Key Insights

The global nuclear power reactor decommissioning market is poised for significant expansion, driven by an aging global nuclear fleet and escalating regulatory demands for safe and efficient end-of-life management. The market, valued at $8170.1 million in 2023, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4% through 2030. This upward trend is underpinned by several key factors: a substantial number of nuclear power plants approaching operational retirement, stringent environmental and safety regulations necessitating advanced decommissioning strategies, and continuous technological innovation in dismantling and waste management, enhancing efficiency and cost-effectiveness.

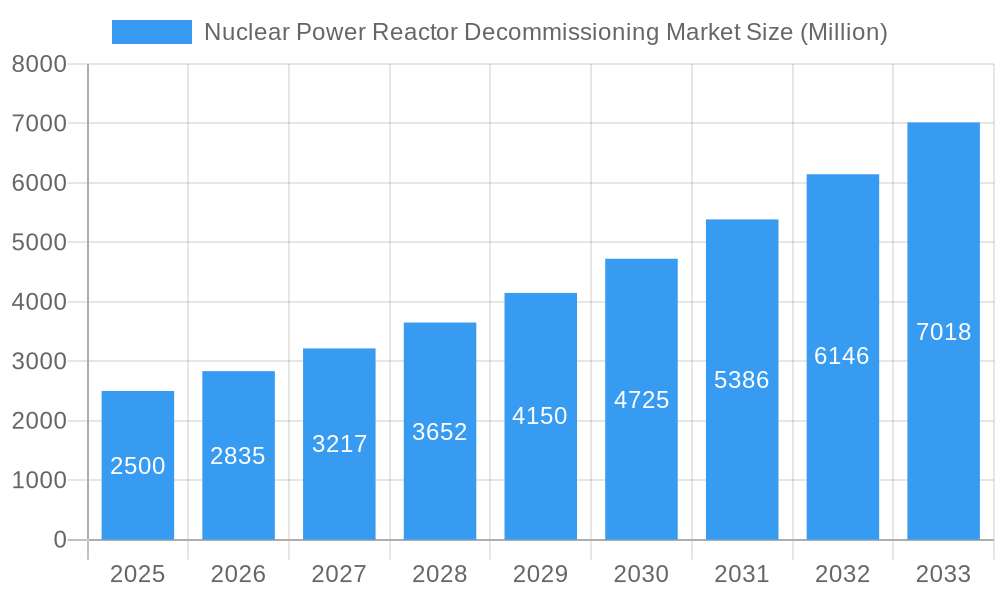

Nuclear Power Reactor Decommissioning Market Market Size (In Billion)

Market segmentation reveals robust opportunities across diverse reactor types, applications, and capacities. North America, Asia Pacific, and Europe are anticipated to lead market share, owing to their extensive nuclear power infrastructure and the high volume of plants scheduled for decommissioning. Leading industry players, including Aecom, Orano Group, and Westinghouse Electric Company, are actively investing in R&D to bolster their decommissioning expertise. While the increasing complexity of decommissioning larger reactors and managing radioactive waste presents inherent challenges, these also create lucrative avenues for specialized services and technological advancements. The market's outlook is highly positive, indicating substantial growth potential in the foreseeable future.

Nuclear Power Reactor Decommissioning Market Company Market Share

Nuclear Power Reactor Decommissioning Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Nuclear Power Reactor Decommissioning market, offering invaluable insights for stakeholders across the nuclear power industry. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report examines market dynamics, leading players, technological advancements, and future growth projections. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Nuclear Power Reactor Decommissioning Market Dynamics & Concentration

The Nuclear Power Reactor Decommissioning market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as specialized expertise, regulatory compliance, and substantial capital investment required for decommissioning projects. While precise market share data for individual companies remains commercially sensitive, Aecom, Orano Group, and Westinghouse Electric Company are recognized as major players, alongside Enercon Services Inc, NorthStar Group Services Inc, GE Hitachi Nuclear Services, James Fisher & Sons PLC, Bechtel Group Inc, Fluor Corporation, Babcock International Group PLC, and Studsvik AB. The market is witnessing increased M&A activity, with approximately xx deals recorded between 2019 and 2024, driving consolidation and enhancing the capabilities of major players. Innovation is driven by the need for more efficient and cost-effective decommissioning techniques, particularly in addressing challenges posed by aging reactor technology and the increasing volume of nuclear waste. Stringent regulatory frameworks, including those pertaining to nuclear safety and waste management, significantly shape market dynamics. The absence of readily available substitutes for specialized decommissioning services ensures sustained market demand. End-user trends are primarily influenced by the aging global nuclear power plant fleet and the increasing focus on environmental responsibility.

- Key Factors:

- High capital investment barriers to entry.

- Stringent safety and regulatory requirements.

- Growing number of aging nuclear power plants globally.

- Increasing demand for safe and efficient decommissioning solutions.

- Technological advancements in decommissioning techniques.

Nuclear Power Reactor Decommissioning Market Industry Trends & Analysis

The Nuclear Power Reactor Decommissioning market is experiencing robust growth, driven by the aging global fleet of nuclear power reactors and the increasing urgency for responsible nuclear waste management. This necessitates large-scale decommissioning projects worldwide. A heightened focus on environmental sustainability and stringent regulatory compliance further fuels market expansion. Technological advancements are pivotal, with innovations in robotics, automation, and advanced waste processing techniques leading to more efficient and cost-effective decommissioning solutions. These advancements are progressively penetrating the market, reflecting the industry's ongoing commitment to optimization and risk mitigation. Stakeholders, including governmental agencies, nuclear power operators, and regulatory bodies, increasingly prioritize solutions that minimize environmental impact and adhere to the highest safety protocols. The competitive landscape is dynamic, featuring both collaboration and competition among established multinational corporations and specialized, agile firms. While major players maintain significant market share, smaller companies are successfully capitalizing on niche opportunities, driving innovation and efficiency. This dynamic interplay shapes industry trends and fosters continuous improvement. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), significantly influenced by governmental policies, evolving decommissioning protocols, and the escalating need for safe and sustainable solutions.

Leading Markets & Segments in Nuclear Power Reactor Decommissioning Market

The Nuclear Power Reactor Decommissioning market exhibits varied growth patterns across different segments and geographic regions. While data on precise market dominance remains proprietary, North America and Europe currently represent significant market segments, largely driven by the substantial number of aging reactors in these regions and robust regulatory frameworks. Asia-Pacific is poised for significant growth in the coming years, reflecting planned decommissioning activities across several countries.

Key Drivers by Segment:

- By Reactor Type: Pressurized Water Reactor (PWR) holds the largest market share due to its widespread use globally. However, the decommissioning of other reactor types, such as Boiling Water Reactors (BWRs) and Pressurized Heavy Water Reactors (PHWRs), is also significantly contributing to market growth.

- By Application: Commercial power reactors account for the largest share of the market. The decommissioning of prototype and research reactors also contributes to market growth.

- By Capacity: The 100-1000 MW capacity segment holds a substantial market share, reflecting the prevalent size of commercial nuclear power plants.

Geographic Dominance:

- North America and Europe: Driven by a large number of aging reactors and strong regulatory frameworks.

- Asia-Pacific: Poised for significant growth due to increasing decommissioning plans.

Nuclear Power Reactor Decommissioning Market Product Developments

Recent years have witnessed transformative advancements in decommissioning technologies, with a strong emphasis on automation, robotics, and sophisticated waste management solutions. These innovations are not only reducing costs and improving safety but are also minimizing environmental impact. New approaches to dismantling reactor components, including the development of specialized tools and techniques for handling highly radioactive materials, are gaining significant traction. The market is increasingly focused on developing holistic decommissioning strategies, integrating diverse technologies tailored to the unique characteristics and challenges posed by each reactor type. Companies are aggressively pursuing competitive differentiation through enhanced efficiency, cost-effectiveness, and specialized expertise in areas such as remote handling, waste characterization, and site remediation.

Key Drivers of Nuclear Power Reactor Decommissioning Market Growth

The growth of the Nuclear Power Reactor Decommissioning market is primarily driven by the increasing number of aging nuclear power plants nearing the end of their operational lifespan. Stringent governmental regulations regarding nuclear waste management and decommissioning are also key growth drivers. Technological advancements in decommissioning methods, emphasizing improved safety and efficiency, further propel market growth. Economic factors, such as the cost of extending plant lifespans versus decommissioning, influence decision-making and ultimately stimulate market demand.

Challenges in the Nuclear Power Reactor Decommissioning Market

Significant challenges exist within this market, including the high costs associated with decommissioning, particularly for larger reactors. Regulatory complexities and lengthy approval processes can delay project timelines. The specialized nature of the work creates reliance on a limited number of skilled professionals, potentially limiting the pace of decommissioning efforts. Supply chain constraints for specialized equipment and materials can also impede progress and increase costs. Furthermore, managing the long-term storage and disposal of radioactive waste remains a significant operational and logistical challenge. These factors collectively impact the overall market growth rate.

Emerging Opportunities in Nuclear Power Reactor Decommissioning Market

The Nuclear Power Reactor Decommissioning market presents substantial opportunities for innovation and expansion. Advancements in robotics and remote handling technologies offer significant potential for cost reduction and improved worker safety, minimizing human exposure to hazardous environments. Strategic alliances and collaborative partnerships between established players and smaller, specialized firms can accelerate the adoption of cutting-edge technologies and increase overall market efficiency. Expanding into emerging markets with a large number of aging reactors presents significant growth potential, requiring the development of tailored solutions adapted to local regulatory frameworks and infrastructure capabilities. Governmental initiatives promoting safer and more sustainable decommissioning practices, including increased funding for research and development and the establishment of clear regulatory guidelines, will play a crucial role in driving long-term growth and market stability.

Leading Players in the Nuclear Power Reactor Decommissioning Market Sector

- Aecom

- Orano Group

- Westinghouse Electric Company

- Enercon Services Inc

- NorthStar Group Services Inc

- GE Hitachi Nuclear Energy

- James Fisher & Sons PLC

- Bechtel Group Inc

- Fluor Corporation

- Babcock International Group PLC

- Studsvik AB

Key Milestones in Nuclear Power Reactor Decommissioning Market Industry

- 2020: Introduction of a new robotic system for dismantling reactor components by [Company Name - if available, otherwise omit].

- 2022: Successful completion of a large-scale decommissioning project in [Country - if available, otherwise omit] by [Company Name - if available, otherwise omit].

- 2023: Major regulatory changes impacting decommissioning practices implemented in [Country - if available, otherwise omit].

- 2024: Strategic partnership formed between [Company Name 1] and [Company Name 2] to develop new decommissioning technologies. (replace bracketed info with available data)

Strategic Outlook for Nuclear Power Reactor Decommissioning Market Market

The future of the Nuclear Power Reactor Decommissioning market looks promising, driven by the continued aging of global nuclear power plants and a growing emphasis on responsible waste management. Technological advancements, coupled with strategic partnerships and governmental support, will play a significant role in shaping the market landscape. Companies that successfully adapt to evolving regulations and embrace innovative decommissioning technologies are well-positioned to capitalize on the substantial market opportunities ahead. The market is projected to experience continued expansion through 2033, presenting lucrative opportunities for investment and growth.

Nuclear Power Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. High-temperature Gas-cooled Reactor

- 1.5. Liquid Metal Fast Breeder Reactor

- 1.6. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. 100-1000 MW

- 3.3. Above 1000 MW

Nuclear Power Reactor Decommissioning Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Nuclear Power Reactor Decommissioning Market Regional Market Share

Geographic Coverage of Nuclear Power Reactor Decommissioning Market

Nuclear Power Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Commercial Reactors Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. High-temperature Gas-cooled Reactor

- 5.1.5. Liquid Metal Fast Breeder Reactor

- 5.1.6. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. 100-1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. North America Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Pressurized Heavy Water Reactor

- 6.1.3. Boiling Water Reactor

- 6.1.4. High-temperature Gas-cooled Reactor

- 6.1.5. Liquid Metal Fast Breeder Reactor

- 6.1.6. Other Reactor Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Power Reactor

- 6.2.2. Prototype Power Reactor

- 6.2.3. Research Reactor

- 6.3. Market Analysis, Insights and Forecast - by Capacity

- 6.3.1. Below 100 MW

- 6.3.2. 100-1000 MW

- 6.3.3. Above 1000 MW

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. Asia Pacific Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Pressurized Heavy Water Reactor

- 7.1.3. Boiling Water Reactor

- 7.1.4. High-temperature Gas-cooled Reactor

- 7.1.5. Liquid Metal Fast Breeder Reactor

- 7.1.6. Other Reactor Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Power Reactor

- 7.2.2. Prototype Power Reactor

- 7.2.3. Research Reactor

- 7.3. Market Analysis, Insights and Forecast - by Capacity

- 7.3.1. Below 100 MW

- 7.3.2. 100-1000 MW

- 7.3.3. Above 1000 MW

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. Europe Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Pressurized Heavy Water Reactor

- 8.1.3. Boiling Water Reactor

- 8.1.4. High-temperature Gas-cooled Reactor

- 8.1.5. Liquid Metal Fast Breeder Reactor

- 8.1.6. Other Reactor Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Power Reactor

- 8.2.2. Prototype Power Reactor

- 8.2.3. Research Reactor

- 8.3. Market Analysis, Insights and Forecast - by Capacity

- 8.3.1. Below 100 MW

- 8.3.2. 100-1000 MW

- 8.3.3. Above 1000 MW

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. South America Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Pressurized Heavy Water Reactor

- 9.1.3. Boiling Water Reactor

- 9.1.4. High-temperature Gas-cooled Reactor

- 9.1.5. Liquid Metal Fast Breeder Reactor

- 9.1.6. Other Reactor Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Power Reactor

- 9.2.2. Prototype Power Reactor

- 9.2.3. Research Reactor

- 9.3. Market Analysis, Insights and Forecast - by Capacity

- 9.3.1. Below 100 MW

- 9.3.2. 100-1000 MW

- 9.3.3. Above 1000 MW

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Middle East and Africa Nuclear Power Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Pressurized Heavy Water Reactor

- 10.1.3. Boiling Water Reactor

- 10.1.4. High-temperature Gas-cooled Reactor

- 10.1.5. Liquid Metal Fast Breeder Reactor

- 10.1.6. Other Reactor Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Power Reactor

- 10.2.2. Prototype Power Reactor

- 10.2.3. Research Reactor

- 10.3. Market Analysis, Insights and Forecast - by Capacity

- 10.3.1. Below 100 MW

- 10.3.2. 100-1000 MW

- 10.3.3. Above 1000 MW

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aecom

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Orano Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Westinghouse Electric Company*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enercon Services Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NorthStar Group Services Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Hitachi Nuclear Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 James Fisher & Sons PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bechtel Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fluor Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Babcock International Group PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Studsvik AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Aecom

List of Figures

- Figure 1: Global Nuclear Power Reactor Decommissioning Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Nuclear Power Reactor Decommissioning Market Revenue (million), by Reactor Type 2025 & 2033

- Figure 3: North America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 4: North America Nuclear Power Reactor Decommissioning Market Revenue (million), by Application 2025 & 2033

- Figure 5: North America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Nuclear Power Reactor Decommissioning Market Revenue (million), by Capacity 2025 & 2033

- Figure 7: North America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 8: North America Nuclear Power Reactor Decommissioning Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue (million), by Reactor Type 2025 & 2033

- Figure 11: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 12: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue (million), by Application 2025 & 2033

- Figure 13: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue (million), by Capacity 2025 & 2033

- Figure 15: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 16: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue (million), by Country 2025 & 2033

- Figure 17: Asia Pacific Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nuclear Power Reactor Decommissioning Market Revenue (million), by Reactor Type 2025 & 2033

- Figure 19: Europe Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 20: Europe Nuclear Power Reactor Decommissioning Market Revenue (million), by Application 2025 & 2033

- Figure 21: Europe Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Nuclear Power Reactor Decommissioning Market Revenue (million), by Capacity 2025 & 2033

- Figure 23: Europe Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 24: Europe Nuclear Power Reactor Decommissioning Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Nuclear Power Reactor Decommissioning Market Revenue (million), by Reactor Type 2025 & 2033

- Figure 27: South America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 28: South America Nuclear Power Reactor Decommissioning Market Revenue (million), by Application 2025 & 2033

- Figure 29: South America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Nuclear Power Reactor Decommissioning Market Revenue (million), by Capacity 2025 & 2033

- Figure 31: South America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 32: South America Nuclear Power Reactor Decommissioning Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue (million), by Reactor Type 2025 & 2033

- Figure 35: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 36: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue (million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue (million), by Capacity 2025 & 2033

- Figure 39: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 40: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Nuclear Power Reactor Decommissioning Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 2: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 4: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 6: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 8: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 10: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 12: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 14: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 16: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 18: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 20: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Reactor Type 2020 & 2033

- Table 22: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Application 2020 & 2033

- Table 23: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Capacity 2020 & 2033

- Table 24: Global Nuclear Power Reactor Decommissioning Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Power Reactor Decommissioning Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Nuclear Power Reactor Decommissioning Market?

Key companies in the market include Aecom, Orano Group, Westinghouse Electric Company*List Not Exhaustive, Enercon Services Inc, NorthStar Group Services Inc, GE Hitachi Nuclear Services, James Fisher & Sons PLC, Bechtel Group Inc, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the Nuclear Power Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 8170.1 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Commercial Reactors Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Power Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Power Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Power Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the Nuclear Power Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence