Key Insights

The North American Thermal Energy Storage (TES) market, valued at $4.72 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 7.21% through 2033. This expansion is driven by the increasing integration of renewable energy sources, the imperative for grid stability, and stringent environmental regulations promoting energy efficiency and reduced carbon emissions. TES technologies are gaining traction in power generation for grid optimization and in the heating and cooling sector for managing peak demand and decreasing fossil fuel dependence. Advancements in sensible, latent, and thermochemical heat storage are enhancing performance and cost-effectiveness. Key technologies include molten salt, chilled water, and ice-based systems. Leading companies are fostering market growth through innovation and deployment, with the United States dominating the market due to substantial renewable energy investments and supportive government policies.

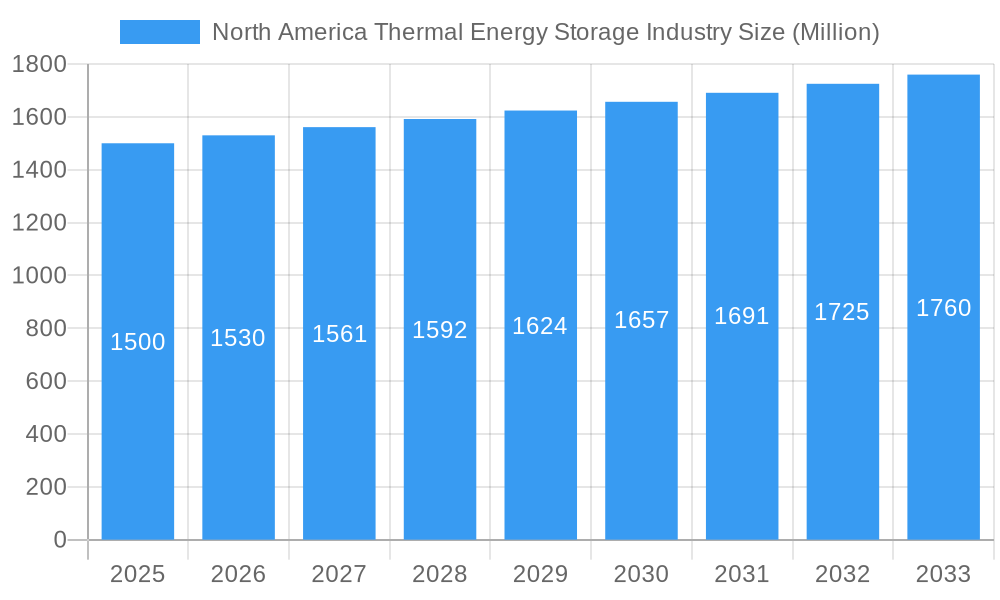

North America Thermal Energy Storage Industry Market Size (In Billion)

While initial investment costs for TES systems can be significant, long-term operational savings and environmental advantages are increasingly motivating adoption. Challenges such as improving efficiency, reducing costs for certain storage methods, and enhancing the scalability and reliability of large-scale systems are being addressed. The ongoing integration of renewable energy, supportive governmental initiatives, and heightened environmental consciousness are expected to significantly propel the North American TES market. Future market evolution will likely emphasize collaboration among technology providers, energy producers, and policymakers to accelerate widespread adoption and overcome existing limitations.

North America Thermal Energy Storage Industry Company Market Share

North America Thermal Energy Storage Industry: Market Report 2019-2033

Unlocking the Potential of Thermal Energy Storage in North America: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North America thermal energy storage industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, technological advancements, and competitive landscapes, this study covers the period 2019-2033, using 2025 as the base and estimated year. The report forecasts market trends until 2033, analyzing historical data from 2019-2024. The total market size is expected to reach xx Million by 2033.

North America Thermal Energy Storage Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, identifying key players and their market shares. We examine the drivers of innovation, regulatory influences, substitute products, end-user trends, and mergers and acquisitions (M&A) activities within the industry. The North American thermal energy storage market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. However, the entry of new players and technological advancements are driving increased competition.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This is projected to slightly decrease to xx% by 2033 due to increased competition from smaller companies and new entrants.

- Innovation Drivers: Government incentives for renewable energy integration and the growing need for grid stability are key drivers of innovation.

- Regulatory Frameworks: Stringent environmental regulations and policies promoting renewable energy sources are shaping the industry's trajectory.

- Product Substitutes: Conventional energy storage solutions, such as pumped hydro, pose a competitive threat, but thermal storage offers advantages in specific applications.

- End-User Trends: The increasing adoption of renewable energy sources by industries and residential consumers is driving the demand for thermal energy storage.

- M&A Activities: The number of M&A deals in the industry has seen a steady increase in recent years (xx deals in 2024), reflecting the strategic importance of thermal storage technology. This trend is expected to continue, with xx deals projected for 2033.

North America Thermal Energy Storage Industry Industry Trends & Analysis

This section delves into the market's growth trajectory, analyzing market drivers, technological disruptions, consumer preferences, and competitive dynamics. The North America thermal energy storage market is experiencing significant growth, driven by factors such as increasing energy costs, the growing adoption of renewable energy, and stringent environmental regulations. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is projected to reach xx% by 2033. Technological advancements, particularly in materials science and system integration, are playing a crucial role in driving market growth. Consumer preference is shifting towards sustainable and cost-effective energy solutions, boosting demand for thermal energy storage.

Leading Markets & Segments in North America Thermal Energy Storage Industry

This section identifies the dominant regions, countries, and segments within the North American thermal energy storage market. The analysis encompasses various types (Molten Salt, Chilled Water, Heat, Ice, Others), applications (Power Generation, Heating & Cooling), and technologies (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage).

Dominant Segments:

- Type: Molten salt storage systems currently dominate the market, driven by their high energy density and efficiency. However, chilled water storage is witnessing significant growth in the building sector.

- Application: Power generation is the largest application segment, followed by heating and cooling in the industrial and building sectors.

- Technology: Sensible heat storage currently holds the largest market share, owing to its relative maturity and cost-effectiveness. However, latent heat storage is gaining traction due to its higher energy density.

Key Regional Drivers:

- California: Strong renewable energy mandates and supportive policies are driving significant growth in the state.

- Texas: The state's large industrial sector and growing demand for grid stability are key market drivers.

- Northeastern US: Growing adoption of renewable energy and initiatives to reduce carbon emissions are fostering market growth.

North America Thermal Energy Storage Industry Product Developments

Recent product innovations focus on improving efficiency, reducing costs, and expanding applications. New materials and system designs are enhancing energy density and thermal performance. The integration of advanced control systems and data analytics is optimizing system operation and energy management. Companies are emphasizing modular and scalable designs to cater to various project sizes and customer needs.

Key Drivers of North America Thermal Energy Storage Industry Growth

The North American thermal energy storage market is experiencing robust growth, driven by a powerful confluence of factors. The increasing reliance on intermittent renewable energy sources, such as solar and wind power, necessitates efficient and reliable energy storage solutions to ensure grid stability and consistent power delivery. This demand is further amplified by government initiatives, including substantial tax credits, subsidies, and supportive policies designed to accelerate the adoption of renewable energy technologies and reduce carbon emissions. These incentives significantly de-risk investments in thermal energy storage, making it a more attractive proposition for both private and public entities. Furthermore, the escalating cost of electricity and the urgent need to decarbonize the energy sector are compelling businesses and utilities to explore and implement thermal energy storage as a crucial component of their sustainability strategies. The market's growth is also fueled by advancements in technology, leading to more efficient and cost-effective storage solutions.

Challenges in the North America Thermal Energy Storage Industry Market

Despite its considerable potential, the North American thermal energy storage industry faces significant hurdles. High upfront capital expenditures and extended payback periods remain major obstacles to widespread adoption, particularly for smaller-scale projects. Supply chain complexities and the limited availability of specialized materials can lead to project delays, cost overruns, and ultimately, reduced market penetration. Integrating thermal energy storage systems into existing infrastructure can also present technical and regulatory challenges, requiring extensive planning and coordination. These challenges, coupled with the need for skilled labor and specialized expertise, contribute to a slower rate of market expansion than initially projected. While precise figures are difficult to pinpoint, the cumulative impact of these factors is likely to temper growth in the near term.

Emerging Opportunities in North America Thermal Energy Storage Industry

The long-term outlook for the North American thermal energy storage industry remains exceptionally positive, driven by continuous technological innovation, strategic collaborations, and expanding market applications. Significant advancements in materials science are leading to the development of more efficient and cost-effective storage systems, unlocking new applications across diverse sectors. Increased government funding for research and development, coupled with substantial private sector investment, is accelerating innovation and reducing the cost barrier to entry. The expansion into new market segments, including building heating and cooling, industrial processes, and transportation, presents enormous growth opportunities. Furthermore, the increasing integration of thermal energy storage with other clean energy technologies, such as geothermal and waste heat recovery, creates synergistic opportunities for further market expansion.

Leading Players in the North America Thermal Energy Storage Industry Sector

- SolarReserve LLC

- Terrafore Technologies LLC

- Baltimore Aircoil Company

- Aalborg CSP A/S

- Trane Technologies PLC

- SaltX Technology Holding AB

- Abengoa SA

- Burns & McDonnell

- BrightSource Energy Inc

Key Milestones in North America Thermal Energy Storage Industry Industry

- 2020: Significant investment in R&D for advanced thermal storage materials, laying the groundwork for future technological breakthroughs.

- 2022: Launch of several large-scale thermal energy storage projects successfully demonstrating commercial viability and attracting further investment.

- 2023: A notable increase in strategic partnerships between energy storage companies and renewable energy developers, fostering innovation and accelerating market penetration.

- 2024: Several key mergers and acquisitions reshaped the competitive landscape, signaling a period of consolidation and increased industry maturity.

- Ongoing: Continued advancements in materials science, system design, and control technologies are driving down costs and enhancing the performance of thermal energy storage systems.

Strategic Outlook for North America Thermal Energy Storage Market

The North America thermal energy storage market is poised for significant growth over the next decade. Continued technological advancements, supportive government policies, and increasing private sector investment will drive market expansion. Strategic partnerships and collaborations among technology providers, energy companies, and policymakers will be crucial for unlocking the full potential of thermal energy storage and achieving a sustainable energy future. Focus on reducing costs, improving efficiency, and expanding applications will be key to realizing this potential.

North America Thermal Energy Storage Industry Segmentation

-

1. Type

- 1.1. Molten Salt

- 1.2. Chilled Water

- 1.3. Heat

- 1.4. Ice

- 1.5. Others

-

2. Application

- 2.1. Power Generation

- 2.2. Heating & Cooling

-

3. Technology

- 3.1. Sensible Heat Storage

- 3.2. Latent Heat Storage

- 3.3. Thermochemical Heat Storage

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Thermal Energy Storage Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of North America Thermal Energy Storage Industry

North America Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities

- 3.3. Market Restrains

- 3.3.1. 4.; Rising adoption of cleaner alternatives

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Molten Salt

- 5.1.2. Chilled Water

- 5.1.3. Heat

- 5.1.4. Ice

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation

- 5.2.2. Heating & Cooling

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Sensible Heat Storage

- 5.3.2. Latent Heat Storage

- 5.3.3. Thermochemical Heat Storage

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Molten Salt

- 6.1.2. Chilled Water

- 6.1.3. Heat

- 6.1.4. Ice

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation

- 6.2.2. Heating & Cooling

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Sensible Heat Storage

- 6.3.2. Latent Heat Storage

- 6.3.3. Thermochemical Heat Storage

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Molten Salt

- 7.1.2. Chilled Water

- 7.1.3. Heat

- 7.1.4. Ice

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation

- 7.2.2. Heating & Cooling

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Sensible Heat Storage

- 7.3.2. Latent Heat Storage

- 7.3.3. Thermochemical Heat Storage

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Molten Salt

- 8.1.2. Chilled Water

- 8.1.3. Heat

- 8.1.4. Ice

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation

- 8.2.2. Heating & Cooling

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Sensible Heat Storage

- 8.3.2. Latent Heat Storage

- 8.3.3. Thermochemical Heat Storage

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Terrafore Technologies LLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Baltimore Aircoil Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Aalborg CSP A/S

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Trane Technologies PLC*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SaltX Technology Holding AB

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Burns & McDonnell

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: North America Thermal Energy Storage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Thermal Energy Storage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Thermal Energy Storage Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Thermal Energy Storage Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America Thermal Energy Storage Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: North America Thermal Energy Storage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Thermal Energy Storage Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Thermal Energy Storage Industry?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the North America Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Terrafore Technologies LLC, Baltimore Aircoil Company, Aalborg CSP A/S, Trane Technologies PLC*List Not Exhaustive, SaltX Technology Holding AB, Abengoa SA, Burns & McDonnell, BrightSource Energy Inc.

3. What are the main segments of the North America Thermal Energy Storage Industry?

The market segments include Type, Application, Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the downstream sector4.; Rising offshore Oil exploration activities.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising adoption of cleaner alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the North America Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence