

- Total SA

- Occidental Petroleum Corporation

- Oman Oil Company SAOC

- Nabors Industries Ltd

- Baker Hughes Company

- Royal Dutch Shell PLC

- Halliburton Company

- Precision Drilling Corporation

- Schlumberger Limited

- Petroleum Development Oman

Key Milestones in Oman Directional Drilling Industry Industry

- 2019: Increased investment in offshore exploration activities by major operators.

- 2020: Introduction of advanced MWD/LWD tools for enhanced real-time data acquisition.

- 2021: Significant adoption of Rotary Steerable Systems (RSS) in complex onshore wells.

- 2022: Implementation of digital drilling solutions and AI for operational optimization.

- 2023: Focus on local content development and training programs for Omani workforce.

- 2024: Continued exploration of unconventional hydrocarbon resources requiring advanced directional drilling.

Strategic Outlook for Oman Directional Drilling Industry Market

The strategic outlook for the Oman Directional Drilling Industry remains highly positive, driven by sustained demand for oil and gas and continuous technological innovation. Key growth accelerators include the increasing application of digital technologies for operational efficiency and data analytics, the expansion of Rotary Steerable System (RSS) usage for complex wellbore construction, and the exploration of untapped onshore and offshore reserves. Strategic partnerships between international and local entities will foster a more competitive and skilled market. The industry is well-positioned to capitalize on Oman's rich hydrocarbon resources, with a strong emphasis on efficient, accurate, and sustainable drilling practices that will define its future success and market leadership in the region.

Oman Directional Drilling Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Types

- 2.1. Rotary Steerable System (RSS)

- 2.2. Conventional

Oman Directional Drilling Industry Segmentation By Geography

- 1. Oman

Oman Directional Drilling Industry Regional Market Share

Geographic Coverage of Oman Directional Drilling Industry

Oman Directional Drilling Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Directional Drilling Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rotary Steerable System (RSS)

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Occidental Petroleum Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oman Oil Company SAOC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nabors Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Baker Hughes Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Halliburton Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Precision Drilling Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schlumberger Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Petroleum Development Oman

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Oman Directional Drilling Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Directional Drilling Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Oman Directional Drilling Industry Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Oman Directional Drilling Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Oman Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 5: Oman Directional Drilling Industry Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Oman Directional Drilling Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Directional Drilling Industry?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Oman Directional Drilling Industry?

Key companies in the market include Total SA, Occidental Petroleum Corporation, Oman Oil Company SAOC, Nabors Industries Ltd, Baker Hughes Company, Royal Dutch Shell PLC, Halliburton Company, Precision Drilling Corporation, Schlumberger Limited, Petroleum Development Oman.

3. What are the main segments of the Oman Directional Drilling Industry?

The market segments include Location of Deployment, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.01 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Directional Drilling Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Directional Drilling Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Directional Drilling Industry?

To stay informed about further developments, trends, and reports in the Oman Directional Drilling Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence